Market Overview

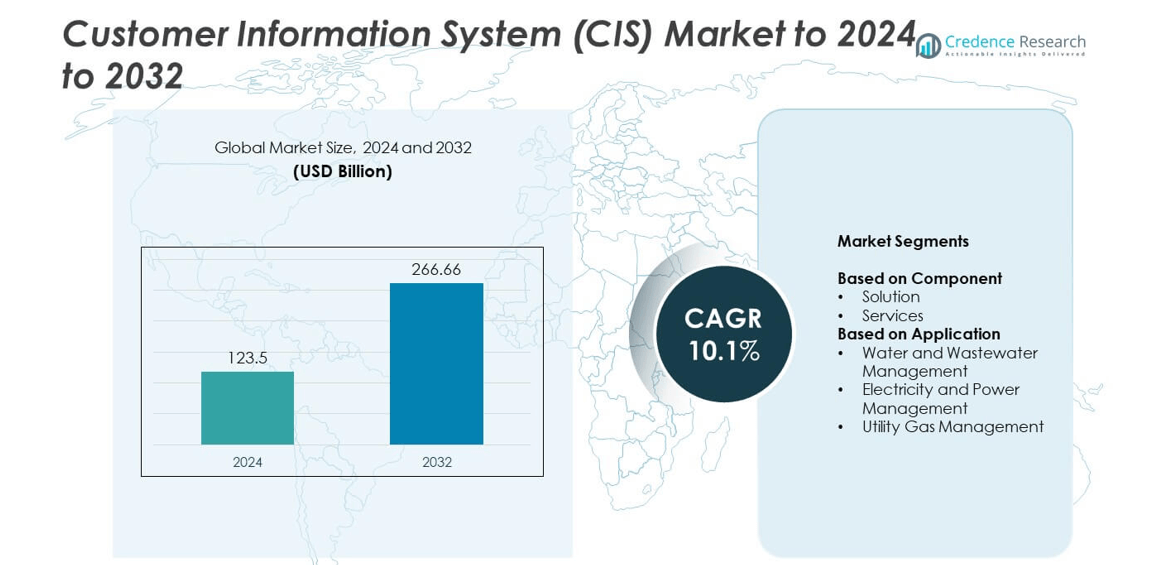

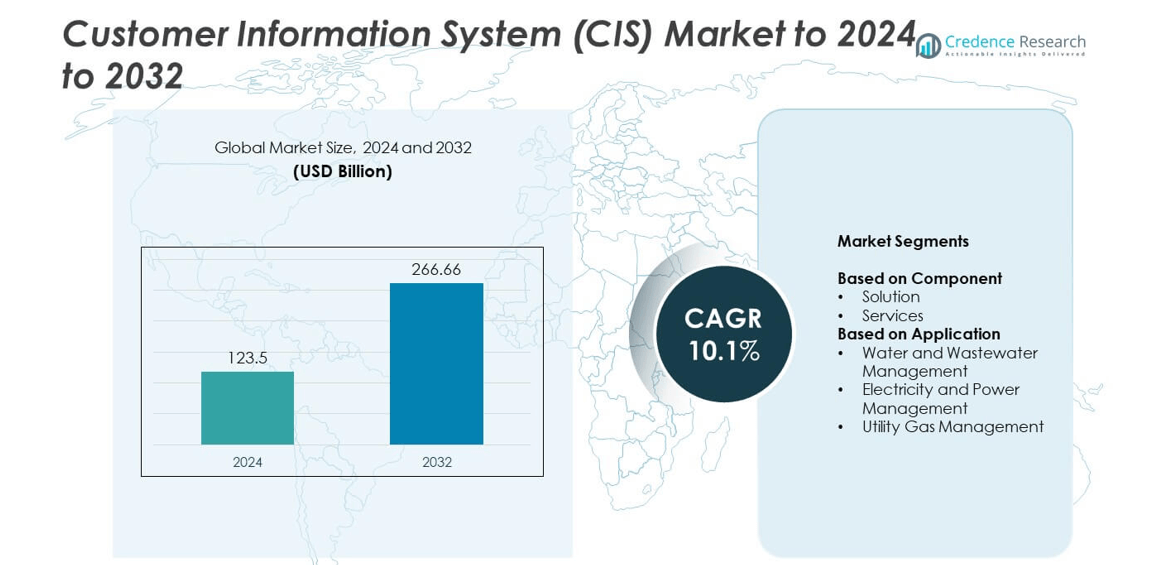

The Customer Information System (CIS) Market size was valued at USD 123.5 billion in 2024 and is anticipated to reach USD 266.66 billion by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Customer Information System (CIS) Market Size 2024 |

USD 123.5 billion |

| Customer Information System (CIS) Market, CAGR |

10.1% |

| Customer Information System (CIS) Market Size 2032 |

USD 266.66 billion |

The Customer Information System (CIS) market is characterized by strong competition among major players such as Fluentgrid Limited, Hansen Technologies, Oracle Corporation, Gentrack, Advanced Utility Systems, IBM Corporation, Milestone Utility Services, SAP SE, Itineris, and Cayenta. These companies focus on enhancing product capabilities through AI integration, cloud deployment, and predictive analytics to improve customer engagement and operational efficiency. North America led the market with a 38% share in 2024, driven by advanced digital infrastructure and widespread adoption of smart grid solutions. Europe followed with 29%, supported by strict data regulations and modernization of utility networks, while Asia-Pacific accounted for 24%, fueled by urban expansion and rising utility digitalization.

Market Insights

- The Customer Information System (CIS) market was valued at USD 123.5 billion in 2024 and is projected to reach USD 266.66 billion by 2032, growing at a CAGR of 10.1%.

- Rising digital transformation in utilities and regulatory mandates for accurate billing and transparency are driving market growth.

- Cloud-based CIS solutions and AI integration for predictive analytics and customer management are key emerging trends.

- Competition remains strong, with companies focusing on platform modernization, cybersecurity, and integration with smart grid technologies.

- North America led with a 38% share in 2024, followed by Europe at 29% and Asia-Pacific at 24%, while the solution segment dominated with over 64% share of the total market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the Customer Information System (CIS) market in 2024 with over 64% share. This dominance is driven by the growing adoption of integrated billing, customer analytics, and account management platforms among utilities. Solutions offer enhanced automation, real-time data handling, and personalized customer engagement features. Increasing demand for unified systems to improve billing accuracy and service reliability continues to support growth. Utilities are also adopting AI-enabled CIS solutions to optimize operational efficiency and minimize manual errors, strengthening the segment’s leadership in the overall market.

- For instance, City of Roseville’s InvoiceCloud rollout delivered 139% e-payment growth and a 20% drop in call-center volume within 11 months.

By Application

The electricity and power management segment held the largest share of 51% in 2024, leading the CIS market. Rising investments in smart grid infrastructure and digital metering systems are key growth drivers. Utilities are deploying CIS solutions to manage real-time consumption data, billing, and outage communication more effectively. The shift toward renewable integration and growing urban energy demand further boost adoption. Electricity providers increasingly rely on advanced CIS platforms to enhance transparency, improve customer satisfaction, and streamline revenue management across large consumer bases.

- For instance, Meralco served over 8,000,000 customers across 39 cities and 72 municipalities, requiring large-scale CIS operations.

Key Growth Drivers

Rising Digitalization in Utility Operations

Utilities are rapidly embracing digital transformation to improve customer service and operational efficiency. The deployment of smart grids, IoT devices, and digital metering systems demands advanced CIS platforms for real-time data processing and customer engagement. These systems enable automated billing, predictive maintenance, and personalized services, supporting utilities in managing large customer bases efficiently. The integration of digital tools also helps reduce operational costs and enhance service accuracy, making digitalization one of the primary drivers of market growth.

- For instance, Great Britain had ~35.5 million smart meters installed by March 2024, expanding CIS data flows.

Increasing Focus on Customer Experience Optimization

The need for improved customer satisfaction is pushing utilities to modernize their information systems. CIS platforms provide real-time insights into customer behavior, enabling personalized communication and faster issue resolution. Enhanced self-service options, digital payment systems, and automated complaint tracking are boosting adoption rates. As customer expectations for transparency and convenience grow, utilities are prioritizing CIS upgrades to improve retention and engagement, making this a major factor propelling market expansion.

- For instance, E.ON Next was ordered to compensate nearly 250,000 prepayment customers for billing failures.

Regulatory Push for Utility Modernization

Governments and regulatory bodies are encouraging digital adoption in utilities to ensure transparency and operational compliance. Initiatives promoting smart infrastructure and automated billing systems have accelerated CIS deployment. Regulatory mandates for accurate data reporting and secure data handling further drive demand. Utilities implementing modern CIS platforms benefit from streamlined reporting, reduced errors, and adherence to compliance standards. This policy-driven digitalization wave continues to strengthen CIS adoption globally.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics are transforming how utilities manage customer data and forecast usage patterns. CIS platforms are evolving to include machine learning algorithms for billing accuracy, fraud detection, and customer behavior prediction. This integration allows proactive customer support and efficient resource management. The use of analytics-driven decision-making creates new opportunities for utilities to improve performance while offering personalized energy solutions to consumers.

- For instance, Oracle’s Opower programs report 24+ TWh cumulative energy savings across 175+ utilities.

Cloud-Based CIS Deployment

Cloud-based solutions are becoming the preferred choice for utilities due to scalability and cost-effectiveness. Cloud deployment reduces infrastructure costs and enhances data accessibility for remote teams. The flexibility to integrate with CRM, ERP, and billing systems supports seamless digital operations. Growing preference for subscription-based cloud models is creating long-term opportunities for vendors. This shift also allows utilities to handle large data volumes securely, supporting better customer management and operational agility.

- For instance, Next Kraftwerke, a German energy aggregator, reported a networked capacity of 12,700 MW in the first quarter of 2025, operating one of the largest Virtual Power Plant (VPP) networks in Europe.

Key Challenges

Data Security and Privacy Concerns

As CIS platforms handle vast amounts of customer information, data protection remains a significant challenge. Cybersecurity threats, including ransomware and phishing attacks, can compromise sensitive utility and consumer data. Compliance with data protection regulations like GDPR and CCPA requires continuous monitoring and system upgrades. Utilities must invest heavily in encryption, authentication, and access control solutions to mitigate risks. Balancing security costs with operational efficiency remains a key concern for the sector.

High Implementation and Integration Costs

The high upfront investment for deploying advanced CIS platforms poses a major barrier, especially for small and mid-sized utilities. Integrating new systems with legacy infrastructure often demands additional customization, training, and technical support. These costs can delay return on investment and limit adoption in developing regions. Vendors are responding with modular and cloud-based offerings, but affordability continues to be a challenge for many utilities seeking to modernize their operations.

Regional Analysis

North America

North America held the largest share of 38% in the Customer Information System (CIS) market in 2024. The region’s dominance is driven by the high adoption of smart grids, digital billing, and customer management systems by major utilities. U.S. and Canadian power companies are investing heavily in AI-driven CIS platforms to enhance service reliability and customer experience. Supportive government policies and growing demand for data-driven energy management strengthen the regional market. Strong presence of key vendors and advanced IT infrastructure continues to sustain market leadership in the forecast period.

Europe

Europe accounted for a 29% share in the global CIS market in 2024, supported by strict data protection regulations and modernization of utility networks. Utilities across Germany, the U.K., and France are implementing CIS solutions to comply with transparency and billing standards. The region’s emphasis on renewable energy integration and digital customer engagement further promotes adoption. Technological collaborations and cross-border smart grid projects enhance efficiency. Continuous regulatory reforms and sustainability-focused initiatives are expected to maintain Europe’s strong position in the global CIS landscape.

Asia-Pacific

Asia-Pacific captured 24% of the Customer Information System market in 2024, emerging as a rapidly growing region. Expanding urban infrastructure and rising electricity demand in China, India, and Japan are driving CIS adoption. Governments are promoting smart city projects and digital transformation in utilities to improve energy efficiency. Increasing investments in grid modernization and mobile-enabled billing platforms boost market expansion. The presence of local IT vendors offering affordable cloud-based CIS platforms supports wider penetration. Growing focus on customer service optimization continues to accelerate regional growth.

Latin America

Latin America accounted for an 6% share of the CIS market in 2024, driven by ongoing digitalization of public utilities. Countries such as Brazil, Mexico, and Chile are implementing CIS solutions to improve billing transparency and reduce service losses. Regulatory initiatives promoting smart metering and efficient energy use support market adoption. However, limited infrastructure and financial constraints among small utilities slow full-scale deployment. Growing partnerships with global technology providers and increasing investment in utility automation are expected to strengthen regional market performance in coming years.

Middle East & Africa

The Middle East & Africa region held a 3% share in the global CIS market in 2024. The adoption is primarily concentrated in Gulf nations focusing on digital utility transformation and smart grid infrastructure. Governments in the UAE, Saudi Arabia, and South Africa are investing in integrated CIS platforms to support sustainable power management. Growing water and wastewater projects also contribute to demand. However, limited digital infrastructure in several African countries hinders growth. Gradual urbanization and policy-driven modernization efforts are expected to support long-term market development.

Market Segmentations:

By Component

By Application

- Water and Wastewater Management

- Electricity and Power Management

- Utility Gas Management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Customer Information System (CIS) market features strong competition among leading providers such as Fluentgrid Limited, Hansen Technologies, Oracle Corporation, Gentrack, Advanced Utility Systems, IBM Corporation, Milestone Utility Services, SAP SE, Itineris, and Cayenta. The market is driven by innovation in customer data management, cloud-based deployment, and integration with smart grid technologies. Companies are investing in AI and machine learning to enhance predictive analytics, improve billing accuracy, and strengthen customer engagement. Strategic alliances, product customization, and regulatory compliance are key areas of focus. Vendors are also expanding their service portfolios to include consulting, system integration, and managed services to gain a competitive edge. The shift toward cloud and hybrid CIS models supports scalability and operational flexibility, appealing to both large and mid-sized utilities. Continuous upgrades and cybersecurity enhancements remain central to sustaining customer trust and maintaining leadership in this fast-evolving digital utility ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Hansen launched HansenCIS, an AI-powered virtual agent. Integrated with its core CIS offerings, the solution uses conversational and generative AI to automate routine customer service tasks like billing inquiries, account management, and service transfers, aiming to reduce operational costs.

- In 2024, SAP launched its generative AI copilot, Joule, and enacted a major restructuring program to re-focus its investments toward artificial intelligence (AI).

- In 2023, IBM acquired Apptio, expanding its IT financial and data management capabilities, indirectly enhancing its CIS portfolio with new analytics and financial planning tools.

Report Coverage

The research report offers an in-depth analysis based on Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities will increasingly adopt AI-powered CIS platforms for predictive analytics and automated decision-making.

- Cloud-based CIS deployments will continue to expand due to scalability and lower infrastructure costs.

- Integration with IoT and smart meters will enhance real-time data management and customer insights.

- Governments will push for digital transformation in utilities to ensure transparency and service efficiency.

- CIS vendors will focus on developing modular solutions for small and mid-sized utility companies.

- Cybersecurity investments will rise to protect customer data and maintain regulatory compliance.

- Mobile-enabled CIS systems will support better customer engagement and self-service features.

- Growing renewable energy integration will increase the need for flexible CIS platforms.

- Partnerships between utilities and technology providers will accelerate innovation in CIS offerings.

- Emerging markets will witness rapid adoption of cloud and hybrid CIS systems to modernize legacy infrastructure.