Market Overview

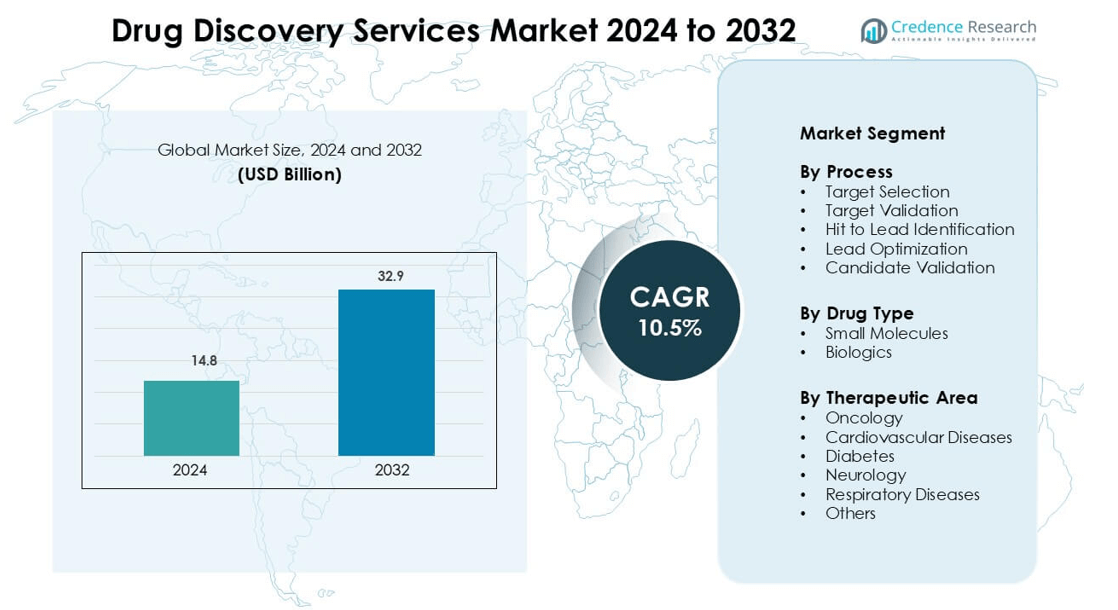

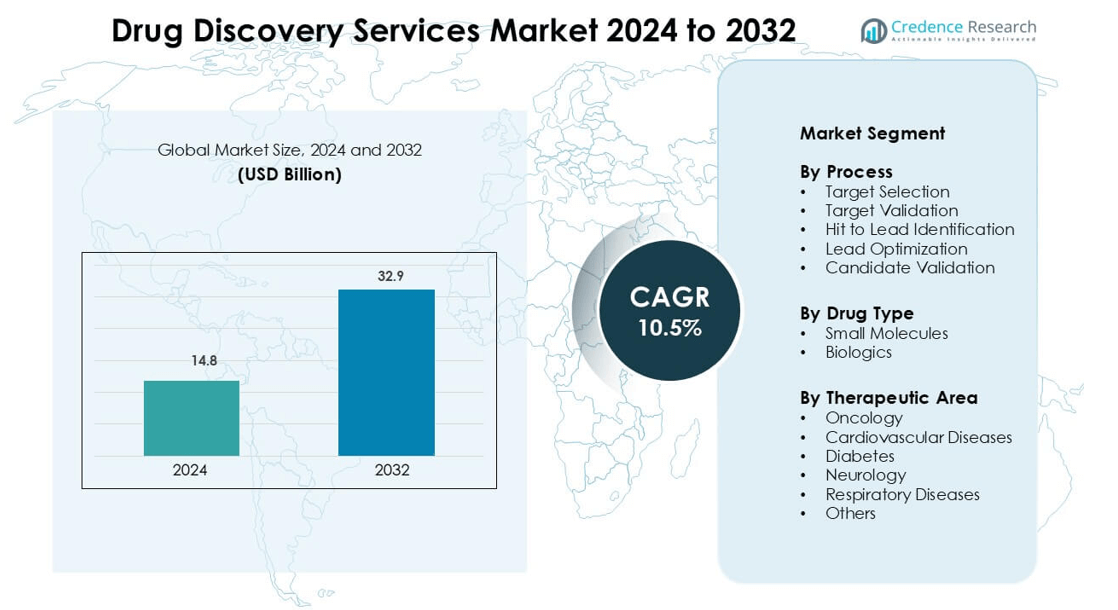

Drug Discovery Services Market was valued at USD 14.8 billion in 2024 and is anticipated to reach USD 32.9 billion by 2032, growing at a CAGR of 10.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug Discovery Services Market Size 2024 |

USD 14.8 billion |

| Drug Discovery Services Market, CAGR |

10.5% |

| Drug Discovery Services Market Size 2032 |

USD 32.9 billion |

The Drug Discovery Services Market is driven by major service providers such as Abbott Laboratories Inc., AstraZeneca PLC, Bayer AG, Advinus Therapeutics, Albany Molecular Research Inc., Aurigene, Charles River Laboratories International, ChemBridge Corporation, Agilent Technologies Ubiquigent, and Covance. These firms offer end-to-end discovery capabilities including target screening, lead optimization, and pre-clinical validation across small molecules and biologics. North America leads the market with a 39% share, supported by strong funding, advanced research infrastructure, and high outsourcing demand from pharmaceutical and biotech companies. Strategic collaborations, automated labs, and AI-enabled platforms continue to strengthen competitiveness and accelerate drug development timelines across the market.

Market Insights

- The Drug Discovery Services Market is valued at USD 14.8 billion in 2024 and is projected to grow at a CAGR of 10.5% from 2025 to 2032.

- Rising outsourcing of early-stage R&D, high development cost, and demand for faster drug timelines drive heavy adoption of external discovery partners with advanced screening, medicinal chemistry, and predictive analytics.

- AI-enabled molecular design, robotics, virtual screening, and biologics discovery platforms shape current trends, while providers expand into immunotherapy, gene therapy, and precision medicine pipelines to secure long-term projects.

- North America holds the highest regional share at 39%, supported by strong funding and innovation clusters, while small molecules lead the market with the largest segment share due to broad therapeutic use and lower cost compared to biologics.

- Market restraints include high project failure rates, strict regulatory compliance, and rising quality expectations, which increase operational pressure on mid-sized CROs and prolong development timelines for complex molecules.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Process

Target selection leads the segment with a 28% share. Demand grows due to rising use of genomics, AI-based protein modeling, and biomarker discovery in early-stage programs. Companies invest in screening platforms that predict disease pathways faster, which reduces failure in later phases. Target validation follows as drug developers rely on cell-based and animal models to confirm clinical relevance. Hit-to-lead identification and lead optimization gain steady traction as pharma firms outsource chemistry, ADME studies, and toxicity profiling to shorten timelines and reduce R&D cost. Candidate validation remains important for IND filing.

- For instance, GSK has established collaborations and internal programs that use CRISPR technology and functional genomics to identify and validate drug targets. They prioritize genetically validated targets, noting that such targets are at least twice as likely to become successful medicines.

By Drug Type

Small molecules dominate the market with a 57% share. High oral bioavailability, clear synthesis routes, and lower development cost drive adoption. CROs expand medicinal chemistry, fragment-based screening, and structure-guided design services to support rapid pipeline expansion. Biologics gain strong momentum as demand rises for monoclonal antibodies, cell therapies, and vaccines. Biotech firms use outsourced expression systems, protein engineering, and bioassays to validate complex targets. Growth in gene therapy and recombinant platforms continues to shift spending toward biologics, but small molecules retain leadership due to wide therapeutic coverage.

- For instance, Pfizer does leverage AI and modeling in its small-molecule research, as evidenced by its collaboration with companies like XtalPi and its use of modeling to screen compounds for treatments like Paxlovid.

By Therapeutic Area

Oncology holds the dominant position with a 41% share. Cancer programs rely on outsourced target discovery, immunotherapy screening, and biomarker-linked trials. Precision medicine, rising cancer incidence, and strong venture funding boost demand for specialized CRO support. Cardiovascular and diabetes pipelines stay active due to lifestyle disease burden and demand for safer molecules. Neurology and respiratory disease segments expand as drug developers apply AI-based modeling and CNS-penetration studies. Rare disease and autoimmune programs fall under “others,” supported by regulatory incentives that promote fast-track development and orphan drug status.

Key Growth Drivers

Rising Outsourcing of Early-Stage R&D

Global pharmaceutical and biotech companies outsource early-stage discovery to reduce cost, accelerate timelines, and access specialized expertise. Contract research organizations offer chemistry, structure-based design, and high-throughput screening platforms that improve hit identification. Outsourcing also reduces infrastructure investment and lets sponsors scale projects quickly. Small and mid-sized biotech firms rely heavily on external discovery partners due to limited in-house lab capacity. The growth of virtual biotech models increases demand for external screening, target validation, and lead optimization support. CROs expand global delivery centers, hire skilled scientists, and integrate automated labs to meet high project volumes. This shift creates sustained growth in the Drug Discovery Services Market.

- For instance, Charles River Laboratories operates over 100 discovery and safety assessment sites worldwide, supporting over 1,500 active drug discovery programs annually across areas including oncology, central nervous system (CNS) disorders, and rare diseases.

Advancements in AI, Automation, and Predictive Modeling

AI algorithms accelerate hit identification and molecular design, cutting years from discovery cycles. Machine learning models predict protein interaction, toxicity, and drug-likeness with stronger accuracy. Automated robotic labs run parallel experiments, reduce manual errors, and support 24/7 workflows. Cloud-based platforms handle huge biological datasets and allow remote decision-making. Pharma companies invest in digital discovery engines to improve success rates for complex molecules. These technologies also help reduce late-stage failures by improving pre-clinical accuracy. The increasing adoption of AI-led workflows, virtual screening, and automated chemistry drives the market toward faster, risk-optimized research.

- For instance, Insilico Medicine’s Pharma.AI platform generated 20-22 preclinical candidates.

Expansion of Biologics, Cell Therapy, and Gene Therapy Pipelines

Growing focus on personalized and targeted therapies boosts demand for advanced biologics research. Biotech firms develop monoclonal antibodies, recombinant proteins, cell therapies, and viral vectors, which require specialized discovery platforms. CROs set up expression systems, protein engineering services, and functional bioassays to support complex projects. Regulatory incentives for rare diseases and orphan therapies encourage investment in novel biologics. Immunotherapy and CAR-T research accelerate outsourcing due to technical complexity and high development cost. As biologics pipelines scale, the market sees sustained spending on discovery, characterization, and pre-clinical validation of next-generation therapies.

Key Trend & Opportunity

Growth of Precision Medicine and Biomarker-Based Discovery

Precision medicine drives discovery programs toward patient-specific pathways, genomic profiling, and targeted drug action. Biomarker-based screening improves probability of clinical success by selecting the right patient groups at early stages. CROs expand bioinformatics, multi-omics analytics, and companion diagnostic development to support personalized pipelines. Oncology, rare diseases, and immunology lead adoption of biomarker-linked discovery models. This trend opens opportunities for providers offering integrated platforms that combine genomic data, AI modeling, and clinical sample analysis. Companies with strong molecular profiling capability gain competitive advantage as precision-focused trials increase.

- For instance, Illumina’s NovaSeq X Plus platform sequences up to 20,000 whole genomes per year, enabling large-scale genomic profiling for precision oncology and rare disease research.

Integration of Cloud-Based Collaboration and Virtual Drug Discovery Models

Cloud platforms simplify data management and allow distributed teams to share results in real time. Virtual drug discovery uses digital screening, automated chemistry, and simulation tools to design compounds before lab testing. CROs integrate secure cloud environments that support remote project execution and decentralized R&D. These platforms reduce operational cost and scale to large datasets from genomics, protein mapping, and high-content screening. Investors fund cloud-native biotech startups that operate without physical labs and rely entirely on outsourced discovery. This model creates new business opportunities for data-rich CROs.

- For instance, Atomwise’s AtomNet® AI engine has analyzed more than 16 billion small molecules for structure-based virtual screening across 750 research collaborations globally.

Key Challenge

High Attrition Rate and Probability of Clinical Failure

Multiple candidates fail during pre-clinical and early clinical stages, causing high financial risk. Even successful discovery does not guarantee performance in humans due to toxicity or poor efficacy. CROs improve predictive studies using AI, animal models, and ADME testing, but attrition remains a major concern. Failure in advanced trials increases total development cost and delays product launch. Sponsors demand higher validation accuracy and data quality from discovery providers. This challenge drives companies to invest in predictive analytics and advanced pre-clinical tools, yet scientific uncertainty continues to affect market growth.

Regulatory Complexity and Compliance Requirements

Drug discovery operates under strict global guidelines for data management, animal testing, and pre-clinical reporting. Cross-border outsourcing demands compliance with FDA, EMA, ICH, and regional standards. CROs must maintain robust documentation, audit trails, and validated systems to support regulatory submissions. Non-compliance leads to penalties, rejected filings, or trial delays. As biologics, gene therapy, and personalized drugs rise, regulatory scrutiny becomes more intense. Providers invest in quality management systems and skilled regulatory teams, but compliance cost adds operational pressure. This challenge is significant for mid-sized CROs with limited resources.

Regional Analysis

North America

North America leads the Drug Discovery Services Market with a 39% share. The region benefits from strong pharmaceutical spending, advanced research infrastructure, and high adoption of AI-driven discovery tools. The United States hosts major biotech clusters, CRO headquarters, and well-funded oncology and immunotherapy pipelines. Venture capital investment supports virtual biotech models that outsource discovery to reduce fixed cost. Regulatory incentives for orphan drugs further boost demand for early-stage research. Canada contributes through clinical research partnerships and government-backed innovation programs. Strong collaboration between industry and academic labs strengthens the region’s market leadership.

Europe

Europe holds a 31% share of the market, supported by established pharma hubs in Germany, the United Kingdom, Switzerland, and France. The region benefits from strong biologics pipelines, advanced translational medicine centers, and structured research funding programs. CROs offer integrated target screening, lead optimization, and IND-support services to global clients. EMA regulatory standards encourage high-quality data and advanced validation studies. The United Kingdom and Germany lead outsourcing demand due to innovation in rare disease and diagnostics research. Collaboration among pharma companies, universities, and research institutes supports continued growth in specialized discovery services.

Asia-Pacific

Asia-Pacific accounts for a 20% share and remains the fastest-growing region, driven by cost-effective R&D, skilled scientific workforce, and expanding biotech startups. China and India emerge as major outsourcing hubs due to large chemistry teams, advanced screening labs, and strong outsourcing demand from Western sponsors. Japan and South Korea invest in biologics, stem cell research, and precision medicine programs. Regional governments support innovation through biotech parks and funding schemes. Rapid expansion of clinical trial activity and contract research partnerships increases the region’s contribution to global drug discovery pipelines.

Latin America

Latin America holds a 6% share, supported by growing clinical research networks in Brazil, Mexico, and Argentina. The region focuses on infectious diseases, oncology, and CNS disorders, creating steady demand for early-stage discovery support. Local CROs collaborate with global pharma companies for pre-clinical testing, bioanalysis, and screening services. Government initiatives encourage R&D investment and academic-industry collaboration. Although infrastructure development is slower than in Asia, outsourcing costs remain competitive. Rising healthcare spending and availability of diverse patient populations increase partnership opportunities for drug discovery providers.

Middle East & Africa

Middle East & Africa capture a 4% share and show gradual growth with increasing investments in healthcare research and pharmaceutical manufacturing. Countries such as Saudi Arabia, the UAE, and South Africa expand biotechnology clusters and medical research centers. Demand grows for outsourced target screening, pre-clinical studies, and biomarker-linked research in oncology and rare diseases. Partnerships with international CROs help transfer technology and scientific expertise. Limited research infrastructure and funding remain challenges, but national policies focused on healthcare innovation support long-term expansion of discovery activities in the region.

Market Segmentations

By Process

- Target Selection

- Target Validation

- Hit to Lead Identification

- Lead Optimization

- Candidate Validation

By Drug Type

- Small Molecules

- Biologics

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Diabetes

- Neurology

- Respiratory Diseases

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Drug Discovery Services Market features a mix of global contract research organizations, mid-sized biotech-focused service providers, and specialized data-analytics firms. Companies compete on scientific expertise, speed of delivery, therapeutic specialization, and access to advanced technologies such as AI screening, predictive modeling, and high-throughput platforms. Major players expand service portfolios across target validation, medicinal chemistry, pre-clinical evaluation, and IND-enabling studies to create integrated discovery pipelines. Strategic partnerships with pharmaceutical companies and academic institutes help secure long-term contracts and strengthen innovation. Firms also invest in automated labs, cloud-based data systems, and robotics to reduce turnaround time. Mergers, acquisitions, and geographic expansion remain common, as providers seek larger client bases and niche capabilities in biologics, immunotherapy, and gene therapy. Competition continues to intensify as outsourcing grows across North America, Europe, and Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Charles River Laboratories International Partnered with X-Chem to boost hit ID using DEL tech.

- In October 2024, Charles River Laboratories International Agreed with Lundbeck to use Logica for CNS discovery.

Report Coverage

The research report offers an in-depth analysis based on Process, Drug Type, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for outsourced early-stage R&D will continue to rise as pharma companies reduce internal cost.

- AI and machine learning tools will accelerate hit identification and molecular design.

- Virtual drug discovery and cloud-based collaboration models will expand across global projects.

- Small molecules will remain widely used, but biologics and gene therapies will gain stronger momentum.

- Automated labs and robotics will shorten screening and optimization timelines.

- Precision medicine and biomarker-based discovery will attract more investment from biotech firms.

- CROs will expand integrated service portfolios, covering target validation through IND-enabling studies.

- North America will maintain leadership, while Asia-Pacific will show the fastest growth in outsourcing.

- Strategic mergers and acquisitions will increase as companies seek advanced technologies and global reach.

- Improved predictive testing tools will help reduce failure rates and improve clinical success.