Market Overview:

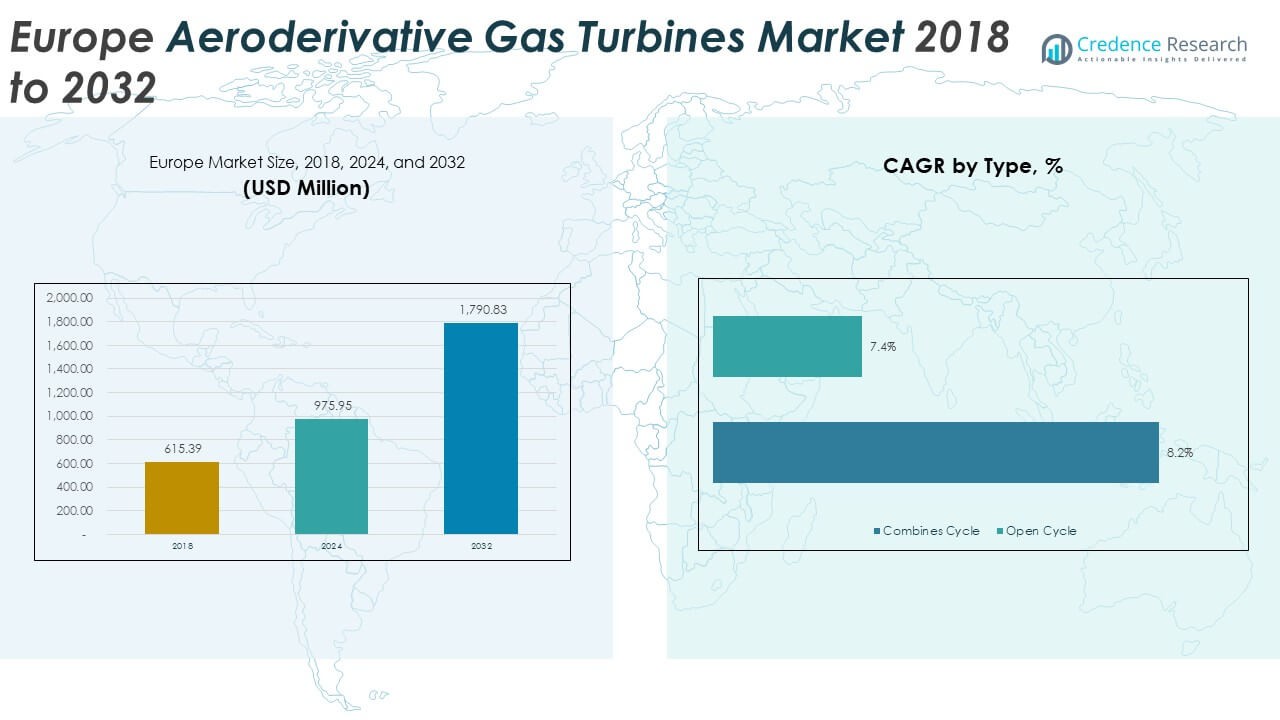

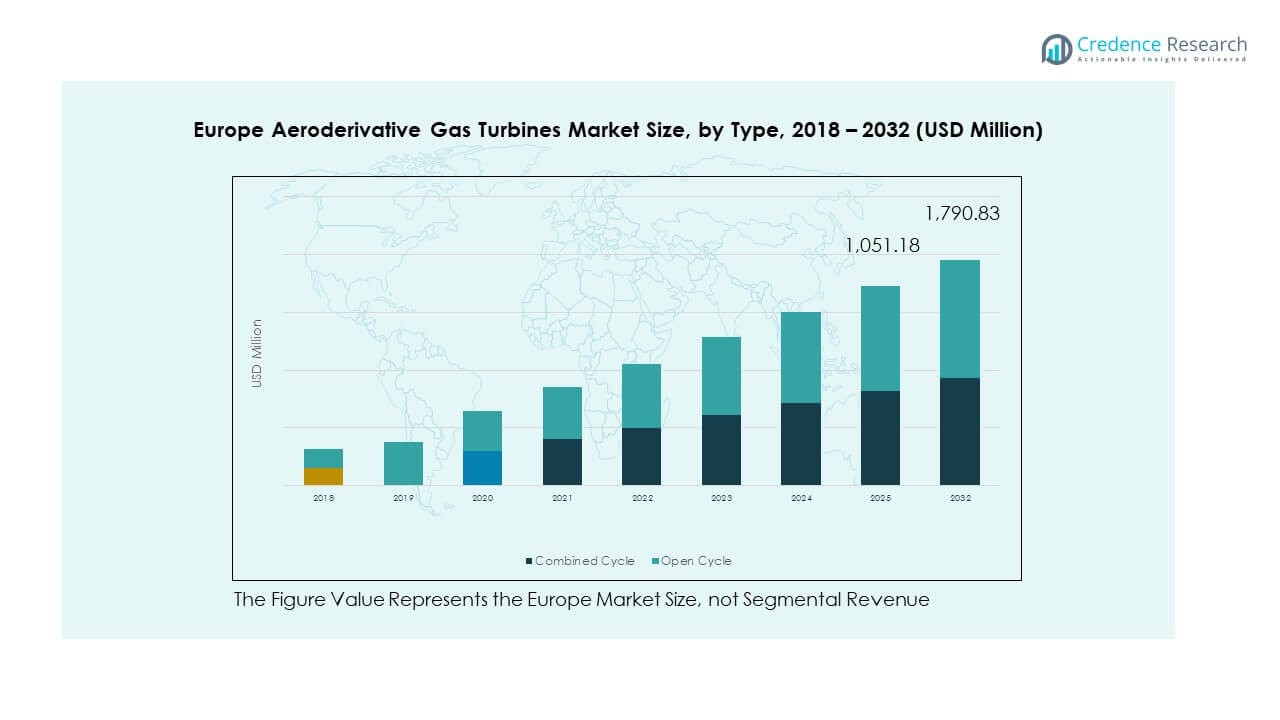

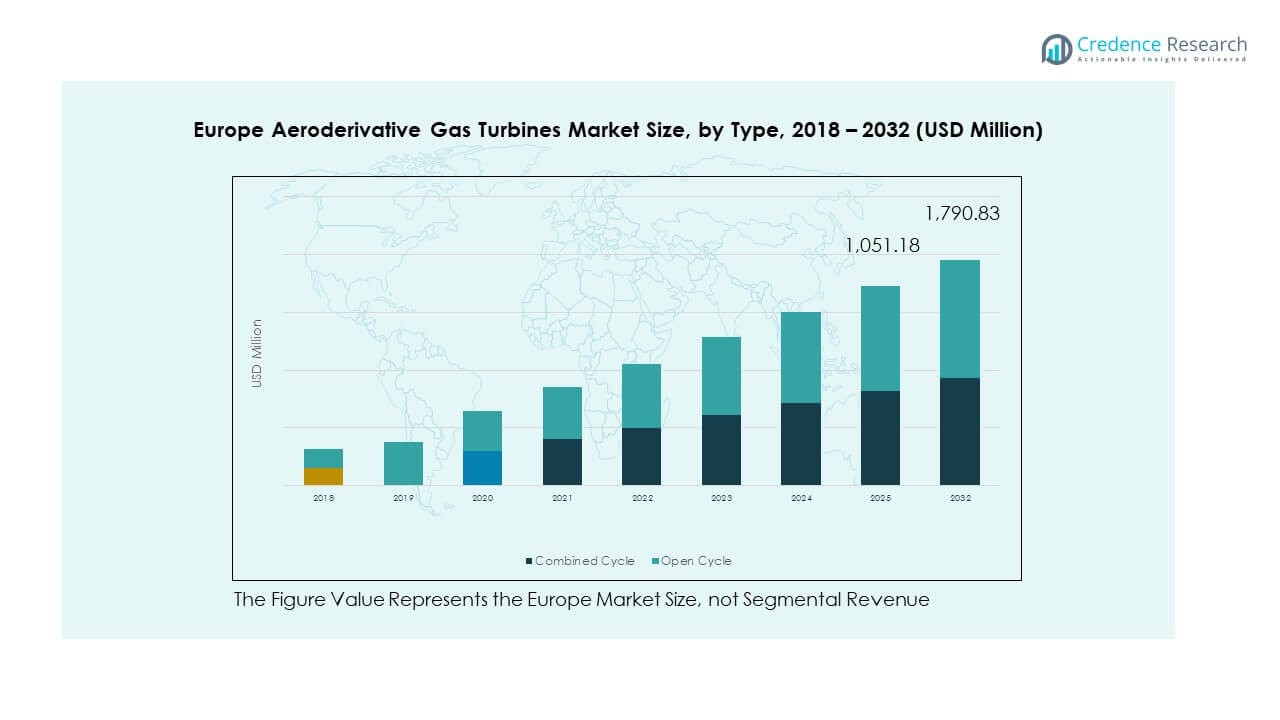

The Europe Aeroderivative Gas Turbines Market size was valued at USD 615.39 million in 2018 to USD 975.95 million in 2024 and is anticipated to reach USD 1,790.83 million by 2032, at a CAGR of 7.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Aeroderivative Gas Turbines Market Size 2023 |

USD 975.95 Million |

| Europe Aeroderivative Gas Turbines Market, CAGR |

7.90% |

| Europe Aeroderivative Gas Turbines Market Size 2032 |

USD 1,790.83 Million |

The market growth is driven by the rising demand for flexible and efficient power generation systems that can complement renewable energy integration. Aeroderivative gas turbines are preferred for their fast start-up capability, high efficiency, and suitability for distributed power generation. Increasing adoption across industrial, marine, and utility applications is boosting demand. Furthermore, growing investments in cleaner energy infrastructure and modernization of aging power plants across Europe are creating new opportunities for aeroderivative turbine deployment.

Regionally, Western Europe leads the market due to established energy infrastructure, strict emission norms, and growing reliance on renewable integration support. Countries like Germany, the U.K., and France are key adopters, owing to their advanced industrial base and renewable energy policies. Southern and Eastern Europe are emerging markets, supported by grid modernization efforts, expansion of gas-fired power plants, and energy diversification strategies. The presence of offshore oil and gas projects also strengthens demand in select regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Aeroderivative Gas Turbines Market was valued at USD 615.39 million in 2018, reached USD 975.95 million in 2024, and is projected to hit USD 1,790.83 million by 2032, growing at a CAGR of 7.90%.

- The Global Aeroderivative Gas Turbines Market size was valued at USD 2,288.5 million in 2018 to USD 3,617.3 million in 2024 and is anticipated to reach USD 6,608.2 million by 2032, at a CAGR of 7.85% during the forecast period.

- Western Europe led with 42% share in 2024, driven by advanced infrastructure and strong renewable integration. Southern Europe followed with 28% share, supported by modernization programs. Eastern Europe and Russia captured 30%, reflecting infrastructure upgrades and energy diversification.

- The fastest-growing subregion is Eastern Europe and Russia, holding 30% share, supported by oil and gas investments, grid stability needs, and transition from coal-based systems.

- Combined cycle turbines accounted for 59% share in 2024, reflecting higher adoption in large-scale and efficient power generation projects.

- Open cycle turbines held 41% share, benefiting from demand in aviation, marine, and emergency energy applications where mobility and rapid deployment are critical.

Market Drivers:

Growing Integration of Renewable Energy and the Need for Flexible Backup Power

The increasing penetration of renewable energy sources in Europe is driving demand for highly flexible backup systems. Wind and solar generation require reliable balancing solutions that can operate at partial loads without compromising efficiency. Aeroderivative turbines offer fast start-up and shutdown, making them ideal for stabilizing grids with intermittent energy supply. Governments are prioritizing energy security while meeting climate targets, creating opportunities for gas-fired solutions. The Europe Aeroderivative Gas Turbines Market benefits from investments in hybrid power systems and distributed generation projects. Utilities are aligning resources toward balancing supply fluctuations with sustainable technologies. It supports the modernization of energy networks, ensuring stability during peak load shifts. Growing emphasis on cleaner power generation continues to accelerate adoption across multiple industries.

- For instance, Siemens Energy’s SGT-A65 aeroderivative gas turbine delivers over 41% simple-cycle efficiency and can reach full power output in under five minutes, making it suitable for fast-start and distributed generation applications.

Rising Investments in Industrial Decentralized Power and Cogeneration Applications

Industries across Europe are increasingly investing in decentralized power generation to reduce reliance on central grids. Aeroderivative turbines provide localized energy solutions for refineries, chemical plants, and manufacturing facilities. Their high efficiency and combined heat and power (CHP) capabilities enhance operational performance while reducing costs. The Europe Aeroderivative Gas Turbines Market gains traction from industrial adoption where energy-intensive sectors demand stable supply. Governments promote cogeneration to optimize energy use and reduce greenhouse gas emissions. It strengthens industrial competitiveness by ensuring uninterrupted operations during grid instability. The growing demand for power reliability aligns with corporate sustainability goals. Aeroderivative turbines are positioned as a preferred solution for industrial power resilience.

- For instance, GE’s LM6000 PC aeroderivative gas turbine delivers approximately 43 MW at 42% thermal efficiency, making it an efficient choice for cogeneration and industrial power applications.

Expansion of Offshore Oil and Gas Exploration and Marine Applications

The offshore sector remains a critical driver of aeroderivative turbine demand in Europe. Oil and gas platforms require compact, lightweight, and reliable turbines capable of operating in challenging marine environments. Aeroderivative designs offer higher power-to-weight ratios and superior mobility compared to heavy-duty models. The Europe Aeroderivative Gas Turbines Market finds consistent demand from floating production facilities and offshore support vessels. Rising exploration activities in the North Sea reinforce turbine installations across offshore energy assets. It enables improved efficiency while reducing fuel consumption, supporting sustainability targets of energy operators. Growing emphasis on offshore wind integration also boosts hybrid turbine adoption. Marine industries recognize their role in delivering cost-effective and durable energy solutions.

Modernization of Aging Power Infrastructure Across Europe

Many European countries face the challenge of modernizing aging thermal power infrastructure. Governments prioritize upgrading inefficient systems with advanced turbines capable of reducing emissions and operational costs. Aeroderivative units provide scalability and flexibility required for distributed energy networks. The Europe Aeroderivative Gas Turbines Market is propelled by policy initiatives encouraging replacement of outdated systems. Energy transition programs support natural gas adoption as a bridge fuel while phasing out coal. It ensures a reliable and cleaner alternative for peak load and backup operations. Utility operators view turbine deployment as essential for long-term resilience of national grids. The modernization drive continues to create stable opportunities across multiple European regions.

Market Trends:

Integration of Digital Monitoring and Predictive Maintenance Platforms

Digitalization is shaping the operational landscape of aeroderivative turbines across Europe. Operators adopt real-time monitoring platforms to track performance and predict failures before downtime occurs. Advanced analytics improve turbine availability, extending lifecycle performance and optimizing costs. The Europe Aeroderivative Gas Turbines Market reflects this trend through adoption of AI-based solutions. Manufacturers introduce predictive algorithms integrated with remote diagnostics for proactive maintenance. It enhances energy efficiency while reducing maintenance-related risks for operators. Grid operators also benefit from higher system reliability under fluctuating renewable inputs. Digital advancements remain a central trend that redefines operational strategy in the turbine sector.

Growing Shift Toward Hybrid and Distributed Energy Generation Models

Hybrid power systems are gaining prominence as European nations diversify energy supply. Aeroderivative turbines combine effectively with storage solutions and renewables to ensure grid stability. Distributed generation reduces reliance on centralized plants, offering localized resilience. The Europe Aeroderivative Gas Turbines Market reflects this shift with rising adoption in microgrids and district power systems. Demand for rapid deployment and portable energy is shaping turbine design strategies. It supports both industrial clusters and emergency power needs during critical demand periods. Energy planners are aligning hybrid solutions with national sustainability goals. Turbines are increasingly integrated into flexible energy ecosystems delivering long-term benefits.

Emphasis on Lightweight and Modular Turbine Designs for Multiple Applications

Design innovation plays a vital role in meeting evolving power demands across Europe. Manufacturers focus on compact, lightweight, and modular turbines suitable for marine, industrial, and utility sectors. The Europe Aeroderivative Gas Turbines Market benefits from innovations that enhance transportability and installation speed. Modular units reduce project lead times and lower costs for diverse end-users. It provides scalability, allowing operators to expand capacity in stages. The trend aligns with offshore projects where mobility and quick deployment are critical. Compact configurations also support emerging urban power projects. Ongoing design advancements strengthen competitiveness in dynamic energy markets.

- For instance, GE Vernova commissioned a 300 MW grid-stability power plant at RWE’s Biblis site in Germany, deploying 11 LM2500XPRESS+G5 aeroderivative turbines to provide rapid, modular power and support renewable integration.

Decarbonization Policies Driving Fuel Transition and Cleaner Combustion Technologies

European decarbonization targets drive the adoption of low-emission gas turbine technologies. Manufacturers develop combustion systems designed for hydrogen blends and synthetic fuels. The Europe Aeroderivative Gas Turbines Market aligns with these policies by deploying cleaner generation solutions. Governments enforce stringent emission standards, pushing utilities toward advanced turbine installations. It accelerates development of flexible fuel systems that meet energy transition requirements. Operators integrate fuel-flexible turbines to ensure compliance while maintaining performance. This trend creates opportunities for hydrogen-ready turbine solutions across the region. Decarbonization policies remain central to market direction, shaping long-term technology adoption.

- For instance, Mitsubishi Power successfully demonstrated 30% hydrogen co-firing in its M501JAC gas turbine at the T-Point 2 facility in Japan, achieving stable combustion under grid-connected operations with low NOₓ emissions.

Market Challenges Analysis:

High Operational Costs and Complex Maintenance Requirements

Operational cost remains a key challenge for widespread adoption of aeroderivative turbines in Europe. Maintenance demands are complex due to advanced components requiring specialized expertise and spare parts. The Europe Aeroderivative Gas Turbines Market faces pressure from high lifecycle expenses, limiting uptake in smaller utilities. It creates dependency on skilled labor and OEM contracts, which often increase costs further. Industrial users weigh these costs against alternatives such as reciprocating engines or heavy-duty turbines. Unscheduled downtime adds financial strain, reducing competitiveness in price-sensitive sectors. Limited supply of specialized parts sometimes extends outage durations. These constraints present strong barriers for wider adoption across the region.

Regulatory and Environmental Pressures Impacting Market Expansion

Environmental regulations in Europe are stringent, requiring compliance with evolving emission standards. Utilities must balance investment costs with regulatory compliance in turbine deployment. The Europe Aeroderivative Gas Turbines Market is challenged by policy uncertainty and stricter carbon frameworks. It limits decision-making flexibility for operators who face unclear long-term rules. Competition from renewable technologies further reduces investment appeal for some stakeholders. Public opposition to natural gas reliance continues to grow across certain markets. Financing institutions are also cautious toward projects reliant on fossil-based generation. These combined pressures shape a challenging environment for consistent market expansion.

Market Opportunities:

Rising Adoption of Hydrogen and Alternative Fuel Integration in Turbines

Hydrogen adoption creates a significant opportunity for aeroderivative turbines across European markets. Manufacturers are designing fuel-flexible turbines capable of operating on hydrogen blends or synthetic fuels. The Europe Aeroderivative Gas Turbines Market benefits from policies encouraging cleaner fuel transitions. It positions turbines as a strategic component of decarbonization initiatives. Operators view hydrogen readiness as an attractive investment to future-proof assets. Emerging projects explore hybrid systems integrating renewable hydrogen production. Early adoption will strengthen the role of aeroderivative turbines in long-term energy strategies. Flexible fuel integration unlocks diverse opportunities for growth across multiple industries.

Expansion of Distributed and Emergency Power Applications in Developing Regions

Distributed generation projects present another opportunity for market expansion. Industrial clusters and urban centers require localized, efficient, and flexible backup solutions. The Europe Aeroderivative Gas Turbines Market finds growth potential in district heating and microgrid applications. It addresses emergency response needs where portable and quick-deployment power units are essential. Governments encourage investments in localized energy networks to enhance resilience. Industrial users seek reliability in power supply while optimizing operational costs. Turbines align with these objectives, offering both stability and sustainability benefits. Expanding distributed energy projects reinforce the future growth prospects of this market.

Market Segmentation Analysis:

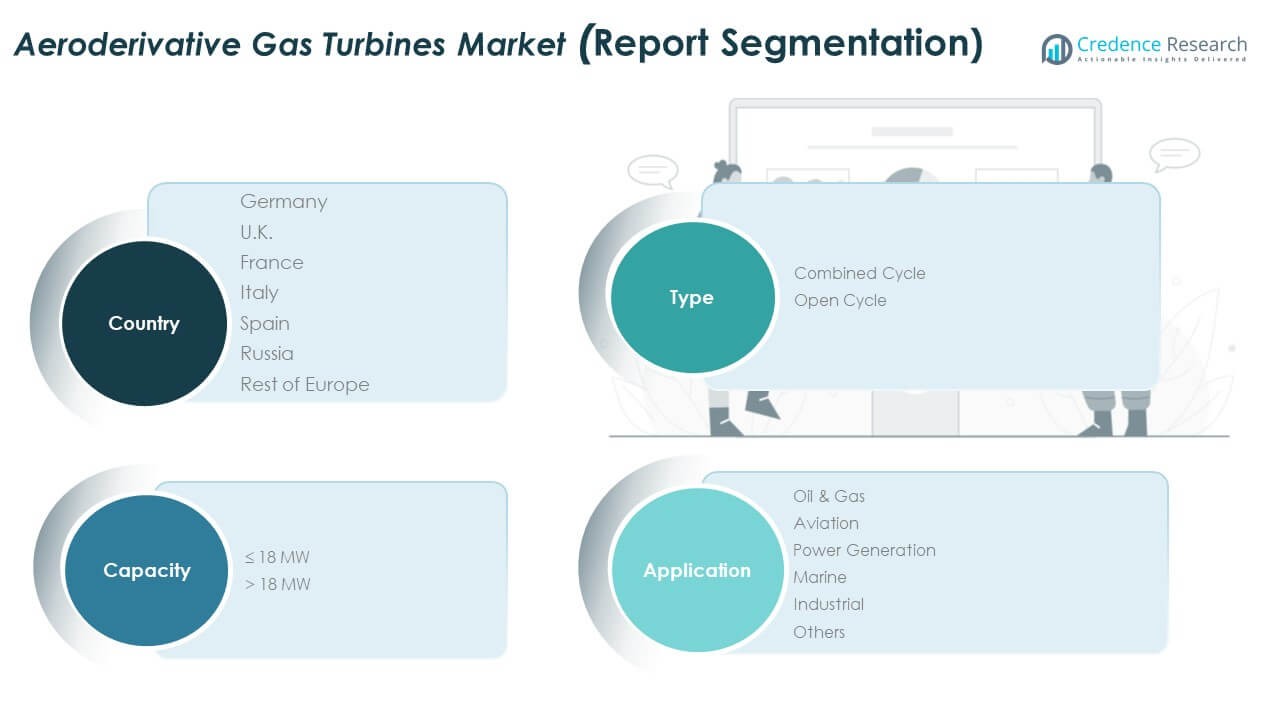

The Europe Aeroderivative Gas Turbines Market is segmented

By type

Into combined cycle and open cycle systems. Combined cycle units hold strong adoption across utilities and large industrial sites due to higher efficiency and reduced emissions. Open cycle models are widely deployed in marine, aviation, and emergency applications where rapid start-up and mobility are critical. It supports flexible use cases across both centralized and distributed energy frameworks, ensuring relevance across multiple sectors.

- For instance, E.ON and MM Neuss commissioned Europe’s first fully automated, large-scale combined heat and power (CHP) plant at their Neuss site in Germany. The facility delivers 22 MW of electrical and 59 MW of thermal output, achieves a fuel utilization rate of up to 91%, and cuts CO₂ emissions by up to 22,000 tons annually

By capacity

The market divides into ≤18 MW and >18 MW categories. Turbines with ≤18 MW capacity are suitable for industrial clusters, offshore platforms, and localized generation projects that require compact designs and quick deployment. Units above 18 MW dominate large-scale power generation and oil and gas installations, offering higher output and operational stability. It provides scalability for diverse end users seeking efficient solutions under varying operational conditions.

By Application

Segmentation highlights demand from oil and gas, aviation, power generation, marine, industrial, and other sectors. Oil and gas operations utilize turbines for offshore and onshore production platforms, where efficiency and durability are vital. Aviation depends on aeroderivative technology for auxiliary and backup power. Power generation remains a core segment, driven by energy transition goals and renewable integration. Marine and industrial uses continue to expand with rising focus on distributed and portable generation. It reinforces the versatile role of aeroderivative turbines across Europe’s evolving energy and industrial landscape.

- For example, GE Vernova secured orders for 29 LM2500XPRESS aeroderivative gas turbine packages from Crusoe, intended to power AI data centers. These units offer five-minute fast-start capability, are 95% factory-assembled for swift installation, and include Selective Catalytic Reduction (SCR) technology that significantly reduces emissions

Segmentation:

By Type

- Combined Cycle

- Open Cycle

By Capacity

By Application

- Oil & Gas

- Aviation

- Power Generation

- Marine

- Industrial

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe dominates the Europe Aeroderivative Gas Turbines Market with a market share of 42%. Countries such as Germany, the UK, and France drive adoption through advanced energy infrastructure and supportive regulatory frameworks. These nations emphasize decarbonization policies and rely on aeroderivative turbines to balance intermittent renewable generation. The region invests heavily in combined cycle and hybrid power projects, making it a hub for innovation and modernization. Industrial demand also remains strong, supported by refineries, chemical plants, and large-scale manufacturing facilities. It reflects a mature yet expanding market that aligns energy security with sustainability goals.

Southern Europe accounts for 28% of the market, driven by strong demand in Italy, Spain, and surrounding nations. Growth is tied to the modernization of power systems, rising industrial activity, and adoption of distributed energy solutions. Countries with significant offshore potential also deploy aeroderivative turbines in marine and oil and gas operations. The region continues to prioritize flexible and mobile energy solutions that can address peak load and backup power requirements. It benefits from investments in energy diversification and ongoing integration of renewable resources. The market outlook for this subregion remains steady with strong industrial and energy-based opportunities.

Eastern Europe and Russia collectively represent 30% of the Europe Aeroderivative Gas Turbines Market, supported by infrastructure upgrades and energy diversification strategies. Russia plays a significant role with investments in oil and gas exploration, marine projects, and industrial applications. Eastern European nations adopt aeroderivative turbines to strengthen grid stability and reduce reliance on coal-based systems. This subregion demonstrates growing interest in open cycle turbines for portable and rapid deployment needs. It also benefits from regional policy shifts promoting energy efficiency and reliability. Market expansion continues as countries invest in both capacity upgrades and sustainable energy integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Aeroderivative Gas Turbines Market is highly competitive, with global and regional players focusing on innovation, partnerships, and expansion strategies. General Electric and Siemens lead the market with strong portfolios in both combined and open cycle systems, supported by digital service platforms and advanced efficiency technologies. Pratt & Whitney and Mitsubishi Heavy Industries strengthen their positions by offering lightweight, modular turbines designed for marine, aviation, and industrial applications. Baker Hughes and Solar Turbines Incorporated contribute to market diversity by addressing decentralized energy needs and offshore projects. It reflects a competitive field where leading manufacturers emphasize reliability, fuel flexibility, and cost efficiency to capture broader demand. Market participants actively invest in hydrogen-ready and low-emission technologies to align with Europe’s decarbonization goals. Strategic developments such as mergers, acquisitions, and collaborations expand product reach and regional presence. Companies deploy predictive maintenance tools and AI-driven diagnostics to enhance customer value and reduce operational costs. Competition also extends to aftersales services, where operators demand long-term reliability and performance guarantees. Regional suppliers target niche applications and localized distribution to strengthen market penetration.

Recent Developments:

- In July 2025, GE Vernova announced a major delivery agreement with Crusoe, a leading AI infrastructure provider, to supply 29 LM2500XPRESS aeroderivative gas turbine packages for Crusoe’s data centers, targeting rapid AI-driven energy demand and emissions mitigation.

- In April 2025, Duke Energy entered a notable partnership with GE Vernova to procure up to eleven American-produced GE Vernova natural gas turbines. This partnership aims to fulfill Duke Energy’s growing demands driven by economic development and the rise of data center power needs.

- In March 2024, TRS Services, a key provider specializing in maintenance, repair, and overhaul of component parts for industrial gas turbines, announced its acquisition by Battle Investment Group. The acquisition is designed to strengthen TRS’s operations and expand strategic growth, particularly in servicing aeroderivative gas turbines used across remote, mobile, and off-grid power solutions, crucial for distributed energy needs in North America

- In November 2024, Wärtsilä joined a research consortium led by the University of Vaasa and funded by Business Finland to scale up a hydrogen-argon power cycle for net-zero power generation. The approach replaces air with recycled argon and oxygen in combustion engines and uses hydrogen as fuel, resulting in only water and inert argon as byproducts.

- In December 2024, Siemens Energy entered a strategic partnership with UK power giant SSE on the “Mission H2 Power” project, focused on developing combustion systems for the SGT5-9000HL gas turbine to operate 100% on hydrogen, supporting full decarbonization of SSE’s Keadby 2 Power Station.

Report Coverage:

The research report offers an in-depth analysis based on Type, Capacity and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Aeroderivative Gas Turbines Market will continue to expand with rising renewable integration requiring fast-response backup systems.

- Industrial adoption will increase as companies prioritize localized generation, cogeneration, and resilient energy infrastructure.

- Offshore oil and gas activities will sustain demand, with turbines supporting marine and floating production platforms.

- Hybrid models combining turbines with storage and renewable sources will gain momentum in distributed networks.

- Hydrogen-ready designs and fuel-flexible technologies will emerge as critical growth enablers in long-term strategies.

- Digital platforms for predictive maintenance and real-time monitoring will redefine service models and performance reliability.

- Governments will encourage modernization of aging infrastructure, driving replacement demand for efficient aeroderivative systems.

- Lightweight and modular turbine designs will support growth in portable and emergency applications across multiple industries.

- Strategic alliances among global manufacturers will expand market penetration and strengthen regional positioning.

- Sustainability policies and stricter emission standards will accelerate innovation and adoption of cleaner turbine solutions.