Market Overview

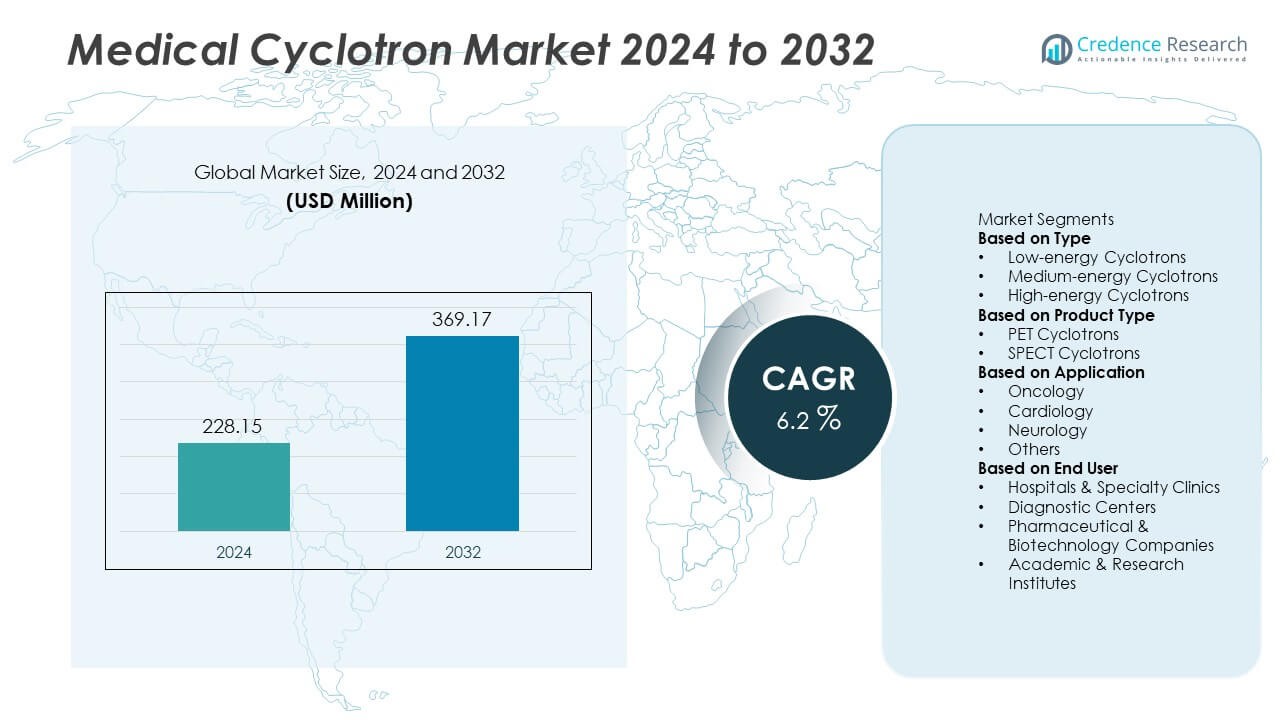

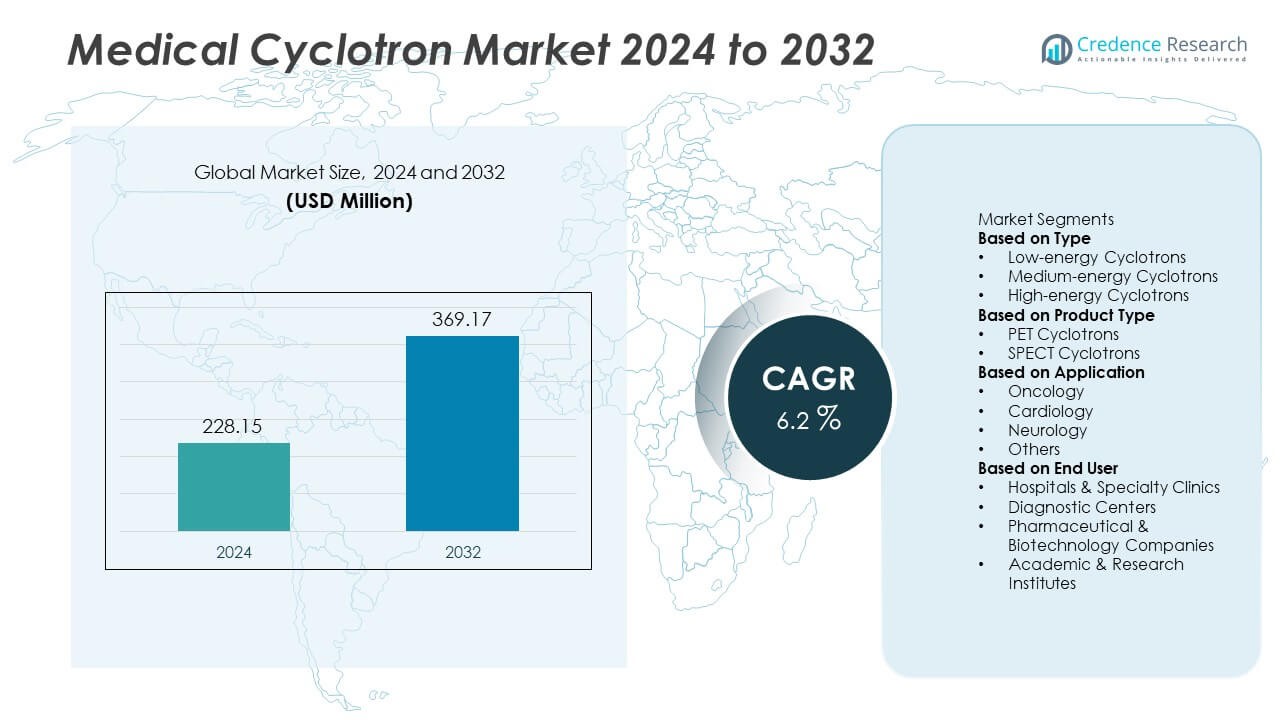

The Medical Cyclotron market was valued at USD 228.15 million in 2024. It is projected to reach USD 369.17 million by 2032, registering a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Cyclotron Market Size 2024 |

USD 228.15 Million |

| Medical Cyclotron Market, CAGR |

6.2% |

| Medical Cyclotron Market Size 2032 |

USD 369.17 Million |

The Medical Cyclotron market is shaped by key companies such as IBA Radiopharma Solutions, Siemens Healthineers, GE HealthCare, Sumitomo Heavy Industries, Advanced Cyclotron Systems, Best Cyclotron Systems, PMB-Alcen, TRIUMF Innovations, Ion Beam Applications, and Varian Medical Systems, all competing through technology improvements, compact system designs, and enhanced isotope production capabilities. North America leads the market with a 38% share, driven by strong nuclear medicine infrastructure, radiopharmaceutical production networks, and high PET-CT imaging usage. Europe follows with a 32% share, supported by established radiopharmacy hubs and rising theranostic adoption, while Asia-Pacific holds a 22% share and shows the fastest growth due to expanding cancer diagnostics and government investment in nuclear medicine.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medical Cyclotron market was valued at USD 228.15 million in 2024 and is projected to reach USD 369.17 million by 2032, registering a CAGR of 6.2% during the forecast period.

- Growing demand for PET and SPECT imaging in oncology drives adoption, with oncology applications holding a 62% share as hospitals and radiopharmacies expand radiotracer production for cancer diagnostics and treatment monitoring.

- Technological advancements such as compact, self-shielded cyclotrons and automated isotope handling support higher efficiency and broaden installation across hospital-based radiopharmacies and decentralized radiopharmaceutical manufacturing models.

- Competitive landscape remains strong with leading players focusing on advanced target systems, higher yield efficiency, and partnerships for theranostics expansion, while high capital costs and the need for specialized infrastructure continue to restrain adoption among mid-sized healthcare facilities.

- North America leads with a 38% share, followed by Europe at 32% and Asia-Pacific at 22%, supported by investments in nuclear medicine and radiopharmaceutical production, while low-energy cyclotrons dominate by type with a 46% share.

Market Segmentation Analysis:

By Type:

Low-energy cyclotrons hold a leading 46% share of the Medical Cyclotron market. These systems are widely preferred due to lower operational costs, compact design, and suitability for producing key PET radioisotopes for routine imaging. Medium-energy cyclotrons follow with rising adoption in research facilities and advanced radiopharmaceutical production. High-energy cyclotrons account for a smaller share due to higher installation and maintenance requirements. The dominance of low-energy units is driven by growing demand for PET diagnostics, increasing cancer screening procedures, and rapid expansion of nuclear medicine centers in both developed and emerging healthcare markets.

- For instance, IBA’s Cyclone KIUBE system supports dual-beam extraction and delivers proton energy up to 18MeV, enabling production of Fluorine-18 at a capacity of 7000mCi per batch.

By Product Type:

PET cyclotrons dominate the market with a 71% share, supported by increasing use of PET imaging for oncology, neurology, and cardiology diagnostics. Their ability to produce short-lived isotopes such as Fluorine-18 drives extensive usage across hospital radiopharmacies and commercial isotope suppliers. SPECT cyclotrons maintain demand in specific cardiology and organ-function imaging, yet PET systems outperform in imaging accuracy and clinical adoption. Growth in PET radiopharmaceutical pipelines, emphasis on early disease detection, and rising installations of PET-CT and PET-MRI scanners continue to strengthen the dominance of PET cyclotrons across global nuclear medicine applications.

- For instance, GE HealthCare’s PETtrace 890 supports 160 µA (microampere) beam current, enabling reliable Fluorine-18 production for continuous radiotracer supply across high-volume imaging centers.

By Application:

Oncology represents the dominant segment with a 62% share of the Medical Cyclotron market. The strong demand is linked to the increasing clinical reliance on PET-based cancer detection, treatment monitoring, and therapy planning. Cardiology and neurology imaging also expand steadily as precision diagnostics gain adoption in chronic disease management. Growing cancer incidence, the shift toward personalized treatment, and expanding radiotracer development pipelines accelerate cyclotron installations in hospital-based radiopharmacies. The segment’s growth further strengthens as healthcare systems invest in advanced radiopharmaceutical production to improve diagnostic accuracy and reduce dependence on imported isotopes.

Key Growth Driver:

Rising Demand for PET and SPECT Diagnostic Procedures

Growing use of PET and SPECT imaging in oncology, cardiology, and neurology supports strong Medical Cyclotron market expansion. Cyclotrons enable reliable production of short-lived isotopes such as Fluorine-18 and Carbon-11, which play a key role in early disease detection and treatment planning. Rising cancer prevalence, improved access to nuclear medicine, and favorable reimbursement policies further strengthen adoption. Hospitals and diagnostic networks continue investing in advanced radiopharmaceutical capabilities to improve diagnostic accuracy. This increasing reliance on molecular imaging drives new cyclotron installations across developed and emerging healthcare markets.

- For instance, Siemens Healthineers, through its PETNET network, operates over 50 radiopharmacies worldwide, ensuring daily distribution of Fluorine-18 radiotracers to hospital imaging departments.

Expansion of Radiopharmaceutical Manufacturing Facilities

Growing radiopharmaceutical development and commercial isotope supply needs encourage cyclotron deployment among private radiopharmacies and hospital-based production units. Companies are expanding centralized and decentralized manufacturing models to ensure stable availability of short half-life isotopes. Government funding for nuclear medicine infrastructure and supportive regulatory frameworks enhance market expansion. Clinical research on next-generation PET tracers broadens usage beyond oncology, increasing adoption in cardiology and neurology. As clinical trials intensify, producers require scalable isotope production systems, positioning cyclotrons as essential components of radiopharmaceutical development and distribution networks.

- For instance, Advanced Cyclotron Systems Inc. (ACSI) supports decentralized manufacturing through its TR-19 and TR-24 cyclotrons, which provide 19 to 24MeV energy for multi-isotope production, enabling supply for Fluorine-18, Nitrogen-13, Carbon-11, and Zirconium-89 clinical research programs.

Technological Advancements and Compact Cyclotron Designs

Advances in cyclotron engineering enhance performance, automation, and radiation safety, enabling reduced shielding and faster installation timelines. Compact, self-shielded cyclotrons support integration within hospitals and regional imaging centers without extensive construction requirements. Improved production control, higher isotope yield, and simplified maintenance strengthen operational efficiency. These advancements lower lifecycle costs and increase accessibility for mid-sized care providers. As nuclear medicine volumes grow, technologically advanced cyclotrons remain essential for continuous isotope supply and streamlined radiopharmaceutical workflows.

Key Trend & Opportunity:

Growing Adoption of Theranostics and Targeted Radiotherapy

Theranostics is reshaping clinical nuclear medicine by combining diagnostic imaging and targeted radionuclide therapy for personalized cancer treatment. Cyclotrons enable production of therapeutic and diagnostic isotopes used in prostate, thyroid, and neuroendocrine tumor management. Increasing adoption of PSMA-targeted and other molecular radiopharmaceuticals creates demand for flexible, hospital-linked isotope production. Partnerships between treatment centers, research institutes, and pharmaceutical companies support broader commercialization. This integration of imaging and therapy represents a major growth opportunity for cyclotron manufacturers and radiopharmacy solution providers.

- For instance, Telix Pharmaceuticals utilizes cyclotron-produced Gallium-68 tracers for PSMA theranostic programs, supporting clinical studies involving hundreds of enrolled patients across oncology sites.

Decentralized and Hospital-Based Isotope Production

Decentralized production models allow hospitals and regional radiopharmacies to generate isotopes on-site, reducing reliance on external suppliers and improving availability for time-critical PET imaging. This approach reduces transport risks, regulatory complexity, and isotope decay during transit. Growth in regional distribution hubs and mobile radiotracer services supports wider adoption. Emerging markets prioritize localized isotope access to strengthen diagnostic capacity. Decentralized cyclotron installations create promising opportunities for manufacturers, service providers, and integrated radiopharmacy operators.

- For instance, Eckert & Ziegler operates regional radiopharmacies equipped with Gallium-68 generators, which are a low-cost, easily transportable alternative to cyclotrons for producing Ga-68 on-site, to meet diagnostic requirements for neuroendocrine tumors.

Key Challenge:

High Capital Costs and Complex Infrastructure Requirements

Significant capital investment remains a major barrier, especially for smaller hospitals and diagnostic centers. Cyclotron deployment requires specialized radiation shielding, advanced ventilation, secure isotope handling systems, and trained personnel, increasing total cost of ownership. Lower imaging volumes and limited nuclear medicine budgets restrict adoption in cost-sensitive regions. Vendors must provide compact, cost-efficient systems, leasing models, and managed radiopharmacy services to mitigate purchasing constraints. These financial challenges slow market penetration and limit adoption among mid-scale healthcare operators.

Regulatory Compliance and Radioactive Material Handling

Strict regulatory oversight governs licensing, isotope production, radiation protection, and waste management, adding operational complexity. Healthcare facilities must maintain rigorous safety standards, documentation, and reporting, requiring specialized staff including nuclear pharmacists and radiation safety officers. Workforce shortages delay new cyclotron approvals and limit expansion in several countries. Non-compliance risks disrupt isotope supply and can impact patient care. Harmonized regulatory guidelines, workforce training programs, and digital compliance systems are essential to support safe and scalable cyclotron adoption.

Regional Analysis

North America

North America holds a leading 38% share of the Medical Cyclotron market, driven by strong nuclear medicine infrastructure and high PET-CT adoption rates. The United States leads installations due to expanding radiopharmaceutical production, favorable reimbursement policies, and strong investment in oncology diagnostics. Canada supports growth with increasing cyclotron deployment in hospital radiopharmacies to reduce reliance on imported isotopes. Academic research, clinical trials on novel tracers, and rising cancer screening programs continue to expand regional demand. Strong collaboration between imaging centers and pharmaceutical developers reinforces North America’s position in advancing molecular imaging and theranostic applications.

Europe

Europe accounts for a 32% share of the Medical Cyclotron market, supported by established radiopharmacy networks and strong regulatory backing for nuclear medicine. Germany, France, Italy, and the United Kingdom lead due to robust PET imaging usage and public healthcare investment. Cyclotron deployment increases as hospitals move toward localized isotope production for oncology and neurology diagnostics. EU emphasis on theranostics and targeted radiotherapy further boosts demand for clinical isotope manufacturing. Joint research programs, cross-border isotope distribution, and growing installation of self-shielded cyclotrons accelerate adoption across regional medical and research institutions.

Asia-Pacific

Asia-Pacific captures a 22% share and represents the fastest-growing region, driven by rising cancer incidence, expanding diagnostic imaging capacity, and government support for nuclear medicine infrastructure. China and India increase hospital-based cyclotron installations to expand PET-CT access, reduce isotope shortages, and support new radiopharmaceutical manufacturing. Japan and South Korea advance medical cyclotron technology through research and commercial isotope production. Growing investment from private imaging chains and pharmaceutical companies strengthens market momentum. The region’s shift toward localized radiotracer supply and broader adoption of precision oncology continues to create significant long-term growth opportunities.

Latin America

Latin America holds a 5% share of the Medical Cyclotron market, with growth supported by expanding PET imaging access and public healthcare upgrades. Brazil and Mexico lead installations due to increasing adoption in oncology diagnosis and efforts to reduce dependency on imported isotopes. Limited availability of skilled personnel and higher capital costs remain challenges, yet government and private sector partnerships improve infrastructure. Emerging radiopharmacy hubs, combined with training programs in nuclear medicine, are driving gradual regional adoption. Enhanced cancer care programs and rising patient awareness support increased cyclotron demand across key cities.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, driven by gradual nuclear medicine adoption and rising investment in advanced cancer diagnostics. Gulf countries, including the United Arab Emirates and Saudi Arabia, expand cyclotron and PET-CT installations through healthcare modernization initiatives. Africa shows slower growth due to limited isotope production facilities and cost constraints, although South Africa supports the region with established radiopharmacy capabilities. Partnerships with global radiopharmaceutical companies and new cancer treatment centers improve future prospects. Training programs and government support are expected to strengthen clinical cyclotron deployment over time.

Market Segmentations:

By Type

- Low-energy Cyclotrons

- Medium-energy Cyclotrons

- High-energy Cyclotrons

By Product Type

- PET Cyclotrons

- SPECT Cyclotrons

By Application

- Oncology

- Cardiology

- Neurology

- Others

By End User

- Hospitals & Specialty Clinics

- Diagnostic Centers

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Medical Cyclotron market features strong competition among leading companies, including IBA Radiopharma Solutions, Siemens Healthineers, GE HealthCare, Sumitomo Heavy Industries, Advanced Cyclotron Systems, Best Cyclotron Systems, PMB-Alcen, TRIUMF Innovations, Ion Beam Applications, and Varian Medical Systems. These players compete on technology innovation, energy efficiency, production capacity, and system integration for PET and SPECT isotope manufacturing. Companies focus on compact, self-shielded designs that enable hospital-based installations and reduce radiation infrastructure requirements. Strategic partnerships with radiopharmacies, pharmaceutical companies, and diagnostic networks strengthen supplier positions in key growth markets. Several manufacturers invest in automation, remote monitoring, and advanced target systems to increase isotope yield and operational safety. After-sales service, maintenance contracts, and regulatory support remain critical differentiators as healthcare providers prioritize reliable isotope supply for oncology, neurology, and cardiology diagnostics. Continuous research on new radiotracers and rising demand for theranostic applications are expected to influence future competitive strategies.

Key Player Analysis

- IBA Radiopharma Solutions

- Siemens Healthineers

- GE HealthCare

- Sumitomo Heavy Industries, Ltd.

- Advanced Cyclotron Systems Inc.

- Best Cyclotron Systems, Inc.

- PMB-Alcen

- TRIUMF Innovations

- Ion Beam Applications S.A. (IBA)

- Varian Medical Systems

Recent Developments

- In May 2025, Ion Beam Applications S.A. (IBA) signed a contract with PET Pharm Bio in Taiwan to install its high-energy “Cyclone IKON” cyclotron for PET and SPECT isotope production, enabling production of isotopes such as Iodine-123 and Zirconium-89.

- In February 2025, IBA also entered a Memorandum of Understanding with Framatome to develop a global network of alpha-emitting cyclotrons for production of the radioisotope Astatine-211, aimed at supporting targeted alpha therapies for oncology.

- In December 2024, Siemens Healthineers completed the acquisition of Advanced Accelerator Applications Molecular Imaging from Novartis, adding a European manufacturing and distribution network of PET radiopharmaceuticals to its portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of compact and self-shielded cyclotrons in hospital radiopharmacies.

- Demand for isotopes used in oncology imaging and therapy will continue to grow.

- Theranostics will drive investments in new radiopharmaceutical production capabilities.

- Automation and digital monitoring will improve isotope yield and operational safety.

- More decentralized and regional production hubs will reduce dependence on imported isotopes.

- Partnerships between cyclotron makers and radiopharmaceutical companies will expand isotope portfolios.

- Skilled workforce development in nuclear medicine will become a priority for healthcare systems.

- Regulatory frameworks will evolve to support faster cyclotron approvals and safer operations.

- Advancements in PET tracer research will increase applications beyond oncology into cardiology and neurology.

- Growing nuclear medicine infrastructure in Asia-Pacific and Latin America will create new market growth opportunities.