Market Overview

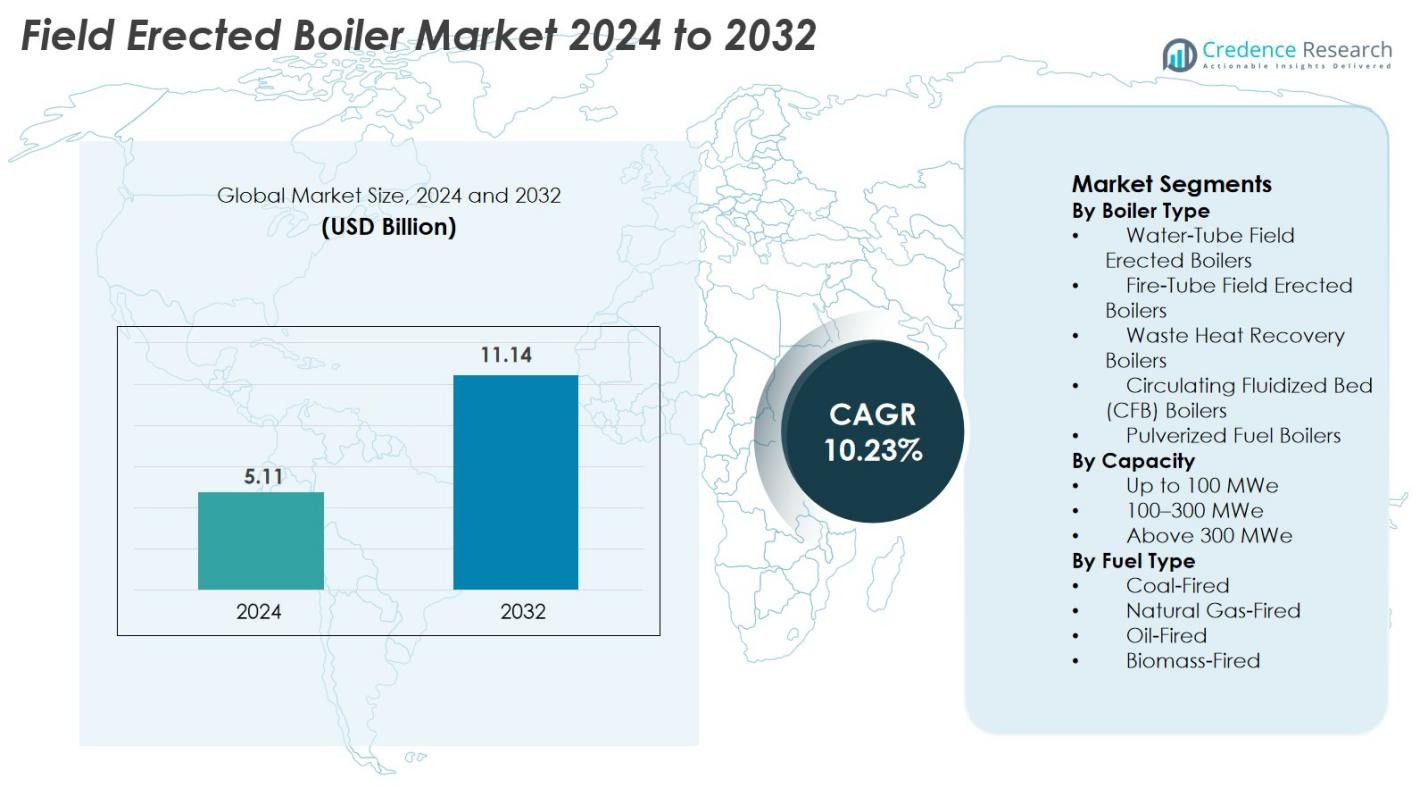

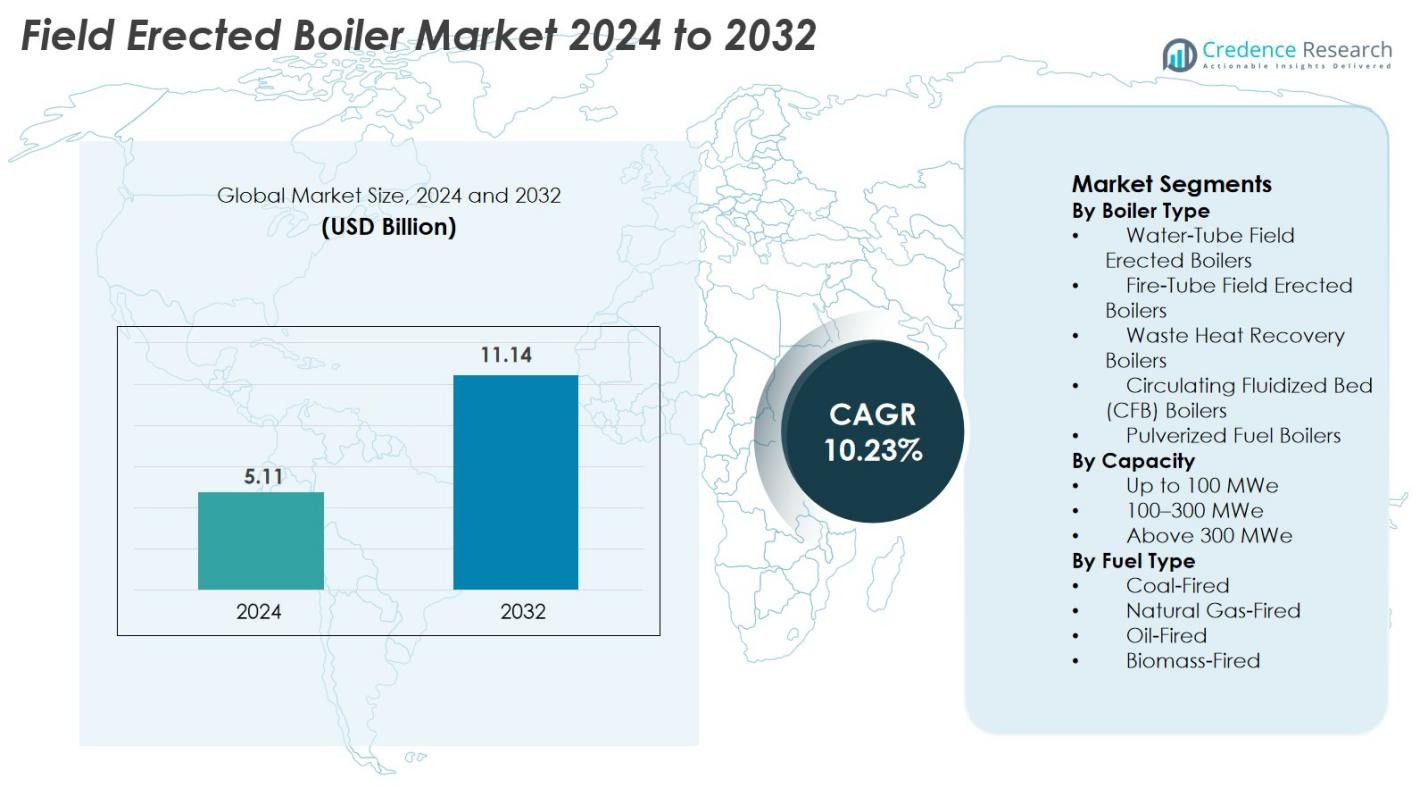

Field Erected Boiler Market size was valued at USD 5.11 Billion in 2024 and is anticipated to reach USD 11.14 Billion by 2032, at a CAGR of 10.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Field Erected Boiler Market Size 2024 |

USD 5.11 Billion |

| Field Erected Boiler Market, CAGR |

10.23% |

| Field Erected Boiler Market Size 2032 |

USD 11.14 Billion |

Field Erected Boiler Market is driven by strong participation from leading manufacturers including Zeeco Connecticut, Alfa Laval Corporate AB, Applied Control Engineering Inc., Indeck Power Equipment Co., Ware Inc., Allied General Services, Industrial Boiler & Mechanical Co. Inc., Miller & Chitty Co. Inc., HydroTherm, and Emerson Electric Company. These companies strengthen market growth through advanced combustion technologies, high-efficiency steam generation systems, and comprehensive field engineering capabilities. Asia Pacific remains the dominant regional market with a 42.6% share in 2024, supported by rapid industrialization and large-scale power plant installations. North America and Europe follow, driven by modernization of thermal assets and stringent emission compliance requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Field Erected Boiler Market was valued at USD 5.11 Billion in 2024 and is projected to reach USD 11.14 Billion by 2032, expanding at a CAGR of 10.23%.

- Market growth is driven by rising demand for high-capacity steam generation in power plants and heavy industries, supported by modernization of aging thermal assets and expansion of petrochemical, mining, and metal processing sectors.

- A key trend includes increasing adoption of biomass, natural gas, and waste heat recovery boilers, alongside digital monitoring, automation, and predictive maintenance capabilities to improve operational efficiency.

- Leading players such as Zeeco Connecticut, Alfa Laval Corporate AB, Indeck Power Equipment Co., Miller & Chitty Co. Inc., and Emerson Electric Company compete through advanced combustion technologies, multi-fuel capabilities, and customized engineering solutions.

- Asia Pacific dominates the market with a 42.6% share, followed by North America at 21.4% and Europe at 19.8%, while Water-Tube Boilers lead the boiler type segment with a 42.7% share.

Market Segmentation Analysis

By Boiler Type

Water-Tube Field Erected Boilers dominated the Field Erected Boiler Market in 2024, accounting for 42.7% of total installations. Their leadership stems from their ability to handle high pressures, rapid steam generation, and suitability for large power plants and heavy industrial operations. Waste Heat Recovery Boilers also expanded steadily due to rising demand for energy efficiency and emission reduction. Circulating Fluidized Bed (CFB) Boilers gained traction in biomass and low-grade fuel applications, while Fire-Tube and Pulverized Fuel Boilers maintained relevance in smaller-scale and legacy facilities.

- For instance, Water-tube boilers are widely used in large steam-turbine power plants because they can safely generate high-pressure steam at pressures up to ~ 160 bar and temperatures up to ~ 550 °C a level of steam quality and capacity that fire-tube boilers cannot match.

By Capacity

The 100–300 MWe capacity segment held the largest share in 2024, capturing 46.3% of the Field Erected Boiler Market. This range remains the preferred choice for utility operators and industrial power producers seeking optimal balance between output, fuel efficiency, and operational scalability. The Above 300 MWe segment continues to grow with ongoing large-scale thermal power projects, while Up to 100 MWe units remain popular for captive industrial plants. Demand across capacities is driven by grid stability needs, industrial expansion, and modernization of fossil-based and hybrid power infrastructure.

- For instance, BHEL’s 210 MWe units deployed across multiple Indian thermal stations operate with proven efficiency parameters above 34% and continue to be the most widely installed mid-range field-erected boiler configuration.

By Fuel Type

Coal-Fired Field Erected Boilers remained the dominant fuel category in 2024 with 39.8% market share, supported by high fuel availability in emerging economies and ongoing reliance on coal-based thermal power. Natural Gas-Fired Boilers grew rapidly due to lower emissions and rising adoption of gas-based industrial heating. Biomass-Fired Boilers gained momentum with renewable energy mandates, while Oil-Fired units sustained demand in remote industrial operations. Overall market growth is driven by a shift toward cleaner combustion, hybrid fuel systems, and rising investment in low-NOx and energy-efficient boiler configurations.

Key Growth Drivers

Growing Demand for Large-Scale Power Generation Infrastructure

The global acceleration of power generation projects continues to be a major growth driver for the Field Erected Boiler Market. Expanding electricity consumption from industrialization, urban growth, and demographic shifts is pushing utilities to enhance thermal power capacity, particularly in Asia Pacific, the Middle East, and Africa. Field erected boilers remain essential due to their ability to support high-capacity, high-pressure steam generation required for plants above 100 MWe. Many regions are modernizing aging thermal assets, replacing inefficient boilers with high-efficiency, low-NOx and digitally controlled units. Countries relying on coal and natural gas for base-load stability continue investing in site-assembled boilers for flexibility and long-term performance. The need to stabilize grids with rising renewable penetration further sustains demand for efficient steam-generating systems. Collectively, these factors reinforce the continued growth of field erected boilers across global power markets.

- For instance, NTPC Limited commissioned the 1,600 MW (2 × 800 MW) Gadarwara Super Thermal Power Station in Madhya Pradesh, India a supercritical coal-fired plant built with on-site assembly.

Industrial Expansion Across Heavy Manufacturing Sectors

Expanding operations across industries such as chemicals, petrochemicals, pulp and paper, mining, metals, and food processing are significantly driving adoption of field erected boilers. These sectors require continuous, high-volume steam and heat supply, which packaged boilers cannot adequately deliver. Field erected boilers offer greater capacity, robust construction, and long service life, making them ideal for large industrial facilities and captive power systems. Emerging economies are witnessing rapid manufacturing investments and refinery expansions, increasing the need for reliable boiler installations. Meanwhile, developed economies are upgrading older boilers to improve thermal efficiency and reduce operational costs. Many industries are also adopting on-site power generation to reduce dependence on grid electricity and enhance cost control. With rising industrial energy consumption, field erected boilers have become a strategic asset supporting high-load operations and process stability.

- For instance, BASF’s Ludwigshafen chemical complex operates large field-erected steam generators supporting process steam networks exceeding 100 km, enabling uninterrupted high-pressure steam supply for chemical production lines.

Rising Adoption of Energy-Efficient and Low-Emission Technologies

Stricter global emission standards and rising emphasis on sustainability are pushing industries to adopt energy-efficient and low-emission field erected boilers. Governments are imposing tighter regulations on NOx, SOx, and particulate emissions, encouraging investments in high-efficiency burners, flue gas recirculation, and advanced combustion systems. Field erected boilers supporting natural gas, biomass, waste heat recovery, and multi-fuel capabilities are gaining strong traction due to their lower environmental impact. Industrial plants are increasingly adopting waste heat recovery boilers to capture excess process heat and reduce fuel consumption. Additionally, the integration of automated controls for air–fuel management enhances operational efficiency and compliance. As companies pursue ESG goals and carbon-reduction pathways, demand for modernized, cleaner boiler systems continues to rise, strengthening the market outlook.

Key Trend & Opportunity

Digitalization, Automation, and Predictive Maintenance

Digital transformation is reshaping the Field Erected Boiler Market, with industries adopting IoT-enabled monitoring systems, AI-based diagnostics, and predictive maintenance tools. Modern boilers equipped with smart sensors continuously analyze parameters such as temperature, pressure, fuel usage, and emissions, allowing operators to detect performance deviations in real time. Predictive algorithms reduce unplanned downtime, extend component life, and optimize combustion efficiency. Digital twins enable simulation of boiler behavior under various operating conditions, improving decision-making and maintenance planning. Remote monitoring platforms support multi-site operations, enabling centralized control for large industrial groups. This shift toward intelligent, automated boiler systems offers manufacturers significant opportunities to innovate and deliver advanced digital solutions that enhance reliability, safety, and lifecycle performance.

- For instance, Siemens’ SPPA-T3000 platform provides real-time boiler diagnostics and remote operation for large utility boilers, using integrated sensors and digital dashboards adopted across multiple thermal plants worldwide.

Shift Toward Renewable and Hybrid Fuel Boiler Systems

The global transition to cleaner energy sources is creating strong opportunities for biomass-fired, waste-to-energy, and hybrid fuel boilers within the field erected category. Governments in Asia, Europe, and Latin America are promoting renewable thermal solutions to reduce dependence on fossil fuels. Field erected boilers that operate on agricultural residues, wood pellets, industrial by-products, and municipal waste are increasingly preferred due to their lower carbon footprint. Hybrid boilers capable of switching between coal, biomass, and natural gas offer flexibility during fuel supply fluctuations. Waste heat recovery units are gaining popularity for their ability to improve energy efficiency and reduce operational costs. As industries align with carbon-neutrality targets, renewable-ready boiler solutions are becoming a central element of sustainable industrial transformation.

- For instance, the Avedøre Power Station in Denmark operates multi-fuel field-erected boilers capable of burning wood pellets, natural gas, and light fuel oil, supporting flexible low-carbon generation with documented high thermal efficiencies.

Key Challenge

High Installation Costs and Long Construction Timelines

Field erected boilers require substantial capital investment due to complex engineering, large-scale fabrication, and site-specific assembly. Installation costs rise further when projects involve advanced emission control systems, custom configurations, or premium materials for high-temperature operations. Construction timelines are typically long, involving groundwork, structural development, logistics coordination, and skilled manpower. Any delays in permitting, environmental clearances, or material supply chains can extend project schedules significantly. For small and mid-sized industries, the high upfront expenditure can be a barrier, prompting some to select modular or packaged alternatives with faster commissioning. These financial and operational constraints restrict market adoption in price-sensitive and resource-constrained sectors.

Environmental Compliance Pressure and Decline of Coal-Fired Projects

Tightening environmental regulations represent a major challenge, particularly for coal-fired field erected boilers. Many countries are adopting aggressive decarbonization policies, shutting down older coal plants, and restricting new coal-based installations. Industries operating coal-fired boilers face rising compliance costs, requiring advanced pollution control systems, monitoring devices, and upgraded fuel-handling infrastructure. Transitioning to cleaner fuels such as natural gas or biomass often requires major redesign and investment. Public and investor pressure to meet climate commitments is also reshaping procurement strategies across heavy industries. Combined, these factors limit long-term demand for conventional fuel-based field erected boilers and push manufacturers toward cleaner, more adaptable alternatives.

Regional Analysis

North America

North America held 21.4% of the Field Erected Boiler Market in 2024, driven by modernization of aging thermal power units, refinery expansions, and strong investments in industrial heating infrastructure. The U.S. leads regional demand due to ongoing upgrades in oil & gas, chemicals, and metals industries, supported by stringent emission regulations that encourage adoption of efficient, low-NOx boiler systems. Growth is also supported by increasing adoption of natural gas-fired and waste heat recovery boilers across industrial facilities. Canada contributes moderately, driven by mining operations, pulp & paper expansion, and renewable-integrated hybrid boiler deployments.

Europe

Europe accounted for 19.8% of the market in 2024, supported by large-scale industrial retrofits, decarbonization projects, and rising adoption of biomass- and waste-fired field erected boilers. Germany, the UK, and France lead demand as industries replace older coal-fired installations with cleaner and more efficient technologies. The region’s stringent emission regulations—particularly NOx and CO₂ reduction mandates—drive investments in advanced combustion control and hybrid fuel systems. Eastern Europe shows steady growth due to industrial expansion in metals, chemicals, and district heating networks. Overall, Europe’s transition toward energy-efficient and renewable-ready boilers continues to shape market development.

Asia Pacific

Asia Pacific dominated the Field Erected Boiler Market in 2024 with a 42.6% share, driven by rapid industrialization, large-scale power plant installations, and expanding manufacturing hubs. China, India, Japan, and South Korea lead demand due to rising electricity consumption, petrochemical capacity additions, and growth in mining, metals, and cement industries. Ongoing construction of coal, gas, and biomass power plants further strengthens market uptake. Southeast Asia also shows strong momentum, supported by refinery upgrades and industrial diversification. The region’s combination of high energy demand, infrastructure development, and supportive government policies ensures sustained long-term growth.

Latin America

Latin America captured 8.7% of the global market in 2024, with growth anchored by expanding oil & gas refining, mining, and chemical processing operations. Brazil and Mexico drive regional demand through industrial expansion and modernization of thermal power assets. The region is increasingly adopting field erected boilers for biomass-based power due to abundant agricultural residues, supporting renewable energy objectives. Investments in pulp & paper and food processing industries also fuel market demand. While economic volatility occasionally impacts project timelines, the modernization of legacy boilers and growth in industrial heating applications continue to stimulate regional adoption.

Middle East & Africa

The Middle East & Africa region held 7.5% of the Field Erected Boiler Market in 2024, supported by ongoing refinery expansions, petrochemical projects, and industrial diversification plans. Countries such as Saudi Arabia, the UAE, and Qatar lead installations due to strong energy infrastructure development and high steam demand in oil processing facilities. Africa shows increasing adoption in mining, metals, and cement industries, particularly in South Africa and Nigeria. Investments in waste heat recovery systems and natural gas-fired boilers are rising as industries pursue efficiency and emission compliance. Overall, sustained industrial growth supports steady regional market expansion.

Market Segmentations

By Boiler Type

- Water-Tube Field Erected Boilers

- Fire-Tube Field Erected Boilers

- Waste Heat Recovery Boilers

- Circulating Fluidized Bed (CFB) Boilers

- Pulverized Fuel Boilers

By Capacity

- Up to 100 MWe

- 100–300 MWe

- Above 300 MWe

By Fuel Type

- Coal-Fired

- Natural Gas-Fired

- Oil-Fired

- Biomass-Fired

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Field Erected Boiler Market is characterized by a mix of global engineering firms, regional manufacturers, and specialized industrial boiler companies focusing on large-scale steam generation and high-efficiency thermal solutions. Key players such as Zeeco Connecticut, Alfa Laval Corporate AB, Applied Control Engineering Inc., Indeck Power Equipment Co., Ware Inc., Allied General Services, Industrial Boiler & Mechanical Co. Inc., Miller & Chitty Co. Inc., HydroTherm, and Emerson Electric Company actively compete through technology innovation, customized engineering services, and strong aftersales support. Market participants prioritize advanced combustion technologies, low-NOx systems, modular field erection methods, and digital monitoring solutions to meet rising efficiency and emission standards. Strategic partnerships with EPC contractors, refinery operators, and power producers further enhance market presence. Continuous modernization of industrial heating assets and strong investments in energy-efficient boiler systems create opportunities for manufacturers offering integrated solutions, multi-fuel capabilities, and long-term service contracts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, the government in India mandated that for industrial-boiler tenders under certain categories, only domestic suppliers may participate restricting foreign participation for supply and services, including fabrication, erection, and installations.

- In January 2025, Babcock & Wilcox Enterprises, Inc. (B&W) announced that its Thermal segment was awarded a contract worth USD 13 million to retrofit boiler-cleaning equipment, including supply and installation of Diamond Power sootblowers and HydroJet systems for a power plant in Southeast Asia.

- In January 2025, Miura revised upward its full-year guidance, citing the acquisition of Cleaver-Brooks and strong demand for marine and industrial boilers outside Japan.

Report Coverage

The research report offers an in-depth analysis based on Boiler Type, Capacity, Fuel Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward high-efficiency and low-emission boiler technologies to comply with global environmental regulations.

- Adoption of biomass, waste-to-energy, and hybrid fuel boilers will accelerate as industries pursue cleaner thermal energy solutions.

- Digitalization, including IoT-based monitoring and predictive maintenance, will become a standard feature in next-generation field erected boilers.

- Utilities and industries will invest more in waste heat recovery systems to reduce fuel consumption and improve operational efficiency.

- Growth in large-scale thermal power projects across Asia Pacific and the Middle East will continue to drive demand.

- Manufacturers will expand engineering capabilities to deliver customized, large-capacity boilers tailored for complex industrial operations.

- Retrofit and modernization projects will rise as industries upgrade aging boilers to meet efficiency and emission standards.

- Supply chain localization will gain importance to reduce project delays and enhance regional manufacturing strength.

- Partnerships between boiler OEMs, EPC contractors, and automation companies will increase to deliver integrated solutions.

- Renewable-ready boiler designs will gain prominence as industries prepare for long-term carbon reduction targets.