Market Overview

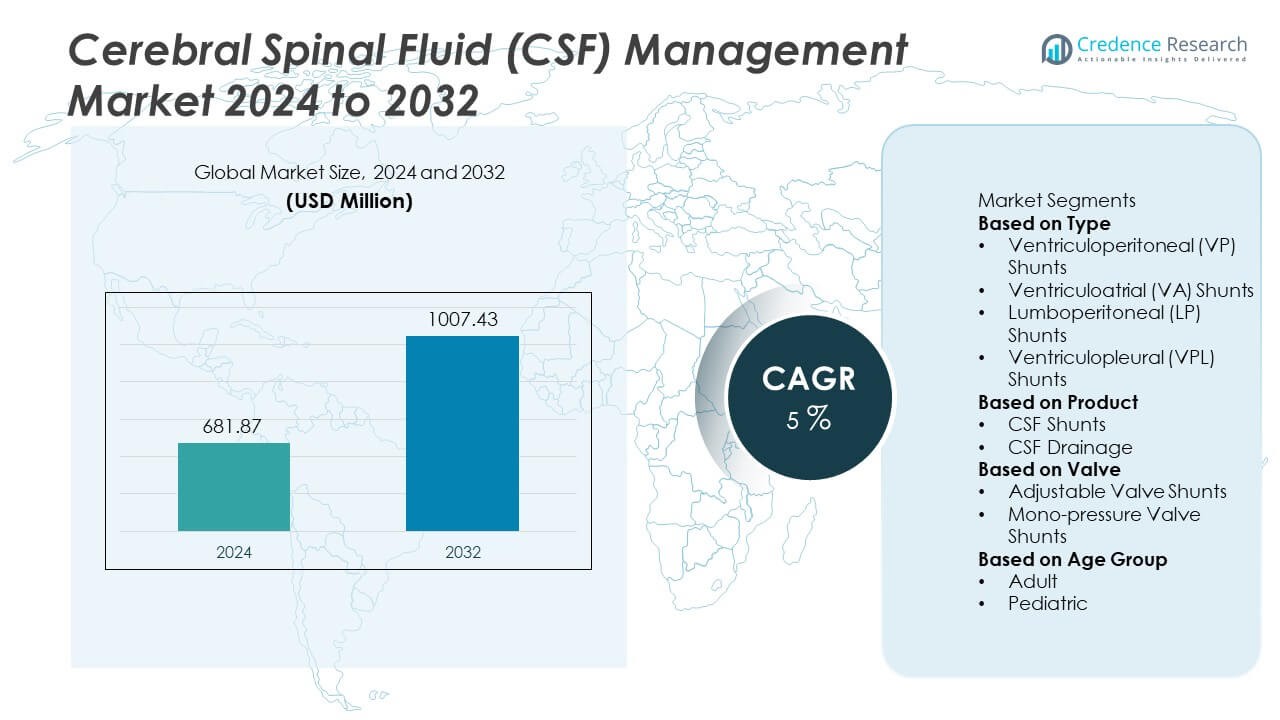

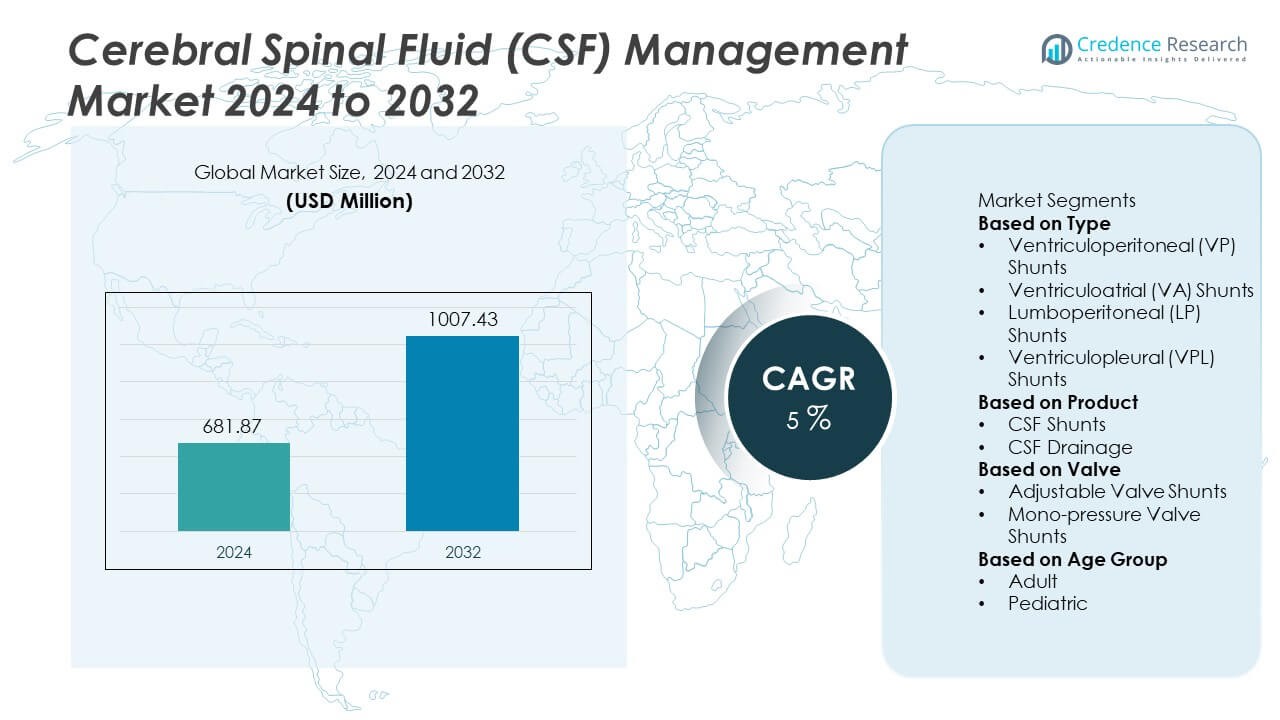

The Cerebral Spinal Fluid (CSF) Management Market was valued at USD 681.87 million in 2024. The market is expected to reach USD 1,007.43 million by 2032, registering a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cerebral Spinal Fluid (CSF) Management Market Size 2024 |

USD 681.87 Million |

| Cerebral Spinal Fluid (CSF) Management Market, CAGR |

5% |

| Cerebral Spinal Fluid (CSF) Management Market Size 2032 |

USD 1,007.43 Million |

The top players in the Cerebral Spinal Fluid (CSF) Management market include Medtronic, Integra LifeSciences, B. Braun Melsungen AG, Sophysa, Spiegelberg GmbH & Co. KG, Christoph Miethke GmbH & Co. KG, Möller Medical GmbH, Boston Scientific Corporation, Becker Smith Medical, and Orbis Neuro, each focusing on advanced adjustable valve shunts, antimicrobial catheters, and smart intracranial pressure monitoring systems to improve hydrocephalus treatment outcomes. Asia Pacific leads the market with a 32% share, driven by a high prevalence of congenital hydrocephalus and expanding neurosurgical capacity. North America follows with 30%, supported by strong clinical adoption of programmable shunts and well-developed neurocritical care units, while Europe holds a 25% share due to investments in infection-resistant shunt materials and advanced ICP monitoring technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cerebral Spinal Fluid (CSF) Management market reached USD 681.87 million in 2024 and is projected to reach USD 1,007.43 million by 2032, registering a CAGR of 5% during the forecast period.

- Rising prevalence of hydrocephalus and traumatic brain injuries drives demand for CSF drainage and shunt systems, with Ventriculoperitoneal (VP) shunts holding the largest 62% segment share due to strong clinical adoption and lower revision risks.

- Key trends include increasing integration of programmable and MRI-compatible adjustable valve shunts, along with higher use of antimicrobial catheter coatings and telemetric intracranial pressure monitoring for improved patient outcomes.

- Medtronic, Integra LifeSciences, B. Braun, Sophysa, Spiegelberg, and Christoph Miethke lead the competitive landscape, focusing on innovation in infection-resistant CSF shunts, remote pressure adjustment systems, and reduced complication rates through advanced valve technology.

- Asia Pacific leads regional demand with a 32% share, followed by North America at 30% and Europe at 25%, supported by expanding neurosurgical infrastructure, improved diagnosis rates, and growing access to advanced hydrocephalus treatment solutions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Ventriculoperitoneal (VP) shunts hold the dominant 62% share in the Cerebral Spinal Fluid (CSF) Management market. Their strong adoption is driven by proven clinical outcomes, lower complication rates, and compatibility with both pediatric and adult hydrocephalus patients. VP shunts efficiently divert excess cerebrospinal fluid from the ventricles to the peritoneal cavity, reducing intracranial pressure and preventing neurological damage. Ventriculoatrial (VA) and lumboperitoneal (LP) shunts remain preferred alternatives for patients with abdominal contraindications, while ventriculopleural (VPL) shunts serve niche cases. Growing hydrocephalus prevalence and advancements in catheter and valve materials continue to support VP shunt dominance.

- For instance, Medtronic’s Strata II valve has five performance levels (P/L 0.5 to P/L 2.5), which offer a comprehensive range of pressure control options. Adjustable valves like the Strata II are designed to allow non-invasive pressure setting adjustments, a feature intended to help manage changing patient needs and potentially reduce the need for surgical revisions.

By Product

CSF shunts account for the largest 71% market share, driven by widespread use in long-term hydrocephalus management and higher procedure volumes across neurosurgical centers. Increasing adoption of programmable and anti-siphon shunt systems enhances treatment accuracy and reduces revision surgeries. CSF drainage systems are utilized primarily in acute and temporary management of trauma-related or post-surgical cerebrospinal fluid accumulation. Demand for external ventricular drainage (EVD) rises in neurocritical care units where continuous ICP monitoring is required. Continued development of infection-resistant shunt designs and minimally invasive implantation techniques drives further market growth.

- For instance, Integra LifeSciences’ Certas Plus valve offers 8 programmable pressure settings, enabling non-invasive adjustments that can reduce the need for shunt revision surgeries to alter valve pressure, according to company data sheets and product information.

By Valve

Adjustable valve shunts represent the leading segment with a 58% share due to their ability to regulate CSF flow without revision surgery. These systems allow physicians to customize pressure settings based on patient response, reducing overdrainage or underdrainage complications and improving clinical outcomes. Mono-pressure valve shunts remain in use for cost-sensitive treatment settings but are gradually being replaced by more advanced programmable models. Increasing preference for integrated pressure sensors and MRI-compatible adjustable valves strengthens this segment. The need for personalized CSF management and reduced reoperation rates continues to support strong adoption of adjustable valve technologies.

Key Growth Drivers

Rising Prevalence of Hydrocephalus and Neurological Disorders

The growing incidence of hydrocephalus among infants, adults, and elderly patients drives demand for CSF management solutions. Higher diagnosis rates of traumatic brain injury, intracranial hemorrhage, and neurodegenerative disorders also contribute to market expansion. Hospitals and neurosurgical centers increasingly adopt advanced shunt and drainage systems for long-term CSF regulation. Expanded access to neuroimaging improves early intervention, leading to higher treatment volumes. These factors strengthen the market for ventriculoperitoneal and adjustable valve shunt technologies that help prevent complications associated with cerebrospinal fluid buildup.

- For instance, the LiquoGuard®7 automated cerebrospinal fluid (CSF) drainage system has been utilized in neurosurgical procedures, supporting intracranial pressure monitoring and regulation. Other systems include the Spiegelberg ventricular drainage catheters or the Medtronic Duet External Drainage and Monitoring System.

Advancements in Shunt and Valve Technologies

Continuous improvements in shunt materials, catheter coatings, and programmable valve mechanisms support strong market growth. Adjustable and MRI-compatible valve shunts reduce the need for revision surgeries and allow pressure settings to be modified non-invasively. Smart CSF systems with anti-siphon, flow-control, and infection-resistant features improve patient outcomes. Hospitals replace older, fixed-pressure devices with customizable treatment options as clinical evidence favors programmable systems. These technological upgrades increase adoption across pediatric and adult hydrocephalus treatment programs.

- For instance, Christoph Miethke GmbH & Co. KG manufactures the proGAV 2.0 adjustable valve, which features a gravity-assisted unit designed to reduce over-drainage during posture changes.

Expansion of Neurosurgical and Critical Care Infrastructure

Healthcare systems invest in advanced neurocritical care units and neurosurgical facilities, supporting CSF drainage and shunt placement procedures. Growth in trained neurosurgeons and wider availability of external ventricular drainage (EVD) systems enable timely management of traumatic and post-surgical CSF complications. Government funding and private healthcare expansion increase surgical capacity in emerging markets, improving access to hydrocephalus treatment. Rising adoption of minimally invasive procedures further strengthens demand for innovative CSF management devices.

Key Trends & Opportunities

Increasing Demand for Infection-Resistant and Biocompatible Shunt Systems

Manufacturers introduce antimicrobial catheter coatings and biocompatible materials to reduce shunt-associated infections, one of the leading causes of revision surgery. Advanced silicone blends, silver-ion technologies, and hydrogel-treated surfaces enhance system durability and patient safety. hospital protocols emphasize shunt sterility and monitoring solutions to improve clinical outcomes. The trend opens opportunities for next-generation programmable shunts integrated with sensing and wireless adjustment capabilities.

- For instance, B. Braun supplied silver alloy-treated external ventricular drain (EVD) catheters to neurosurgical centers, and studies have shown they can lead to a significant reduction in the risk of cerebrospinal fluid infections compared to standard catheters in some clinical settings.

Rising Adoption of Telemetry and ICP Monitoring Integration

Digital CSF management solutions gain momentum as clinicians seek continuous intracranial pressure (ICP) monitoring and remote adjustment capabilities. Sensor-enabled shunt systems and smart EVD platforms support early detection of obstruction and overdrainage. Software-based data dashboards enable treatment customization and reduce emergency revision procedures. This trend supports partnerships between device makers and neurotechnology companies to expand connected CSF care models.

- For instance, Miethke GmbH & Co. KG developed the M.scio telemetry-enabled shunt device, which allows clinicians to retrieve valve pressure settings non-invasively using an NFC-based reader.

Key Challenges

Risk of Shunt Malfunction and Revision Surgeries

Despite advancements, shunt obstruction, overdrainage, infection, and mechanical failure remain major challenges. High revision rates increase patient risk and raise overall care costs. Hospitals require strict post-implant monitoring and follow-up, adding clinical workload. The need for improved durability and failure-resistant valve designs drives ongoing product development, yet device complexity increases regulatory and cost constraints.

High Treatment Costs and Limited Access in Developing Regions

CSF management surgeries involve specialized neurosurgical expertise, diagnostic imaging, and advanced device procurement, leading to high treatment expenses. Limited reimbursement coverage and a shortage of neurosurgical infrastructure restrict adoption in low-income countries. Many patients remain untreated or rely on older, fixed-pressure shunts with higher complication rates. Cost-efficient and scalable shunt solutions are necessary to expand access and reduce global treatment disparities.

Regional Analysis

North America

North America holds a 30% share of the Cerebral Spinal Fluid (CSF) Management market, supported by strong neurosurgical infrastructure, high diagnosis rates of hydrocephalus, and advanced neurocritical care capabilities. The United States drives most of the regional demand with a large base of pediatric and adult patients undergoing VP shunt and EVD procedures. Hospitals widely adopt adjustable valve systems and MRI-compatible shunts to minimize revision surgeries. Favorable reimbursement coverage and continuous clinical research accelerate device innovation and early intervention. Growing awareness of traumatic brain injury and postoperative CSF complications further reinforces market adoption across specialized neurological treatment centers in the United States and Canada.

Europe

Europe accounts for a 25% market share, driven by well-established neurology departments and widespread adoption of programmable CSF shunt technologies. Germany, the United Kingdom, France, and Italy lead clinical utilization due to strong hydrocephalus management programs and access to advanced imaging. Healthcare systems emphasize infection control, encouraging use of antimicrobial catheters and biocompatible shunt components. Increasing clinical use of intracranial pressure monitoring and telemetric diagnostics supports improved outcomes. Europe’s aging population contributes to a growing number of patients with normal pressure hydrocephalus (NPH), sustaining long-term demand for adjustable valve shunts and external drainage systems.

Asia Pacific

Asia Pacific holds the largest 32% share of the market, driven by a high prevalence of congenital hydrocephalus, rising neurosurgery capacity, and improving healthcare access in China, India, and Japan. Expanding medical device adoption and higher pediatric treatment volumes strengthen demand for VP shunts and cost-effective drainage systems. Regional manufacturers introduce competitive shunt models to support affordability, while international companies expand distribution networks. Investments in trauma centers and neurological ICUs enhance treatment capabilities. Increasing public healthcare spending and wider implementation of neonatal screening programs reinforce accelerated market growth across the region.

Latin America

Latin America represents a 7% market share, with growing adoption of CSF shunt procedures in Brazil, Mexico, and Argentina. Expanding access to neurosurgical care and improving hospital infrastructure drive market development, particularly for pediatric hydrocephalus treatment. Budget constraints influence product selection, increasing demand for cost-efficient mono-pressure and standard VP shunts. International partnerships and government-led healthcare programs help improve treatment availability. Growing incidence of brain injuries linked to road accidents and post-infectious hydrocephalus also contributes to increasing use of CSF drainage and shunt systems across public and private hospitals.

Middle East and Africa

Middle East and Africa hold a 6% share of the market, driven by gradual improvements in neurosurgical services and investments in advanced hospital facilities in Saudi Arabia, the United Arab Emirates, and South Africa. Demand for VP shunts and EVD systems grows as healthcare networks expand diagnostic and surgical capabilities for hydrocephalus and severe brain injuries. Limited specialist availability and higher treatment costs pose adoption challenges in parts of Africa. However, humanitarian neurosurgical programs and medical training initiatives are improving access to CSF management solutions. As hospitals modernize, the region is expected to experience steady market growth.

Market Segmentations:

By Type

- Ventriculoperitoneal (VP) Shunts

- Ventriculoatrial (VA) Shunts

- Lumboperitoneal (LP) Shunts

- Ventriculopleural (VPL) Shunts

By Product

By Valve

- Adjustable Valve Shunts

- Mono-pressure Valve Shunts

By Age Group

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Medtronic, Integra LifeSciences, B. Braun Melsungen AG, Sophysa, Spiegelberg GmbH & Co. KG, Christoph Miethke GmbH & Co. KG, Möller Medical GmbH, Boston Scientific Corporation, Becker Smith Medical, and Orbis Neuro lead the competitive landscape of the Cerebral Spinal Fluid (CSF) Management market. The market is characterized by strong focus on programmable valve shunts, infection-resistant catheter materials, and integrated intracranial pressure monitoring technologies. Leading manufacturers invest in developing MRI-compatible adjustable shunts and smart CSF systems capable of remote pressure modifications and improved drainage control. Strategic partnerships with neurosurgical centers and clinical research organizations help validate device performance and reduce revision rates. Companies expand market reach through training programs for surgeons and distribution network enhancements across Asia Pacific and Latin America. The competitive environment continues to shift toward personalized hydrocephalus treatment, leveraging telemetric monitoring, improved shunt durability, and minimally invasive implantation techniques to strengthen patient outcomes and long-term therapy effectiveness.

Key Player Analysis

- Medtronic

- Integra LifeSciences

- Braun Melsungen AG

- Sophysa

- Spiegelberg GmbH & Co. KG

- Christoph Miethke GmbH & Co. KG

- Möller Medical GmbH

- Boston Scientific Corporation

- Becker Smith Medical

- Orbis Neuro

Recent Developments

- In June 2025, Cooper University Health Care launched a clinical trial using the investigational CereVasc eShunt System to evaluate this new, less invasive treatment option for hydrocephalus patients.

- In February 2025, Integra LifeSciences reported its financial results for the fourth quarter and full year ended December 31, 2024. During that period, its CSF management segment grew in the low double-digits, driven by its BactiSeal® and Certas® Plus product lines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Valve, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as early diagnosis of hydrocephalus improves across all age groups.

- Programmable valve shunts will gain wider adoption due to reduced revision surgery needs.

- Telemetry-enabled CSF monitoring systems will support remote pressure adjustments.

- Antimicrobial and biocompatible shunt materials will help reduce infection rates.

- Pediatric hydrocephalus treatment volumes will increase with improved neonatal screening.

- Integration of AI-assisted ICP monitoring will enhance clinical decision-making.

- Hospitals will expand use of EVD systems for trauma, stroke, and post-surgical CSF management.

- Emerging markets will improve access to advanced shunt technologies through healthcare investments.

- Partnerships between device manufacturers and neurosurgical institutes will accelerate product innovation.

- Long-term patient outcome tracking will become a standard component of CSF management therapies.

Market Segmentation Analysis:

Market Segmentation Analysis: