Market Overview

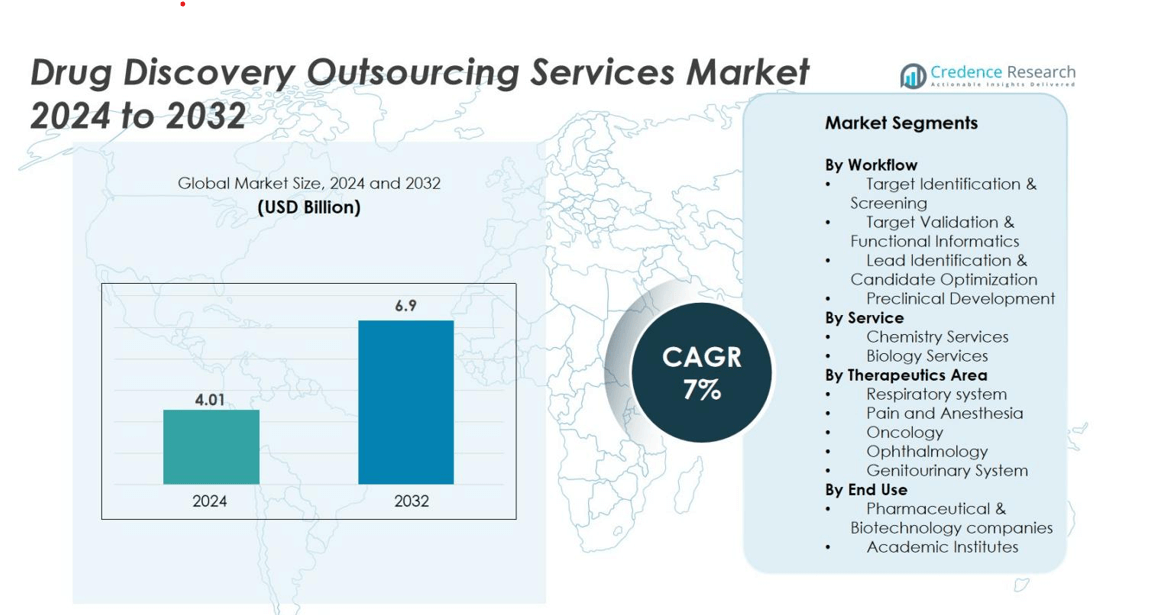

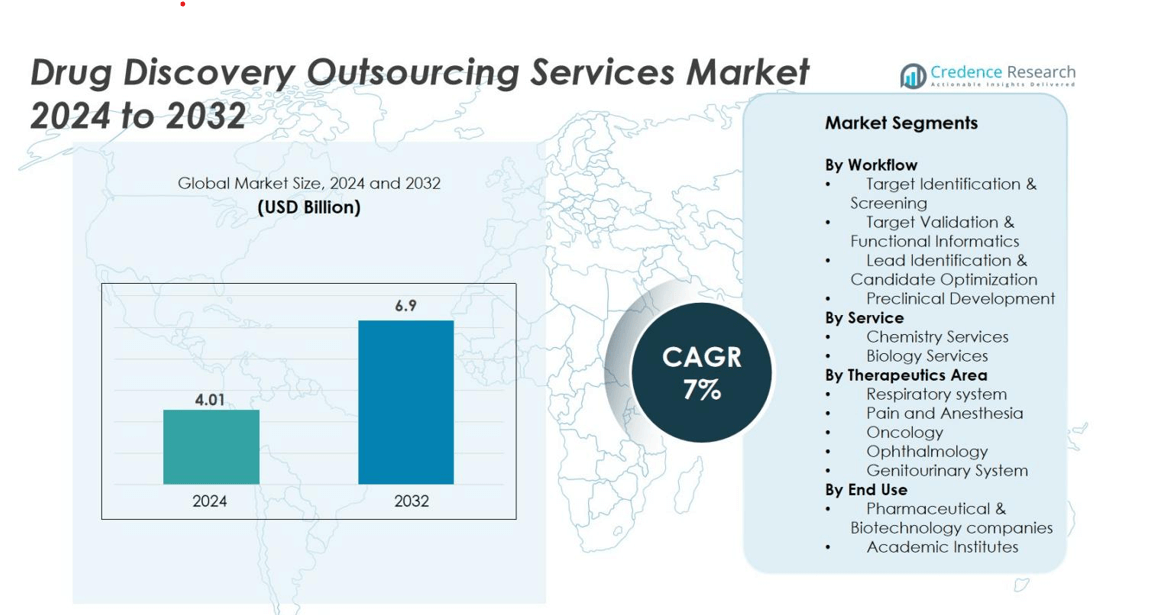

Drug Discovery Outsourcing Services market size was valued at USD 4.01 Billion in 2024 and is anticipated to reach USD 6.9 Billion by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug Discovery Outsourcing Services Market Size 2024 |

USD 4.01 Billion |

| Drug Discovery Outsourcing Services Market, CAGR |

7% |

| Drug Discovery Outsourcing Services Market Size 2032 |

USD 6.9 Billion |

Top players in the Drug Discovery Outsourcing Services market include Charles River Laboratories, Thermo Fisher Scientific Inc., WuXi AppTec, EVOTEC, GenScript, Merck & Co., Inc., Albany Molecular Research Inc., Dalton Pharma Services, and Laboratory Corporation of America Holdings. These companies strengthen their positions through AI-enabled screening, medicinal chemistry expertise, and integrated preclinical capabilities. North America leads the market with a 38% share in 2024, supported by strong pharma spending, mature biotech ecosystems, and FDA-driven research standards. Europe follows with a 29% share, driven by advanced biologics programs and university–industry research partnerships, while Asia-Pacific’s growing outsourcing capacity and competitive pricing continue to attract global R&D contracts.

Market Insights

- The Drug Discovery Outsourcing Services market was valued at USD 4.01 Billion in 2024 and will reach USD 6.9 Billion by 2032, growing at a 7% CAGR during the forecast period.

- Rising R&D costs and demand for faster development timelines drive outsourcing of medicinal chemistry, high-throughput screening, and preclinical studies. Pharma and biotech companies use CRO expertise to cut operational burden and reduce early-stage failure rates.

- AI-enabled screening, predictive modeling, cloud-based data analysis, and automation create strong trends, improving hit identification and shortening candidate selection. Integrated discovery-to-preclinical service models gain momentum.

- Leading players such as Charles River Laboratories, Thermo Fisher Scientific Inc., EVOTEC, WuXi AppTec, GenScript, and Merck & Co., Inc. compete through platform expansion, partnerships, and global research networks. Chemistry Services remain dominant with a 56% share.

- North America leads with a 38% share, followed by Europe at 29% and Asia-Pacific at 22%, supported by strong biotech clusters, regulatory support, and growing outsourcing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Workflow

Target Identification & Screening holds the dominant position in the workflow segment with a 32% market share in 2024. Pharma and biotech companies depend on high-throughput screening, AI-based hit discovery, and biomarker-based target selection to cut early-stage failure risk. Demand rises as pipelines shift toward biologics, gene therapies, and precision medicines. Target Validation & Functional Informatics also expands due to CRISPR-based assays and transcriptomic profiling. Lead Identification & Candidate Optimization benefit from structure-based drug design, while Preclinical Development grows with outsourced toxicology and ADME studies, but Target Identification & Screening remains the largest due to its wide adoption and high spending.

- For instance, Charles River Laboratories has advanced high-throughput screening platforms integrated with AI algorithms, significantly accelerating hit discovery by analyzing complex data patterns more accurately.

By Service

Chemistry Services lead the service segment with a 56% market share in 2024. Clients outsource medicinal chemistry, peptide synthesis, compound library design, and analytical chemistry to speed up lead optimization and shorten time-to-IND filing. Demand grows with increased small-molecule research, combinatorial chemistry, and scalable synthesis support. Biology Services gain traction through cell-based assays, protein engineering, and bioassay development, driven by growth in biologics and antibody-drug conjugates. However, Chemistry Services remain dominant because they cover a wider range of early discovery tasks and require specialized infrastructure that many companies prefer to outsource.

- For instance, Aurigene Pharmaceutical Services provides integrated chemistry and biology drug discovery solutions with cGMP manufacturing capabilities for peptides and new chemical entities, facilitating faster clinical trial readiness.

By Therapeutic Area

Oncology dominates the therapeutic landscape with a 41% market share in 2024. Cancer drug pipelines rise due to immunotherapy, cell therapy, checkpoint inhibitors, and targeted therapies. CROs provide tumor model development, biomarker analysis, genomic profiling, and in-vitro screening to support precision oncology programs. Respiratory and Pain & Anesthesia research also expand due to chronic disease prevalence and demand for non-opioid therapeutics, while Ophthalmology and Genitourinary System studies benefit from rare disease programs. Yet oncology holds the largest share because cancer accounts for the highest R&D investments, fastest-growing clinical pipelines, and strong demand for outsourced preclinical and translational research.

Key Growth Drivers

Rising R&D Costs and Demand for Faster Drug Development

Pharma and biotech companies face rising R&D expenditure, long development timelines, and strict approval requirements. Outsourcing reduces overhead costs linked to lab infrastructure, workforce, and regulatory compliance. Contract research organizations (CROs) offer scalable resources, AI-enabled screening, and high-throughput platforms to accelerate early discovery and lead optimization. Small and mid-sized biotechs rely heavily on outsourcing because they lack large in-house laboratories. Big pharma also moves non-core discovery work to partners to shorten cycle time and focus on strategic assets. The rising number of drug candidates in oncology, neurology, and rare diseases strengthens demand for specialized discovery services. As development failures increase at early stages, companies depend on CRO expertise to improve hit validation and reduce attrition.

- For instance, Atomwise employs its AtomNet convolutional neural network to virtually screen a vast chemical space of over 16 billion compounds, achieving an average hit rate of approximately 7.6% across diverse therapeutic targets, and a 74% success rate for finding at least one hit in a target, which significantly outperforms the 50% success rate often observed with traditional high-throughput screening hit identification campaigns.

Growth in Complex and Biologic Drug Pipelines

The global drug pipeline continues to shift toward monoclonal antibodies, recombinant proteins, cell therapies, nucleic acid-based therapies, and antibody-drug conjugates. These biologic and precision therapy programs require specialized screening platforms, genomics tools, and advanced bioassays. Many pharma companies lack the required biologics infrastructure, prompting them to outsource target discovery, functional genomics, and in-vitro biology to CROs with niche expertise. Growth in immuno-oncology and rare disease therapy accelerates demand for customized in-vivo models, biomarker development, and translational research services. CROs also invest in automation, robotics, and high-content imaging to support complex molecule development.

- For instance, WuXi Biologics employs a combination of hybridoma, phage display, yeast display, and single B cell screening technologies for monoclonal antibody discovery, enabling efficient identification and development of therapeutic antibodies.

Adoption of AI, Automation, and Digital Drug Discovery

Drug developers adopt AI, machine learning, computational chemistry, and virtual screening to cut development time and improve candidate success rates. CROs integrate neural-network-based modeling, protein structure prediction, and predictive toxicology platforms to enhance early discovery efficiency. Automated liquid handling and robotic systems improve compound screening and reduce manual errors, while cloud-based informatics supports real-time data sharing between sponsors and CRO labs. AI-enabled hit identification shortens discovery by months and reduces the number of failed molecules entering preclinical studies. Companies also rely on digital twin models and omics-driven insights for target validation and lead optimization.

Key Trends & Opportunities

Expansion of End-to-End Integrated Outsourcing Models

CROs now offer integrated discovery-to-preclinical services rather than isolated chemistry or biology tasks. Sponsors prefer single-partner models to reduce coordination delays, data loss, and handover issues. Large outsourcing firms expand through mergers and acquisitions to create global discovery networks, animal facilities, and GMP-ready development labs. Integrated workflows help clients move from target discovery to IND filing with reduced risk and faster timelines. Mid-size biotechs benefit because they lack internal project management teams. As more pipelines adopt complex therapy modalities, integrated partnerships offer scientific continuity, regulatory support, and streamlined communication.

- For instance, Syngene International has implemented an integrated CMC strategy that supports expedited IND filings and Phase 1 studies, reducing regulatory filing timelines to approximately 11 months through early risk mitigation and dedicated project management.

Rise of Collaborative Discovery and Risk-Sharing Models

Strategic partnerships between pharma and CROs now include milestone-based payments, shared IP licensing, and co-development agreements. Sponsors reduce upfront cost, while CROs gain revenue from successful commercialization. Increasing partnerships in oncology, neurological disorders, and gene therapy pipelines highlight this model. Risk-sharing encourages CROs to invest in proprietary screening platforms, disease models, and AI engines. As early discovery becomes more data-driven, collaborations improve knowledge transfer and reduce duplication of experiments. This trend opens opportunities for technology-intensive CROs and expands global innovation networks across the U.S., Europe, and Asian biotech clusters.

- For instance, Roche’s 2025 co-development and co-commercialization deal with Zealand Pharma for the obesity drug petrelintide involved a $1.65 billion upfront payment with profit-sharing in the U.S. and Europe.

Key Challenges

Data Security, IP Protection, and Regulatory Compliance

Data breaches, cyber-risks, and IP theft create major concerns for outsourcing partners, especially when working across borders. Sponsors hesitate to share proprietary molecules, genetic data, or computational libraries without stringent security frameworks. CROs must meet strict regulatory compliance across GxP standards, animal ethics, and data protection laws. Multi-country collaborations require complex documentation and vary by region, slowing project timelines. As cyberattacks rise in life sciences sectors, CROs invest in encrypted data systems, controlled lab access, and ISO-certified digital platforms. Strong governance remains essential to maintain sponsor trust and prevent legal risks.

Limited Standardization and High R&D Failure Rates

Drug discovery remains unpredictable, with many candidates failing during hit validation or preclinical testing. Variations in assay quality, biological reproducibility, and compound libraries create challenges for standardization. Small biotechs often lack strong experimental design, leading to rework or delays once outsourced. CROs must align methodologies with client expectations, regulatory guidelines, and therapeutic mechanisms. Failure rates create cost pressure and extend project timelines. Continuous investment in assay validation, quality control, advanced analytics, and scientific expertise is required to reduce risk. Despite outsourcing benefits, unpredictable biological response remains a structural restraint on market growth.

Regional Analysis

North America

North America holds the largest share of the Drug Discovery Outsourcing Services market with 38% in 2024. The region benefits from well-established pharmaceutical companies, high R&D spending, and strong biotechnology pipelines. Outsourcing demand increases as large pharma focuses on cost reduction and faster candidate screening. U.S.-based CROs expand capabilities in high-throughput screening, AI-enabled drug design, and biomarker discovery. The presence of strong academic research networks and venture-backed biotech startups also accelerates service adoption. Regulatory clarity from the FDA encourages partnerships, while growing oncology and rare disease programs further strengthen outsourcing opportunities across early discovery and preclinical stages.

Europe

Europe accounts for 29% of the market in 2024, driven by strong biotech clusters in Germany, the U.K., Switzerland, Italy, and France. Pharma companies depend on outsourcing to meet strict regulatory requirements and reduce research timelines. The region has advanced genomics research, specialized screening facilities, and strong expertise in biologics and biosimilars. Collaborative projects between universities, research institutes, and CROs support customized discovery programs. Growth in cell and gene therapy research also increases outsourcing needs for functional genomics, in-vitro modeling, and translational biology. Government funding and supportive clinical research regulations further boost demand.

Asia-Pacific

Asia-Pacific represents 22% of the market in 2024 and remains the fastest-growing regional segment. China, India, South Korea, and Singapore lead due to strong CRO infrastructure, skilled scientific talent, and competitive pricing advantages. Sponsors outsource chemistry, in-vivo research, and toxicology studies to shorten cycle time and scale capacity. APAC CROs expand into advanced biology services, high-content screening, and computational drug design. Government initiatives supporting biotech innovation, drug discovery incubators, and translational research centers accelerate regional growth. Expansion of global pharma R&D centers in Shanghai, Bengaluru, and Seoul strengthens outsourcing demand across early discovery workflows.

Latin America

Latin America captures 6% market share in 2024 with growth led by Brazil, Mexico, and Argentina. The region’s pharma industry increasingly outsources preclinical research, compound synthesis, and ADME studies to reduce costs. Local CROs invest in laboratory infrastructure and regulatory compliance to attract global projects. Partnerships between international sponsors and local research centers expand capacity for toxicity screening and in-vitro biology. Although the region remains smaller than North America and Europe, demand increases as chronic disease programs, biosimilars, and generic drug development expand. Continued improvements in research standards and skilled workforce support long-term growth prospects.

Middle East & Africa

Middle East & Africa hold 5% of the market in 2024, with research spending concentrated in Saudi Arabia, Israel, South Africa, and the UAE. Governments invest in biotechnology hubs, academic research funding, and translational medicine initiatives. Multinational pharma companies outsource limited early discovery tasks but show growing interest in genomics and biomedical research collaboration. Infrastructure constraints and regulatory complexity slow adoption, yet emerging innovation clusters in Israel and UAE attract global partnerships. Growth in infectious disease research and precision medicine programs creates new outsourcing opportunities, positioning the region for gradual market expansion.

Market Segmentations

By Workflow

- Target Identification & Screening

- Target Validation & Functional Informatics

- Lead Identification & Candidate Optimization

- Preclinical Development

By Service

- Chemistry Services

- Biology Services

By Therapeutics Area

- Respiratory system

- Pain and Anesthesia

- Oncology

- Ophthalmology

- Genitourinary System

By End Use

- Pharmaceutical & Biotechnology companies

- Academic Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Drug Discovery Outsourcing Services market remains moderately consolidated, with global CROs, specialist research firms, and integrated development partners competing for large-scale multi-year contracts. Leading companies such as Charles River Laboratories, Thermo Fisher Scientific Inc., WuXi AppTec, EVOTEC, GenScript, Albany Molecular Research Inc., Dalton Pharma Services, Laboratory Corporation of America Holdings, and Merck & Co., Inc. expand their discovery platforms through automation, AI-driven screening, and advanced bioassay capabilities. Many players focus on integrated discovery solutions that combine medicinal chemistry, functional biology, pharmacokinetics, and preclinical toxicology within a single workflow. Strategic partnerships and risk-sharing models strengthen long-term relationships with pharma and biotechnology sponsors. Companies also invest in specialized disease models, target validation tools, and protein engineering to support biologics, cell therapies, and antibody-drug conjugates. Mergers, acquisitions, and geographic expansion help leading CROs increase service capacity, improve turnaround time, and offer seamless discovery-to-IND support across global pipelines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GenScript

- Merck & Co., Inc.

- Albany Molecular Research Inc.

- Charles River Laboratories

- WuXi AppTec

- EVOTEC

- Dalton Pharma Services

- Thermo Fisher Scientific Inc.

- Laboratory Corporation of America Holdings

- EVOTEC

Recent Developments

- In March 2025, Syngene International Limited acquired its first U.S. biologics site in Baltimore, equipped with multiple monoclonal‑antibody (mAb) manufacturing lines.

- In October 2024, Samsung Biologics launched its high‑concentration formulation platform “S‑HiCon™” to support the development and manufacturing of high‑dose biopharmaceuticals.

- In July 2024, Exscientia plc announced an expanded partnership with Amazon Web Services (AWS) to utilize its AI and machine‑learning tools, aimed at enhancing the company’s end‑to‑end drug‑discovery and automation platform.

Report Coverage

The research report offers an in-depth analysis based on Workflow, Service, Therapeutics Area, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for integrated discovery-to-preclinical service models will rise as sponsors prefer single-partner workflows.

- AI and machine learning will accelerate hit discovery, predictive toxicology, and virtual screening.

- Biologic and cell therapy pipelines will increase demand for protein engineering, bioassays, and advanced in-vitro models.

- More risk-sharing partnerships and milestone-based outsourcing contracts will emerge between CROs and pharma companies.

- Automation, robotics, and cloud-based lab management will shorten turnaround time and reduce human error.

- Asia-Pacific CROs will gain stronger market share due to competitive pricing and expanding research capacity.

- Outsourcing of biomarker discovery and precision medicine programs will grow across oncology and rare diseases.

- CROs will invest in specialized animal models, organ-on-chip systems, and high-content imaging.

- Data integrity, cyber-security, and regulatory compliance will shape partner selection and contract structure.

- Smaller biotech firms will continue to rely on outsourcing to avoid infrastructure costs and speed development timelines.