Market Overview

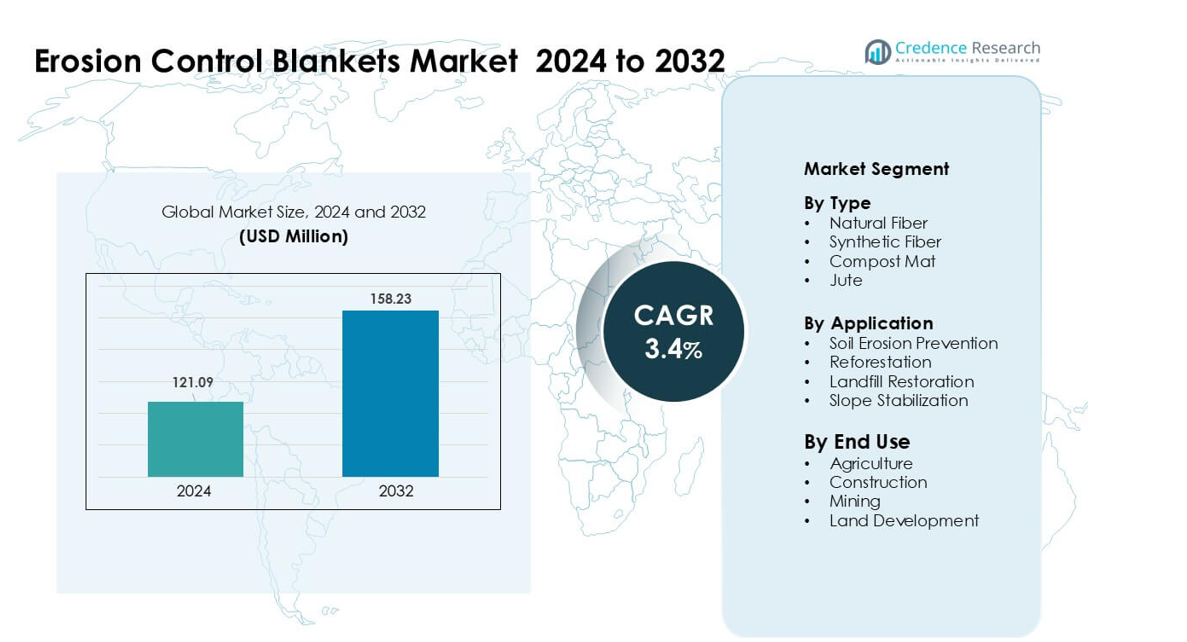

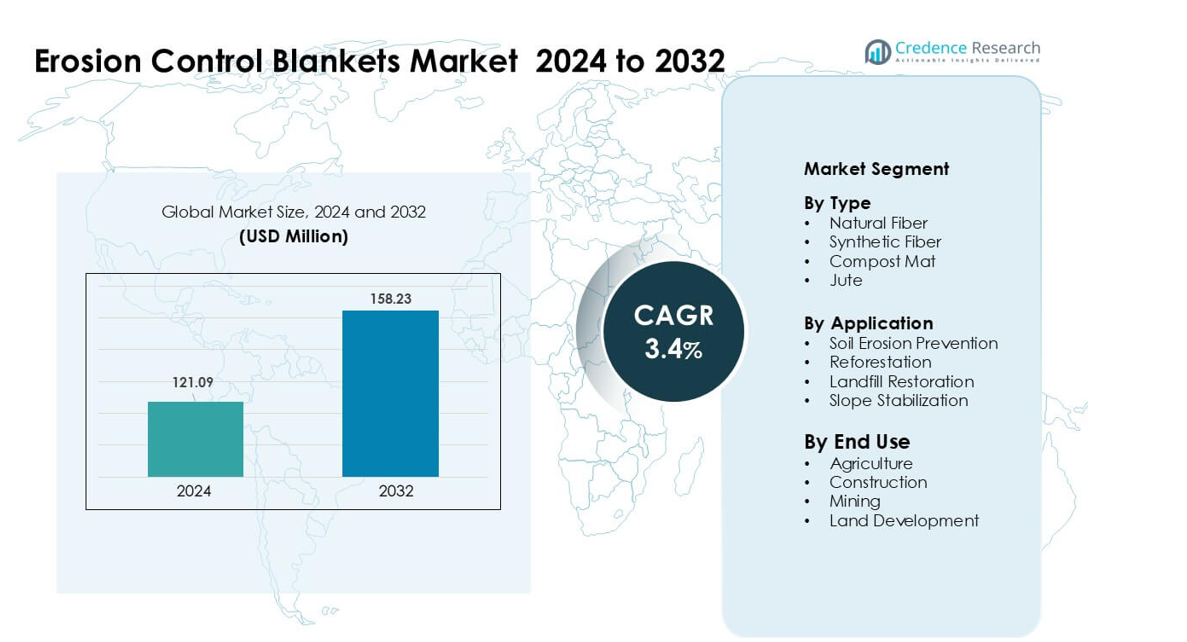

Erosion Control Blankets Market was valued at USD 121.09 million in 2024 and is anticipated to reach USD 158.23 million by 2032, growing at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Erosion Control Blankets Market Size 2024 |

USD 121.09 million |

| Erosion Control Blankets Market, CAGR |

3.4% |

| Erosion Control Blankets Market Size 2032 |

USD 158.23 million |

The Erosion Control Blankets Market is shaped by key companies such as Hydroseeding Ltd, Contech Engineered Solutions LLC, Cherokee Manufacturing, ABG Ltd, L & M Supply Co, American Excelsior, Hydroseal LLC, Bonterra, EastCoastErosion.com, and Erosion Control Blankets. These players compete through biodegradable mats, synthetic reinforced designs, and site-specific stabilization solutions. Product improvements in durability, moisture retention, and ease of installation help them meet rising demand across construction, mining, and land-restoration projects. North America led the market in 2024 with about 38% share, supported by strong regulatory enforcement, advanced infrastructure activity, and higher adoption of certified erosion-control materials.

Market Insights

- The Erosion Control Blankets Market reached USD 121.09 million in 2024 and is projected to hit USD 158.23 million by 2032, expanding at a 3.4% CAGR.

- Rising construction, highway upgrades, and stricter soil-stability mandates drive strong adoption, with natural fiber blankets holding the largest share at about 46% due to sustainability and regulatory support.

- Key trends include increased use in reforestation, post-disaster land repair, and growth in biodegradable and hybrid blanket designs that improve durability and moisture retention.

- Competition intensifies as major players upgrade stitching patterns, tensile strength, and installation efficiency while expanding distributor networks to improve access in growth markets.

- North America led with around 38% share in 2024, supported by strict erosion-control rules and heavy infrastructure spending, while soil-erosion prevention applications dominated with nearly 52% share, reinforcing broad market demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Natural fiber erosion control blankets dominated the type segment in 2024 with about 46% share. These blankets gained strong demand due to their biodegradability, moisture retention, and better soil integration. Jute and coir mats offered higher tensile strength, which supported use in road projects and riverbank protection. Synthetic fiber products grew at a steady pace due to longer lifespan, yet adoption stayed lower because many agencies preferred eco-friendly materials for compliance. Compost mats expanded in wetland areas but remained a smaller niche due to higher cost and limited supplier reach.

- For instance, a field study using a 500 g/m² jute blanket (J500) recorded a 99.4% reduction in soil loss compared with bare soil, while a 700 g/m² coir blanket (C700) achieved a 97.9% reduction under identical slope and rainfall conditions underscoring the effectiveness of natural fiber blankets in slope stabilization.

By Application

Soil erosion prevention held the leading position in 2024 with nearly 52% share. Construction companies, highway agencies, and municipal bodies used blankets to stabilize exposed soil during earthwork. Rising rainfall variability and frequent slope failures pushed demand for quick-deploy erosion solutions. Reforestation projects also adopted blankets to protect seedlings, though their share remained lower due to project-based cycles. Landfill restoration and slope stabilization grew in mining and urban redevelopment sites, but both segments stayed smaller because they rely on periodic remediation work rather than continuous activity.

- For instance, contractors installing biodegradable coir mats rated for channel and slope work such as those by a major supplier report that their mats can handle water flows up to 8 feet per second (≈ 2.4 m/s), making them suitable even for heavy runoff conditions during monsoons or sudden rainfall.

By End Use

Construction emerged as the dominant end-use segment in 2024 with around 40% share. Large road expansion programs and rapid urban infrastructure work increased blanket installation across embankments, drainage channels, and cut-and-fill zones. Agriculture used erosion blankets for water retention and seed protection, but adoption varied by region and farm size. Mining companies deployed blankets for tailing slope stabilization, though uptake stayed moderate due to selective site needs. Land development projects used blankets in housing and industrial parks, yet their share remained smaller because usage depends on seasonal land grading activity.

Key Growth Drivers:

Rising Infrastructure Development and Urban Expansion

Global road building, rail expansion, and urban land-development projects continue to drive higher use of erosion control blankets. Contractors rely on these blankets to stabilize soil on embankments, drainage channels, and cut-and-fill slopes during construction. Governments enforce stricter erosion and sediment control standards, which pushes mandatory adoption across large public works. Rapid urban expansion also increases land clearing, which exposes soil to rainfall, runoff, and wind erosion. This environment raises the need for quick-deploy stabilization solutions with predictable performance. The growth of industrial parks, logistics hubs, and renewable energy installations further increases installation volume as many of these sites require slope protection and long-term surface reinforcement.

- For instance, a recent industry summary notes that on steep slopes and disturbed soil surfaces, rolled erosion control blankets (RECPs) are often installed immediately after grading allowing “immediate soil stabilization” and helping prevent sediment runoff even before vegetative cover establishes.

Growing Environmental Regulations and Soil Protection Mandates

Environmental agencies worldwide enforce stronger rules on sediment control, watershed protection, and land restoration. These rules support broad uptake of erosion control blankets as compliant solutions for disturbed landscapes. Mining, construction, and agriculture face higher penalties for runoff-induced water contamination, leading companies to adopt blankets as preventive tools. Reforestation and habitat restoration projects also contribute to demand because blankets help anchor seedlings and protect topsoil during early growth phases. Climate-change-driven rainfall intensity increases soil erosion risk, prompting regulators to tighten protection measures. As a result, organizations across public and private sectors integrate erosion blankets into mandatory environmental management plans, driving consistent market expansion.

- For instance, field measurements from a European forest-road restoration project showed that applying erosion control blankets or nets on slopes reduced absolute soil loss by over 95% compared with unprotected bare soil plots.

Rising Adoption of Natural Fiber and Biodegradable Materials

Demand for natural fiber erosion control blankets grows as industries shift toward eco-friendly materials. Products made from jute, coir, and straw support biodegradability while offering strong soil integration and moisture retention benefits. Governments promote sustainable land rehabilitation practices, which encourage the use of organic mats in riverbanks, hilly terrains, and agricultural zones. Many large infrastructure projects now specify biodegradable materials to reduce long-term waste and avoid synthetic microplastic contamination. This push aligns with ESG goals, making natural fiber blankets a preferred choice for contractors. The lower ecological footprint and strong performance in diverse terrains continue to accelerate adoption across global markets.

Key Trend & Opportunity :

Expansion of Reforestation and Land Restoration Projects

Reforestation campaigns and degraded land restoration programs create new opportunities for erosion control blanket suppliers. Governments and environmental groups increasingly rely on blankets to stabilize soil, protect seedlings, and support vegetation growth in early stages. Post-wildfire rehabilitation work also contributes to rising demand, as blankets help anchor slopes and prevent runoff in affected regions. International climate commitments encourage large-scale planting drives, which require reliable soil stabilization tools. This expanding activity provides steady project-driven demand, especially in regions prioritizing forest recovery, watershed repair, and carbon-offset initiatives. Growing global focus on land regeneration strengthens the long-term opportunity for these products.

- For instance, in a tropical climate field trial using a palm-fiber based erosion control blanket over embankments during a three-month rainy season, the covered plot lost 16.7 kg of soil versus 154.6 kg in an adjacent bare-soil plot a dramatic soil-loss reduction, illustrating how natural-fibre blankets can support land restoration, slope protection, and seedling survival under heavy rainfall.

Advancements in Product Engineering and Performance Materials

Manufacturers develop high-strength, longer-lasting, and more site-specific erosion control blankets using improved fiber blends and advanced stitching patterns. Innovations focus on better tensile strength, moisture retention, and resistance to UV degradation, enabling use in steeper slopes and harsh climates. Some companies introduce hybrid blankets combining natural and synthetic fibers to optimize strength and biodegradability. Digital modeling tools also help engineers select blankets tailored to slope gradient, soil type, and expected rainfall. These advancements elevate product reliability and broaden adoption across complex infrastructure projects, unlocking new commercial opportunities for premium-grade erosion solutions.

- For instance, recent material-science research on natural-fiber composites (including those used for soil stabilization) has documented how engineering fiber blends can significantly enhance durability and mechanical performance compared to traditional natural-fiber mats improving feasibility for use on steeper or more demanding terrain.

Key Challenge:

High Variability in Installation Quality and Site Performance

The performance of erosion control blankets depends heavily on correct installation, but skill levels vary widely across markets. Many contractors lack adequate training, resulting in improper anchoring, uneven contact with the soil, and early failure in high-rainfall events. Poor installation raises maintenance costs and reduces trust among project managers. Complex sites such as steep slopes or loose soils further increase difficulty, requiring skilled labor and precise deployment methods. This variability poses a major challenge to consistent market expansion. Without standardized training programs, blanket performance can vary across regions, which limits wider acceptance in large public infrastructure projects.

Cost Sensitivity and Competition from Lower-Cost Alternatives

Price remains a major barrier to adoption, especially in small agriculture projects and budget-constrained construction sites. Many users opt for temporary, cheaper solutions such as loose mulch, rock cover, or basic synthetic nets instead of engineered blankets. While these alternatives offer lower upfront cost, they reduce long-term stability, yet buyers in cost-sensitive markets still choose them. Transportation costs for bulky blanket rolls also increase project expenses in remote areas. These factors create resistance to switching from low-cost erosion methods to higher-performing blankets. As a result, market penetration remains uneven, particularly in developing regions where cost remains the primary decision factor.

Regional Analysis:

North America

North America held the largest share in 2024 with about 38% of the Erosion Control Blankets Market. Strong infrastructure spending, highway maintenance programs, and strict erosion-control regulations boosted large-scale adoption. Federal and state agencies enforced sediment control standards, pushing contractors to use certified natural and synthetic blankets. The region also saw high use in pipeline corridors, mining restoration, and wildfire rehabilitation projects. Strong preference for biodegradable materials supported growth in jute and coir blankets. Well-established manufacturers and advanced engineering practices further strengthened North America’s leading position across public and private land-development activity.

Europe

Europe accounted for nearly 27% share in 2024, supported by strict environmental regulations and sustainable land management policies. Countries such as Germany, the U.K., and France implemented strong controls on soil runoff, driving adoption in transport projects and riverbank protection. Reforestation programs and post-flood restoration also created consistent demand. The region favored biodegradable mats due to EU sustainability directives, encouraging use of jute, coir, and hybrid blankets. Growth in renewable energy sites, including wind farms and solar parks, added new installation zones. Extensive green-infrastructure initiatives helped Europe maintain a strong, regulation-driven market presence.

Asia-Pacific

Asia-Pacific captured about 24% share in 2024, driven by major road construction, land development, and riverbank protection projects. China, India, Japan, and Southeast Asian countries expanded hillside infrastructure, which increased erosion exposure. Government-led afforestation programs and watershed restoration efforts also boosted demand for natural fiber blankets. Rapid urbanization pushed heavy earthmoving activity, raising the need for slope stabilization. However, cost-sensitive buyers often favored low-cost alternatives, slowing adoption in rural zones. Despite this, strong population growth, land conversion, and climate-intensified rainfall patterns continue to position Asia-Pacific as one of the fastest-growing regional markets.

Latin America

Latin America held roughly 7% share in 2024, supported by land restoration, mining rehabilitation, and hillside agriculture. Countries such as Brazil, Chile, and Colombia increased environmental restoration work, which boosted blanket adoption. Mining operations in the Andean region used erosion blankets for tailing slopes and disturbed land. Urban expansion around major cities also contributed to new installations. However, limited contractor training and budget constraints slowed penetration across rural areas. Growing interest in reforestation, watershed repair, and sustainable farming practices is expected to create steady project-based demand in the region.

Middle East & Africa

The Middle East & Africa region accounted for about 4% share in 2024, driven by infrastructure development, land stabilization, and desert reclamation programs. Gulf countries increased road and utility construction, which required erosion-control solutions on embankments and sandy slopes. Africa saw rising use in mining rehabilitation and community reforestation projects. However, adoption remained slower due to climate extremes, limited awareness, and cost barriers. Government-led land restoration efforts in North Africa and water-management projects in East Africa are gradually improving demand. Expanding construction and environmental initiatives support long-term growth across diverse terrains in the region.

Market Segmentations:

By Type

- Natural Fiber

- Synthetic Fiber

- Compost Mat

- Jute

By Application

- Soil Erosion Prevention

- Reforestation

- Landfill Restoration

- Slope Stabilization

By End Use

- Agriculture

- Construction

- Mining

- Land Development

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the Erosion Control Blankets Market features a mix of global manufacturers and regional specialists focused on soil stabilization, sustainable materials, and engineered performance solutions. Key players such as Hydroseeding Ltd, Contech Engineered Solutions LLC, Cherokee Manufacturing, ABG Ltd, L & M Supply Co, American Excelsior, Hydroseal LLC, Bonterra, EastCoastErosion.com, and Erosion Control Blankets strengthen competition through diverse product portfolios covering natural fiber, synthetic, and hybrid blanket designs. Companies invest in advanced stitching methods, improved tensile strength, and customizable roll formats to meet varied terrain and climate requirements. Many suppliers expand production capacity to support rising infrastructure and restoration projects. Sustainability goals push leading manufacturers to innovate biodegradable solutions, while distributors enhance market reach through stronger contractor networks and training programs. Partnerships with environmental agencies, construction firms, and land developers

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In November 2025, Bonterra promoted PP-reinforced erosion control blankets for infrastructure projects in Uganda, highlighting soil stabilization and vegetation support benefits for roads, embankments, and drainage systems in East Africa.

- In April 2025, Contech won nine project‑of‑the‑year awards at the 13th Annual National Corrugated Steel Pipe Association (NCSPA) meeting reflecting strong performance in infrastructure and civil‑engineering projects.

- In March 2024, Hydroseal LLC Hydroseal introduced biodegradable geosynthetics, including mulch mats made from natural plant fibers, as a compostable alternative to conventional synthetic erosion-control products, strengthening its sustainable blankets and mats portfolio

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for erosion control blankets will rise as infrastructure and road expansion projects increase.

- Natural fiber blankets will gain stronger adoption due to sustainability and biodegradability goals.

- Hybrid blankets combining natural and synthetic fibers will see wider use for high-slope stabilization.

- Governments will enforce stricter erosion and sediment control rules across construction sites.

- Reforestation and land-restoration programs will remain major demand drivers in developing regions.

- Mining and landfill rehabilitation projects will expand blanket usage for long-term slope stability.

- Advancements in stitching, tensile strength, and UV resistance will improve product performance.

- Manufacturers will strengthen distribution networks to improve availability in remote markets.

- Digital modeling tools will guide better blanket selection based on soil and slope conditions.

- Asia-Pacific will emerge as a fast-growing market due to rapid land development and climate-driven erosion risks.