Market Overview

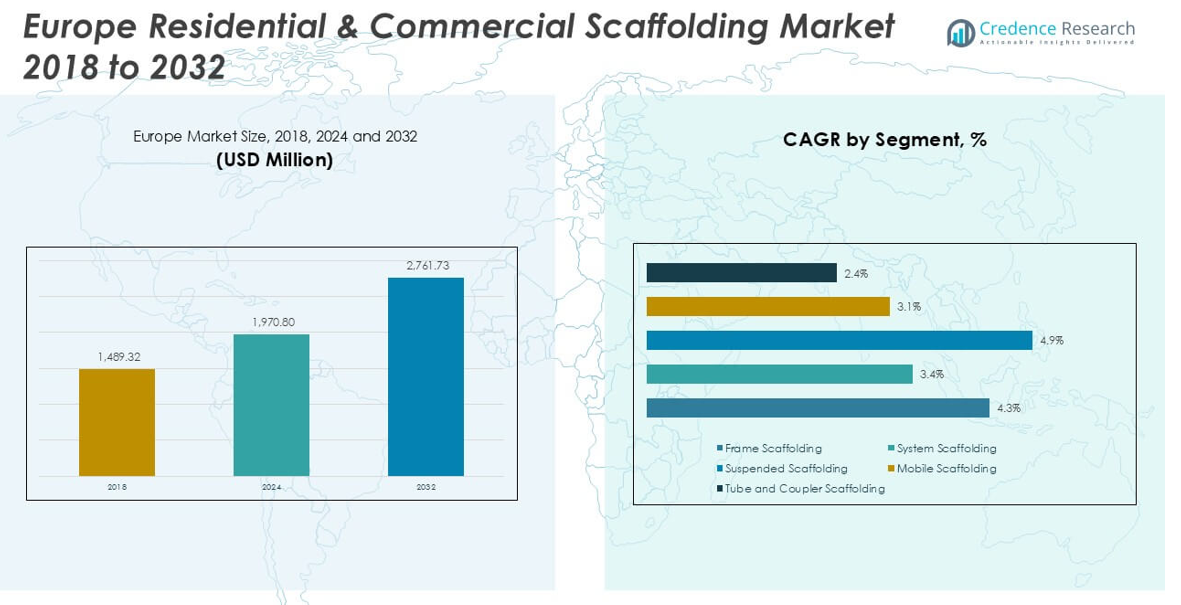

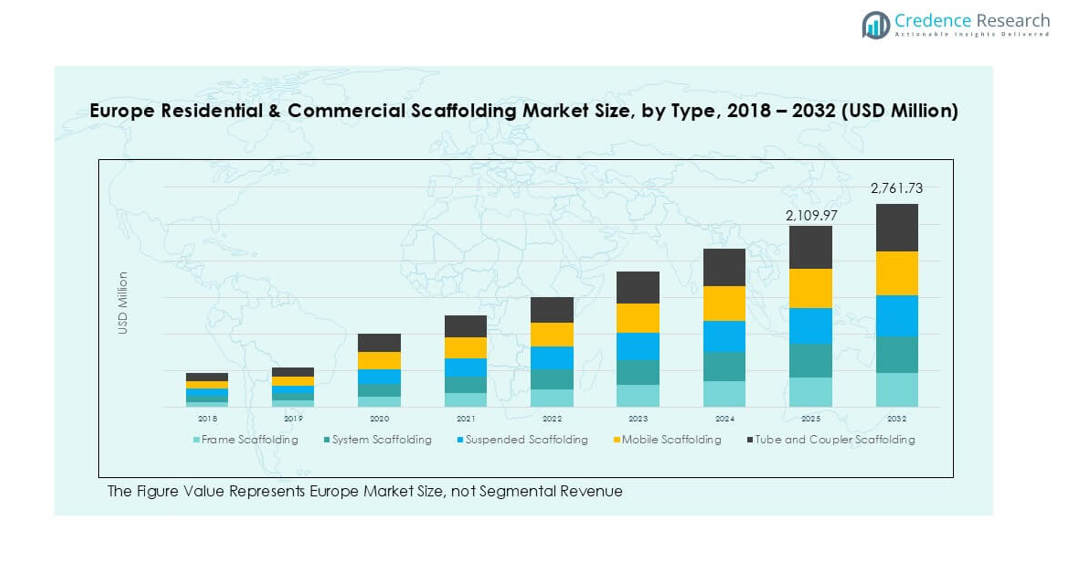

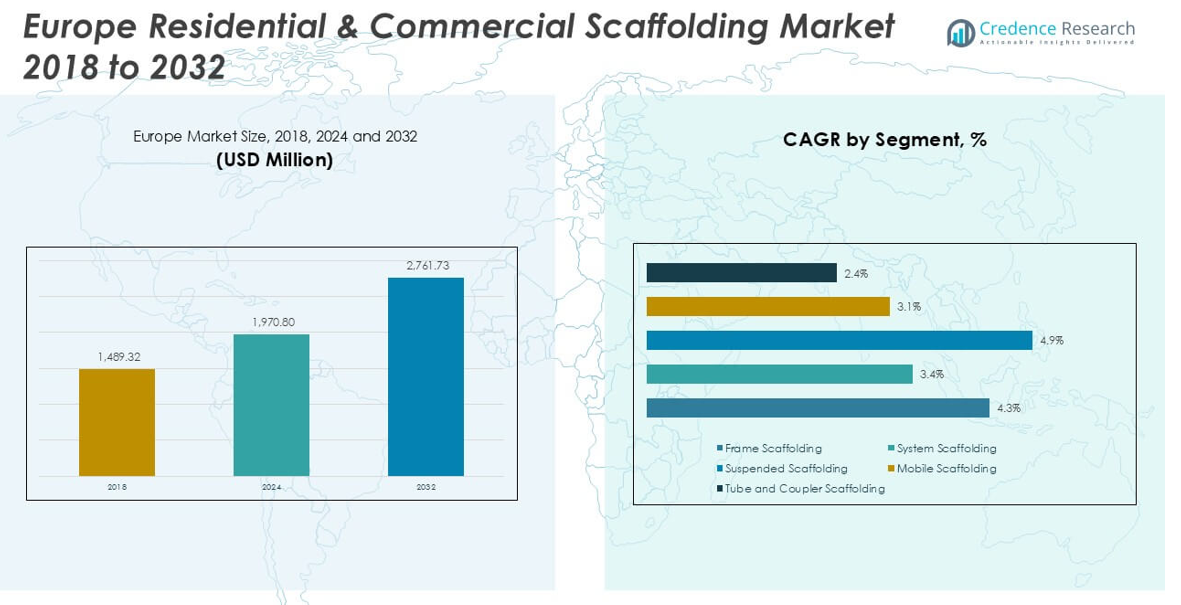

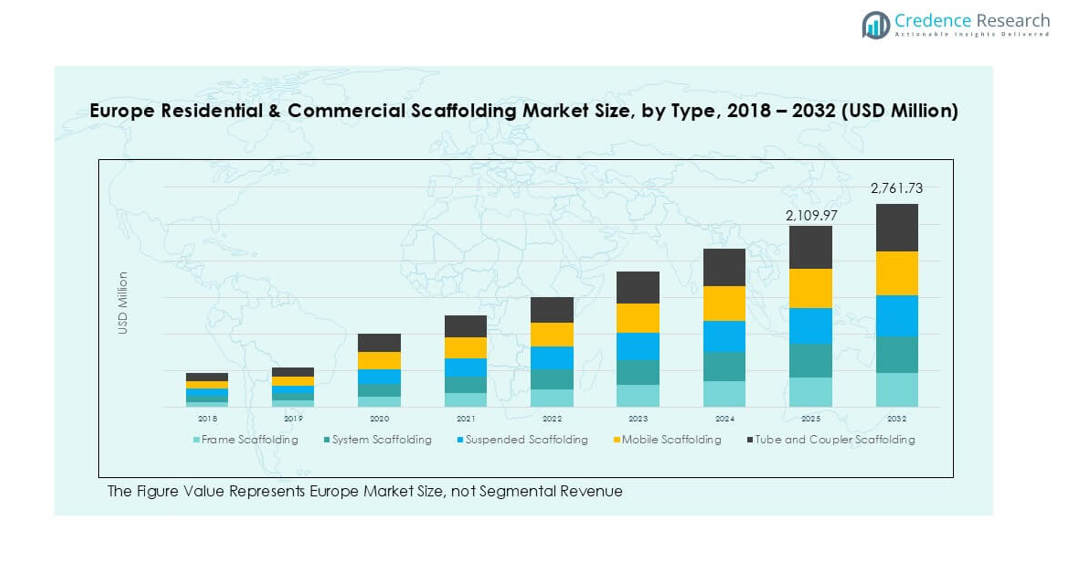

The Europe Residential & Commercial Scaffolding market size was valued at USD 1,489.32 million in 2018, increased to USD 1,970.80 million in 2024, and is anticipated to reach USD 2,761.73 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Residential & Commercial Scaffolding Market Size 2024 |

USD 1,970.80 million |

| Europe Residential & Commercial Scaffolding Market, CAGR |

3.9% |

| Europe Residential & Commercial Scaffolding Market Size 2032 |

USD 2,761.73 million |

The Europe Residential & Commercial Scaffolding market is led by key players such as Wilhelm Layher, Altrad Group, ULMA Corporation, and ADTO Industrial Group, who dominate through extensive product portfolios, advanced safety systems, and robust rental networks. These companies maintain a competitive edge by offering modular, lightweight, and compliant scaffolding solutions tailored to both residential and commercial applications. Other notable contributors include Brand Industrial Services, Inc., MJ-Gerüst GmbH, and Aluminium Scaffold Towers Limited, focusing on regional and specialized services. Germany stands as the leading region, commanding approximately 25% of the market share in 2024, driven by strong construction activity, regulatory compliance, and technological advancements in scaffolding systems.

Market Insights

- The Europe Residential & Commercial Scaffolding market was valued at USD 1,970.80 million in 2024 and is projected to reach USD 2,761.73 million by 2032, growing at a CAGR of 3.9% during the forecast period.

- Market growth is primarily driven by increasing urban infrastructure projects, stringent worker safety regulations, and rising demand for renovation across aging European buildings.

- A notable trend includes the growing adoption of modular and prefabricated scaffolding systems, along with digital integration such as Building Information Modeling (BIM) to streamline project planning.

- The competitive landscape is dominated by players like Wilhelm Layher, Altrad Group, ULMA Corporation, and ADTO Industrial Group, who are focusing on innovation, rental service expansion, and compliance with EU safety standards.

- Germany leads the regional market with a 25% share, followed by the UK (21%) and France (17%), while frame scaffolding and steel scaffolding are the leading segments by type and material respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Europe Residential & Commercial Scaffolding market, frame scaffolding emerged as the dominant sub-segment, accounting for the largest market share in 2024. This type is widely used due to its ease of assembly, cost-effectiveness, and suitability for both residential and commercial construction. The growing number of mid-rise and high-rise building projects across Europe has further driven demand for frame scaffolding. System scaffolding also holds a significant share, supported by increasing adoption in complex architectural designs. Meanwhile, mobile and suspended scaffolding are gaining traction in maintenance and renovation tasks, especially in urban settings.

- For instance, Wilhelm Layher produces over 15,000 tons of frame and system scaffolding annually at its Güglingen-Eibensbach plant in Germany, supporting high-volume demand across Europe.

By Material

Steel scaffolding led the market by material type, holding the highest revenue share in 2024, owing to its superior strength, durability, and load-bearing capacity. It is highly preferred in large-scale commercial projects and high-rise constructions where safety and structural integrity are critical. Aluminum scaffolding follows as a growing segment, primarily driven by its lightweight nature and ease of transport, making it ideal for smaller residential projects and temporary works. Bamboo and wood scaffolding, although declining in popularity, still see limited use in traditional or low-cost construction areas, especially in Eastern Europe.

- For instance, Altrad Group operates multiple steel fabrication sites in Europe with a combined production output of over 20,000 metric tons annually, significantly contributing to the supply of steel scaffolding components.

By Application

The new construction segment dominated the market in terms of application, representing the largest share in 2024. The steady growth in residential housing developments and commercial infrastructure projects across Europe, particularly in countries like Germany, France, and the UK, has significantly contributed to this trend. Urban expansion, rising investments in public infrastructure, and government initiatives aimed at housing development have further bolstered this segment. Renovation and maintenance also constitute a considerable share, supported by increasing refurbishment activities in aging urban structures. The “Others” category includes niche applications, such as event setups and temporary access platforms.

Market Overview

Surge in Urban Infrastructure Development

The rising demand for urban infrastructure across Europe is a key growth driver for the residential and commercial scaffolding market. Rapid urbanization and increasing investments in high-rise buildings, commercial centers, and transport infrastructure are propelling scaffolding needs. Governments across major economies like Germany, France, and the UK are prioritizing infrastructure modernization and urban renewal projects, leading to increased construction activity. This surge necessitates scalable, safe, and efficient scaffolding systems to support construction timelines, thereby contributing significantly to market expansion.

- For instance, ULMA Construction provided over 250,000 square meters of scaffolding systems for a multi-year metro expansion project in Paris (Grand Paris Express), enabling complex multi-level access and support structures.

Stringent Worker Safety Regulations

Growing enforcement of workplace safety regulations in Europe has intensified the demand for high-quality scaffolding systems. Regulatory bodies such as the European Agency for Safety and Health at Work (EU-OSHA) mandate secure access platforms and fall protection measures during construction. As a result, construction companies are increasingly investing in compliant scaffolding solutions, especially in commercial and public infrastructure projects. This regulatory push is encouraging the adoption of modern scaffolding types like system scaffolding and mobile platforms, thereby driving market growth.

- For instance, MJ-Gerüst GmbH integrated advanced fall protection features in over 30,000 square meters of system scaffolding deployed in public infrastructure projects across Germany in 2023.

Increase in Renovation and Retrofitting Projects

Europe’s aging building stock is prompting a rise in renovation and retrofitting projects, particularly in urban centers. With many structures requiring upgrades for energy efficiency, safety, or aesthetic reasons, scaffolding is essential to provide safe access for workers and equipment. This is especially true in historical cities where preservation of older buildings is a priority. The increased focus on sustainability and green building practices further amplifies the need for temporary access systems, reinforcing scaffolding demand in the renovation segment.

Key Trends & Opportunities

Adoption of Modular and Prefabricated Scaffolding Systems

A growing trend in the Europe scaffolding market is the shift towards modular and prefabricated systems that offer improved flexibility, faster installation, and enhanced safety. These systems reduce labor intensity and downtime on construction sites, aligning with the increasing demand for time-efficient project delivery. Manufacturers are also introducing advanced modular scaffolds with interchangeable components and lighter materials, opening new opportunities in both residential and commercial sectors. This trend supports cost-efficiency while meeting evolving architectural and regulatory requirements.

- For instance, ADTO Industrial Group exported more than 12,000 modular scaffold units to European partners in 2024, helping reduce average assembly time on mid-scale construction sites by up to 40 hours per project.

Digital Integration and Smart Construction Practices

The integration of digital technologies in construction is creating new opportunities for scaffolding providers. Building Information Modeling (BIM), project tracking software, and digital safety compliance tools are transforming the way scaffolding is planned and managed. Contractors are increasingly seeking digitally integrated scaffolding solutions to improve site coordination, reduce errors, and optimize material use. This tech-driven transformation presents a promising opportunity for players offering innovative, data-enabled scaffolding products and services across the European market.

- For instance, Brand Industrial Services, Inc. implemented BIM-enabled planning tools across 120 construction projects in the UK and France during 2024, improving scaffolding layout efficiency by 25% and reducing material wastage by 18 tons across sites.

Key Challenges

Fluctuating Raw Material Prices

The Europe scaffolding market faces significant challenges due to volatility in raw material prices, particularly steel and aluminum. These fluctuations directly impact production costs and profit margins for manufacturers and rental companies. Unpredictable supply chain dynamics, influenced by global trade tensions or energy price changes, further exacerbate the issue. Companies are compelled to either absorb the cost or pass it on to customers, which may affect project budgets and lead to delays or cancellations in some cases.

Labor Shortages and Skilled Workforce Constraints

A persistent shortage of skilled labor in the construction sector is posing challenges to scaffolding operations. The assembly, disassembly, and inspection of scaffolding require trained professionals to ensure safety and efficiency. However, the aging workforce and limited influx of new skilled workers are straining project timelines and increasing labor costs. This gap in technical proficiency not only affects the quality of scaffolding installation but also raises safety risks, potentially hindering market growth.

Complex Regulatory Compliance Across Regions

Navigating the diverse regulatory frameworks across different European countries presents a compliance challenge for scaffolding manufacturers and service providers. While safety standards are generally high, variations in national building codes, certification processes, and equipment specifications create operational complexities. Companies operating in multiple countries must invest in extensive testing and documentation to meet localized requirements, slowing down market entry and expansion efforts. This fragmented regulatory landscape can deter new entrants and complicate cross-border projects.

Regional Analysis

United Kingdom

The United Kingdom holds a significant share in the Europe Residential & Commercial Scaffolding market, accounting for approximately 21% of the regional market in 2024. The country’s active residential housing programs and substantial investments in commercial infrastructure, such as office buildings and transport projects, are key growth drivers. London and other major cities are experiencing a surge in high-rise and mixed-use developments, boosting demand for safe and efficient scaffolding systems. Additionally, government regulations emphasizing worker safety have increased the adoption of system and frame scaffolding across both residential and commercial construction sectors.

France

France represents around 17% of the Europe Residential & Commercial Scaffolding market, supported by robust construction activity in both residential and commercial segments. Major urban development projects in Paris, Lyon, and Marseille, combined with energy-efficient building renovation initiatives, have accelerated scaffolding demand. The country also benefits from favorable government policies aimed at infrastructure modernization. The rising trend of restoring historic buildings and the promotion of sustainable construction practices have further reinforced the use of modern scaffolding technologies, particularly aluminum and modular systems that offer better adaptability and safety.

Germany

Germany dominates the European scaffolding market with a leading share of 24% in 2024. The country’s strong construction industry, driven by large-scale residential housing demand and continuous commercial infrastructure upgrades, contributes to its market leadership. Key metropolitan areas like Berlin, Munich, and Frankfurt are witnessing increased activity in high-rise and industrial construction, requiring advanced scaffolding systems. Additionally, Germany’s strict occupational safety regulations promote the adoption of high-quality scaffolding materials and modular configurations. Investments in smart cities and green building practices also support long-term growth in the German scaffolding sector.

Italy

Italy holds a moderate share of approximately 11% in the regional scaffolding market. The country’s market is primarily driven by renovation and restoration projects, especially in heritage-rich cities such as Rome, Florence, and Venice. The government’s tax incentives for building retrofits and seismic upgrades have supported consistent demand for scaffolding services. While new residential construction has shown modest growth, the extensive maintenance and refurbishment work in older urban areas ensure steady market activity. The adoption of lightweight and adaptable scaffolding systems, such as mobile and aluminum variants, is gradually increasing across Italian sites.

Spain

Spain accounts for around 9% of the Europe Residential & Commercial Scaffolding market. The market is experiencing recovery and growth, driven by new housing projects and rising commercial real estate investments. Regions like Madrid and Barcelona are central to this growth, where both public and private construction activity is gaining momentum. Additionally, the country’s focus on tourism infrastructure and urban regeneration initiatives supports scaffolding demand. Increased safety compliance and the growing use of prefabricated scaffolding components are contributing to enhanced productivity and wider adoption of modern systems in construction projects.

Russia

Russia contributes approximately 8% to the European scaffolding market, with growth largely supported by government-led infrastructure development and industrial construction projects. Despite economic challenges and geopolitical tensions, the construction sector remains active, particularly in urban centers such as Moscow and St. Petersburg. However, regulatory complexities and price fluctuations in raw materials affect market dynamics. Steel scaffolding remains dominant due to its durability and wide applicability, while modernization efforts in commercial sectors are gradually opening up opportunities for more efficient and lightweight scaffolding systems.

Rest of Europe

The Rest of Europe region collectively holds about 10% of the market share, encompassing countries such as the Netherlands, Poland, Sweden, and Belgium. These markets are characterized by growing construction output, urban renewal programs, and infrastructure modernization. Countries like Poland and the Czech Republic are seeing increased investments in residential and commercial building projects, while Northern European nations are leading in sustainable and energy-efficient construction practices. The demand for modular scaffolding systems and aluminum-based solutions is rising due to their environmental compatibility and compliance with evolving European construction standards.

Market Segmentations:

By Type

- Frame Scaffolding

- System Scaffolding

- Suspended Scaffolding

- Mobile Scaffolding

- Tube and Coupler Scaffolding

By Material

- Steel Scaffolding

- Aluminum Scaffolding

- Bamboo and Wood Scaffolding

By Application

- New Construction

- Renovation and Maintenance

- Others

By End User

- Residential Construction

- Commercial Construction

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Residential & Commercial Scaffolding market is characterized by the presence of several established players and regional manufacturers competing on the basis of product quality, safety standards, service offerings, and pricing. Key players such as Wilhelm Layher, Altrad Group, ULMA Corporation, and ADTO Industrial Group dominate the market through extensive product portfolios, strong distribution networks, and long-standing industry expertise. Companies are increasingly focusing on product innovation, lightweight materials, and modular scaffolding systems to meet evolving construction demands and stringent regulatory requirements. Strategic alliances, mergers, and acquisitions are being adopted to expand geographic reach and enhance service capabilities. Additionally, rental services are gaining traction, prompting companies to diversify their business models. The market also sees participation from specialized firms like Aluminium Scaffold Towers Limited and Euroscaffold Nederland, which cater to niche segments and smaller-scale projects. Overall, the competitive landscape is dynamic, with a strong emphasis on safety compliance, technological integration, and sustainable scaffolding solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADTO Industrial Group

- Altrad Group

- ULMA Corporation

- Aluminium Scaffold Towers Limited

- Euroscaffold Nederland

- MJ-Gerüst GmbH

- Waco Scaffolding and Equipment Company

- Brand Industrial Services, Inc.

- Wilhelm Layher

- GBM

Recent Developments

- In July 2025, ULMA Construction highlighted their “Smart Construction Technology” for ambitious residential projects, specifically mentioning the Symphony Village project in Rome. This technology likely involves innovative formwork systems and other solutions to enhance efficiency and quality in large-scale residential developments. The Symphony Village project, located near Rome, is a large-scale residential complex comprising 470 living units across multiple buildings.

- In June 2025, Altrad completed a €1.25 billion bond issue to support growth and optimize capital structure, signifying robust financial health and the ability to invest in industrial and construction scaffolding services.

- In April 2025, Brand Industrial Services is expected to maintain its strong position in the U.S. scaffolding contractors market, driven by sustained demand across various construction sectors. This includes commercial, infrastructure, and some residential applications. The construction industry in the U.S. is projected to experience continued growth, further contributing to the demand for scaffolding services.

Market Concentration & Characteristics

The Europe Residential & Commercial Scaffolding Market exhibits a moderately concentrated structure, with a mix of large multinational firms and regional players. Major companies such as Wilhelm Layher, Altrad Group, ULMA Corporation, and ADTO Industrial Group hold significant market shares due to their extensive product portfolios, advanced manufacturing capabilities, and strong distribution networks. It reflects characteristics of a mature market, driven by regulatory compliance, demand for safety, and growing infrastructure investments. The presence of well-established rental service models contributes to recurring revenue and customer retention. Technological advancements, including modular scaffolding systems and digital integration, support competitive differentiation. The market sees stable demand from both residential and commercial segments, with increased activity in renovation projects and urban development. While barriers to entry are moderate, compliance with strict safety and quality standards limits rapid new entrant growth. It operates in a framework shaped by EU safety directives and national building codes, reinforcing the need for standardized, high-performance scaffolding solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe residential and commercial scaffolding market is expected to grow steadily, driven by ongoing urban infrastructure development.

- Increasing renovation and retrofitting projects across aging European buildings will continue to boost scaffolding demand.

- Modular and prefabricated scaffolding systems will gain popularity due to their efficiency, safety, and ease of installation.

- The market will witness rising demand for aluminum scaffolding, particularly in residential and light commercial applications.

- Digital tools such as Building Information Modeling (BIM) will become more integrated into scaffolding planning and project management.

- Rental-based scaffolding services will expand as contractors seek cost-effective and flexible access solutions.

- Regulatory compliance and worker safety requirements will drive the adoption of high-quality, certified scaffolding systems.

- Cross-border infrastructure investments and EU-backed projects will create new opportunities for market expansion.

- Skilled labor shortages may lead to increased demand for user-friendly, easy-to-assemble scaffolding designs.

- Manufacturers will focus on sustainability by developing lightweight, reusable, and recyclable scaffolding materials.