Market Overview:

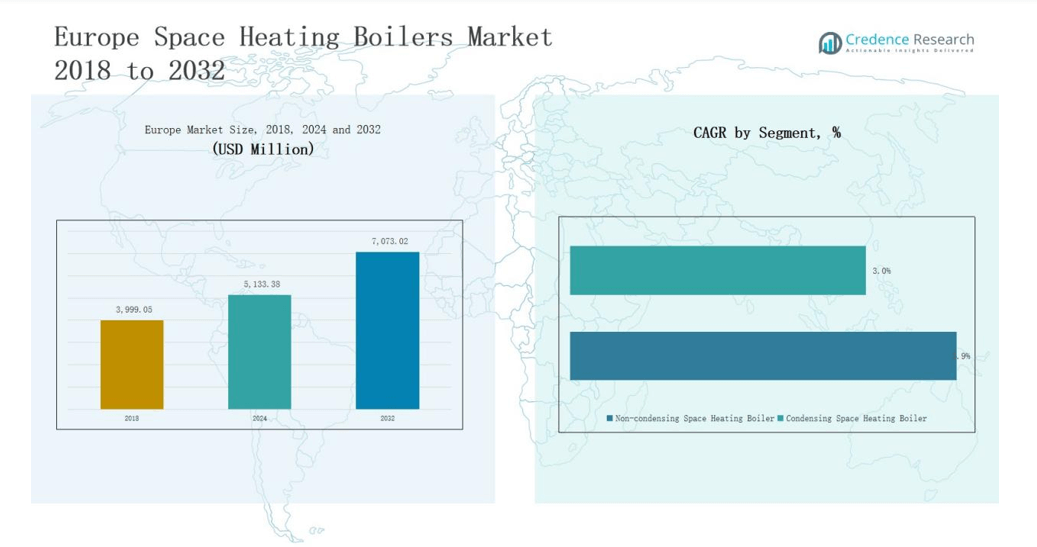

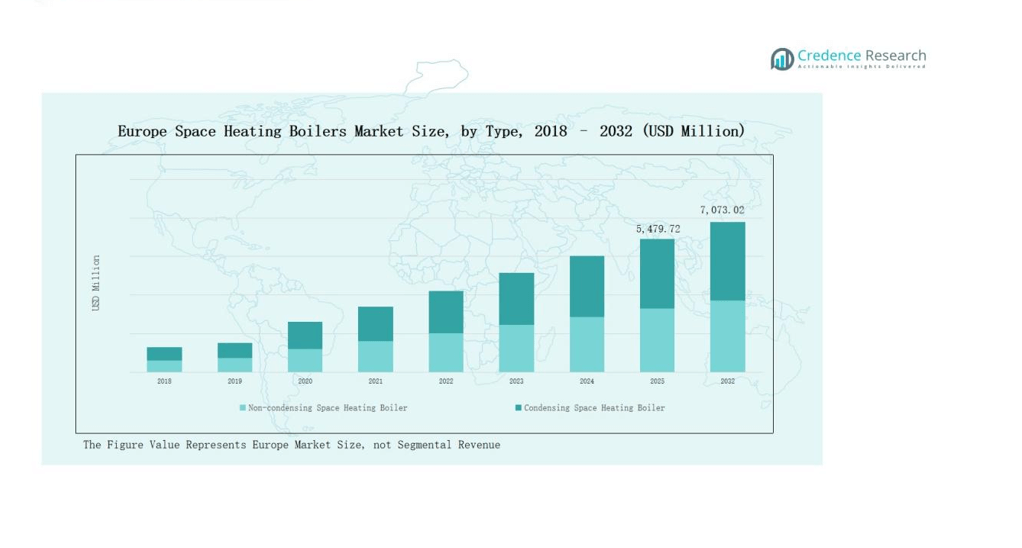

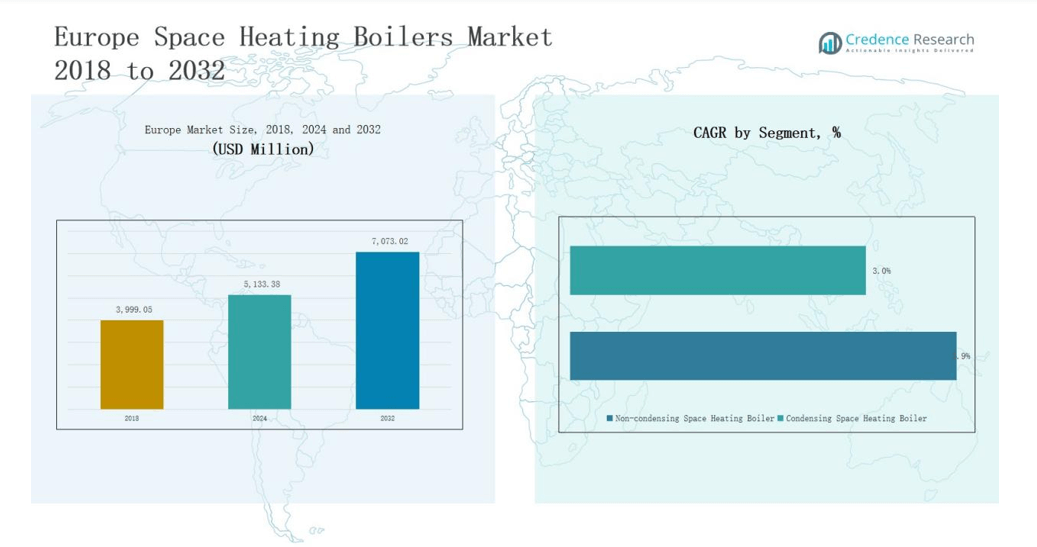

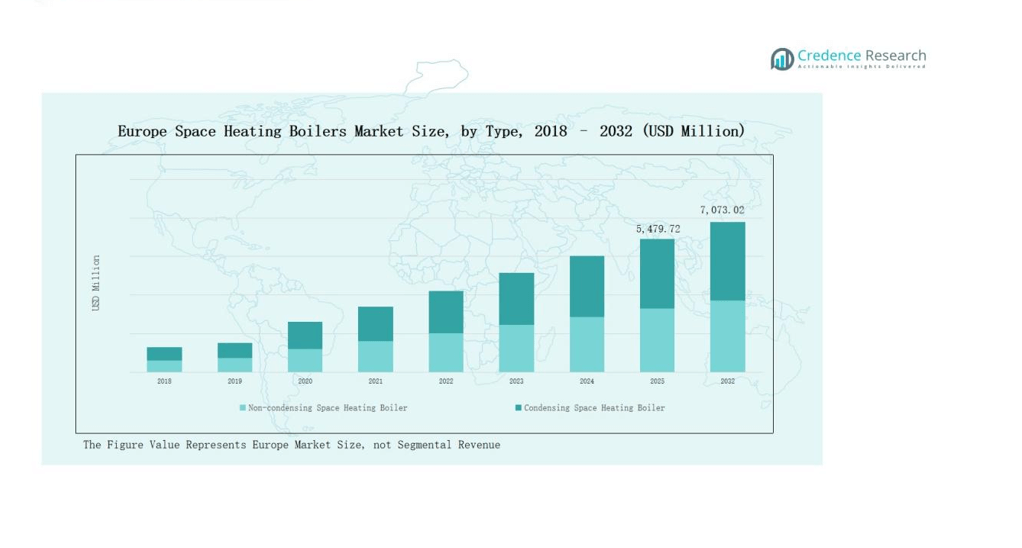

Europe Space Heating Boilers Market size was valued at USD 3,999.05 million in 2018 to USD 5,133.38 million in 2024 and is anticipated to reach USD 7,073.02 million by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Space Heating Boilers Market Size 2024 |

USD 5,133.38 million |

| Europe Space Heating Boilers Market, CAGR |

3.7% |

| Europe Space Heating Boilers Market Size 2032 |

USD 7,073.02 million |

The Europe Space Heating Boilers Market is shaped by strong competition among leading players, including Viessmann Group, Bosch Thermotechnology, Vaillant Group, Worcester Bosch, Ideal Boilers, Baxi Heating, Ariston Thermo Group, Ferroli, Atlantic Group, and De Dietrich Thermique. These companies emphasize condensing technology, hybrid solutions, and smart-connected systems to meet stringent EU energy efficiency regulations and evolving consumer demand. Strategic investments in product innovation, regional expansion, and partnerships strengthen their positions across residential, commercial, and industrial segments. Among regional markets, Germany leads with a 21% share in 2024, driven by strict efficiency laws, extensive renovation programs, and the presence of top domestic manufacturers such as Viessmann and Vaillant, making it the central hub for boiler adoption and innovation in Europe.

Market Insights

- The Europe Space Heating Boilers Market grew from USD 3,999.05 million in 2018 to USD 5,133.38 million in 2024 and will reach USD 7,073.02 million by 2032.

- Condensing boilers held 68% share in 2024, driven by EU efficiency rules, government incentives, and strong adoption, while non-condensing boilers declined to 32% share.

- Residential applications led with 59% share in 2024, followed by commercial at 27% and industrial at 14%, supported by renovation and performance standards.

- Gas-fired boilers dominated operations with 71% share in 2024, while electric held 13%, oil-fired 9%, and coal and others together contributed 7%.

- Germany led the regional landscape with 21% share in 2024, followed by the UK at 19%, France at 15%, Russia at 14%, Italy at 12%, Spain at 9%, and Rest of Europe at 10%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Condensing space heating boilers dominate the Europe market with nearly 68% share in 2024. Their leadership is driven by strict EU energy efficiency directives, widespread adoption of condensing technology, and government incentives promoting low-emission systems. Non-condensing boilers, holding around 32% share, continue to decline due to regulatory restrictions but remain relevant in replacement demand for older systems.

- For instance, BDR Thermea has highlighted government-backed replacement schemes in the Netherlands and the UK as key drivers for the adoption of alternative heating solutions like heat pumps and hydrogen boilers, not condensing boilers.

By Application

The residential segment accounts for the largest share at 59% in 2024, reflecting strong household adoption supported by renovation programs and energy performance standards in housing. Commercial applications capture about 27% share, with demand rising in offices, retail, and institutional buildings seeking cost savings. Industrial usage represents nearly 14% share, primarily in process heating but faces slower growth due to higher adoption of alternative energy systems.

- For intance, in 2022, Svea Solar partnered with EV charging manufacturer Wallbox to add EV charging options to its solar packages in multiple countries.

By Operation

Gas-fired space heating boilers dominate operations with 71% share in 2024, supported by Europe’s advanced gas infrastructure, stable supply, and competitive costs. Electric boilers hold close to 13% share, gaining traction in markets with renewable power integration. Oil-fired boilers contribute around 9% share, concentrated in rural areas without gas connectivity. Coal and other fuels combined account for nearly 7% share, showing a steady decline due to decarbonization policies and fuel transition initiatives.

Market Overview

Key Growth Drivers

Regulatory Push for Energy Efficiency

The Europe Space Heating Boilers Market benefits from strong policy support targeting energy efficiency. EU directives, such as the Energy Performance of Buildings Directive, mandate high-efficiency heating systems. Subsidies and tax incentives encourage households and businesses to replace outdated boilers with modern condensing models. This regulatory push drives consistent market demand while phasing out non-compliant technologies. Rising consumer awareness of energy savings further strengthens adoption, ensuring sustained growth across both residential and commercial sectors.

- For instance, in the UK, the government’s Boiler Upgrade Scheme has already supported installations of efficient heat appliances from manufacturers like Worcester Bosch, providing grants of up to £5,000 toward replacements.

Modernization of Residential Infrastructure

A large portion of Europe’s housing stock remains outdated, creating demand for heating system upgrades. Renovation programs in Germany, the UK, and France emphasize boiler replacement as part of energy transition goals. Residential consumers increasingly choose condensing gas boilers for cost savings and efficiency. Government-backed renovation schemes and low-interest loans make upgrades more affordable, fueling market penetration. As consumers prioritize comfort and lower utility bills, modernization of housing infrastructure continues to drive robust demand for new boilers.

- For instance, Vaillant reported in 2023 that its ecoTEC plus condensing boiler achieved up to 94% efficiency, with sales growth in France and Germany attributed to households lowering gas consumption during high energy price periods.

Gas Infrastructure and Supply Stability

Europe maintains an extensive gas distribution network, particularly in Western and Central regions. This infrastructure supports the dominance of gas-fired boilers, which account for the majority of installations. Despite rising interest in electrification, stable natural gas supply ensures affordability and reliability in heating. Countries like Italy and the Netherlands rely heavily on gas systems, reinforcing their market share. The established network lowers transition barriers, making gas-fired condensing boilers the preferred choice for both replacement and new installations across Europe.

Key Trends & Opportunities

Shift Toward Low-Carbon Heating Solutions

The market shows a growing trend toward low-carbon and hybrid heating technologies. Integration of boilers with renewable systems such as solar thermal panels and heat pumps is rising. Manufacturers are investing in hybrid boilers that combine gas with renewable electricity to reduce emissions. This trend opens opportunities for companies to offer innovative, eco-friendly solutions aligned with Europe’s decarbonization goals. Strong environmental policies create fertile ground for hybrid and next-generation condensing technologies, appealing to both policymakers and sustainability-conscious consumers.

- For instance, HKB Boiler Solutions offers hybrid boilers capable of converting up to 5 MW of excess electrical power into usable steam or hot water, significantly reducing CO2 emissions by optimizing fuel use.

Expansion of Smart and Connected Boilers

Smart boilers equipped with IoT-enabled controls and digital integration present strong growth potential. These systems allow users to monitor energy use, reduce consumption, and optimize heating schedules remotely. Growing consumer preference for smart homes and energy management tools accelerates demand. Manufacturers such as Vaillant and Bosch are investing in connected solutions to differentiate offerings. The trend opens opportunities in value-added services, predictive maintenance, and efficiency optimization, positioning connected boilers as an emerging driver in the European market landscape.

- For instance, Bosch’s EasyControl is an internet-connected thermostat that uses a ‘Home Presence Detection’ feature to learn user behavior and location via connected smartphones. It automatically adjusts the heating by turning it down when the last person leaves and turning it up when someone returns home.

Key Challenges

Rising Competition from Alternative Heating Systems

The market faces pressure from competing technologies such as heat pumps and district heating systems. EU decarbonization strategies prioritize electrification, gradually reducing reliance on fossil fuel-based boilers. Governments in Nordic countries are actively phasing out oil-fired boilers, while subsidies for heat pumps increase adoption. This shift poses a long-term threat to boiler demand. To remain competitive, boiler manufacturers must innovate hybrid or renewable-compatible systems that align with policy trends and consumer expectations for sustainable heating.

Stricter Emission Regulations

Stricter emission control measures present a challenge for traditional boiler manufacturers. EU regulations continue to set tougher limits on carbon and nitrogen oxide emissions from heating systems. These rules increase compliance costs for producers and force investments in advanced technologies. Non-condensing and oil-fired boilers face steep decline as they fail to meet new standards. Smaller manufacturers with limited R&D budgets struggle to adapt, reducing their competitiveness in the market. The pressure to comply accelerates consolidation among major players.

Volatility in Fuel Prices

Fluctuating prices of natural gas and oil create uncertainty in the Europe Space Heating Boilers Market. Consumers remain sensitive to energy cost fluctuations, which can shift preferences toward alternative heating systems. The Russia–Ukraine conflict heightened concerns about gas supply security and pricing volatility across Europe. Rising costs discourage boiler replacement and delay consumer investments. Manufacturers face demand instability in such conditions, making long-term growth forecasts more complex. Diversification of energy sources becomes critical to address this ongoing challenge.

Regional Analysis

UK

The UK holds 19% share of the Europe Space Heating Boilers Market in 2024. Strong government initiatives such as the Boiler Upgrade Scheme encourage replacement of old systems with condensing models. Residential demand dominates due to a large housing stock requiring modernization. Commercial buildings also contribute steadily, driven by energy efficiency targets. Gas-fired boilers remain the preferred choice, supported by well-developed infrastructure. Growing interest in hybrid and smart systems shapes the UK market outlook, reflecting its commitment to decarbonization.

Germany

Germany accounts for 21% share of the Europe Space Heating Boilers Market in 2024. The country leads in adoption of condensing boilers supported by stringent energy laws. Large-scale renovation programs drive replacement demand, particularly in residential and commercial segments. It benefits from a strong domestic manufacturing base, including companies like Viessmann and Vaillant. Gas-fired boilers dominate, but heat pumps are gaining traction under policy support. Germany’s focus on low-carbon heating accelerates innovation and creates opportunities for advanced boiler systems.

France

France represents 15% share of the Europe Space Heating Boilers Market in 2024. Strong reliance on gas-fired boilers drives sales, supported by favorable infrastructure. The residential sector leads adoption due to ongoing modernization of housing. The government promotes energy transition, encouraging efficient condensing systems through subsidies. It also focuses on reducing carbon emissions, influencing consumer choices. French boiler manufacturers remain competitive in domestic and export markets, leveraging innovation and compliance with environmental standards.

Italy

Italy holds 12% share of the Europe Space Heating Boilers Market in 2024. The market benefits from widespread use of gas-fired boilers due to well-established distribution networks. Residential installations dominate demand, supported by government incentives for energy-efficient upgrades. Italy emphasizes condensing technology adoption, aligning with EU sustainability objectives. It also experiences rising demand for compact and hybrid models suited to urban housing. The Italian market continues to expand under policy-driven replacement cycles and consumer focus on reducing energy bills.

Spain

Spain captures 9% share of the Europe Space Heating Boilers Market in 2024. Demand is centered in residential and commercial buildings with growing focus on efficient systems. Gas-fired boilers lead installations, while condensing models gain traction under EU compliance rules. Government-backed energy efficiency programs stimulate replacement demand. It faces increasing interest in hybrid and electric solutions due to renewable energy integration. Manufacturers expand product offerings tailored to regional climate needs, supporting future market growth.

Russia

Russia contributes 14% share of the Europe Space Heating Boilers Market in 2024. The country relies heavily on oil-fired and coal-based boilers, reflecting its energy mix. Transition toward efficient and low-emission systems is slower compared to Western Europe. Industrial demand remains strong, supported by harsh climate conditions and large-scale facilities. It continues to invest in modernization programs but faces challenges from outdated infrastructure. Gas-fired boilers gain traction where infrastructure improves, creating gradual growth potential.

Rest of Europe

The Rest of Europe region holds 10% share of the Europe Space Heating Boilers Market in 2024. Demand arises from smaller economies in Central and Eastern Europe. Replacement cycles drive growth, with condensing boilers gaining share under EU regulatory influence. Gas-fired systems remain dominant where infrastructure supports supply, while electric boilers grow in markets integrating renewables. It benefits from EU funding programs that promote sustainable heating adoption. Regional diversity in energy policies shapes market dynamics and adoption levels.

Market Segmentations:

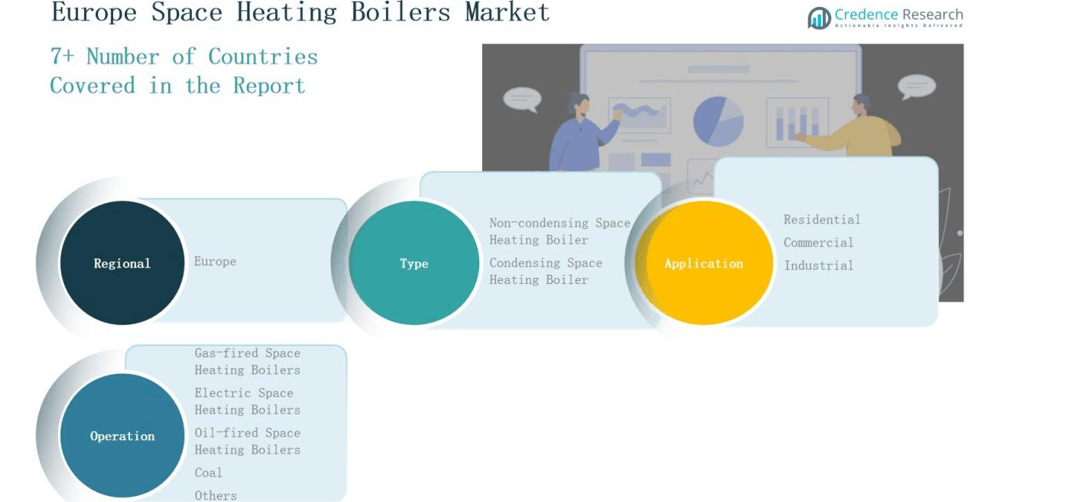

By Type

- Non-condensing Space Heating Boiler

- Condensing Space Heating Boiler

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Space Heating Boilers

- Electric Space Heating Boilers

- Oil-fired Space Heating Boilers

- Coal

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Space Heating Boilers Market is highly competitive, with leading players focusing on technological innovation, energy efficiency, and regulatory compliance to strengthen market presence. Companies such as Viessmann Group, Bosch Thermotechnology, and Vaillant Group dominate through advanced condensing boiler portfolios and wide distribution networks. Worcester Bosch, Ideal Boilers, and Baxi Heating maintain strong positions in the UK, supported by well-established brand recognition. Ariston Thermo Group, Ferroli, and De Dietrich Thermique expand their footprint by offering compact, hybrid, and smart-connected boilers tailored for residential and commercial applications. Atlantic Group leverages diversified product offerings and regional presence across France and neighboring countries. Competition centers on meeting EU decarbonization targets, with manufacturers investing in low-emission technologies, hybrid systems, and IoT-enabled solutions. Strategic partnerships, product launches, and government incentive-driven replacements shape the market dynamics. Continuous innovation and adaptation to evolving energy policies remain essential for sustaining leadership in this growing and regulated industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Viessmann Group

- Bosch Thermotechnology

- Vaillant Group

- Worcester Bosch

- Ideal Boilers

- Baxi Heating

- Ariston Thermo Group

- Ferroli

- Atlantic Group

- De Dietrich Thermique

Recent Developments

- In 2024, Bosch Home Comfort Group completed the acquisition of Johnson Controls’ global residential and light-commercial HVAC business, strengthening its position in the European space heating boilers market.

- In January 2024, Carrier Global finalized the acquisition of Viessmann’s heat pump division, a strategic move that reshaped competition in Europe’s heating sector.

- In June 2025, LG Electronics agreed to acquire a 100% stake in OSO, a European provider of water heating solutions, to strengthen its HVAC business in Europe and beyond.

- In June 2025, Babcock Wanson Group acquired Chr. Møller, a Danish company specializing in industrial boiler services, to expand its decarbonization capabilities and grow operations across over 14 countries in Europe.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for condensing boilers will rise as regulations phase out inefficient systems.

- Gas-fired boilers will maintain dominance while hybrid and electric models gain traction.

- Renovation programs will drive strong replacement demand in residential housing.

- Commercial buildings will increasingly adopt smart and connected boiler technologies.

- Industrial usage will gradually decline due to alternative heating solutions.

- Policy-driven decarbonization will accelerate adoption of low-emission and hybrid boilers.

- Digital integration will enhance predictive maintenance and energy management services.

- Rising fuel price volatility will influence consumer preferences toward electric options.

- Eastern European countries will see growth supported by EU funding for efficiency upgrades.

- Competition among key players will intensify through innovation, partnerships, and product diversification.