Market Overview

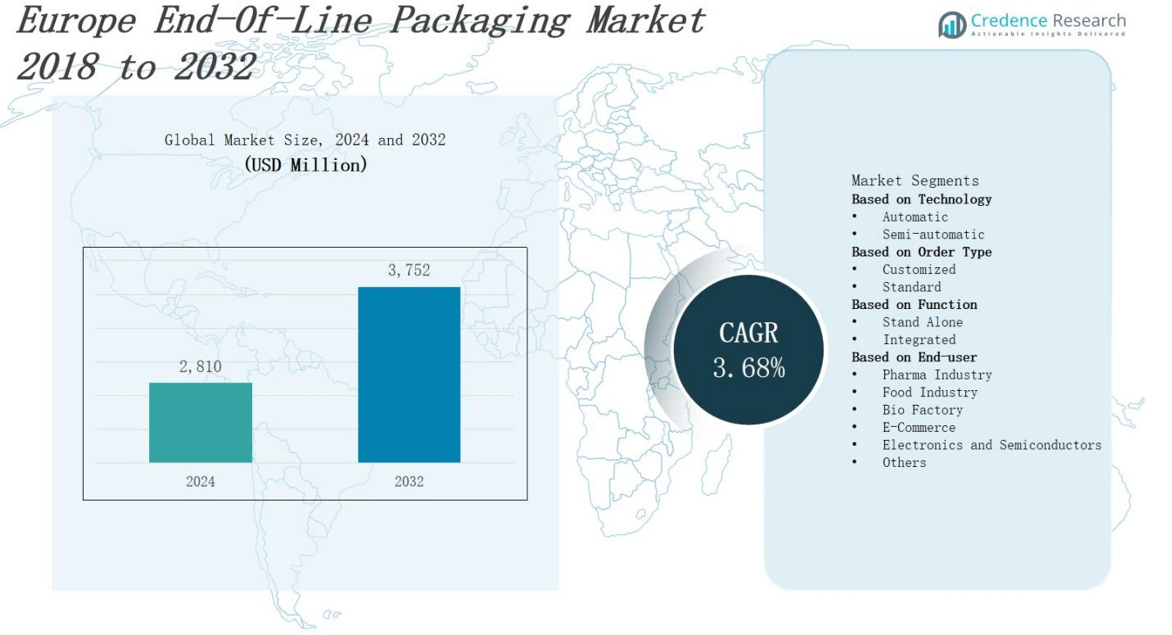

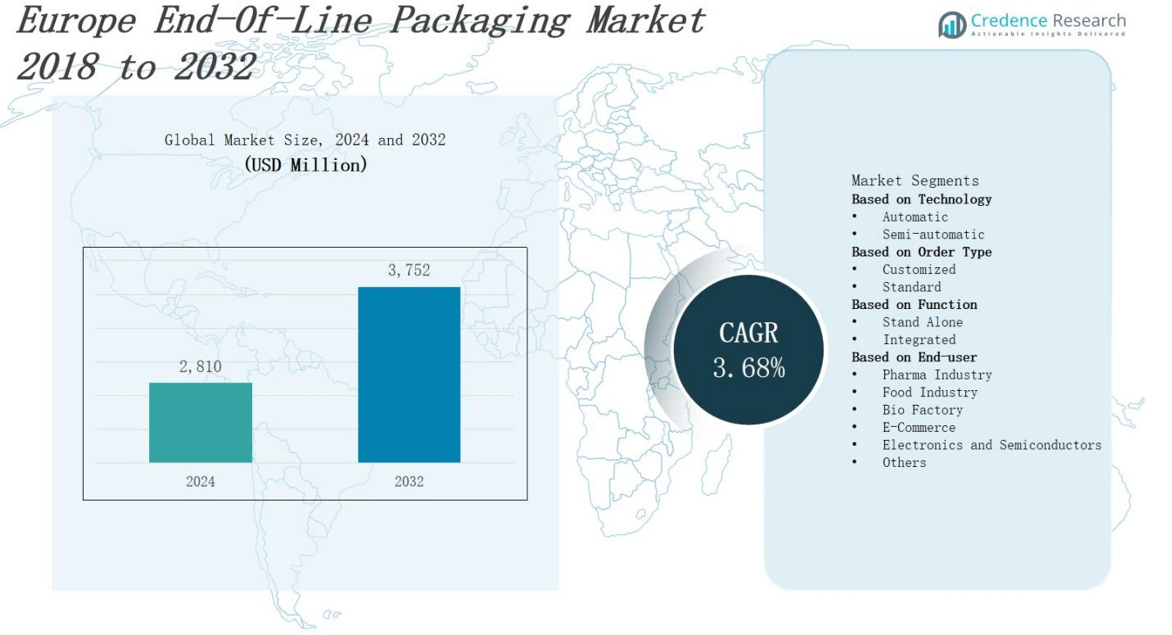

In 2024, the Europe end‑of‑line packaging market was valued at USD 2,810 million and is projected to reach USD 3,752 million by 2032, reflecting a CAGR of 3.68%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe End Of Line Packaging Market Size 2024 |

USD 2,810 million |

| Europe End Of Line Packaging Market, CAGR |

3.68% |

| Europe End Of Line Packaging Market Size 2032 |

USD 3,752 million |

Manufacturers in the Europe end‑of‑line packaging market drive growth through automation investments, robotics and smart conveyors that improve throughput and reduce labor costs. Rising e‑commerce volumes prompt adoption of integrated labeling, wrapping and palletizing solutions to meet fast delivery expectations. Stricter sustainability regulations encourage use of recyclable materials and energy‑efficient machinery. Digitalization enables real‑time monitoring and predictive maintenance that minimize downtime. Customization demands drive flexible packaging lines capable of handling diverse product formats. Labor shortages reinforce demand for automated systems. Manufacturers leverage Industry 4.0 technologies and collaborative robots to enhance operational efficiency and align with evolving regulatory and consumer expectations.

Western Europe leads with 50% share and high adoption of automated palletizing solutions, driven by Robert Bosch GmbH and OPTIMA Packaging Group GmbH. Northern Europe holds 30% share and prioritizes sustainable wrappers and robotics from Festo Inc and Fromm Group. Eastern Europe accounts for 20% share, where Endoline Machinery Ltd and RADPAK modernize lines with retrofit kits. The Europe end‑of‑line packaging market features modular conveyors by Flex Link and Quin Systems Ltd. Coesia Group, B&R and DS Smith compete on integrated labeling and wrap cells. Shemesh Automation LTD offers specialized end‑of‑line solutions.

Market Insights

- In 2024, the Europe end‑of‑line packaging market reached USD 2,810 million and it will attain USD 3,752 million by 2032 at a 3.68% CAGR.

- It drives growth through automation investments, robotics and smart conveyors that improve throughput and reduce labor costs in the Europe end‑of‑line packaging market.

- Rising e‑commerce volumes prompt integrated labeling, wrapping and palletizing solutions to meet fast delivery expectations in the Europe end‑of‑line packaging market.

- Stricter sustainability regulations encourage recyclable materials and energy‑efficient machinery across the Europe end‑of‑line packaging market.

- Digitalization enables real‑time monitoring and predictive maintenance that minimize downtime in the Europe end‑of‑line packaging market.

- Western Europe leads with 50% share, Northern Europe follows with 30%, and Eastern Europe holds 20% in the Europe end‑of‑line packaging market.

- It leverages modular, scalable lines and retrofit solutions to support diverse formats and extend machine lifecycles in the Europe end‑of‑line packaging market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Automation and Efficiency

Manufacturers invest in robotics and smart conveyors to improve throughput and reduce labor costs. It responds to rising wage pressure across the region. The Europe end‑of‑line packaging market benefits from modular systems that adapt to seasonal demand. Operators achieve faster cycle times and lower error rates. Automated palletizing and wrapping machines handle high volumes with minimal supervision. It supports workforce shortages by shifting manual tasks to machines.

E‑Commerce and Delivery Pressure

Online retail growth fuels demand for rapid order fulfilment and integrated labelling solutions. The Europe end‑of‑line packaging market gains from inline printers that apply shipping information at high speeds. Providers offer scalable modules that integrate with warehouse management systems. Customers expect accurate labelling, swift shrink wrapping and secure pallet attachments. It cuts lead time between packing and dispatch. Companies deploy turnkey lines to satisfy tight delivery windows.

Sustainability and Compliance

Regulatory mandates push equipment manufacturers to use recyclable materials and energy‑efficient motors. The Europe end‑of‑line packaging market adapts by offering lightweight film wrappers and eco‑friendly stretch films. It meets strict emissions standards and waste reduction targets. OEMs design machines with lower power consumption and recyclable components. Customers seek equipment that complies with circular economy policies. Suppliers routinely audit lifecycle footprint and certify machinery under recent EU directives.

- For instance, Baumüller has introduced high-torque electric motors with over 90% efficiency, replacing hydraulic drives in shredders to significantly reduce energy consumption and raw material use, while incorporating liquid cooling systems that enhance power density and enable heat reuse for other applications.

Digitalization and Flexibility

Advanced control systems with real‑time monitoring and predictive maintenance minimize downtime and extend machine life. The Europe end‑of‑line packaging market leverages IoT platforms to track performance metrics and schedule service interventions. Operators adjust line speed and format without halting production. It supports quick format changeovers and volume shifts. Vendors integrate touchscreen interfaces and cloud reporting tools. Companies gain full visibility and efficient troubleshooting across complex packaging lines.

- For instance, Johnson & Johnson integrated automation and digitalization through a unified data architecture on their packaging lines, reducing material waste by 18% and increasing production speed by 30%.

Market Trends

Rise of Modular, Scalable Packaging Lines

Manufacturers deploy modular line architectures that adapt to volume shifts and format changes. The Europe end‑of‑line packaging market experiences demand for preconfigured modules that integrate palletizing, labelling and wrapping. It enables rapid line scale‑up without major capital overhaul. Providers sell plug‑and‑play units that accelerate installation and commissioning. Production leads choose modular systems to avoid production stops. It reduces risk by isolating maintenance to specific modules.

- For instance, ABB offers plug-and-play robotic palletizing cells that speed up installation and commissioning, reducing downtime substantially.

Integration of Collaborative Robots and Humans

Collaboration between robotics and human operators drives efficiency gains. The Europe end‑of‑line packaging market integrates collaborative robots that handle varied unit loads and adjust to line pace. It frees workers from repetitive tasks and scales throughput. System designers embed safety features that enable human‑machine interaction. Early adopters report lower cycle times and higher uptime. It fosters workforce reskilling and redirects labor to quality control.

- For instance, in warehouse operations, cobots optimize picking routes and handle heavy loads, enabling human workers to focus on complex tasks, which can double or even triple productivity while reducing physical fatigue.

Adoption of Predictive Maintenance and Analytics

Connectivity between equipment and cloud platforms drives predictive interventions. The Europe end‑of‑line packaging market connects PLCs and sensors to real‑time analytics dashboards. It triggers maintenance alerts before breakdowns occur. Service teams schedule repairs during planned stops and preserve line availability. Data scientists fine‑tune algorithms that calculate asset health scores. It optimizes spare‑parts inventory and prolongs machinery lifecycle. End users gain clear visibility into performance metrics.

Embrace of Sustainable, Mono‑Material Wrappers

Demand for recyclable films and bio‑based wrap propels material innovation. The Europe end‑of‑line packaging market embraces mono‑material structures that simplify recycling. It tests compostable films and minimize waste streams. Machine vendors adapt roll dispensers and seal jaws to handle new substrates. Sustainability leads audit machinery energy consumption and seek certified components. It aligns equipment selection with corporate net‑zero ambitions. Clients compare lifecycle assessments when selecting packaging lines.

Market Challenges Analysis

Complex Regulatory and Compliance Requirements

Manufacturers face stricter waste directives and extended producer responsibility schemes across Europe. The Europe end‑of‑line packaging market must adapt to Packaging and Packaging Waste Regulation revisions and updated operational guidelines. It requires rapid updates to machinery, documentation and quality protocols. New certification demands slow equipment deployment and cross‑border coordination. Companies invest in audit processes and traceability systems to prove compliance and align with sustainability goals. It exposes OEMs to fines, reputational risks and project delays if inspections fail. Stakeholders struggle with varied national interpretations of EU codes and enforcement timelines.

High Capital Investment and Integration Complexity

Automated line deployment triggers large upfront expenditures for robotics, conveyors and control systems. The Europe end‑of‑line packaging market burdens operators with high lease or purchase costs and substantial maintenance support agreements. It challenges mid‑sized companies with limited budgets and resource constraints. Integrators must align new equipment with legacy IT, PLC architectures and enterprise software. Firms allocate resources to system training, pilot runs and extensive integration testing. It exposes projects to schedule slippage, technical hurdles and cost overruns. Vendors negotiate financing plans and extended service contracts, yet tight margins persist across supply chains.

Market Opportunities

Expansion of Smart Packaging Services

Manufacturers integrate digital serialization and track‑and‑trace solutions into end‑of‑line operations. The Europe end‑of‑line packaging market benefits from service contracts that include remote monitoring and performance analytics. It creates recurring revenue for OEMs. Software partnerships enable subscription offerings and software updates. Clients gain visibility across supply chains and speed recalls. OEMs can bundle installation, training and support packages. Providers strengthen customer relationships through data insights and proactive maintenance plans.

Growth in Retrofit and Upgrade Solutions

Industry players target aging packaging lines with modernization kits and control system replacements. The Europe end‑of‑line packaging market sees demand for modular upgrades that avoid full system purchases. It lowers capital burden for mid‑sized operators. Integrators supply plug‑in modules for robotics, sensors and HMI panels. Clients select phased implementation and finance plans. OEMs extend machine lifecycle and performance. Providers establish aftermarket channels for spare parts and training services.

Market Segmentation Analysis:

By Technology

Manufacturers deploy automatic systems to handle high volumes with consistent speed and precision. The Europe end‑of‑line packaging market favors fully automatic solutions for food, beverage and pharmaceutical lines with minimal manual input. Semi‑automatic equipment serves niche operations that require lower capital and flexible production. Suppliers offer convertibility between modes to meet seasonal demand. It reduces downtime and simplifies maintenance through standardized components. OEMs support hybrids that shift between manual and automated tasks.

- For instance, Coca-Cola Europacific Partners Germany commissioned three high-speed Krones lines in Lüneburg, including a glass bottling system capable of processing 60,000 containers per hour, highlighting the demand for fully automatic, high-throughput solutions.

By Order Type

Clients specify customized lines that adapt to unique product dimensions and labeling requirements. The Europe end‑of‑line packaging market experiences rising orders for tailored configurations that support brand identity and small‑batch production. Standard systems dominate high‑volume lines with proven reliability and lower price points. Suppliers maintain core platforms that integrate popular modules across orders. It streamlines commissioning through repeatable designs and robust support networks. OEMs expand service offerings to include rapid configuration adjustments.

- Fpr instance, Rovema GmbH helped Myllyn Paras, a traditional Finnish food company, by installing modular packaging machines that allow easy switching between bag shapes and formats, including paper packaging, supporting sustainability and small-batch production needs.

By Function

Operators select stand‑alone machines for targeted functions such as wrapping or palletizing where line integration proves unnecessary. The Europe end‑of‑line packaging market shows strong demand for integrated solutions that combine labeling, coding and wrapping in continuous workflows. It reduces floor space by consolidating tasks into unified cells. Providers design scalable cells that support multiple functions without separate modules. Clients benefit from single‑vendor accountability and faster troubleshooting. OEMs highlight turnkey systems that simplify project management.

Segments:

Based on Technology

Based on Order Type

Based on Function

Based on End-user

- Pharma Industry

- Food Industry

- Bio Factory

- E-Commerce

- Electronics and Semiconductors

- Others

Based on the Region:

- Europe

- Germany

- France

- U.K.

- Italy

- Poland

- Spain

- Sweden

- Rest of Europe

Regional Analysis

Western Europe

Western Europe commands 50% share of the Europe end‑of‑line packaging market. Germany drives demand for automatic palletizing solutions and conveyors. Major OEMs install new lines in packaging facilities to meet high throughput needs. It benefits from robust manufacturing hubs and advanced logistics networks. France and the UK invest in digital labeling modules to improve traceability. Clients prioritize energy‑efficient machines that reduce operational costs. Stakeholders expand retrofit projects to modernize aging lines.

Northern Europe

Northern Europe holds 30% share of the Europe end‑of‑line packaging market. It focuses on compliance with strict environmental standards and carbon reduction targets. Sweden and Denmark adopt mono‑material wrappers and compostable films. Operators deploy semi‑automatic lines to support niche food producers and beverage brands. It leverages digital monitoring to schedule maintenance and avoid downtime. Local integrators partner with OEMs to deliver turnkey solutions that meet sustainability goals. Investment in collaborative robots continues to address labor shortages.

Eastern Europe

Eastern Europe accounts for 20% share of the Europe end‑of‑line packaging market. Poland and Czech Republic lead growth in beverage and consumer goods lines. Manufacturers upgrade standard wrapping and labeling machines to support export requirements. It benefits from lower labor costs and competitive investment incentives. Suppliers offer retrofit kits that boost performance without full line replacement. It maintains focus on standard order types that require minimal custom setup. Regional distributors expand service networks to reduce downtime and improve responsiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- OPTIMA Packaging Group GmbH

- RADPAK

- Fromm Group

- Endoline Machinery Ltd

- Robert Bosch GmbH

- Quin Systems Ltd

- Festo Inc

- DS Smith

- Flex Link

- Shemesh Automation LTD

- Coesia Group

- B&R

Competitive Analysis

Leading OEMs compete on automation features and service networks. The Europe end‑of‑line packaging market splits between global integrators like Robert Bosch GmbH and Coesia Group, mid‑size specialists such as OPTIMA Packaging Group GmbH and Endoline Machinery Ltd, plus niche innovators like Shemesh Automation LTD and RADPAK. It rewards suppliers that deliver rapid line commissioning, flexible format changeovers and remote support packages. B&R and Festo Inc leverage control expertise to boost system uptime. DS Smith and Fromm Group emphasize sustainable materials and energy‑efficient designs. Flex Link and Quin Systems Ltd target modular conveyors that adapt to volume shifts. It values partners that integrate predictive maintenance dashboards and offer retrofit kits for legacy lines. Providers gain advantage by aligning financing options with budget constraints of mid‑tier operators. Competition intensifies on digitalization, service‑level agreements and solution scalability. OEMs invest in customized training programs and spare‑parts inventories to enhance responsiveness and project support.

Recent Developments

- In May 2025, Labelexpo unveiled new folding‑carton printing technology, broadening its packaging solutions to accommodate emerging print methods.

- In July 2024, Coesia acquired a minority stake in PWR (Packaging with Robots) to enhance its automated end‑of‑line robotics and vision‑system offerings.

- In February 2025, FROMM Packaging Systems launched the Paperpad Machine, delivering precise void‑filling for efficient end‑of‑line operations.

- In February 2024, The Cut’it! Ranpak introduced the EVO automated in‑line packaging machine, ensuring materials meet the EU’s 40% void‑fill directive with minimal waste.

Market Concentration & Characteristics

Major global integrators and mid‑size specialists dominate the Europe end‑of‑line packaging market and account for over 60% of installed capacity. It exhibits moderate concentration with top ten OEMs offering turnkey automation, retrofit kits and service contracts. Niche vendors capture specialized segments through flexible conveyors, collaborative robots and mono‑material wrappers. It demands high capital investment, robust financing plans and strong aftermarket networks. Buyers seek integrated solutions that combine palletizing, labeling and wrapping into single cells. It rewards suppliers that deliver rapid commissioning, predictive maintenance dashboards and remote support. End users benefit from scalable platforms that accommodate volume shifts without full line replacement. It reflects a balance between large‑scale production needs and small‑batch customization, driving OEMs to expand modular architectures, training services and spare‑parts availability.

Report Coverage

The research report offers an in-depth analysis based on Technology, Order Type, Fundtion, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will adopt advanced automation technologies to accelerate production speeds and increase overall line efficiency.

- Producers will integrate collaborative robotics into end‑of‑line automation to automate manual tasks and improve consistency.

- Regulators will mandate recyclable film usage on packaging lines to satisfy strict environmental compliance standards.

- Operators will implement predictive maintenance powered by real‑time analytics to minimize downtime and maximize uptime.

- Clients will adopt modular end‑of‑line systems that allow quick capacity adjustments and seamless production scalability.

- Operations teams will deploy IoT‑enabled control platforms to monitor line performance and optimize output proactively.

- Suppliers will install collaborative robots alongside operators to automate tasks and enhance line safety reliably.

- Companies will upgrade end‑of‑line equipment with retrofit kits that extend equipment lifespan and boost performance.

- OEMs will offer service contracts that include remote support, predictive analytics and scheduled maintenance visits.

- Brands will demand customized end‑of‑line solutions that handle niche production runs, support brand differentiation strategies.