Market Overview

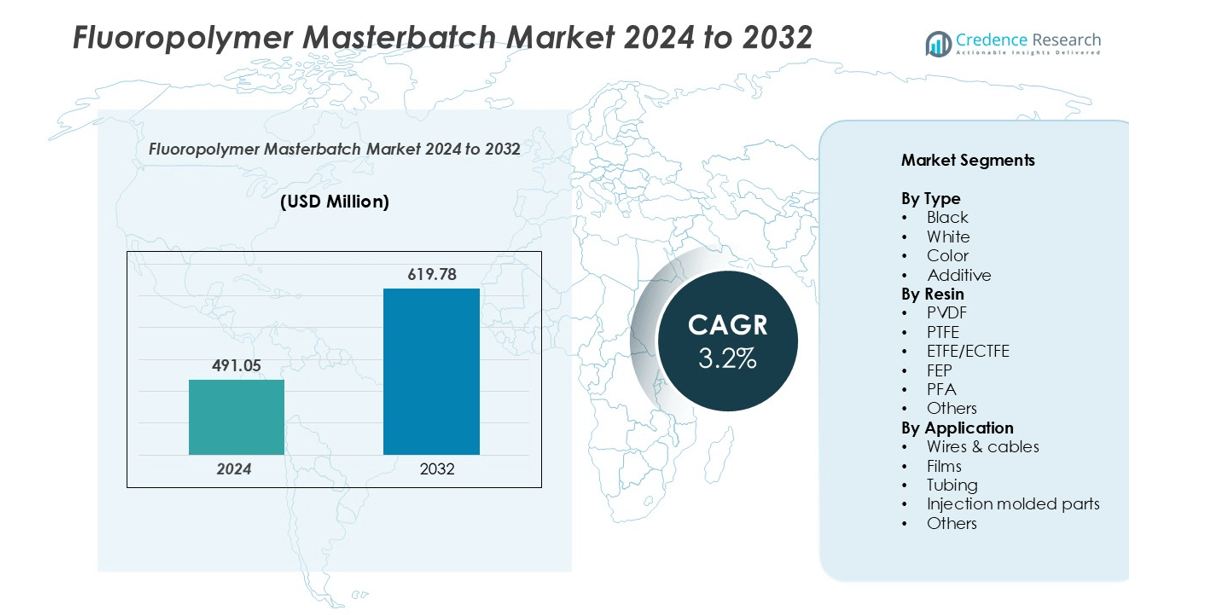

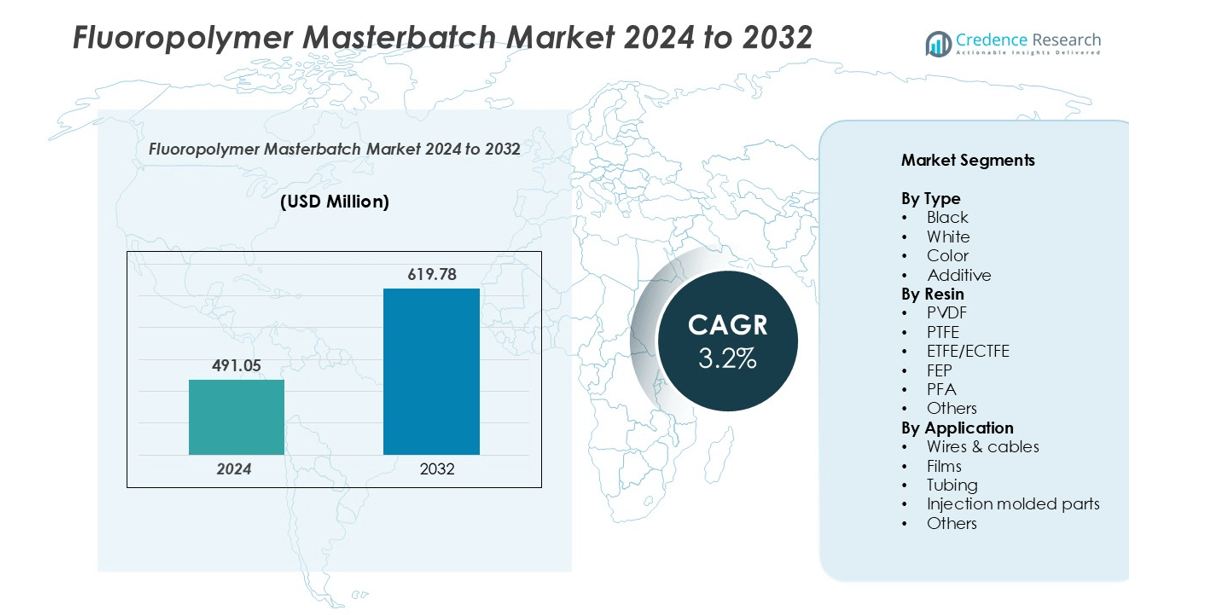

The Fluoropolymer Masterbatch market size was valued at USD 491.05 million in 2024 and is anticipated to reach USD 619.78 million by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluoropolymer Masterbatch Market Size 2024 |

USD 491.05 million |

| Fluoropolymer Masterbatch Market, CAGR |

3.2% |

| Fluoropolymer Masterbatch Market Size 2032 |

USD 619.78 million |

The fluoropolymer masterbatch market is dominated by leading players including Ampacet Corporation, Avient Corporation, Americhem, RTP Company, Everflon, Avi Additives Pvt. Ltd., and Sarvan Carbochem LLP, who focus on product innovation, quality, and regional expansion. Asia-Pacific leads the market with a 33% share, driven by rapid industrialization, automotive growth, and electronics manufacturing in China, India, and Japan. North America holds approximately 28% of the market, supported by advanced aerospace, automotive, and renewable energy applications, while Europe accounts for around 25%, with strong demand for sustainable and high-performance polymers. These companies leverage R&D capabilities to develop PVDF, PTFE, FEP, and PFA-based masterbatches for applications in wires, cables, films, and tubing. Strategic partnerships, capacity expansions, and tailored solutions for high-performance and eco-friendly applications strengthen their competitive positioning across global regions.

Market Insights

- The Fluoropolymer masterbatch market was valued at USD 491.05 million in 2024 and is projected to reach USD 619.78 million by 2032, growing at a CAGR of 3.2%.

- Market growth is driven by rising demand in automotive, aerospace, and electronics sectors, where PVDF and PTFE-based masterbatches provide thermal stability, chemical resistance, and electrical insulation.

- Key trends include the adoption of sustainable and high-performance masterbatches, development of customized additives for flame retardancy, UV resistance, and color consistency, and increasing use in electric vehicles and renewable energy infrastructure.

- The competitive landscape is led by Ampacet Corporation, Avient Corporation, Americhem, RTP Company, Everflon, Avi Additives Pvt. Ltd., and Sarvan Carbochem LLP, focusing on innovation, capacity expansion, and regional penetration to strengthen market presence.

- Regionally, Asia-Pacific leads with 33% share, followed by North America at 28% and Europe at 25%, while Wires & Cables dominate the application segment, with PVDF as the preferred resin type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Fluoropolymer masterbatch market by type is segmented into Black, White, Color, and Additive. Among these, Black masterbatch holds the dominant share due to its extensive application in industrial wiring, cable insulation, and protective coatings. Its high demand is driven by its ability to provide excellent UV resistance, thermal stability, and color consistency in harsh environments. White and Color masterbatches are growing steadily for consumer electronics and decorative applications, while Additive masterbatches are increasingly used to impart specific properties such as flame retardancy and conductivity, supporting niche industrial requirements.

- For instance, Supreme Petrochem’s black masterbatches are utilized in the production of cables, offering enhanced UV protection and mechanical strength.

By Resin:

In terms of resin type, the market is categorized into PVDF, PTFE, ETFE/ECTFE, FEP, PFA, and Others. PVDF dominates the market due to its high chemical resistance, mechanical strength, and widespread use in wiring, films, and tubing applications. PTFE and ETFE/ECTFE are preferred for high-temperature and chemical-intensive environments, while FEP and PFA find specialized use in high-purity applications such as medical tubing and lab equipment. The strong industrial demand for lightweight, durable, and chemically resistant materials is driving the adoption of PVDF and other high-performance fluoropolymers.

- For instance, according to Alfa Chemistry and other sources, PVDF is a material with high mechanical strength suitable for fluid handling systems. Typical PVDF properties include tensile strength between 50 and 60 MPa and compressive strength from 70 to 100 MPa, though specific Alfa Chemistry product specifications list a lower tensilestrength range of 17.0 to 48.0 Mpa for some tubing.

By Application:

The application segment includes Wires & Cables, Films, Tubing, Injection Molded Parts, and Others. Wires & Cables represent the largest share, propelled by the increasing need for high-performance electrical insulation in automotive, aerospace, and electronics industries. Films and tubing are expanding in sectors requiring chemical resistance, flexibility, and temperature tolerance, such as chemical processing and medical equipment. Injection molded parts and other applications are gaining traction for specialized industrial and consumer products, supported by advancements in processing technologies and the rising demand for lightweight, durable components.

Key Growth Drivers

Rising Demand in Electrical and Electronics Industry

The growing need for high-performance electrical insulation materials is a significant driver for the fluoropolymer masterbatch market. Fluoropolymer masterbatches, particularly PVDF and PTFE-based types, offer excellent thermal stability, chemical resistance, and electrical insulation properties, making them ideal for wires, cables, and electronic components. The expansion of electric vehicles, renewable energy installations, and high-speed data transmission networks has fueled the demand for reliable and durable insulating materials. For instance, manufacturers are increasingly adopting fluoropolymer masterbatches in automotive wire harnesses, which require consistent performance under extreme temperatures. Additionally, the surge in consumer electronics production has further accelerated the need for color-consistent and UV-stable masterbatches, reinforcing the market’s growth trajectory across multiple end-use sectors.

- For instance, Delta Tecnic’s fluoropolymer masterbatches enable cables to operate effectively in environments with temperatures ranging from -40ºC to 200ºC, providing excellent resilience and UV resistance.

Increased Focus on Chemical and Corrosion Resistance Applications

Industries requiring materials that withstand harsh chemicals and corrosive environments are driving the adoption of fluoropolymer masterbatches. PVDF, FEP, and PFA masterbatches are widely used in chemical processing equipment, tubing, and piping systems due to their excellent chemical inertness and thermal resistance. The expansion of industrial chemical manufacturing, pharmaceuticals, and water treatment plants has intensified the need for these high-performance polymers. For instance, in chemical transport tubing, FEP masterbatches are preferred to maintain structural integrity and prevent contamination. This capability reduces maintenance costs and increases operational efficiency, which encourages end-users to favor fluoropolymer solutions over conventional polymers, thereby fueling market growth globally.

- For instance, Polyfluor’s PFA fluoropolymer tubing can withstand a continuous working temperature of up to 260°C, making it suitable for applications requiring high-temperature capabilities.

Growing Adoption in Automotive and Aerospace Sectors

Fluoropolymer masterbatches are increasingly applied in automotive and aerospace industries for lightweight, durable, and heat-resistant components. The demand is particularly driven by electric vehicles and fuel-efficient aircraft that require advanced insulation for wiring, tubing, and injection-molded parts. PVDF and PTFE masterbatches are utilized in automotive fuel lines, EV battery components, and aircraft insulation systems, where high thermal stability and chemical resistance are critical. For instance, the use of fluoropolymer masterbatches in EV battery harnesses ensures safe operation under extreme temperature fluctuations. Rising investment in next-generation vehicles and aerospace components directly translates into increased consumption of fluoropolymer masterbatches, reinforcing their strategic importance in high-performance applications.

Key Trends & Opportunities

Shift Towards Sustainable and High-Performance Materials

The market is witnessing a growing trend toward sustainable and eco-friendly fluoropolymer masterbatches that reduce environmental impact without compromising performance. Manufacturers are investing in formulations that improve recyclability and minimize material waste, aligning with global sustainability initiatives. For example, color and additive masterbatches are now being designed to reduce UV degradation and extend product lifecycle in outdoor applications. Additionally, high-performance formulations are enabling fluoropolymers to replace traditional plastics in critical applications, such as chemical-resistant tubing and insulating films, opening opportunities for market expansion. Companies that innovate in energy-efficient processing and reduce raw material consumption can capitalize on the increasing demand for sustainable, high-performance polymer solutions.

- For instance, Avient’s LubriOne™ internally lubricated formulations offer excellent wear resistance, reduced friction, heat buildup, noise, and vibration, while also being available in PTFE-free grades and grades formulated with recycled content.

Advancements in Customization and Functional Additives

Customizable masterbatches and functional additives are becoming a prominent trend in the market, allowing end-users to tailor properties such as flame retardancy, anti-static behavior, and enhanced mechanical performance. The demand for specialized applications in medical, automotive, and electronics industries has led manufacturers to offer tailored solutions that meet exact specifications. For instance, PTFE-based additive masterbatches are increasingly used in low-friction automotive components to enhance durability. This trend creates opportunities for companies to differentiate their products through innovation, supporting premium pricing and long-term partnerships with high-end industrial clients, while driving broader adoption across diverse sectors.

- For instance, Americhem’s InLube® PBTGF20TF15 masterbatch is designed to deliver low friction and improved wear resistance, making it suitable for applications in various industries, including transportation, industrial, household, healthcare, electrical, and electronics.

Expansion in Emerging Markets

Emerging markets in Asia-Pacific and Latin America present significant opportunities due to industrialization, infrastructure development, and rising demand for consumer electronics and electric vehicles. Countries such as India, China, and Brazil are witnessing increased investments in automotive and electronics manufacturing, which directly boosts fluoropolymer masterbatch consumption. For example, PVDF masterbatches are extensively used in high-performance wiring for new EV production plants in China. Market players that establish local manufacturing facilities or partnerships in these regions can capitalize on lower production costs, reduced lead times, and expanding customer bases, creating a strong growth trajectory over the next decade.

Key Challenges

High Raw Material and Production Costs

One of the major challenges in the fluoropolymer masterbatch market is the high cost of raw materials such as PVDF, PTFE, and PFA resins, which are more expensive than conventional polymers. These costs directly impact the pricing of finished masterbatches, making adoption challenging for price-sensitive end-users in emerging markets. Additionally, the specialized processing techniques required for uniform dispersion and color consistency increase production complexity and energy consumption. Manufacturers must balance cost-efficiency with quality, and price volatility of fluoropolymer resins can disrupt supply chains. This challenge often limits market penetration in industries that prioritize cost over high-performance attributes.

Processing and Compatibility Limitations

Fluoropolymer masterbatches present challenges in processing due to their high melting points, low surface energy, and chemical inertness, which can complicate mixing with other polymers or colorants. Compatibility issues with standard thermoplastics may require specialized equipment or additives to achieve desired properties, increasing operational complexity. For instance, uniform dispersion of PTFE masterbatches in injection molding applications demands precise temperature control and shear conditions. These technical constraints may slow adoption in small-scale manufacturing or low-tech applications, requiring continuous innovation in processing aids, compounding techniques, and training for end-users to overcome these limitations.

Regional Analysis

North America

North America holds a significant share of the fluoropolymer masterbatch market, driven by advanced automotive, aerospace, and electronics industries. The region’s dominance, accounting for approximately 28% of the global market, is supported by high adoption of PVDF and PTFE masterbatches in wires, cables, and chemical-resistant tubing. Strong R&D capabilities, stringent quality standards, and the presence of key manufacturers like Chemours and Solvay reinforce market growth. Additionally, rising demand for electric vehicles and renewable energy infrastructure fuels the use of high-performance insulating and protective materials, further strengthening North America’s position as a mature and technologically advanced market for fluoropolymer solutions.

Europe

Europe commands a substantial market share of around 25% in the fluoropolymer masterbatch market, largely due to the region’s well-established automotive, aerospace, and industrial sectors. PVDF and FEP-based masterbatches are widely utilized in high-performance wiring, chemical-resistant films, and injection-molded components. Growing environmental regulations and sustainability initiatives are driving adoption of recyclable and energy-efficient formulations. Germany, France, and the UK lead in automotive and electronics manufacturing, creating consistent demand for advanced fluoropolymer solutions. Additionally, Europe’s focus on technological innovation and high-quality standards enables manufacturers to introduce customized color and additive masterbatches, supporting market expansion across diverse applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the fluoropolymer masterbatch market, contributing approximately 33% of the global share. Rapid industrialization, expanding electronics and automotive manufacturing, and increasing electric vehicle adoption are driving demand for PVDF, PTFE, and ETFE/ECTFE masterbatches. Countries like China, India, and Japan are investing heavily in infrastructure and renewable energy projects, fueling consumption of high-performance wires, cables, and tubing. The presence of local manufacturers, combined with lower production costs, supports regional growth. Additionally, increasing consumer electronics production and government incentives for advanced material usage present opportunities for further expansion in Asia-Pacific’s fluoropolymer masterbatch market.

Latin America

Latin America represents around 7% of the fluoropolymer masterbatch market, driven primarily by industrial applications, electrical infrastructure projects, and automotive production. Brazil and Mexico are key markets, with demand focused on PVDF and PTFE masterbatches for wires, tubing, and chemical-resistant applications. Market growth is supported by increasing infrastructure development, renewable energy investments, and rising electrification of industrial processes. However, price sensitivity and slower adoption of high-performance polymers compared to developed regions limit market penetration. Despite these challenges, the growing need for durable, chemically resistant materials presents steady opportunities for fluoropolymer masterbatch manufacturers in Latin America.

Middle East & Africa (MEA)

The MEA region accounts for approximately 7% of the global fluoropolymer masterbatch market, with growth driven by oil & gas, chemical processing, and infrastructure sectors. PTFE and PVDF masterbatches are commonly applied in high-performance tubing, insulation, and corrosion-resistant components. The expansion of industrial projects and rising demand for durable, chemically inert materials support market development. Countries like Saudi Arabia, UAE, and South Africa are increasingly adopting advanced fluoropolymers for electrical, chemical, and construction applications. Challenges such as raw material costs and limited local production capacity are being offset by imports from Europe and Asia-Pacific, ensuring a steady supply of high-quality fluoropolymer masterbatches.

Market Segmentations:

By Type:

- Black

- White

- Color

- Additive

By Resin:

- PVDF

- PTFE

- ETFE/ECTFE

- FEP

- PFA

- Others

By Application:

- Wires & cables

- Films

- Tubing

- Injection molded parts

- Others

By Geography:

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The fluoropolymer masterbatch market is highly competitive, characterized by the presence of global and regional players focusing on product innovation, strategic partnerships, and capacity expansion to strengthen their market position. Key companies such as Ampacet Corporation, Avient Corporation, Americhem, RTP Company, Everflon, Avi Additives Pvt. Ltd., and Sarvan Carbochem LLP actively compete by offering specialized masterbatches tailored for applications in wires, cables, films, tubing, and injection-molded components. Market leaders emphasize R&D to develop PVDF, PTFE, FEP, and PFA-based solutions with enhanced thermal stability, chemical resistance, and color consistency. Strategic initiatives such as mergers, acquisitions, and collaborations enable companies to expand regional footprints, particularly in high-growth markets like Asia-Pacific. Additionally, the adoption of sustainable and energy-efficient manufacturing practices serves as a differentiating factor, helping players meet regulatory requirements while addressing evolving customer demands, thereby intensifying competitive dynamics across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, Americhem, Inc. released EcoLube, a line of PFAS-free lubricated compounds with advanced properties for plastic parts aligning with industry regulations and promoting environmental responsibility.

- In June 2024, RTP Company introduced a new line of custom cellulose fiber reinforced polypropylene (PP) compounds for expanding its Eco Solutions product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Type, Resin, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of fluoropolymer masterbatches in electric vehicles and renewable energy applications is expected to grow significantly.

- Demand for PVDF and PTFE-based masterbatches in wires, cables, and tubing will continue to rise.

- Manufacturers are likely to focus on developing sustainable and recyclable masterbatch solutions.

- Customizable additive masterbatches for flame retardancy, UV resistance, and color consistency will gain traction.

- Expansion of automotive, aerospace, and electronics industries in Asia-Pacific will drive regional growth.

- Technological advancements in processing and compounding will improve product performance and efficiency.

- Increasing industrial applications in chemical processing and water treatment will boost demand.

- Strategic partnerships, mergers, and capacity expansions by key players will intensify competition.

- Growth in injection-molded parts and high-performance films will create new market opportunities.

- Innovation in energy-efficient production and low-waste formulations will shape market development.