| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Cyber Physical Systems Market Size 2024 |

USD 32983.93 Million |

| Europe Cyber Physical Systems Market, CAGR |

9.39% |

| Europe Cyber Physical Systems Market Size 2032 |

USD 67618.31 Million |

Market Overview:

The Europe Cyber Physical Systems Market is projected to grow from USD 32983.93 million in 2024 to an estimated USD 67618.31 million by 2032, with a compound annual growth rate (CAGR) of 9.39% from 2024 to 2032.

Several factors are propelling the expansion of the CPS market in Europe. The region’s strong emphasis on Industry 4.0 initiatives has led to widespread adoption of smart manufacturing and automation solutions. Additionally, the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) into industrial processes enhances operational efficiency and productivity, further fueling demand for CPS. Moreover, the European Union’s regulatory frameworks, such as the Cyber Resilience Act, aim to bolster cybersecurity measures, thereby encouraging organizations to invest in advanced CPS technologies to ensure compliance and resilience. The rise in connected devices and cloud computing services is also playing a crucial role in driving CPS deployment across sectors. Furthermore, increasing investments in research and innovation by both public and private institutions are accelerating the development of next-generation CPS solutions.

Regionally, Europe’s CPS market exhibits notable activity across key countries. Germany, with its advanced manufacturing sector, leads in adopting CPS solutions, particularly in automotive and industrial automation. France and the United Kingdom are also significant players, focusing on integrating CPS in transportation and energy sectors. Southern European countries, including Italy and Spain, are progressively embracing CPS technologies, especially in smart infrastructure projects. This diverse regional engagement underscores Europe’s commitment to leveraging CPS for enhanced industrial performance and innovation. In Northern Europe, countries like Sweden and Finland are prioritizing CPS in healthcare and smart city applications, benefiting from robust digital infrastructure. Additionally, cross-border collaborations and EU-funded initiatives are further fostering uniform growth and knowledge exchange across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe CPS market is expected to grow from USD 32,983.93 million in 2024 to USD 67,618.31 million by 2032, registering a CAGR of 9.39%.

- The Global Cyber Physical Systems is projected to grow from USD 1,25,271.30 million in 2024 to an estimated USD 2,71,668.59 million by 2032, with a compound annual growth rate (CAGR) of 10.16% from 2024 to 2032.

- Industry 4.0 initiatives and smart manufacturing advancements across countries like Germany, France, and the UK are accelerating CPS adoption in production environments.

- The convergence of CPS with IoT, AI, and big data analytics is enhancing real-time decision-making and predictive maintenance across key sectors.

- Regulatory frameworks, including the EU’s Cyber Resilience Act, are driving investments in secure, resilient CPS architectures to ensure compliance and data protection.

- Significant public and private investments through programs like Horizon Europe are fueling research, innovation, and real-world implementation of CPS solutions.

- High implementation costs, integration complexities, and a lack of standardized protocols present challenges, especially for small and medium enterprises.

- Germany leads regional adoption, while France, the UK, Italy, Spain, and Nordic countries are expanding CPS applications across automotive, healthcare, and energy sectors.

Market Drivers:

Market Drivers:

Advancement of Industry 4.0 and Smart Manufacturing

The ongoing implementation of Industry 4.0 strategies across Europe serves as a primary driver for the Cyber-Physical Systems market. European industries, particularly in Germany, France, and the UK, are rapidly embracing automation, intelligent monitoring, and real-time control mechanisms in their manufacturing operations. For instance, Germany has emerged as a leader in integrating CPS technologies through its “Plattform Industrie 4.0” initiative, with 62% of German companies utilizing Industry 4.0 solutions such as IoT sensors and digital twins to optimize production processes. CPS forms the backbone of smart factories, integrating physical production processes with digital technologies to create self-optimizing systems. This transformation enables enterprises to improve productivity, reduce operational costs, and achieve greater customization, which is essential in highly competitive global markets. As a result, there is a sustained demand for CPS technologies to support end-to-end digitalization of the manufacturing sector.

Integration of IoT, AI, and Big Data Analytics

The convergence of CPS with enabling technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and Big Data analytics is significantly boosting the market’s growth. These technologies facilitate seamless interaction between hardware and software components, enabling intelligent decision-making in real time. For instance, in the automotive and energy sectors, CPS allows predictive maintenance, autonomous operations, and real-time fault detection. European enterprises are increasingly investing in such integrated solutions to achieve operational excellence, reliability, and responsiveness. As digital transformation continues to be a priority, the synergy between CPS and smart technologies will remain a strong catalyst for market expansion.

Focus on Cybersecurity and Regulatory Compliance

Cybersecurity concerns are becoming increasingly prominent as CPS networks expand and grow more interconnected. Recognizing the associated risks, European regulatory bodies are reinforcing cybersecurity protocols to ensure resilience and data protection. The European Union’s Cyber Resilience Act and other digital regulations promote secure-by-design principles in embedded systems and connected devices. These regulatory frameworks are prompting industries to adopt secure CPS architectures that protect against potential vulnerabilities. The heightened regulatory oversight not only encourages best practices but also boosts confidence among stakeholders, thereby accelerating the deployment of CPS across critical infrastructure and industrial domains.

Public-Private Investments and Research Initiatives

Europe’s strong emphasis on research, innovation, and collaborative development further drives the CPS market forward. Public-private partnerships, including Horizon Europe programs and national funding schemes, are supporting the development of advanced CPS applications in sectors such as aerospace, defense, healthcare, and transportation. For example, pilot projects focusing on smart manufacturing have validated real-world applications of CPS technologies, driving broader adoption across industries. Research institutes and universities across the continent are playing a key role in advancing the theoretical and practical capabilities of CPS. Additionally, several pilot projects and testbeds are enabling real-world validation of CPS applications, encouraging broader adoption across industries. These initiatives reinforce Europe’s position as a leading hub for cyber-physical innovation and industrial modernization.

Market Trends:

Rising Adoption in Healthcare and Medical Devices

One of the emerging trends in the European CPS market is its growing application in the healthcare sector. Cyber-Physical Systems are increasingly being integrated into medical devices and hospital management systems to enable real-time monitoring, automated diagnostics, and remote patient care. For instance, Germany’s Digital Health Act (DVG) has facilitated the prescription of digital health applications, boosting the adoption of CPS-enabled remote patient monitoring (RPM) tools. This trend has accelerated in the wake of rising healthcare demands and the push for digital health transformation across Europe. Countries such as the Netherlands, Germany, and Sweden are investing in smart healthcare infrastructures that rely on CPS to enhance clinical workflows and improve patient outcomes. The ability of CPS to support interoperability and data-driven decision-making is transforming healthcare delivery models and paving the way for personalized medicine.

Expansion of Smart Cities and Intelligent Transportation

The development of smart cities across Europe is fostering the widespread use of CPS in urban planning and infrastructure management. Municipal governments are deploying CPS technologies in traffic control systems, energy grids, public safety networks, and environmental monitoring platforms. For example, Spain has implemented CPS to synchronize traffic lights and manage public transport logistics, while Denmark uses these systems to optimize energy consumption. These systems enable cities to operate more efficiently by using real-time data to optimize urban services and enhance the quality of life for citizens. For example, in Spain and Denmark, CPS is being used to synchronize traffic lights, manage public transport logistics, and reduce energy consumption. As EU funding and national investments in smart city projects continue to grow, the demand for CPS-enabled infrastructure solutions is expected to rise steadily.

Emergence of Edge Computing and 5G Integration

Another significant trend shaping the Europe CPS market is the integration of edge computing and 5G technology. With the increasing need for low-latency communication and decentralized processing, edge computing is becoming essential to the effective deployment of CPS. In sectors such as manufacturing, logistics, and utilities, edge-enabled CPS applications are facilitating faster decision-making and reducing dependency on centralized cloud infrastructure. Meanwhile, the rollout of 5G networks across countries like France, Italy, and Finland is enhancing connectivity, making it possible for CPS to operate with greater responsiveness and precision. This combination is expected to open new possibilities for real-time automation and autonomous systems.

Growth in Cross-Sector Collaboration and Standardization

Europe is witnessing a growing trend of cross-sector collaboration to establish uniform CPS standards and frameworks. Industry leaders, academic institutions, and regulatory bodies are working together to develop common architectures and interoperability protocols for CPS applications. This cooperative approach aims to overcome fragmentation and foster a more cohesive CPS ecosystem across various industries. Initiatives such as the European Cyber-Physical Systems Platform (CPSoS) are helping align research with practical industrial needs. The increased focus on standardization and collaboration is not only accelerating innovation but also ensuring that CPS solutions are scalable, secure, and adaptable to evolving technological landscapes.

Market Challenges Analysis:

High Implementation Costs and Complexity

One of the primary restraints facing the Europe Cyber-Physical Systems market is the high cost and technical complexity associated with implementation. For instance, the DigiFed project, funded by the European Union, has highlighted that many small and medium-sized enterprises (SMEs) struggle to adopt CPS due to limited financial and technical resources. Deploying CPS requires substantial investment in advanced hardware, software integration, and network infrastructure. Small and medium-sized enterprises (SMEs), which form a large part of Europe’s industrial base, often struggle to allocate the financial and technical resources necessary for full-scale CPS deployment. Furthermore, integrating CPS into legacy systems can be both time-consuming and cost-intensive, leading to delays and reluctance in adoption. These financial and operational barriers limit market penetration, particularly among resource-constrained organizations.

Data Security and Privacy Concerns

As CPS networks become increasingly interconnected, ensuring data security and privacy presents a significant challenge. CPS collects and processes vast amounts of sensitive data in real time, making these systems highly vulnerable to cyber threats, data breaches, and unauthorized access. Despite regulatory frameworks such as the General Data Protection Regulation (GDPR) and the Cyber Resilience Act, maintaining robust cybersecurity standards across a diverse range of industries remains complex. The evolving nature of cyber threats further complicates efforts to secure CPS infrastructures, especially in critical sectors such as healthcare, energy, and transportation.

Lack of Skilled Workforce and Standardization Gaps

The shortage of skilled professionals in the areas of embedded systems, cybersecurity, and industrial automation presents another significant obstacle. The successful deployment and maintenance of CPS require interdisciplinary expertise, which remains in short supply across many European countries. Additionally, the lack of universal standards for CPS design, communication protocols, and system interoperability continues to pose challenges. Without consistent frameworks, ensuring seamless integration and scalability across industries becomes increasingly difficult, slowing down the overall growth of the market.

Market Opportunities:

The Europe Cyber-Physical Systems market presents significant opportunities as the region accelerates its digital transformation across multiple industries. With increasing investment in smart manufacturing, healthcare digitization, and intelligent infrastructure, CPS is becoming a foundational technology for innovation. The European Union’s commitment to funding research and development through programs such as Horizon Europe and Digital Europe enhances opportunities for market expansion. These initiatives promote collaboration between academia, industry leaders, and startups, enabling the rapid commercialization of CPS technologies. Additionally, as sectors like aerospace, defense, and logistics demand higher levels of automation and system intelligence, CPS adoption is poised to grow substantially, offering vendors opportunities to deliver tailored, high-value solutions.

Another key opportunity lies in the integration of CPS with emerging technologies such as digital twins, blockchain, and advanced robotics. The ability to create synchronized virtual-physical environments allows for predictive maintenance, operational efficiency, and product lifecycle optimization across a wide array of industries. The growing focus on sustainability and energy efficiency across Europe also opens the door for CPS applications in green technologies and smart energy systems. Moreover, the rollout of 5G and the expansion of edge computing infrastructure create favorable conditions for low-latency, real-time CPS applications, particularly in autonomous transportation and industrial automation. As regulatory frameworks become more supportive of digital infrastructure and cybersecurity, CPS providers have an opportunity to scale solutions while aligning with evolving compliance standards. Overall, the Europe CPS market stands at the intersection of policy support, technological maturity, and rising demand—creating a fertile ground for growth and innovation.

Market Segmentation Analysis:

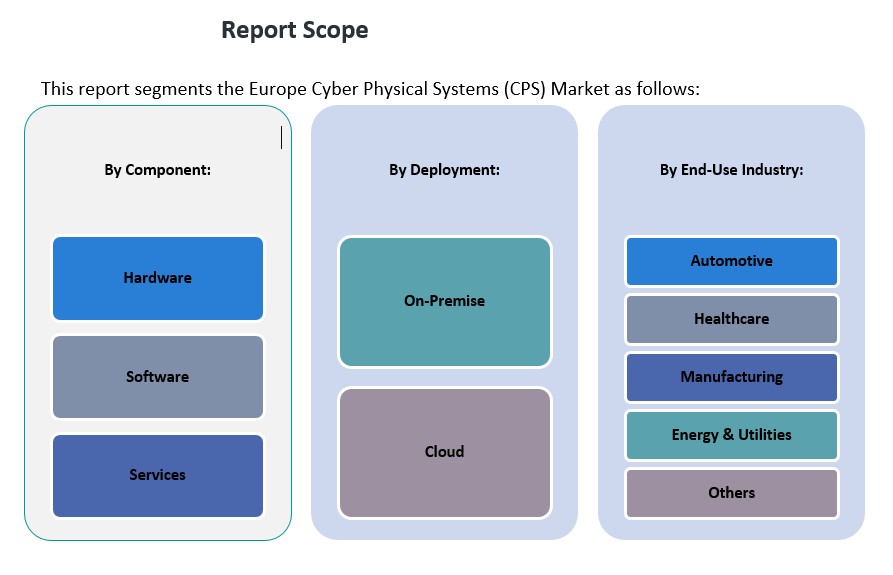

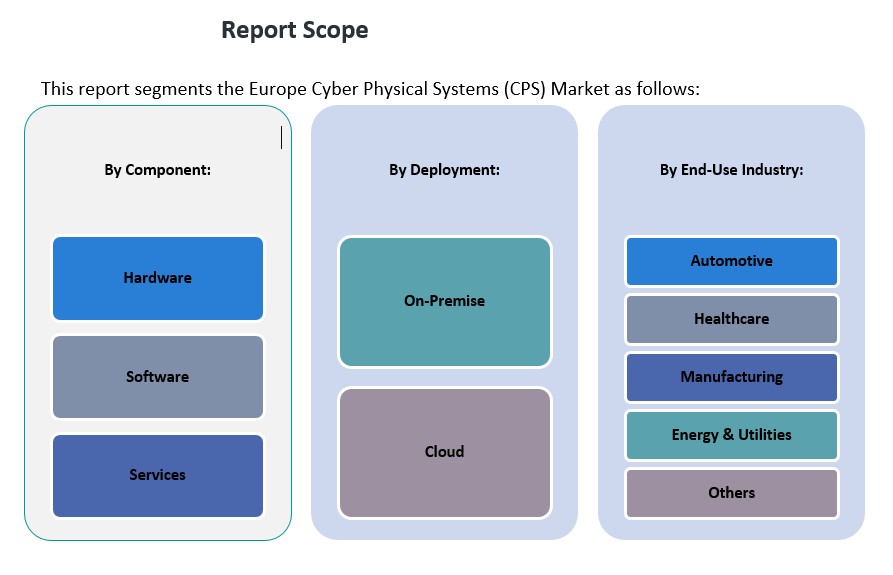

The Europe Cyber-Physical Systems market is segmented by component, deployment, and end-use industry, each contributing distinctly to the market’s overall dynamics.

By component, the hardware segment holds a significant share, driven by the demand for sensors, actuators, and embedded systems essential for real-time data processing and control. However, the software segment is witnessing rapid growth as industries prioritize intelligent analytics, system modeling, and control algorithms. The services segment, encompassing consulting, integration, and maintenance, is gaining momentum due to the complexity of CPS deployment and the increasing need for ongoing support and system optimization.

By deployment, on-premise solutions continue to dominate due to stringent data security and compliance requirements, particularly in critical sectors such as healthcare and energy. Nevertheless, the cloud segment is expanding steadily as organizations seek scalable, cost-efficient solutions that support remote monitoring and centralized control. This trend is supported by the increasing availability of robust cloud infrastructure across Europe and growing trust in cloud-based platforms.

By end-use industry, the manufacturing sector leads CPS adoption, spurred by Industry 4.0 initiatives and the need for automation and real-time system control. The automotive sector follows closely, integrating CPS for autonomous driving systems, predictive maintenance, and vehicle-to-everything (V2X) communication. Healthcare is emerging as a high-growth area, leveraging CPS for remote diagnostics and smart medical devices. The energy and utilities segment is also adopting CPS for grid automation and efficient resource management. The others category includes aerospace, logistics, and smart infrastructure, which collectively contribute to broadening the application landscape across the region.

Segmentation:

By Component:

- Hardware

- Software

- Services

By Deployment:

Regional Analysis:

The European Cyber-Physical Systems (CPS) market demonstrates significant growth, with regional variations reflecting the diverse industrial landscapes and technological advancements across the continent. Europe holds approximately 25% of the global CPS market share, positioning it as the second-largest market after North America.

Germany: A Leader in CPS Adoption

Germany stands at the forefront of CPS adoption in Europe, driven by its robust manufacturing sector and commitment to Industry 4.0 initiatives. The country’s emphasis on integrating advanced technologies into production processes has led to widespread implementation of CPS solutions, particularly in automotive manufacturing and industrial automation. This strategic focus enhances operational efficiency and maintains Germany’s competitive edge in the global market.

United Kingdom and France: Embracing Technological Integration

The United Kingdom and France are also key players in the European CPS landscape. In the UK, significant investments in smart infrastructure and digital transformation have propelled the adoption of CPS across various sectors, including transportation and energy. France mirrors this trend, with a strong emphasis on integrating CPS into aerospace and defense industries, reflecting the nation’s strategic priorities and industrial strengths.

Italy and Spain: Emerging CPS Markets

Italy and Spain represent emerging markets for CPS within Europe. Both countries are increasingly focusing on smart manufacturing and automation to revitalize their industrial sectors. In Italy, the emphasis on precision engineering and automotive production drives CPS adoption, while Spain’s investments in renewable energy and smart grid technologies underscore the growing relevance of CPS in energy management and sustainability initiatives.

Eastern Europe: Growing Potential

Eastern European countries, including Poland, Hungary, and the Czech Republic, are witnessing a gradual increase in CPS adoption. This growth is fueled by expanding manufacturing bases, favorable investment climates, and initiatives to modernize industrial operations. As these nations continue to integrate into the broader European industrial network, their role in the CPS market is expected to strengthen, contributing to the overall regional growth.

Key Player Analysis:

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Bosch Rexroth AG

- Thales Group

- Dassault Systèmes

- SAP SE

- Rolls-Royce Holdings plc

- Airbus SE

- Philips N.V.

Competitive Analysis:

The Europe Cyber-Physical Systems (CPS) market is characterized by a competitive landscape with the presence of both global technology giants and regional innovators. Leading players such as Siemens AG, ABB Ltd., Schneider Electric SE, and Bosch GmbH dominate the market by offering comprehensive CPS solutions across manufacturing, energy, and transportation sectors. These companies leverage strong R&D capabilities, strategic partnerships, and robust distribution networks to maintain their market positions. In addition, software and IT firms like SAP SE and Atos SE contribute significantly through advanced analytics and digital integration platforms. The competitive environment is further intensified by emerging startups and research-driven enterprises developing niche, sector-specific CPS applications. As technological convergence accelerates, competition is shifting toward innovation in real-time data processing, cybersecurity, and system interoperability. The focus on sustainability and smart infrastructure across Europe is also driving firms to differentiate through energy-efficient and scalable CPS solutions tailored to diverse industry needs.

Recent Developments:

- On March 7, 2025, the EU-funded ADVANCE project announced its progress in advancing verification and validation processes for cyber-physical systems (CPS). The initiative developed innovative methodologies to improve dependability, safety, and security in CPSs, including techniques for robust testing, fault injection, and data analysis.

- On April 4, 2025, Bosch Rexroth partnered with Trackunit to integrate BODAS Connect OTA technology into Trackunit’s ecosystem. This collaboration enables remote diagnostics and software updates for construction machinery while ensuring compliance with cybersecurity regulations like the Cyber Resilience Act.

- On March 6, 2025, Armis, a prominent cyber exposure management company, acquired OTORIO, a leading provider of operational technology (OT) and cyber-physical system (CPS) security. OTORIO’s Titan platform will now be integrated into Armis’ Centrix™ cloud-based platform, expanding its capabilities to include on-premises CPS solutions for air-gapped environments.

Market Concentration & Characteristics:

The Europe Cyber-Physical Systems (CPS) market demonstrates a moderately concentrated structure, with a few dominant players accounting for a significant share of the market. Major firms such as Siemens AG, ABB Ltd., Schneider Electric SE, and Bosch GmbH possess strong technological capabilities and established customer bases, particularly in sectors like manufacturing, automotive, and energy. These key players drive innovation and standard-setting across the region, while numerous small and medium enterprises (SMEs) contribute specialized solutions, enhancing the market’s dynamism. The market is characterized by rapid technological advancements, increasing convergence with IoT and AI, and a strong regulatory emphasis on data security and system resilience. Customization, interoperability, and real-time processing are critical attributes that define CPS solutions in Europe. Additionally, public-private partnerships and EU-funded R&D initiatives play a pivotal role in fostering innovation, ensuring the market remains agile and responsive to evolving industrial and infrastructure demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing integration of CPS with AI and machine learning will enhance automation and decision-making capabilities across industries.

- Expansion of 5G and edge computing infrastructure will enable real-time CPS applications in manufacturing, healthcare, and transportation.

- Rising investments in smart cities and digital infrastructure will drive demand for CPS in urban mobility and energy management systems.

- Growth in electric and autonomous vehicles will boost CPS adoption in the automotive sector for safety, control, and navigation.

- Enhanced regulatory support, such as the Cyber Resilience Act, will promote secure CPS deployment across critical sectors.

- Cross-sector collaboration and standardization efforts will improve interoperability and scalability of CPS solutions.

- SMEs will gain more access to CPS technologies through cost-effective, cloud-based solutions and government incentives.

- Academic and industrial research partnerships will continue to fuel innovation and practical CPS implementation.

- Focus on sustainability and energy efficiency will create opportunities for CPS in green technologies and smart grids.

- Evolving cybersecurity challenges will drive continuous development of secure, resilient CPS architectures.

Market Drivers:

Market Drivers: