Market Overview

Europe Cheese Market size was valued at USD 19,047.07 million in 2024 and is anticipated to reach USD 26,979.95 million by 2032, at a CAGR of 4.05% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Cheese Market Size 2024 |

USD 19,047.07 Million |

| Europe Cheese Market, CAGR |

4.05% |

| Europe Cheese Market Size 2032 |

USD 26,979.95 Million |

The Europe cheese market is driven by increasing consumer demand for diverse cheese varieties, bolstered by changing dietary preferences and a growing inclination towards premium and artisanal cheeses. The rise in cheese consumption, particularly in snacks, ready-to-eat meals, and fast food, is further fueling market expansion. Additionally, the shift toward healthier and organic options, along with innovations in low-fat, lactose-free, and plant-based cheese alternatives, is gaining traction. The growing foodservice industry, particularly in quick-service restaurants and food chains, is another key contributor to market growth. Regional preferences for specific cheese types, such as cheddar, gouda, and brie, also play a significant role. Furthermore, the development of cheese varieties with unique flavors and textures, alongside increasing product offerings in supermarkets and online retail platforms, is supporting the market’s upward trajectory. These trends, along with strong domestic production in European countries, underpin the market’s potential for growth.

The European cheese market is characterized by a strong presence of key players across various regions, each contributing to its growth and diversity. Countries like the UK, France, Germany, and the Netherlands dominate the market, with robust cheese consumption driven by both traditional varieties and a growing demand for premium and artisanal products. Major players such as Arla Foods, FrieslandCampina, Groupe Bel, and Glanbia plc lead the market with extensive product portfolios and strong distribution networks. These companies, along with others like Hochland SE, Parmalat S.p.A., and Emmi AG, have a significant influence on cheese production and innovation. They continue to cater to evolving consumer preferences, focusing on healthier, organic, and plant-based options. As the demand for sustainable and regionally produced cheeses grows, these key players are well-positioned to capitalize on emerging trends while maintaining their market leadership across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Europe Cheese Market size was valued at USD 19,047.07 million in 2024 and is anticipated to reach USD 26,979.95 million by 2032, at a CAGR of 4.05% during the forecast period (2024-2032).

- The global cheese market was valued at USD 97,440.00 million in 2024 and is projected to reach USD 1,46,171.12 million by 2032, growing at a CAGR of 5.20% during the forecast period.

- Increasing consumer demand for diverse cheese varieties, including premium and artisanal options, is driving market growth.

- Health-conscious choices, such as low-fat, lactose-free, and organic cheeses, are gaining traction among European consumers.

- The growing popularity of plant-based and dairy-free alternatives is a notable market trend, catering to vegan and lactose-intolerant consumers.

- Intense competition among major players like Arla Foods, FrieslandCampina, and Groupe Bel is shaping the market, with companies focusing on product innovation and premium offerings.

- Supply chain disruptions and rising production costs, particularly raw material shortages, are some key market restraints.

- Regional dominance by the UK, France, and Germany reflects diverse cheese consumption patterns and strong local production.

Report Scope

This report segments the Europe Cheese Market as follows:

Market Drivers

Growing Consumer Demand for Diverse Cheese Varieties

The increasing consumer preference for diverse cheese varieties is one of the primary drivers of the Europe cheese market. With a rich heritage of cheese production across the continent, Europe boasts a wide range of cheese options, from traditional types like cheddar, brie, and gouda, to innovative artisanal varieties. As consumers seek new and unique flavors, the demand for specialty cheeses with distinct textures and tastes continues to rise. For instance, a survey conducted by the European Dairy Association revealed that consumers in countries like France and Italy are increasingly exploring artisanal cheese varieties, with a notable preference for locally produced options. This diversification of product offerings has spurred growth in both retail and foodservice sectors, catering to consumers’ growing interest in exploring different cheese profiles. Additionally, the rise of cheese as an ingredient in various food products, including snacks and ready-to-eat meals, further accelerates demand, ensuring cheese remains a staple in modern European diets.

Increasing Popularity of Health-Conscious and Organic Options Another significant driver is the growing inclination toward healthier and organic food options. European consumers are becoming more health-conscious, seeking products that align with their wellness goals. This trend has led to the rising demand for healthier cheese varieties, such as reduced-fat, low-sodium, and lactose-free options. For instance, a report by the European Food Safety Authority highlighted a surge in demand for organic cheese, particularly in Northern Europe, where consumers prioritize sustainability and health benefits. Furthermore, organic cheese production has gained momentum, as more consumers opt for organic, sustainably sourced, and non-GMO products. As a result, dairy manufacturers are increasingly focusing on creating cheese varieties that cater to these needs, responding to consumer preferences for cleaner and more sustainable food choices. The availability of organic and health-oriented cheeses is becoming an essential factor in driving the overall market growth.

Expanding Foodservice Industry and Cheese-Based Offerings

The growth of the foodservice industry plays a crucial role in boosting the Europe cheese market. Quick-service restaurants (QSRs), casual dining chains, and fast-casual eateries are increasingly incorporating cheese-based dishes into their menus. From pizza and burgers to sandwiches and salads, cheese is an integral ingredient in a variety of food offerings. The rise of delivery services and the popularity of convenience-oriented dining further contribute to the demand for cheese products. With the growing emphasis on high-quality ingredients in restaurant offerings, the foodservice sector is increasingly sourcing premium and artisanal cheeses, which in turn drives the overall market growth. The expansion of cheese offerings in the foodservice industry is expected to continue fueling demand throughout the forecast period.

Innovation and Product Diversification

Innovation and product diversification are key factors driving the Europe cheese market. Manufacturers are continuously introducing new cheese varieties, textures, and flavors to cater to evolving consumer preferences. This includes the development of plant-based and dairy-free cheese alternatives, as the demand for vegan and lactose-free products continues to rise. Additionally, innovations in packaging, such as convenient portion sizes and vacuum-sealed packaging, make cheese products more accessible and attractive to consumers. The ability to offer a variety of cheese types, such as blue cheese, goat cheese, and premium-aged varieties, in different forms, including grated, sliced, or whole blocks, enhances consumer choice and convenience. These innovations and product expansions are pivotal in ensuring sustained market growth, meeting the diverse needs of consumers and expanding cheese consumption across different consumer segments.

Market Trends

Rising Demand for Plant-Based and Lactose-Free Cheeses

One of the prominent trends in the European cheese market is the growing demand for plant-based and lactose-free alternatives. As more consumers adopt vegan, vegetarian, or lactose-free diets for health or ethical reasons, dairy manufacturers are increasingly introducing plant-based cheeses made from nuts, soy, and coconut. For instance, a report by the European Food Safety Authority highlights that the prevalence of lactose intolerance in Europe has driven significant innovation in lactose-free cheese products, catering to diverse dietary needs. Additionally, the rise in lactose intolerance across Europe has driven demand for lactose-free dairy products, including cheese. These alternatives offer consumers the ability to enjoy cheese without the discomfort associated with lactose. As the trend for plant-based diets continues to grow, the market for non-dairy cheese products is expected to expand significantly, providing manufacturers with opportunities for innovation and meeting evolving consumer preferences.

Premiumization and Artisan Cheese Consumption

The European cheese market is witnessing a shift toward premiumization, with consumers showing a growing interest in high-quality, artisanal, and specialty cheeses. Premium cheese products, often made from locally sourced ingredients and produced through traditional methods, are gaining popularity among discerning consumers seeking unique and refined flavors. For instance, a study by the European Dairy Association revealed that consumers in France and Italy are increasingly opting for artisanal cheese varieties, with a strong preference for locally produced options that emphasize craftsmanship. Artisan cheese, characterized by small-batch production and distinct regional profiles, is increasingly seen as a luxury food item. This trend is particularly evident in regions with strong cheese cultures, such as France, Italy, and the UK, where consumers are willing to pay a premium for products with high quality, unique characteristics, and an emphasis on craftsmanship. As consumer preferences shift towards premium offerings, manufacturers are capitalizing on this trend by expanding their portfolios to include gourmet cheese varieties.

Growing Role of Online Retail and E-Commerce

The European cheese market is benefiting from the increasing role of online retail and e-commerce. With the rise of online grocery shopping and the growing convenience of home delivery services, cheese sales through digital platforms have surged. E-commerce enables consumers to access a wider variety of cheeses, including premium, hard-to-find, and international varieties, that may not be available in local supermarkets. This trend is particularly appealing to consumers seeking convenience and a broader selection. Additionally, the ability to read reviews and ratings on online platforms has helped build trust in purchasing cheeses from new or specialized producers. As online shopping continues to grow, the cheese market is expected to see further digitalization, with brands and retailers leveraging e-commerce as a key channel for growth.

Increasing Focus on Sustainable and Eco-Friendly Packaging

Sustainability has become a significant trend in the European cheese market, driven by consumer awareness about environmental impact. As demand for environmentally friendly packaging increases, cheese manufacturers are investing in more sustainable packaging options. This includes the use of recyclable, biodegradable, and compostable materials, as well as reducing plastic waste by utilizing alternative packaging solutions like paper, glass, or plant-based plastics. Additionally, eco-conscious consumers are increasingly opting for brands that prioritize sustainable practices, from production to packaging. This trend is pushing companies to adopt greener strategies, not only to meet regulatory standards but also to align with the values of the modern consumer, further driving growth in the European cheese market.

Market Challenges Analysis

Supply Chain Disruptions and Raw Material Shortages

One of the major challenges facing the European cheese market is the disruption of supply chains and shortages of raw materials. The production of cheese heavily relies on the availability of high-quality milk, and any instability in milk supply can significantly impact cheese production. Issues such as fluctuating milk prices, environmental conditions affecting dairy farming, and labor shortages in agriculture can lead to production delays or increased costs. Additionally, disruptions in transportation and logistics, particularly due to global crises or trade barriers, can lead to delays in the distribution of cheese products. These challenges force manufacturers to adapt to supply chain volatility, often increasing production costs, which may be passed on to consumers in the form of higher prices, potentially reducing demand.

Stringent Regulations and Health Concerns

Another challenge in the European cheese market is the increasingly stringent regulatory environment and rising health concerns. The European Union has strict regulations regarding food safety, labeling, and production standards, which can impose additional costs and complexities for cheese producers. For instance, the EU’s Regulation (EC) No 852/2004 on food hygiene requires cheese manufacturers to implement rigorous safety protocols, which can increase operational costs. Compliance with these regulations requires continuous investment in quality control and safety measures. Furthermore, consumer concerns about the health impacts of cheese, particularly regarding its fat, salt, and cholesterol content, are rising. As public awareness of the health implications of consuming high-fat and processed foods increases, there is pressure on cheese producers to innovate and offer healthier alternatives. However, reformulating products without compromising on taste and texture remains a challenge. These factors contribute to both operational and marketing difficulties for manufacturers in a highly competitive market.

Market Opportunities

The European cheese market presents several opportunities driven by evolving consumer preferences and technological advancements. As demand for plant-based and lactose-free alternatives continues to rise, manufacturers have the chance to innovate and expand their product offerings to cater to these growing segments. The increasing adoption of vegan and dairy-free diets, combined with higher awareness of lactose intolerance, presents a promising opportunity for companies to diversify their portfolios and tap into the rapidly expanding market for non-dairy cheeses. Furthermore, the shift toward health-conscious consumer choices, such as reduced-fat, low-sodium, and organic cheeses, provides an avenue for growth as more consumers seek healthier, more sustainable food options.

In addition to product diversification, the European cheese market also benefits from the expanding e-commerce sector. With the rise of online grocery shopping and direct-to-consumer sales models, companies have the opportunity to reach a broader audience by offering their products through digital platforms. This trend enables consumers to access a wider variety of cheeses, including premium, artisanal, and hard-to-find varieties, providing manufacturers with a valuable channel for increasing market reach. The growing preference for premium, locally sourced, and artisanal cheese also creates an opportunity for producers to emphasize quality and craftsmanship, positioning their products as premium offerings in a competitive market. Additionally, sustainability initiatives, such as eco-friendly packaging and sustainable production practices, present a growing opportunity to align with consumer values and differentiate brands in an increasingly environmentally conscious market.

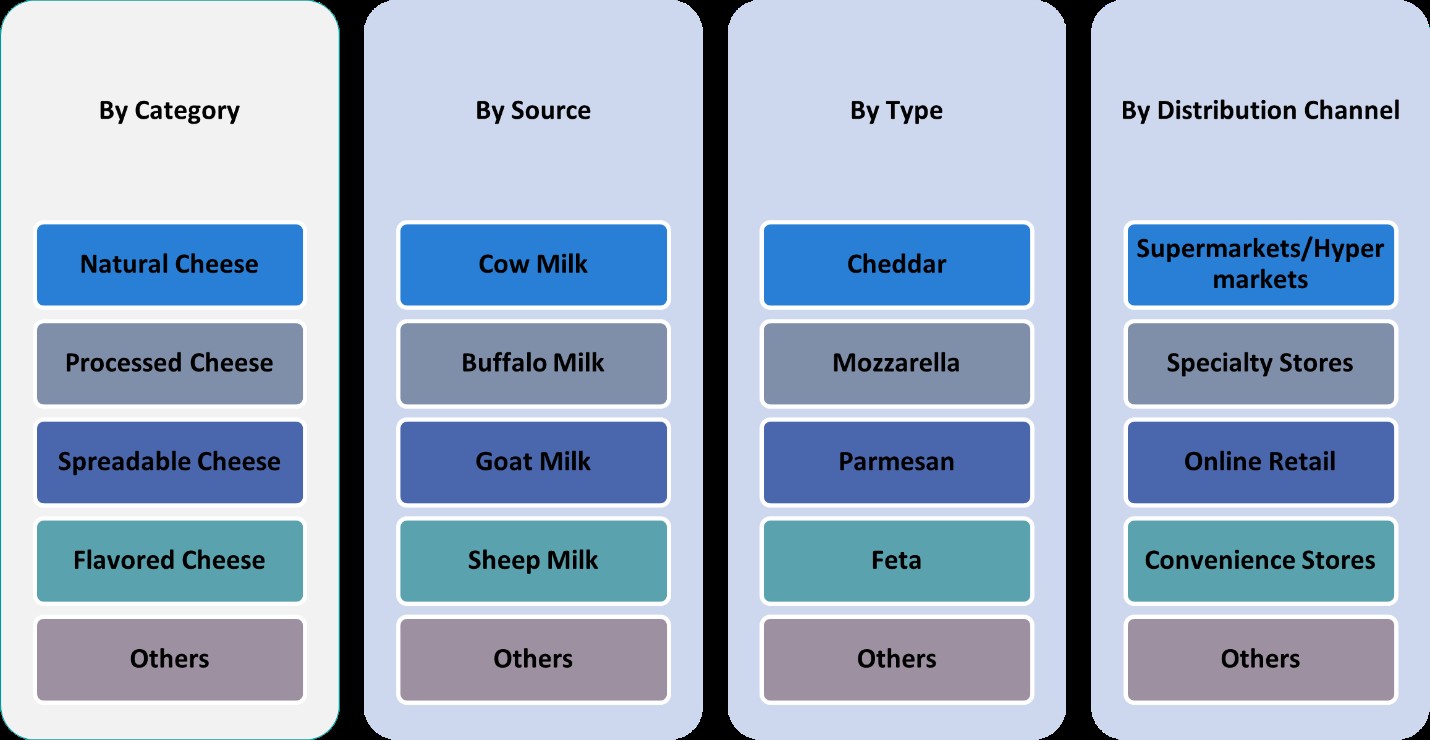

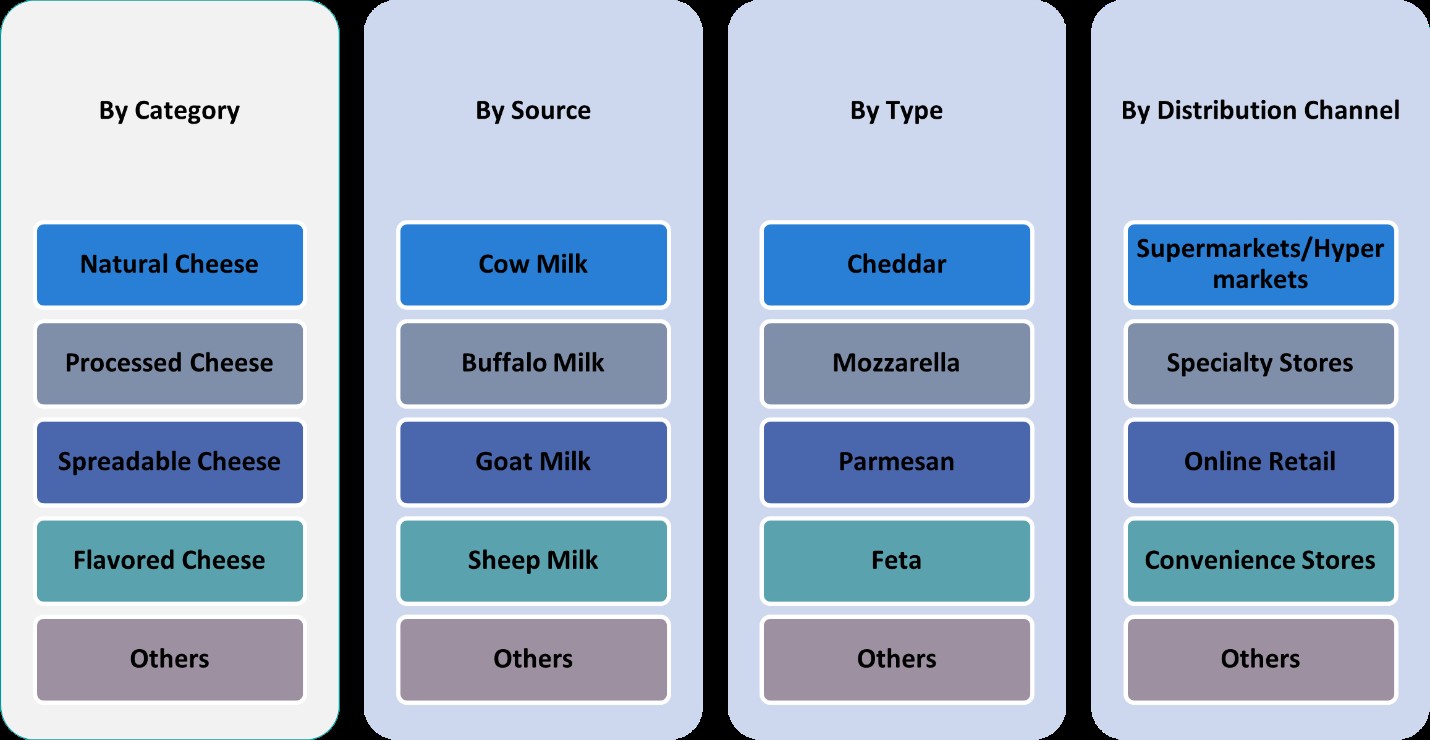

Market Segmentation Analysis:

By Category:

The European cheese market is divided into several key categories, each contributing to its overall growth. Cheddar remains one of the dominant cheese types in the region, known for its versatility and wide consumer base. It is commonly used in both culinary applications and as a standalone snack, making it a staple in many European households. Processed cheese has also seen sustained demand, driven by its convenience and longer shelf life. This segment is favored for use in fast food and ready-to-eat products. Meanwhile, spreadable cheese is gaining popularity due to its ease of use and association with healthier, lighter alternatives. The flavored cheese segment, which includes cheeses infused with herbs, spices, or other seasonings, is witnessing significant growth, particularly among younger consumers seeking innovative and unique flavors. The others category, which includes specialized and artisanal varieties, is also growing as consumers increasingly seek out premium and region-specific cheese options.

By Source:

The European cheese market is also segmented based on the source of milk used in production. Cow milk is the most commonly used, dominating the market due to its widespread availability and cost-effectiveness. This segment accounts for a substantial share, as it is the primary source for popular cheeses like cheddar, gouda, and mozzarella. Buffalo milk, known for its rich and creamy texture, is becoming increasingly popular in certain regions of Europe, particularly for producing specialty cheeses like mozzarella di bufala. Goat milk cheeses are also seeing a rise in demand, particularly among health-conscious consumers who prefer lower-fat and lactose-friendly options. Sheep milk cheese, renowned for its rich flavor and high nutritional value, is gaining traction in the premium cheese market, particularly in Mediterranean countries. Finally, the others category includes cheeses made from alternative milk sources, such as camel or plant-based options, which cater to niche markets seeking unique or dietary-specific alternatives.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

UK

UK holds a significant share of the European cheese market, accounting for approximately 22% of the total market value. The demand for cheese in the UK is driven by its strong culinary culture and the widespread consumption of varieties like cheddar, mozzarella, and processed cheese. The market is also seeing increasing interest in premium and organic cheeses, reflecting a shift towards more sustainable and health-conscious consumption. The country’s robust retail and foodservice sectors support this growth, with cheese being a staple in both household consumption and as an ingredient in fast food and casual dining establishments. Additionally, the growing trend of online grocery shopping further boosts cheese sales, enabling access to a broader range of products.

France

France, known for its rich cheese heritage, is another key player in the European cheese market, holding around 18% market share. The French cheese market is characterized by a wide variety of products, including iconic cheeses like brie, camembert, and Roquefort. France’s strong local production and consumption of artisanal cheeses contribute to its dominance in the market. The country’s diverse cheese culture is reflected in both the retail and foodservice sectors, where premium and specialty cheeses enjoy high demand. Furthermore, the increasing popularity of organic and sustainably produced cheeses aligns with growing consumer interest in healthier and more environmentally friendly food options.

Germany

Germany holds a market share of approximately 14% in the European cheese market, with a strong consumer preference for traditional cheeses like gouda, quark, and processed cheese. The German market has seen steady growth in cheese consumption, driven by the country’s large and diverse foodservice industry, where cheese is used in various traditional dishes such as sandwiches, sausages, and baked goods. As health trends continue to influence consumer behavior, there is a growing demand for lighter and lower-fat cheese varieties, along with lactose-free and organic options. The demand for processed cheese and cheese snacks is also strong, reflecting the trend toward convenience foods.

Netherlands

The Netherlands holds around 12% of the market share, making it a significant player in the European cheese industry. The Dutch are renowned for their cheese production, particularly gouda and edam, which have global recognition. The Netherlands benefits from a strong export market, with a significant portion of its cheese production being sold internationally. Within Europe, Dutch cheeses are widely consumed, not only in households but also in the foodservice industry. As consumer preferences evolve towards premium and organic offerings, the Netherlands is well-positioned to capitalize on these trends, with both traditional and innovative cheese varieties appealing to a broad range of consumers across Europe.

Key Player Analysis

- Arla Foods

- FrieslandCampina

- Groupe Bel

- Fonterra Co-operative Group (European Operations)

- Glanbia plc

- Hochland SE

- Parmalat S.p.A.

- Emmi AG

- Valio Ltd.

Competitive Analysis

The European cheese market is highly competitive, with several key players dominating the landscape. Leading companies such as Arla Foods, FrieslandCampina, Groupe Bel, Fonterra Co-operative Group (European Operations), Glanbia plc, Hochland SE, Parmalat S.p.A., Emmi AG, and Valio Ltd. are at the forefront of innovation, production, and distribution. These players have extensive product portfolios that cater to diverse consumer preferences, ranging from traditional varieties to premium and plant-based options. Companies are increasingly focusing on diversifying their portfolios to include premium, organic, and plant-based cheeses, responding to changing consumer preferences for healthier, more sustainable options. Innovation in flavors, packaging, and production methods, such as the use of lactose-free and low-fat ingredients, helps companies maintain a competitive edge. The market is also characterized by a strong presence in both retail and foodservice sectors, where cheese is a staple in various culinary applications. Companies are focusing on meeting regional tastes and preferences, with many offering products that cater to local cheese traditions. Additionally, premium and artisanal cheeses are gaining traction, particularly in regions with rich cheese heritage, as consumers seek higher-quality, unique options. The demand for organic, sustainably sourced, and plant-based alternatives continues to challenge traditional cheese producers, prompting them to adapt to new trends to remain competitive. As the market evolves, the emphasis on product quality, sustainability, and catering to niche consumer demands will play a key role in shaping the competitive landscape of the European cheese industry.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The European cheese market exhibits a moderate level of market concentration, with several leading players dominating production and distribution. These companies have established strong brand recognition, large-scale production facilities, and extensive distribution networks that enable them to cater to both local and international markets. Despite the dominance of a few key players, the market remains fragmented due to the presence of numerous smaller, regional producers and artisanal cheese makers who focus on premium, specialty, and locally produced varieties. This fragmentation is driven by consumer demand for unique flavors, organic options, and sustainable products, which allow smaller producers to thrive alongside larger, multinational corporations. The market is characterized by continuous product innovation, particularly in the areas of plant-based, lactose-free, and low-fat cheeses, reflecting changing consumer preferences for healthier and more sustainable choices. Additionally, there is an increasing emphasis on eco-friendly packaging and sustainable production practices to align with growing environmental concerns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The European cheese market is expected to see continued growth due to rising demand for premium and artisanal varieties.

- Health-conscious consumers will drive the demand for reduced-fat, low-sodium, and organic cheese options.

- Innovative cheese flavors and blends will gain popularity, with manufacturers focusing on unique regional offerings.

- E-commerce platforms are likely to become a major distribution channel, providing greater access to specialty cheeses.

- The growing interest in plant-based and vegan alternatives will lead to more plant-based cheese products entering the market.

- Sustainability initiatives, such as eco-friendly packaging and sourcing practices, will become a key focus for cheese producers.

- The increasing trend of at-home dining and cooking will boost consumer interest in cheese as an ingredient in homemade meals.

- There will be a rise in cross-border cheese trade within the EU, with consumers seeking a wider variety of international products.

- Technological advancements in cheese production and packaging will enhance product quality and extend shelf life.

- Changing dietary preferences, especially among younger generations, will influence the development of new cheese products with novel ingredients and flavors.