| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Construction Aggregates Market Size 2024 |

USD 1,05,699.55 Million |

| Europe Construction Aggregates Market, CAGR |

4.13% |

| Europe Construction Aggregates Market Size 2032 |

USD 1,46,067.84 Million |

Market Overview

Europe Construction Aggregates Market size was valued at USD 1,05,699.55 million in 2024 and is anticipated to reach USD 1,46,067.84 million by 2032, at a CAGR of 4.13% during the forecast period (2024-2032).

The Europe construction aggregates market is driven by increasing infrastructure development, urbanization, and government investments in sustainable construction. The rising demand for residential and commercial spaces, coupled with highway and railway expansion projects, fuels market growth. Additionally, the shift towards recycled and eco-friendly aggregates aligns with stringent environmental regulations, promoting sustainable practices. Advancements in construction technology, including smart city initiatives and prefabrication techniques, further accelerate demand. The market also benefits from growing public-private partnerships (PPPs) in large-scale infrastructure projects. However, fluctuating raw material prices and environmental concerns regarding excessive quarrying pose challenges. The adoption of digital solutions for supply chain optimization and enhanced material efficiency is a notable trend. Moreover, the increasing use of lightweight aggregates in green building projects contributes to industry expansion.

The Europe construction aggregates market is geographically diverse, with significant demand across Western, Southern, Eastern, and Northern Europe. Countries such as Germany, the UK, France, and Italy lead in aggregate consumption due to extensive infrastructure projects, urbanization, and housing developments. Eastern Europe, including Poland and Russia, is witnessing rapid growth driven by expanding transportation networks and industrial construction. Sustainability initiatives in Northern Europe, particularly in Sweden and Denmark, are also shaping market trends by increasing the use of recycled and eco-friendly aggregates. Key players in the market include CRH plc, Heidelberg Materials AG, Holcim Group, CEMEX S.A.B. de C.V., and Colas Group, among others. These companies focus on innovation, mergers, and sustainability-driven solutions to maintain competitiveness. With rising infrastructure investments and technological advancements in material processing, Europe’s construction aggregates market is poised for steady growth in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe construction aggregates market was valued at USD 1,05,699.55 million in 2024 and is expected to reach USD 1,46,067.84 million by 2032, growing at a CAGR of 4.13% from 2024 to 2032.

- Rising infrastructure development, urbanization, and government investments in transportation and residential projects are driving market growth.

- Sustainability trends and strict environmental regulations are encouraging the adoption of recycled and eco-friendly aggregates.

- The market is witnessing increased technological advancements in aggregate processing, including automation, AI-driven supply chains, and lightweight materials.

- Key players such as CRH plc, Heidelberg Materials AG, Holcim Group, and CEMEX S.A.B. de C.V. are focusing on mergers, acquisitions, and sustainable innovations.

- Fluctuating raw material prices, high energy costs, and environmental restrictions on quarrying are key restraints affecting market expansion.

- Western Europe leads in demand, while Eastern and Northern Europe are experiencing growth due to rising industrialization and sustainable construction initiatives.

Report Scope

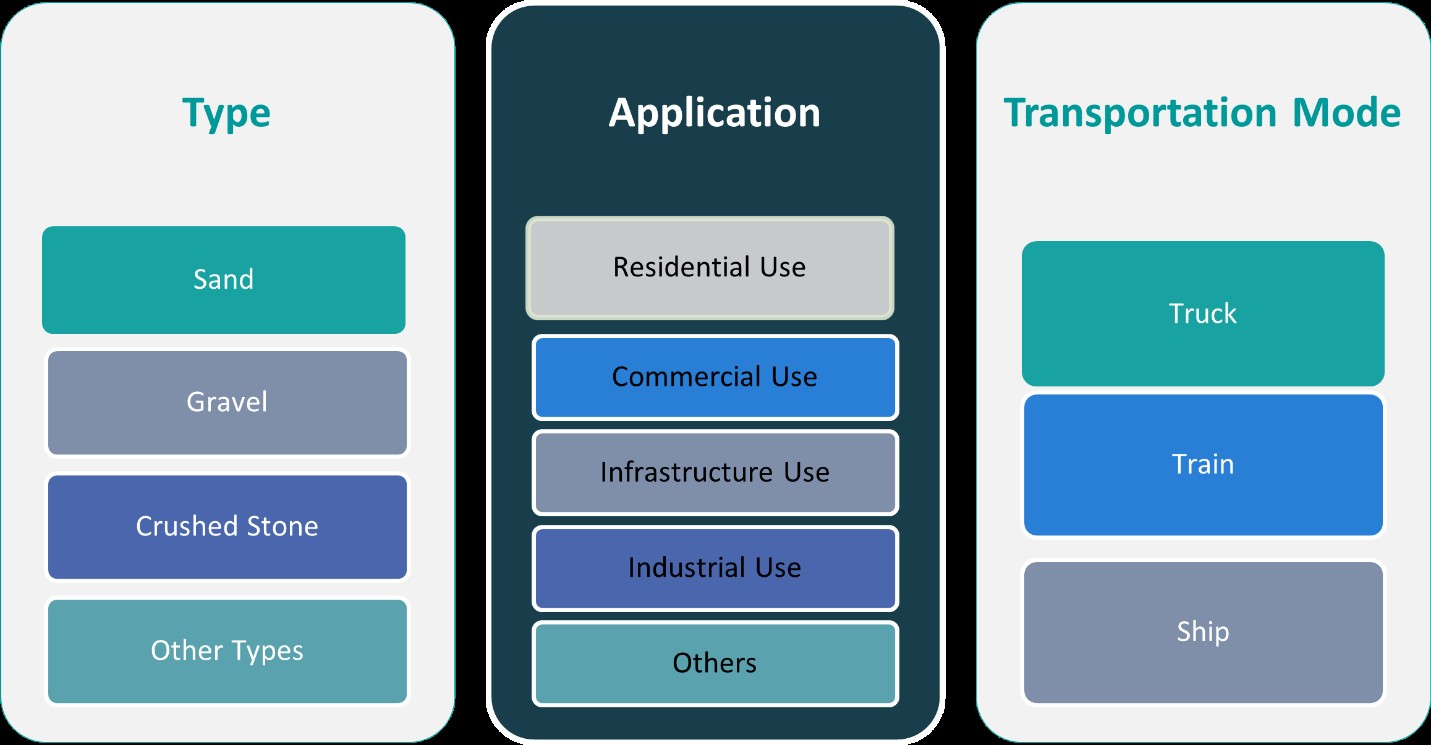

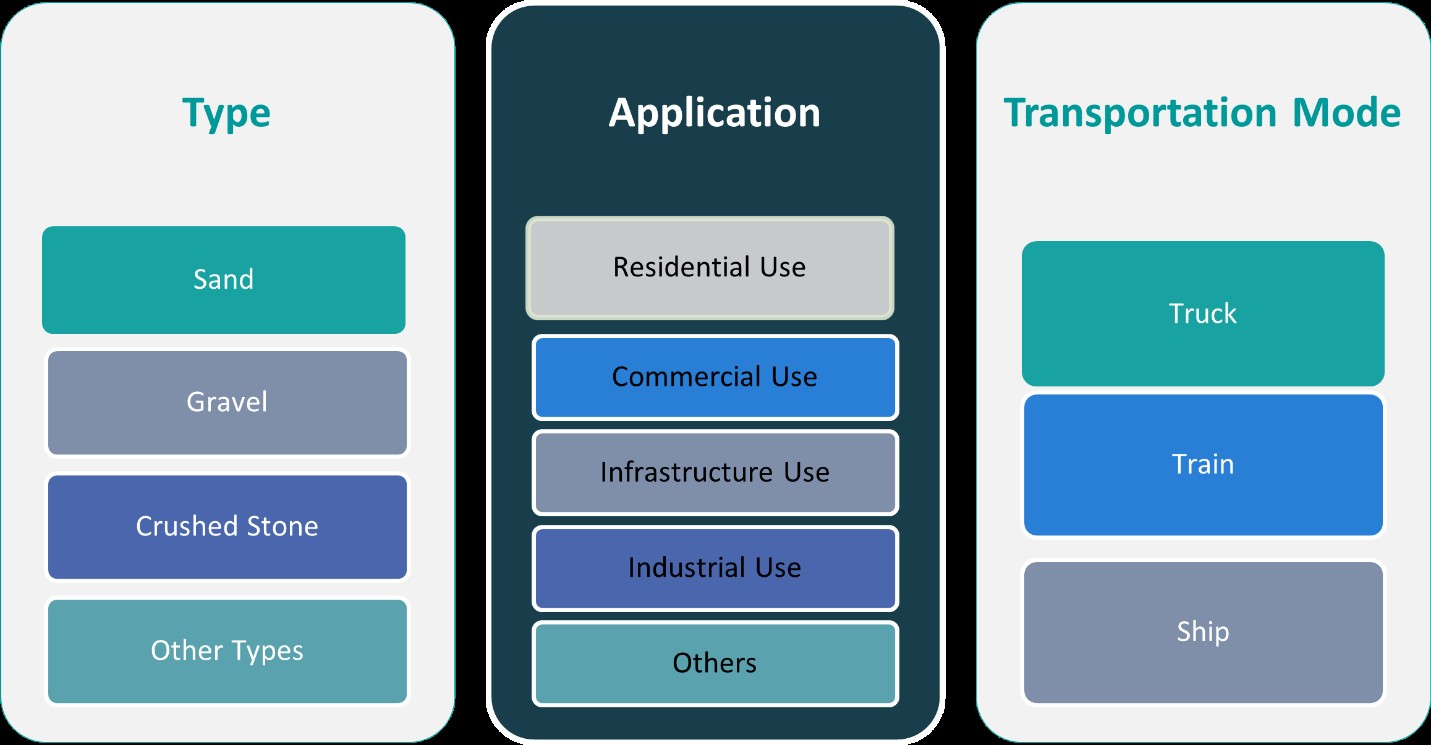

This report segments the Europe Construction Aggregates Market as follows:

Market Drivers

Infrastructure Development and Urbanization

The rapid expansion of infrastructure projects across Europe is a key driver of the construction aggregates market. Governments and private investors are heavily investing in roadways, bridges, tunnels, and railway networks to enhance connectivity and economic growth. Additionally, increasing urbanization is fueling the demand for residential and commercial spaces, leading to a surge in construction activities. Countries such as Germany, France, and the UK are witnessing extensive urban renewal projects, further driving the need for high-quality aggregates. As cities expand and modernize, the demand for aggregates in concrete production, road base materials, and asphalt applications continues to grow steadily.

Government Policies and Sustainable Construction Initiatives

Stringent environmental regulations and sustainability goals set by the European Union (EU) are shaping the construction aggregates market. For instance, EU policies such as the Circular Economy Action Plan encourage the reuse of construction and demolition waste, as evidenced by initiatives in Austria where recycled aggregates are mandated for public construction projects. Governments are encouraging the use of recycled and eco-friendly aggregates to minimize environmental impact and reduce dependency on natural resources. Policies promoting circular economy principles, such as the reuse of construction and demolition waste, are fostering innovation in aggregate production. Additionally, financial incentives for green building projects and stricter emission norms for construction activities are pushing companies to adopt sustainable alternatives. These regulatory frameworks not only ensure resource conservation but also create new growth opportunities for aggregate producers.

Advancements in Construction Technologies

The integration of advanced construction technologies, such as prefabrication, 3D printing, and smart materials, is significantly influencing the aggregates market. The increasing adoption of modular construction methods requires high-performance aggregates with precise specifications, driving demand for specialized materials. Digital solutions, including Building Information Modeling (BIM) and automated supply chain management, are enhancing efficiency in material procurement and usage. Additionally, innovations in lightweight aggregates are enabling the construction of energy-efficient buildings, aligning with Europe’s carbon neutrality targets. These technological advancements are improving construction quality while boosting demand for aggregates tailored to modern engineering requirements.

Public-Private Partnerships and Investment in Large-Scale Projects

Public-private partnerships (PPPs) are playing a crucial role in the expansion of Europe’s infrastructure sector, directly impacting the demand for construction aggregates. For instance, the European Investment Bank (EIB) has financed numerous PPP projects, such as the construction of flood defense systems in the Netherlands and renewable energy infrastructure in Spain. The European Investment Bank (EIB) and other financial institutions are actively supporting infrastructure development, ensuring a steady demand for aggregates. Furthermore, the focus on resilient infrastructure, such as flood defense systems and climate-adaptive urban planning, is driving long-term market growth. With continued investments in critical infrastructure, the construction aggregates market is expected to maintain a positive trajectory in the coming years.

Market Trends

Growing Adoption of Recycled and Sustainable Aggregates

Sustainability is a dominant trend in the Europe construction aggregates market, driven by strict environmental regulations and the push for circular economy practices. Governments and industry players are increasingly prioritizing recycled aggregates sourced from construction and demolition waste. These materials not only reduce landfill waste but also lower carbon emissions associated with traditional quarrying. The use of alternative aggregates, such as slag, fly ash, and crushed concrete, is gaining momentum as companies seek to align with Europe’s carbon neutrality goals. This trend is expected to accelerate as regulatory bodies continue to promote eco-friendly construction materials.

Increased Demand from Smart Cities and Infrastructure Projects

The development of smart cities and large-scale infrastructure projects across Europe is driving demand for high-quality construction aggregates. For instance, surveys from the European Union indicate significant funding allocated to modernizing transport networks, such as the Trans-European Transport Network (TEN-T), which relies heavily on specialized aggregates for durability. Governments are also prioritizing resilient infrastructure, such as flood management systems and climate-adaptive urban designs, requiring specialized aggregates for enhanced durability. The European Union’s funding for modernizing transport networks and expanding renewable energy infrastructure is further supporting the steady growth of the aggregates market.

Technological Advancements in Aggregate Processing

The construction aggregates industry is witnessing rapid advancements in processing technologies, improving material efficiency and reducing waste. For instance, companies in Denmark are employing automated crushing and screening equipment to optimize aggregate production, while AI-driven quality control systems are enhancing material precision. Automated crushing and screening equipment, along with AI-driven quality control systems, are optimizing aggregate production. Additionally, the use of digital solutions such as Building Information Modeling (BIM) is streamlining aggregate selection and project planning, enhancing construction efficiency. Innovations in lightweight aggregates and self-healing concrete are also influencing market dynamics by offering materials with superior performance characteristics. These technological developments are making aggregates more adaptable to modern construction needs while promoting resource efficiency.

Fluctuating Raw Material Costs and Supply Chain Optimization

Rising energy costs, raw material price fluctuations, and supply chain disruptions are impacting the availability and cost of construction aggregates in Europe. The industry is increasingly focusing on optimizing logistics and transportation to reduce costs and enhance efficiency. Digital supply chain management tools, including real-time tracking and predictive analytics, are helping companies manage inventory and distribution more effectively. Additionally, regional sourcing of aggregates is gaining traction to mitigate risks associated with global supply chain uncertainties. As companies prioritize cost-effective and sustainable solutions, the demand for locally sourced and recycled aggregates is expected to rise in the coming years.

Market Challenges Analysis

Environmental Regulations and Resource Depletion

The Europe construction aggregates market faces significant challenges due to stringent environmental regulations and the depletion of natural resources. Governments and regulatory bodies have imposed strict policies on quarrying activities to reduce ecological damage and carbon emissions. Compliance with these regulations often leads to increased operational costs for aggregate producers, as they must invest in sustainable mining practices, advanced filtration systems, and eco-friendly transportation methods. Additionally, the growing scarcity of high-quality natural aggregates is pushing the industry toward alternative materials, such as recycled and manufactured aggregates. While these alternatives support sustainability goals, their widespread adoption requires significant investment in new processing technologies and infrastructure, creating financial and logistical hurdles for many companies.

Fluctuating Raw Material Costs and Supply Chain Disruptions

Volatile raw material prices and ongoing supply chain disruptions present another major challenge for the construction aggregates market. For instance, government reports from the UK indicate rising energy costs as a significant factor impacting the production and transportation of aggregates. Additionally, geopolitical tensions, trade restrictions, and global supply chain disruptions have led to irregular material availability, delaying construction projects and increasing costs. Companies must adopt digital supply chain solutions and regional sourcing strategies to mitigate these risks. However, implementing such solutions requires significant investment and technological expertise, which may not be feasible for all industry players. As a result, maintaining a steady supply of aggregates at competitive prices remains a critical challenge for the European market.

Market Opportunities

The Europe construction aggregates market presents significant growth opportunities driven by increasing demand for sustainable and recycled materials. With stringent environmental regulations promoting circular economy practices, there is a rising shift toward the use of recycled aggregates from construction and demolition waste. This transition not only reduces reliance on natural resources but also aligns with Europe’s carbon neutrality goals. Companies investing in advanced recycling technologies and eco-friendly alternatives, such as lightweight and self-healing aggregates, can gain a competitive edge. Additionally, the growing emphasis on green building initiatives and sustainable infrastructure development is creating new revenue streams for aggregate manufacturers that prioritize environmental responsibility.

Another key opportunity lies in the expansion of large-scale infrastructure projects, including smart cities, high-speed rail networks, and renewable energy installations. Governments across Europe are increasing investments in public infrastructure, supported by EU funding programs, which is expected to drive long-term demand for high-quality aggregates. The adoption of digital solutions such as AI-driven supply chain optimization and automated material processing is further enhancing operational efficiency, reducing costs, and improving product quality. Companies that leverage these technological advancements while focusing on regional sourcing and supply chain resilience can strengthen their market position. As urbanization and industrialization continue to rise, the demand for durable, high-performance aggregates will further accelerate, providing sustained growth opportunities for the sector.

Market Segmentation Analysis:

By Type:

The Europe construction aggregates market is categorized into sand, gravel, crushed stone, and other types, each serving distinct roles in construction projects. Sand is widely used in concrete production, mortar, and asphalt mixtures, making it a fundamental material for both residential and commercial construction. However, concerns over sand depletion have led to an increasing focus on alternative and manufactured sand. Gravel is another essential aggregate used in road construction, drainage systems, and railway ballast. Its demand is driven by the expansion of transport infrastructure and urban development projects. Crushed stone, known for its durability, is a preferred choice in high-strength concrete, road base materials, and large-scale infrastructure projects, such as bridges and tunnels. The other types category includes materials like recycled aggregates and slag, which are gaining traction due to sustainability initiatives and circular economy policies. As governments enforce stricter environmental regulations, the use of alternative aggregates is expected to rise, promoting a shift toward eco-friendly construction practices.

By Application:

Based on application, the market is segmented into residential use, commercial use, infrastructure use, and industrial use, each contributing to the growing demand for construction aggregates. Residential construction remains a key driver, with increasing urbanization and housing demand leading to higher consumption of aggregates in concrete, flooring, and landscaping applications. Commercial construction, including office buildings, retail spaces, and hotels, also fuels demand, particularly for high-quality aggregates used in premium flooring and decorative concrete solutions. Infrastructure projects, such as roads, highways, airports, and railways, represent one of the largest segments, as governments invest in improving connectivity and public services. The durability and strength of aggregates are crucial for ensuring the longevity of infrastructure developments. Lastly, the industrial sector, which includes manufacturing plants, warehouses, and energy facilities, utilizes aggregates in foundation work and site preparation. With the ongoing expansion of renewable energy projects and industrial zones, this segment is poised for steady growth, reinforcing the overall demand for construction aggregates.

Segments:

Based on Type:

- Sand

- Gravel

- Crushed Stone

- Other Types

Based on Application:

- Residential Use

- Commercial Use

- Infrastructure Use

- Industrial Use

Based on End- User:

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

Western Europe

Western Europe holds the largest market share in the Europe construction aggregates industry, accounting for approximately 40% of the total market. Countries such as the UK, France, Germany, Belgium, and the Netherlands drive demand due to extensive infrastructure investments, urban redevelopment, and sustainable construction practices. Germany, being Europe’s largest construction market, significantly contributes to aggregate consumption, particularly in commercial and residential projects. The UK and France are also key players, focusing on road expansions, railway networks, and housing projects. Additionally, the Netherlands and Belgium emphasize eco-friendly construction, boosting demand for recycled aggregates. Strict environmental regulations in this region further encourage the adoption of sustainable alternatives, shaping long-term market growth.

Southern Europe

Southern Europe, including Italy, Spain, and Austria, holds a market share of approximately 20%, supported by growing infrastructure projects and urban expansion. Spain and Italy, two of the largest economies in this region, are seeing increased demand for aggregates due to rising tourism-driven commercial construction and housing sector recovery. Italy, in particular, is investing in earthquake-resistant infrastructure, which requires high-strength aggregates. Spain’s government is also focusing on transportation infrastructure, including road and rail projects, driving demand for crushed stone and gravel. Austria, with its emphasis on sustainable construction and green building initiatives, is increasingly using recycled aggregates. Despite economic fluctuations, Southern Europe’s construction sector remains resilient, offering opportunities for aggregate producers.

Eastern Europe

Eastern Europe, particularly Poland, Russia, and other Central European nations, accounts for nearly 18% of the construction aggregates market. Poland has become a key player in the region due to rapid urbanization and significant investments in road and railway projects. Russia, with its vast landmass and infrastructure expansion efforts, also contributes significantly to aggregate demand, particularly in large-scale industrial and energy-related projects. The construction of modern housing and commercial spaces in major cities across Eastern Europe is further boosting the need for aggregates like sand and crushed stone. As these economies continue to develop, the demand for cost-effective and durable construction materials is expected to rise, making Eastern Europe an attractive market for aggregate manufacturers.

Northern Europe

Northern Europe, including Sweden, Denmark, and Switzerland, holds a 12% market share, characterized by a strong focus on sustainability and advanced construction technologies. Sweden is at the forefront of green building initiatives, driving demand for eco-friendly and lightweight aggregates. Denmark, with its extensive coastal infrastructure projects, requires large quantities of aggregates for marine construction and climate-adaptive urban planning. Switzerland, known for its precision engineering and high-quality infrastructure, maintains a steady demand for premium aggregates. The region’s commitment to low-carbon construction methods and advanced material recycling is reshaping aggregate consumption patterns. As the shift toward sustainable urbanization continues, Northern Europe is expected to see steady market expansion.

Key Player Analysis

- CRH plc

- Colas Group

- CEMEX S.A.B. de C.V.

- Heidelberg Materials AG

- EUROVIA Kamenolomy AS

- Sika AG

- Tarmac

- Buzzi S.p.A.

- Boral Limited

- Carmeuse

- CEMROS

- Holcim Group

Competitive Analysis

The Europe construction aggregates market is highly competitive, with key players such as CRH plc, Heidelberg Materials AG, Holcim Group, CEMEX S.A.B. de C.V., Colas Group, Sika AG, EUROVIA Kamenolomy AS, Tarmac, Buzzi S.p.A., Boral Limited, Carmeuse, and CEMROS driving market growth through innovation, mergers, and sustainability initiatives. These companies have established strong regional presences, leveraging advanced aggregate processing technologies, digital supply chain solutions, and eco-friendly alternatives to gain a competitive edge. Leading firms invest in advanced aggregate processing technologies, digital supply chain solutions, and eco-friendly alternatives to meet evolving regulatory and environmental requirements. The industry is witnessing increased consolidation through mergers and acquisitions, allowing companies to expand their geographic reach and enhance their production capacities. Sustainability remains a key competitive factor, with companies prioritizing recycled aggregates and carbon-neutral solutions to align with stringent EU regulations. Infrastructure development, urbanization, and large-scale transportation projects continue to drive demand, prompting firms to enhance their product offerings and operational efficiency. Additionally, market players are leveraging automation, artificial intelligence, and data analytics to optimize logistics and improve cost-effectiveness. Despite challenges such as fluctuating raw material prices and environmental restrictions, strong investment in innovation and sustainability is expected to shape the competitive landscape in the coming years.

Recent Developments

- In September 2024, Holcim started the Holcim Sustainable Construction Academy. This is a free online training program that teaches about eco-friendly building methods. It helps people who work in construction learn new skills. The program offers both online classes and face-to-face training.

- In October 2024, CRH Ventures launched the Sustainable Building Materials accelerator to scale up creative climate and build technology firms that specialize in CO2-mineralized materials and sustainable binder solutions.

- In July 2024, Heidelberg Materials launched a recycling plant in Katowice, Poland, using a patented ReConcrete process to recycle demolition concrete and replace virgin material.

- In July 2024, Cemex USA formed a joint venture with Couch Aggregates and Premier Holdings for the production and distribution of aggregates in the Mid-South region. Cemex USA already had a strategic partnership with Couch Aggregates. The company stated that this vertical integration, combined with Premier Holdings’ Gulf Coast marine terminals, would accelerate its regional growth.

- In April 2024, Rogers Group joined The Road Forward initiative to advance sustainable asphalt production and paving practices.

- In January 2024, Heidelberg Materials launched Evo Build, its new global brand for low-carbon and circular products. This initiative aims to provide sustainable solutions for the construction industry, focusing on reducing carbon emissions and promoting circular economy principles.

Market Concentration & Characteristics

The Europe construction aggregates market exhibits a moderate to high level of market concentration, with a mix of global corporations and regional players competing for market share. Leading companies dominate through extensive production facilities, advanced processing technologies, and strong distribution networks, while smaller firms focus on niche markets and regional demand. The market is characterized by significant government regulations, particularly concerning environmental impact and sustainable mining practices. High capital investment requirements for quarrying, transportation, and processing equipment create barriers to entry, limiting new competitors. Additionally, the industry relies heavily on infrastructure projects, urban development, and residential construction, making demand cyclical and influenced by economic fluctuations. Sustainability initiatives, including the adoption of recycled aggregates and eco-friendly production methods, are reshaping market dynamics. Companies that integrate digital technologies, automation, and efficient supply chain management gain a competitive advantage, ensuring steady growth despite challenges such as fluctuating raw material costs and regulatory constraints.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe construction aggregates market will continue to grow due to increasing infrastructure development and urban expansion.

- Sustainability and environmental regulations will drive the adoption of recycled and eco-friendly aggregates.

- Advancements in digital technologies, automation, and AI-driven supply chain management will enhance operational efficiency.

- Rising demand for smart cities and green infrastructure will create new opportunities for aggregate manufacturers.

- Government investments in renewable energy projects and climate-resilient infrastructure will boost aggregate consumption.

- Companies will focus on mergers, acquisitions, and strategic partnerships to expand their market presence.

- Fluctuating raw material prices and energy costs will remain key challenges for industry players.

- The demand for high-performance and lightweight aggregates will increase due to evolving construction requirements.

- Regional sourcing and localized production will become essential to mitigate supply chain disruptions.

- The shift towards circular economy practices will reshape production methods and material usage in the industry.