Market Overview:

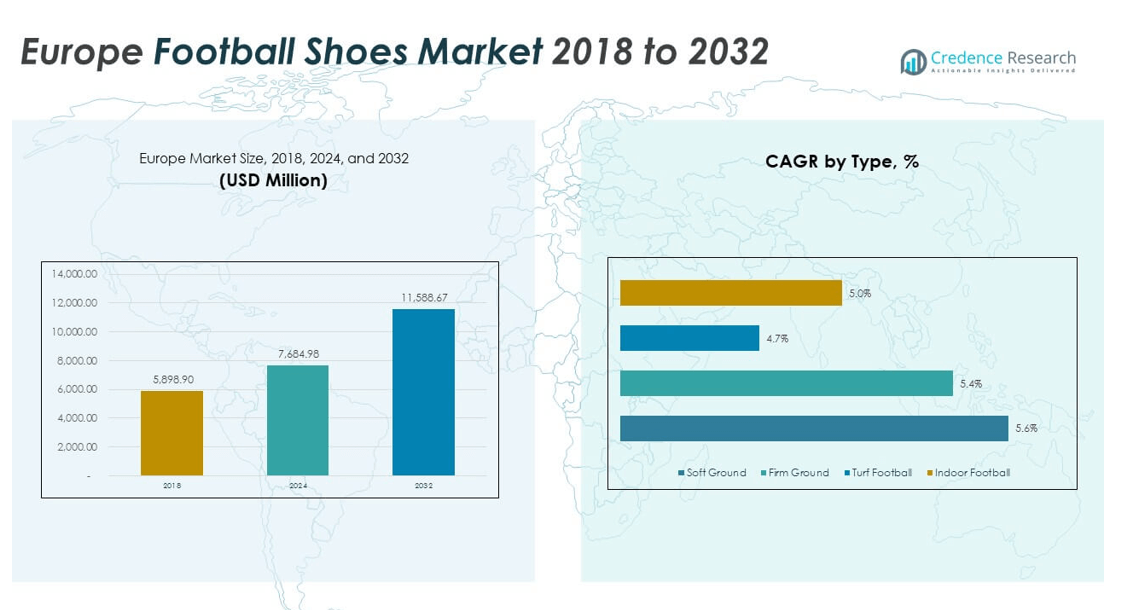

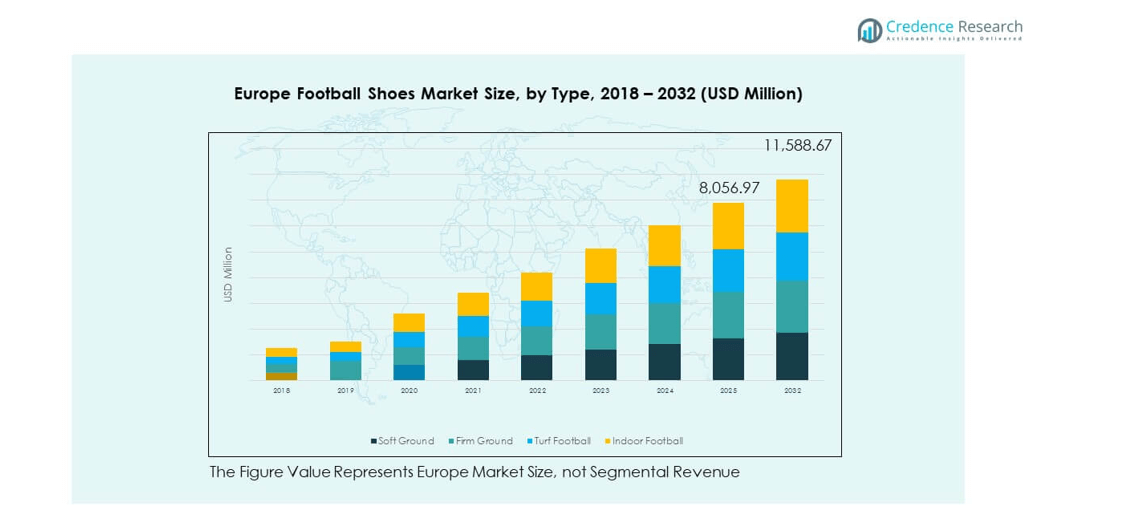

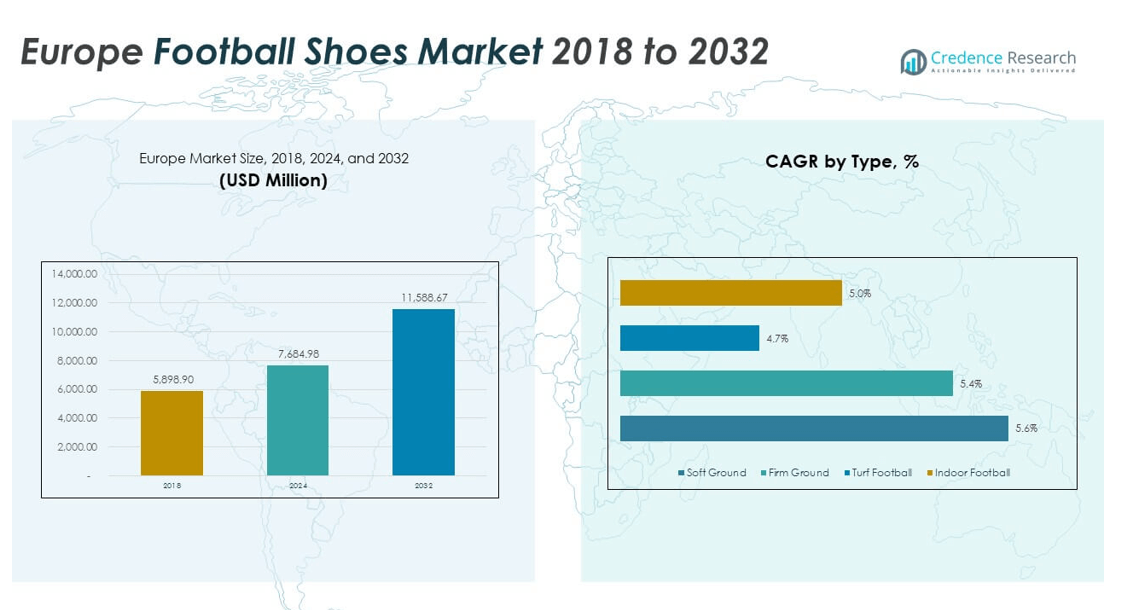

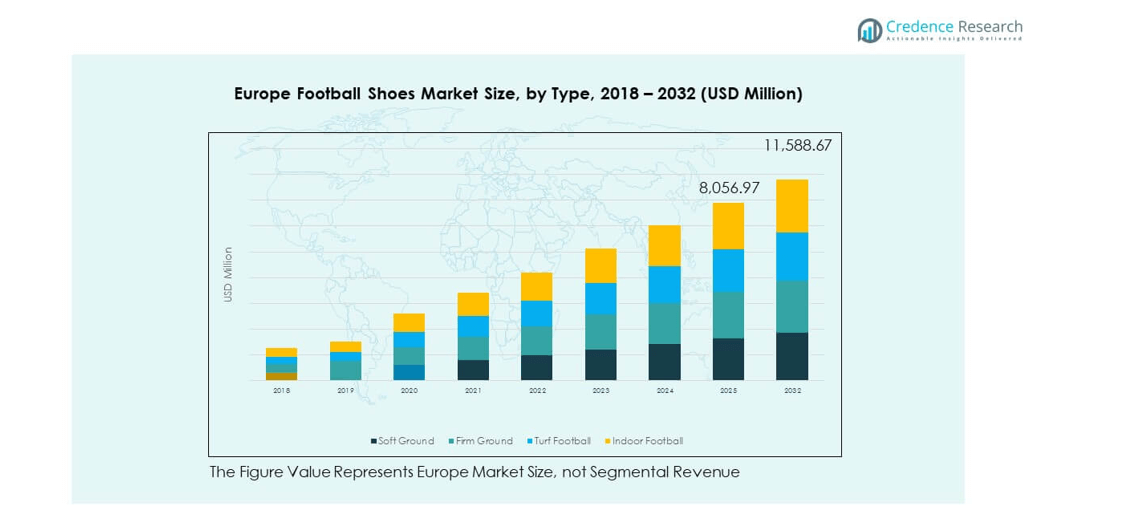

The Europe Football Shoes Market size was valued at USD 5,898.90 million in 2018 to USD 7,684.98 million in 2024 and is anticipated to reach USD 11,588.67 million by 2032, at a CAGR of 5.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Football Shoes Market Size 2024 |

USD 7,684.98 million |

| Europe Football Shoes Market, CAGR |

5.27% |

| Europe Football Shoes Market Size 2032 |

USD 11,588.67 million |

Growth in the market is driven by increasing football participation at both amateur and professional levels. Investments in grassroots development programs and youth academies across Europe foster wider adoption of performance footwear. Rising consumer preference for technologically advanced shoes that enhance comfort and reduce injury risk supports premium demand. Celebrity endorsements and collaborations with elite players influence buying behavior, creating aspirational value. Expanding digital platforms improve product accessibility and strengthen consumer engagement, fueling overall market expansion.

Western Europe leads the market with countries such as Germany, the U.K., and France benefitting from long-standing football traditions and developed club infrastructure. Southern Europe, including Italy and Spain, holds a strong presence supported by active leagues and vibrant fan culture. Eastern Europe is emerging with growing investments in sports facilities and increasing disposable incomes driving adoption. Northern Europe demonstrates demand for sustainable and performance-focused shoes, reflecting consumer preference for innovation. Together, these subregions highlight a mix of established dominance and emerging growth potential within the Europe Football Shoes Market.

Market Insights

- The Europe Football Shoes Market was valued at USD 5,898.90 million in 2018, grew to USD 7,684.98 million in 2024, and is projected to reach USD 11,588.67 million by 2032, expanding at a CAGR of 5.27%.

- Western Europe holds the largest share at 45%, driven by established football leagues, strong consumer spending, and long-standing traditions. Southern Europe follows with 30%, supported by Italy and Spain’s vibrant football culture, while Eastern and Northern Europe together account for 25%.

- Eastern Europe is the fastest-growing region with a 15% share, supported by rising sports infrastructure investments, increasing disposable incomes, and higher participation in grassroots football.

- Firm ground shoes dominate segment distribution with 42% share, reflecting their adaptability across multiple pitch conditions.

- Indoor football shoes hold 18% share, supported by urban growth, small-sided formats, and increasing recreational adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Participation in Grassroots and Professional Football Across the Region

The Europe Football Shoes Market benefits from rising participation in grassroots and professional football. Strong football culture across Germany, the U.K., France, and Spain increases demand for high-quality shoes. National associations promote youth leagues, boosting early adoption of performance footwear. Clubs invest in academies, ensuring players seek advanced shoes at younger ages. Brand visibility during international tournaments inspires consumer purchases. Sponsorship deals create aspirational value, influencing youth and adult buyers. Online retail expansion helps consumers access latest launches quickly. These factors sustain long-term demand for innovative football shoes.

Influence of Endorsements and Celebrity Associations Driving Consumer Preferences

Football icons play a central role in shaping product choices among young and aspirational consumers. Endorsements by top players add strong aspirational value to premium lines. Campaigns featuring famous athletes showcase innovative features of shoes, reinforcing trust. Consumers often link performance quality with shoes endorsed by professionals. It creates higher brand loyalty within competitive product categories. Growing digital campaigns extend reach across social media and streaming platforms. Brands align product launches with major tournaments for greater exposure. This strategy strengthens consumer engagement with both professional and lifestyle segments.

Advances in Technology and Innovation in Performance Enhancement Features

Footwear companies focus on delivering advanced performance technologies in football shoes. Lightweight materials, precision studs, and breathable fabrics enhance comfort and agility. Research and development efforts create shoes that reduce fatigue during long matches. New designs focus on injury prevention through better cushioning and support. Major brands integrate data-driven insights into product innovation cycles. It strengthens differentiation in a market with multiple global competitors. Demand rises among professionals and hobbyists seeking high-performance gear. These developments highlight innovation as a key driver for long-term market growth.

- For instance, Nike’s Air Zoom Mercurial, released in June 2022, features a 4-mm Air Zoom Strobel unit across the soleplate, designed to deliver enhanced responsiveness and propulsion as highlighted in Nike’s official product briefing.

Evolving Consumer Demand for Personalization and Aesthetic Appeal

The demand for personalized products drives innovation in shoe customization. Consumers value unique color combinations, patterns, and designs reflecting personal style. Football enthusiasts look for limited editions aligned with club or tournament themes. Digital customization tools enhance consumer experiences both online and offline. It enables players at all levels to express individuality while maintaining performance. Brands integrate eco-friendly materials in customized models to address sustainability expectations. This approach widens appeal beyond functional performance into lifestyle categories. Personalization acts as a growth accelerator for the Europe Football Shoes Market.

- For instance, Nike By You allows consumers in Italy to personalize football boots, such as the Phantom 6 Low Elite, choosing from numerous colors, materials, fit options, and even adding a custom ID or message, enabling direct-to-consumer customized performance footwear through Nike’s digital platform.

Market Trends

Expansion of Sustainable and Eco-Friendly Football Shoe Designs Across Europe

Sustainability trends influence consumer purchasing decisions in the Europe Football Shoes Market. Companies integrate recycled plastics, bio-based materials, and natural fibers into shoe production. Consumers increasingly prefer eco-friendly products aligned with environmental concerns. Sustainability certifications boost credibility among conscious buyers. It positions brands as leaders in responsible innovation. Retailers highlight eco-friendly lines through targeted marketing campaigns. Government initiatives supporting green manufacturing further strengthen adoption. This trend reshapes product development strategies across leading companies in the region.

- For instance, Adidas confirmed in its 2023 sustainability report that 96% of the polyester used across its global product range came from recycled sources, reinforcing its commitment to transition entirely to recycled polyester by 2025.

Rise of Digital Platforms and E-Commerce Channels for Wider Reach

Digital platforms transform the way football shoes reach consumers across Europe. E-commerce provides access to premium lines previously limited to select regions. Social media platforms showcase new releases with interactive campaigns. Virtual try-on tools and augmented reality enhance buying experiences online. It creates higher consumer confidence in digital purchases. Retailers leverage analytics to understand regional demand more effectively. Seasonal promotions on online platforms generate higher volumes of sales. Growth of e-commerce strengthens accessibility for urban and rural football enthusiasts alike.

- For example, in January 2025, Nike released the Tiempo Legend 10 Elite Luxe FG “Montebelluna” colorway (Port Wine / Bright Crimson) globally via Nike.com and select retailers. The model launched on January 28-30, 2025, produced in Montebelluna, Italy, highlighting premium craftsmanship and limited-edition status (only 5,000 pairs). It features a leather upper, metallic Swoosh, and Italian flag detailing.

Increasing Popularity of Lifestyle Integration Beyond Sporting Activities

Football shoes now appeal beyond professional use, entering lifestyle categories. Consumers wear them as fashion accessories in urban and casual contexts. Major brands launch lifestyle editions inspired by professional models. This crossover trend increases adoption among non-players seeking stylish footwear. It supports higher revenues from diversified consumer groups. Collaborations with fashion designers create limited collections that boost exclusivity. It blurs the line between sportswear and streetwear. The Europe Football Shoes Market gains a larger consumer base by appealing to style-conscious buyers.

Integration of Smart Features and Data-Driven Technologies in Footwear

Smart technologies emerge as a growing trend in football footwear innovation. Sensors embedded in shoes track speed, movement, and performance metrics. Brands integrate mobile applications to provide users with real-time insights. It appeals to professionals and hobbyists seeking performance feedback. Data analytics improves training outcomes and supports injury prevention. Partnerships between tech firms and footwear brands accelerate this innovation. Early adoption among elite athletes influences broader market penetration. This trend highlights technology as a critical growth dimension for footwear manufacturers.

Market Challenges Analysis

High Market Competition and Pricing Pressures Across Leading and Regional Brands

The Europe Football Shoes Market faces strong competition from global and regional players. Intense rivalry reduces pricing flexibility for established brands. Premium products often compete with low-cost alternatives targeting budget buyers. It creates challenges in maintaining consistent profit margins across product categories. Strong brand loyalty among consumers limits entry for emerging players. Counterfeit products add another dimension to pricing and trust concerns. Companies must balance innovation costs with affordability expectations. These pressures require strategies that focus on differentiation and unique consumer experiences.

Supply Chain Disruptions and Sustainability Compliance Requirements Increasing Costs

The football footwear industry experiences disruptions linked to raw material shortages and logistics. Supply chain volatility impacts timely product availability in different markets. Compliance with strict sustainability standards increases costs of manufacturing. It forces brands to invest in certified sourcing and green production processes. Rising labor costs in production hubs further affect profitability. Unstable economic conditions in parts of Europe influence consumer spending on non-essential goods. Brands must manage cost control while meeting sustainability expectations. These challenges slow expansion in a highly competitive market landscape.

Market Opportunities

Expansion Into Untapped Eastern European Regions With Rising Football Infrastructure

The Europe Football Shoes Market holds growth opportunities in developing Eastern European regions. Rising investments in sports infrastructure encourage wider football participation. Youth development programs in these areas expand demand for affordable and mid-range shoes. It enables brands to capture new consumers outside traditional football strongholds. Governments support initiatives for grassroots sports, strengthening accessibility for younger players. Online platforms bridge distribution gaps by reaching underserved regions. Market penetration in these areas creates fresh revenue streams for global and local brands.

Development of Innovative Materials and Customization Platforms for Broader Appeal

New material innovation offers significant opportunities for differentiation in football footwear. Research into lightweight composites and sustainable fabrics supports advanced product development. It meets consumer expectations for comfort, performance, and environmental responsibility. Customization platforms allow players to design shoes that reflect personal identity. Brands offering tailored experiences build stronger emotional connections with buyers. Growth in premium segments strengthens value creation across mature markets. The Europe Football Shoes Market benefits from aligning material innovation with lifestyle-driven demand.

Market Segmentation Analysis

By type, firm ground shoes dominate the Europe Football Shoes Market due to their versatility across natural pitches. Soft ground shoes retain relevance in regions with wet climates, while turf football shoes expand steadily with the growth of artificial playing surfaces. Indoor football shoes show consistent adoption driven by demand from urban players and small-sided leagues. It demonstrates a balanced mix of professional and recreational usage across all type categories.

- For example, in 2025, Diadora launched the Brasil Elite Tech ITA LPX, promoted as the lightest leather football boot ever produced by the brand. Crafted in Italy with premium leather and designed for firm ground play, the model highlights Diadora’s focus on combining traditional craftsmanship with lightweight innovation.

By stud segment, metal studs maintain popularity among professionals seeking grip and performance on wet grounds. Rubber studs show higher adoption across amateur players and youth leagues because of their comfort and safety. Flat sole designs grow with indoor sports culture and casual football enthusiasts. It highlights a wide distribution of consumer preferences shaped by playing conditions and skill levels.

By sales channel, retail outlets account for significant revenue with strong brand-led stores and sports retailers driving purchases. E-commerce continues to expand with growing digital adoption, personalized shopping, and wider access to limited editions. Direct-to-consumer channels strengthen brand-consumer relationships through exclusive product offerings and better engagement. It positions online and direct sales as critical growth enablers alongside traditional retail distribution.

- For instance, Puma’s Direct-to-Consumer business, covering retail and e-commerce, grew by 16.6% in 2024 on a currency-adjusted basis, with e-commerce sales alone rising 21.1%, according to the company’s audited annual filings.

Segmentation

By Type Segment

- Soft Ground

- Firm Ground

- Turf Football

- Indoor Football

By Stud Segment

- Metal Studs

- Rubber Studs

- Flat Sole

By Sales Channel Segment

- Retail Channels

- E-commerce

- Direct to Consumer

By Country Segment (Europe Scope)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis

Western Europe

Western Europe dominates the Europe Football Shoes Market with a 45% share, led by Germany, the U.K., and France. Strong football traditions and established professional leagues sustain high consumer demand. Investments in youth academies and grassroots programs increase penetration of premium products. High disposable incomes allow consumers to adopt innovative and customized footwear. Sponsorship deals and frequent product launches further strengthen market presence. It maintains leadership through advanced retail networks and strong brand positioning.

Southern Europe

Southern Europe accounts for 30% of the Europe Football Shoes Market, with Italy and Spain as key contributors. The popularity of local clubs and international tournaments fuels steady product adoption. Consumers show strong interest in stylish and performance-driven shoes, reflecting both lifestyle and sporting use. Increasing youth participation strengthens demand for mid-range categories. Tourism-driven retail sales support higher seasonal consumption of sports gear. It benefits from a vibrant football culture and widespread club loyalty across the region.

Eastern and Northern Europe

Eastern and Northern Europe together represent 25% of the Europe Football Shoes Market. Eastern Europe is emerging, with Russia and Poland expanding through sports infrastructure projects. Growing disposable incomes encourage adoption of branded products in urban centers. Northern Europe, including Scandinavia, focuses on performance and sustainability in footwear. Consumers favor eco-friendly innovations and technologically advanced products. It shows potential for steady growth driven by increased investments in training and facilities. Expanding e-commerce channels also support greater accessibility in these subregions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Nike Inc.

- Adidas AG

- Puma SE

- Umbro

- Mizuno

- Lotto Sport Italia

- New Balance

- KEEZA

- Skechers

- Sokito

- Other Key Players

Competitive Analysis

The Europe Football Shoes Market is highly competitive, with global brands and regional companies targeting diverse consumer segments. Nike, Adidas, and Puma dominate the market through strong product portfolios, athlete endorsements, and wide distribution networks. Their consistent focus on innovation and marketing helps retain market leadership. Smaller players like Mizuno, Lotto Sport Italia, and Umbro maintain relevance through niche positioning and heritage-based appeal. New entrants such as Sokito and KEEZA emphasize sustainability and affordability, capturing attention in specific demographics. It remains a competitive space where differentiation through design, technology, and digital engagement plays a vital role. Mergers, sponsorships, and product launches continue to define competitive strategies in this market.

Recent Developments

- In September 2025, Adidas AG advanced its partnership efforts in the French market by collaborating with lifestyle brand Kith. On September 19, 2025, they jointly released the “Kith for adidas Football Fall 2025” collection, which blends sports and streetwear fashion for French consumers seeking exclusive, collaborative football footwear drops.

- In June 2025, Nike Inc. launched the highly anticipated France National Team kit for the Women’s Euro 2025, presenting a bold statement in innovation, self-expression, and athletic performance. This kit features Nike’s advanced Dri-FIT ADV technology, state-of-the-art body-mapping, and the use of sustainable materials like Nike Grind, developed from recycled production waste, old sneakers, and unsold footwear.

- In March 2025, Adidas AG released the special Adidas 11Pure 2025 football boots, featuring a maroon colorway and a Taurus leather upper. This model marks a nostalgic nod to the classic 11Pro boot, combined with a modern Copa Pure soleplate, and celebrates Toni Kroos’ retirement by renaming the Adipure 11Pro as TKPro. The new design became available on March 4, 2025, aligning with elevated demand from the French football community for innovative materials and fit.

- In March 2025, Puma SE completed a significant share buyback program, acquiring over 2.8 million shares for approximately €100 million, signaling financial restructuring and strengthening of company equity. In early 2025, Puma launched its largest brand campaign, “Go Wild,” and became the official partner of the English Premier League, reinforcing its influence within football culture.

- In January 2025, Nike unveiled the Tiempo Legend X ‘Luxe’ football boots inspired by Italian football icon Andrea Pirlo, continuing its tradition of premium craftsmanship at the Montebelluna factory in Italy. The design honors Pirlo’s reputation for elegance on the pitch and incorporates unique references to Italian culture, including a special wine-inspired colorway and details like the Italian flag embroidered on the sock lining.

Report Coverage

The research report offers an in-depth analysis based on Type, Stud and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising grassroots programs across Europe will expand youth adoption of professional-grade footwear.

- Lifestyle integration will broaden demand as football shoes gain traction in casual fashion markets.

- Technological innovation in materials will strengthen product differentiation and performance features.

- Digital sales channels will capture larger shares through online customization and direct consumer access.

- Regional expansion in Eastern Europe will create opportunities as sports infrastructure continues to grow.

- Sustainability initiatives will influence product development, with eco-friendly lines gaining higher visibility.

- Brand collaborations with athletes and clubs will intensify competition for consumer loyalty.

- Demand for mid-range shoes will increase, supported by wider affordability and accessibility.

- Smart features integrated into footwear will reshape training and performance analysis across consumer levels.

- The Europe Football Shoes Market will remain dynamic, driven by innovation, consumer engagement, and regional diversity.