Market Overview:

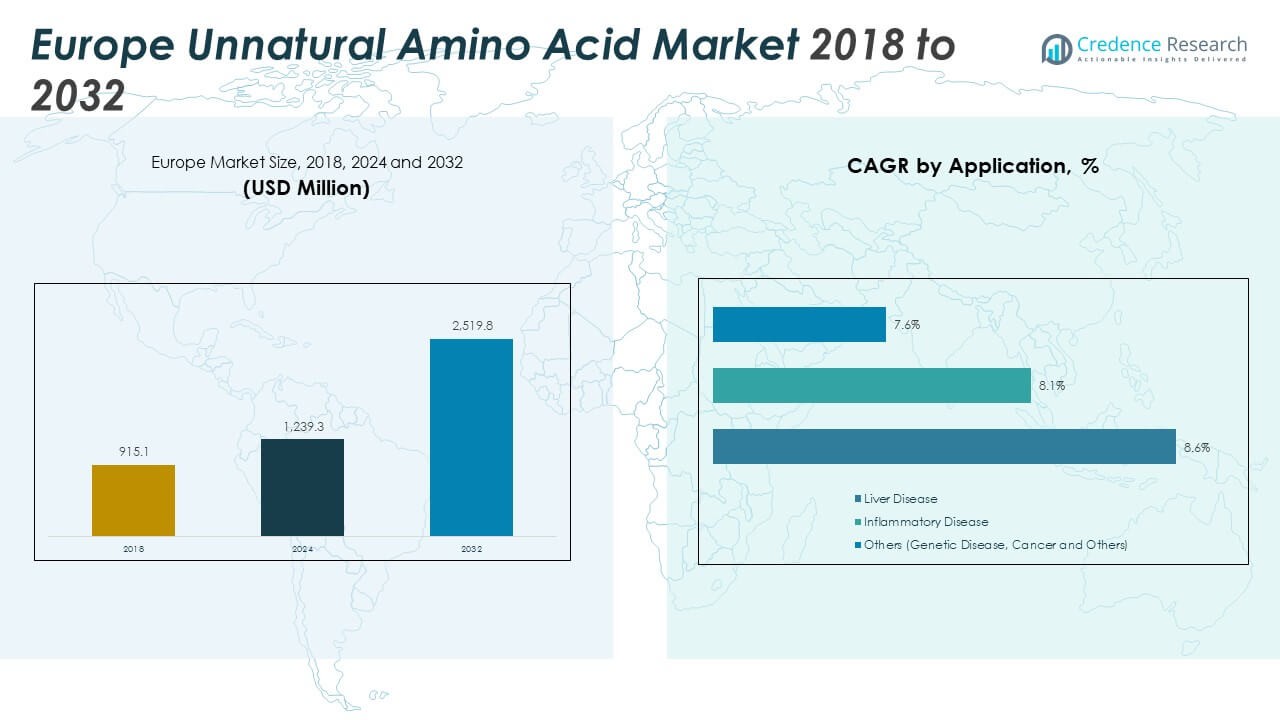

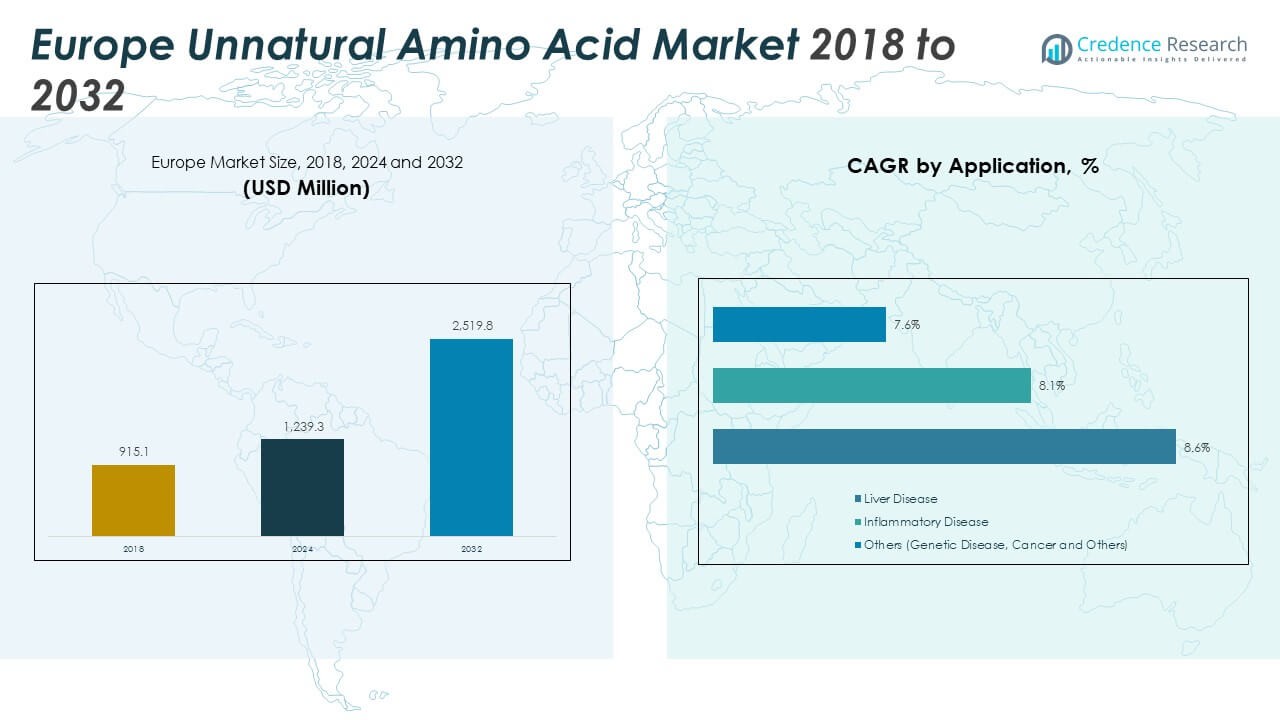

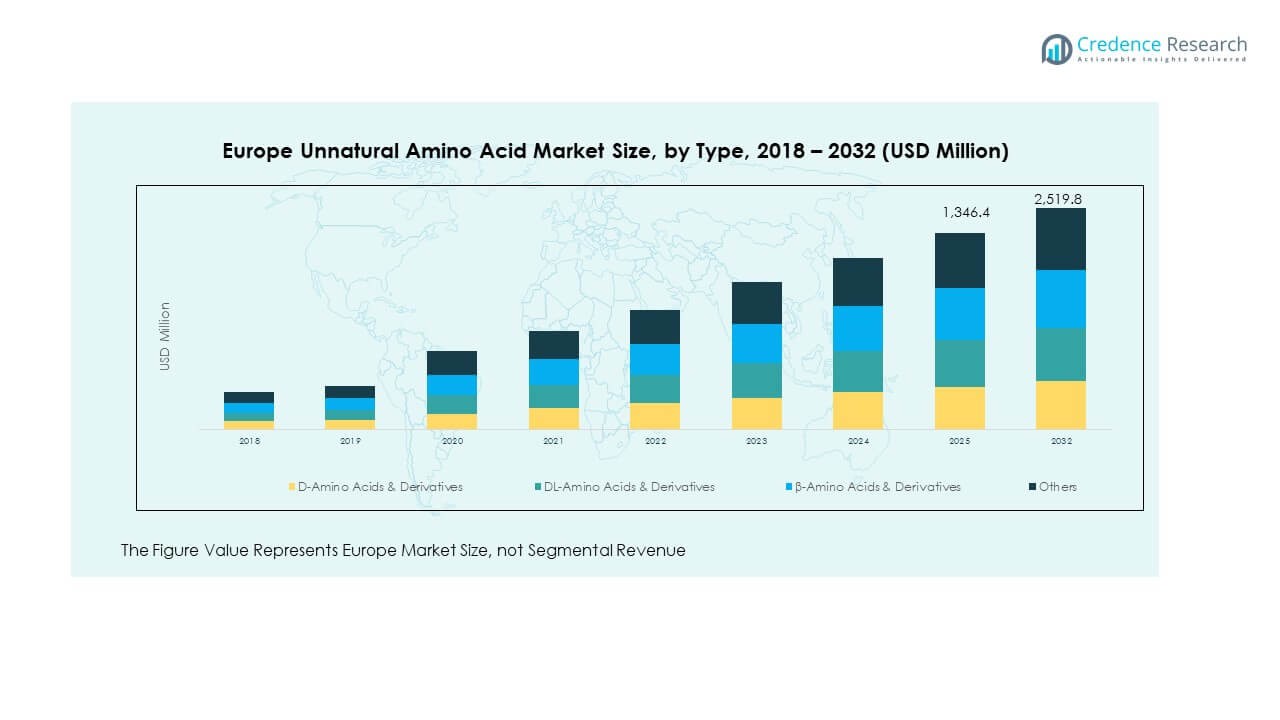

The Europe Unnatural Amino Acid Market size was valued at USD 915.1 million in 2018 to USD 1,239.3 million in 2024 and is anticipated to reach USD 2,519.8 million by 2032, at a CAGR of 9.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Unnatural Amino Acid Market Size 2024 |

USD 1,239.3 Million |

| Europe Unnatural Amino Acid Market, CAGR |

9.40% |

| Europe Unnatural Amino Acid Market Size 2032 |

USD 2,519.8 Million |

The market growth is driven by the rising application of unnatural amino acids in advanced drug discovery and targeted therapies. Pharmaceutical and biotechnology companies are increasingly using these compounds to improve drug stability, enhance bioavailability, and extend half-life. Expanding research in protein engineering, coupled with increased demand for next-generation therapeutics, continues to strengthen adoption. Government support for innovative healthcare solutions, combined with a surge in chronic disease prevalence, is further boosting market prospects across Europe.

Regionally, Western Europe dominates the market, with Germany, the United Kingdom, and France leading due to strong pharmaceutical and biotech industries. These countries benefit from well-established R&D infrastructures and higher healthcare investments. Meanwhile, Central and Eastern European nations are emerging as growth hubs, supported by expanding clinical trials and partnerships with global firms. The increasing focus on biopharmaceutical innovation and collaborations across academic and industrial research centers is also reinforcing the market’s regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Unnatural Amino Acid Market was valued at USD 915.1 million in 2018, reached USD 1,239.3 million in 2024, and is projected to attain USD 2,519.8 million by 2032, expanding at a CAGR of 9.40%.

- Western Europe held the largest share at 47% in 2024, supported by strong pharmaceutical R&D and healthcare investment. Southern Europe followed with 22%, benefiting from active biotech clusters, while Eastern and Northern Europe together accounted for 31% due to outsourcing and government-backed research.

- Eastern Europe is the fastest-growing region with 16% share, driven by cost-effective clinical research operations and rising biotech partnerships with global players.

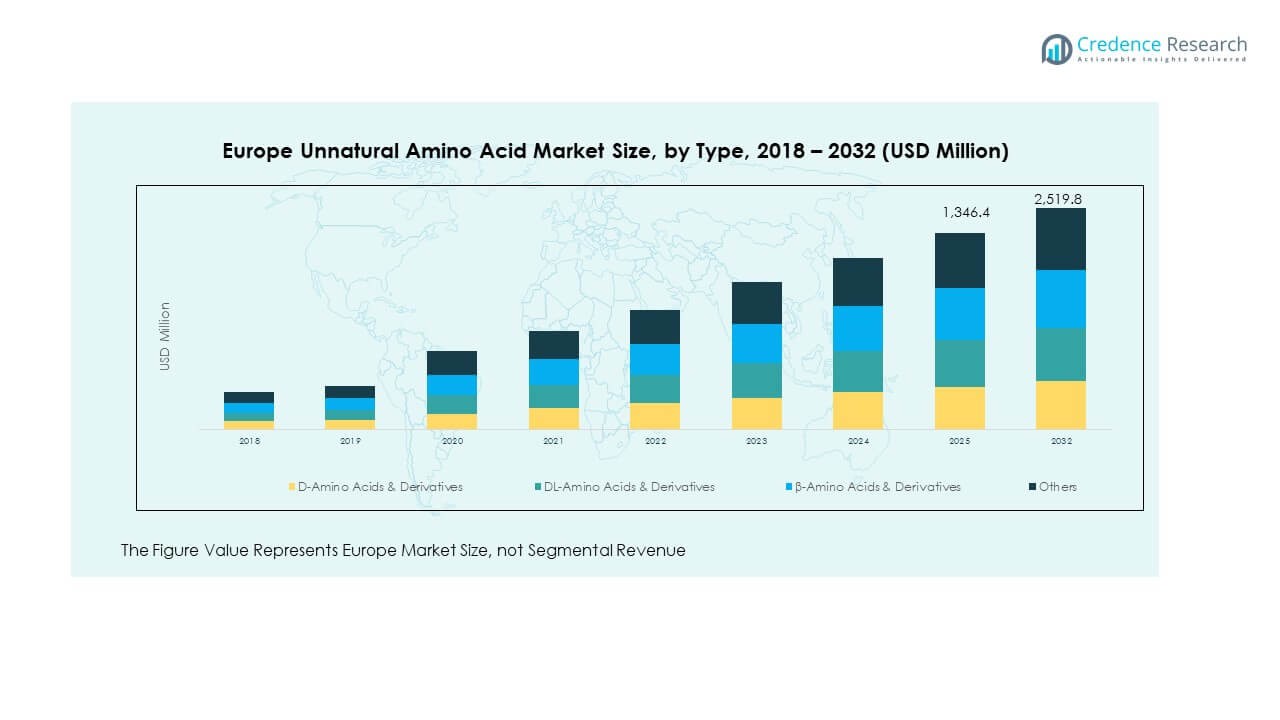

- By type, D-amino acids & derivatives accounted for 34% of the market share in 2024, reflecting their dominance in therapeutic and stability-focused applications.

- DL-amino acids & derivatives represented 27% of the market share in 2024, supported by their utility in synthetic biology and structural research applications.

Market Drivers:

Rising Demand for Protein Engineering and Targeted Therapeutics Driving Adoption of Unnatural Amino Acids

The growth of the Europe Unnatural Amino Acid Market is supported by a sharp rise in protein engineering applications. Pharmaceutical innovators are deploying unnatural amino acids to improve therapeutic precision and structural stability of proteins. It strengthens drug efficacy by offering novel molecular interactions not possible with natural amino acids. Demand is further driven by the rise of antibody-drug conjugates that rely on site-specific modifications. Healthcare institutions recognize the benefits of enhanced half-life and reduced toxicity. Investors continue to focus on companies delivering engineered amino acid solutions for unmet clinical needs. The strong linkage between drug innovation and amino acid research provides long-term momentum. It is creating a competitive environment that accelerates the adoption of specialized compounds across Europe.

Expanding Biopharmaceutical Research Accelerates Use of Synthetic Amino Acid Platforms in Therapeutics

Rising biopharmaceutical research across Europe fuels consistent adoption of synthetic amino acids. Academic institutions and research labs are increasingly partnering with biotech firms to develop next-generation therapies. The Europe Unnatural Amino Acid Market benefits from increased R&D spending aimed at tackling chronic diseases. It helps create tailored drug profiles with improved solubility and resistance to enzymatic breakdown. Funding from European research programs strengthens infrastructure for advanced molecular design. Pharmaceutical manufacturers integrate these amino acids into vaccines, peptides, and protein-based drugs. Rising focus on rare disease treatment reinforces investment in unique amino acid chemistries. The collaborative environment across research clusters supports innovation pipelines that stimulate market expansion.

Rising Healthcare Investments and Government Support Foster Advanced Drug Development Applications

Government agencies and private investors continue to allocate resources toward advanced biopharmaceutical development. The Europe Unnatural Amino Acid Market gains momentum from supportive policy frameworks encouraging drug innovation. It receives significant backing through regulatory approvals that accelerate novel drug launches. Increasing healthcare budgets across Europe enable institutions to adopt new therapeutic technologies faster. National healthcare systems emphasize effective treatments that balance innovation with cost efficiency. Investors seek opportunities in biologics development where unique amino acids enhance treatment performance. Funding programs in Germany, France, and the UK promote commercialization of research breakthroughs. It creates favorable conditions for integrating engineered amino acids into mainstream drug development.

- For instance, Munich-based AMSilk engineers spider silk proteins using synthetic biology approaches, creating biopolymers designed for durability and biocompatibility. The company has advanced these materials for use in medical implants and drug delivery platforms, supported by European funding and strategic collaborations.

Increasing Chronic Disease Burden Creates Strong Demand for Enhanced Therapies in European Markets

The rising prevalence of cancer, cardiovascular, and neurological disorders drives the adoption of novel treatment approaches. The Europe Unnatural Amino Acid Market benefits from demand for stable, effective, and patient-friendly drug options. It supports the development of therapeutics with longer dosage intervals and improved delivery systems. Hospitals and clinics show preference for drugs that reduce side effects through engineered formulations. Biopharma companies leverage amino acid modifications to expand targeted therapy portfolios. Patients with chronic illnesses require precision therapies that extend life expectancy and improve quality of life. Demand is also linked to an aging population with higher treatment needs. It reinforces long-term prospects by ensuring a steady base of clinical demand.

- For instance, research at ETH Zurich has demonstrated methods for incorporating unnatural amino acids into proteins, including at multiple sites, to enable site-specific modifications. These advancements provide tools for engineering proteins with novel properties and functionalities, which is foundational to therapeutic development.

Market Trends:

Growing Integration of Unnatural Amino Acids in Precision Bioconjugation Technologies for Advanced Drug Design

The Europe Unnatural Amino Acid Market experiences growth through precision bioconjugation platforms. Pharmaceutical companies adopt amino acids to achieve site-specific labeling and controlled drug-to-antibody ratios. It enhances stability of biologics and reduces heterogeneity during manufacturing. The approach enables efficient production of antibody-drug conjugates with improved safety profiles. Research institutions implement these compounds in next-gen diagnostic imaging tools. Adoption extends to enzyme modification techniques, creating stable industrial biocatalysts. Pharmaceutical R&D pipelines are increasingly shaped by this controlled conjugation technology. It strengthens demand across both therapeutic and diagnostic applications in the region.

- For instance, Genentech has developed site-specific antibody-drug conjugates (ADCs) using unnatural amino acid incorporation, which allows precise control of the drug-to-antibody ratio and improves product homogeneity compared to conventional random conjugation methods. This strategy enhances therapeutic index and stability by reducing variability in ADC design.

Rising Adoption of High-Throughput Screening Platforms Accelerating Discovery of Novel Unnatural Amino Acid Variants

High-throughput screening platforms gain importance in identifying and optimizing new amino acid derivatives. The Europe Unnatural Amino Acid Market witnesses stronger engagement from biotech firms leveraging automated platforms. It reduces development timelines and enhances reproducibility in therapeutic discovery. AI-driven analytics help predict binding affinities and structural benefits of new molecules. Screening advances integrate with computational modeling to guide synthesis of unique amino acids. Pharma companies employ these techniques to expand their clinical trial pipelines. Researchers find value in scalable methods that deliver consistent experimental outputs. It pushes the market toward faster innovation cycles and sustained product development.

- For instance, pharmaceutical companies such as Novartis employ high-throughput screening platforms in oncology research, enabling the rapid evaluation of large libraries of enzyme inhibitors. These technologies support the discovery of optimized lead candidates and can be adapted for unnatural amino acid–based therapeutic development.

Increasing Role of Unnatural Amino Acids in Next-Generation Vaccine Development Programs Across Europe

The application of engineered amino acids in vaccine design has gained momentum across European research. The Europe Unnatural Amino Acid Market benefits from their use in stabilizing vaccine proteins. It enhances immune response durability and enables precise antigen presentation. Governments prioritize vaccine readiness, driving investment in alternative molecular technologies. Biotechnology firms collaborate with universities to design novel peptide-based vaccines. Demand extends beyond infectious disease, moving into oncology vaccines for long-term treatment. Clinical trials increasingly incorporate engineered amino acids into vaccine delivery systems. It reinforces market growth by diversifying therapeutic applications beyond conventional drug classes.

Expansion of Customized Research Services for Academic and Industrial Partnerships in Europe

A growing number of service providers specialize in customized amino acid synthesis. The Europe Unnatural Amino Acid Market gains from partnerships between CROs, academic labs, and pharma companies. It supports development of tailored solutions for specific therapeutic projects. Services include small-scale experimental design and large-scale compound manufacturing. Industrial partnerships ensure faster movement of discoveries into clinical testing. Universities benefit from access to cutting-edge synthesis tools. Rising outsourcing trends align with the need for cost efficiency and technical expertise. It enables broad adoption by lowering entry barriers for mid-size biotech firms.

Market Challenges Analysis:

High Production Costs and Complex Synthesis Processes Restrict Wider Commercial Adoption in Healthcare and Research

The Europe Unnatural Amino Acid Market faces challenges linked to high production costs and complex synthesis. It requires advanced chemical expertise, specialized facilities, and skilled workforce. Many smaller biotech firms struggle to scale operations due to financial barriers. High costs hinder accessibility of these compounds for mid-tier laboratories. Limited production yields further add to the cost burden during large-scale research. Pharmaceutical firms face delays in adopting engineered amino acids into mainstream therapies. Investors often weigh risks before funding small developers due to uncertain scalability. It restricts broader commercialization despite significant therapeutic potential.

Regulatory and Standardization Barriers Create Uncertainty for Biopharma Developers and Clinical Trials

Strict regulatory frameworks across Europe pose another obstacle for market players. The Europe Unnatural Amino Acid Market is affected by fragmented approval standards across countries. It creates delays in clinical trial approvals and product launches. Pharmaceutical firms must navigate extensive safety validations and compliance checks. Lack of standardized guidelines on engineered amino acids adds to uncertainty. Clinical developers encounter prolonged timelines in integrating compounds into therapies. Small biotech firms often lack resources to meet evolving compliance requirements. It slows momentum in translating innovative discoveries into approved clinical applications.

Market Opportunities:

Rising Potential of Collaborations Between Biopharma Firms and Academic Institutions to Advance Drug Discovery

The Europe Unnatural Amino Acid Market holds strong opportunities through strategic collaborations between academia and industry. It creates innovation platforms for drug discovery with enhanced stability and specificity. Universities provide access to high-level research, while companies bring commercial scalability. Government-backed grants encourage cross-institutional programs targeting chronic and rare diseases. Research partnerships expand clinical applications, supporting patient-centric solutions. Biotech startups leverage such collaborations to gain early market presence. It accelerates the translation of molecular innovations into viable therapies. Partnerships continue to build a robust pipeline of advanced treatments across Europe.

Expanding Scope of Synthetic Biology and AI-Driven Drug Design in Enhancing Market Growth Potential

Synthetic biology and artificial intelligence are reshaping molecular design frameworks in Europe. The Europe Unnatural Amino Acid Market benefits from integration of AI tools in compound screening. It helps identify promising amino acid structures with therapeutic relevance. Synthetic biology platforms accelerate scalable production of engineered molecules. Companies invest in computational tools to improve efficiency and reduce time-to-market. AI-driven predictions assist in reducing experimental failures. It creates opportunities for personalized medicine through tailored molecular engineering. The convergence of technology and biology continues to unlock long-term growth potential.

Market Segmentation Analysis:

The Europe Unnatural Amino Acid Market is segmented

By type

Into D-amino acids & derivatives, DL-amino acids & derivatives, β-amino acids & derivatives, and others. D-amino acids hold strong relevance due to their role in enhancing drug stability and improving pharmacokinetics. DL-amino acids gain traction in synthetic biology and biochemistry research for their structural versatility. β-amino acids demonstrate expanding utility in peptide therapeutics, offering improved resistance to enzymatic degradation. Other specialized derivatives support niche applications in advanced molecular engineering.

- For instance, researchers at ETH Zurich developed β-peptide foldamers with full β-amino acid backbones, which demonstrated resistance to trypsin and proteinase K for over 72 hours, while analogous α-peptides were completely degraded in under 2 hours, as documented in their published preclinical work

By application

The market includes liver disease, inflammatory disease, and others such as genetic diseases and cancer. It finds major adoption in liver disease therapies where engineered amino acids improve treatment outcomes and dosage efficiency. Inflammatory disease applications are supported by their ability to strengthen peptide-based drug design for chronic conditions. Cancer-focused research integrates these compounds for targeted therapy and precision medicine approaches. Rare genetic disorders also benefit from tailored amino acid solutions, fueling demand across research-driven segments.

- For instance, Ultragenyx Pharmaceuticals developed UX007 (triheptanoin), a synthetic triglyceride therapy approved for long-chain fatty acid oxidation disorders. Clinical trials demonstrated that UX007 reduced the frequency and severity of major clinical events, offering significant benefits to rare disease patients.

By end-use

The market is divided into pharmaceutical and others, including biotechnological companies, research laboratories, and academic institutes. Pharmaceutical companies dominate demand due to their consistent integration of unnatural amino acids in drug development pipelines. It supports clinical programs targeting chronic and rare diseases with high unmet needs. Biotech firms explore smaller-scale applications, particularly in vaccine and peptide drug design. Academic institutes contribute to discovery and innovation through collaborations with industry leaders. This multi-dimensional adoption reinforces growth across Europe’s advanced life sciences ecosystem.

Segmentation:

By Type

- D-Amino Acids & Derivatives

- DL-Amino Acids & Derivatives

- β-Amino Acids & Derivatives

- Others

By Application

- Liver Disease

- Inflammatory Disease

- Others (Genetic Disease, Cancer, and Others)

By End-Use

- Pharmaceutical

- Others (Biotechnological Companies, Research Laboratories, and Academic Institutes)

Regional Analysis:

Western Europe accounts for the largest share of the Europe Unnatural Amino Acid Market, representing 47% of the regional revenue. The subregion is driven by strong pharmaceutical and biotechnology industries in Germany, the United Kingdom, and France. It benefits from advanced R&D infrastructure, established healthcare systems, and high investment in biologics. Pharmaceutical leaders in these countries integrate unnatural amino acids into antibody-drug conjugates and therapeutic peptides. Strong collaboration between universities and biopharma firms supports innovation pipelines. It continues to be the hub for clinical trials and commercialization of advanced molecular therapies.

Southern Europe contributes 22% of the market, with Italy and Spain emerging as key participants. Growth in this subregion is supported by expanding biotechnological companies and academic institutions that adopt amino acid modifications for targeted drug development. Italy demonstrates strength through specialty chemical companies and partnerships with pharmaceutical players. Spain benefits from rising investment in medical research and clinical applications of amino acids. The subregion shows growing demand for therapies targeting liver and inflammatory diseases. It reflects an increasing role in both applied research and early-stage drug discovery.

Eastern and Northern Europe together account for 31% of the market share, with Russia, Poland, and Nordic countries driving expansion. Eastern Europe leverages lower operational costs and a growing focus on clinical research outsourcing, strengthening its presence. Russia demonstrates rising investment in biologics and a gradual adoption of amino acid-based therapies. Northern Europe benefits from advanced healthcare systems and strong government backing for biotech innovations. The Europe Unnatural Amino Acid Market gains momentum from cross-border collaborations between Nordic biotech firms and Western European pharmaceutical companies. It reinforces the regional balance by diversifying innovation and manufacturing capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Unnatural Amino Acid Market is characterized by a mix of global pharmaceutical leaders, chemical manufacturers, and specialized biotech firms. Major players such as Bayer AG, BASF SE, and AstraZeneca strengthen their presence through investments in advanced drug discovery platforms. It benefits from their established pipelines that integrate unnatural amino acids into therapeutics for chronic and rare diseases. Specialty firms like Senn Chemicals AG and Miat S.p.A. focus on custom synthesis, enabling tailored solutions for research laboratories and smaller biotech companies. These firms build value by offering high-purity compounds that support both preclinical and clinical programs. Regional companies such as Nagase Europe GmbH and Yoneyama Yakuhin Kogyo reinforce competition through distribution networks and supply of specialty amino acids for research and pharmaceutical applications. Partnerships between academic institutions and industry players continue to accelerate innovation, driving collaborative advancements in protein engineering and therapeutic peptides. The competitive landscape is further shaped by mergers, acquisitions, and joint ventures aimed at enhancing product portfolios and expanding geographic reach. It reflects a dynamic market where large multinational firms dominate in scale, while niche players thrive through specialization and innovation. This balance ensures sustained competition across the European ecosystem.

Recent Developments:

- In August 2025, Bayer AG entered into a landmark partnership with Kumquat Biosciences, valued at up to $1.3 billion, to co-develop Kumquat’s novel KRAS G12D inhibitor for oncology applications, enhancing Bayer’s precision oncology portfolio. This alliance aims to advance the drug candidate through early clinical trials and ultimately commercialize it for the treatment of cancers with high unmet needs, such as pancreatic, colorectal, and lung cancers.

- In July 2025, AstraZeneca announced a $50 billion investment to expand its US-based manufacturing and R&D capabilities by 2030. This expansion includes establishing a Virginia facility dedicated to cutting-edge drug substances such as peptides and small molecules—crucial for advancing APIs and biopharmaceutical manufacturing, indirectly supporting innovations in unnatural amino acids.

- In June 2025, Argenx partnered with Unnatural Products, agreeing on a collaboration worth up to USD 1.5 billion to develop oral macrocyclic peptides targeting inflammatory and immunological diseases. The deal aims to deliver once-daily oral alternatives to current infused antibody treatments, leveraging the advantages of macrocyclic peptides such as stability without cold storage and resistance to protease degradation.

- In June 2025, BASF SE reinforced its footprint in North America’s biopharmaceutical sector by inaugurating a new Good Manufacturing Practice (GMP) Solution Center in Wyandotte, Michigan. The facility, launched on June 17, 2025, is dedicated to advancing pharmaceutical ingredient quality, collaborative product development, and production innovation, thereby strengthening BASF’s ability to serve the growing demand for high-quality excipients and bioprocessing ingredients in the unnatural amino acid market.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for protein engineering applications will expand, supported by greater adoption of precision therapeutics.

- Research in chronic and rare diseases will create opportunities for specialized amino acid derivatives.

- Collaborations between universities and pharmaceutical companies will accelerate translational research outcomes.

- Synthetic biology and AI-driven platforms will streamline discovery and production of novel compounds.

- Customized synthesis services will gain traction among biotech firms and research institutions.

- Vaccine development will increasingly integrate engineered amino acids for improved stability and response.

- Outsourcing to CROs across Eastern Europe will strengthen regional participation in clinical research.

- Rising healthcare budgets and supportive policies will foster adoption of innovative therapies.

- Niche firms specializing in high-purity compounds will maintain competitive advantage against large-scale producers.

- Expansion of partnerships across Europe will sustain growth momentum in advanced biopharmaceuticals.