Market Overview:

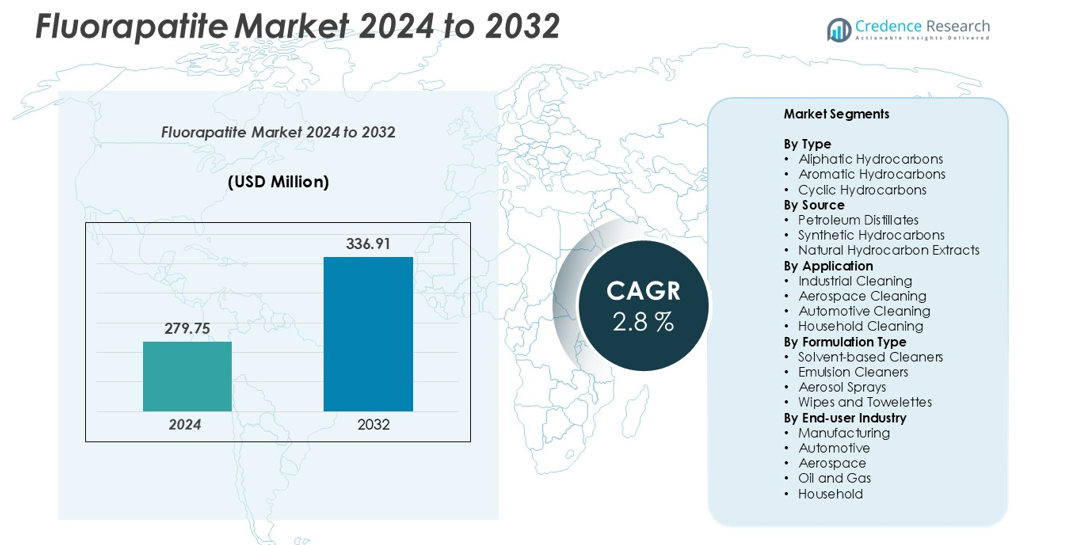

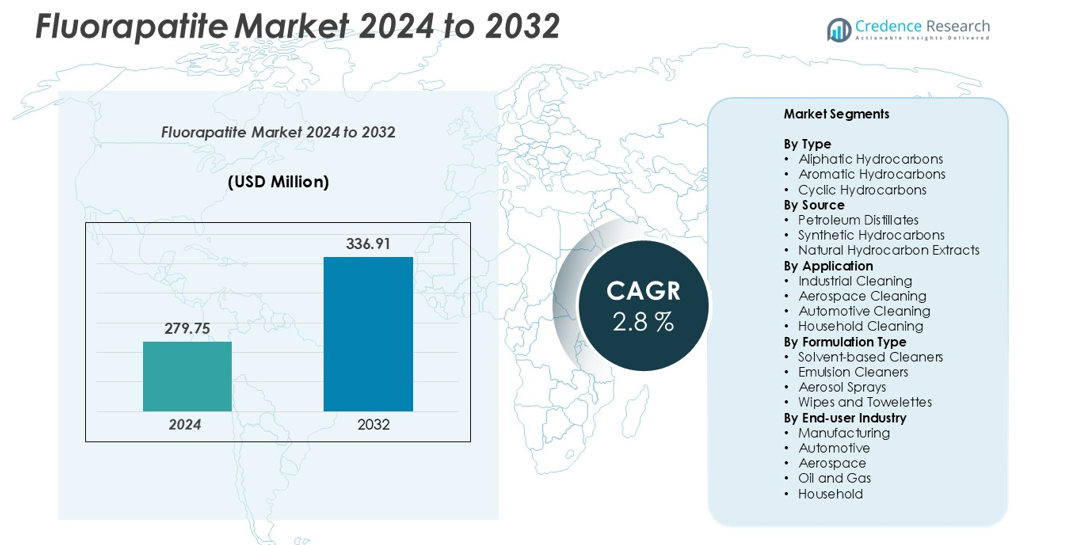

Fluorapatite market size was valued at USD 279.75 million in 2024 and is anticipated to reach USD 336.91 million by 2032, at a CAGR of 2.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorapatite Market Size 2024 |

USD 279.75 million |

| Fluorapatite Market, CAGR |

2.8% |

| Fluorapatite Market Size 2032 |

USD 336.91 million |

The Fluorapatite market is led by prominent companies including Crystal Classics, Dakota Matrix, GB Minerals, ICL, Sihui Feiilafeng Non-Metallic Mineral Materials, and Sihui Haichuan Non-Metallic Mineral Materials. These players drive growth through strategic expansions, technological advancements in extraction and processing, and partnerships with industrial and agricultural sectors. Asia-Pacific emerges as the dominant region, accounting for approximately 35% of the global market, fueled by high demand from China and India in fertilizer production and chemical industries. North America follows with around 28% market share, supported by industrial applications and stringent quality standards. Europe holds roughly 25%, driven by eco-friendly and specialty applications, while the Middle East & Africa and Latin America account for 7% and 5%, respectively, reflecting growing mining operations and agricultural development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fluorapatite market was valued at USD 279.75 million in 2024 and is projected to reach USD 336.91 million by 2032, growing at a CAGR of 2.8% during the forecast period.

- Market growth is driven by rising demand in fertilizer production and industrial applications, particularly in chemical manufacturing and specialty coatings, supported by technological advancements in extraction and processing.

- Key trends include the adoption of sustainable and eco-friendly production methods, expansion into emerging markets such as Asia-Pacific and Latin America, and integration into high-value specialty chemical applications.

- The competitive landscape is led by Crystal Classics, Dakota Matrix, GB Minerals, ICL, Sihui Feiilafeng Non-Metallic Mineral Materials, and Sihui Haichuan Non-Metallic Mineral Materials, with companies focusing on capacity expansion, partnerships, and product quality differentiation.

- Regional analysis shows Asia-Pacific as the largest market with ~35% share, followed by North America (~28%), Europe (~25%), Middle East & Africa (~7%), and Latin America (~5%), while aliphatic hydrocarbons dominate the type segment

Market Segmentation Analysis:

By Type

The Fluorapatite market, segmented by type, includes aliphatic hydrocarbons, aromatic hydrocarbons, and cyclic hydrocarbons. Among these, aliphatic hydrocarbons dominate, accounting for the largest market share due to their superior solubility and versatility in various industrial applications. Their widespread use in metal finishing, chemical synthesis, and specialized coatings drives demand. Increased adoption in environmentally compliant formulations and demand for high-purity hydrocarbon derivatives further fuels growth. Additionally, advancements in extraction technologies have enhanced yield and quality, reinforcing the preference for aliphatic hydrocarbons over aromatic and cyclic alternatives in key industrial sectors.

- For instance, ExxonMobil’s Product Solutions business leverages proprietary hydroprocessing and catalyst technologies to produce high-purity aliphatic fluids and solvents for various industrial applications, including coatings and polymers.

By Source

Segmenting the market by source, Fluorapatite is primarily derived from petroleum distillates, synthetic hydrocarbons, and natural hydrocarbon extracts. Petroleum distillates lead this segment, capturing the majority market share owing to their cost-effectiveness, availability, and consistent chemical properties. Rising industrial demand for high-efficiency solvents and cleaners, coupled with established refining infrastructure, supports this dominance. Moreover, ongoing innovations in refining processes enhance purity and performance, encouraging broader industrial adoption. Synthetic and natural extracts are gradually gaining traction, driven by sustainability initiatives and growing consumer preference for eco-friendly solutions.

- For instance, Shell finalized the sale of its Energy and Chemicals Park in Singapore, which includes assets on Pulau Bukom, to a joint venture between Indonesia’s Chandra Asri Group and Glencore in April 2025, with the facility now being called the Aster Chemicals and Energy Park.

By Application

The application segment of the Fluorapatite market spans industrial, aerospace, automotive, and household cleaning. Industrial cleaning represents the largest share, driven by the need for effective degreasing and maintenance of machinery across manufacturing, oil and gas, and chemical sectors. The increasing complexity of industrial equipment and emphasis on operational efficiency intensify demand for high-performance hydrocarbon-based cleaners. Aerospace and automotive applications are expanding due to precision cleaning requirements, while household use grows modestly, primarily influenced by rising consumer awareness of advanced cleaning solutions and regulatory emphasis on low-toxicity formulations.

Key Growth Drivers

Increasing Industrial Applications

Fluorapatite is witnessing substantial growth due to its expanding use in industrial applications, particularly in the production of fertilizers, chemicals, and specialty coatings. Its high phosphorus content and chemical stability make it a preferred material in phosphate-based manufacturing processes. Rising global demand for agricultural products is directly driving the consumption of fluorapatite in fertilizer production, especially for phosphate fertilizers. In addition, industries such as chemical processing, metallurgy, and electronics increasingly rely on high-purity fluorapatite for efficient operations. Technological advancements in refining and processing methods have improved the material’s yield, purity, and performance, further incentivizing its adoption. These factors collectively enhance the market’s growth trajectory, particularly in regions with strong industrial bases and agricultural activity.

- For instance, The Mosaic Company operates large phosphate beneficiation complexes in Florida, where it processes millions of metric tons of phosphate rock annually to support the production of phosphate-based fertilizers for global agricultural markets.

Technological Advancements in Extraction and Processing

Advancements in extraction and processing technologies have significantly bolstered the Fluorapatite market. Modern beneficiation techniques, including flotation, magnetic separation, and acid leaching, have improved the recovery rate and quality of fluorapatite, reducing impurities and enabling tailored particle sizes for diverse industrial applications. Automation and precision control in processing plants have optimized operational efficiency, reducing waste and energy consumption while ensuring consistent product quality. These technological innovations have expanded fluorapatite’s usability in high-demand sectors, such as advanced chemical manufacturing, specialty coatings, and high-performance fertilizers. Additionally, improvements in environmentally friendly processing methods are enabling compliance with stringent environmental regulations, attracting industries seeking sustainable sourcing. This combination of higher quality, reduced costs, and regulatory alignment is driving broader adoption and strengthening the market outlook globally.

- For instance, OCP Group’s Jorf Lasfar complex is a massive industrial hub that relies on a network of water-saving technologies, including a slurry pipeline from its mines and extensive water treatment and recycling, to reduce its environmental impact and conserve water.

Rising Demand from the Agriculture Sector

The agriculture sector remains a pivotal growth driver for the Fluorapatite market due to its critical role in fertilizer production. Phosphate fertilizers derived from fluorapatite provide essential nutrients that enhance crop yields and soil fertility, which are increasingly crucial amid growing global food demand. Expanding arable land in developing countries and modernization of farming practices are accelerating the need for high-quality phosphate inputs. Governments and agricultural organizations are actively promoting balanced fertilizer usage to improve productivity and maintain soil health, thereby increasing fluorapatite consumption. Additionally, innovations in controlled-release and fortified fertilizers that incorporate fluorapatite are gaining traction, enabling efficient nutrient delivery and reducing environmental runoff. Collectively, these factors are establishing the agriculture sector as a consistent and growing source of demand for fluorapatite, supporting long-term market expansion.

Key Trends & Opportunities

Focus on Sustainable and Eco-Friendly Solutions

A prominent trend in the Fluorapatite market is the growing emphasis on sustainability and eco-friendly processing. Companies are increasingly adopting green extraction methods that minimize environmental impact while ensuring high product quality. This includes techniques that reduce chemical waste, lower energy consumption, and optimize resource utilization. Sustainable sourcing of fluorapatite, particularly from natural phosphate reserves, is also gaining importance to meet regulatory requirements and corporate social responsibility goals. Additionally, industries are exploring biodegradable and environmentally safe formulations for fertilizers and chemical applications, opening opportunities for premium, eco-conscious products. The trend aligns with global sustainability initiatives and creates a competitive advantage for manufacturers investing in innovative, green production processes.

- For instance, Yara International’s Porsgrunn plant has implemented catalytic technology to significantly reduce nitrous oxide (N₂O) emissions from nitric acid production. The company is also pursuing a green ammonia project. An initial plan from 2020 had a potential target of cutting 800,000 tons of CO₂ annually from the full electrification of its ammonia plant. In 2024, however, Yara commissioned a 24 MW green hydrogen plant at the facility, which is used to produce low-carbon fertilizer and saves up to 41,000 tons of CO₂ emissions annually. The plant also operates an NPK pilot project to test various phosphate rock sources and has collaborated on a project to extract rare-earth elements from phosphate used in fertilizer production.

Expansion into Emerging Markets

Fluorapatite manufacturers are increasingly targeting emerging markets in Asia, Latin America, and Africa, where industrialization and agricultural modernization are accelerating. Rapid urbanization, government-led infrastructure projects, and growing industrial bases are fueling demand for chemical-grade fluorapatite and related products. Agricultural expansion and the adoption of advanced fertilizers further drive regional consumption. Companies are leveraging partnerships, local production facilities, and strategic distribution networks to tap into these high-growth regions. The market opportunity is amplified by the rising need for high-quality raw materials and tailored product solutions in emerging economies, offering both volume growth and diversification potential for global players.

- For instance, The OCP Group’s Strategic Program Mzinda-Meskala is developing two integrated corridors, with the Mzinda-Safi Corridor targeting an annual production of 12 million tonnes of phosphate rock by 2028, and the Meskala-Essaouira Corridor targeting an additional 20 million tonnes of rock annually by 2030.

Integration with Specialty Chemical Applications

Fluorapatite is increasingly being incorporated into specialty chemical applications, including high-performance coatings, corrosion inhibitors, and electronic-grade phosphates. The material’s chemical stability, high phosphorus content, and adaptability make it suitable for these advanced applications, which command higher margins and long-term contracts. Industries such as electronics, automotive, and aerospace are exploring customized fluorapatite derivatives to enhance product performance, durability, and efficiency. This trend creates opportunities for manufacturers to innovate through product differentiation, offering specialty-grade fluorapatite tailored to specific industrial needs. The combination of rising demand for high-value applications and continuous technological innovation positions the market for sustained growth and premium product adoption.

Key Challenges

Environmental and Regulatory Constraints

The Fluorapatite market faces challenges due to stringent environmental regulations and sustainability concerns. Mining, processing, and refining of phosphate-based minerals often involve the use of acids and generate chemical effluents, which can impact soil, water, and air quality. Regulatory compliance requires significant investment in pollution control, waste management, and sustainable operational practices, raising operational costs for manufacturers. Additionally, stricter international and local regulations can affect production timelines and limit market accessibility, particularly in sensitive ecological regions. Companies must balance profitability with environmental responsibility, making regulatory adherence a critical challenge that can slow expansion or affect margins.

Volatility in Raw Material Availability and Pricing

Market growth is also constrained by the fluctuating availability and pricing of raw fluorapatite sources. Mining limitations, geopolitical factors, and seasonal variations can cause supply disruptions, impacting production and delivery schedules. Price volatility in global phosphate markets directly affects the cost of downstream products, including fertilizers and industrial chemicals. Smaller producers may struggle to maintain stable supply chains, while larger companies face margin pressures amid rising input costs. These uncertainties necessitate strategic sourcing, inventory management, and investment in alternative or synthetic production methods to mitigate risk, posing operational and financial challenges for market participants.

Regional Analysis

North America

North America holds a significant share of the Fluorapatite market, driven primarily by high demand in industrial and agricultural applications. The United States leads the region, accounting for the majority of market consumption due to its advanced fertilizer industry, chemical manufacturing, and technological adoption in extraction processes. Canada and Mexico contribute to growth through expanding mining operations and increasing industrial activities. The region’s stringent environmental regulations encourage the use of high-purity and environmentally compliant fluorapatite products, further shaping demand. North America’s market share is estimated at around 28%, supported by consistent industrial output and strong agricultural requirements.

Europe

Europe represents a key region in the Fluorapatite market, capturing a substantial share due to mature industrial infrastructure and stringent quality standards. Germany, France, and the UK drive regional consumption through fertilizer production, specialty chemicals, and metal processing industries. Rising demand for sustainable and eco-friendly phosphate-based products, along with regulatory emphasis on low-toxicity formulations, encourages high adoption of fluorapatite. Technological advancements in beneficiation and recycling processes also support market expansion. Europe accounts for approximately 25% of the global market share, reflecting steady growth fueled by industrial modernization, high-value applications, and the increasing use of advanced fertilizer solutions.

Asia-Pacific

The Asia-Pacific region dominates the Fluorapatite market with the largest share, estimated at around 35%, driven by rapid industrialization and agricultural expansion. China and India are the leading contributors, supported by large-scale fertilizer production, chemical industries, and growing infrastructure development. Increasing urbanization, rising food demand, and government initiatives promoting modern farming techniques further boost market adoption. The region benefits from abundant natural phosphate reserves, cost-effective production, and expanding processing capabilities. Continuous investments in extraction technology and environmentally compliant operations enhance product quality and output, making Asia-Pacific the fastest-growing regional market with strong long-term growth potential.

Middle East & Africa

The Middle East & Africa (MEA) market for Fluorapatite accounts for approximately 7% of global share, supported by mining activities and fertilizer production hubs in countries such as Morocco and Saudi Arabia. Morocco, home to one of the largest phosphate reserves, drives regional exports and industrial consumption. Increasing agricultural initiatives and infrastructure projects in the Gulf Cooperation Council (GCC) countries create additional demand for phosphate-based products. Despite the availability of resources, market growth faces challenges related to logistical constraints, fluctuating raw material prices, and regulatory frameworks. Nonetheless, strategic investments in mining and processing facilities continue to support market expansion in the region.

Latin America

Latin America holds a moderate market share of around 5% in the global Fluorapatite market, with Brazil and Argentina as key contributors. The region’s agricultural sector is the primary driver, where phosphate-based fertilizers derived from fluorapatite enhance soil fertility and crop yields. Industrial applications in chemicals and metal treatment further support market consumption. Despite limited local production capacities compared to Asia-Pacific, the region benefits from import partnerships and investments in processing infrastructure. Market growth is expected to remain steady, fueled by modernization in agriculture, government support for sustainable farming practices, and growing awareness of high-quality phosphate resources.

Market Segmentations:

By Type

- Aliphatic Hydrocarbons

- Aromatic Hydrocarbons

- Cyclic Hydrocarbons

By Source

- Petroleum Distillates

- Synthetic Hydrocarbons

- Natural Hydrocarbon Extracts

By Application

- Industrial Cleaning

- Aerospace Cleaning

- Automotive Cleaning

- Household Cleaning

By Formulation Type

- Solvent-based Cleaners

- Emulsion Cleaners

- Aerosol Sprays

- Wipes and Towelettes

By End-user Industry

- Manufacturing

- Automotive

- Aerospace

- Oil and Gas

- Household

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Fluorapatite market is moderately consolidated, with key players such as Crystal Classics, Dakota Matrix, GB Minerals, ICL, Sihui Feiilafeng Non-Metallic Mineral Materials, and Sihui Haichuan Non-Metallic Mineral Materials leading the industry. These companies focus on strategic initiatives including mergers and acquisitions, capacity expansion, and technological advancements to strengthen market presence. Innovation in extraction, processing, and environmentally compliant production methods differentiates market leaders, while partnerships with fertilizer, chemical, and specialty manufacturing sectors expand distribution networks. Regional diversification, especially into high-growth Asia-Pacific and Latin American markets, provides additional competitive leverage. Companies also emphasize product quality, customization, and sustainable sourcing to meet regulatory standards and customer demand. The competitive environment encourages continuous investment in R&D, operational efficiency, and market penetration strategies, positioning established players to capture market share while enabling emerging entrants to exploit niche opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

Recent Developments

- In Jan 2024, Solstice Gold Corp. shared an exploration update on its Church and Kamuck Projects in the Quetico Subprovince, within the Quetico lithium district. In August 2023, Church exploration found muscovite, garnet, and possibly beryl or fluorapatite. At Kamuck, after just one day, up to 3% Li2O was detected in a green mineral, likely fluorapatite.

- In 2022, a leading mining company ramped up fluorapatite production to meet the growing demand for phosphates in fertilizers and industrial applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application, Formulation Type, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fluorapatite will continue to rise due to expanding fertilizer and industrial applications.

- Adoption of advanced extraction and processing technologies will improve product quality and operational efficiency.

- Sustainable and eco-friendly production methods will gain prominence across global markets.

- Emerging markets in Asia-Pacific, Latin America, and Africa will drive significant growth opportunities.

- Specialty chemical applications will expand, creating high-value product demand.

- Companies will increasingly invest in research and development to innovate and differentiate products.

- Strategic partnerships and collaborations will strengthen supply chains and market reach.

- Regulatory compliance and environmental standards will influence production practices and market strategies.

- Integration with high-performance and value-added products will boost market competitiveness.

- Market growth will remain steady, supported by continuous industrialization and modernization of agricultural practices.