Market Overview

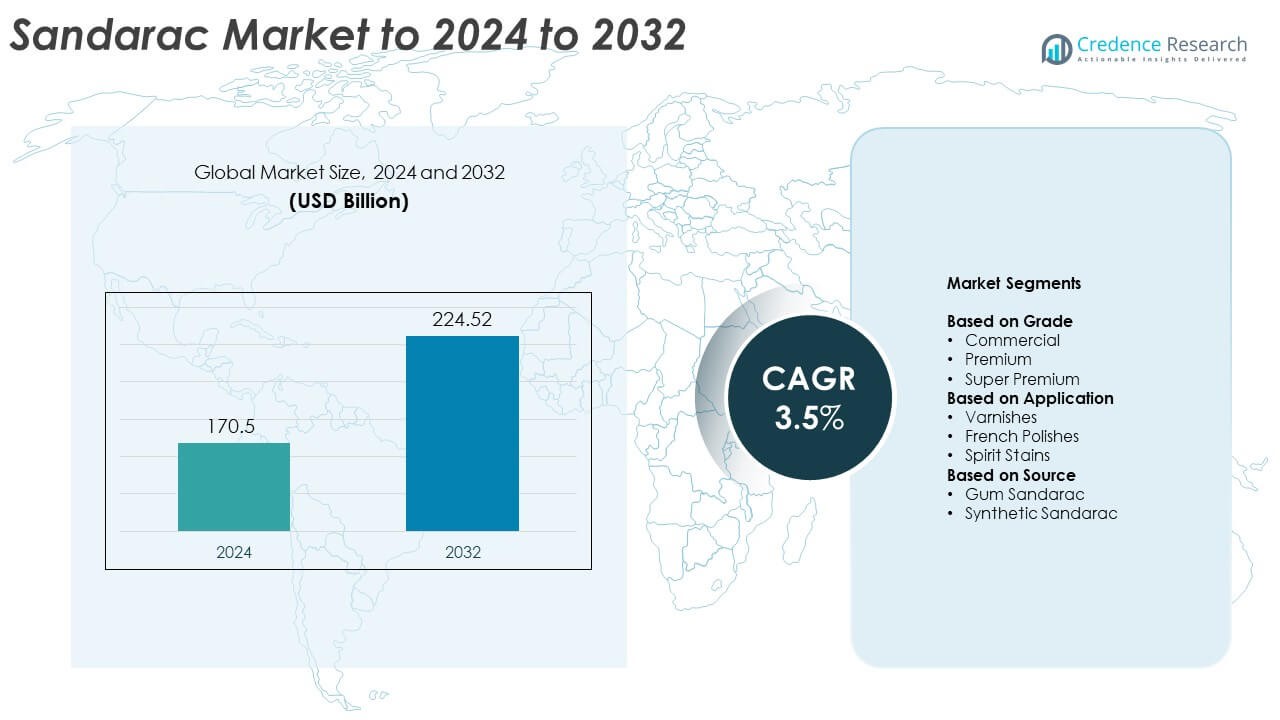

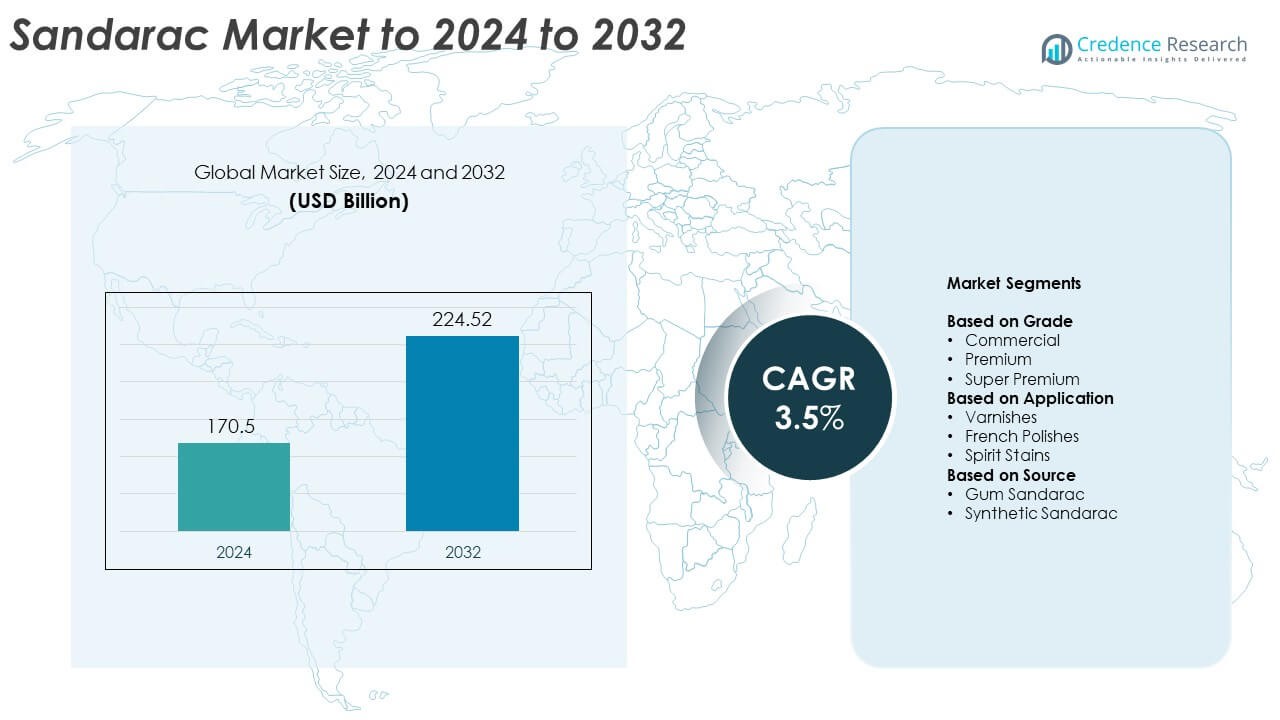

The Sandarac market size was valued at USD 170.5 billion in 2024 and is anticipated to reach USD 224.52 billion by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sandarac Market Size 2024 |

USD 170.5 Billion |

| Sandarac Market, CAGR |

3.5% |

| Sandarac Market Size 2032 |

USD 224.52 Billion |

The Sandarac market is characterized by strong competition among leading players such as Arkema S.A., PPG, BASF SE, Ashland Global Holdings Inc., Eastman Chemical Company, Huntsman Corporation, Solvay S.A., and AkzoNobel N.V. These companies focus on sustainable resin innovations, bio-based coating solutions, and advanced formulation technologies to meet rising demand across premium wood finishes, cosmetics, and fine art restoration. Strategic collaborations and R&D investments are key strategies to enhance performance and expand market reach. Regionally, Europe led the global market with a 31% share in 2024, supported by robust demand from luxury coatings, natural varnishes, and green chemistry applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sandarac market was valued at USD 170.5 billion in 2024 and is projected to reach USD 224.52 billion by 2032, growing at a CAGR of 3.5%.

- Rising demand for natural and sustainable resins across varnishes, cosmetics, and art restoration is driving market growth.

- Key trends include growing use of bio-based coating materials, development of synthetic Sandarac alternatives, and focus on eco-friendly production methods.

- The market is moderately consolidated, with major players investing in innovation, sustainable sourcing, and hybrid resin formulations to maintain competitiveness.

- Europe led with a 31% share in 2024, followed by North America at 27% and Asia-Pacific at 25%, while the gum Sandarac segment dominated globally with a 64% share.

Market Segmentation Analysis:

By Grade

The premium segment dominated the Sandarac market with a 46% share in 2024. This segment’s leadership stems from its widespread use in high-quality varnishes and fine art restoration due to its superior transparency and hardness. Manufacturers prefer premium-grade Sandarac for creating long-lasting, glossy finishes on wood and paintings. Demand is rising from the luxury furniture and instrument sectors that value natural resins with excellent aging resistance. Increased adoption in high-end coating formulations continues to strengthen the premium segment’s market position globally.

- For instance, according to Kremer Pigmente’s technical data sheets, sandarac (item #60100) has an acid value generally between 140 and 154 mg KOH/g.

By Application

The varnishes segment held the largest share of 52% in 2024, driven by its extensive use in wood coatings, antique restoration, and musical instruments. Sandarac-based varnishes are valued for their natural gloss, durability, and resistance to humidity and alcohol. The increasing preference for bio-based and low-VOC coating materials has enhanced demand for traditional resins like Sandarac. Growing usage among art conservators and niche furniture makers further supports segment growth, particularly in Europe and North America.

- For instance, Liberon states its Easy French Polish covers 8–12 m²/L and dries in 3–4 hours, supporting varnish demand across restoration and instruments.

By Source

The gum Sandarac segment accounted for 64% of the market share in 2024, dominating due to its natural origin and superior resin purity. Extracted from Tetraclinis articulata trees in North Africa, gum Sandarac remains highly sought after in the premium coating and polish industries. Its natural hardness and aromatic quality make it ideal for traditional craftsmanship and eco-friendly product formulations. Rising consumer preference for plant-derived raw materials and sustainable resins continues to drive growth in this segment.

Key Growth Drivers

Rising Demand for Natural and Sustainable Resins

The increasing preference for bio-based and eco-friendly materials is a major growth driver for the Sandarac market. Consumers and manufacturers are shifting toward natural resins due to stricter environmental regulations and sustainability goals. Sandarac, derived from natural tree gum, offers biodegradability and low toxicity compared to synthetic alternatives. Its demand is rising in premium wood coatings, cosmetics, and fine art restoration, where sustainability and purity are key selling points, enhancing long-term market expansion.

- For instance, Covestro reports Decovery® resins with up to 52% plant-based content, verified by ¹⁴C testing, reflecting a shift to bio-based coatings.

Growing Applications in Varnishes and Polishes

Sandarac’s unique properties, such as high gloss and resistance to alcohol and moisture, make it ideal for varnishes and French polishes. The expanding luxury furniture, musical instrument, and fine art sectors are increasing consumption of Sandarac-based finishes. As manufacturers seek natural alternatives to synthetic coatings, this segment continues to grow. Rising use in artisanal and high-end wood finishing further supports market demand across Europe and Asia-Pacific.

- For instance, Hammerl (JOHA®) specifies oil varnish drying of ~1–6 days per coat, showing sustained use of natural-resin finishes in high-end woodwork.

Expansion in the Cosmetics and Fragrance Sector

The use of Sandarac resin as a natural fixative in perfumes and cosmetic formulations is boosting market growth. Its pleasant aroma, film-forming ability, and compatibility with essential oils make it suitable for organic personal care products. With consumers favoring natural ingredients, cosmetic brands are increasingly replacing synthetic polymers with Sandarac-based formulations. The clean-label movement and growing luxury fragrance market are driving adoption, especially in Europe and the Middle East.

Key Trends and Opportunities

Rising Adoption of Synthetic Sandarac Alternatives

Advancements in synthetic Sandarac are creating new opportunities for large-scale industrial applications. Synthetic versions replicate the natural resin’s performance while offering consistent quality and reduced supply risk. Manufacturers are investing in lab-derived resins for use in coatings and adhesives to ensure price stability and scalability. This trend supports broader adoption in automotive coatings and specialty varnishes while maintaining environmental compliance.

- For instance, BASF’s Laropal® A 81 (synthetic aldehyde resin) has a softening range of 80–95 °C and density ~1.1 g/cm³, widely used as a conservation varnish alternative.

Integration into Bio-based Coatings and Green Chemistry

Sandarac’s compatibility with bio-based solvents and resins aligns with the ongoing shift toward green chemistry. Companies are developing hybrid formulations combining Sandarac with other natural components to enhance flexibility and performance. Growing regulatory support for sustainable coatings in Europe and North America offers opportunities for innovation. This trend is expected to attract new entrants focusing on eco-friendly material development and niche applications in decorative finishes.

- For instance, AkzoNobel highlights GREENGUARD Gold-certified coatings. The GREENGUARD Gold certification program requires the Total Volatile Organic Compound (TVOC) emission rate to be less than or equal to 220 µg/m³ (0.22 mg/m³) under UL 2818.

Key Challenges

Limited Supply of Natural Raw Material

The supply of natural gum Sandarac is restricted to specific regions in North Africa, mainly Morocco and Algeria. Limited tree availability and climatic dependence affect production volumes, leading to supply fluctuations. Overharvesting also poses environmental concerns, making sustainability certification vital for export markets. The resulting price volatility and inconsistent quality hinder market stability, compelling manufacturers to explore synthetic alternatives for long-term resilience.

Competition from Synthetic and Substitute Resins

Increasing availability of synthetic resins like alkyds, shellac, and acrylics presents a major challenge for Sandarac producers. These materials offer lower costs, uniform quality, and easier sourcing compared to natural resins. Industrial users prefer substitutes for high-volume applications due to better scalability and process efficiency. To sustain competitiveness, Sandarac manufacturers must focus on niche, premium applications and highlight natural, aesthetic, and environmental advantages.

Regional Analysis

North America

North America accounted for 27% of the Sandarac market share in 2024, driven by the rising demand for natural varnishes and premium wood coatings. The United States leads due to growing adoption in luxury furniture restoration, fine arts, and eco-friendly cosmetic formulations. The region benefits from increasing consumer awareness of sustainable and bio-based materials. Expanding applications in niche markets such as musical instruments and artisanal crafts also support regional growth. The presence of several premium coating manufacturers and distributors further strengthens North America’s position in the global market.

Europe

Europe held a 31% share of the Sandarac market in 2024, emerging as the leading regional market. Strong demand from the wood finishing, perfume, and fine art restoration sectors drives growth. France, Italy, and Germany dominate consumption due to their established luxury goods industries and preference for natural ingredients. Government policies promoting green materials and reduced chemical emissions support market expansion. Increasing investments in heritage restoration projects and premium woodcraft applications also boost demand across the region, reinforcing Europe’s leadership in natural resin-based coatings and polishes.

Asia-Pacific

Asia-Pacific captured 25% of the Sandarac market share in 2024, supported by rising production and consumption of wood coatings and decorative finishes. China, Japan, and India are key contributors due to growing manufacturing capabilities and expanding furniture industries. Increasing demand for bio-based coating materials and natural resins is influencing local manufacturers to adopt Sandarac in premium applications. The growth of sustainable cosmetic and fragrance industries across Japan and South Korea also contributes significantly. Rapid urbanization and export-oriented manufacturing are likely to enhance regional market potential.

Latin America

Latin America represented 10% of the Sandarac market share in 2024, with growing adoption in furniture, crafts, and cosmetic products. Brazil and Mexico lead the market, driven by the increasing use of natural resins in decorative coatings and sustainable formulations. Rising exports of eco-friendly varnishes and polishes support regional demand. The availability of raw materials and emerging artisanal industries contribute to local market expansion. Increasing investments in small-scale resin processing facilities are also improving supply capabilities, supporting long-term regional growth opportunities.

Middle East & Africa

The Middle East & Africa accounted for 7% of the Sandarac market share in 2024, primarily driven by the natural gum Sandarac supply from North African countries. Morocco and Algeria are major sources, supporting both domestic use and exports to Europe and Asia. The region benefits from rising interest in sustainable resin harvesting and certification initiatives. Increasing utilization in traditional crafts, regional perfumery, and religious artifacts further drives demand. Growing awareness of eco-friendly materials and expanding international trade are expected to strengthen the region’s future market presence.

Market Segmentations:

By Grade

- Commercial

- Premium

- Super Premium

By Application

- Varnishes

- French Polishes

- Spirit Stains

By Source

- Gum Sandarac

- Synthetic Sandarac

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sandarac market features a moderately consolidated competitive landscape, with major players such as Arkema S.A., PPG, Ashland Global Holdings Inc., BASF SE, and others leading global supply and innovation efforts. These companies focus on developing sustainable resin technologies and advanced coating solutions to meet the growing demand for natural and eco-friendly materials. Industry participants are investing in R&D to enhance product performance, improve resin purity, and expand bio-based coating applications. Strategic partnerships with varnish, cosmetic, and fragrance manufacturers are helping firms strengthen distribution networks and brand presence. Many producers are also shifting toward sustainable sourcing and synthetic alternatives to overcome raw material constraints linked to limited tree-based resin supply. Additionally, advancements in hybrid resin formulations and digitalized manufacturing processes are fostering competition and differentiation. Overall, the market is driven by innovation, product quality enhancement, and environmental compliance across major production and end-use regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema S.A.

- PPG

- Ashland Global Holdings Inc.

- BASF SE

- Eastman Chemical Company

- Huntsman Corporation

- Solvay S.A.

- Lanxess AG

- Clariant AG

- The Dow Chemical Company

- Croda International Plc

- Kemira Oyj

- AkzoNobel N.V.

- DuPont de Nemours, Inc.

- Evonik Industries AG

Recent Developments

- In 2025, Kemira continued to focus on innovative and sustainable fiber-based solutions, particularly in its Packaging & Hygiene Solutions business unit.

- In 2024, PPG announced and completed the sale of its silicas products business to Qemetica and its U.S. and Canada architectural coatings business to American Industrial Partners.

- In 2024, Arkema Finalized acquisition of Dow’s flexible packaging laminating adhesives business strengthening Arkema’s adhesive solutions.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sandarac market will expand steadily with increasing preference for natural and sustainable resins.

- Growing applications in premium varnishes and furniture finishes will drive long-term demand.

- Rising use in eco-friendly cosmetics and perfumes will strengthen market opportunities.

- Synthetic Sandarac development will help reduce supply limitations and ensure product consistency.

- North Africa’s production capacity expansion will support stable global supply chains.

- Adoption of bio-based coating technologies will enhance Sandarac’s role in green formulations.

- Emerging demand from luxury and artisanal sectors will sustain premium pricing trends.

- Strategic partnerships between resin suppliers and coating manufacturers will improve market reach.

- Increasing restoration activities in heritage architecture will boost product utilization.

- Continuous innovation in hybrid natural-synthetic blends will improve performance and market competitiveness.