Market Overview

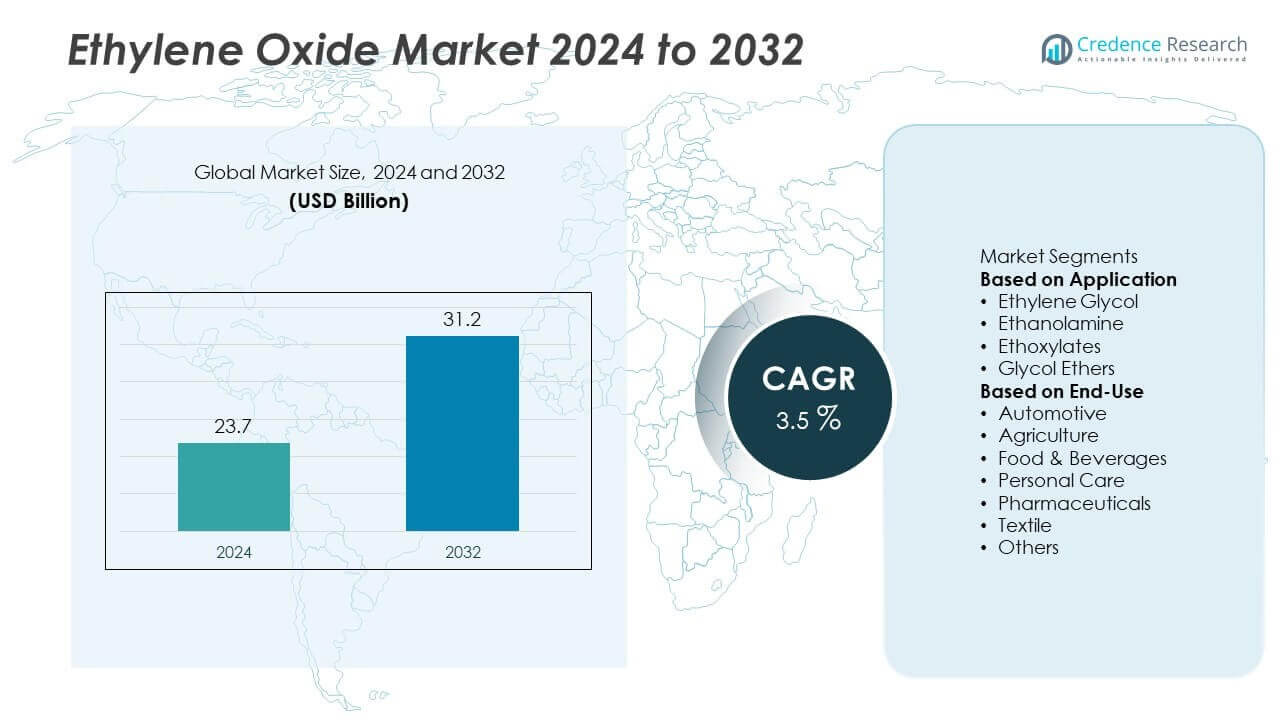

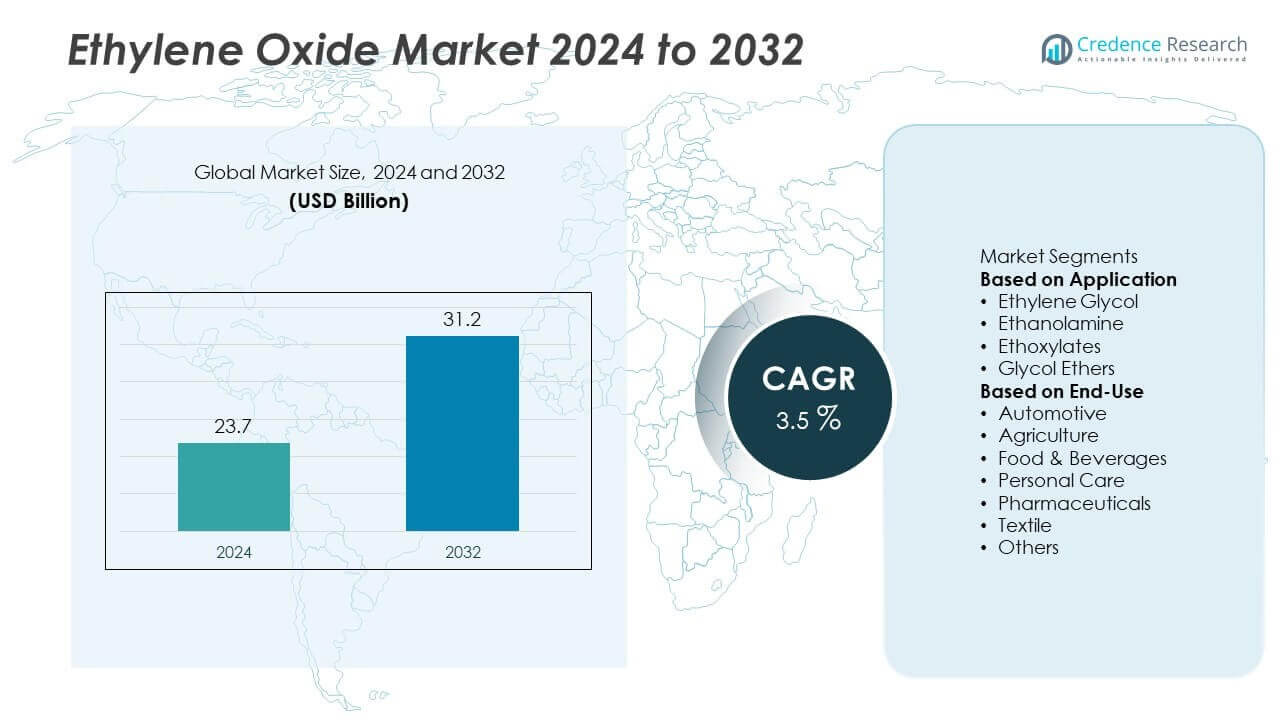

The Ethylene Oxide Market size was valued at USD 23.7 billion in 2024 and is projected to reach USD 31.2 billion by 2032, expanding at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethylene Oxide Market Size 2024 |

USD 23.7 Billion |

| Ethylene Oxide Market, CAGR |

14.80% |

| Ethylene Oxide Market Size 2032 |

USD 31.2 Billion |

The Ethylene Oxide Market grows steadily due to rising demand for ethylene glycol in polyester fibers, PET resins, and automotive coolants. Expanding applications in healthcare, particularly in sterilization of medical devices, further support growth.

The Ethylene Oxide Market demonstrates broad geographical distribution, with Asia-Pacific leading growth due to strong consumption in textiles, packaging, and industrial chemicals. China dominates production and demand, while India and Southeast Asian countries show rapid adoption in healthcare and detergents. North America maintains steady demand supported by a mature automotive sector, advanced healthcare systems, and significant consumption of surfactants and glycol derivatives. Europe emphasizes sustainability and strict regulatory compliance, driving innovation in safer and eco-friendly production technologies. Latin America and the Middle East & Africa show rising opportunities supported by industrial development, petrochemical expansion, and increasing use of sterilization in healthcare. It benefits from strong regional diversity, ensuring consistent demand across industries. Key players such as BASF SE, Dow, Shell plc, and Reliance Industries Ltd. focus on capacity expansion, technological advancement, and sustainability initiatives, strengthening their competitive positioning in both established and emerging markets worldwide.

Market Insights

- Ethylene Oxide Market size was valued at USD 23.7 billion in 2024 and is projected to reach USD 31.2 billion by 2032, growing at a CAGR of 3.5%.

- Strong drivers include rising demand for ethylene glycol in polyester fibers, PET resins, and antifreeze applications, along with expanding usage in healthcare sterilization.

- Key trends highlight a shift toward sustainable and safer production processes, adoption of advanced catalysts, and rising use of ethylene oxide derivatives in personal care and household products.

- Competitive dynamics feature global players such as BASF SE, Dow, Shell plc, and Reliance Industries Ltd., which focus on capacity expansions, technological innovations, and compliance with regulatory frameworks.

- Restraints include health and safety concerns due to the hazardous nature of ethylene oxide, stringent environmental regulations, and raw material price volatility linked to crude oil and natural gas.

- Asia-Pacific dominates consumption with high demand from textile, packaging, and chemical industries, while North America shows steady adoption in automotive, healthcare, and personal care sectors.

- Europe emphasizes regulatory-driven innovation and sustainable production, while Latin America and the Middle East & Africa offer emerging opportunities through industrial expansion, petrochemical projects, and growing healthcare applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from the Ethylene Glycol Industry

The Ethylene Oxide Market grows steadily with strong demand from the ethylene glycol industry. Ethylene glycol is widely used in the production of polyester fibers, PET resins, and antifreeze solutions. It plays a vital role in the textile and packaging industries that require large-scale supply. Expanding e-commerce activity boosts PET demand, strengthening consumption of ethylene oxide in resin production. Rising global textile demand, supported by population growth and urbanization, further accelerates consumption. This driver continues to anchor the long-term growth trajectory of ethylene oxide.

- For instance, Indorama Ventures, a major global manufacturer and consumer of mono-ethylene glycol (MEG), utilizes this chemical in its global polyester and PET operations, with MEG being produced from ethylene oxide (EO) as the critical upstream feedstock.

Expanding Applications in Healthcare and Sterilization

The healthcare industry supports significant growth in the Ethylene Oxide Market. Ethylene oxide is one of the most effective sterilizing agents for medical devices and surgical instruments. It ensures safety by eliminating microorganisms while preserving product quality. Rising demand for single-use medical devices and increased hospital procedures strengthen market needs. It also supports sterilization in pharmaceuticals and packaging for sensitive healthcare products. With growing healthcare infrastructure in developing nations, ethylene oxide adoption continues to expand steadily.

- For instance, in 2023, Sterigenics, a Sotera Health company, reported $667 million in net revenues for its sterilization services using methods including EO, gamma, and E-beam. Sotera Health is the second-largest provider in the sterilization services market.

Growth in Specialty Chemicals and Surfactants Production

The Ethylene Oxide Market benefits from its extensive use in the production of surfactants and specialty chemicals. Surfactants derived from ethoxylates are essential in detergents, cleaning agents, and personal care products. It supports consumer demand for hygiene and home care products worldwide. Specialty chemicals derived from ethylene oxide also find application in agrochemicals, lubricants, and emulsifiers. Rising industrialization and consumer demand for convenience products enhance growth. This broad chemical base reinforces the importance of ethylene oxide across industries.

Infrastructure Development and Industrial Expansion

Industrial expansion and infrastructure growth create new opportunities for the Ethylene Oxide Market. Construction industries rely on ethylene oxide derivatives used in paints, adhesives, and coatings. It strengthens performance in applications where durability and resistance are critical. Expanding industrial projects in Asia-Pacific, Latin America, and the Middle East support higher adoption. Rapid economic growth in these regions drives consumption of ethylene oxide in multiple end-use sectors. Continuous investment in industrial chemicals ensures ethylene oxide remains a key input for global growth.

Market Trends

Shift Toward Safer and Sustainable Production Processes

The Ethylene Oxide Market shows a strong trend toward safer and environmentally sustainable production practices. Producers face regulatory pressures to reduce emissions and manage the hazardous nature of ethylene oxide. It encourages investment in advanced containment systems and eco-friendly technologies. Companies are adopting cleaner catalysts and energy-efficient methods to meet environmental goals. Governments emphasize stricter safety compliance, pushing innovation in production facilities. This trend ensures long-term viability while addressing environmental and health concerns.

- For instance, Shell’s OMEGA process achieves a mono-ethylene glycol (MEG) selectivity of 99.3–99.5% from ethylene oxide (EO), compared to conventional thermal hydration methods with a selectivity of around 90%. This significantly reduces the formation of by-products like di- and tri-ethylene glycol and also lowers CO₂ emissions per tonne of product by reducing energy-intensive steam and wastewater usage.

Rising Adoption in the Personal Care and Household Sector

Demand for ethylene oxide-based derivatives grows in personal care and household cleaning applications. Surfactants, detergents, and emulsifiers produced from ethoxylates gain wider usage across consumer markets. It supports the increasing focus on hygiene, especially after global health concerns. Rising disposable incomes in developing countries boost sales of premium personal care and cleaning products. Producers expand product portfolios to meet specific performance requirements in these sectors. The trend strengthens ethylene oxide’s role in daily consumer goods.

- For instance, in 2023, BASF increased its European alkoxylation capacity in Antwerp and Ludwigshafen by “well in excess of 150,000 metric tons per year” to serve various industries, including household detergents and personal care. The company operates a global production network for alkoxylates (a type of ethoxylate) to supply these key ingredients to its customers.

Technological Advancements in End-Use Industries

Innovation in downstream industries drives demand within the Ethylene Oxide Market. Manufacturers of polyester fibers, PET resins, and specialty chemicals adopt advanced processes that rely heavily on ethylene oxide derivatives. It enables higher product performance, energy efficiency, and cost reduction in applications. Automation and digital monitoring in chemical plants improve consistency and safety in production. Industries integrate ethylene oxide into more complex product formulations to enhance durability and quality. This trend expands the range of applications supported by ethylene oxide.

Expanding Role in Developing Economies

Emerging economies create strong growth opportunities for the Ethylene Oxide Market. Rapid industrialization in Asia-Pacific, Latin America, and the Middle East increases consumption across textiles, packaging, and healthcare. It benefits from government-backed infrastructure projects and rising consumer demand for packaged goods. Local producers invest in capacity expansions to reduce reliance on imports and serve domestic markets. Growth of healthcare systems in these regions boosts ethylene oxide usage in medical sterilization. This regional expansion strengthens the global footprint of ethylene oxide applications.

Market Challenges Analysis

Health, Safety, and Environmental Concerns

The Ethylene Oxide Market faces persistent challenges due to the hazardous nature of the compound. Ethylene oxide is highly flammable, toxic, and classified as a potential carcinogen, which raises concerns for workers and surrounding communities. It requires strict handling, storage, and transportation standards, significantly increasing compliance costs. Regulatory agencies in North America and Europe enforce stringent monitoring, restricting flexibility for manufacturers. Public concerns over exposure risks intensify pressure on producers to adopt safer practices. Investments in advanced safety infrastructure are necessary, but they increase operational costs and limit smaller players. These challenges continue to shape the industry’s growth outlook.

Raw Material Volatility and Supply Chain Risks

Dependence on petrochemical feedstocks exposes the Ethylene Oxide Market to raw material price volatility. Crude oil and natural gas fluctuations directly impact ethylene availability, creating uncertainty for producers. It disrupts long-term supply agreements and increases costs for downstream industries. Geopolitical instability and trade restrictions further intensify supply chain risks. Rising freight costs and shipping disruptions also affect timely delivery of ethylene oxide and its derivatives. Manufacturers are under pressure to diversify feedstock sources and enhance supply resilience. These risks complicate planning and pose barriers to consistent profitability in the global market.

Market Opportunities

Expansion in Healthcare and Sterilization Applications

The Ethylene Oxide Market presents strong opportunities in the healthcare sector, particularly in sterilization applications. Medical devices, surgical tools, and pharmaceutical packaging rely heavily on ethylene oxide due to its effectiveness in eliminating microorganisms. It maintains the integrity of sensitive materials that cannot withstand heat or radiation sterilization. Rising global healthcare expenditure and growth of hospital infrastructure in developing nations strengthen demand. Increasing adoption of single-use medical devices also creates long-term opportunities for producers. Continuous innovation in sterilization technologies reinforces the importance of ethylene oxide in modern healthcare systems.

Growth Potential in Emerging Economies and Consumer Industries

Emerging economies provide significant growth prospects for the Ethylene Oxide Market. Rapid industrialization in Asia-Pacific, Latin America, and the Middle East boosts consumption across textiles, packaging, and chemicals. It benefits from growing demand for detergents, surfactants, and personal care products driven by rising income levels. Expansion of e-commerce fuels demand for PET-based packaging, further increasing ethylene oxide use. Local producers in developing regions invest in capacity expansions to reduce import reliance and capture domestic demand. This combination of consumer-driven growth and industrial expansion creates strong opportunities for ethylene oxide producers worldwide.

Market Segmentation Analysis:

By Application

The Ethylene Oxide Market is segmented by application into ethylene glycol, surfactants, ethanolamines, glycol ethers, and sterilants. Ethylene glycol dominates usage, supported by large-scale demand in polyester fiber, PET resin, and automotive coolants. It remains the most critical application, anchoring the long-term growth trajectory of the market. Surfactants represent another major application, driven by their use in detergents, cleaning agents, and personal care products. Ethanolamines derived from ethylene oxide play an important role in agrochemicals, gas treatment, and industrial formulations. Glycol ethers support demand in paints, coatings, and adhesives, particularly in construction and automotive industries. Sterilants show increasing adoption in medical and pharmaceutical sectors, where ethylene oxide ensures reliable disinfection without damaging sensitive materials. Each application segment reflects the versatility of ethylene oxide in industrial, consumer, and healthcare fields.

- For instance, Dow is a leading chemical manufacturer that produces ethylene oxide (EO), a key intermediate in the chemical industry. While no single company is likely to have an annual output of 3 million tonnes, Dow is a significant global producer, with its production supporting downstream applications worldwide.

By End-Use

End-use industries of the Ethylene Oxide Market include textiles, automotive, healthcare, personal care, construction, and chemicals. The textile industry drives large-scale demand through polyester fibers, supported by urbanization and rising global consumption of affordable fabrics. It also supports PET-based packaging needs in the consumer goods and e-commerce sectors. The automotive sector depends on ethylene oxide derivatives for antifreeze, coolants, lubricants, and coatings that ensure performance and durability. Healthcare remains a critical end-use, with ethylene oxide widely applied in medical sterilization and pharmaceutical packaging. Personal care and household products such as shampoos, detergents, and cleaners strengthen consistent demand. Construction relies on ethylene oxide derivatives in adhesives, paints, and sealants for infrastructure projects. The chemicals sector integrates ethylene oxide into specialty products that support agriculture, industrial processing, and energy applications. This broad base of industries highlights the compound’s importance as a key building block in global production networks.

- For instance, Sterigenics, part of Sotera Health, sterilizes over 20 billion medical devices in the U.S. each year using ethylene oxide (EO), a figure representing about 50% of all sterile medical devices in that market. Meanwhile, BASF is a major global producer of ethoxylates used in detergents, cleaners, and other products for personal care and household markets.

Segments:

Based on Application

- Ethylene Glycol

- Ethanolamine

- Ethoxylates

- Glycol Ethers

Based on End-Use

- Automotive

- Agriculture

- Food & Beverages

- Personal Care

- Pharmaceuticals

- Textile

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 25% share of the Ethylene Oxide Market in 2024, supported by a strong industrial base and advanced infrastructure. The United States leads the region, driven by high demand for ethylene glycol used in polyester fibers, PET resins, and automotive coolants. It benefits from a mature automotive sector that consumes large volumes of antifreeze and lubricants derived from ethylene oxide. Canada contributes with increasing applications in healthcare and medical sterilization, supported by rising demand for single-use medical devices. Investments in modern chemical plants and compliance with strict safety standards strengthen the region’s production landscape. Rising demand for detergents and personal care products also contributes to steady growth. North America’s emphasis on safety and sustainability ensures consistent innovation in production and end-use applications.

Europe

Europe accounts for a 20% share of the Ethylene Oxide Market, shaped by strict regulatory frameworks and growing demand in specialty chemicals. Germany, France, and the United Kingdom remain major contributors due to their advanced automotive and healthcare industries. It benefits from established demand for paints, coatings, and adhesives in the construction sector. The region focuses heavily on sustainable practices, driving innovation in ethylene oxide production processes. Eastern European countries such as Poland and Hungary see rising consumption, supported by industrial expansion. Healthcare remains a strong driver, with ethylene oxide widely used in sterilization of medical instruments. Europe balances compliance with high product demand, making it a steady but highly regulated market.

Asia-Pacific

Asia-Pacific dominates with a 40% share of the Ethylene Oxide Market, making it the largest regional consumer. China leads demand with massive consumption in polyester fiber and PET resin industries serving both domestic and export markets. India follows with rising adoption in packaging, automotive, and healthcare applications. It benefits from high population density, strong urbanization trends, and expanding middle-class consumption. Southeast Asian countries including Vietnam, Indonesia, and Thailand strengthen growth through textile manufacturing and industrial applications. Japan and South Korea contribute with advanced chemical industries and healthcare adoption. Regional producers continue to expand capacity to meet rising demand both locally and internationally. Asia-Pacific’s rapid economic growth ensures it remains the most dynamic region for ethylene oxide.

Latin America

Latin America represents a 7% share of the Ethylene Oxide Market, supported by growing industrialization and rising demand in consumer goods. Brazil leads the region with strong applications in automotive, detergents, and packaging. Mexico contributes significantly with growth in manufacturing and chemical processing industries. It benefits from government programs promoting industrial expansion and increasing foreign investment. Other countries such as Argentina and Chile show steady growth with rising adoption in healthcare and construction. Limited local production capacity often creates reliance on imports, affecting cost structures. Despite these challenges, Latin America offers steady opportunities through population growth and rising disposable incomes.

Middle East & Africa

The Middle East & Africa account for an 8% share of the Ethylene Oxide Market, driven by abundant raw material availability and expanding petrochemical projects. Saudi Arabia and the United Arab Emirates lead the region with large-scale investments in ethylene oxide production facilities. It benefits from strong demand in construction, packaging, and detergents supported by rapid urban development. Africa shows rising adoption, with South Africa leading in healthcare sterilization and industrial chemicals. Countries like Egypt and Nigeria also demonstrate growing demand supported by population growth. Strategic location of Middle Eastern producers enhances exports to Europe and Asia-Pacific. The region continues to strengthen its role as both a major producer and growing consumer of ethylene oxide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Ethylene Oxide Market includes Shell plc, Reliance Industries Ltd., BASF SE, India Glycols Limited, Indorama Ventures Public Company Limited, LyondellBasell Industries Holdings B.V., NIPPON SHOKUBAI CO., LTD., Dow, INEOS, and Sinopec Shanghai Petrochemical Company Limited. These companies compete on the basis of large-scale production capacity, technological advancement, and global supply networks. It is shaped by rising demand for ethylene glycol, surfactants, and sterilants that drive continuous investment in capacity expansions. Leading producers emphasize safer and more sustainable manufacturing processes to comply with strict environmental and safety regulations. Integration across petrochemical value chains enables efficiency and cost optimization, particularly in regions with access to low-cost feedstocks. Companies also focus on strategic collaborations, new plant developments, and modernization of existing facilities to maintain competitiveness. Innovation in catalysts and process technologies helps improve output while reducing emissions. The Ethylene Oxide Market remains highly competitive, with global leaders balancing compliance, efficiency, and innovation to secure long-term growth opportunities across diverse end-use sectors.

Recent Developments

- In August 2024, Reliance Industries Ltd. commissioned a new column in its EO plant, increasing capacity by 45,000 tonnes per annum.

- In 2024, BASF SE invested a “high double-digit million‑euro” amount in opening a Catalyst Development and Solids Processing Center in Ludwigshafen, facilitating pilot-scale EO catalyst innovation.

- In October 2023, BASF SE started operations of its expanded EO and derivatives complex at Antwerp, adding 400,000 tonnes per year of production capacity for EO and derivatives.

- In 2023, INEOS expanded capacity in the U.S. by acquiring LyondellBasell’s Bayport EO business, adding a 420,000 tpy ethylene oxide plant, a 375,000 tpy ethylene glycols plant, and a 165,000 tpy glycol ethers plant, strengthening vertical integration.

Report Coverage

The research report offers an in-depth analysis based on Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ethylene glycol in polyester fibers and PET resins will continue to drive growth.

- Healthcare sterilization applications will expand with rising use of single-use medical devices.

- Surfactants and detergents will see higher demand with growing hygiene and personal care needs.

- Technological innovation in catalysts and processes will improve efficiency and reduce emissions.

- Safety and environmental regulations will push adoption of cleaner and sustainable production methods.

- Asia-Pacific will maintain dominance with rapid industrialization and expanding textile and packaging sectors.

- North America and Europe will focus on compliance, innovation, and safer production facilities.

- Emerging economies in Latin America and Africa will offer new opportunities through industrial growth.

- Strategic partnerships and capacity expansions will strengthen global supply networks.

- Diversification into specialty chemicals and advanced formulations will broaden applications and market resilience.