Market Overview:

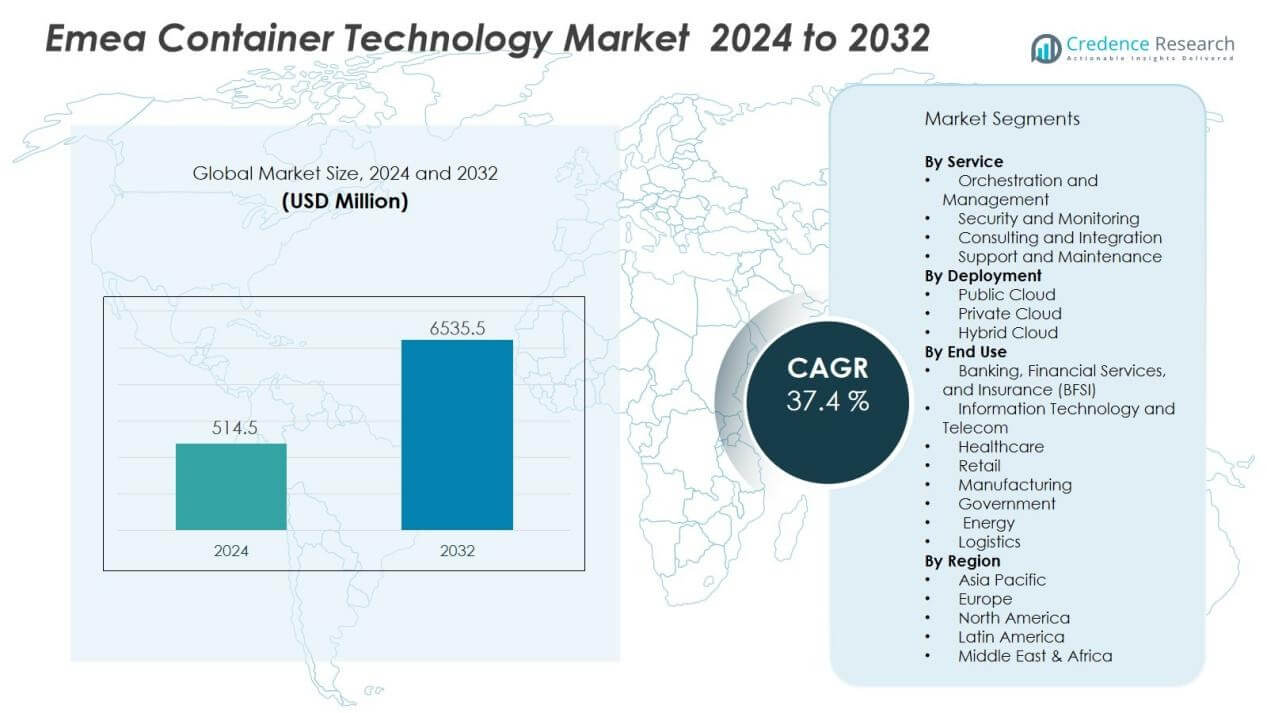

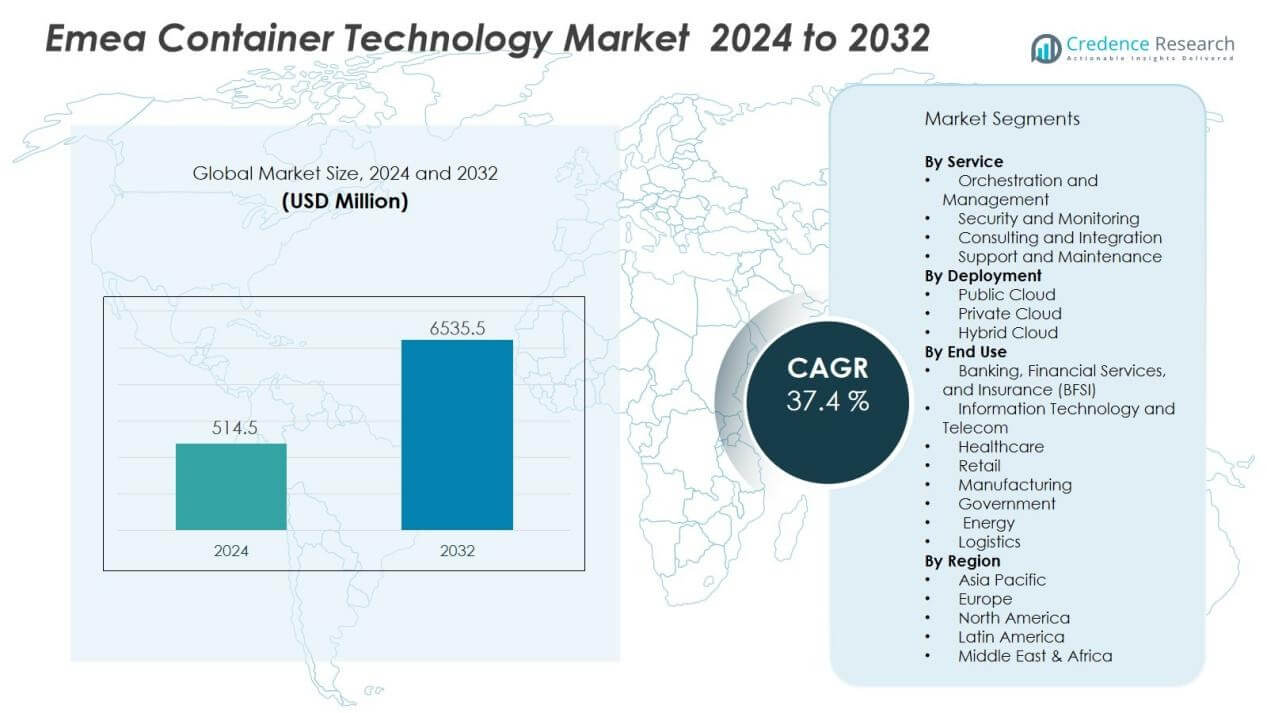

The emea container technology market size was valued at USD 514.5 million in 2024 and is anticipated to reach USD 6535.5 million by 2032, at a CAGR of 37.4 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Emea Container Technology Market Size 2024 |

USD 514.5 Million |

| Emea Container Technology Market, CAGR |

37.4% |

| Emea Container Technology Market Size 2032 |

USD 6535.5 Million |

Key drivers include the accelerating shift toward hybrid and multi-cloud strategies, growing adoption of DevOps practices, and the need for faster application delivery. Containers enable businesses to streamline operations, enhance resource utilization, and improve portability across IT environments. Additionally, advancements in container orchestration tools, security frameworks, and integration with artificial intelligence are broadening enterprise use cases, further fueling adoption across diverse sectors such as BFSI, healthcare, manufacturing, and telecom.

Regionally, Western Europe dominates the market, supported by advanced IT infrastructure, strong cloud adoption, and the presence of global technology providers. The Middle East is witnessing rapid adoption, driven by government-backed digital transformation programs and investments in smart city projects. Africa is emerging as a growth frontier, supported by expanding internet penetration, mobile-driven ecosystems, and rising interest from global cloud providers entering the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The EMEA container technology market was valued at USD 514.5 million in 2024 and is expected to reach USD 6535.5 million by 2032, growing at a CAGR of 37.4%.

- Rising demand for cloud-native applications and microservices is driving adoption, as enterprises seek faster deployment and scalability.

- Hybrid and multi-cloud strategies strengthen reliance on containers by enabling workload portability, reducing vendor lock-in, and optimizing efficiency.

- Integration with DevOps practices accelerates testing, deployment, and scaling, supported by automation tools like Kubernetes that enhance productivity.

- Security and compliance remain critical, with evolving solutions improving visibility, monitoring, and risk management while meeting regulatory standards.

- The market faces challenges from management complexity and skills shortages, requiring specialized expertise in orchestration and networking.

- Western Europe held 47% share in 2024, supported by advanced IT infrastructure and widespread DevOps adoption.

- The Middle East accounted for 28% share, fueled by smart city programs and government-backed digital transformation initiatives.

- Africa represented 25% share, with growth supported by internet penetration, mobile-driven ecosystems, and expanding data center investments.

Market Drivers:

Rising Demand for Cloud-Native Applications and Microservices:

The EMEA container technology market benefits from the rapid adoption of cloud-native applications and microservices. Enterprises prefer containers for their ability to simplify application deployment and scaling. This approach improves agility, reduces downtime, and supports continuous development cycles. Companies in sectors such as BFSI, telecom, and retail are using containers to achieve faster innovation and stronger customer experiences.

- For Instance, Deutsche Telekom used process orchestration with Camunda to manage and orchestrate its large fleet of approximately 3,000 Robotic Process Automation (RPA) bots used for customer service workflows, enabling greater visibility and scalability.

Expansion of Hybrid and Multi-Cloud Strategies :

Organizations across EMEA are embracing hybrid and multi-cloud models to increase flexibility. Container technology enables smooth migration and workload portability across different cloud environments. It reduces vendor lock-in, enhances operational efficiency, and optimizes cost structures. This trend strengthens enterprise reliance on containers, making them a critical component of digital transformation strategies.

- For Instance, IBM Consulting has demonstrated the capability to migrate containerized applications between Red Hat OpenShift clusters, a process that can be highly automated and performed quickly under controlled conditions

Integration with DevOps Practices and Automation Tools :

The integration of containers with DevOps methodologies is a strong driver in the EMEA container technology market. Containers align with DevOps by enabling faster testing, deployment, and scaling of applications. Automated orchestration platforms like Kubernetes further improve productivity and reduce manual effort. These tools enhance resource utilization and support continuous delivery pipelines across industries.

Focus on Security, Compliance, and Advanced Capabilities:

Security and compliance remain central to enterprise IT priorities in EMEA. Containers are gaining traction due to evolving solutions that address vulnerabilities and regulatory requirements. Advances in container security platforms provide visibility, monitoring, and risk management capabilities. At the same time, integration with AI-driven tools strengthens application resilience and positions containers as a reliable technology choice for critical business operations.

Market Trends:

Growing Role of Kubernetes and Advanced Orchestration Platforms:

The EMEA container technology market is witnessing strong adoption of Kubernetes and other orchestration solutions. Enterprises rely on these platforms to manage large-scale container deployments with efficiency and automation. Kubernetes supports scalability, resilience, and workload distribution, making it a preferred choice across industries. It also integrates with monitoring and logging tools, strengthening system performance. The trend highlights a shift from experimental projects toward enterprise-grade container ecosystems. It drives wider use in sectors with complex IT environments, including financial services and telecommunications.

- For Instance, Zalando manages its microservices architecture on numerous, smaller Kubernetes clusters, rather than one single, large cluster

Rising Focus on Edge Deployments and AI-Driven Applications:

A significant trend involves the expansion of containers into edge computing environments. Enterprises use containers to support real-time analytics, IoT applications, and localized workloads. The EMEA container technology market benefits from this shift, as it aligns with growing investments in 5G and distributed networks. It enables faster decision-making and supports resource-constrained environments at the edge. Integration with AI and machine learning frameworks is also increasing, creating new opportunities for data-driven insights. This evolution positions containers as a foundation for next-generation digital applications across the region.

- For instance, Vodafone has leveraged Kubernetes to orchestrate its extensive network of edge sites across Europe, enabling faster analytics and robust edge AI workloads for its network operations.

Market Challenges Analysis:

Complexity of Management and Skills Shortages:

The EMEA container technology market faces challenges due to the complexity of managing large-scale deployments. Enterprises often struggle with integrating containers into existing IT systems without disrupting operations. It requires specialized expertise in orchestration, networking, and monitoring that many organizations lack. The shortage of skilled professionals slows adoption and increases reliance on external vendors. Companies also encounter steep learning curves when deploying advanced tools like Kubernetes. These factors create barriers for organizations aiming to scale container strategies effectively.

Security Risks and Compliance Pressures:

Security remains a major concern, with containers introducing new vulnerabilities across environments. The EMEA container technology market must address issues related to isolation, image integrity, and runtime threats. It becomes difficult to meet strict compliance standards in regulated industries when visibility is limited. Enterprises often invest in third-party security tools to safeguard sensitive data, adding cost and complexity. Inconsistent practices across hybrid and multi-cloud setups further raise risks. The need for stronger security frameworks and governance remains a critical challenge for widespread adoption.

Market Opportunities:

Expansion of Digital Transformation and Industry-Specific Use Cases :

The EMEA container technology market holds strong opportunities through ongoing digital transformation initiatives. Enterprises across sectors such as healthcare, manufacturing, and retail are adopting containers to modernize applications and improve efficiency. It allows organizations to accelerate time-to-market while reducing infrastructure costs. Government-backed smart city programs and cloud-first strategies also expand potential adoption. Containers can support advanced use cases, including telemedicine, predictive maintenance, and omnichannel retail. These factors create fertile ground for providers to develop tailored solutions that address sector-specific needs.

Growth Potential in Edge, AI, and Cloud-Native Ecosystems :

Emerging technologies provide significant opportunities for containers in the region. The integration of containers with edge computing supports real-time data processing for IoT and 5G networks. It enhances agility and scalability in distributed environments, creating demand among telecom and energy companies. Growing use of AI and machine learning frameworks within containers enables enterprises to unlock deeper insights and improve decision-making. The EMEA container technology market benefits from strong cloud-native adoption, which strengthens opportunities for vendors offering orchestration, security, and monitoring solutions. This environment positions containers as a strategic enabler of next-generation IT infrastructure.

Market Segmentation Analysis:

By Service:

The EMEA container technology market by service is led by container orchestration and management solutions. Enterprises prefer these services to simplify scaling, automate deployment, and improve resource allocation. It also includes consulting, integration, and support services that help organizations optimize container adoption. Growing demand for security and monitoring solutions further strengthens the services segment. Vendors are expanding offerings to address compliance and enterprise-grade requirements.

- For instance, BoxBoat Technologies, acquired by IBM, boasts over 40 dedicated professionals helping Fortune 100 clients with Kubernetes implementations.

By Deployment:

Deployment models in the EMEA container technology market highlight strong adoption of hybrid and public cloud environments. Enterprises choose hybrid deployment to balance regulatory compliance with operational flexibility. Public cloud models gain traction due to cost efficiency and scalability. It also enables faster workload migration and global reach. Private cloud adoption remains steady in industries with strict data protection needs, such as banking and healthcare. This mix of models reflects diverse enterprise priorities across the region.

- For instance, Metric Insights utilized Kubernetes deployment on public cloud environments, with their services running in containers managed by a single unprivileged user as of version 6.4.1, optimizing secure and scalable external communications for data processing.

By End Use:

End-use segments demonstrate varied adoption across industries. BFSI, telecom, and IT services dominate demand, driven by the need for agility and scalability. It is also widely adopted in healthcare, retail, and manufacturing to support digital transformation. Governments in the region adopt containers to modernize infrastructure and deliver citizen services. Energy and logistics industries are exploring containers for real-time operations and efficiency. This broad base of end users supports steady long-term growth for the market.

Segmentations:

By Service

- Orchestration and Management

- Security and Monitoring

- Consulting and Integration

- Support and Maintenance

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End Use

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology and Telecom

- Healthcare

- Retail

- Manufacturing

- Government

- Energy

- Logistics

By Region:

- Western Europe

- Middle East

- Africa

Regional Analysis:

Western Europe:

Western Europe held 47% market share in the EMEA container technology market in 2024. Strong cloud adoption, advanced IT infrastructure, and widespread use of DevOps practices support its dominance. Enterprises in financial services, healthcare, and retail are leading adopters, focusing on agility and cost efficiency. It benefits from the presence of global cloud providers and strong partnerships with local system integrators. The region’s regulatory landscape also encourages investment in secure and compliant container platforms. Germany, the UK, and France remain key contributors due to their established enterprise IT ecosystems.

Middle East:

The Middle East accounted for 28% market share in the EMEA container technology market in 2024. Government initiatives focused on digital transformation and smart cities drive strong adoption in this region. It is supported by national strategies that emphasize AI, 5G, and advanced cloud infrastructure. Enterprises in sectors such as energy, telecom, and banking are adopting container solutions to modernize operations. The presence of large-scale public sector projects provides vendors with new opportunities. Countries including the UAE and Saudi Arabia lead adoption through their investments in digital-first economies.

Africa:

Africa represented 25% market share in the EMEA container technology market in 2024. Expanding internet penetration and increasing investments in mobile-driven ecosystems fuel adoption across the continent. It is also supported by international cloud providers establishing new data centers in key markets. Enterprises in sectors such as fintech, logistics, and education see containers as cost-effective solutions for scalability. The rise of local startups further strengthens demand for flexible IT infrastructure. South Africa, Nigeria, and Kenya play leading roles, positioning the continent as a growing opportunity for global and regional providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IBM

- Microsoft

- Amazon Web Services, Inc.

- Google LLC

- Joyent

- Broadcom

- Rancher

- Sysdig, Inc.

- SUSE

- Perforce Software, Inc.

Competitive Analysis:

The EMEA container technology market is shaped by global technology leaders and regional players. Key participants include IBM, Microsoft, Amazon Web Services, Inc., Google LLC, Joyent, Broadcom, Rancher, Sysdig, Inc., and SUSE. These companies compete by offering advanced orchestration, security, and monitoring platforms that meet enterprise-grade requirements. It is driven by the ability of vendors to integrate containers with hybrid and multi-cloud strategies, providing flexibility and reducing vendor lock-in. Players invest in partnerships, acquisitions, and innovation to strengthen their presence across diverse industries such as BFSI, telecom, and healthcare. Open-source solutions also play a critical role, allowing enterprises to adopt cost-effective and scalable models. The market remains competitive with strong demand for differentiated services and localized support. Vendors that address security, compliance, and automation challenges will continue to build stronger positions and expand customer adoption across the region.

Recent Developments:

- In February 2025, IBM completed its acquisition of HashiCorp, creating a comprehensive end-to-end hybrid cloud management platform to accelerate cloud adoption.

- In April 2025, Microsoft launched the 2025 Release Wave 1 update for Dynamics 365 and Power Platform, introducing hundreds of new features focused on Copilot AI.

- In July 2025, AWS introduced Amazon Aurora DSQL, its fastest serverless distributed SQL database for mission-critical workloads.

Report Coverage:

The research report offers an in-depth analysis based on Service, Deployment, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The EMEA container technology market will continue to expand with stronger adoption across enterprises.

- Hybrid and multi-cloud strategies will strengthen, driving demand for container portability and workload flexibility.

- It will see deeper integration with DevOps pipelines, improving automation, testing, and continuous delivery.

- Kubernetes and advanced orchestration platforms will remain central, enabling scalable and resilient deployments.

- Security solutions tailored for containers will evolve, addressing compliance and risk management needs.

- Edge computing adoption will accelerate, with containers powering IoT and 5G-enabled real-time applications.

- AI and machine learning workloads will increasingly run on containers, enhancing data-driven decision-making.

- Public sector investments in digital transformation and smart cities will fuel regional opportunities.

- It will create stronger growth potential in Africa, where expanding connectivity supports container adoption.

- Strategic partnerships among global cloud providers, local vendors, and governments will define market expansion.