Market Overview

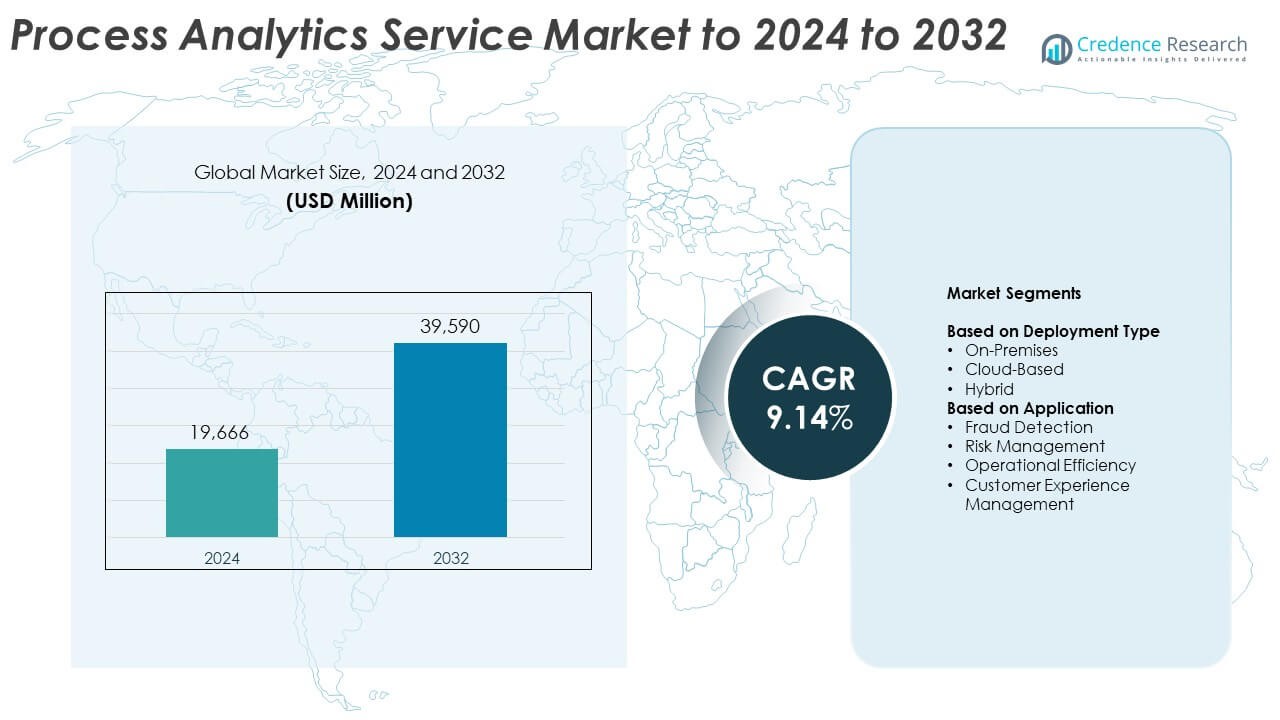

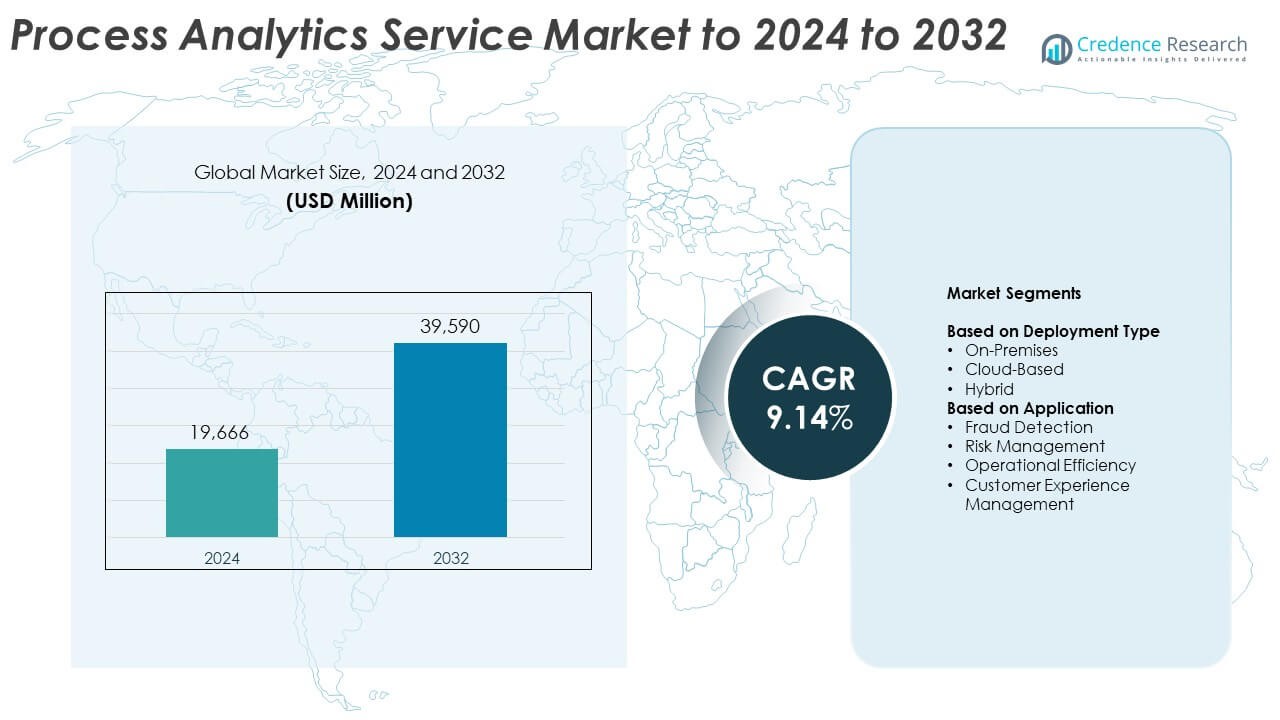

Process Analytics Service Market size was valued at USD 19,666 million in 2024 and is anticipated to reach USD 39,590 million by 2032, at a CAGR of 9.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Process Analytics Service Market Size 2024 |

USD 19,666 Million |

| Process Analytics Service Market, CAGR |

9.14% |

| Process Analytics Service Market Size 2032 |

USD 39,590 Million |

The process analytics service market is led by major players such as SAP, Microsoft, IBM, Oracle, Tableau, Qlik, and Accenture, who collectively drive innovation through AI-powered analytics, automation, and cloud-based solutions. These companies focus on enhancing process visibility, compliance, and operational efficiency for enterprises across industries. North America dominated the global market in 2024 with a 38.6% share, supported by strong digital transformation initiatives and high adoption of advanced analytics tools. Europe followed with a 27.4% share, driven by regulatory compliance needs, while Asia-Pacific accounted for 24.1%, emerging as the fastest-growing region due to rapid cloud adoption and expanding enterprise digitization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The process analytics service market was valued at USD 19,666 million in 2024 and is projected to reach USD 39,590 million by 2032, growing at a CAGR of 9.14%.

- Growing digital transformation initiatives and adoption of AI-driven analytics tools are driving market growth across manufacturing, BFSI, and healthcare sectors.

- Cloud-based deployment dominated with a 58.3% share in 2024, supported by scalable infrastructure and cost-efficient integration with enterprise systems.

- The market is highly competitive, with global players focusing on AI, automation, and predictive analytics to strengthen service portfolios and expand client bases.

- North America led the market with a 38.6% share, followed by Europe at 27.4% and Asia-Pacific at 24.1%, driven by strong cloud adoption, regulatory compliance needs, and rapid enterprise digitalization.

Market Segmentation Analysis:

By Deployment Type

The cloud-based segment dominated the process analytics service market in 2024 with a 58.3% share. Its dominance stems from the growing need for scalable, cost-efficient, and easily deployable analytics platforms. Cloud deployment allows real-time process visibility, seamless integration with enterprise systems, and reduced infrastructure costs. Organizations in sectors like banking and healthcare are rapidly adopting cloud-based solutions for advanced data analysis and continuous process improvement. Increased demand for remote accessibility and AI-driven insights further accelerates cloud adoption among global enterprises.

- For instance, Snowflake Inc. processed 4.2 billion daily queries across its cloud analytics platform.

By Application

The operational efficiency segment held the largest market share of 46.5% in 2024, driven by the rising focus on workflow optimization and productivity improvement. Companies use process analytics to detect process bottlenecks, reduce cycle times, and enhance resource utilization. The adoption of automation and AI-enabled monitoring tools has boosted efficiency-focused deployments across industries. Growing digital transformation initiatives in manufacturing, logistics, and BFSI sectors continue to fuel demand for process analytics solutions that deliver measurable operational gains and strategic decision-making benefits.

- For instance, Tech Data cut procure-to-pay cycle time by 57% within one year using process mining.

Key Growth Drivers

Rising Adoption of Digital Transformation Initiatives

Enterprises are investing heavily in digital transformation to improve operational transparency and efficiency. Process analytics services enable organizations to visualize and analyze complex workflows, helping them identify inefficiencies and optimize performance. The growing use of automation, AI, and IoT across industries enhances data-driven decision-making, boosting the demand for process analytics solutions. This adoption is particularly strong in manufacturing, BFSI, and healthcare sectors seeking to modernize legacy systems and gain actionable insights from large process data volumes.

- For instance, Johnson & Johnson achieved a 30% touch-time reduction and 40% fewer price changes after deploying process mining.

Increasing Need for Compliance and Risk Management

Businesses face stricter regulatory requirements and audit needs across sectors such as finance, healthcare, and energy. Process analytics tools help companies track compliance metrics, detect anomalies, and maintain transparent operational records. The ability to provide real-time visibility and automated reporting supports organizations in meeting global regulatory standards efficiently. Rising data governance concerns and the need for proactive risk mitigation are prompting enterprises to integrate process analytics into compliance management frameworks.

- For instance, HSBC screens over 1.2 billion transactions per month and has, more recently, reduced AML false positives by 60% using AI in collaboration with Google Cloud. An earlier initiative with a different vendor had reported a 20% reduction.

Growing Use of Cloud-Based Analytics Platforms

The shift toward cloud-based analytics platforms is driving rapid adoption of process analytics services. Cloud solutions offer flexibility, scalability, and cost-efficiency, making them ideal for dynamic business environments. Organizations benefit from reduced infrastructure costs and faster implementation timelines. Cloud integration also enhances collaboration, allowing teams to access insights remotely. Continuous advancements in AI-powered cloud tools are further improving process visualization and automation, strengthening the role of cloud deployment in enterprise analytics strategies.

Key Trends and Opportunities

Integration of AI and Machine Learning

Artificial intelligence and machine learning are transforming process analytics by enabling predictive insights and automated decision-making. These technologies enhance process mining accuracy, identify performance trends, and forecast potential disruptions. Businesses are leveraging ML algorithms to optimize workflows and improve customer experiences through data-driven interventions. This integration opens opportunities for vendors to develop intelligent analytics platforms that deliver faster, deeper insights and support adaptive process management across industries.

- For instance, RATIONAL cut blocked-order sales cycle time by 40% through Celonis-enabled analytics.

Emergence of Real-Time Process Monitoring

Real-time process monitoring is emerging as a major opportunity for organizations seeking immediate operational visibility. Continuous data collection from multiple systems allows rapid detection of inefficiencies and deviations. This real-time approach supports proactive interventions, minimizing downtime and enhancing process reliability. Companies in logistics, manufacturing, and financial services are adopting real-time analytics to improve responsiveness and agility. The growing need for continuous improvement and faster decision cycles is fueling adoption of such live monitoring solutions.

- For instance, Uber’s Chaperone system audited over 1 billion messages per day (or about a trillion events daily) to monitor Kafka pipelines end-to-end, as reported in a December 2016 Uber Engineering blog post.

Expansion of Industry-Specific Process Solutions

Vendors are increasingly developing tailored process analytics services to meet the unique needs of industries such as healthcare, telecom, and energy. Custom-built solutions address domain-specific compliance requirements and operational challenges. This trend supports higher adoption rates among enterprises looking for precise and adaptable analytics capabilities. As industries continue digital transformation, the demand for vertical-specific process analytics is expected to accelerate, creating new opportunities for solution providers to expand market reach.

Key Challenges

Data Privacy and Security Concerns

The collection and analysis of large volumes of process data raise significant privacy and security challenges. Organizations handling sensitive information must ensure compliance with stringent data protection laws such as GDPR and HIPAA. Any breach or misuse of data can lead to financial penalties and loss of customer trust. Ensuring secure data storage, encryption, and controlled access remains a top priority for analytics providers. These concerns can slow down adoption, especially among highly regulated sectors.

Integration Complexity with Legacy Systems

Integrating process analytics solutions with outdated or incompatible legacy systems presents a major implementation challenge. Many organizations struggle to unify disparate data sources, resulting in incomplete process visibility. The high cost and technical complexity of integration often delay deployment and reduce overall efficiency. Vendors are focusing on offering low-code and API-based integration tools to address these issues, but full interoperability across diverse enterprise systems remains difficult for large-scale enterprises.

Regional Analysis

North America

North America dominated the process analytics service market in 2024 with a 38.6% share, driven by strong digital transformation initiatives and the rapid adoption of advanced analytics platforms. The United States leads regional demand, supported by major investments from technology, BFSI, and healthcare sectors. Companies are integrating AI-based process optimization tools to enhance operational transparency and decision-making. The region benefits from a mature IT infrastructure and a strong presence of leading analytics service providers, encouraging widespread implementation across enterprises seeking improved efficiency and compliance.

Europe

Europe accounted for a 27.4% share of the process analytics service market in 2024, supported by stringent regulatory frameworks and growing enterprise adoption of compliance-focused analytics. Countries such as Germany, the United Kingdom, and France are leading innovation in process mining and workflow automation. The region’s emphasis on sustainable business practices and data protection drives adoption across industries like manufacturing, retail, and financial services. Increasing deployment of hybrid analytics models and integration with ERP systems further enhances operational visibility and risk management in European enterprises.

Asia-Pacific

Asia-Pacific held a 24.1% share of the process analytics service market in 2024 and is the fastest-growing regional market. Rapid digitalization, expanding cloud adoption, and government initiatives supporting Industry 4.0 are fueling demand. Countries including China, Japan, and India are witnessing high investments in business process optimization and automation. The growing presence of IT service providers and technology startups accelerates adoption among enterprises seeking operational efficiency. Expanding data infrastructure and increasing demand for customer-centric insights are further strengthening regional market growth across diverse industries.

Latin America

Latin America captured a 6.1% share of the process analytics service market in 2024, driven by digital transformation efforts in banking, telecommunications, and retail sectors. Brazil and Mexico are leading adopters, supported by rising cloud infrastructure and expanding SME participation. Regional enterprises are embracing process analytics to improve service quality and manage compliance risks effectively. Growing investment in IT modernization and analytics training programs is fostering gradual adoption. However, limited awareness and data integration challenges continue to restrain full-scale deployment across several industries in the region.

Middle East & Africa

The Middle East and Africa accounted for a 3.8% share of the process analytics service market in 2024, with increasing adoption in the financial, energy, and government sectors. Countries such as the United Arab Emirates and South Africa are investing in digital infrastructure and cloud-based analytics platforms. The region’s focus on smart city development and e-governance projects supports steady market growth. Although overall adoption remains in the early stages, rising enterprise awareness of process optimization benefits and expanding digital transformation programs are expected to accelerate future market penetration.

Market Segmentations:

By Deployment Type

- On-Premises

- Cloud-Based

- Hybrid

By Application

- Fraud Detection

- Risk Management

- Operational Efficiency

- Customer Experience Management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Leading players in the process analytics service market include SAP, Tableau, Microsoft, Qlik, Alteryx, IBM, ThoughtSpot, Celonis, TIBCO Software, Domo, Accenture, Bain and Company, SAS Institute, Oracle, MicroStrategy, and Sisense. The market is highly competitive, characterized by continuous innovation and technology integration to enhance data visualization, automation, and process optimization capabilities. Companies are investing in advanced analytics, AI, and machine learning to improve predictive accuracy and deliver actionable business insights. Strategic collaborations and cloud partnerships are key strategies for expanding market presence and strengthening service portfolios. Vendors are also focusing on user-friendly interfaces and scalable solutions to meet the needs of small and large enterprises. Growing demand for real-time monitoring and integration with enterprise software systems is intensifying competition. Continuous product upgrades and the introduction of industry-specific analytics models are further shaping the competitive dynamics, driving differentiation and long-term customer retention in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SAP

- Tableau

- Microsoft

- Qlik

- Alteryx

- IBM

- ThoughtSpot

- Celonis

- TIBCO Software

- Domo

- Accenture

- Bain and Company

- SAS Institute

- Oracle

- MicroStrategy

- Sisense

Recent Developments

- In 2024, SAP aunched new AI-powered “process optimization” features within the SAP Signavio Process Transformation Suite, designed to automatically detect inefficiencies in enterprise resource planning (ERP) processes.

- In 2024, IBM unveiled new features in the IBM Process Mining software that leverage generative AI to automate the documentation of process maps and generate recommendations for improvement.

- In 2023, Celonis Unveiled the next generation of its Process Intelligence Graph, which uses a combination of AI and machine learning to automatically generate data models and provide deeper, real-time insights into business processes.

Report Coverage

The research report offers an in-depth analysis based on Deployment Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth driven by AI-powered process optimization tools.

- Cloud deployment will continue to expand as enterprises seek flexible and scalable analytics solutions.

- Real-time process monitoring will become standard for performance tracking and rapid decision-making.

- Integration with robotic process automation will create new opportunities for workflow efficiency.

- Industry-specific analytics platforms will gain traction in healthcare, BFSI, and manufacturing sectors.

- Data governance and compliance management will remain top priorities for global enterprises.

- Strategic partnerships between analytics vendors and cloud providers will boost solution innovation.

- Small and medium enterprises will increasingly adopt low-cost, subscription-based analytics services.

- Advancements in predictive analytics will enable proactive process improvement and risk detection.

- The growing focus on sustainability and energy-efficient operations will enhance market adoption globally.