| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Cardiovascular Devices Market Size 2024 |

USD 19,117.85 Million |

| Europe Cardiovascular Devices Market, CAGR |

6.3% |

| Europe Cardiovascular Devices Market Size 2032 |

USD 33,278.16 Million |

Market Overview

The Europe Cardiovascular Devices Market is projected to grow from USD 19,117.85 million in 2024 to an estimated USD 33,278.16 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2025 to 2032. This market expansion is primarily driven by increasing cardiovascular diseases (CVD) prevalence and the rising demand for advanced medical devices.

Several key drivers are shaping the cardiovascular devices market in Europe. The growing prevalence of heart diseases, rising healthcare expenditure, and increasing awareness of early diagnosis and treatment are driving the demand for cardiovascular devices. In addition, technological advancements in minimally invasive surgeries and remote monitoring devices are improving patient outcomes and boosting the market. The demand for innovative solutions in diagnostics, therapeutics, and surgical interventions is expected to continue growing in the coming years.

Geographically, Europe holds a significant share of the global cardiovascular devices market. The region’s strong healthcare infrastructure, high adoption rate of advanced technologies, and well-established healthcare systems contribute to this dominance. Countries like Germany, the UK, and France are major contributors to the market. Key players in the Europe Cardiovascular Devices Market include Medtronic, Abbott Laboratories, Siemens Healthineers, and Boston Scientific, among others. These companies are focused on expanding their product portfolios and adopting new technologies to meet the rising demand for cardiovascular treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Cardiovascular Devices Market is projected to grow from USD 19,117.85 million in 2024 to USD 33,278.16 million by 2032, driven by technological advancements and an aging population.

- The global cardiovascular devices market is projected to grow from USD 72,115.60 million in 2024 to USD 133,700.94 million by 2032, with a CAGR of 7.1% from 2025 to 2032, driven by increasing cardiovascular diseases and advancements in medical technology.

- Increasing prevalence of cardiovascular diseases, rising healthcare expenditure, and demand for innovative diagnostic and surgical devices are key drivers of market growth.

- Advancements in minimally invasive surgeries, remote monitoring devices, and AI integration are enhancing the precision and effectiveness of cardiovascular treatments.

- High device costs and regulatory challenges may hinder the adoption of advanced cardiovascular technologies, especially in price-sensitive regions.

- Western Europe, led by countries like Germany, the UK, and France, dominates the market due to strong healthcare infrastructure and high adoption of advanced cardiovascular technologies.

- Eastern Europe is experiencing rapid growth due to healthcare improvements, rising awareness of heart diseases, and increasing demand for cardiovascular devices.

- Leading companies such as Medtronic, Abbott Laboratories, Siemens Healthineers, and Boston Scientific are driving market innovation and expanding product portfolios to meet rising demand.

Report Scope

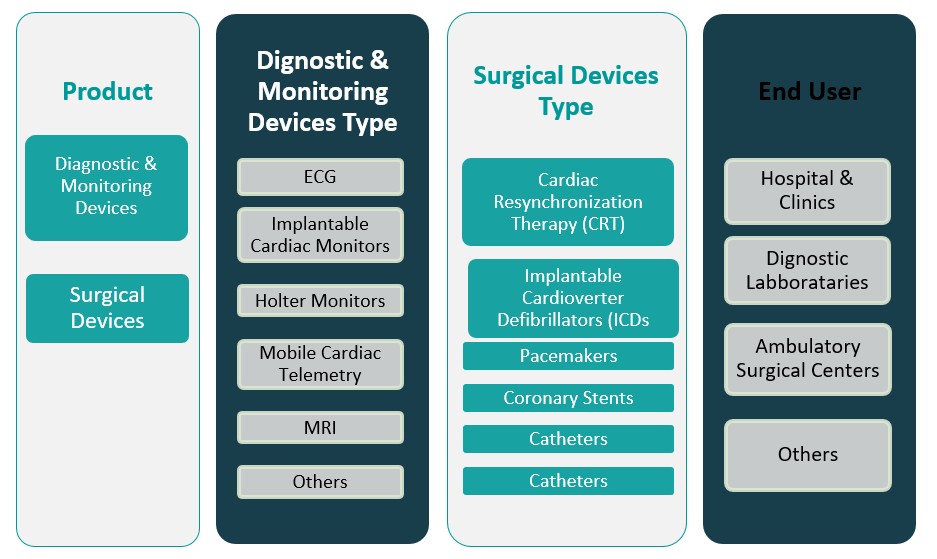

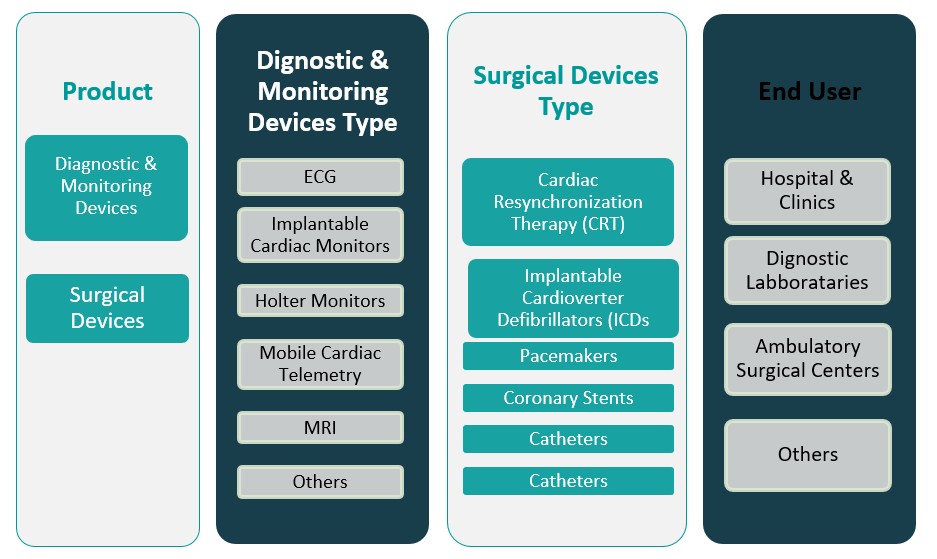

This report segments the Europe Cardiovascular Devices Market as follows:

Market Drivers

Increasing Prevalence of Cardiovascular Diseases (CVDs)

The rising incidence of cardiovascular diseases (CVDs) across Europe is one of the primary drivers of the cardiovascular devices market. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of mortality in Europe, accounting for approximately 40% of all deaths. This growing prevalence is attributed to lifestyle changes, such as poor diet, physical inactivity, smoking, and an aging population. For instance, the European cardiovascular devices market has seen significant investments from leading medical technology companies. In 2024, Medtronic introduced AI-powered enhancements to its Reveal Linq ICM devices, improving early detection of heart conditions. Additionally, over 500 new cardiac care centers have been established across Europe to meet the rising demand for cardiovascular treatments. As the population continues to age, the demand for effective cardiovascular treatments and interventions rises, boosting the market for cardiovascular devices such as stents, pacemakers, defibrillators, and diagnostic tools. Early detection and timely intervention are critical in managing CVDs, leading to a greater adoption of advanced cardiovascular devices for disease prevention and treatment. The increasing burden of CVDs is thus a major factor driving the growth of this market in Europe.

Technological Advancements and Innovations in Cardiovascular Devices

Technological advancements have significantly transformed the landscape of the cardiovascular devices market in Europe. The development of minimally invasive procedures, such as catheter-based treatments, has revolutionized cardiovascular interventions. Devices like drug-eluting stents, advanced pacemakers, and heart valve repair systems are now more efficient and safer, allowing for better patient outcomes and shorter recovery times. For instance, in May 2024, Medtronic announced the integration of AI into its Reveal Linq ICM devices in the U.S., Australia, and New Zealand, with plans to introduce the update in Europe by the end of the year. Additionally, several European hospitals have adopted robotic-assisted cardiovascular surgeries, reducing recovery times and improving patient outcomes. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in cardiovascular diagnostics and treatment is enhancing the precision of interventions. These innovations are helping physicians make more accurate diagnoses, predict patient outcomes, and personalize treatments for individuals. With advancements in remote monitoring devices and telemedicine, patients can now be monitored outside of the hospital, reducing the burden on healthcare systems while improving patient care. As these technological advancements continue to evolve, the demand for advanced cardiovascular devices is expected to increase, driving market growth.

Growing Healthcare Expenditure and Government Initiatives

Increased healthcare spending across Europe is another critical factor contributing to the growth of the cardiovascular devices market. Governments and private institutions are investing heavily in healthcare infrastructure, medical technologies, and the development of medical devices to address the rising healthcare needs. Many European countries have implemented healthcare reforms to improve access to quality care and reduce healthcare disparities. Additionally, public health campaigns focusing on heart disease prevention, such as promoting healthy eating and encouraging physical activity, are contributing to greater awareness and early detection of cardiovascular diseases. As a result, healthcare systems are prioritizing cardiovascular care, leading to greater investments in medical technologies, including cardiovascular devices. These investments, combined with government initiatives to promote preventive healthcare, have created a favorable environment for the growth of the cardiovascular devices market in Europe.

Aging Population and Lifestyle Changes

The aging population in Europe is a significant factor driving the demand for cardiovascular devices. According to Eurostat, the median age of the European population is steadily increasing, with a substantial proportion of individuals over the age of 65. As people age, the risk of cardiovascular diseases increases, making the older population more susceptible to heart-related conditions. The prevalence of conditions like hypertension, diabetes, and high cholesterol in the elderly population further exacerbates the risk of CVDs. Alongside aging, lifestyle changes, such as unhealthy diets, sedentary lifestyles, and increasing stress levels, are also contributing to the rising number of cardiovascular disease cases in Europe. The growing demand for treatments for age-related cardiovascular conditions, such as coronary artery disease, arrhythmias, and heart failure, is expected to drive the demand for cardiovascular devices such as pacemakers, defibrillators, and heart valves. Consequently, the aging population, combined with changing lifestyles, is expected to continue driving market growth in the region.

Market Trends

Minimally Invasive Cardiovascular Procedures

One of the most notable trends in the Europe Cardiovascular Devices Market is the shift toward minimally invasive procedures. Traditional open-heart surgeries are increasingly being replaced by less invasive methods, which offer numerous benefits including shorter recovery times, reduced risk of complications, and smaller incisions. For instance, robotic-assisted cardiac surgery has been successfully implemented across Europe, particularly in procedures such as mitral valve repair and coronary artery bypass grafting. Studies indicate that robotic coronary surgery in Europe has been performed safely and effectively with minimal perioperative complications over the last 15 years. Devices such as drug-eluting stents, catheter-based systems, and transcatheter aortic valve replacements (TAVR) are gaining popularity due to their ability to treat complex cardiovascular conditions with minimal trauma to the patient. These innovations are making cardiovascular treatments more accessible, less expensive, and more patient-friendly. The rise of minimally invasive surgeries is a response to the demand for more efficient, safer, and less disruptive interventions, ultimately driving the adoption of advanced cardiovascular devices across Europe.

Integration of Artificial Intelligence (AI) in Cardiovascular Diagnostics

Artificial Intelligence (AI) is transforming cardiovascular diagnostics in Europe. AI technologies, including machine learning and predictive analytics, are increasingly being incorporated into cardiovascular devices, particularly in imaging, diagnostics, and treatment planning. For instance, AI-powered algorithms are being used to analyze medical images such as ECGs, CT scans, and MRIs with higher accuracy than traditional methods. AI has demonstrated significant potential in diagnosing cardiovascular diseases, including heart failure, atrial fibrillation, and congenital heart conditions. These innovations help physicians detect abnormalities, predict patient outcomes, and recommend personalized treatments based on vast amounts of data. AI’s ability to continuously learn from data and improve over time is enhancing diagnostic precision, improving patient care, and streamlining clinical workflows. The integration of AI in cardiovascular devices is positioning Europe as a leader in AI-driven medical innovation.

Wearable Cardiovascular Devices and Remote Monitoring

The growing trend toward wearable cardiovascular devices and remote patient monitoring is reshaping the European market. With the rise of chronic cardiovascular conditions and the need for continuous monitoring, wearables such as smartwatches, ECG monitors, and blood pressure cuffs are gaining traction among both patients and healthcare providers. These devices allow for real-time monitoring of heart rate, rhythm, and other vital signs, enabling early detection of cardiovascular issues before they become critical. The ability to remotely monitor patients’ cardiovascular health reduces hospital visits, lowers healthcare costs, and improves patient compliance. Furthermore, wearable devices are increasingly equipped with features such as data storage, cloud integration, and mobile apps, enhancing their usability and effectiveness in managing heart diseases.

Personalized Medicine and Customized Cardiovascular Devices

Personalized medicine is becoming a significant trend in the Europe Cardiovascular Devices Market. With a better understanding of individual genetic profiles and health conditions, cardiovascular treatments are moving away from a one-size-fits-all approach to more tailored solutions. Customization is increasingly evident in devices such as stents, heart valves, and pacemakers, which can now be designed to meet the specific needs of individual patients. Advanced manufacturing techniques, such as 3D printing, allow for the production of patient-specific devices, which improve device compatibility and outcomes. Personalized cardiovascular care is also being facilitated by advancements in genomics and biomarker discovery, enabling healthcare providers to develop more precise treatment plans based on genetic predispositions. This trend is enhancing patient satisfaction and improving overall treatment efficacy, driving the market for customized cardiovascular devices.

Market Challenges

Regulatory and Reimbursement Challenges

One of the primary challenges facing the Europe Cardiovascular Devices Market is the complex regulatory landscape and reimbursement issues. The approval process for cardiovascular devices in Europe is stringent, with manufacturers required to meet the regulatory standards set by the European Medicines Agency (EMA) and other national regulatory bodies. The high cost and time-consuming nature of obtaining regulatory approval for new devices or innovations can hinder market entry and slow down the adoption of cutting-edge technologies. Additionally, reimbursement policies for cardiovascular devices vary significantly across different European countries. While some regions offer comprehensive reimbursement schemes, others face limitations, making it difficult for healthcare providers to adopt expensive or innovative cardiovascular devices. For instance, Medtronic announced in May 2024 that it would integrate artificial intelligence into its Reveal Linq ICM devices in the U.S., Australia, and New Zealand, with plans to introduce the AI update in Europe by the end of 2024. This demonstrates the regulatory hurdles companies face when launching new technologies in the European market. Inadequate reimbursement policies can also place a financial burden on patients, restricting access to advanced treatments. These challenges require manufacturers to navigate a complex web of regulations and reimbursement systems, which can delay product launches, limit market expansion, and ultimately impact the market growth.

High Device Costs and Affordability Issues

The high cost of advanced cardiovascular devices remains another significant challenge in the European market. While innovations such as minimally invasive procedures, wearable devices, and AI-powered technologies offer substantial benefits, they also come with a high price tag. The cost of research and development (R\&D), regulatory approvals, and manufacturing often results in devices being priced out of reach for many healthcare systems, particularly in smaller or economically constrained countries. Additionally, as healthcare systems across Europe face budget constraints and increasing demand for healthcare services, cost containment is a key concern. The affordability of cardiovascular devices, especially for the elderly population and those with chronic conditions, becomes a barrier to widespread adoption. Moreover, the cost burden on patients, in terms of out-of-pocket expenses for advanced treatments and procedures, exacerbates the problem. As a result, device manufacturers are under increasing pressure to balance innovation with cost-effectiveness while ensuring broader accessibility to their products.

Market Opportunities

Growing Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive cardiovascular procedures presents a significant market opportunity for device manufacturers in Europe. These procedures, which involve smaller incisions and reduced recovery times compared to traditional surgeries, are rapidly gaining traction due to their patient-friendly benefits. As cardiovascular diseases continue to rise, especially among the aging population, the demand for advanced minimally invasive treatments such as catheter-based interventions, transcatheter valve replacements, and drug-eluting stents is expected to increase. This trend is driven by the growing adoption of technologies that allow for safer and more efficient interventions with fewer complications. Manufacturers that can develop innovative, cost-effective, and reliable devices for minimally invasive procedures are well-positioned to capture a larger share of the growing European market. The shift towards less invasive treatments, coupled with the increasing number of heart disease patients seeking non-surgical options, creates ample opportunities for market expansion.

Expansion of Remote Monitoring and Wearable Devices

The rising demand for remote patient monitoring and wearable cardiovascular devices represents a notable market opportunity in Europe. With the growing prevalence of chronic cardiovascular conditions, healthcare providers are increasingly turning to wearable devices and remote monitoring solutions to manage patient health outside traditional clinical settings. Devices such as wearable ECG monitors, blood pressure cuffs, and smartwatches are gaining popularity due to their ability to provide real-time data on vital signs, enabling early detection of potential issues. This shift towards home healthcare and remote monitoring is not only reducing healthcare costs but also enhancing patient outcomes by allowing for continuous monitoring. Companies that focus on developing advanced, user-friendly, and data-integrated cardiovascular devices are likely to see strong demand, as healthcare systems across Europe embrace these technologies to improve the quality and accessibility of care.

Market Segmentation Analysis

By Product

The Europe Cardiovascular Devices Market is broadly segmented into two main categories: diagnostic & monitoring devices and surgical devices. Diagnostic & monitoring devices include products used for the detection, diagnosis, and monitoring of cardiovascular conditions, such as electrocardiogram (ECG) machines, blood pressure monitors, and cardiac imaging systems. These devices play a crucial role in the early detection and management of cardiovascular diseases, which is particularly important as the prevalence of such conditions continues to rise in Europe. The demand for these devices is driven by increasing health awareness, advancements in technology, and the growing need for regular monitoring of heart health. On the other hand, surgical devices include products such as stents, pacemakers, defibrillators, and heart valves, which are used for the surgical treatment and management of cardiovascular diseases. The adoption of minimally invasive techniques has further accelerated the demand for surgical devices, as they offer shorter recovery times and lower complication rates. Both segments contribute significantly to the overall market growth, with surgical devices witnessing a higher growth rate due to the aging population and rising incidences of heart conditions.

By End User

The end-user segment of the Europe Cardiovascular Devices Market includes hospitals & clinics, diagnostic laboratories, ambulatory surgical centers, and others. Hospitals and clinics hold the largest share of the market due to their ability to provide comprehensive cardiovascular care, ranging from diagnostics to advanced surgical treatments. These facilities are equipped with the latest cardiovascular devices, ensuring better patient outcomes. Diagnostic laboratories are also critical players in the market, as they offer specialized cardiovascular diagnostic services, including imaging, blood tests, and monitoring. With the increasing demand for early disease detection and the growing burden of cardiovascular diseases, diagnostic laboratories are expected to see significant growth in their adoption of advanced cardiovascular devices. Ambulatory surgical centers (ASCs) are another growing segment, offering a more cost-effective and patient-friendly option for cardiovascular procedures. These centers cater to patients who require non-invasive or minimally invasive procedures, contributing to the rise of outpatient care for cardiovascular conditions. Other end-users, such as home healthcare providers, are also emerging as potential drivers of market growth, particularly with the rise of remote monitoring technologies and wearables.

Segments

Based on Product

- Diagnostic & Monitoring Devices

- Surgical Devices

Based on End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

Based on Diagnostic & Monitoring Devices Type

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- MRI

- Others

Based on Surgical Devices Type

- Cardiac Resynchronization Therapy (CRT)

- Implantable Cardioverter Defibrillators (ICDs

- Pacemakers

- Coronary Stents

- Catheters

Based on Region

Regional Analysis

Western Europe (70%)

Western Europe holds the largest market share in the Europe Cardiovascular Devices Market, accounting for approximately 70% of the total market value. This dominance is primarily driven by the high prevalence of cardiovascular diseases, an aging population, and well-established healthcare systems in countries such as Germany, the United Kingdom, France, and Italy. The advanced healthcare infrastructure in these nations allows for the wide adoption of cutting-edge cardiovascular technologies, including diagnostic tools, surgical devices, and minimally invasive procedures. Furthermore, government initiatives to promote cardiovascular health, along with comprehensive reimbursement policies, are boosting the demand for innovative cardiovascular devices in the region. The presence of major players in the market, including Medtronic, Abbott Laboratories, and Siemens Healthineers, further strengthens Western Europe’s position in the market.

Eastern Europe (20%)

Eastern Europe is witnessing significant growth, capturing approximately 20% of the market share. This growth can be attributed to increasing healthcare investments, improved healthcare access, and a rising awareness of cardiovascular diseases. Countries in Eastern Europe, including Poland, Russia, and Hungary, are expanding their healthcare systems and adopting advanced cardiovascular devices to address the rising prevalence of heart disease. Additionally, the increasing number of cardiovascular patients and the growing demand for affordable healthcare solutions are driving market growth. Although Eastern Europe still lags behind Western Europe in terms of healthcare infrastructure, it is expected to experience robust growth in the coming years, as technological adoption and healthcare standards continue to improve.

Key players

- Abbott

- GE HealthCare

- Medtronic

- Siemens Healthineers

- Philips Healthcare

- Boston Scientific

- Biotronik

- Terumo Corporation

- LivaNova

- Vygon

- R. Bard (now part of BD)

- Berlin Heart

- Fresenius Medical Care

- Esaote

Competitive Analysis

The Europe Cardiovascular Devices Market is highly competitive, with major players striving to maintain and expand their market share through product innovation, strategic partnerships, and geographic expansion. Leading companies such as Abbott, Medtronic, Siemens Healthineers, and Boston Scientific are at the forefront, leveraging advanced technologies and comprehensive product portfolios to meet the growing demand for cardiovascular solutions. These companies focus on minimally invasive procedures, diagnostic tools, and patient-specific treatments to offer improved outcomes and greater convenience. Additionally, companies like GE HealthCare and Philips Healthcare are strengthening their presence by integrating artificial intelligence and digital health technologies into their devices, enabling better patient monitoring and diagnostic capabilities. Biotronik, Terumo Corporation, and LivaNova, meanwhile, are investing in specialized cardiovascular devices such as stents, pacemakers, and heart valves to cater to the diverse needs of the European market. The competition among these players is expected to intensify as they focus on innovation and expansion across emerging markets.

Recent Developments

- In February 2025, Abbott issued a safety notification for certain Assurity and Endurity pacemakers due to potential epoxy mixing issues during manufacturing, which could lead to device malfunction.

- In April 2025, GE HealthCare launched the Revolution™ Vibe CT system featuring Unlimited One-Beat Cardiac imaging and AI solutions, enhancing cardiac imaging capabilities.

- In April 2025, Medtronic reported promising evidence for its Affera™ pulsed field ablation technologies in treating atrial fibrillation patients.

- In May 2024, Siemens Healthineers announced new cardiology applications with artificial intelligence for the Acuson Sequoia ultrasound system, including a new 4D transesophageal (TEE) transducer for cardiology exams.

- In February 2025, Philips developed a miniaturized intracardiac transducer, enabling higher-resolution views of cardiac structures and functions, benefiting structural heart disease and electrophysiology procedures.

- In March 2025, Boston Scientific announced the acquisition of SoniVie Ltd. to expand its interventional cardiology therapies offerings with ultrasound-based renal denervation technology.

- In June 2024, Biovac Institute entered a partnership with Sanofi to locally manufacture inactivated polio vaccines in Africa, aiming to serve the potential needs of over 40 African countries.

Market Concentration and Characteristics

The Europe Cardiovascular Devices Market exhibits a moderate level of market concentration, with a few large global players dominating the landscape. Companies such as Abbott, Medtronic, Siemens Healthineers, and Boston Scientific hold a significant share of the market due to their extensive product portfolios, strong brand presence, and ability to innovate with advanced technologies. However, there is also a substantial presence of mid-sized and specialized companies like Biotronik, Terumo Corporation, and LivaNova, which focus on niche cardiovascular segments such as stents, pacemakers, and heart valves. The market is characterized by continuous innovation, particularly in minimally invasive devices, remote monitoring technologies, and artificial intelligence integration, as companies strive to meet the growing demand for efficient, cost-effective, and patient-friendly solutions. Moreover, the competitive landscape is shaped by ongoing collaborations, partnerships, and mergers to enhance product offerings and expand into emerging markets across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, End User, Diagnostic & Monitoring Devices Type, Surgical Devices Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for minimally invasive cardiovascular devices is expected to increase significantly, driven by patient preference for shorter recovery times and reduced surgical risks. Technological advancements will continue to fuel innovation in this segment.

- The integration of artificial intelligence (AI) and machine learning in cardiovascular devices will enhance diagnostic accuracy and patient outcomes. AI-powered devices will allow for more personalized and predictive healthcare solutions.

- Wearable cardiovascular devices such as smartwatches and ECG monitors will continue to grow in popularity. These devices enable continuous monitoring, providing real-time data to patients and healthcare providers, facilitating early detection of cardiovascular issues.

- As the European population ages, the demand for cardiovascular treatments will rise. This demographic shift will lead to an increased prevalence of cardiovascular diseases, further expanding the market for advanced medical devices.

- Government initiatives aimed at improving healthcare access and supporting innovative medical technologies will provide a favorable environment for market growth. Increased funding for cardiovascular research and development is expected to accelerate device adoption.

- As healthcare systems in Eastern Europe improve, there will be a rise in demand for advanced cardiovascular devices. Enhanced healthcare access will enable broader use of cutting-edge technologies in these emerging markets.

- Preventive healthcare measures, including early cardiovascular disease detection and management, will become a priority. This focus will drive the adoption of diagnostic and monitoring devices to detect heart conditions at early stages.

- Remote patient monitoring solutions will continue to see significant adoption, enabling patients to manage chronic cardiovascular conditions from home. This trend will reduce healthcare costs and improve patient compliance.

- Manufacturers will focus on developing cost-effective cardiovascular devices for price-sensitive markets in Eastern Europe. These affordable solutions will ensure wider accessibility to advanced treatments for cardiovascular diseases.

- The future of cardiovascular treatments will see a shift toward personalized care, with devices tailored to individual patient needs. Customized treatments will enhance the effectiveness of interventions and improve overall patient outcomes.