Market Overview:

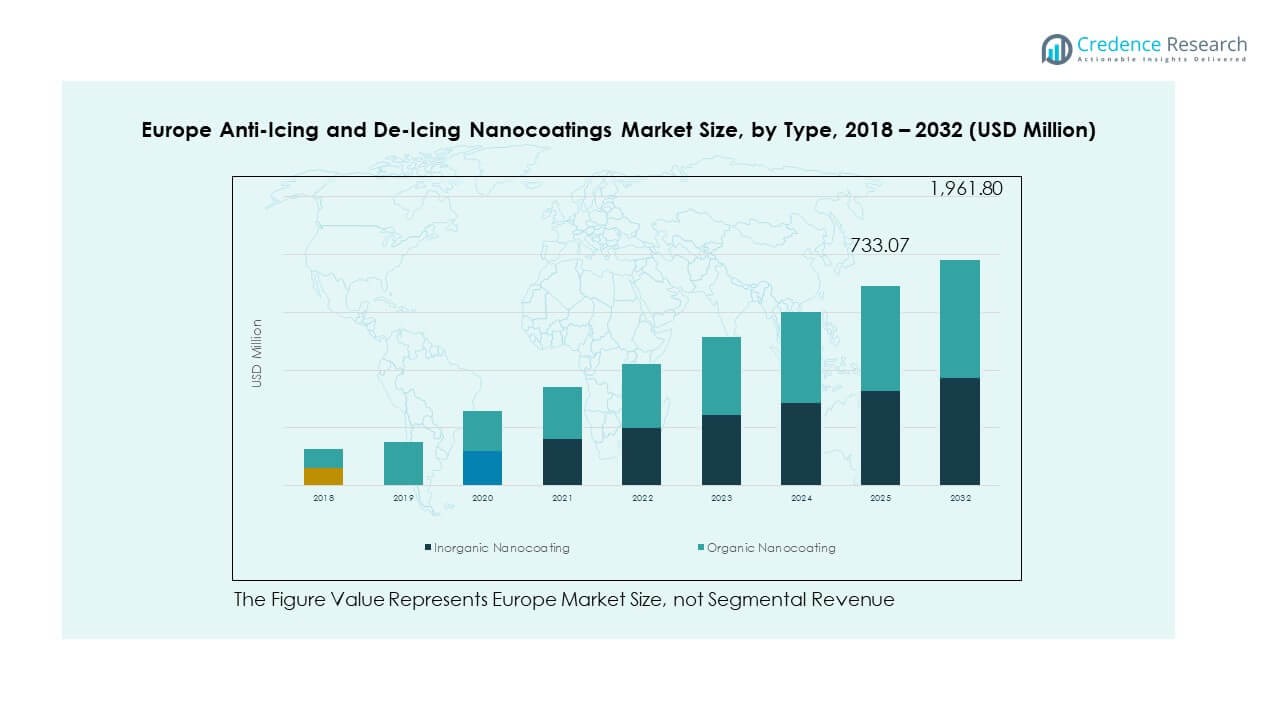

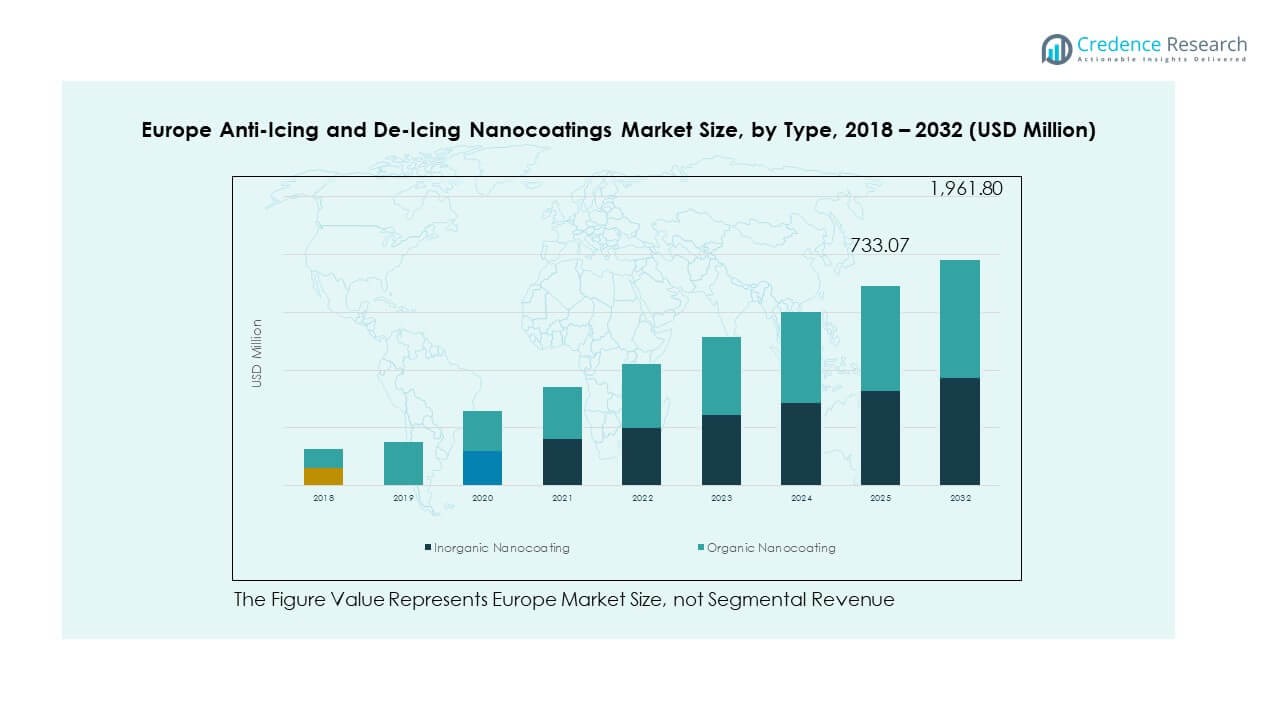

The Europe Anti-Icing and De-Icing Nanocoatings Market size was valued at USD 79.25 million in 2018 to USD 187.33 million in 2024 and is anticipated to reach USD 584.22 million by 2032, at a CAGR of 15.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Anti-Icing and De-Icing Nanocoatings Market Size 2024 |

USD 187.33 Million |

| Europe Anti-Icing and De-Icing Nanocoatings Market, CAGR |

15.1% |

| Europe Anti-Icing and De-Icing Nanocoatings Market Size 2032 |

USD 584.22 Million |

Growing demand for safety and operational efficiency across transportation, energy, and aerospace sectors is driving market growth. Airlines and automotive manufacturers increasingly adopt nanocoatings to reduce reliance on chemical de-icing solutions and improve performance in cold conditions. The coatings extend equipment life by protecting surfaces from ice adhesion, corrosion, and mechanical wear. Furthermore, rising sustainability goals push industries to adopt eco-friendly solutions, with nanocoatings emerging as a cost-efficient and reliable alternative to conventional de-icing methods.

Geographically, Western Europe dominates the market, with countries such as Germany, France, and the United Kingdom leading adoption due to strong aerospace, automotive, and renewable energy sectors. The Nordic countries are emerging as key growth regions, driven by harsh winters and the need for reliable anti-icing solutions across energy and transportation. Eastern European nations are gradually adopting nanocoatings, supported by infrastructure modernization and rising investments in cold-weather technologies. This mix of mature and emerging markets positions Europe as a critical hub for nanocoating advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Anti-Icing and De-Icing Nanocoatings Market was valued at USD 79.25 million in 2018, reached USD 187.33 million in 2024, and is projected to reach USD 584.22 million by 2032, growing at a CAGR of 15.1%.

- Western Europe held the largest share at 38%, supported by advanced aerospace, automotive, and energy industries; Northern Europe followed with 27%, driven by harsh winters and wind energy demand; Eastern Europe accounted for 20%, fueled by infrastructure upgrades and renewable energy projects.

- Northern Europe is the fastest-growing subregion with 27% share, propelled by extreme cold conditions, expanding offshore wind projects, and strong research collaboration.

- In 2024, inorganic nanocoatings accounted for 60% of the market share due to their durability and superior thermal resistance.

- Organic nanocoatings represented 40% of the market share, supported by demand for eco-friendly and flexible solutions in textiles and packaging.

Market Drivers

Rising Focus on Safety Standards and Regulatory Compliance in Cold-Weather Operations

Stringent European regulations around aviation, transportation, and energy sectors are pushing industries to adopt advanced protective coatings. Safety in extreme cold remains a key concern, and nanocoatings are increasingly recognized as a preventive solution. The coatings reduce ice accumulation on surfaces, lowering risks of accidents and operational failures. Aircraft manufacturers integrate them into components to meet evolving air safety rules. Automotive firms adopt coatings for windshields, mirrors, and sensors to maintain driver safety in snow-prone regions. Wind energy projects in northern Europe also face strict compliance requirements for turbine performance. This trend strengthens demand for innovative nanocoatings. The Europe Anti-Icing and De-Icing Nanocoatings Market benefits from regulatory frameworks supporting sustainable, effective alternatives to chemical de-icing.

Increasing Adoption in Aerospace and Aviation Industries Driving Market Expansion

Aerospace remains one of the largest users of advanced nanocoatings across Europe. Airlines and aircraft manufacturers focus on reducing dependency on chemical de-icing fluids. These fluids add significant operational costs and environmental risks, which makes nanocoatings attractive. The coatings improve safety by enabling faster ice removal and longer-lasting protection. Engine efficiency improves due to reduced weight caused by frozen deposits on aircraft wings. Maintenance intervals extend, lowering costs for operators while ensuring reliability during winter. Passenger safety gains further attention, driving investment in surface technologies. The Europe Anti-Icing and De-Icing Nanocoatings Market shows strong growth as airlines embrace coatings for efficiency and compliance.

- For example, in March 2024, the Nordex Group secured a 98 MW order from Holmen Energi for the Blisterliden wind farm in Västerbotten, northern Sweden. The contract includes supplying and installing 14 N163/6.X turbines fitted with the Nordex Advanced Anti‑Icing System, delivered in a cold‑climate version to ensure reliable operation under severe winter conditions.

Expanding Use of Nanocoatings in Renewable Energy Infrastructure Across Europe

Renewable energy expansion in Europe increases the demand for anti-icing nanocoatings. Wind farms located in Nordic countries experience efficiency losses from blade icing. Coatings provide a sustainable solution by improving energy output during severe winters. Turbine downtime reduces significantly when blades remain ice-free for longer durations. Energy firms save costs by avoiding frequent maintenance visits in harsh climates. Governments encourage renewable energy firms to adopt technologies that reduce environmental impact. Nanocoatings align with carbon neutrality targets by replacing chemical alternatives. The Europe Anti-Icing and De-Icing Nanocoatings Market gains momentum from energy operators seeking reliable winter performance solutions.

Growing Need for Cost Reduction and Operational Efficiency in Transportation and Infrastructure

Transportation companies across Europe search for ways to enhance efficiency in icy conditions. Rail operators face major delays due to frozen tracks and infrastructure issues. Nanocoatings minimize ice adhesion and improve service reliability in colder months. Road safety authorities explore coatings for bridges, traffic signs, and highways to prevent dangerous ice buildup. The shipping industry deploys coatings on vessels to improve safety and efficiency in Arctic routes. This reduces dependency on salt-based de-icing methods, lowering both costs and environmental damage. Public infrastructure planners adopt nanocoatings for long-term sustainability goals. The Europe Anti-Icing and De-Icing Nanocoatings Market grows steadily as cost-efficient protection remains a major driver.

- For instance, Hempel’s Hempaguard X7 nanocoatinghas achieved up to 20% reduction in vessel fuel consumption and mitigated 5 million tons of CO₂ emissions this result is verified by DNV and has been documented across over 2,000 ship applications.

Market Trends

Rising Shift Toward Eco-Friendly Nanocoating Formulations Across Industrial Sectors

Industries across Europe prioritize sustainability and eco-friendly practices, creating a strong demand for green nanocoatings. Manufacturers develop non-toxic and biodegradable formulations to replace traditional chemical de-icing. It reduces the ecological impact on soil and water systems near airports and highways. Public policies encourage innovation that aligns with the European Green Deal objectives. Airports in particular embrace eco-friendly options to meet environmental regulations. Coatings using water-based chemistries gain popularity due to reduced toxicity and high durability. Automotive firms also incorporate eco-designed coatings into new vehicle designs. The Europe Anti-Icing and De-Icing Nanocoatings Market continues shifting toward sustainable products as companies address climate concerns.

- For instance, VTT Technical Research Centre of Finland has developed bio-based nanocellulose coatings that demonstrated strong oxygen, grease, and mineral oil barrier performance, verified through peer-reviewed packaging trials and commercial pilots. The technology is recognized as a key innovation in sustainable advanced materials within Finland’s research and industrial ecosystem.

Increasing Integration of Smart Coatings with Embedded Sensor Technologies

Smart coatings embedded with sensors represent a new wave of innovation in nanocoating applications. These coatings detect ice buildup in real time and alert operators. It improves monitoring for aircraft wings, turbine blades, and automotive systems. Research institutions and aerospace leaders collaborate to accelerate adoption of intelligent coatings. The technology reduces human intervention and enhances predictive maintenance schedules. Europe’s focus on advanced material science supports large-scale development projects. Real-time monitoring ensures faster response to freezing events, minimizing risk. The Europe Anti-Icing and De-Icing Nanocoatings Market advances with smart technologies transforming operational control across industries.

Strong Research Collaboration Between Industry and Academia Strengthening Market Growth

European research institutes play a key role in advancing nanocoating science. Universities partner with aerospace and energy companies to test advanced anti-icing solutions. Collaborative projects secure funding from both government and private investments. It accelerates development cycles and enhances commercialization opportunities for innovative formulations. Joint ventures explore hybrid solutions combining nanocoatings with heating technologies. Large-scale testing in Nordic climates strengthens confidence in new applications. This collaborative environment ensures faster adoption across multiple industries. The Europe Anti-Icing and De-Icing Nanocoatings Market benefits from strong research partnerships supporting rapid innovation.

- For instance, the Nordic TopNANO project, involving Norwegian and Swedish research agencies with industrial partners, validated passive anti-icing nanocoatings in scaled-up field tests at wind parks during winter. The initiative created a Nordic platform for industrial anti-icing solutions, supported by cross-border collaborations funded by national research councils.

Growing Interest in Application Beyond Aerospace and Energy Sectors Expanding Market Potential

Applications of nanocoatings now extend beyond traditional aerospace and energy uses. Textile manufacturers explore coatings for winter sportswear and protective gear. Food packaging companies experiment with coatings to prevent frost buildup on surfaces. Electronics firms apply protective layers to sensors and circuits vulnerable to ice formation. It broadens the market scope, bringing new commercial opportunities for suppliers. The trend highlights cross-industry interest in leveraging ice-repellent surfaces. Diversified use cases expand the consumer base and lower dependency on a single sector. The Europe Anti-Icing and De-Icing Nanocoatings Market expands rapidly as industries beyond aerospace begin adoption.

Market Challenges Analysis

High Development Costs and Complex Manufacturing Limiting Commercial Expansion

The development of advanced nanocoatings requires significant investment in research and testing. Complex production processes demand high-end facilities and precision equipment. It raises manufacturing costs, limiting affordability for many smaller industries. Companies face difficulty in scaling production to meet large industrial demand. High costs discourage adoption in low-margin markets like consumer goods and infrastructure. Certification processes also extend time-to-market, delaying potential returns. Competitive pricing pressure further reduces profitability for new entrants. The Europe Anti-Icing and De-Icing Nanocoatings Market struggles to balance innovation with commercial viability.

Limited Awareness and Adoption Barriers Among End-Users Restricting Growth

End-users across several sectors remain cautious about adopting nanocoatings. A lack of awareness about long-term benefits slows purchasing decisions. Industries still rely on conventional methods due to familiarity and lower upfront costs. It reduces penetration in public infrastructure and mid-sized enterprises. Resistance arises from uncertainty over durability under extreme climate conditions. Limited case studies make it harder to convince decision-makers in emerging economies. Training requirements for applying coatings also create operational challenges. The Europe Anti-Icing and De-Icing Nanocoatings Market faces hurdles in bridging knowledge gaps and overcoming resistance to change.

Market Opportunities

Expansion into Consumer Goods and Everyday Applications Creating New Demand Streams

Opportunities are expanding beyond industrial sectors into consumer applications. Textile producers adopt nanocoatings for jackets, gloves, and sports equipment. It ensures comfort and protection in harsh winter conditions. Household appliance firms apply coatings to prevent frost inside refrigerators and freezers. Automotive aftermarket suppliers explore nanocoating kits for private vehicles. Consumer-driven adoption reduces reliance on large industrial projects alone. New applications broaden awareness of nanocoating benefits and accelerate market reach. The Europe Anti-Icing and De-Icing Nanocoatings Market leverages rising consumer interest to expand market penetration.

Strategic Investment in Emerging Regions Offering High Growth Prospects

Eastern Europe and Nordic countries present strong opportunities for future expansion. Growing infrastructure modernization projects create demand for cost-effective ice prevention. It provides suppliers with access to new revenue streams and growth potential. Government initiatives in renewable energy boost demand for turbine blade protection. Harsh winters drive interest in advanced coatings for transportation and logistics. Strategic partnerships with local firms support faster distribution and acceptance. The Europe Anti-Icing and De-Icing Nanocoatings Market captures new prospects by focusing investment on high-demand emerging regions.

Market Segmentation Analysis:

The Europe Anti-Icing and De-Icing Nanocoatings Market is segmented

By type

Into inorganic and organic nanocoatings. Inorganic nanocoatings dominate due to their durability, strong thermal resistance, and ability to perform in extreme cold environments. Industries such as aerospace, energy, and transportation rely on inorganic solutions for long-term performance on aircraft wings, wind turbine blades, and infrastructure surfaces. Organic nanocoatings, while emerging, attract attention for flexibility, eco-friendly properties, and potential use in textiles and packaging. The shift toward sustainable materials is encouraging greater adoption of organic formulations, though their market share remains secondary to inorganic coatings.

- For instance, NEI Corporation offers NANOMYTE® SuperCN inorganic coatings, tested to provide over 1,000 hours of corrosion resistance in salt fog environments, while P2i’s Aridion™ organic nanocoating is deployed by global hearing aid manufacturers to protect millions of devices from moisture damage.

By application

The market shows strong traction in transportation where safety and reliability drive demand for advanced coatings on vehicles, aircraft, and rail systems. Energy is another leading segment, with wind farms in Northern and Eastern Europe investing in nanocoatings to reduce turbine downtime and maintain efficiency during severe winters. Electronics present growth potential, with coatings applied to sensors, circuits, and delicate components vulnerable to frost damage. Textiles gain demand in sportswear and protective gear, offering water repellence and ice resistance for consumer and industrial use. Food and packaging adopt nanocoatings to ensure freshness and prevent frost buildup during storage and transit. Other applications, including shipping and infrastructure, reflect steady uptake, supported by investments in cost efficiency and environmental compliance. It highlights a broadening scope where both industrial and consumer sectors recognize the value of nanocoatings in improving performance under icy conditions.

- For instance, Cytonix develops and offers a range of hydrophobic and superhydrophobic nanocoatings, such as its CytoThane and MicroCure series. These products are used in various industrial applications for water, ice, and snow repellency.

Segmentation:

By Type

- Inorganic Nanocoating

- Organic Nanocoating

By Application

- Transportation

- Textiles

- Energy

- Electronics

- Food & Packaging

- Others

By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe leads the Europe Anti-Icing and De-Icing Nanocoatings Market, accounting for 38% of the total share. The region benefits from advanced aerospace, automotive, and energy industries, with Germany, France, and the UK driving adoption. Strong regulatory frameworks and innovation-focused policies encourage the use of nanocoatings in aviation and transportation sectors. Infrastructure modernization programs also contribute to increased application in public safety and industrial assets. Companies in this region emphasize research and commercialization, giving Western Europe a competitive edge. It continues to set the pace for product innovation and market expansion across Europe.

Northern Europe secures 27% of the market share, driven by extreme weather conditions and the need for reliable anti-icing solutions. Countries such as Sweden, Norway, and Finland show strong demand for nanocoatings in wind energy and transportation sectors. The growth of offshore wind farms in the Nordic region fuels adoption of coatings that extend turbine life and reduce downtime. Harsh winters and frequent ice-related risks in aviation and infrastructure strengthen the demand base. Research collaborations between regional universities and industry players accelerate the deployment of advanced coatings. It positions Northern Europe as one of the most resilient and innovation-driven subregions.

Eastern and Southern Europe collectively represent 35% of the market share, with Eastern Europe holding 20% and Southern Europe 15%. Eastern Europe shows rising adoption in infrastructure and energy projects, particularly in Russia and Poland, where colder climates intensify the need for anti-icing technologies. Government-backed investments in renewable energy also support regional growth. Southern Europe, with countries such as Italy and Spain, demonstrates slower uptake but rising demand in transportation and packaging industries. Warmer climates reduce reliance on coatings in some sectors, yet winter conditions in mountainous areas sustain niche applications. It reflects a mixed growth outlook but highlights untapped opportunities for long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Battelle

- CG2 Nanocoatings

- Fraunhofer

- Hygratek

- Kiss Polymers

- Luna Innovations

- Nanovere Technologies

- NEI Corporation

- Opus Materials Technology

- Other Key Players

Competitive Analysis:

The Europe Anti-Icing and De-Icing Nanocoatings Market features a competitive landscape shaped by innovation, partnerships, and regional expansions. Key players such as Battelle, Fraunhofer, NEI Corporation, Nanovere Technologies, and Luna Innovations focus on developing advanced formulations with improved durability and eco-friendly attributes. Companies emphasize product differentiation through performance in extreme cold, corrosion resistance, and compliance with European environmental standards. Strategic collaborations between industry leaders and research institutions support commercialization of next-generation coatings. It strengthens the market by aligning cutting-edge science with practical industrial needs. Competition also revolves around mergers, acquisitions, and joint ventures that enhance global reach and expand product portfolios. Firms invest heavily in R&D to integrate smart nanocoatings with sensing capabilities, creating new value propositions for aerospace, energy, and transportation clients. Regional players such as CG2 Nanocoatings and Opus Materials Technology cater to niche markets with tailored solutions. Market concentration remains moderate, with global leaders holding significant share while smaller innovators drive flexibility and experimentation. It creates a dynamic balance where established firms maintain dominance, yet emerging players introduce disruptive technologies.

Recent Developments:

- In February 2025, PPG introduced its non-BPA HOBA Pro 2848 coatings for aluminum bottles at Paris Packaging Week, reinforcing its commitment to sustainable and innovative coating solutions while strengthening its position in advanced coatings markets.

- In January 2025, a Riga-based nanocoating startup, Naco Technologies, secured €1.5 million in a pre-Series A funding round co-led by Radix Ventures. It will use the funding to build a production facility in Poland and accelerate its international expansion, especially for coatings that improve hydrogen production efficiency.

- In October 2024, PPG announced a strategic portfolio shift by agreeing to sell its US and Canada architectural coatings business to American Industrial Partners, with the deal expected to close by early 2025. The move allows PPG to redirect resources toward high-growth segments such as advanced coatings, including anti-icing nanocoatings designed for Nordic climates.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for nanocoatings in aviation will rise as airlines prioritize safety and efficiency.

- Renewable energy projects in Nordic regions will drive adoption across turbine applications.

- Smart coatings with sensor integration will reshape predictive maintenance in aerospace and energy.

- Sustainable formulations will dominate as industries move away from chemical de-icing solutions.

- Transportation infrastructure will expand use to enhance road, rail, and maritime safety.

- Consumer textiles and sportswear will emerge as new markets for advanced protective coatings.

- Electronics applications will grow as sensors and circuits require protection in harsh climates.

- Regional collaboration between academia and industry will accelerate commercialization of new technologies.

- Strategic partnerships and M&A activity will increase to strengthen competitive positions.

- The Europe Anti-Icing and De-Icing Nanocoatings Market will remain a hub for innovation in cold-weather performance.