Market Overview:

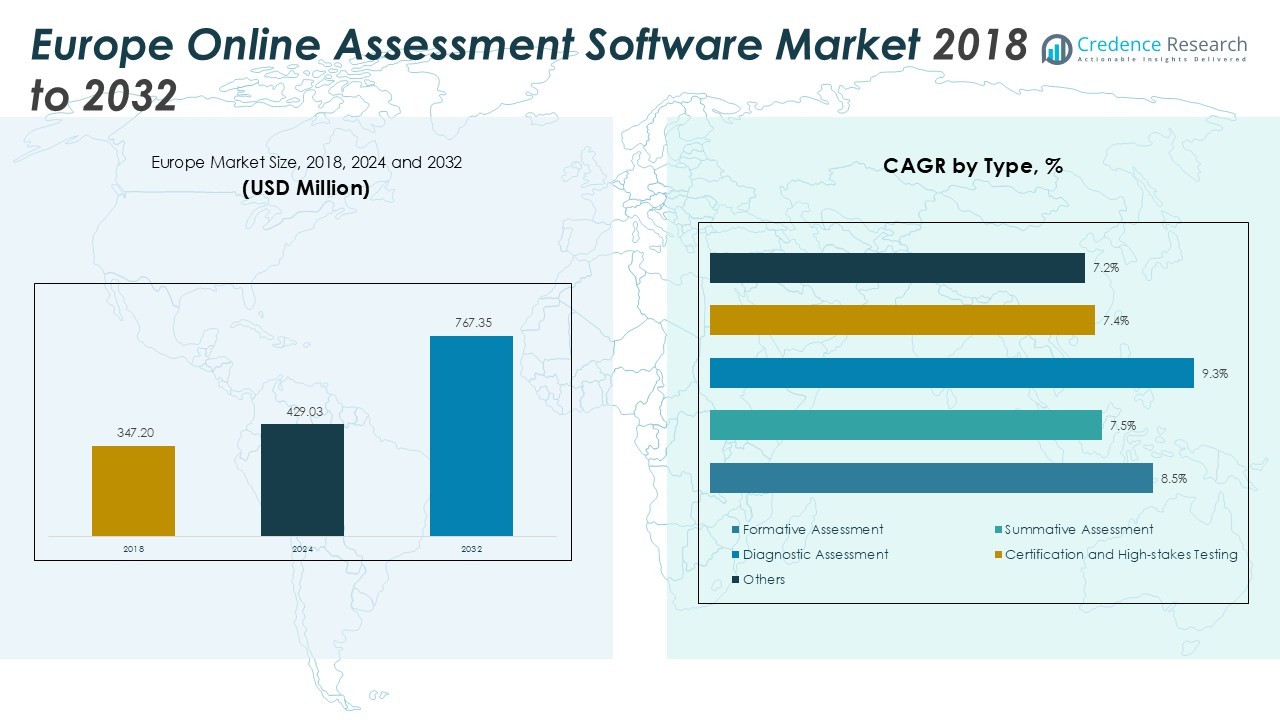

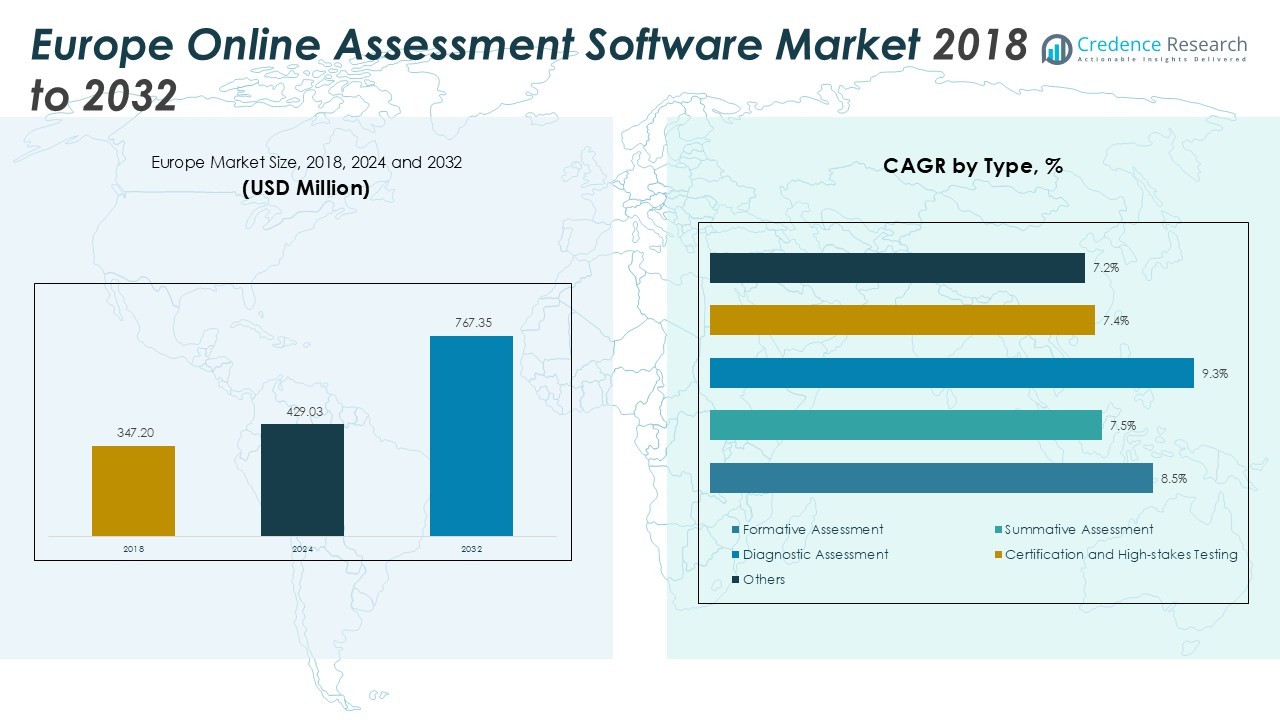

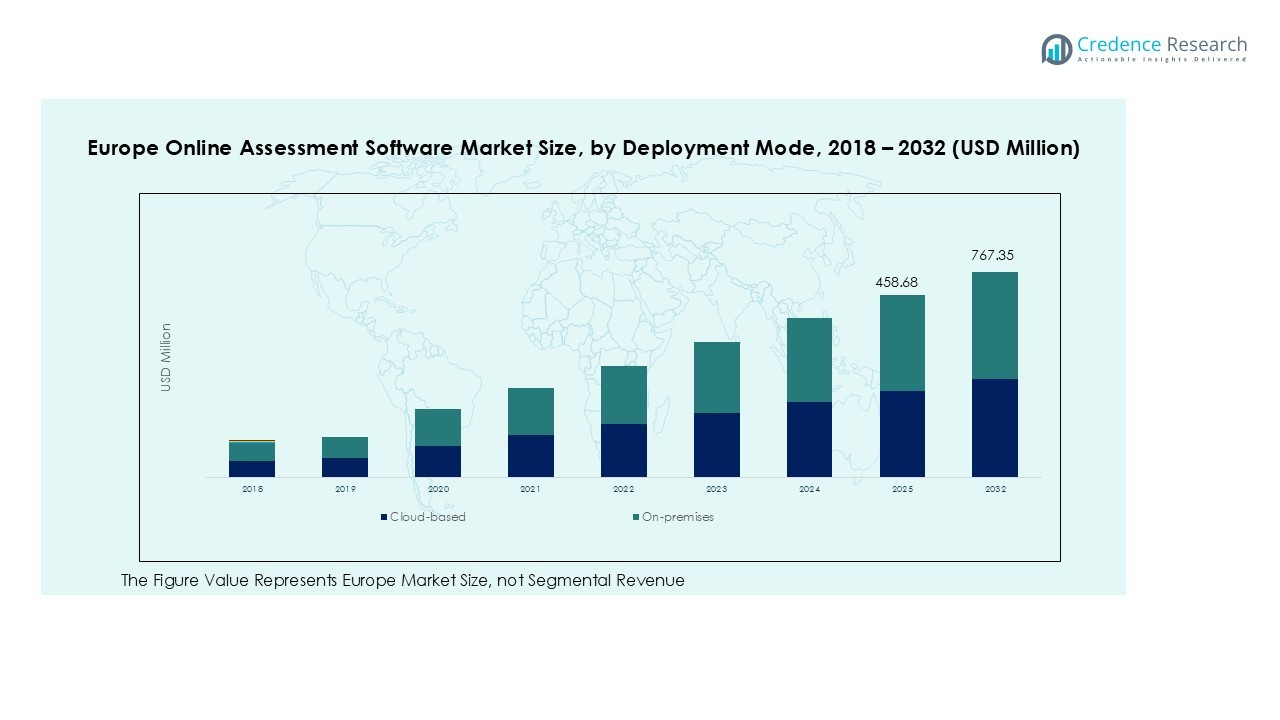

The Europe Online Assessment Software Market size was valued at USD 347.20 million in 2018 to USD 429.03 million in 2024 and is anticipated to reach USD 767.35 million by 2032, at a CAGR of 5.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Online Assessment Software Market Size 2024 |

USD 429.03 Million |

| Europe Online Assessment Software Market, CAGR |

5.71% |

| Europe Online Assessment Software Market Size 2032 |

USD 767.35 Million |

Market growth is primarily driven by the rapid digital transformation across educational institutions and enterprises, heightened demand for remote learning and virtual assessments, and the integration of artificial intelligence and analytics in assessment platforms. Increasing emphasis on personalized learning, skill-based evaluations, and data-driven recruitment further propels adoption. Additionally, government initiatives supporting digital education infrastructure and online certification programs contribute significantly to market development.

Regionally, Western Europe holds a dominant position, led by countries such as the UK, Germany, and France, accounting for the largest share due to well-established IT infrastructure, high digital literacy, and strong demand from the corporate and academic sectors. Northern and Southern Europe show emerging opportunities, driven by increased adoption of e-learning and online certification programs. The market benefits from the presence of major software providers, advanced technological integration, and growing awareness of online assessment benefits across all sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market grew from USD 347.20 million in 2018 to USD 429.03 million in 2024 and is projected to reach USD 767.35 million by 2032, at a CAGR of 5.71%.

- Rapid digital transformation in education and corporate training drives demand for scalable and efficient assessment solutions.

- Integration of AI and analytics enhances accuracy, personalized evaluation, and actionable insights for institutions and organizations.

- Rising adoption of remote learning, online certification, and corporate upskilling programs fuels market expansion.

- Government initiatives supporting digital education infrastructure and skill-based evaluations encourage wider software adoption.

- Western Europe holds 55% of the market, led by the UK, Germany, and France, due to advanced IT infrastructure and strong demand.

- Northern and Southern Europe account for 25%, and Central and Eastern Europe hold 20%, offering growth opportunities from e-learning and cloud-based adoption.

Market Drivers:

Growing Demand for Digital Transformation in Education and Corporate Training

The Europe Online Assessment Software Market experiences strong growth driven by the shift toward digital transformation in education and corporate learning. Institutions and organizations increasingly adopt online platforms to conduct assessments efficiently, streamline evaluation processes, and ensure consistency in performance measurement. It enables educators and HR professionals to manage large volumes of candidates with minimal manual effort. The demand for scalable and flexible assessment solutions continues to rise, creating significant opportunities for software providers.

Integration of Artificial Intelligence and Advanced Analytics

The integration of artificial intelligence (AI) and analytics in assessment software enhances accuracy, personalization, and insights into learner performance. It provides real-time feedback, predictive performance analysis, and automated scoring, which improves decision-making for educational institutions and employers. These advanced features help organizations identify skill gaps and optimize training programs effectively. The adoption of AI-driven assessment tools strengthens the competitive position of software providers in the European market.

- For instance, the company Digiexam enhances the reliability of its platform with an autosave feature that automatically saves a student’s progress every 10 seconds, safeguarding against data loss during an exam.

Increased Focus on Remote Learning and Online Certification Programs

Rising adoption of remote learning and certification programs fuels demand for online assessment solutions. It allows institutions and enterprises to conduct examinations, skill assessments, and certification evaluations without geographic constraints. The growing popularity of e-learning platforms, professional certification, and corporate upskilling programs further accelerates market expansion. Organizations seek reliable and secure platforms to maintain assessment integrity while reaching a broader audience.

- For instance, Pearson VUE’s OnVUE platform sets clear technical standards for remote proctoring integrity, requiring candidates to use a webcam with a minimum resolution of 640×480 for all online exams.

Regulatory Support and Emphasis on Skill-Based Evaluations

Government initiatives promoting digital education infrastructure and skill-based assessments contribute to market growth. It encourages educational institutions and corporations to implement standardized online assessments. Policies supporting e-learning adoption and workforce development drive demand for software solutions that measure competencies effectively. The market benefits from regulatory frameworks that ensure compliance, security, and quality in online evaluations.

Market Trends:

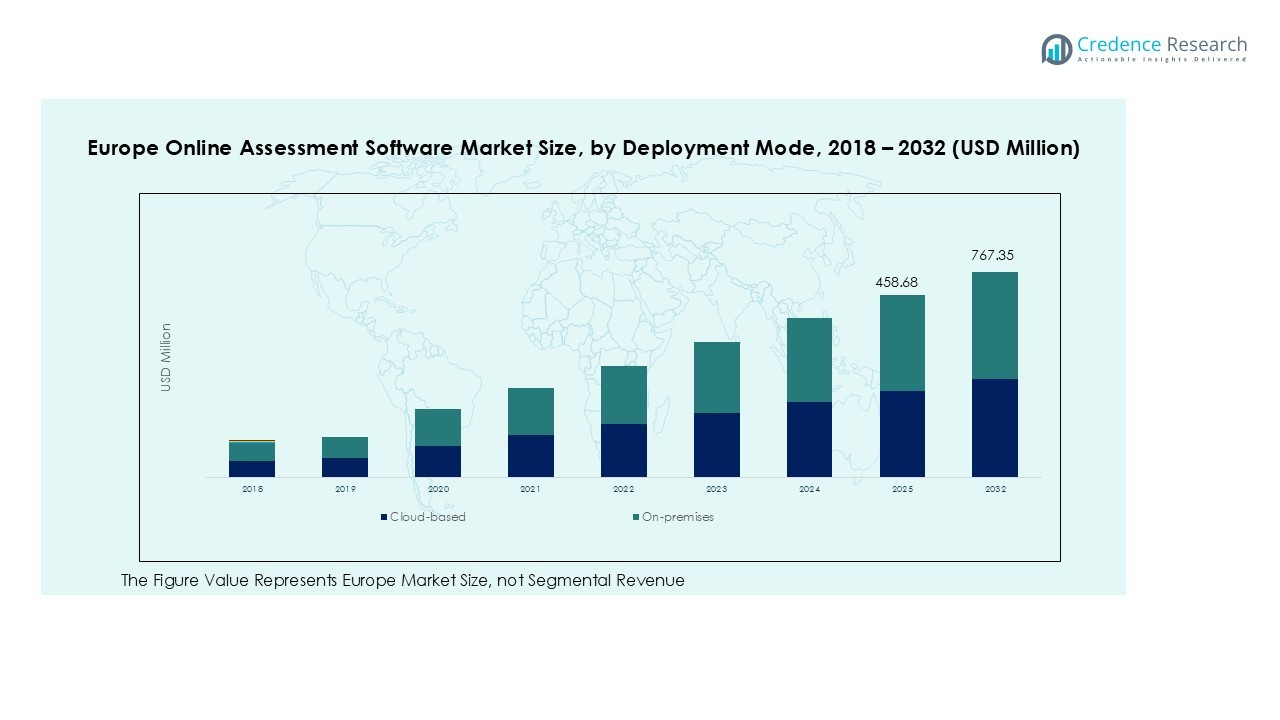

Rapid Adoption of Cloud-Based and Mobile Assessment Solutions

The Europe Online Assessment Software Market demonstrates a clear shift toward cloud-based platforms and mobile-compatible solutions. It allows institutions and organizations to conduct assessments remotely while ensuring secure access and seamless data management. Cloud deployment reduces infrastructure costs and enables real-time monitoring of candidate performance. Mobile accessibility supports learners and employees to complete assessments from any location, increasing participation and engagement. Vendors focus on enhancing user experience, security features, and platform scalability to meet evolving client demands. The trend toward hybrid learning environments further strengthens the adoption of cloud-based assessment tools.

- For instance, Mercer | Mettl’s cloud-based proctoring platform has executed 200,000 proctored assessments in a single day, demonstrating elastic scale for secure, high-stakes remote delivery.

Emphasis on Data-Driven Insights and Personalized Evaluation

Market trends indicate a growing focus on data analytics and personalized evaluation within online assessment platforms. It provides institutions and corporations with actionable insights into candidate performance, skill gaps, and learning outcomes. Adaptive assessments allow tailored question sets based on individual proficiency, improving assessment accuracy and relevance. Integration of AI and machine learning technologies enhances predictive analysis and automated reporting. Organizations leverage these insights to optimize training programs, recruitment strategies, and academic curricula. The continuous evolution of AI-driven evaluation tools positions the market for sustained growth and technological advancement.

- For instance, SHL’s OPQ32 assessment captures 32 work-related personality dimensions, enabling granular, role-aligned profiles that support personalized, data-driven decisions.

Market Challenges Analysis:

Data Security and Privacy Concerns in Online Assessment Platforms

The Europe Online Assessment Software Market faces significant challenges related to data security and privacy. It handles sensitive candidate information, including personal details, academic records, and performance data, which require stringent protection measures. Ensuring compliance with GDPR and other regional data protection regulations remains a critical concern for software providers. Any breach or misuse of data can undermine trust and limit adoption among educational institutions and enterprises. Vendors must invest in advanced encryption, secure authentication, and robust cybersecurity protocols to mitigate these risks. High implementation costs for secure systems can also restrict market penetration in smaller organizations.

Technical Limitations and Resistance to Digital Transition

Limited technical infrastructure and resistance to adopting digital assessment solutions create additional obstacles. It may face challenges in regions with inconsistent internet connectivity or outdated hardware, reducing the effectiveness of online assessments. Training educators and HR professionals to operate advanced software can require significant time and resources. Some organizations prefer traditional evaluation methods, slowing digital adoption despite clear efficiency benefits. Compatibility issues among different platforms and integration with existing learning management systems can further complicate deployment. Overcoming these technical and operational barriers remains essential to achieving wider market growth.

Market Opportunities:

Expansion of E-Learning and Corporate Upskilling Programs

The Europe Online Assessment Software Market benefits from the growing demand for e-learning and corporate upskilling programs. It supports educational institutions and enterprises in delivering standardized assessments across diverse locations efficiently. Increasing investments in remote learning infrastructure and professional training initiatives create new adoption opportunities. The rise of online certification programs and skill-based evaluations drives the need for reliable assessment platforms. Vendors can target partnerships with universities, vocational institutions, and corporate training providers to expand their market presence. Customized solutions for sector-specific requirements offer further growth potential.

Adoption of AI-Driven and Adaptive Assessment Technologies

Emerging opportunities exist in the adoption of AI-driven and adaptive assessment technologies. It enables personalized evaluation, predictive performance analysis, and automated reporting for both academic and corporate users. Integration with learning management systems enhances workflow efficiency and improves candidate engagement. Advanced analytics allow organizations to identify skill gaps and optimize training strategies effectively. Continuous technological innovation and the growing emphasis on data-driven decision-making strengthen the market outlook. Expanding cloud-based deployment and mobile-compatible platforms further enhance accessibility, creating avenues for increased adoption across Europe.

Market Segmentation Analysis:

By Type

The Europe Online Assessment Software Market categorizes its offerings into formative assessment, summative assessment, diagnostic assessment, certification and high-stakes testing, and others. It shows strong demand for formative and certification assessments due to the need for continuous evaluation and standardized credentialing in academic and corporate environments. Summative and diagnostic assessments gain traction in institutions aiming to measure overall performance and identify knowledge gaps efficiently. Vendors focus on enhancing platform versatility to support multiple assessment types, meeting diverse client requirements.

- For instance, the European Training Foundation’s FormA toolkit supports educators by providing a presentation of 34 different formative assessment methods and activities, fostering more adaptive and impactful learning journeys.

By Deployment Mode

Cloud-based solutions dominate the market, offering scalability, remote accessibility, and real-time data management. It enables institutions and organizations to deploy assessments without extensive IT infrastructure while ensuring secure and reliable operations. On-premises deployment maintains relevance for enterprises and institutions requiring complete control over data and internal systems. Market players emphasize hybrid capabilities to provide flexibility, supporting clients across varied technical environments and security preferences.

- For instance, Digital Realty launched its Innovation Lab in 2025 to test hybrid cloud deployments, featuring high-density colocation that supports advanced AI workloads of up to 150kW per cabinet.

By End-User

Education holds the largest share, driven by schools, universities, and e-learning platforms adopting digital assessment solutions for student evaluation and certification. Corporate training programs follow closely, leveraging online assessments to evaluate employee skills, recruitment, and performance management. Healthcare, government, and other sectors increasingly implement online assessments for compliance testing, professional certifications, and internal training programs. It helps end-users reduce administrative overhead, ensure accuracy, and enhance data-driven decision-making across all segments.

Segmentations:

By Type

- Formative Assessment

- Summative Assessment

- Diagnostic Assessment

- Certification and High-stakes Testing

- Others

By Deployment Mode

By End-User

- Education

- Corporate

- Healthcare

- Government

- Others

Country Analysis

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Dominance of Western Europe Driven by Advanced Digital Infrastructure

Western Europe holds 55% of the Europe Online Assessment Software Market, led by strong adoption in the UK, Germany, and France. It benefits from well-established IT infrastructure, high digital literacy, and widespread use of online learning and corporate training solutions. Educational institutions and enterprises implement digital assessment platforms to improve efficiency and evaluation accuracy. Leading software providers maintain a strong presence, offering tailored solutions that comply with local regulations. Continuous investment in cloud-based and AI-powered assessment tools reinforces Western Europe’s market leadership.

Emerging Opportunities in Northern and Southern Europe

Northern and Southern Europe account for 25% of the market, with Sweden, Norway, Italy, and Spain driving adoption. It experiences increasing demand due to the growth of e-learning platforms, professional certification programs, and corporate upskilling initiatives. Government support for digital education infrastructure further promotes market expansion. Organizations prioritize secure, scalable, and mobile-compatible assessment solutions. Regional partnerships and local vendors strengthen accessibility and address specific educational and corporate requirements, accelerating adoption across these regions.

Central and Eastern Europe Exhibiting Steady Expansion

Central and Eastern Europe represent 20% of the Europe Online Assessment Software Market, with Poland, the Czech Republic, and Hungary leading adoption. It benefits from digital transformation initiatives in education and workforce development programs, despite infrastructure and digital literacy limitations in certain areas. Investments in cloud-based platforms and AI-enhanced assessment tools modernize evaluation processes. Government initiatives supporting e-learning and professional training reinforce growth potential. Vendors focus on cost-effective, scalable, and compliant solutions to capture opportunities in these emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Online Assessment Software Market features intense competition with both global and regional players striving to expand their market presence. It is characterized by strategic developments such as mergers and acquisitions, new product launches, and regional expansions to strengthen competitive positioning. Leading companies focus on innovation in AI-driven assessment tools, cloud-based platforms, and adaptive learning solutions to meet diverse client needs. ExamSoft Worldwide, Questionmark, HireVue, Vervoe, and ProProfs dominate the market with comprehensive product portfolios and strong regional outreach. Vendors prioritize enhancing platform security, compliance with GDPR, and seamless integration with learning management systems to attract educational institutions and corporate clients. Smaller players concentrate on niche solutions and personalized services to gain a competitive edge. Continuous investment in research and development, strategic partnerships, and customer-focused offerings remain crucial for sustaining growth and market leadership across Europe.

Recent Developments:

- In October 2025, HireVue introduced its latest product, Interview Insights, which uses AI to analyze interview content and identify key moments demonstrating a candidate’s job-related skills.

- In January 2024, Questionmark launched Advanced Assessments, an evolution of its assessment platform that allows for the creation of industry-specific and scenario-based exams.

Report Coverage:

The research report offers an in-depth analysis based on Type, Deployment Mode, End-User and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and Europeeconomic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing adoption of AI-driven and adaptive assessment tools will enhance personalized evaluation and predictive analytics.

- Expansion of cloud-based platforms will increase accessibility, scalability, and real-time data management across institutions and enterprises.

- Remote learning and corporate upskilling programs will continue to drive demand for secure and flexible online assessment solutions.

- Integration with learning management systems will streamline workflows and improve efficiency in education and corporate sectors.

- Government initiatives supporting digital education infrastructure and skill-based evaluation will create new opportunities for software adoption.

- Rising focus on data-driven decision-making will encourage institutions and organizations to implement advanced analytics and reporting features.

- Mobile-compatible assessment solutions will expand user engagement and accessibility in geographically diverse regions.

- Enhanced cybersecurity and compliance measures will strengthen trust and adoption among academic and corporate clients.

- Niche solutions targeting specialized sectors, including healthcare and government, will drive incremental growth.

- Strategic partnerships, mergers, and product innovations will continue to shape competitive dynamics and market expansion across Europe.