Market Overview

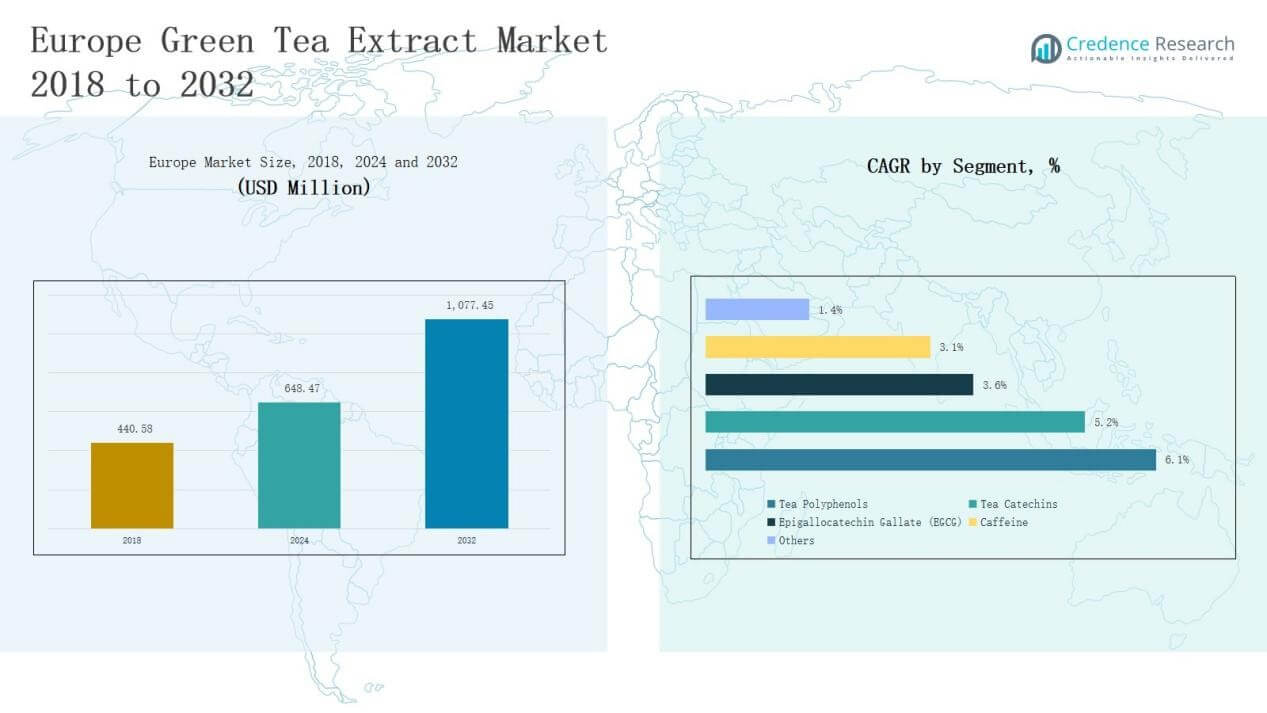

Europe Green Tea Extract Market size was valued at USD 440.58 million in 2018, reaching USD 648.47 million in 2024, and is anticipated to attain USD 1,077.45 million by 2032, at a CAGR of 6.02% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Green Tea Extract Market Size 2024 |

USD 648.47 Million |

| Europe Green Tea Extract Market, CAGR |

6.02% |

| Europe Green Tea Extract Market Size 2032 |

USD 1,077.45 Million |

The Europe Green Tea Extract Market is highly competitive, with leading players including Tate & Lyle PLC, MartinBauer Group, DSM Nutritional Products, Givaudan, and Unilever’s Lipton brand, supported by regional specialists such as Pukka Herbs, Clipper Teas, Yogi Tea Europe GmbH, Nexira, Naturex SA, Pierre Fabre Group, Arkopharma, and Robertet Group. These companies focus on product innovation, sustainable sourcing, and expanding applications across nutraceuticals, functional beverages, and cosmetics to strengthen market presence. Regionally, Germany leads with a 34% share in 2024, driven by strong nutraceutical adoption, advanced retail infrastructure, and increasing consumer demand for clean-label, premium formulations.

Market Insights

- The Europe Green Tea Extract Market grew from USD 440.58 million in 2018 to USD 648.47 million in 2024 and is projected to reach USD 1,077.45 million by 2032.

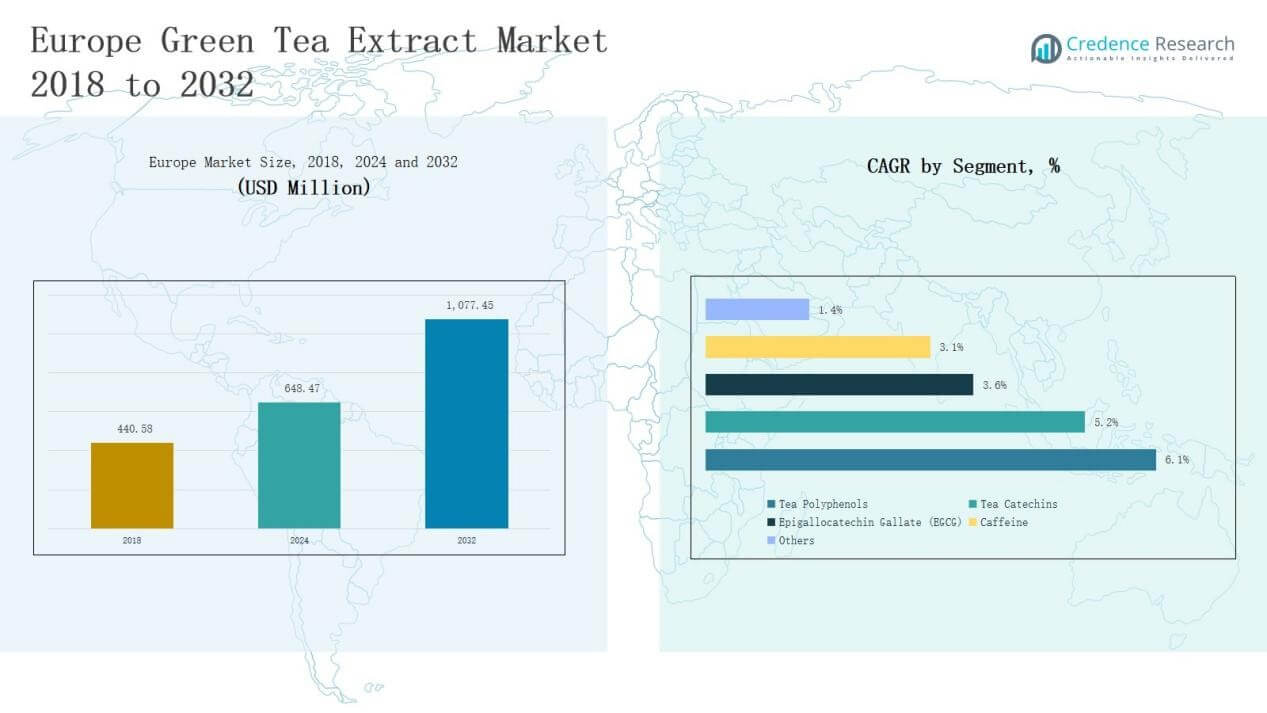

- Tea Catechins lead the market with a 38% share in 2024, driven by strong demand in nutraceuticals and beverages for their antioxidant, weight management, and anti-aging benefits.

- Powder form dominates with a 46% share in 2024, supported by its stability, longer shelf life, solubility, and widespread use across supplements, functional foods, and cosmetics.

- Nutraceuticals & Dietary Supplements hold the largest application share at 41% in 2024, boosted by rising health awareness, EGCG-rich formulations, and preventive healthcare adoption in Europe.

- Germany leads regionally with 34% share in 2024, followed by the United Kingdom at 28%, France at 19%, Italy at 12%, and Rest of Europe at 7%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Tea Catechins dominate the Europe Green Tea Extract Market with a 38% share in 2024, supported by their wide recognition as natural antioxidants with proven health benefits. They are increasingly used in cardiovascular health, weight management, and anti-aging solutions, making them the preferred ingredient across nutraceuticals and beverages. Growing consumer demand for clean-label products and functional ingredients has further fueled catechin adoption, while expanding clinical evidence supporting their efficacy continues to strengthen this segment’s market leadership.

For instance, Kemin Industries Europe launched green tea-derived functional ingredients under its Phenolic Antioxidants portfolio, targeting clean-label beverage fortification and anti-aging solutions.

By Form

Powder form leads the Europe market with a 46% share in 2024, reflecting its versatility and strong demand from food, nutraceutical, and cosmetic industries. Powdered extracts are widely favored due to their stability, ease of transport, and longer shelf life compared to liquid or capsule alternatives. They offer excellent solubility in formulations, making them suitable for beverages, supplements, and functional foods. Rising application in sports nutrition and fortified food categories has reinforced powdered extracts as the most dominant form in Europe.

For instance, Nestlé Health Science expanded its Optifast powdered meal replacement range in Europe, highlighting demand for convenient, protein-rich nutrition in weight management and sports categories.

By Application

Nutraceuticals & Dietary Supplements remain the largest application segment, accounting for 41% of the Europe Green Tea Extract Market in 2024. This dominance is driven by rising consumer preference for natural supplements targeting weight management, immunity boosting, and overall wellness. Growing demand for EGCG-rich formulations in capsule and powder formats has strengthened the role of green tea extracts in preventive healthcare. Increasing health awareness, coupled with Europe’s aging population, continues to support strong growth momentum within the nutraceuticals segment.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Nutraceuticals and Functional Foods

The growing consumer shift toward preventive healthcare is a primary driver of the Europe Green Tea Extract Market. Nutraceuticals and functional foods enriched with green tea extracts are gaining traction due to their antioxidant, anti-inflammatory, and weight management benefits. Rising cases of lifestyle-related diseases, combined with increasing consumer preference for natural and plant-based products, are accelerating demand. This trend is particularly strong in developed European countries, where health-conscious consumers are seeking supplements that align with clean-label and organic claims.

For instance, Arkopharma launched green-tea-extract-based weight management capsules in France under its Arkocaps line, responding to growing demand for plant-based and clean-label dietary supplements.

Expanding Applications in Cosmetics and Personal Care

Green tea extract has become a critical ingredient in cosmetics due to its anti-aging, anti-inflammatory, and skin-protective properties. Growing consumer focus on natural skincare and rising demand for herbal beauty products are boosting market expansion. Major European cosmetic brands increasingly incorporate EGCG-rich formulations into facial creams, serums, and hair care products to appeal to eco-conscious consumers. Regulatory encouragement for safer, plant-derived cosmetic ingredients is further driving adoption. This diversification of applications ensures steady demand beyond traditional nutraceutical and food categories.

For instance, Beiersdorf’s Nivea introduced a Naturally Good Green Tea Face Cream in Germany, formulated with green tea extract to address consumer demand for sustainable, plant-based ingredients.

Strong R&D Investments and Product Innovation

Continuous investments in research and development by both multinational players and regional firms are fueling innovation in Europe’s green tea extract market. Companies are focusing on developing high-purity extracts, EGCG-enriched products, and sustainable sourcing practices to meet evolving consumer expectations. Partnerships between research institutions and nutraceutical companies are also contributing to new clinical validations, enhancing consumer trust. The emphasis on customized formulations, such as capsules, functional beverages, and powders, strengthens market penetration across diverse applications while ensuring long-term growth momentum.

Key Trends & Opportunities

Clean-Label and Organic Product Preference

European consumers increasingly favor clean-label and organic products, creating opportunities for green tea extract producers. Extracts marketed as non-GMO, sustainably sourced, and free from synthetic additives are enjoying strong growth across nutraceuticals, food, and cosmetics. Manufacturers investing in organic-certified extracts are well-positioned to capture premium segments. With rising demand for transparency and traceability in sourcing, brands emphasizing sustainability and ethical practices are expected to gain consumer trust, strengthening their competitive edge in the European marketplace.

For instance, Taiyo GmbH introduced its Sunphenon organic green tea extract range in Europe, emphasizing EU-organic certification and clean-label positioning for functional beverages.

Growth in Functional Beverages Market

The functional beverages sector in Europe presents a strong opportunity for green tea extract integration. Rising consumer preference for ready-to-drink teas, energy drinks, and wellness beverages enriched with catechins and EGCG is boosting demand. Health-conscious millennials and urban consumers are driving this shift, seeking convenient formats for daily nutrition. Manufacturers are increasingly collaborating with beverage brands to introduce innovative, plant-based drinks with added health benefits. This trend highlights the potential of green tea extracts to expand further in Europe’s dynamic beverage industry.

For instance, At Vitafoods Europe 2024, Indena, in partnership with dsm-firmenich, showcased new dietary supplements combining botanicals with biotics. These products target gut health, brain health, and healthy aging and were presented in easy-to-use formats like gummies and oral dispersible granules.

Key Challenges

High Production and Extraction Costs

One of the major challenges in the Europe Green Tea Extract Market is the high cost of production and extraction. Advanced processing techniques required to preserve active compounds like EGCG significantly increase expenses. Sourcing high-quality raw materials further adds to operational costs, especially for organic-certified products. These higher costs often lead to premium pricing, which can restrict accessibility among price-sensitive consumers. Companies face the dual challenge of balancing affordability with quality while maintaining competitiveness in both domestic and export markets.

Regulatory Compliance and Quality Standards

Stringent regulations across Europe regarding dietary supplements, food additives, and cosmetic ingredients pose challenges for green tea extract manufacturers. Compliance with European Food Safety Authority (EFSA) and other regional standards requires significant documentation, testing, and approval timelines. Variations in labeling, dosage restrictions, and health claims across different countries further complicate market entry. Non-compliance risks include product recalls, fines, and reputational damage. Companies must continually invest in quality assurance, certifications, and regulatory expertise to maintain credibility and ensure long-term success.

Market Saturation and Intense Competition

The Europe Green Tea Extract Market faces growing competition from multinational corporations and specialized regional players. Established companies dominate through broad product portfolios, advanced research capabilities, and strong distribution networks, making it difficult for smaller players to gain share. Market saturation in mature countries such as Germany, the UK, and France further intensifies competition, forcing companies to differentiate through innovation or pricing strategies. This competitive pressure often limits margins, creating challenges for sustainable growth in a crowded market landscape.

Regional Analysis

Germany

Germany holds a 34% share of the Europe Green Tea Extract Market in 2024, making it the regional leader. Strong consumer preference for nutraceuticals and functional foods drives growth. The country benefits from advanced retail infrastructure and a health-conscious population that values clean-label products. Pharmaceutical and dietary supplement companies continue to integrate high-purity catechins and EGCG into formulations, reinforcing Germany’s market dominance. Regulatory clarity and established quality standards also encourage innovation. German cosmetic brands further expand usage, ensuring diverse applications for sustained demand.

United Kingdom

The United Kingdom captures a 28% share of the market in 2024, supported by strong demand for nutraceuticals, functional beverages, and herbal teas. Established companies such as Twinings and Unilever’s Lipton brand strengthen the segment through wide distribution and product variety. Consumer awareness of preventive health and preference for organic products enhances growth. The UK also benefits from advanced R&D facilities and regulatory frameworks that encourage natural ingredient adoption. Cosmetics and personal care segments add momentum, widening the market scope.

France

France accounts for a 19% share of the market in 2024, reflecting its strong tradition of herbal wellness and natural product consumption. French companies emphasize sustainable sourcing and innovation across food, nutraceutical, and cosmetic sectors. Demand for green tea extracts in dietary supplements and beauty products continues to grow, supported by rising awareness of skin health and aging concerns. Northern France plays a pivotal role with robust retail and R&D infrastructure. Domestic players compete effectively alongside multinational corporations, ensuring steady expansion.

Italy

Italy holds a 12% share of the Europe Green Tea Extract Market in 2024, supported by rising health consciousness and interest in premium wellness products. Northern Italy drives most of the demand due to strong retail penetration and consumer preference for high-quality, organic formulations. Pharmaceutical and nutraceutical companies adopt EGCG-rich extracts to meet growing demand for natural healthcare products. Italian cosmetic brands also highlight green tea extracts in skincare applications, widening usage. Local firms compete with multinational players through specialized, innovative extracts.

Rest of Europe

The Rest of Europe contributes a 7% share in 2024, covering Spain, the Netherlands, and other regional markets. Growth is supported by increasing adoption of functional foods, beverages, and dietary supplements. Rising disposable income and awareness of natural wellness products help expand demand across these countries. Cosmetics and personal care segments show significant growth potential, particularly in Spain. Smaller domestic producers also focus on sustainable, organic offerings to compete with multinational firms. Although smaller in size, the region represents emerging opportunities.

Market Segmentations:

By Product Type

- Tea Catechins

- Epigallocatechin Gallate (EGCG)

- Polyphenols

- Others

By Form

- Powder

- Liquid

- Capsule/Tablets

By Application

- Pharmaceuticals

- Nutraceuticals & Dietary Supplements

- Food & Beverages

- Cosmetics & Personal Care

- Others

By Distribution Channel

- Online Stores

- Specialty Stores

- Supermarkets/Hypermarkets

- Pharmacies

- Others

By Region

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Competitive Landscape

The Europe Green Tea Extract Market is highly competitive, shaped by the presence of multinational corporations and strong regional specialists. Leading players such as Tate & Lyle, MartinBauer Group, DSM Nutritional Products, Givaudan, and Unilever’s Lipton brand dominate with extensive product portfolios, global distribution networks, and advanced research capabilities. Regional players including Pukka Herbs, Clipper Teas, and Yogi Tea Europe GmbH enhance competition by focusing on organic, clean-label, and sustainably sourced extracts that appeal to health-conscious consumers. Companies invest heavily in product innovation, clinical validation, and eco-friendly sourcing to strengthen market positioning. Strategic collaborations with pharmaceutical, nutraceutical, and cosmetic firms further expand applications across dietary supplements, functional beverages, and personal care. Growing demand for EGCG-rich and high-purity formulations has led to intensified R&D investments, while competitive pricing and private-label growth in retail channels continue to challenge established brands. This dynamic landscape fosters innovation and ensures consistent market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Tate & Lyle PLC

- Twinings

- Unilever (Lipton brand)

- MartinBauer Group

- DSM Nutritional Products

- Givaudan

- Nexira

- Naturex SA

- Pierre Fabre Group

- Arkopharma

- Robertet Group

- Sensient Technologies

- Pukka Herbs

- Clipper Teas

- Yogi Tea Europe GmbH

- Finlays

Recent Developments

- In October 2024, PLT Health Solutions added Cellflo6, a patented green tea extract, to its portfolio to support energy, sports performance, and overall wellness with applications in beverages and dietary supplements.

- In July 2024, the RASFF (EU safety alert system) flagged a supplement from Germany for missing mandatory labelling of EGCG in green tea extract. ss

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for nutraceuticals will continue driving adoption of green tea extracts across Europe.

- Functional beverages will expand as a major application segment supported by health-conscious consumers.

- Cosmetic brands will increasingly integrate green tea extracts in skincare and haircare products.

- Organic and clean-label extracts will gain stronger consumer preference across multiple product categories.

- Pharmaceutical applications will grow with rising research on therapeutic benefits of catechins and EGCG.

- Retail and e-commerce channels will enhance accessibility, strengthening sales in both urban and rural markets.

- Private-label brands will intensify competition by offering affordable green tea extract-based products.

- Sustainability and traceability in sourcing will become critical factors influencing consumer trust.

- Innovation in high-purity and customized formulations will shape new growth opportunities for manufacturers.

- Emerging regions within Europe will witness higher adoption, widening the overall market base.

Key Growth Drivers

Key Growth Drivers