Market Overview:

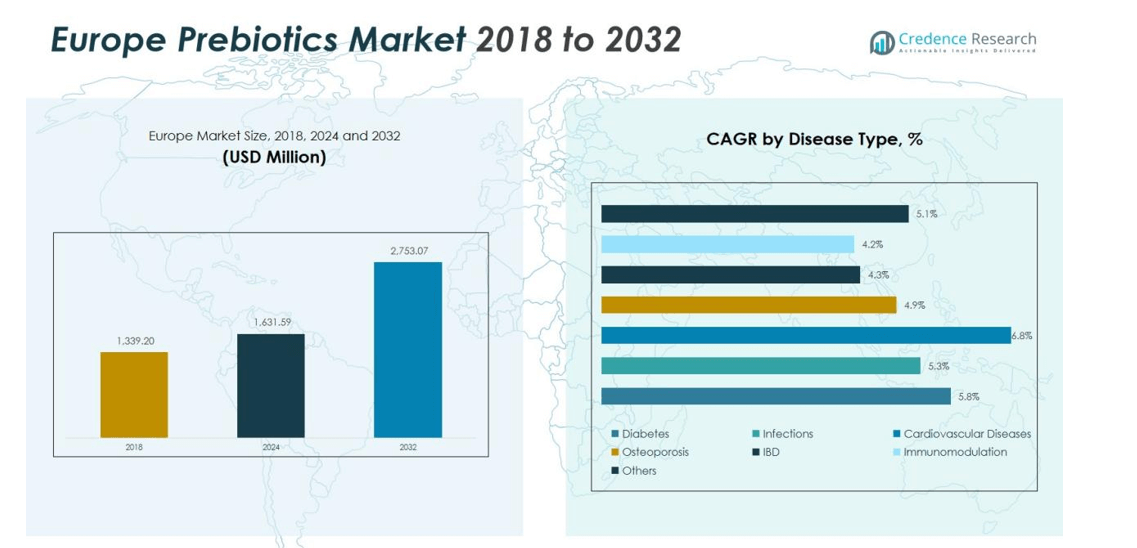

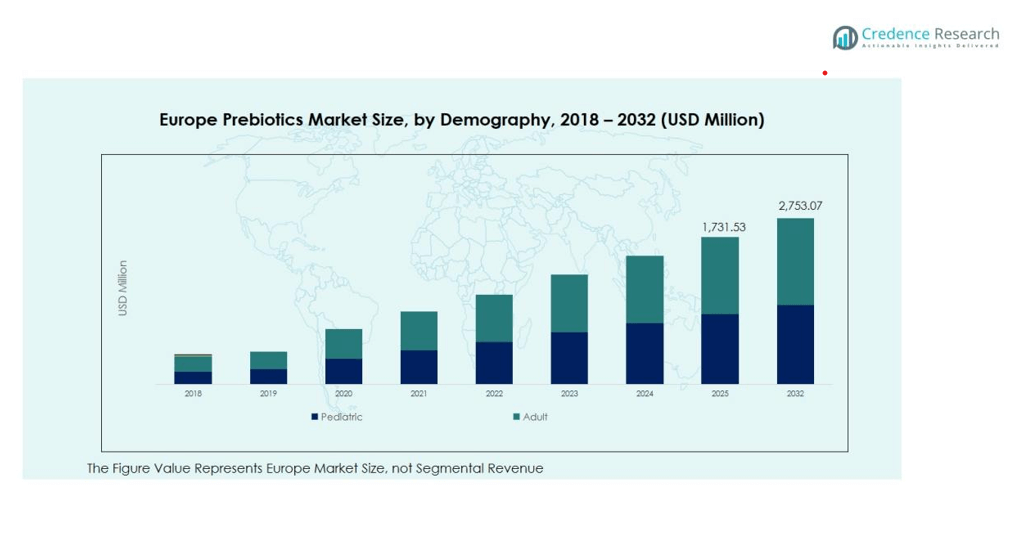

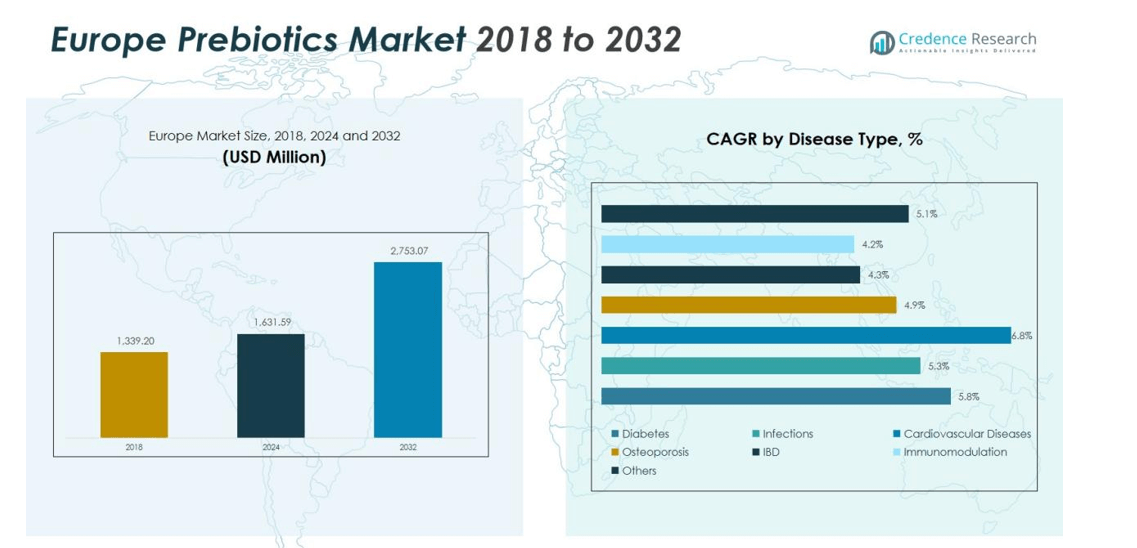

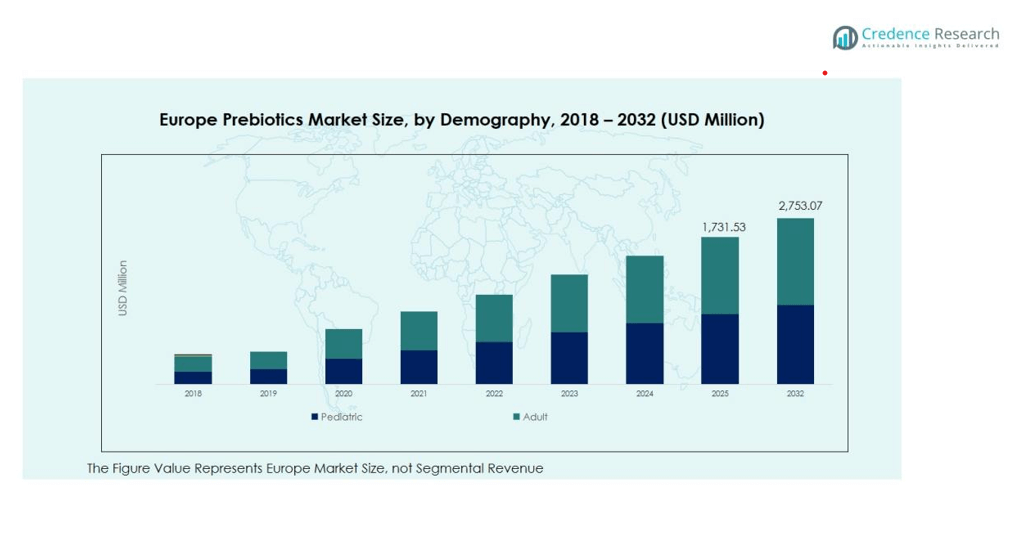

The Europe Prebiotics Market size was valued at USD 1,339.20 million in 2018 to USD 1,631.59 million in 2024 and is anticipated to reach USD 2,753.07million by 2032, at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Prebiotics Market Size 2024 |

USD 1,631.59 million |

| Europe Prebiotics Market, CAGR |

5.29% |

| Europe Prebiotics Market Size 2032 |

USD 2,753.07million |

The market is primarily driven by rising adoption of clean-label, plant-based, and digestive health products across Europe. Regulatory support for functional foods, coupled with a shift toward preventive health solutions, accelerates innovation in prebiotic formulations. The increasing integration of prebiotics in animal nutrition, pharmaceuticals, and dietary supplements also boosts industry diversification and profitability.

Regionally, Western Europe dominates the Europe Prebiotics Market, led by countries such as Germany, France, and the U.K., owing to established food processing industries and advanced R&D capabilities. Northern Europe follows due to high consumer spending on wellness products, while Southern and Eastern Europe are emerging as growth regions driven by urbanization, dietary diversification, and expanding awareness of digestive health benefits.

Market Insights:

- The Europe Prebiotics Market was valued at USD 1,339.20 million in 2018, reached USD 1,631.59 million in 2024, and is projected to attain USD 2,753.07 million by 2032, registering a CAGR of 5.29% during the forecast period.

- Western Europe holds the largest share of 46% due to advanced food processing industries, strong R&D infrastructure, and consumer awareness of gut health.

- Northern Europe accounts for 28% of the market, supported by sustainable sourcing practices and high adoption of functional food products.

- Southern and Eastern Europe collectively represent 18% and are the fastest-growing regions, driven by urbanization, dietary diversification, and increasing focus on preventive healthcare.

- By product, inulin and fructo-oligosaccharides (FOS) together capture 52% of total revenue, while the adult demographic dominates with a 58% share, reflecting higher consumption of functional and digestive health supplements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Focus on Digestive Wellness and Functional Nutrition

The Europe Prebiotics Market is driven by a growing preference for foods that promote gut health and overall well-being. Consumers are actively seeking functional foods fortified with inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS). These ingredients support healthy digestion and immunity, aligning with preventive healthcare trends. Rising awareness of the gut–brain connection has strengthened the adoption of prebiotics in daily diets. Food manufacturers are responding with a wider range of fortified bakery, dairy, and beverage products to meet this growing demand.

- For Instance, BENEO announced a multi-million investment program exceeding €30 million in November 2021 to expand its prebiotic chicory root fiber production capacity globally by over 40 percent at its facilities in Oreye, Belgium, and Pemuco, Chile.

Expansion of Clean-Label and Plant-Based Food Products

Clean-label and plant-based product trends are influencing the demand landscape across Europe. Consumers prefer transparent ingredient lists, minimal additives, and natural sources, which prebiotics naturally support. It benefits from the shift toward sustainable and health-oriented consumption patterns. Food producers are increasingly using prebiotic fibers derived from chicory root, oats, and legumes to enhance both nutritional value and brand appeal. The growing vegan and flexitarian population further accelerates adoption across multiple product categories.

- For example, Givaudan’s OatWell™ oat beta-glucan prebiotic fiber product supports gut health and improved cardiovascular and glycemic control, backed by more than 60 scientific publications, and enjoys over 80% consumer awareness in Europe, enhancing oat-based plant product innovation and adoption.

Strong Regulatory Support and Technological Advancements in Food Innovation

Supportive policies from the European Food Safety Authority (EFSA) strengthen product credibility and consumer trust. Manufacturers in the Europe Prebiotics Market leverage regulatory clarity to launch scientifically validated, health-claim-approved formulations. Advances in food technology, such as microencapsulation and synbiotic combinations, improve ingredient stability and effectiveness. It drives continuous innovation across the food and supplement industries. Collaboration between food scientists and biotechnology firms fosters efficient production and product diversification.

Rising Application Across Non-Food Sectors

Prebiotics are expanding beyond food and beverage into pharmaceuticals, nutraceuticals, and animal nutrition. Pharmaceutical companies incorporate prebiotic components into formulations targeting immunity and metabolic health. It is also gaining traction in animal feed to improve gut microflora and reduce antibiotic dependence. The personal care industry is exploring prebiotics for skin microbiome balance and anti-inflammatory benefits. This diversification of applications broadens revenue potential and enhances long-term market sustainability.

Market Trends:

Integration of Prebiotics in Functional Beverages, Dairy, and Bakery Products

Manufacturers in the Europe Prebiotics Market are increasingly incorporating prebiotics into mainstream food categories such as yogurt, milk alternatives, energy bars, and bakery items. This integration reflects growing consumer demand for convenient nutrition that supports gut and immune health. It aligns with the shift toward functional and fortified foods designed to meet specific wellness goals. Dairy producers are introducing yogurts enriched with inulin and FOS to enhance fiber intake, while beverage brands are formulating prebiotic-infused drinks targeting digestive balance. The bakery industry is adopting prebiotic fibers to improve texture and health appeal in bread, biscuits, and snacks. Demand for on-the-go nutritional solutions is accelerating innovation across retail and online channels. The growing influence of wellness-focused diets continues to shape product development and portfolio expansion across Europe.

- For Instance, PepsiCo announced the launch of a new product, Pepsi Prebiotic Cola, containing 3 grams of prebiotic fiber per 12-ounce can, and with 5 grams of cane sugar and 30 calories.

Emergence of Personalized Nutrition and Synbiotic Formulations

Personalized nutrition is becoming a defining trend across the regional health and wellness landscape. Consumers seek tailored solutions addressing digestive health, immunity, and metabolic needs based on genetic and lifestyle factors. It is encouraging companies to develop customized prebiotic blends and synbiotic products that combine probiotics and prebiotics for targeted benefits. Advances in gut microbiome research support this trend by linking specific prebiotic compounds to measurable health outcomes. The collaboration between biotechnology firms and food manufacturers is enhancing the precision and diversity of formulations. The rise of e-commerce and digital wellness platforms enables consumers to access personalized dietary recommendations, driving product awareness and adoption. These innovations reflect a broader movement toward data-driven, individualized nutrition strategies in Europe.

- For Instance, The DRG4FOOD’s GENIE project, supported by Ametller Origen in Spain, is deploying an AI-driven nutrition recommendation engine that integrates genetics, microbiome, and biochemical markers.

Market Challenges Analysis:

High Production Costs and Limited Raw Material Availability

The Europe Prebiotics Market faces challenges due to the high cost of production and limited raw material availability. Extraction of prebiotics from natural sources such as chicory root and legumes requires advanced processing methods, raising operational expenses. It increases the final product cost, limiting access for price-sensitive consumers and small-scale manufacturers. Seasonal fluctuations in crop yield further strain supply chains, affecting ingredient consistency and pricing stability. Smaller producers often struggle to maintain margins in a competitive environment dominated by large multinational companies. These factors collectively slow the market’s growth potential and create barriers to mass-market adoption.

Complex Regulatory Framework and Consumer Awareness Gaps

The European regulatory landscape for functional foods and health claims remains complex and stringent. Manufacturers must obtain scientific validation and EFSA approval for specific prebiotic benefits, extending product launch timelines and compliance costs. It challenges new entrants and smaller firms with limited regulatory expertise. Despite growing interest in gut health, many consumers still confuse prebiotics with probiotics, leading to limited awareness of their distinct roles. Inconsistent labeling and marketing claims reduce product transparency and consumer confidence. Companies are addressing these challenges through clearer communication and education campaigns across major European markets.

Market Opportunities:

Expansion of Prebiotics in Nutraceuticals and Dietary Supplements

The Europe Prebiotics Market holds strong potential in the expanding nutraceutical and dietary supplement segment. Consumers are increasingly adopting fiber-rich and gut-health products to manage immunity, metabolism, and weight. It creates demand for prebiotic capsules, powders, and gummies formulated for daily wellness. Growing investment by pharmaceutical and nutraceutical firms supports the development of science-backed prebiotic products with specific health claims. Online retail platforms are widening access to personalized nutrition solutions across Europe. Rising preventive healthcare spending and lifestyle-related digestive concerns are accelerating supplement adoption. This expansion presents a significant growth avenue for manufacturers and ingredient suppliers.

Rising Demand for Sustainable and Plant-Based Ingredient Sourcing

Sustainability is becoming a key differentiator within Europe’s health and nutrition industry. Consumers prefer plant-based, traceable ingredients sourced from renewable origins such as chicory root, oats, and legumes. It encourages manufacturers to invest in eco-friendly sourcing and production processes to enhance brand credibility. Companies focusing on circular economy models and waste reduction gain a competitive edge. Technological advancements in enzymatic extraction and fermentation offer cost-effective and sustainable alternatives to traditional methods. Growing regulatory support for green manufacturing further strengthens market opportunities. This shift toward ethical and sustainable consumption reinforces long-term market expansion.

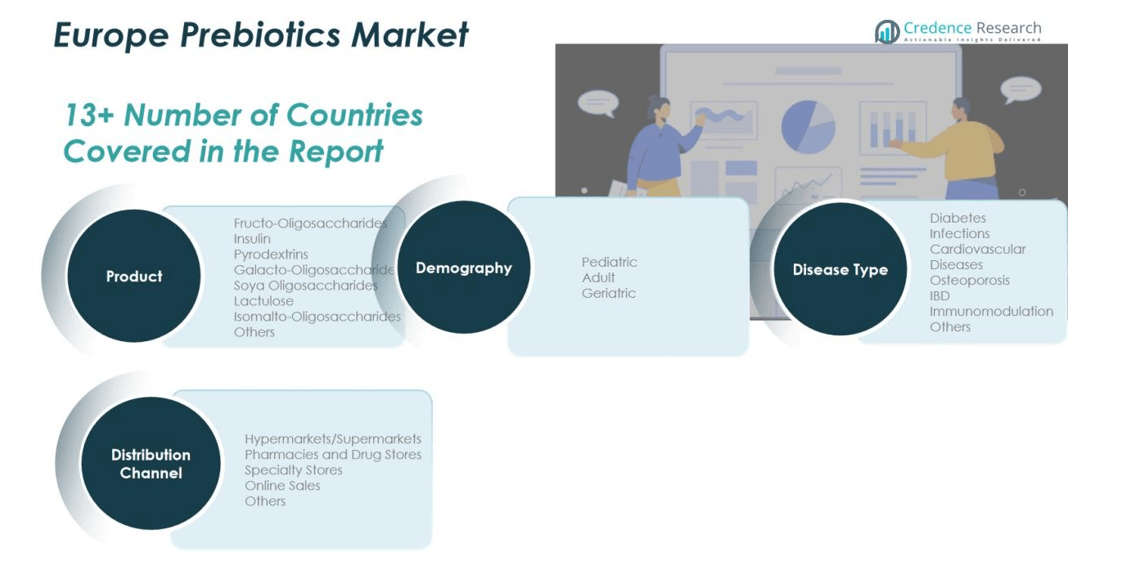

Market Segmentation Analysis:

By Product Segment

The Europe Prebiotics Market is segmented into fructo-oligosaccharides (FOS), inulin, pyrodextrins, galacto-oligosaccharides (GOS), soya oligosaccharides, lactulose, isomalto-oligosaccharides, and others. Inulin and FOS dominate the market due to their high application in functional foods and beverages. It benefits from extensive use in dairy, bakery, and nutrition supplements for improving gut health and fiber intake. GOS is gaining traction in infant formula and clinical nutrition due to its digestive and immune-supporting properties. Product innovation and natural sourcing trends continue to expand usage across industries.

- For Instance, FrieslandCampina Ingredients received regulatory approval in Thailand for its Aequival 2′-FL (an HMO ingredient) for use in infant and follow-up milk formulas.

By Disease Type Segment

This segment covers diabetes, infections, cardiovascular diseases, osteoporosis, inflammatory bowel disease (IBD), immunomodulation, and others. The diabetes segment leads due to increasing demand for dietary fibers that regulate glucose and lipid metabolism. It is followed by cardiovascular diseases and IBD, supported by rising awareness of prebiotics’ role in maintaining heart and digestive health. Immunomodulation applications are expanding, driven by preventive healthcare adoption and clinical validation of gut-immune interactions. Companies are focusing on formulating disease-specific blends for targeted benefits.

- For instance, myota’s prebiotic fiber supplement demonstrated a 0.17 percentage point reduction in HbA1c levels and significant improvements in insulin sensitivity among pre-diabetic patients in a 24-week clinical trial published in 2024.

By Demography Segment

The demography segment includes pediatric, adult, and geriatric populations. The adult group accounts for the largest share due to higher consumption of functional foods and supplements. It reflects a growing focus on digestive wellness and preventive nutrition among working-age consumers. The geriatric population is an emerging user base driven by age-related digestive and metabolic disorders. Pediatric applications continue to expand through fortified infant formulas containing prebiotic ingredients.

Segmentations:

By Product Segment:

- Fructo-Oligosaccharides (FOS)

- Inulin

- Pyrodextrins

- Galacto-Oligosaccharides (GOS)

- Soya Oligosaccharides

- Lactulose

- Isomalto-Oligosaccharides

- Others

By Disease Type Segment:

- Diabetes

- Infections

- Cardiovascular Diseases

- Osteoporosis

- Inflammatory Bowel Disease (IBD)

- Immunomodulation

- Others

By Demography Segment:

- Pediatric

- Adult

- Geriatric

By Distribution Channel Segment:

- Hypermarkets/Supermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Online Sales

- Others

By Country Segment:

- United Kingdom

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Dominance of Western Europe Driven by Strong Food and Nutrition Industries

Western Europe holds the largest share of the Europe Prebiotics Market due to its well-established food, beverage, and nutraceutical sectors. Countries such as Germany, France, and the U.K. lead production and consumption, supported by advanced R&D capabilities and strict regulatory standards promoting functional food innovation. It benefits from widespread consumer awareness of gut health and preference for clean-label products. Leading food manufacturers invest heavily in product diversification using inulin and fructo-oligosaccharides. The region’s emphasis on sustainable ingredient sourcing and technological innovation continues to drive consistent growth across major economies.

Emerging Growth in Southern and Eastern Europe Through Urbanization and Health Awareness

Southern and Eastern Europe are witnessing steady market expansion driven by urban lifestyle changes and rising awareness of digestive health. Countries such as Italy, Spain, and Poland are seeing increased demand for fortified foods and dietary supplements. It is supported by government initiatives encouraging healthy eating and growing retail penetration of functional products. Expanding distribution networks and affordability improvements are strengthening product availability across middle-income consumer groups. Local manufacturers are entering partnerships with global players to enhance production efficiency and brand presence. The increasing focus on preventive healthcare supports long-term market growth in these regions.

Northern Europe Advancing Through Sustainable Sourcing and Technological Innovation

Northern Europe demonstrates strong potential due to its focus on sustainability, innovation, and ethical sourcing. Countries such as Denmark, Sweden, and Finland are leading in developing prebiotics derived from renewable plant sources like oats and legumes. It aligns with regional priorities for environmental responsibility and transparent production. Supportive government policies and research collaborations foster continuous innovation in food technology and gut microbiome science. Consumers in these markets exhibit high adoption of functional foods and supplements, driving consistent revenue growth. The region’s advanced manufacturing ecosystem ensures reliability, traceability, and quality compliance in prebiotic production.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott Laboratories

- Archer Daniels Midland Company

- BASF SE

- Beghin Meiji

- BENEO GmbH

- Biopolis Life Sciences Private Limited

- Ciranda, Inc.

- Clasado Limited

- Cosucra Groupe Warcoing SA

- DuPont de Nemours, Inc.

- Galam Group

- Ingredion Incorporated

- Kerry Group

- Tereos Group

- The Kraft Heinz Company

Competitive Analysis:

The Europe Prebiotics Market is highly competitive, with several multinational and regional players focusing on innovation, product quality, and strategic expansion. Key companies include Abbott Laboratories, Archer Daniels Midland Company, BASF SE, Beghin Meiji, BENEO GmbH, Biopolis Life Sciences Private Limited, and Ciranda, Inc. The competition is driven by increasing demand for functional foods, nutraceuticals, and clean-label products that support digestive health. It encourages companies to invest in advanced extraction technologies, clinical research, and sustainable sourcing practices. Strategic partnerships, mergers, and product launches remain common as firms aim to strengthen market presence and customer loyalty. Companies with diversified portfolios and strong regional distribution networks hold a clear advantage in maintaining long-term growth and brand relevance.

Recent Developments:

- In October 2025, Abbott Laboratories announced strong third-quarter 2025 results emphasizing major growth in its Medical Devices and Diabetes Care segments, particularly due to its FreeStyle Libre technology and expanding device portfolio in global markets.

- In October 2025, BASF SE and Carlyle Group, partnered with Qatar Investment Authority, entered into a binding agreement valued at €7.7 billion for Carlyle’s acquisition of a majority stake in BASF’s coatings business, which includes automotive OEM and refinish coatings and surface treatment operations, with BASF retaining a 40% equity stake; the transaction is expected to close in the second quarter of 2026.

Report Coverage:

The research report offers an in-depth analysis based on Product, Disease Type, Demography, Distribution Channel, Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Prebiotics Market will continue to expand with growing emphasis on digestive and immune health.

- Food and beverage manufacturers will increase integration of prebiotics into functional foods, dairy, and beverages.

- Consumer preference for natural, plant-based ingredients will drive innovation in sustainable prebiotic sourcing.

- Technological advances in extraction and fermentation will improve efficiency and cost-effectiveness.

- Synbiotic formulations combining probiotics and prebiotics will gain strong traction in personalized nutrition.

- Pharmaceutical and nutraceutical sectors will expand usage of prebiotics for metabolic and cardiovascular health.

- Online retail and direct-to-consumer models will enhance accessibility and product awareness across Europe.

- Regulatory clarity and health-claim validation will strengthen consumer confidence and market transparency.

- Regional collaborations between food manufacturers and biotechnology firms will accelerate product diversification.

- Growing awareness of preventive healthcare and the gut–brain connection will ensure sustained long-term demand for prebiotics across Europe.