Market Overview

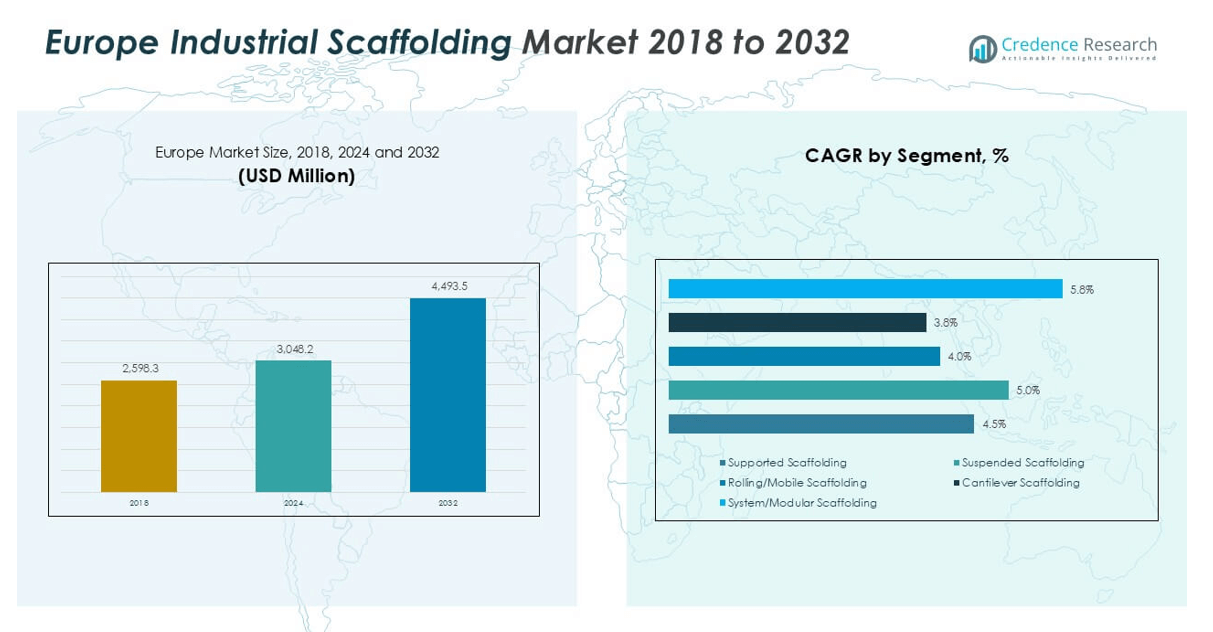

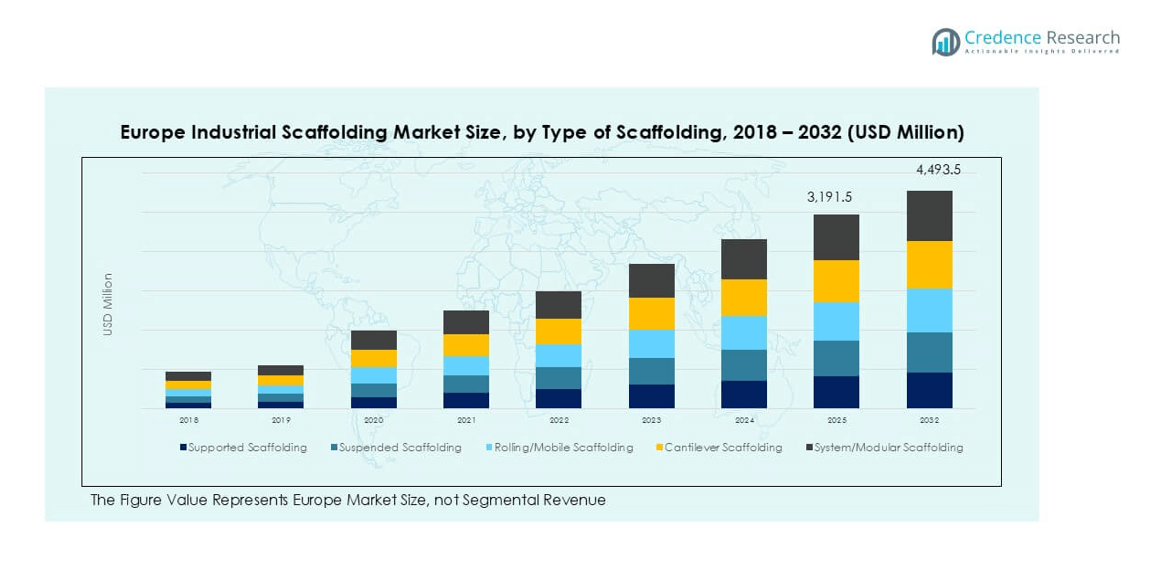

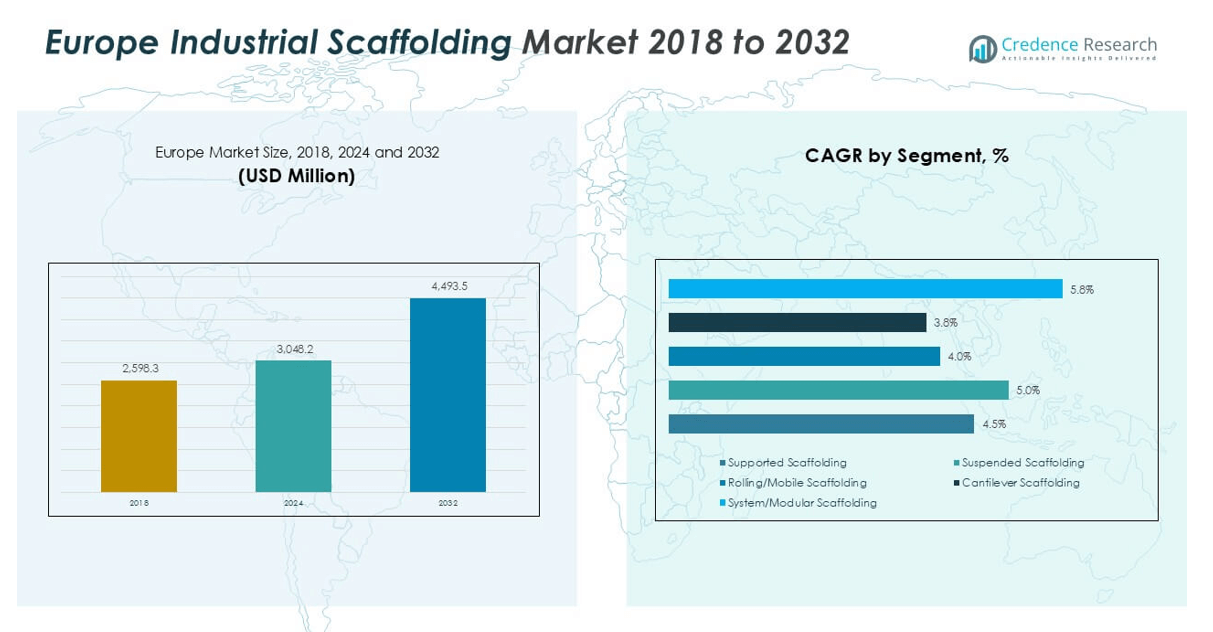

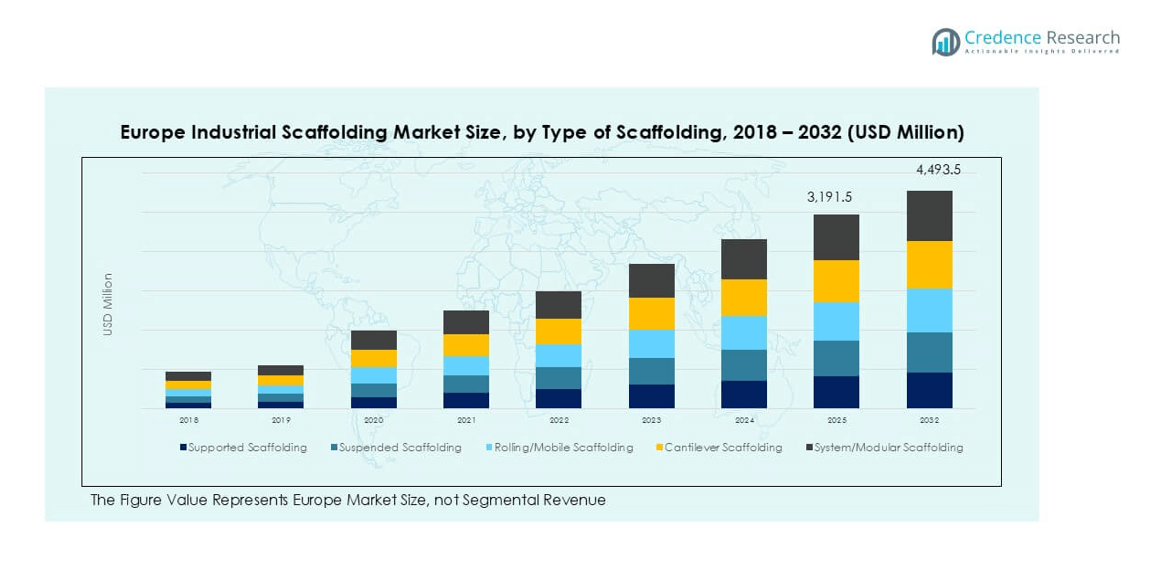

Europe Industrial Scaffolding Market was valued at USD 2,598.26 million in 2018, grew to USD 3,048.15 million in 2024, and is anticipated to reach USD 4,493.55 million by 2032, at a CAGR of 4.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Industrial Scaffolding Market Size 2024 |

USD 3,048.15 million |

| Europe Industrial Scaffolding Market, CAGR |

4.97% |

| Europe Industrial Scaffolding Market Size 2032 |

USD 4,493.55 million |

The Europe industrial scaffolding market features prominent players such as BrandSafway, Doka, Bil-Jax (Haulotte Group), Universal Manufacturing Corp, and Granite Industries, along with regional firms like Matakana Scaffolding and AGF Access Group. These companies compete through broad product portfolios, advanced modular systems, and compliance with strict EU safety standards. Western Europe leads the market with over 40% share, supported by strong infrastructure investment and maintenance in Germany, France, and the UK. Northern Europe follows with 25%, driven by offshore oil & gas and renewable energy projects. Eastern and Southern Europe collectively account for the remaining share, with growth sustained by industrial modernization and EU-backed infrastructure programs.

Market Insights

- The Europe Industrial Scaffolding market was valued at USD 3,048.15 million in 2024 and is projected to reach USD 4,493.55 million by 2032, growing at a CAGR of 4.97%.

- Rising infrastructure modernization, oil & gas maintenance, and power generation projects drive strong demand, with supported scaffolding holding the largest share due to its stability and cost-effectiveness.

- Key trends include increasing adoption of modular and lightweight aluminum scaffolding, along with digital tools such as BIM and smart safety systems enhancing project efficiency and compliance.

- The market is competitive with players like BrandSafway, Doka, and Bil-Jax leading through innovation and broad product portfolios, while regional firms strengthen their position with localized and cost-effective services.

- Western Europe dominates with over 40% share, followed by Northern Europe at 25%, while steel scaffolding leads by material share, supported by its strength and durability in large-scale industrial projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

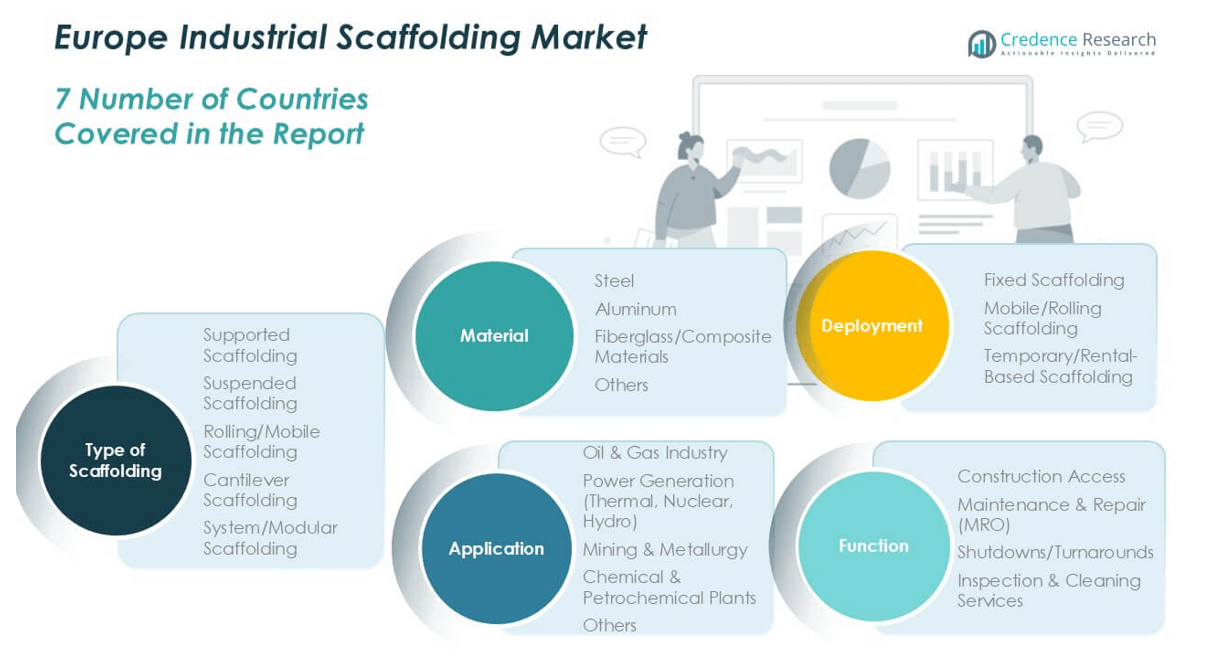

Market Segmentation Analysis:

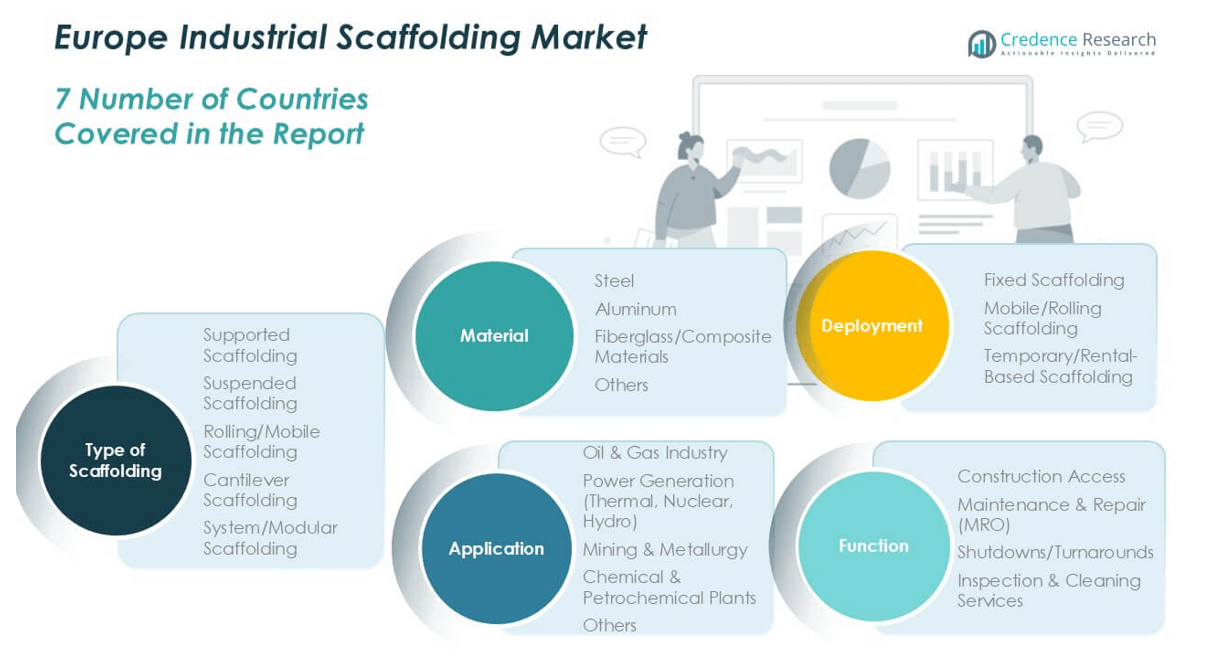

By Type of Scaffolding

Supported scaffolding dominates the Europe industrial scaffolding market, holding the largest share due to its wide usage across construction, oil & gas, and power projects. Its stability, cost-efficiency, and ability to handle heavy loads make it the preferred choice for large-scale industrial operations. Demand rises from infrastructure modernization and strict workplace safety regulations. Modular and rolling scaffolding are gaining traction for projects requiring flexibility and faster assembly, while suspended scaffolding finds use in high-rise maintenance. Cantilever structures remain niche but vital for confined or obstructed spaces.

- For instance, the European scaffolding market in 2024 was instead dominated by modular scaffolding systems, which held over 55% market share. The market is led by companies including PERI Group, Altrad Group, and ULMA.

By Application

The oil & gas industry accounts for the dominant share of scaffolding demand in Europe, supported by extensive offshore and onshore projects. Maintenance, inspection, and construction of refineries and pipelines drive steady adoption of durable scaffolding systems. Power generation facilities, including nuclear and hydro plants, also contribute significantly due to routine maintenance needs. Mining and metallurgy sectors deploy scaffolding for structural support in heavy industrial operations. Chemical and petrochemical plants utilize specialized scaffolds to ensure worker safety in hazardous environments, reinforcing consistent market requirements.

- For instance, in 2024, the general scaffolding market in Europe had a significant portion of global demand, though the specific share for the oil and gas sector is not publicly reported. Major industry players, including BrandSafway and Layher, supplied scaffolding systems for a variety of industrial applications, such as both offshore platforms and onshore refineries.

By Material

Steel scaffolding leads the Europe market with the highest share, driven by its strength, durability, and ability to bear heavy loads. It is widely preferred in large-scale industrial projects that demand long service life and high safety standards. Aluminum scaffolding is gaining momentum due to its lightweight design, easy mobility, and suitability for applications requiring frequent relocation. Fiberglass and composite scaffolding remain niche but essential in chemical plants and power facilities where corrosion resistance and electrical insulation are critical. Other materials contribute marginally, serving specialized industrial needs.

Market Overview

Infrastructure Modernization Across Europe

Rapid urban renewal projects and industrial facility upgrades drive the demand for scaffolding solutions. Governments across Europe are investing heavily in modernizing bridges, transportation systems, and industrial complexes. Supported scaffolding and modular systems see rising adoption for large-scale, high-load requirements. The growing focus on safety compliance and efficient construction practices further supports market growth. Countries like Germany, the UK, and France lead with ongoing projects in transport and energy infrastructure, boosting the requirement for durable, adaptable scaffolding systems in both construction and maintenance activities.

- For instance, scaffolding in the EU must meet six load-classes under EN 12811-1:2003, ensuring sections can safely carry loads ranging from 0.75 kN/m² up to 5.0 kN/m², depending on job type.

Expansion of Energy and Power Projects

Europe’s commitment to cleaner energy and secure power supply enhances scaffolding demand in power plants. Nuclear, hydro, and renewable power facilities require scaffolding for construction, inspection, and maintenance of large structures. Regular plant shutdowns for maintenance fuel consistent scaffolding use, especially steel-based systems that provide strength and durability. Growing investments in offshore wind and hydro projects also drive deployment of advanced scaffolding solutions. The energy transition trend ensures continuous project activity, making the power generation sector one of the strongest drivers for scaffolding demand.

- For instance, Germany currently has about 8.5 GW of offshore wind installed off the North Sea and Baltic coasts, with another 3.72 GW under construction to be commissioned by 2026.

Oil & Gas and Petrochemical Maintenance Activities

The oil & gas sector holds a significant share in scaffolding adoption due to ongoing refinery, pipeline, and offshore platform maintenance. Europe’s aging assets require constant inspection and repair, making scaffolding essential for safe access to complex structures. Specialized scaffolding systems are used in hazardous environments to meet strict safety regulations. Petrochemical plants also rely on scaffolding during shutdowns and overhauls, creating consistent recurring demand. Countries such as Norway, the UK, and the Netherlands remain key contributors, with extensive offshore activities sustaining market growth for scaffolding providers.

Key Trends & Opportunities

Adoption of Modular and Lightweight Scaffolding

System and modular scaffolding are gaining popularity due to faster assembly, higher safety, and reusability. These solutions reduce labor costs and minimize downtime, aligning with Europe’s focus on efficient construction practices. Lightweight aluminum scaffolding presents further opportunities in projects requiring frequent relocation and speed. Companies are developing ergonomic designs and safety enhancements to meet strict EU workplace safety standards. This trend is opening opportunities for manufacturers offering innovative, standardized, and certified scaffolding systems that cater to both large industrial and specialized project requirements.

- For instance, Layher’s Allround modular scaffolding system uses steel or aluminium components that satisfy EN 12810/12811 standards, allowing load classes up to 6.0 kN/m² for heavy maintenance tasks.

Digital Integration and Smart Safety Solutions

The use of digital tools for scaffolding planning and monitoring is an emerging trend in Europe. Technologies such as Building Information Modeling (BIM), 3D simulation, and IoT-enabled monitoring systems enhance efficiency, accuracy, and worker safety. These solutions reduce errors in scaffold design, optimize material usage, and provide real-time safety checks. Companies integrating smart sensors and digital inspection systems gain a competitive advantage. The trend creates opportunities for suppliers offering technology-driven scaffolding services, catering to contractors focused on reducing project costs while meeting stringent EU safety directives.

- For instance, in the Netherlands around 42% of contractors reported active use of BIM for construction projects, using it for clash detection, 3D visualization, or schedule optimization.

Key Challenges

High Labor and Compliance Costs

Strict labor laws and workplace safety standards in Europe increase scaffolding project costs. The sector requires highly skilled workers for safe assembly and dismantling, raising labor expenses. Frequent inspections and certifications, mandated by EU regulations, further add to compliance costs. Smaller firms often struggle to compete due to these high overheads, limiting their participation in large industrial projects. This challenge encourages market consolidation, with larger scaffolding providers holding a stronger position due to their ability to absorb compliance and labor-related expenses.

Volatility in Raw Material Prices

Steel dominates the scaffolding market in Europe, but fluctuations in raw material prices pose significant challenges. Rising steel costs directly impact production expenses, making scaffolding systems more expensive for contractors and end-users. Uncertainty in aluminum and composite material prices also disrupts cost planning for manufacturers. These variations reduce profitability margins and hinder smaller players from scaling operations. To counter this challenge, companies explore recycling initiatives, sourcing alternatives, and lean manufacturing processes, but persistent raw material volatility remains a major restraint for sustained market growth.

Regional Analysis

Western Europe

Western Europe holds the largest share of the Europe industrial scaffolding market, accounting for over 40%. Countries such as Germany, France, and the UK dominate due to extensive industrial bases, advanced infrastructure projects, and strict safety regulations. Ongoing investments in transportation, energy, and commercial construction further strengthen demand for steel and modular scaffolding systems. The region’s oil & gas activities in the North Sea and nuclear power plant maintenance projects continue to generate consistent requirements. High adoption of innovative scaffolding technologies and compliance with EU directives reinforce Western Europe’s leading position in the market.

Northern Europe

Northern Europe contributes around 25% of the market share, driven by strong oil & gas operations in Norway and the UK, alongside renewable energy initiatives across the region. Offshore drilling platforms, wind farms, and hydro projects require advanced scaffolding for construction and maintenance. The region’s strict adherence to safety standards encourages the use of high-quality steel and modular systems. Large-scale shipbuilding and marine activities in countries such as Denmark and Sweden also support steady demand. Northern Europe’s industrial scaffolding market benefits from a combination of heavy industries and energy-transition-related infrastructure projects.

Eastern Europe

Eastern Europe represents nearly 20% of the Europe industrial scaffolding market, supported by infrastructure modernization and industrial expansion in Poland, Russia, and neighboring countries. Ongoing investments in power generation facilities, mining, and metallurgy drive scaffolding adoption across major projects. The demand is particularly strong for supported scaffolding due to its cost-effectiveness and suitability for large construction sites. While regulatory frameworks are less stringent than in Western Europe, rising workplace safety awareness is boosting adoption of certified systems. Economic growth and foreign investments in industrial construction position Eastern Europe as a steadily growing regional market.

Southern Europe

Southern Europe accounts for close to 15% of the market share, driven by construction and maintenance activities in Italy, Spain, and Greece. The region relies heavily on scaffolding for infrastructure development, energy plants, and petrochemical industries. Maintenance of older industrial facilities and refineries remains a consistent demand driver. Aluminum scaffolding finds notable adoption in Southern Europe due to its ease of mobility in projects with frequent relocations. Although economic challenges occasionally slow down construction activities, recovery efforts and EU-backed infrastructure funding continue to support growth. Southern Europe maintains steady demand through diversified industrial projects.

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe industrial scaffolding market is highly competitive, with a mix of global players and regional specialists offering a wide range of products and services. Leading companies such as BrandSafway, Doka, and Bil-Jax focus on large-scale industrial and infrastructure projects, leveraging extensive portfolios of steel, modular, and mobile scaffolding systems. Their strengths lie in strong distribution networks, advanced safety solutions, and compliance with stringent EU regulations. Regional firms, including Matakana Scaffolding and Associated Scaffolding, cater to localized demand with cost-effective and customized solutions, especially for construction and maintenance projects. Players emphasize innovation in lightweight materials, modular designs, and digital integration for project planning to improve efficiency and reduce downtime. Partnerships, mergers, and acquisitions remain key strategies to strengthen market presence. Frequent product upgrades, coupled with expansion into renewable energy and oil & gas maintenance projects, further drive competition, positioning Europe as a dynamic and evolving scaffolding market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BrandSafway

- SafwayAtlantic

- Universal Manufacturing Corp

- Granite Industries

- Bil-Jax (a Haulotte Group brand)

- Bee Access Products, Inc.

- Doka USA Ltd.

- Associated Scaffolding Co.

- Skyway Canada Ltd.

- Matakana Scaffolding

- Northern Scaffold Access Inc.

- AGF Access Group Inc.

- Brock Canada Industrial Ltd.

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice.

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily driven by infrastructure modernization and industrial maintenance projects.

- Supported scaffolding will continue to dominate due to its cost-effectiveness and wide application.

- Modular and system scaffolding will gain traction for faster assembly and improved safety.

- Steel scaffolding will remain the preferred material for heavy industrial use.

- Aluminum scaffolding will expand adoption in projects requiring lightweight and mobile solutions.

- Digital integration with BIM and smart monitoring will enhance project efficiency.

- Oil & gas and power generation sectors will sustain recurring demand for scaffolding.

- Western Europe will retain leadership supported by strong industrial bases and regulations.

- Northern Europe will see rising demand from offshore energy and marine industries.

- Increasing safety standards and regulatory compliance will shape innovation and product design.