| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Biomaterials Market Size 2024 |

USD 49,163.27 Million |

| Europe Biomaterials Market, CAGR |

14.03% |

| Europe Biomaterials Market Size 2032 |

USD 1,40,577.12 Million |

Market Overview

Europe Biomaterials Market size was valued at USD 49,163.27 million in 2024 and is anticipated to reach USD 1,40,577.12 million by 2032, at a CAGR of 14.03% during the forecast period (2024-2032).

The Europe biomaterials market is experiencing robust growth, driven by increasing demand for advanced medical implants, rising geriatric population, and a surge in chronic disease prevalence. Technological advancements in biomaterial science, particularly in regenerative medicine and tissue engineering, are further propelling market expansion. Growing investments in healthcare infrastructure, coupled with favorable government initiatives supporting biocompatible and sustainable materials, are fostering innovation and adoption. Additionally, the shift toward minimally invasive surgical procedures has amplified the use of biomaterials in orthopedic, cardiovascular, and dental applications. Collaborations between research institutions and key industry players are accelerating the development of next-generation biomaterials with enhanced functionality and safety. Trends such as the integration of nanotechnology and 3D printing are also reshaping product development, offering customized and patient-specific solutions. As sustainability becomes a priority, bio-based and biodegradable materials are gaining traction, positioning the biomaterials market as a pivotal component of Europe’s evolving healthcare landscape.

The Europe biomaterials market is characterized by a strong presence of key players across several regions, each contributing to the market’s growth. Germany leads the market with its advanced healthcare infrastructure, strong research and development capabilities, and growing demand for medical devices. The United Kingdom, France, and Italy also play significant roles, driven by innovation in medical technologies and a rising need for biomaterials in orthopedics, cardiovascular care, and tissue engineering. Major players such as Medtronic, Evonik Industries, Solvay, BioComp, and Axogen are at the forefront, offering a wide range of biomaterials for applications in healthcare, from implants to regenerative medicine. These companies focus on expanding their product portfolios, enhancing research capabilities, and improving patient outcomes, positioning themselves as key contributors to the market’s continued growth. Additionally, government initiatives and advancements in biotechnology are further bolstering market expansion across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe biomaterials market was valued at USD 49,163.27 million in 2024 and is projected to reach USD 140,577.12 million by 2032, growing at a CAGR of 14.03%.

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Increasing demand for advanced medical implants and growing aging populations are major drivers of market growth.

- Technological advancements, particularly in nanotechnology and 3D printing, are significantly shaping biomaterial development.

- The shift towards biodegradable and bio-based materials is gaining momentum, driven by environmental sustainability concerns.

- Key players in the market include Medtronic, Evonik Industries, Solvay, BioComp, and Axogen, which are competing through innovation and strategic partnerships.

- Regulatory challenges and high R&D costs remain significant restraints for market expansion and product development.

- Regionally, Germany, the UK, and France are the leading contributors to the market, with strong healthcare infrastructure and ongoing investments in biomaterials innovation.

Report Scope

This report segments the Europe Biomaterials Market as follows:

Market Drivers

Technological Advancements and Research in Biomaterials

Technological innovations in biomaterial science are significantly contributing to the growth of the market. Advanced research in fields like tissue engineering, regenerative medicine, and nanotechnology has opened new avenues for the development of next-generation biomaterials. For instance, European research institutions are actively developing self-healing and antimicrobial biomaterials to improve the performance and longevity of medical implants. Research efforts focused on creating more biocompatible, durable, and efficient materials are paving the way for enhanced medical treatments and procedures. For instance, the development of self-healing and antimicrobial biomaterials is poised to improve the performance and longevity of medical implants. Furthermore, the integration of nanotechnology into biomaterials enhances their mechanical properties, bioactivity, and drug delivery capabilities. These advancements are crucial in meeting the ever-evolving demands of the healthcare sector and ensuring that biomaterials remain at the forefront of medical innovations.

Government Support and Regulatory Advancements

Government initiatives and favorable regulatory frameworks are playing an important role in driving the growth of the biomaterials market in Europe. For instance, the European Commission has introduced policies promoting the development of biocompatible materials and healthcare innovation. Regulatory bodies such as the European Medicines Agency (EMA) and the European Commission are working to streamline the approval processes for new biomaterials and medical devices. These efforts are designed to ensure safety and efficacy while also enabling faster market entry for innovative products. Furthermore, initiatives that focus on sustainable and biodegradable materials are gaining traction, as Europe emphasizes environmental responsibility in healthcare. These regulatory advancements are fostering a supportive environment for the continuous growth of the biomaterials sector.

Increasing Demand for Advanced Medical Implants

The rising demand for advanced medical implants is one of the primary drivers of the Europe biomaterials market. As the aging population continues to grow, the need for medical devices such as orthopedic implants, dental implants, and cardiovascular stents has surged. Older individuals are more prone to conditions like osteoporosis, osteoarthritis, and cardiovascular diseases, which require surgical intervention. Biomaterials play a crucial role in the production of these medical implants, providing durability, compatibility, and functional support. The growing adoption of minimally invasive surgeries, coupled with innovations in implant materials such as bioresorbable polymers and ceramic-based materials, further boosts the demand for advanced biomaterials in medical applications. This trend is expected to continue driving market growth as medical advancements evolve, providing improved patient outcomes and faster recovery times.

Rise in Chronic Diseases and Surgical Procedures

The growing prevalence of chronic diseases, including cardiovascular diseases, diabetes, and musculoskeletal disorders, is driving the demand for biomaterials in Europe. As the burden of these diseases continues to rise, surgical procedures requiring the use of biomaterials for implants, prosthetics, and tissue repairs are increasing. Biomaterials are essential in providing the support, durability, and functionality needed for successful outcomes in these surgeries. The increased focus on treating chronic conditions with more sophisticated treatments, such as joint replacements and heart valve replacements, is fueling the growth of the biomaterials market. Additionally, advancements in minimally invasive surgery techniques are creating opportunities for new biomaterial applications, leading to a shift toward more efficient and patient-specific medical solutions.

Market Trends

Shift Toward Biodegradable and Bio-based Materials

One of the most prominent trends in the Europe biomaterials market is the growing emphasis on biodegradable and bio-based materials. For instance, the BIO-PLASTICS EUROPE initiative, funded by the European Union’s Horizon 2020 program, is actively researching biodegradable bio-based plastics and their market dynamics. As environmental concerns continue to gain attention, there is a marked shift towards materials that are sustainable and have minimal environmental impact. Biomaterials derived from natural sources, such as plant-based polymers and proteins, are being developed to replace traditional petroleum-based materials in medical devices. These bio-based materials not only reduce environmental footprint but also offer enhanced biocompatibility and reduced risk of complications in the body. Furthermore, biodegradable materials, which gradually degrade after fulfilling their purpose, are being increasingly utilized in applications such as drug delivery systems and wound healing, where the material can naturally break down within the body, reducing the need for surgical removal.

Integration of Nanotechnology in Biomaterial Development

Nanotechnology is increasingly being integrated into biomaterials, bringing about significant advancements in their functionality and performance. For instance, European research institutions are focusing on nanostructured biomaterials to improve mechanical properties and bioactivity in medical applications. Nanostructured biomaterials are being used in applications ranging from drug delivery and wound healing to tissue regeneration and implant coatings. These materials can facilitate more precise and controlled release of therapeutic agents, reduce the risk of infection, and promote faster healing. Additionally, nanomaterials can enhance the interaction between the biomaterial and the surrounding tissue, leading to better integration and reduced rejection rates. This trend is driving innovation and creating new opportunities for biomaterials in medical and healthcare applications.

Growth of Personalized Medicine and Customization

Personalized medicine and the growing demand for customized healthcare solutions are reshaping the Europe biomaterials market. As patient-centric healthcare becomes more prevalent, there is an increasing focus on tailoring treatments and medical devices to the individual needs of patients. Biomaterials are evolving to support this trend by offering more customized solutions, such as personalized implants, prosthetics, and tissue scaffolds that are designed to match the unique anatomical and functional requirements of each patient. Technologies like 3D printing are enabling the production of patient-specific biomaterial-based devices, allowing for more precise and effective treatments. This trend is particularly important in orthopedics, dental care, and reconstructive surgery, where personalized solutions lead to better clinical outcomes and enhanced patient satisfaction.

Expansion of Applications in Regenerative Medicine

The growing field of regenerative medicine is driving the demand for innovative biomaterials designed to support tissue repair, regeneration, and replacement. Biomaterials are increasingly being used as scaffolds in tissue engineering to encourage the growth of new cells and tissues. These materials provide the necessary support for the formation of functional tissue and can be used in applications such as bone regeneration, cartilage repair, and skin regeneration. Advances in stem cell research, combined with biomaterial development, are pushing the boundaries of regenerative medicine and offering potential solutions for conditions that were once considered untreatable. The integration of biomaterials with stem cells, growth factors, and gene therapy is expected to revolutionize medical treatments, particularly for conditions related to aging and traumatic injuries, further driving growth in the biomaterials market.

Market Challenges Analysis

Regulatory and Safety Concerns

One of the significant challenges facing the Europe biomaterials market is the complex and stringent regulatory environment. For instance, the European Medicines Agency (EMA) has established rigorous testing and approval processes for biomaterials used in medical applications to ensure patient safety and long-term effectiveness. Biomaterials are used in critical medical applications, such as implants, prosthetics, and drug delivery systems, where patient safety is paramount. The approval timeline for new biomaterials can be lengthy, particularly when developing novel materials that do not fit into existing regulatory frameworks. Inconsistent regulations across different European countries can also create challenges for manufacturers seeking to enter multiple markets, requiring additional resources to meet diverse regulatory standards. Furthermore, adverse reactions to biomaterials, such as inflammation or rejection by the body, remain a concern, making regulatory compliance and safety assessments critical for market success.

High Research and Development Costs

Another challenge for the European biomaterials market is the high cost of research and development (R&D) associated with developing new and innovative materials. The development of biomaterials requires significant investment in research, particularly when pursuing advanced technologies like nanomaterials or biodegradable polymers. These materials often require years of development and testing before they are deemed viable for use in medical applications. Additionally, the costs associated with clinical trials, regulatory approvals, and post-market surveillance can be prohibitive, especially for smaller companies or startups. While the demand for advanced biomaterials is growing, the financial burden of R&D may limit the ability of some companies to compete in this rapidly evolving market. This can create barriers to entry for new players and slow the pace of innovation in the biomaterials sector.

Market Opportunities

The Europe biomaterials market presents significant growth opportunities driven by several key factors. As the demand for advanced healthcare solutions continues to rise, there is an increasing need for innovative biomaterials in areas such as orthopedics, cardiovascular devices, dental care, and tissue engineering. The growing aging population in Europe, along with an increase in chronic diseases and lifestyle-related conditions, provides a substantial market for implants and prosthetics. Additionally, the ongoing advancements in biomaterial technologies, particularly the integration of nanotechnology and 3D printing, open new avenues for customized medical devices tailored to the specific needs of patients. This personalized approach not only improves clinical outcomes but also enhances patient satisfaction, creating lucrative opportunities for companies to develop highly specialized biomaterial solutions.

Moreover, the shift toward sustainability and eco-friendly healthcare solutions presents another opportunity for the biomaterials market in Europe. As environmental awareness increases, there is a rising demand for biodegradable and bio-based materials in medical applications. Biomaterials derived from natural sources offer a viable alternative to traditional synthetic materials, reducing both environmental impact and the risk of long-term complications in the body. The increasing focus on regenerative medicine also holds great promise, with growing interest in biomaterials that support tissue repair and regeneration. Innovations in stem cell research and regenerative technologies, combined with biomaterial development, offer the potential for groundbreaking treatments in areas such as organ regeneration and wound healing. These trends position the European biomaterials market for substantial growth as manufacturers focus on sustainability, customization, and advanced medical solutions.

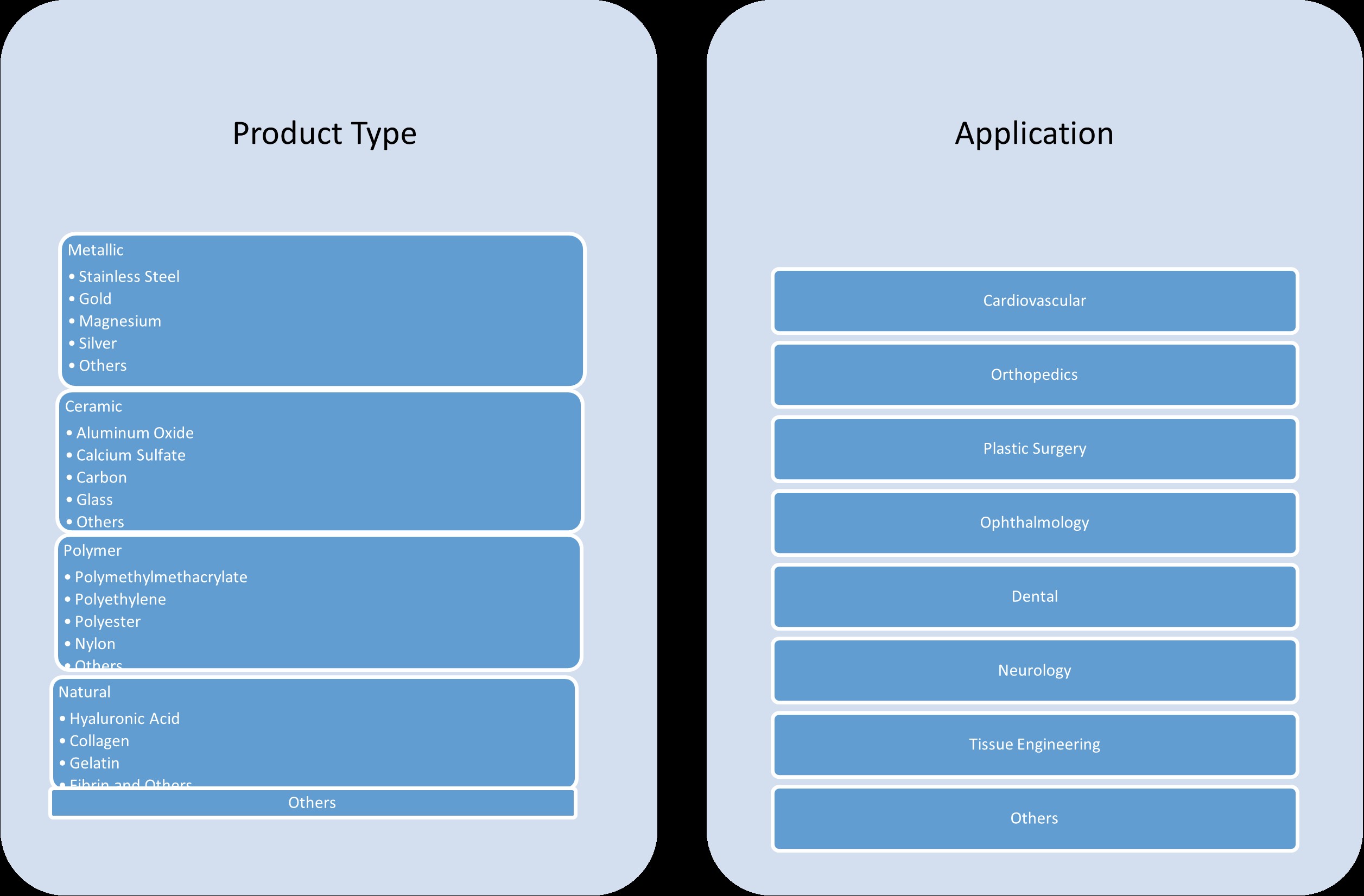

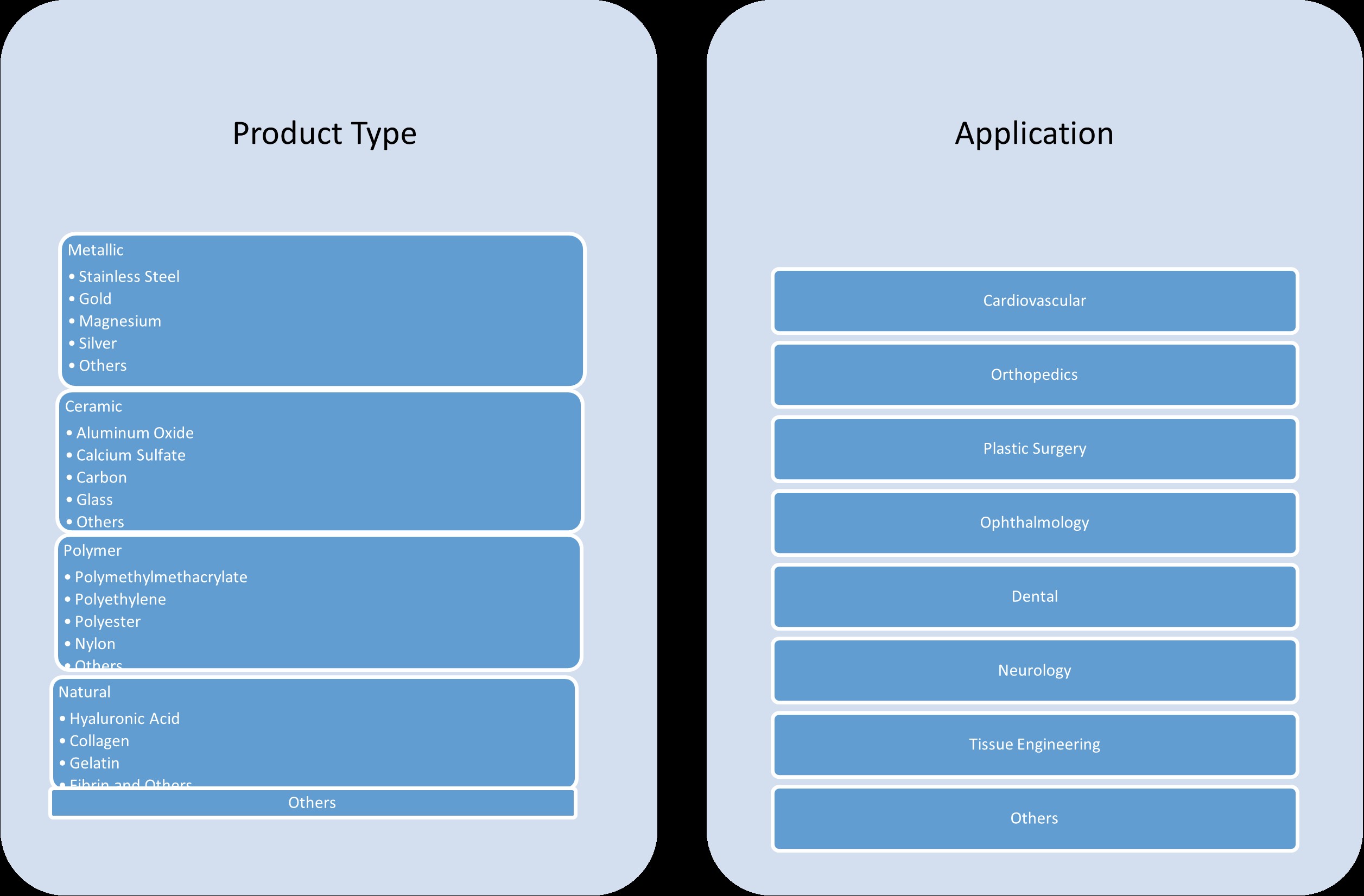

Market Segmentation Analysis:

By Product Type:

The European biomaterials market is segmented by product type into metallic, ceramic, polymer, and natural materials, each offering unique advantages for various medical applications. Metallic biomaterials such as stainless steel, gold, magnesium, and silver are widely used in implants due to their strength, durability, and biocompatibility. Stainless steel remains the most common material for orthopedic implants, while magnesium is gaining attention for its biodegradable properties, particularly in temporary implants. Ceramic biomaterials like aluminum oxide, calcium sulfate, carbon, and glass are preferred in applications requiring biocompatibility and wear resistance, making them ideal for dental implants and bone repair. Polymer biomaterials, including polymethylmethacrylate (PMMA), polyethylene, and nylon, are commonly used in prosthetics, drug delivery systems, and tissue scaffolds. These materials offer flexibility, ease of molding, and lower costs. Lastly, natural biomaterials such as hyaluronic acid, collagen, and gelatin are increasingly utilized in regenerative medicine, wound healing, and tissue engineering due to their inherent biological properties that promote tissue regeneration.

By Application:

The application segments of the European biomaterials market encompass various therapeutic areas, with significant demand across cardiovascular, orthopedics, plastic surgery, ophthalmology, dental, neurology, and tissue engineering. Cardiovascular applications dominate the market, driven by the rising prevalence of heart diseases and the need for stents, vascular grafts, and heart valves. In orthopedics, biomaterials such as bone cements, joint replacements, and spine implants are in high demand, fueled by aging populations and a growing incidence of musculoskeletal disorders. Plastic surgery applications are also expanding as demand increases for biomaterials used in reconstructive procedures and aesthetic enhancements. The ophthalmology segment benefits from biomaterials used in intraocular lenses and corneal implants, addressing the rising incidence of cataracts and other eye conditions. Dental biomaterials are widely used in implants and fillings, with continued advancements improving their functionality. Neurology and tissue engineering segments show promise, particularly with the development of advanced scaffolds for nerve regeneration and tissue repair, reflecting ongoing innovations in regenerative medicine.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

Germany

Germany holds the largest market share, accounting for approximately 25% of the total market. Germany’s dominance is driven by its robust healthcare infrastructure, extensive research and development in biomaterials, and strong manufacturing capabilities. The country’s focus on advanced medical technologies and a well-established medical device industry further contribute to its leading position. Additionally, Germany’s aging population and increasing prevalence of chronic diseases create a significant demand for biomaterials in orthopedic, cardiovascular, and tissue engineering applications, further solidifying its market leadership.

United Kingdom

The United Kingdom is another major player in the European biomaterials market, holding a market share of around 20%. The UK’s advanced healthcare system, alongside substantial government investments in medical research and development, fosters innovation in biomaterials. Additionally, the growing demand for personalized healthcare solutions and the UK’s leadership in the life sciences sector promote market growth. The country’s focus on biotechnology and biomaterial advancements, particularly in regenerative medicine and orthopedics, positions it as a key contributor to the region’s biomaterials market. Furthermore, the rising adoption of minimally invasive surgeries in the UK drives the demand for innovative biomaterials in surgical procedures.

France

France holds a market share of approximately 18% within the European biomaterials market. France’s strong focus on biotechnology and medical device manufacturing, combined with the country’s well-established healthcare infrastructure, supports the growth of the biomaterials sector. France is a leader in the development of new biomaterials, particularly in the fields of tissue engineering, orthopedic implants, and dental biomaterials. The government’s support for healthcare innovation and sustainability, alongside the growing aging population, enhances the demand for biomaterials in various applications, ensuring France’s continued influence in the market.

Italy

Italy holds around 12% of the Europe biomaterials market share. Italy is renowned for its medical device and healthcare manufacturing sector, with a growing emphasis on regenerative medicine, orthopedics, and dental care. The increasing adoption of biomaterials in aesthetic and reconstructive surgery further supports the market’s growth in the country. Italy’s position as a major medical tourism hub, particularly for cosmetic surgery, also contributes to the demand for biomaterials. Moreover, the strong presence of research institutions and collaborations with biomaterial manufacturers ensures Italy’s significant role in shaping the future of biomaterial innovations in Europe.

Rest of Europe

Other regions, such as Spain, Switzerland, Belgium, and Netherlands, collectively account for the remaining market share of approximately 25%. These regions contribute to the growth of the biomaterials market through continued investments in medical technology and increasing demand for specialized biomaterials in both established and emerging healthcare markets. The combined efforts of research, manufacturing, and government support continue to bolster the biomaterials sector across the broader European landscape.

Key Player Analysis

- Medtronic

- Evonik Industries

- Solvay

- BioComp

- Axogen

Competitive Analysis

The competitive landscape of the Europe biomaterials market is shaped by several prominent companies that drive innovation and maintain a strong market presence. Medtronic, Evonik Industries, Solvay, BioComp, and Axogen are key players leading the sector. Companies in this market are focused on expanding their portfolios and enhancing the performance of their biomaterials to cater to various medical applications, including orthopedics, cardiovascular care, dental, and tissue engineering. Key competitive factors include the ability to innovate in the development of biocompatible, sustainable, and high-performance materials that meet the growing demand for personalized healthcare solutions. Additionally, advancements in nanotechnology, 3D printing, and biodegradable materials are reshaping the competitive environment, offering companies new opportunities for growth. The emphasis on sustainability and eco-friendly materials is becoming increasingly important, with companies focusing on developing biomaterials derived from renewable resources. Strategic mergers, acquisitions, and collaborations are also common, as companies seek to enhance their market position and access new technologies. Furthermore, the regulatory landscape plays a crucial role in shaping competition, as companies must navigate complex approval processes to ensure the safety and efficacy of their products. As the market continues to evolve, competition remains fierce, with companies striving to maintain a competitive edge through innovation, quality, and adaptability.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The Europe biomaterials market exhibits moderate concentration, with a few dominant players holding significant market share, while numerous small and mid-sized companies contribute to innovation and niche product offerings. The market is characterized by continuous advancements in technology, with an increasing focus on biocompatibility, sustainability, and customization to meet diverse medical needs. Key players typically invest heavily in research and development to introduce cutting-edge biomaterials, including biodegradable polymers, nanomaterials, and advanced composites. At the same time, smaller companies often specialize in specific areas such as regenerative medicine, tissue engineering, or sustainable biomaterials, offering differentiated products. The market is also influenced by stringent regulatory requirements, which drive companies to ensure the safety and efficacy of their products. Collaboration between industry leaders, research institutions, and startups is common, fostering innovation and accelerating the development of new materials. As a result, the Europe biomaterials market remains dynamic, with a balance of competition and collaboration shaping its growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe biomaterials market is expected to grow steadily due to increasing demand for advanced healthcare solutions and medical implants.

- Technological advancements, including the integration of nanotechnology and 3D printing, will drive innovation in biomaterial applications.

- The rising aging population in Europe will continue to fuel the demand for orthopedic, dental, and cardiovascular biomaterials.

- Biodegradable and bio-based materials will see significant adoption as the demand for eco-friendly solutions grows.

- Regenerative medicine will experience a surge in popularity, with biomaterials playing a crucial role in tissue engineering and organ regeneration.

- Customization and personalized healthcare solutions will drive the development of patient-specific biomaterials, improving clinical outcomes.

- Increased focus on sustainability will push companies to innovate in developing environmentally friendly biomaterials.

- Growing collaboration between research institutions, healthcare providers, and manufacturers will accelerate the development of novel biomaterial technologies.

- Expanding applications in areas such as neurology and wound healing will create new market opportunities for specialized biomaterials.

- The regulatory landscape will continue to evolve, with stricter safety standards ensuring the long-term growth and reliability of biomaterials in medical applications.