Market Overview:

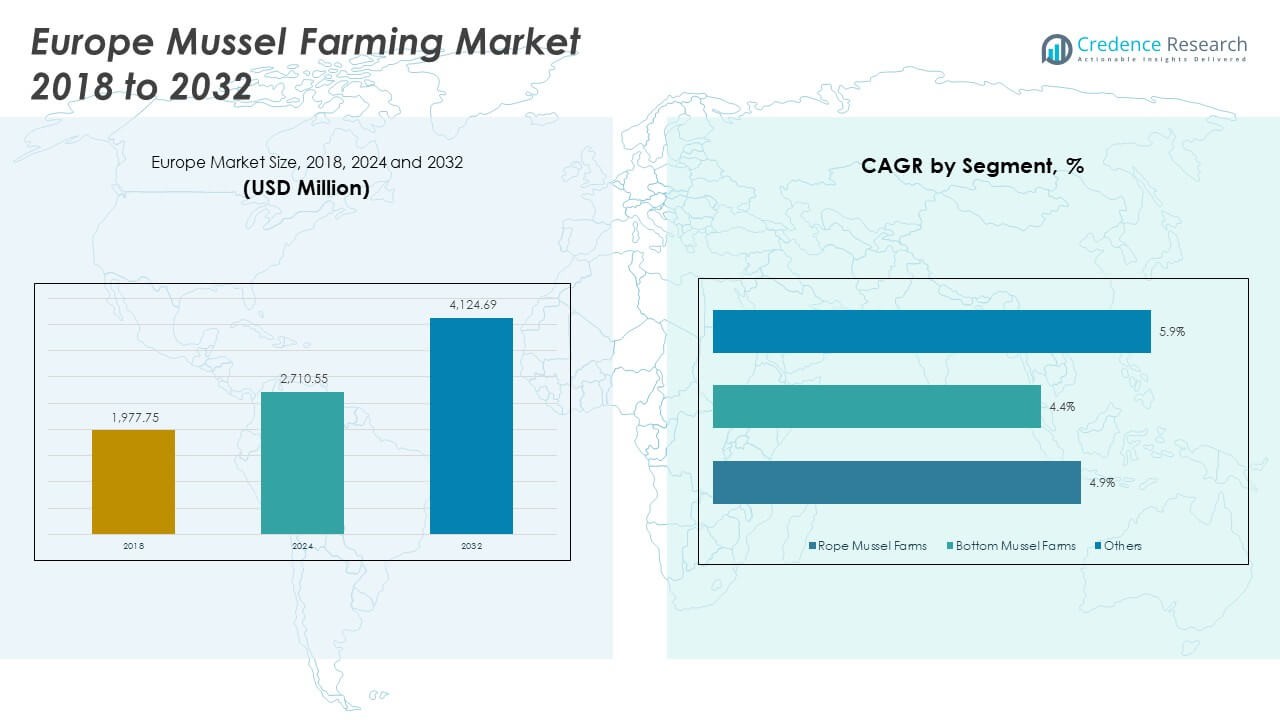

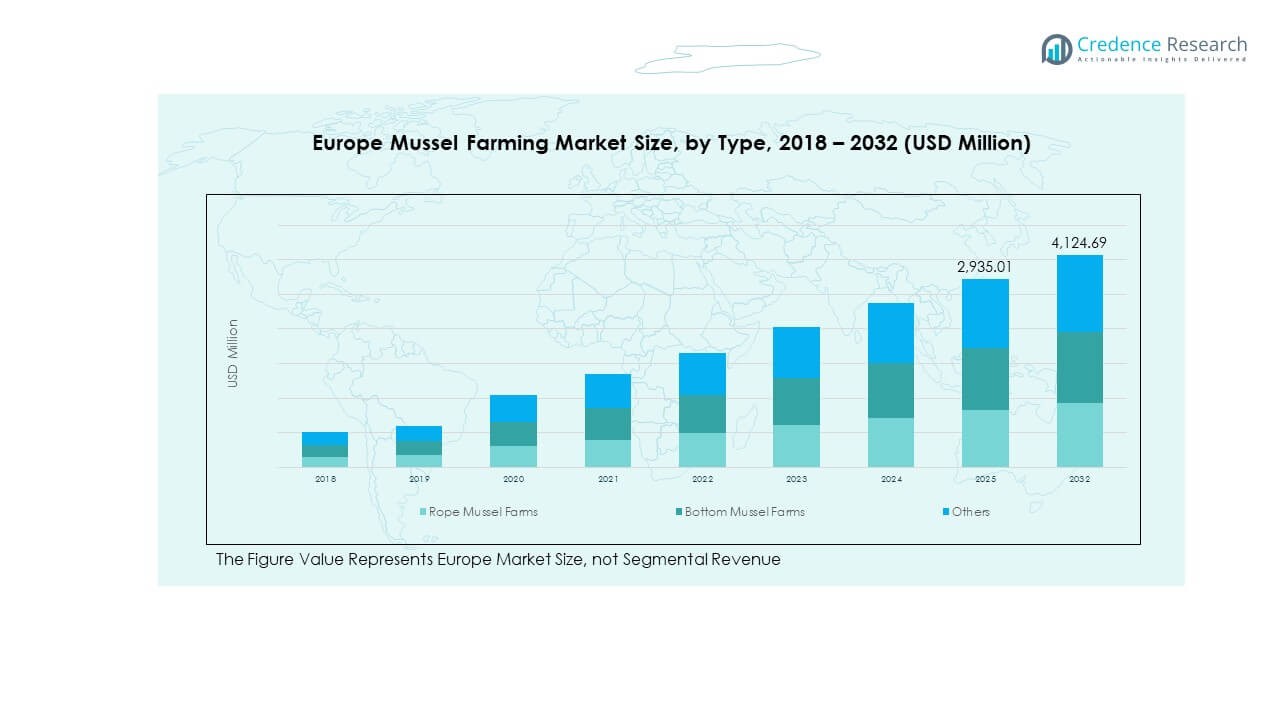

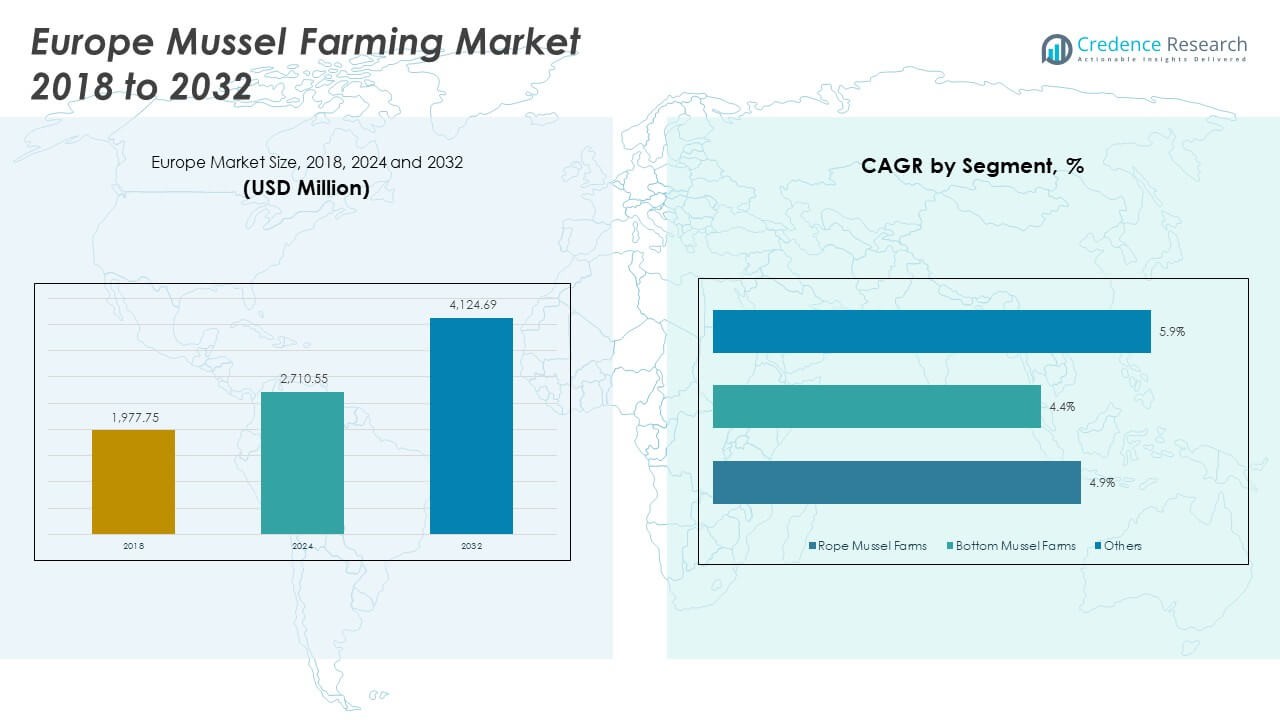

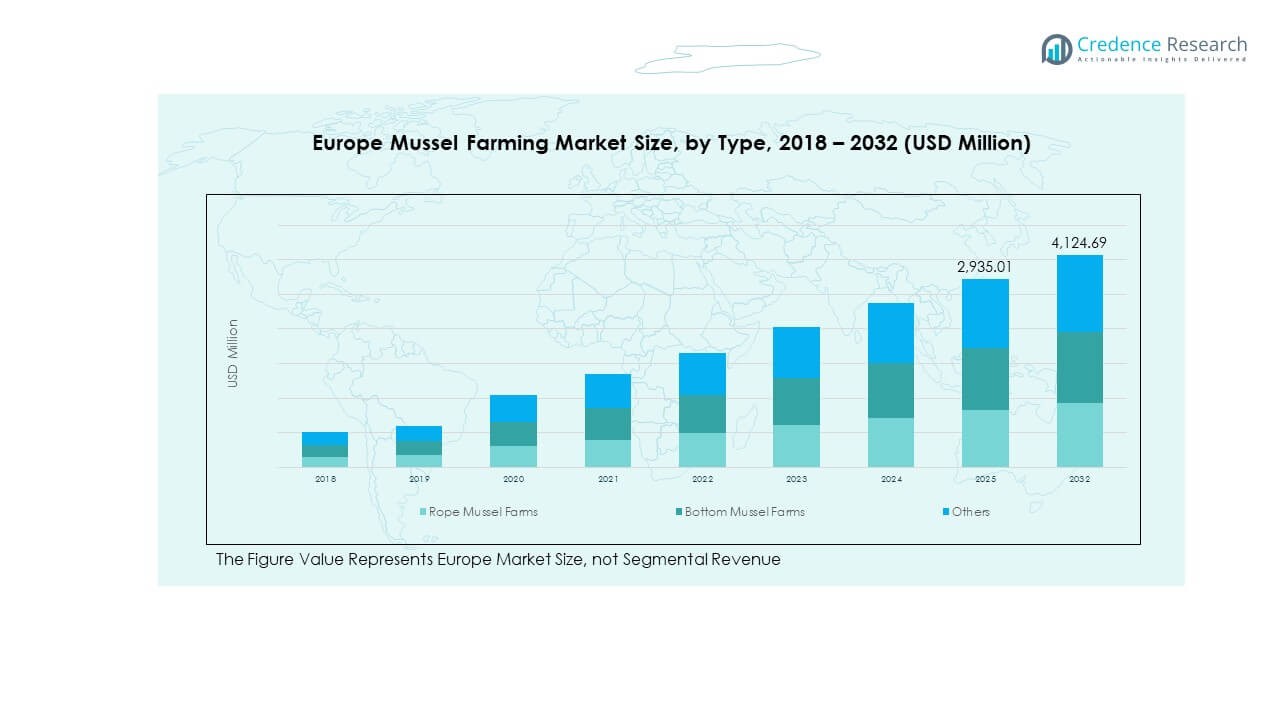

The Europe Mussel Farming Market size was valued at USD 1,977.75 million in 2018 to USD 2,710.55 million in 2024 and is anticipated to reach USD 4,124.69 million by 2032, at a CAGR of 5.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Mussel Farming Market Size 2024 |

USD 2,710.55 Million |

| Europe Mussel Farming Market, CAGR |

5.00% |

| Europe Mussel Farming Market Size 2032 |

USD 4,124.69 Million |

The market is supported by rising seafood consumption, regulatory backing for sustainable aquaculture, and expanding export opportunities. Consumers are showing preference for mussels due to their nutritional benefits, low environmental footprint, and availability across fresh and processed categories. Innovation in farming techniques, including rope-based farming, is helping boost production yields and efficiency. It is also benefiting from government initiatives aimed at food security and sustainable resource use.

Geographically, Western Europe leads with strong production hubs in Spain, France, and the UK. Northern Europe shows increasing adoption due to favorable marine conditions and supportive regulatory frameworks. Eastern Europe is gradually emerging, with untapped opportunities for investment in aquaculture infrastructure. This geographic diversification enhances the long-term resilience and scalability of the Europe Mussel Farming Market.

Market Insights:

Market Insights:

- The Europe Mussel Farming Market was valued at USD 1,977.75 million in 2018, reached USD 2,710.55 million in 2024, and is projected to hit USD 4,124.69 million by 2032, expanding at a 5.00% CAGR.

- Spain dominates with the largest share, supported by Galicia’s large-scale rope farming; France follows with strong aquaculture heritage, while the UK holds the third-largest share due to sustainable coastal farming practices.

- Northern Europe emerges as the fastest-growing region, backed by favorable marine conditions, government sustainability incentives, and rising investments in aquaculture infrastructure.

- Rope mussel farms account for the highest share, capturing nearly 65% of the market in 2024, due to efficiency and high yields.

- Bottom mussel farms represent around 25% share, while the remaining 10% comes from other emerging or hybrid methods, reflecting diversification in production approaches.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference for Sustainable Seafood Products:

The Europe Mussel Farming Market benefits from increasing consumer demand for environmentally sustainable food choices. Mussels are recognized for their low ecological footprint and ability to filter water naturally. Health-conscious consumers view mussels as a rich source of protein, omega-3 fatty acids, and essential nutrients. Retailers and foodservice companies actively promote sustainable seafood options to meet evolving preferences. Governments and NGOs encourage aquaculture practices that reduce reliance on wild fishing stocks. Strong awareness campaigns highlight the environmental and nutritional value of mussels. Export markets, particularly in Asia and North America, favor sustainably farmed products. This collective demand acts as a major growth driver for the industry.

- For instance, certain mussels can filter large volumes of water each day, sometimes up to 50 gallons or more, contributing to water quality naturally. Health-conscious consumers are drawn to mussels, which provide a high amount of protein (often over 20 grams per 100 grams of cooked meat) and are rich in omega-3 fatty acids, with some varieties offering around 600 mg or more per 100 grams. Mussels are also packed with essential vitamins and minerals, including significant amounts of Vitamin B12, iron, and selenium.

Supportive Government Policies and Aquaculture Regulations:

Strong policy frameworks across Europe support the adoption of aquaculture practices that align with sustainability goals. Governments provide subsidies, grants, and technical training to mussel farmers. National aquaculture strategies emphasize the role of mussels in food security and marine ecosystem balance. Compliance with EU Common Fisheries Policy ensures sustainability and long-term industry growth. Strict quality standards maintain consumer trust and export competitiveness. Certification programs such as MSC enhance visibility and consumer confidence. This regulatory environment creates stability and predictability for farmers. It also attracts investments into advanced farming systems and infrastructure.

- For instance, certification schemes like the Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC) cover a portion of European mussel production, with specific countries and types of production exhibiting higher certification rates than others. However, significant portions of European mussel production are also certified under other programs, such as organic standards, or are not certified at all.

Technological Advancements in Mussel Farming Operations:

The Europe Mussel Farming Market benefits from innovations that increase efficiency and reduce labor intensity. Rope cultivation methods improve yields by maximizing marine resources. Automated harvesting equipment reduces costs while improving product consistency. Sensors and IoT solutions optimize water quality monitoring, ensuring healthier growth cycles. Hatchery technologies support reliable seed production, reducing dependence on natural spat. Improved logistics and cold-chain management enable wider distribution and market expansion. These advancements reduce waste and improve profitability for small and large operators alike. Technology adoption strengthens competitiveness across both domestic and international markets.

Expanding Export Opportunities and Global Demand:

European mussels are increasingly sought after in international markets for their quality and sustainability certification. Strong demand from Asian markets creates opportunities for growth in exports. Global consumers associate European mussels with premium quality and trusted farming practices. Trade agreements within and outside the EU support efficient cross-border sales. Exporters benefit from strong branding and established distribution channels. Rising global seafood consumption reinforces export potential. Producers focus on branding mussels as eco-friendly and nutritious seafood choices. This international expansion supports revenue diversification and market resilience.

Market Trends:

Growing Popularity of Ready-to-Cook and Value-Added Mussel Products:

Consumers are seeking convenience in seafood consumption, driving demand for pre-cleaned, packaged, and flavored mussels. Ready-to-cook products save preparation time and cater to urban households. Restaurants and retail chains introduce innovative recipes that highlight mussels as versatile ingredients. Demand for frozen and vacuum-sealed mussels rises in supermarkets. Processors invest in product diversification to attract broader consumer groups. Value-added offerings expand revenue streams for producers. Marketing campaigns emphasize both convenience and nutrition. This trend creates stronger linkages between mussel farming and processing industries.

- For instance, the market for frozen and vacuum-packed mussels is growing, driven by consumer demand for convenient, ready-to-prepare seafood options. Processors are responding to this trend by investing in product innovation, expanding into new value-added categories like ready-to-eat meals, flavored marinades, and gourmet sauces. These developments help meet the needs of busy households, diversify market opportunities, and contribute to the overall expansion of the mussel market.

Integration of Digital Technologies in Aquaculture Monitoring:

The Europe Mussel Farming Market is adopting digital platforms to enhance production efficiency. Farmers integrate IoT sensors to monitor water temperature, salinity, and plankton levels. Artificial intelligence systems provide predictive insights for farming cycles. Data-driven decisions reduce losses and optimize output. Blockchain technology is used to improve traceability across supply chains. These innovations increase transparency and strengthen consumer trust in mussel products. Startups and technology providers collaborate with aquaculture firms to scale adoption. The integration of digital systems represents a key trend shaping modern aquaculture.

- For instance, Artificial intelligence platforms analyze farm data to optimize harvest cycles, while blockchain-based traceability systems are improving supply chain transparency for consumers. These advances help reduce crop losses through better forecasting and control. Many farms are collaborating with technology startups to pilot these digital solutions, supported by government innovation grants and partnerships.

Rising Focus on Climate Resilient Mussel Farming Practices:

Climate change impacts water conditions, prompting farmers to adopt resilient farming strategies. Selective breeding ensures mussels adapt to varying temperatures and salinity. Research institutions collaborate with farmers to develop robust strains. Marine spatial planning reduces risks from environmental pressures. Policy frameworks promote adaptation techniques across coastal regions. Investments in resilient infrastructure mitigate extreme weather risks. Farmers diversify farming sites to minimize environmental vulnerability. These climate-focused strategies safeguard long-term production.

Expansion of Organic and Eco-Certified Mussel Farming:

Consumers increasingly prefer mussels certified as organic or eco-labeled. Certification adds credibility and supports premium pricing strategies. Farmers adopt practices that exclude harmful chemicals and antibiotics. Retailers highlight certified mussels in sustainability-focused marketing campaigns. Eco-certification helps access niche markets domestically and globally. Demand for organic aquaculture aligns with broader green consumer movements. Policy incentives support certification programs. Organic certification expands opportunities for differentiation in competitive markets.

Market Challenges Analysis:

Regulatory Compliance and Cost Constraints in Mussel Farming:

The Europe Mussel Farming Market faces significant challenges in navigating strict regulations. Farmers must comply with environmental standards, seafood safety rules, and labor laws. Compliance increases costs and administrative burdens, especially for small-scale producers. Meeting export requirements adds complexity to production cycles. Certification costs can limit participation of smaller farms. Price competition with imported seafood creates added strain. These financial and regulatory hurdles can impact profitability. Addressing compliance while maintaining competitiveness remains a core challenge for the industry.

Environmental Vulnerabilities and Disease Outbreaks:

Mussel farming operations remain vulnerable to environmental shifts and biological threats. Rising sea temperatures impact mussel growth cycles and quality. Harmful algal blooms disrupt farming activities and reduce yields. Diseases spread quickly in dense farming environments, creating economic losses. Farmers require advanced monitoring to detect threats early. Climate variability introduces uncertainty in production planning. Recovery from disease outbreaks requires time and resources. These environmental challenges demand investment in resilient and adaptive solutions.

Market Opportunities:

Market Opportunities:

Expansion of Aquaculture Infrastructure in Emerging European Regions:

The Europe Mussel Farming Market has opportunities to expand into underdeveloped coastal regions. Governments in Eastern Europe promote aquaculture development to meet food demand. Investments in infrastructure, hatcheries, and training create new growth potential. Private investors explore opportunities in sustainable seafood ventures. These expansions reduce reliance on imports and enhance food self-sufficiency. International partnerships can accelerate capacity building in emerging regions. Early movers benefit from competitive advantages in new markets. This expansion diversifies production and strengthens the regional industry.

Rising Consumer Demand for High-Value and Premium Mussel Products:

Consumers across Europe and abroad seek premium mussel varieties. Restaurants emphasize mussels in gourmet menus and international cuisines. Demand for organic, eco-labeled, and specialty mussels continues to grow. Farmers who invest in premium categories capture higher margins. Value-added processing enhances differentiation in competitive markets. Export markets reward high-quality branding and certifications. This demand opens opportunities for small-scale producers to enter niche markets. The shift toward premium positioning strengthens revenue sustainability.

Market Segmentation Analysis:

By Type

The Europe Mussel Farming Market is segmented into rope mussel farms, bottom mussel farms, and others. Rope farms represent the dominant method, favored for their efficiency, higher productivity, and ability to maximize space in coastal waters. Bottom farms, while traditional, still hold significance in regions where local practices and natural seabeds support cultivation. The “others” category captures experimental and hybrid methods, reflecting innovation in farming systems. This diversity in farming approaches ensures flexibility in adapting to local environmental conditions and consumer demand. It also highlights the balance between modern efficiency and traditional sustainability.

- For instance, Bottom mussel farms, although traditional, continue to operate mainly in regions like the Netherlands and Ireland, where local seabed conditions support their methods. Experimental and hybrid farming systems are emerging, including integrated multi-trophic aquaculture setups, showcasing the sector’s capacity for innovation and adaptation to environmental and market changes.

By Product

Segmentation by product includes marine water and fresh water mussels. Marine water mussels lead due to favorable environmental conditions across Europe’s extensive coastline, particularly in Spain, France, and the UK. Freshwater mussels, though a smaller segment, are important for biodiversity preservation and localized aquaculture practices. They cater to niche demand and often support conservation-driven initiatives. The growing emphasis on sustainable and certified seafood is encouraging both segments to adopt eco-friendly practices. This balance between large-scale marine operations and specialized freshwater farming broadens the overall market scope.

- For instance, Freshwater mussels make up a modest but significant segment, helping maintain biodiversity and supporting conservation projects, particularly in Eastern Europe. Growing demand for certified and environmentally friendly seafood is leading both segments to adopt more sustainable practices, thereby broadening the market while supporting ecological goals.

Segmentation:

Segmentation:

- By Type

- Rope Mussel Farms

- Bottom Mussel Farms

- Others

- By Product

- By Region

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Dominance

Western Europe holds the largest share of the Europe Mussel Farming Market, accounting for nearly 46% in 2024. Spain leads this subregion, with Galicia recognized as one of the largest mussel farming hubs globally. France follows closely, supported by strong aquaculture traditions along the Atlantic and Mediterranean coasts. The UK also contributes significantly, with rope farming concentrated in Scotland and Wales. Western Europe benefits from favorable marine conditions, established infrastructure, and cultural preference for mussels as part of daily diets. Strong export networks further strengthen its leadership. With production scale and consumer demand aligned, Western Europe remains the core driver of market expansion.

Northern and Southern Europe Growth

Northern Europe represents around 28% of the market in 2024, with countries such as Ireland, Denmark, and the Netherlands strengthening rope farming practices. Favorable marine ecosystems and government-backed sustainability incentives support rapid adoption of aquaculture. These nations invest in technology-driven monitoring systems, enhancing output quality and reliability. Southern Europe, led by Italy, contributes approximately 16% share in 2024, with mussels deeply integrated into culinary culture. Italy’s diversified farming practices, including rope and bottom systems, ensure steady domestic supply. Greece and Portugal also participate, though at smaller scales, supported by rising seafood demand. Together, Northern and Southern Europe form a critical base for production growth and market stability.

Eastern Europe and Russia Expansion

Eastern Europe and Russia collectively account for around 10% of the Europe Mussel Farming Market in 2024. Russia shows growing interest in mussel farming along the Black Sea and Pacific coastlines, driven by government-backed aquaculture expansion. Eastern European countries such as Poland and Bulgaria invest in pilot projects to reduce dependence on imports and strengthen food security. These regions remain in early development stages but hold strong potential with improving aquaculture infrastructure. Rising urban seafood consumption supports gradual market penetration. Import demand continues to supplement local supply, giving European exporters access to growing opportunities. With ongoing investments and favorable coastal conditions, Eastern Europe and Russia are expected to increase their market contribution in the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cultivos Toralla

- Barbé Group

- SUDMARIS

- Viking Aquaculture

- West Country Mussels of Fowey Limited

- Coombe Fisheries Ltd

- Perna S.A.

- Marine Harvest

- The Scottish Salmon Company

- Bumble Bee Foods

- Others

Competitive Analysis:

The Europe Mussel Farming Market is characterized by strong competition among established producers and emerging regional players. Leading companies such as Cultivos Toralla, Barbé Group, SUDMARIS, Viking Aquaculture, and Marine Harvest leverage large-scale operations and advanced farming techniques. They emphasize sustainability, eco-certification, and technological innovation to strengthen market positioning. Mid-sized firms like West Country Mussels of Fowey Limited and Coombe Fisheries Ltd maintain competitiveness by focusing on regional supply chains and premium quality products. Strategic partnerships with distributors and retailers expand consumer access across domestic and export markets. Investment in certification programs such as MSC builds trust with consumers and retailers. Innovation in processing and packaging adds value to traditional production. The competitive landscape is shaped by both tradition and innovation, ensuring steady growth of the industry.

Report Coverage:

The research report offers an in-depth analysis based on type and product segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Sustainable aquaculture will remain central to market expansion.

- Eco-certification will strengthen branding and consumer trust.

- Spain and France will maintain leadership in European production.

- Eastern Europe will emerge as a new aquaculture hub.

- Premium mussel categories will drive profitability in exports.

- Climate-resilient farming practices will gain wider adoption.

- Technological innovation will improve yields and reduce costs.

- Distribution partnerships will expand market penetration abroad.

- Rising consumer focus on protein-rich diets will support demand.

- Europe will continue to dominate global mussel farming exports.

Market Insights:

Market Insights: Market Opportunities:

Market Opportunities: Segmentation:

Segmentation: