Market Overview

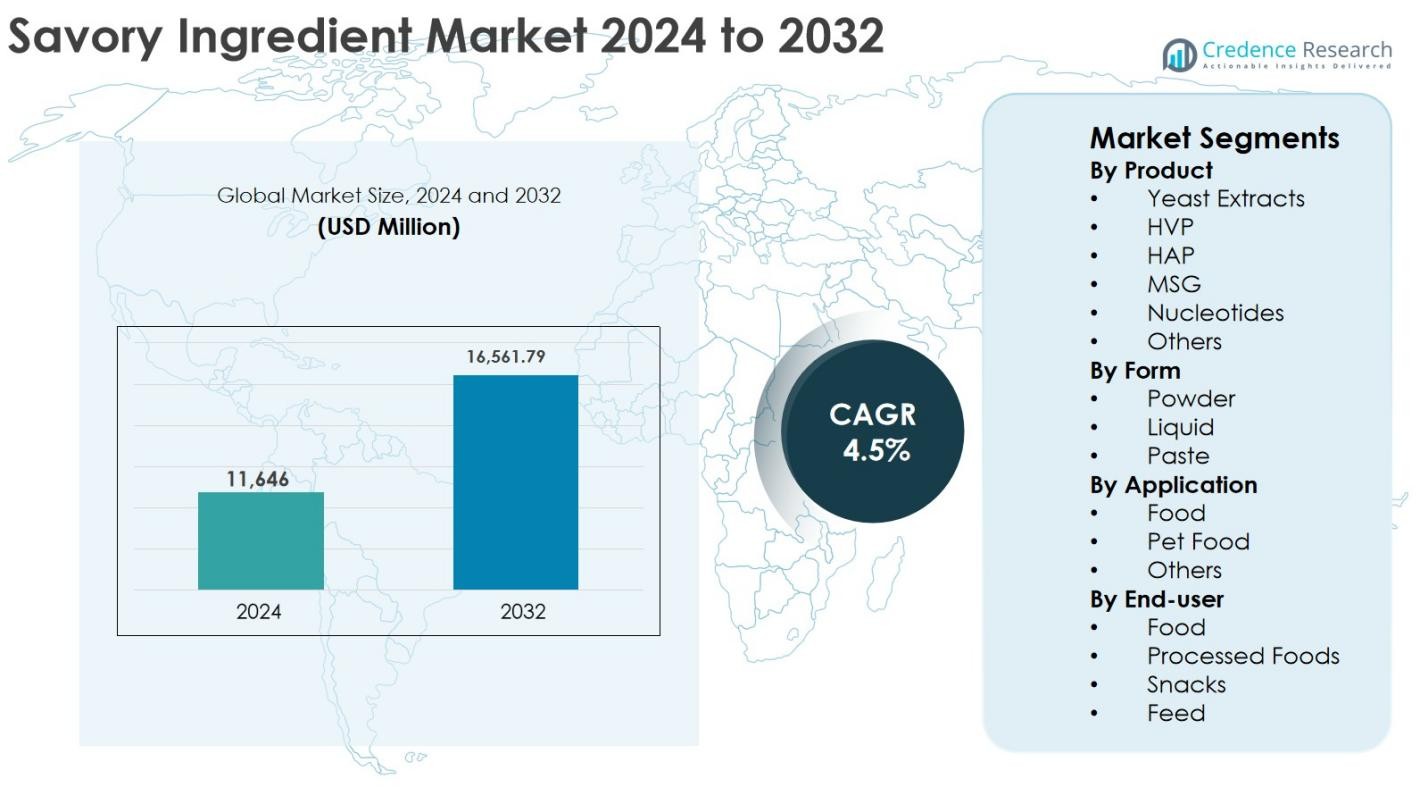

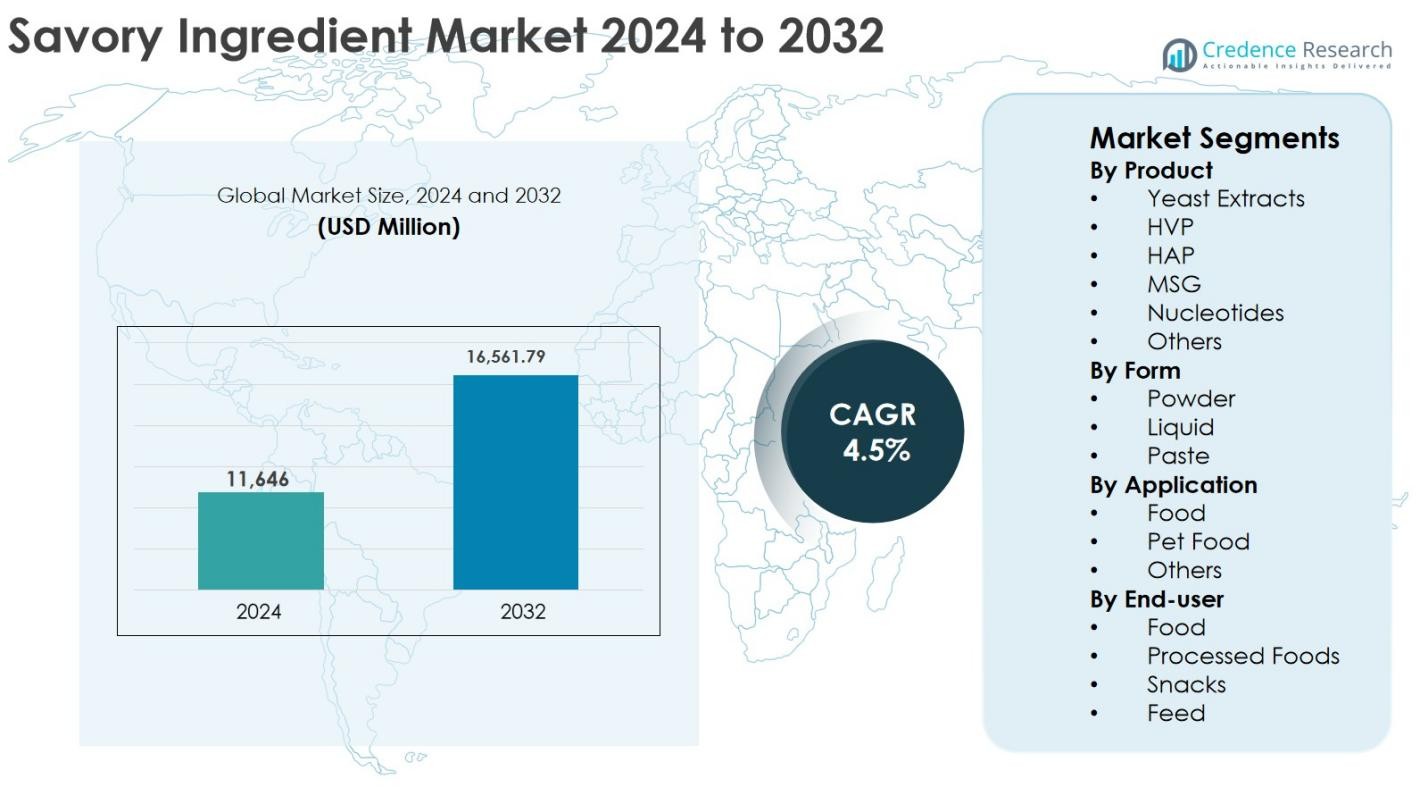

The Savory Ingredient Market size was valued at USD 11,646 million in 2024 and is anticipated to reach USD 16,561.79 million by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Savory Ingredient Market Size 2024 |

USD 11,646 Million |

| Savory Ingredient Market, CAGR |

4.5% |

| Savory Ingredient Market Size 2032 |

USD 16,561.79 Million |

The Savory Ingredient Market is driven by the strong presence of established global players including Ajinomoto Co., Inc., Kerry Group plc, Givaudan, Symrise, Tate & Lyle, Sensient Technologies Corporation, Lesaffre, AngelYeast Co., Vedan International (Holdings) Ltd., and Diana Group S.r.l. These companies focus on fermentation-based innovation, clean-label solutions, and customized flavor systems to address evolving food and pet food applications. Asia-Pacific emerged as the leading region, accounting for 32.8% market share in 2024, supported by high consumption of savory foods and large-scale food processing activities. North America followed with 28.6% share, driven by clean-label adoption and premium food demand, while Europe held 26.4% share, supported by stringent regulations and sodium reduction initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Savory Ingredient Market was valued at USD 11,646 million in 2024 and is projected to reach USD 16,561.79 million by 2032, registering a CAGR of 4.5% during the forecast period, supported by steady demand from food and pet food applications.

- Market growth is primarily driven by rising consumption of processed and convenience foods, clean-label reformulation, and sodium reduction initiatives, with yeast extracts emerging as the dominant product segment holding 34.8% share in 2024 due to natural positioning and umami enhancement.

- Key market trends include increased adoption of fermentation-based ingredients and strong demand from plant-based foods, while powder form dominates the market with 58.6% share owing to ease of storage, longer shelf life, and wide applicability in seasonings and snacks.

- The market landscape is shaped by players such as Ajinomoto, Kerry Group, Givaudan, Symrise, and Tate & Lyle, focusing on product innovation, sustainable sourcing, and customized flavor solutions for food and pet nutrition.

- Regionally, Asia-Pacific leads with 32.8% market share, followed by North America at 28.6% and Europe at 26.4%, while Latin America and Middle East & Africa collectively account for the remaining share, supported by growing food processing activities.

Market Segmentation Analysis:

By Product

The By Product segment in the Savory Ingredient Market is led by Yeast Extracts, which accounted for 34.8% market share in 2024, driven by strong demand for clean-label, natural flavor enhancers. Yeast extracts offer umami intensity while supporting reduced sodium formulations, making them highly preferred in processed foods and snacks. MSG held a notable share due to its cost efficiency and flavor strength, particularly in emerging markets. Meanwhile, nucleotides and HVP are gaining traction in premium and plant-based formulations, supported by rising demand for flavor complexity and taste optimization.

- For instance, Nestlé has highlighted the use of yeast extract in its Maggi bouillon and culinary products to deliver umami taste while enabling salt reduction in line with its sodium-cut targets.

By Form

The By Form segment is dominated by Powder, capturing 58.6% of the market share in 2024, owing to its superior shelf life, ease of handling, and compatibility with dry food processing. Powdered savory ingredients are widely used in seasonings, instant foods, and snack applications, supporting consistent flavor distribution. Liquid forms are increasingly adopted in sauces, soups, and ready-to-eat meals due to better solubility and flavor dispersion. Paste forms maintain a smaller share, mainly used in specialty culinary and industrial food formulations requiring concentrated flavor profiles.

- For instance, PepsiCo’s Lay’s and Doritos ranges rely on dry seasoning powders to deliver uniform flavor coating on snacks at high production speeds.

By Application

The By Application segment is primarily driven by Food, which accounted for 72.4% market share in 2024, supported by rising consumption of processed foods, ready meals, and savory snacks globally. Food manufacturers increasingly rely on savory ingredients to enhance taste while meeting clean-label and reduced-sodium requirements. Pet Food represents a fast-growing sub-segment, fueled by premiumization trends and higher spending on palatability-enhancing ingredients. Other applications, including foodservice and industrial uses, contribute steadily, supported by expanding urban populations and evolving dietary preferences.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The Savory Ingredient Market is significantly driven by the growing consumption of processed, packaged, and convenience foods worldwide. Urbanization, increasing disposable incomes, and busy lifestyles have accelerated demand for ready-to-eat meals, instant snacks, soups, sauces, and frozen foods. Savory ingredients such as yeast extracts, MSG, and HVP are essential for enhancing taste, aroma, and mouthfeel while ensuring consistency at scale. Food manufacturers increasingly depend on these ingredients to differentiate products and meet consumer expectations for bold flavors. Expansion of organized retail, private-label brands, and quick-service restaurants further strengthens demand across both developed and emerging economies.

- For instance, Ajinomoto highlights that its umami seasonings and MSG-based products are widely used in instant noodles, frozen foods, and snacks across Asia and Latin America to deliver intense flavor with consistent quality.

Clean-Label Movement and Sodium Reduction Initiatives

Rising health awareness and regulatory pressure to reduce sodium intake are key growth drivers in the Savory Ingredient Market. Food manufacturers are reformulating products to achieve sodium reduction without compromising flavor quality, driving adoption of yeast extracts, nucleotides, and naturally derived savory enhancers. Clean-label positioning, transparent ingredient lists, and reduced reliance on artificial additives are becoming critical purchasing criteria. This driver is particularly strong in North America and Europe, where regulatory oversight and consumer scrutiny are high. As demand for healthier yet flavorful foods continues to rise, clean-label savory ingredients remain central to product innovation.

- For instance, Unilever has public sodium-reduction targets and uses flavor enhancers, including yeast extracts, across brands like Knorr to support lower-salt recipes that still deliver strong savory taste.

Expansion of Pet Food and Animal Nutrition Applications

The rapid expansion of the global pet food industry is emerging as a strong growth driver for the Savory Ingredient Market. Increasing pet ownership, premiumization of pet diets, and growing focus on palatability have boosted demand for flavor-enhancing ingredients. Savory ingredients improve taste acceptance and aroma in dry and wet pet food formulations, supporting repeat purchases. Manufacturers increasingly use yeast extracts and natural flavor enhancers to align with clean-label trends in pet nutrition. Growth in organized pet care retail and veterinary-recommended diets continues to expand application opportunities.

Key Trends & Opportunities

Innovation in Natural and Fermentation-Based Ingredients

Innovation in fermentation-based and naturally sourced savory ingredients is a key trend shaping the Savory Ingredient Market. Companies are investing in advanced fermentation technologies to develop yeast extracts and nucleotides with enhanced umami profiles and functional benefits. These innovations support clean-label positioning while enabling customization for low-sodium and plant-based formulations. Improved strain selection, sustainable processing, and efficiency gains are creating opportunities for differentiated products. As consumers increasingly associate fermentation with authenticity and health, manufacturers adopting these technologies gain stronger market acceptance and long-term growth potential.

- For instance, DSM-Firmenich has developed next-generation Maxarome yeast extracts produced via controlled fermentation to deliver specific umami and kokumi profiles tailored to soups, snacks, and meat alternatives.

Rising Adoption of Plant-Based and Alternative Protein Foods

The accelerating growth of plant-based and alternative protein foods presents a major opportunity for savory ingredient manufacturers. These products require advanced flavor systems to replicate meat-like taste and texture, increasing demand for savory enhancers. Yeast extracts, HVP, and nucleotides help mask off-notes and enhance umami in plant-based meats, dairy alternatives, and vegan snacks. Growing flexitarian populations and expanding plant-based portfolios across global food brands continue to drive demand. This trend is particularly prominent in Europe and North America and is expanding rapidly in Asia-Pacific.

- For instance, Givaudan has developed dedicated flavoring approaches and solutions such as its PrimeLock+ technology to bridge the taste gap in plant-based meat alternatives by enhancing juiciness, fat perception, and savory impact in pea- and soy-based products.

Key Challenges

Volatility in Raw Material Prices and Supply Chains

The Savory Ingredient Market faces challenges related to volatility in raw material prices and supply chain disruptions. Key inputs such as yeast, corn, and wheat are subject to fluctuations caused by climate conditions, agricultural yields, and global trade uncertainties. Rising energy and transportation costs further pressure production economics. These factors impact pricing stability and profit margins, particularly for small and mid-sized manufacturers. Managing long-term supply contracts while maintaining competitive pricing remains a persistent challenge across the market.

Regulatory Scrutiny and Consumer Perception Concerns

Regulatory complexity and consumer perception issues pose notable challenges for the Savory Ingredient Market. Ingredients such as MSG and hydrolyzed proteins continue to face skepticism in certain regions due to health-related misconceptions. Varying labeling standards, allergen regulations, and ingredient classifications across countries increase compliance costs for manufacturers. Negative consumer sentiment can limit adoption in specific applications. To address these concerns, companies must invest in transparent labeling, reformulation, and consumer education, which can slow product development and increase operational complexity.

Regional Analysis

North America

North America accounted for 28.6% of the Savory Ingredient Market share in 2024, supported by strong demand for processed foods, snacks, and ready-to-eat meals. The region benefits from high consumer awareness regarding clean-label products and sodium reduction, driving adoption of yeast extracts and natural flavor enhancers. The United States dominates regional demand due to advanced food processing infrastructure and continuous product innovation by major manufacturers. Growth in premium pet food and plant-based food categories further supports market expansion. Strong regulatory frameworks and focus on transparent labeling continue to shape product development strategies across the region.

Europe

Europe held 26.4% market share in 2024, driven by stringent food regulations, rising clean-label adoption, and increasing preference for natural savory ingredients. Countries such as Germany, France, and the United Kingdom lead demand due to mature food processing industries and strong consumption of soups, sauces, and bakery products. Sodium reduction initiatives across the region significantly boost the use of yeast extracts and nucleotides. The growing plant-based food sector also supports demand for advanced savory solutions. High consumer focus on sustainability and ingredient transparency continues to influence formulation trends and long-term market growth in Europe.

Asia-Pacific

Asia-Pacific dominated the Savory Ingredient Market with 32.8% market share in 2024, driven by large population base, rising urbanization, and strong consumption of savory foods. China, Japan, and Southeast Asian countries are key contributors due to widespread use of MSG and umami-rich ingredients in traditional and processed foods. Rapid expansion of packaged food manufacturing, foodservice outlets, and instant food categories supports sustained growth. Increasing disposable incomes and westernization of diets further accelerate demand. The region also benefits from strong local production capabilities and growing investments in fermentation-based ingredient innovation.

Latin America

Latin America accounted for 7.1% of the global market share in 2024, supported by rising consumption of processed foods and expanding retail food distribution networks. Countries such as Brazil and Mexico lead regional demand due to growing urban populations and increasing preference for convenience foods. Savory ingredients are widely used in snacks, seasonings, and ready meals to enhance flavor affordability. Growth in the regional pet food industry also contributes to market expansion. However, price sensitivity and economic fluctuations influence adoption rates, encouraging manufacturers to focus on cost-effective savory solutions.

Middle East & Africa

The Middle East & Africa region represented 5.1% market share in 2024, supported by increasing demand for packaged foods and expanding foodservice sectors. Urbanization, population growth, and rising tourism activity drive consumption of savory-flavored foods across Gulf countries. Adoption of savory ingredients is growing in soups, sauces, and meat-based products to enhance taste consistency. In Africa, improving food processing capabilities and rising disposable incomes support gradual market growth. While the market remains smaller compared to other regions, increasing investments in food manufacturing and retail infrastructure present long-term growth opportunities.

Market Segmentations:

By Product

- Yeast Extracts

- HVP

- HAP

- MSG

- Nucleotides

- Others

By Form

By Application

By End-user

- Food

- Processed Foods

- Snacks

- Feed

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Savory Ingredient Market features a well-established competitive landscape characterized by the presence of global ingredient manufacturers and specialized flavor solution providers. Leading companies such as Ajinomoto Co., Inc., Kerry Group plc, Givaudan, Symrise, Tate & Lyle, Sensient Technologies Corporation, Lesaffre, AngelYeast Co., Vedan International (Holdings) Ltd., and Diana Group S.r.l. play a pivotal role in shaping market dynamics. These players focus on product innovation, clean-label solutions, and fermentation-based technologies to strengthen their portfolios. Strategic investments in research and development enable the introduction of customized savory profiles for food, pet food, and plant-based applications. Geographic expansion, capacity enhancement, and partnerships with food manufacturers remain key strategies to improve market reach. Additionally, companies emphasize sustainability, sodium reduction, and natural ingredient sourcing to align with evolving consumer preferences and regulatory requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Symrise

- AngelYeast Co.

- Tate & Lyle

- Givaudan

- Diana Group S.r.l

- Kerry Group plc

- Ajinomoto Co., Inc.

- Lesaffre

- Sensient Technologies Corporation

- Vedan International (Holdings) Ltd.

Recent Developments

- In October 2025, Herbal Isolates, part of Synthite Group, launched a new flavor-enhancing sub-brand called Savouron, expanding its portfolio of savory ingredient solutions including flavor enhancers, dairy and fat systems, and specialty powders targeting broader food applications

- In January 2025, Solina, a global savory food solutions company, completed the acquisition of Advanced Food Systems, Inc. based in Somerset, New Jersey, strengthening its savory ingredient capabilities and footprint in the U.S. market.

- In 2024 , Lesaffre announced the acquisition of a majority stake in Biorigin, enhancing its savory ingredients offering especially yeast derivatives by integrating Biorigin’s production and technology into its global supply chain.

Report Coverage

The research report offers an in-depth analysis based on Product, Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Savory Ingredient Market will continue to benefit from steady growth in processed, packaged, and convenience food consumption across global markets.

- Demand for clean-label and naturally derived savory ingredients will intensify as consumers prioritize health, transparency, and ingredient simplicity.

- Yeast extracts and fermentation-based ingredients will gain wider adoption due to their ability to enhance flavor while supporting sodium reduction.

- Expansion of plant-based and alternative protein foods will drive increased use of savory ingredients to improve taste and mouthfeel.

- The pet food segment will remain a strong growth contributor as premiumization and focus on palatability increase.

- Manufacturers will invest more in research and development to create customized and application-specific savory solutions.

- Powdered savory ingredients will maintain dominance due to ease of handling, storage stability, and broad applicability.

- Asia-Pacific will remain the leading growth region, supported by population growth, urbanization, and evolving dietary patterns.

- Strategic partnerships, capacity expansions, and geographic diversification will shape competitive positioning.

- Regulatory compliance and sustainability initiatives will increasingly influence product development and sourcing strategies.