Market Overview

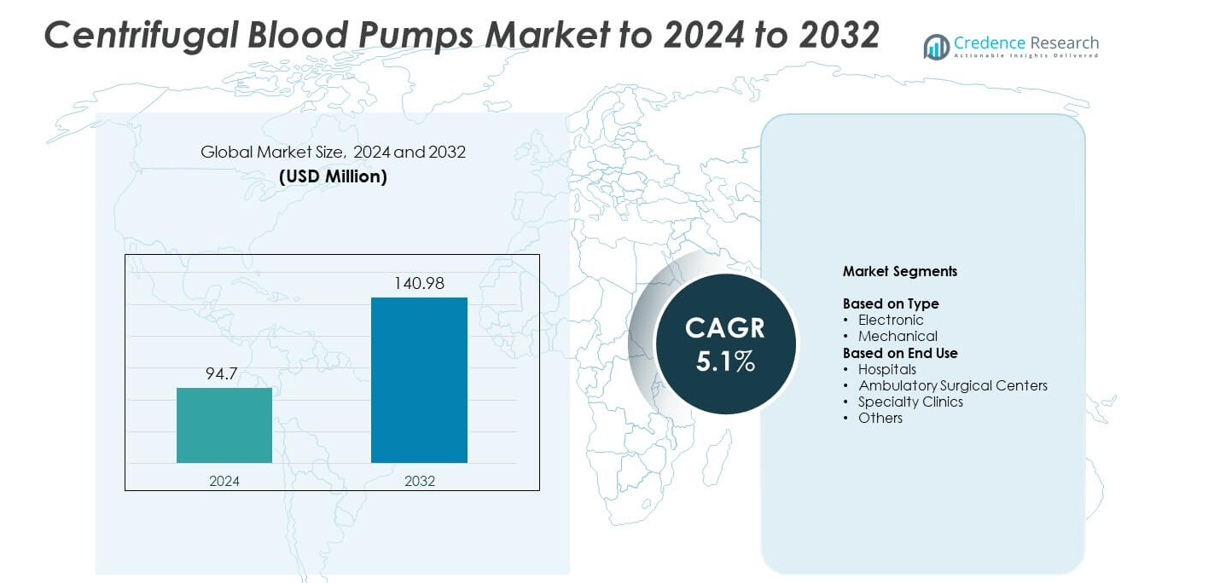

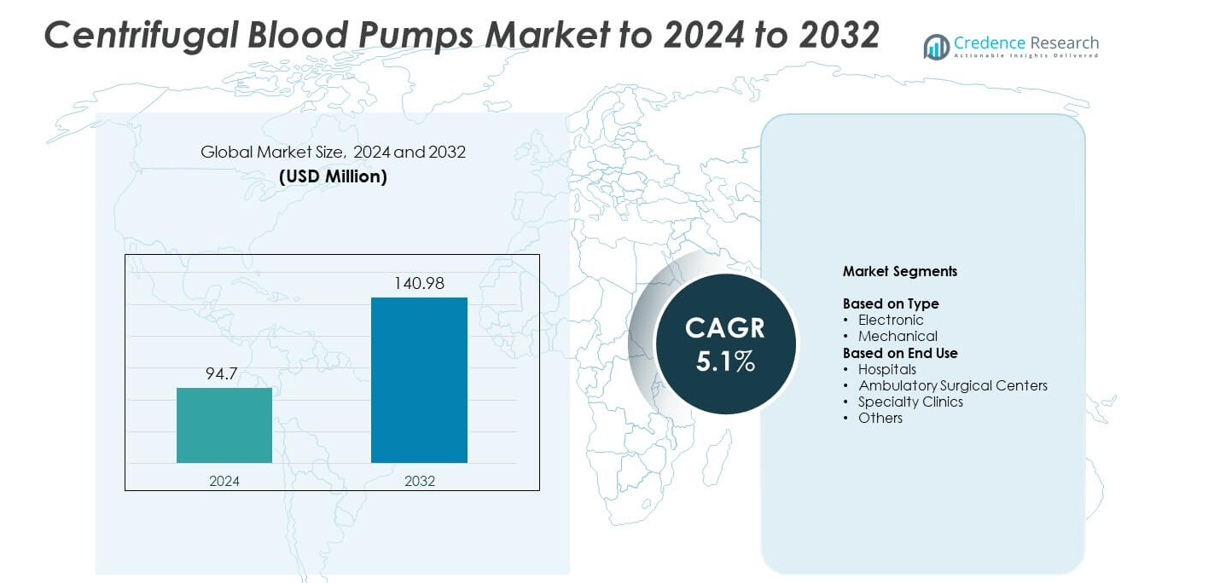

Centrifugal Blood Pumps Market size was valued at USD 94.7 million in 2024 and is anticipated to reach USD 140.98 million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Centrifugal Blood Pumps Market Size 2024 |

USD 94.7 million |

| Centrifugal Blood Pumps Market, CAGR |

5.1% |

| Centrifugal Blood Pumps Market Size 2032 |

USD 140.98 million |

The centrifugal blood pumps market is shaped by major players such as Terumo Corporation, Braille Biomedica Ltd., Abbott Laboratories, Baxter International, Getinge AB, Medtronic, LivaNova plc, Qura Srl, and 3M, all of which compete through advanced perfusion technologies and improved flow-stability designs. These companies focus on electronic control systems, enhanced biocompatibility, and integration with modern ECMO platforms to strengthen clinical outcomes. North America leads the global market with about 39% share in 2024 due to strong cardiac care infrastructure and high adoption of advanced circulatory support systems, followed by Europe with approximately 29% share supported by mature cardiac surgery networks and robust technological uptake.

Market Insights

- The centrifugal blood pumps market reached USD 94.7 million in 2024 and is projected to hit USD 140.98 million by 2032, growing at a CAGR of 5.1%.

• Rising cardiac surgery volume and wider ECMO adoption drive demand, with electronic pump systems holding about 71% share due to strong precision and low mechanical wear.

• Key trends include rapid expansion of portable ECMO platforms, growing automation in perfusion systems, and higher adoption of long-term circulatory support solutions across advanced cardiac units.

• Competition focuses on biocompatible designs, reduced hemolysis, and integration with digital monitoring platforms, while high equipment costs remain a restraint in emerging regions.

• North America leads the market with nearly 39% share, Europe follows with about 29%, and Asia Pacific holds around 22%, supported by expanding cardiac centers and rising ECMO capability across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Electronic centrifugal blood pumps lead this segment with about 71% share in 2024. Hospitals favor electronic systems because they support precise flow regulation, lower vibration, and strong compatibility with modern extracorporeal circuits. Demand grows as cardiac centers adopt advanced ECMO platforms that rely on stable and automated pump control. Mechanical pumps hold a smaller share but remain relevant in cost-sensitive settings where simple designs and easy maintenance support routine cardiovascular procedures. Growth across both types is supported by rising cardiac surgery volumes and wider availability of portable perfusion technologies.

- For instance, Terumo Corporation’s Capiox iCP centrifugal pump delivers up to 8 L/min flow and is rated for a maximum pressure of 700 mmHg according to its official technical specifications.

By End Use

Hospitals dominate the end-use segment with nearly 64% share in 2024 due to high patient inflow, advanced surgical units, and broader adoption of ECMO and cardiopulmonary bypass systems. Large hospitals invest heavily in electronic centrifugal pumps to enhance safety, reduce hemolysis, and support continuous hemodynamic monitoring during complex cardiac procedures. Ambulatory surgical centers and specialty clinics grow steadily as cardiovascular interventions shift to outpatient formats, supported by compact pump designs and better perioperative care infrastructure. Demand across all settings increases with rising cardiac disease prevalence and improved perfusion standards.

- For instance, Getinge AB’s Cardiohelp portable ECMO system supports flows up to 7 L/min and offers a minimum 90-minute battery runtime for transport use, verified in its product documentation.

Key Growth Drivers

Rising Cardiac Surgery Volume

Global cardiac surgery numbers continue to rise due to growing cases of heart failure, congenital disorders, and acute coronary syndromes. This rise increases demand for centrifugal blood pumps that support ECMO and cardiopulmonary bypass procedures. Hospitals adopt these pumps to improve patient stability, reduce hemolysis, and enhance flow control during complex surgeries. As specialized cardiac centers expand and more countries invest in advanced perfusion systems, the market sees steady growth supported by strong surgical workloads and rising treatment accessibility.

- For instance, a study in the Journal of Extracorporeal Technology comparing two different types of centrifugal pumps in a pediatric model found very low levels of plasma-free hemoglobin, typically less than 5 mg/dL for both pumps at the end of a 120-minute run.

Advancement in ECMO and Perfusion Technologies

Improved ECMO platforms and miniaturized perfusion systems boost adoption of centrifugal blood pumps. New designs allow better heat management, smoother flow, and real-time monitoring, which support safer long-term circulatory assistance. Hospitals increasingly choose these pumps to handle critical patients in ICUs, transport units, and emergency settings. Continuous upgrades in sensor integration, magnetic levitation, and automated flow regulation drive demand by improving clinical outcomes and reducing mechanical complications during high-risk support.

- For instance, According to a peer-reviewed article, the MedTech Dispo pump demonstrated a normalized index of hemolysis of 0.0025 ± 0.0005 g/100 L at a flow rate of 5 L/min against 250 mmHg in an in vitro study.

Growing Preference for Electronic Pump Systems

Electronic centrifugal pumps gain wider acceptance due to precise control, reduced mechanical wear, and stable performance in prolonged bypass use. Their reliability in high-acuity cardiac procedures encourages hospitals to upgrade older mechanical units. Strong compatibility with digital perfusion consoles and enhanced monitoring systems also supports rapid adoption. As cardiac centers move toward automation and advanced bypass technologies, electronic pumps remain a major growth driver within both developed and emerging healthcare markets.

Key Trends and Opportunities

Expansion of Portable and Transport ECMO Platforms

Portable ECMO systems create strong opportunities for centrifugal pump adoption as critical care shifts beyond traditional ICUs. Compact pumps help stabilize patients during inter-hospital transfers and emergency retrievals, improving survival chances in acute cardiac and respiratory failure. As mobile ECMO teams grow worldwide, demand increases for lightweight, energy-efficient pumps that maintain flow stability under variable operating conditions. This trend aligns with rising investments in advanced trauma networks and rapid-response cardiovascular care.

- For instance, the official LivaNova product specifications for the LifeSPARC System indicate the pump is capable of providing up to 8 L/min of blood flow.

Integration of Smart Monitoring and Automation

Manufacturers introduce pumps with enhanced controls, integrated sensors, and automated safety features that refine flow accuracy and reduce human error. These systems support real-time adjustment of pressure, temperature, and rotational speed, improving patient protection during long procedures. Smart automation also helps clinical teams manage rising procedure volumes with greater efficiency. Growing adoption of digital perfusion management platforms creates opportunities for connected centrifugal pump systems in both surgical and ICU environments.

- For instance, a 2021 peer-reviewed article published in the Journal of Artificial Organs documented in a study of 40 patients undergoing MiECC that the LivaNova ECMOLIFE pump group had plasma-free hemoglobin levels of 10.6 ± 0.7 mg/dL compared with 19.9 ± 0.3 mg/dL in the control group.

Shift Toward Long-Term Circulatory Support Use

Demand increases as centrifugal pumps expand into long-term circulatory support for cardiogenic shock and post-operative recovery. Improved durability and reduced shear stress allow extended use durations, offering new opportunities in advanced critical care. Hospitals adopt these pumps to handle complex cases where rapid hemodynamic stabilization is essential. The shift expands the application base beyond operating rooms, supporting stronger market penetration in emergency and specialty cardiac units.

Key Challenges

Risk of Hemolysis and Flow Instability

Centrifugal pumps face challenges linked to blood trauma, flow turbulence, and shear stress, especially during extended support. These complications can increase the risk of clotting, inflammation, and organ strain, requiring strict monitoring by clinical teams. Variations in tubing, cannula placement, and pump speed add complexity to maintaining stable performance. These concerns drive hospitals to seek improved designs and create barriers for older or mechanically limited systems.

High Cost and Limited Access in Emerging Regions

Advanced centrifugal pump systems remain expensive due to complex engineering, integrated electronics, and high maintenance needs. Many mid-income and low-income regions struggle to invest in ECMO and perfusion technologies, limiting access to life-saving cardiac support. High procurement costs, limited perfusion staff, and inadequate ICU infrastructure slow adoption. These challenges restrict market expansion despite rising cardiac disease burdens across underserved healthcare systems.

Regional Analysis

North America

North America leads the centrifugal blood pumps market with about 39% share in 2024. Growth comes from high cardiac surgery volumes, strong ECMO adoption, and widespread availability of advanced perfusion systems across major hospitals. The United States drives most demand due to well-established transplant centers and rapid integration of electronic pump platforms in ICUs. Rising investment in portable ECMO transport programs also strengthens usage in emergency care. Canada supports steady expansion through improved cardiac care infrastructure and increasing adoption of minimally invasive support systems, reinforcing the region’s leadership position.

Europe

Europe holds nearly 29% share in 2024, driven by strong cardiac care networks and high utilization of ECMO and bypass systems in Germany, France, Italy, and the United Kingdom. Hospitals in the region prioritize advanced electronic pumps to reduce hemolysis and maintain precise flow control during complex surgeries. Adoption rises as cardiovascular disease prevalence increases and more specialty cardiac units deploy modern perfusion technology. Government-backed investments in critical care units and wider use of mobile ECMO retrieval teams also support market expansion across leading European healthcare systems.

Asia Pacific

Asia Pacific accounts for about 22% share in 2024 and remains the fastest-growing region due to expanding cardiac surgery capacity in China, Japan, India, and South Korea. Hospitals upgrade to electronic centrifugal pumps to support rising ECMO use during respiratory and cardiac emergencies. Rapid growth in private cardiac centers and improved healthcare spending accelerate adoption across developing economies. Japan and South Korea continue to lead technologically, while China’s growing patient base and rising training programs for perfusionists further strengthen regional demand for advanced pump systems.

Latin America

Latin America holds nearly 6% share in 2024, with growth supported by improved cardiac treatment capabilities in Brazil, Mexico, and Argentina. Adoption expands as tertiary hospitals invest in ECMO units, although access remains uneven across public and private facilities. Demand for centrifugal blood pumps increases as cardiovascular disease rates rise and more centers adopt modern perfusion tools to enhance surgical outcomes. Training programs for ECMO specialists and growing awareness of advanced circulatory support options help stimulate gradual but steady market expansion across the region.

Middle East and Africa

The Middle East and Africa region captures about 4% share in 2024, with growth driven by investments in specialized cardiac centers in Saudi Arabia, the United Arab Emirates, and South Africa. Adoption remains moderate but improves as hospitals add ECMO capabilities and expand critical care infrastructure. Limited availability of trained perfusion staff and high equipment costs restrict wider penetration in low-income areas. However, increasing referral networks, rising cardiac disease burden, and government funding for advanced intensive care units support a gradual increase in centrifugal pump deployment.

Market Segmentations:

By Type

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The centrifugal blood pumps market features leading companies such as Terumo Corporation, Braille Biomedica Ltd., Abbott Laboratories, Baxter International, Getinge AB, Medtronic, LivaNova plc, Qura Srl, and 3M. Competition centers on advanced pump engineering, improved biocompatibility, and reduced hemolysis to support safer cardiac procedures. Manufacturers focus on electronic control systems, magnetic levitation technology, and compact designs that enable stable flow during both short-term and extended circulatory support. Many players invest in enhanced ECMO platforms, digital monitoring tools, and integration with modern perfusion consoles to strengthen clinical performance. Strategic moves include partnerships with cardiac centers, expansion of critical care product portfolios, and regulatory approvals for next-generation pump systems. Growing emphasis on automation, sensor accuracy, and long-term durability continues to shape competitive strategies, while emerging markets create opportunities for cost-efficient models with simplified operation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Medtronic launched VitalFlow, an all-in-one ECMO system for simplified use at the bedside and during transport.

- In 2023, Abbott introduced the CentriMag Pre-connected Pack, streamlining system setup in hospital environments to improve efficiency and patient care

- In 2022, LivaNova received FDA 510(k) clearance for its LifeSPARC system, which is a next-generation centrifugal blood pump and controller for ECMO applications.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as cardiac surgery volumes rise worldwide.

- Electronic pump adoption will grow due to stronger flow precision and lower wear.

- ECMO integration will increase as critical care units upgrade support systems.

- Portable pump designs will gain traction for emergency and transport use.

- Automation features will advance to improve safety and reduce human error.

- Demand will rise in Asia Pacific as cardiac centers and ICU capacity expand.

- Long-term circulatory support applications will become more common.

- Manufacturers will focus on reducing hemolysis through improved pump engineering.

- Training programs for perfusion specialists will expand to support broader adoption.

- Cost-optimized models will encourage higher uptake in emerging healthcare markets.