Market Overview

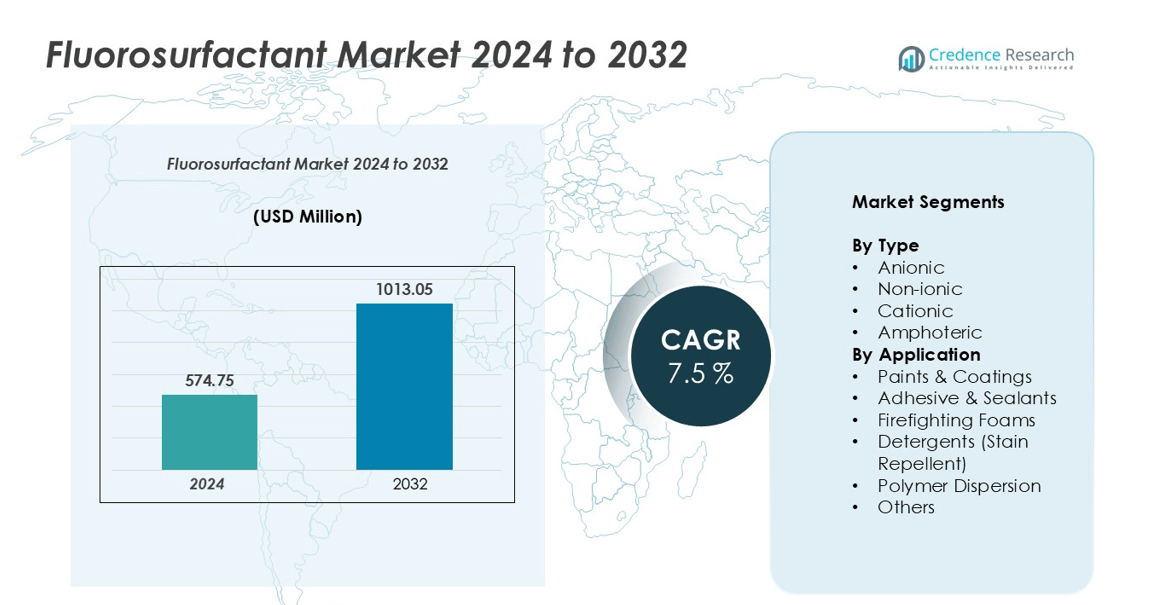

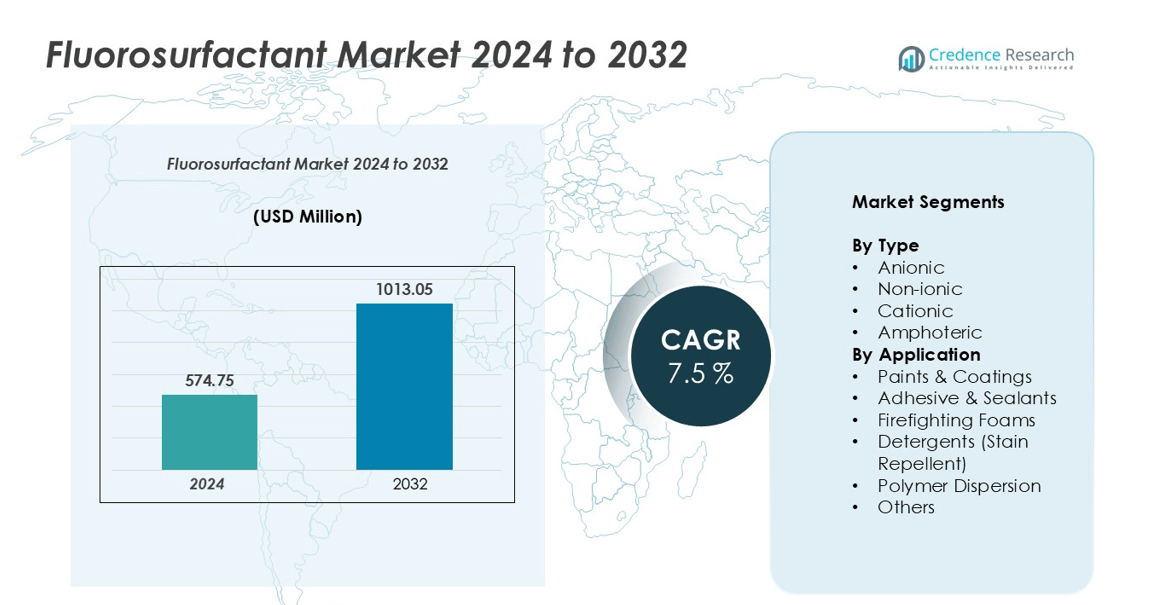

Fluorosurfactant market size was valued at USD 574.75 million in 2024 and is anticipated to reach USD 1013.05 million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorosurfactant Market Size 2024 |

USD 574.75 million |

| Fluorosurfactant Market, CAGR |

7.5% |

| Fluorosurfactant Market Size 2032 |

USD 1013.05 million |

The fluorosurfactant market is led by prominent players including 3M, The Chemours Company, DIC Corporation, Pilot Chemical Corp., OMNOVA Solutions Inc., Dynax Corporation, AGC SEIMI CHEMICAL Co., Ltd., Maflon SpA, Shijiazhuang City Horizon Chemical Industry Co., Ltd., Innovative Chemical Technologies, and Merck KGaA. These companies drive market growth through strategic R&D, product innovation, and regional expansion, focusing on high-performance and eco-friendly surfactants. North America dominates the market with approximately 30% share, followed by Europe at 28%, and Asia-Pacific at 25% due to rapid industrialization and infrastructure development. Latin America and the Middle East & Africa collectively account for the remaining 17%, driven by growing construction, automotive, and oil & gas industries. The competitive strength of these players, combined with regional demand dynamics, reinforces their leadership and ensures sustained growth in the global fluorosurfactant market.

Market Insights

- The global fluorosurfactant market was valued at USD 574.75 million in 2024 and is projected to reach USD 1013.05 million by 2032, growing at a CAGR of 7.5% during the forecast period.

- Growth is driven by rising demand in firefighting foams, industrial coatings, adhesives, and polymer dispersions, supported by stringent fire safety regulations and increasing industrialization across North America, Europe, and Asia-Pacific.

- Key trends include eco-friendly and PFAS-reduced formulations, increasing adoption in waterborne coatings and stain-repellent detergents, and integration into advanced industrial processes to enhance performance and sustainability.

- The market is competitive, led by 3M, The Chemours Company, DIC Corporation, Dynax Corporation, OMNOVA Solutions Inc., and Merck KGaA, focusing on innovation, regional expansions, and strategic partnerships to maintain leadership.

- Restraints include high production costs, raw material volatility, and regulatory pressure on PFAS chemicals, while regional analysis shows North America (30%), Europe (28%), Asia-Pacific (25%), Latin America (9%), and MEA (8%), with anionic type and firefighting foams application as dominant segments

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Fluorosurfactant market by type is segmented into anionic, non-ionic, cationic, and amphoteric categories. Among these, the anionic segment holds the dominant market share due to its excellent wetting, foaming, and emulsifying properties, making it highly suitable for industrial and specialty applications. Rising demand for high-performance coatings, adhesives, and cleaning formulations is driving growth in this segment. Additionally, increasing adoption in fire retardants and stain-repellent products supports the sustained expansion of anionic fluorosurfactants, positioning them as the preferred choice across diverse end-use industries.

- For instance, CAPSTONE™ FS-31, a nonionic fluorosurfactant that provides exceptionally low surface tension in aqueous and solvent-based systems. It is highly effective at very low concentrations, improving wetting, spreading, and leveling in high-performance industrial coatings. This minimizes surface defects like cratering and pinholes. While improved wetting can strengthen adhesion by helping coatings better penetrate substrates, enhancing adhesion is a secondary effect. The CAPSTONE™ line of products, including FS-31, was discontinued in early 2025.

By Application

In terms of application, fluorosurfactants are widely used in paints & coatings, adhesive & sealants, firefighting foams, detergents, polymer dispersion, and other specialty uses. The firefighting foams segment dominates the market due to stringent fire safety regulations and the critical performance requirements in industrial and municipal fire suppression systems. Growth is driven by rising infrastructure development, oil & gas industry expansion, and the need for environmentally compliant, high-efficiency firefighting solutions. Advanced foam formulations with superior spreadability and rapid suppression capabilities continue to fuel demand in this segment.

- For instance, Recent U.S. Naval Research Laboratory (NRL) research indicates that early fluorine-free foams (F3) failed military extinguishing specifications, with some taking over 45 seconds, while newer F3 products continue to be developed as environmentally safer alternatives to the historically faster, but toxic, fluorosurfactant-based foams.

Key Growth Drivers

Rising Demand in Firefighting Foams and Industrial Safety Applications

The increasing adoption of fluorosurfactants in firefighting foams is a major growth driver. Industries such as oil & gas, petrochemicals, and manufacturing require high-performance foams for rapid fire suppression, and fluorosurfactants enhance foam spreadability and stability. Stringent government regulations on fire safety and industrial compliance standards further propel market demand. Additionally, the shift towards environmentally friendly, PFAS-reduced formulations encourages manufacturers to innovate with next-generation fluorosurfactants. This combination of regulatory pressure, industrial safety requirements, and performance advantages sustains robust demand growth across key end-use sectors globally.

- For instance, Dynax Corporation produces the foam-stabilizer product DX5011 for use in AFFF formulations, which achieves low surface tensions (dyne/cm) and interfacial tensions (dyne/cm) that allow the foam solution to spread spontaneously and effectively suppress hydrocarbon fires.

Expansion in Coatings, Adhesives, and Polymer Applications

Fluorosurfactants are increasingly used in paints, coatings, adhesives, and polymer dispersions due to their exceptional wetting, leveling, and stain-repellent properties. Rising construction activities, automotive production, and infrastructure development are driving the need for durable, corrosion-resistant, and high-performance coatings. In adhesives and sealants, fluorosurfactants enhance bonding and surface spreadability, enabling the production of advanced materials. This expansion in industrial and consumer applications directly supports the market’s growth, with manufacturers focusing on product innovation to meet evolving performance and environmental standards.

- For instance, The Chemours Company lists its Capstone® FS-30 and FS-65 products as fluorosurfactants that deliver superior wetting and leveling. FS-30 is a non-ionic fluorosurfactant, while FS-65 has a strong non-ionic character under all conditions. Both products meet the criteria for biodegradability specified in the OECD 301B test method.

Technological Advancements and Eco-friendly Innovations

Advancements in fluorosurfactant technology, including the development of low-global warming potential (GWP) and PFAS-reduced formulations, are fueling market growth. Companies are investing in R&D to produce high-efficiency, environmentally compliant surfactants suitable for multiple applications. Innovations such as waterborne and low-VOC formulations reduce ecological impact while maintaining performance, aligning with global sustainability trends. These technological improvements not only expand the usability of fluorosurfactants in sensitive sectors but also open new market segments, ensuring long-term growth and competitive advantage for manufacturers prioritizing innovation and eco-friendly solutions.

Key Trends & Opportunities

Growth of Eco-friendly and PFAS-reduced Products

A significant market trend is the shift toward eco-friendly fluorosurfactants with reduced per- and polyfluoroalkyl substances (PFAS). Environmental regulations in North America, Europe, and parts of Asia are pushing manufacturers to develop sustainable alternatives without compromising performance. This trend creates opportunities for R&D-focused companies to introduce waterborne and biodegradable formulations, particularly for coatings, firefighting foams, and personal care products. The increasing consumer preference for green solutions and stricter industrial compliance standards further reinforce the adoption of these innovative fluorosurfactants.

- For instance, Syensqo has committed to manufacturing nearly 100% of its fluoropolymers at its Spinetta Marengo facility without using fluorosurfactants by 2026, backed by an investment of over €60 million in new advanced water-treatment technologies to eliminate fluorosurfactant emissions.

Expansion in Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and the Middle East present substantial growth opportunities. Rapid industrialization, rising urban infrastructure projects, and increasing automotive production drive demand for paints, coatings, adhesives, and firefighting solutions containing fluorosurfactants. Additionally, governments in these regions are implementing stricter fire safety and environmental regulations, boosting the adoption of high-performance and compliant surfactants. Manufacturers expanding their presence in these markets can leverage local demand while exploring cost-effective production and supply chain strategies.

- For instance, Analysts note that while there is no public data on China’s exact share of global fluorosurfactant production capacity, market research indicates that the country is a leading producer within the larger fluorochemicals sector. For instance, in 2024, China accounted for approximately 64% of the regional fluorochemical market share in Asia-Pacific, which itself led the global fluorosurfactant market with a 54.59% revenue share.

Integration in Advanced Industrial Processes

Fluorosurfactants are increasingly being incorporated into advanced manufacturing and chemical processing, including specialty polymers, electronics, and high-performance coatings. Their superior wetting, leveling, and anti-foaming properties optimize production efficiency and product quality. This integration trend presents opportunities for specialized formulations tailored to industry-specific applications, enhancing operational efficiency and material performance. Companies developing customized solutions for these niche applications can capture premium market segments and establish long-term partnerships with industrial end-users.

Key Challenges

Environmental and Regulatory Compliance Pressure

One of the primary challenges facing the fluorosurfactant market is the increasing regulatory scrutiny on PFAS chemicals due to their persistence and ecological impact. Stricter restrictions in regions such as the European Union, the United States, and parts of Asia necessitate costly reformulations and compliance testing. Manufacturers must invest significantly in R&D to develop PFAS-reduced or alternative chemistries while maintaining product performance. This regulatory pressure can slow market expansion and increase operational costs, creating a barrier for smaller players and pressuring existing companies to innovate rapidly.

High Production Costs and Raw Material Volatility

Fluorosurfactant production involves specialized chemical processes and high-cost raw materials, which can be volatile due to supply chain disruptions and global economic factors. Price fluctuations in fluorochemical intermediates directly impact manufacturing costs and profit margins. Additionally, scaling eco-friendly or high-performance formulations often requires significant capital investment, which can limit accessibility for smaller manufacturers. These cost constraints and supply uncertainties pose challenges to consistent production, pricing stability, and market competitiveness.

Regional Analysis

North America

North America holds a significant share of the fluorosurfactant market, driven primarily by the United States and Canada. The region accounted for approximately 30% of the global market, led by strong demand in firefighting foams, industrial coatings, and specialty adhesives. Stringent fire safety regulations, environmental compliance standards, and advanced industrial infrastructure are key drivers. Additionally, rising adoption of eco-friendly, PFAS-reduced formulations in line with sustainability initiatives supports market growth. The presence of established fluorochemical manufacturers investing in R&D for high-performance surfactants further strengthens North America’s position as a dominant regional player.

Europe

Europe contributes roughly 28% of the global fluorosurfactant market, with Germany, France, and the UK being major consumers. Market growth is fueled by the construction, automotive, and chemical industries, where high-performance coatings, adhesives, and polymer dispersions are in strong demand. Regulatory frameworks emphasizing low-VOC and environmentally sustainable products drive innovation in PFAS-reduced and waterborne formulations. The region benefits from technological advancements, research collaborations, and an established manufacturing base. Rising industrial safety requirements and eco-conscious consumer trends ensure steady adoption, maintaining Europe’s significant share in the global fluorosurfactant landscape.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing around 25% of the global market, led by China, India, and Japan. Rapid industrialization, urbanization, and automotive and infrastructure development fuel demand for coatings, adhesives, and firefighting solutions. Additionally, emerging environmental regulations are encouraging the adoption of advanced, eco-friendly fluorosurfactants. The presence of cost-competitive manufacturers and expanding production capacities attract global investments, strengthening regional supply chains. Growing consumer awareness of sustainable products and increasing application in polymer dispersions and detergents further support market expansion, positioning Asia-Pacific as a high-growth opportunity for fluorosurfactant manufacturers.

Latin America

Latin America holds approximately 9% of the global fluorosurfactant market, with Brazil and Mexico as key contributors. Market growth is supported by rising infrastructure projects, industrial development, and increasing demand for firefighting foams and coatings. However, slower regulatory enforcement and limited adoption of eco-friendly formulations moderate the growth rate compared to North America and Europe. Expanding construction and automotive sectors, combined with gradual industrial modernization, provide growth opportunities. Strategic partnerships and capacity expansions by international manufacturers are expected to enhance regional supply, gradually increasing Latin America’s market share in the global fluorosurfactant industry.

Middle East & Africa

The Middle East & Africa region accounts for roughly 8% of the global market, with the UAE, Saudi Arabia, and South Africa being prominent consumers. Growth is driven by oil & gas, petrochemical industries, and fire safety infrastructure, where high-performance fluorosurfactants in firefighting foams and industrial coatings are critical. The region is witnessing gradual adoption of environmentally compliant formulations due to rising sustainability awareness. Investments in large-scale industrial and urban infrastructure projects further support demand. Although growth is moderate compared to Asia-Pacific, targeted expansions and collaborations by key manufacturers are expected to strengthen the region’s market presence

Market Segmentations:

By Type

- Anionic

- Non-ionic

- Cationic

- Amphoteric

By Application

- Paints & Coatings

- Adhesive & Sealants

- Firefighting Foams

- Detergents (Stain Repellent)

- Polymer Dispersion

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The global fluorosurfactant market is highly competitive and characterized by the presence of established multinational corporations and specialized regional players. Leading companies such as 3M, The Chemours Company, DIC Corporation, OMNOVA Solutions Inc., Dynax Corporation, and Merck KGaA focus on innovation, product diversification, and strategic partnerships to maintain market leadership. These players invest heavily in R&D to develop high-performance, eco-friendly, and PFAS-reduced formulations for applications across firefighting foams, coatings, adhesives, and polymers. Smaller and emerging players differentiate themselves through niche product offerings, cost-effective production, and regional market penetration. Mergers, acquisitions, and collaborations are common strategies to expand global footprint and enhance technological capabilities. The competitive intensity is further heightened by growing demand for environmentally compliant and high-efficiency surfactants, encouraging continuous innovation, strategic alliances, and capacity expansions across key geographies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M

- DIC CORPORATION

- Dynax Corporation

- Merck KGaA

- OMNOVA Solutions Inc.

- Pilot Chemical Corp.

- Shijiazhuang City Horizon Chemical Industry Co., Ltd.

- AGC SEIMI CHEMICAL CO., LTD.

- Innovative Chemical Technologies

- Maflon SpA

- The Chemours Company

Recent Developments

- In August 2023, DIC Corporation recently announced the launch of the MEGAFACE EFS series, a new lineup of environment-friendly fluorosurfactant. This innovative product series signifies DIC’s commitment to sustainability and environmental stewardship in the chemical industry.

- In March 2022, Alfa Chemistry recently announced the launch of an extensive selection of fluoro surfactants, expanding its portfolio to cater to diverse applications needing advanced surface chemistry solutions. This new lineup offers versatile properties, such as exceptional wetting, spreading, and leveling capabilities, designed to meet the rigorous demands of industries like coatings, adhesives, and electronics.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand in firefighting foams and industrial safety applications.

- Adoption of eco-friendly and PFAS-reduced formulations will increase across all major regions.

- Advanced coatings, adhesives, and polymer applications will continue to drive product innovation.

- Asia-Pacific will emerge as the fastest-growing region due to industrialization and infrastructure development.

- North America and Europe will maintain significant market shares due to strict safety and environmental regulations.

- Companies will invest in R&D to develop high-performance, sustainable surfactants.

- Strategic partnerships, mergers, and acquisitions will intensify to expand global presence.

- Demand for specialty applications in electronics, automotive, and chemical processing will increase.

- Regulatory compliance and sustainability trends will shape product development and adoption.

- Smaller and regional players will focus on niche applications to gain competitive advantage.