Market Overview:

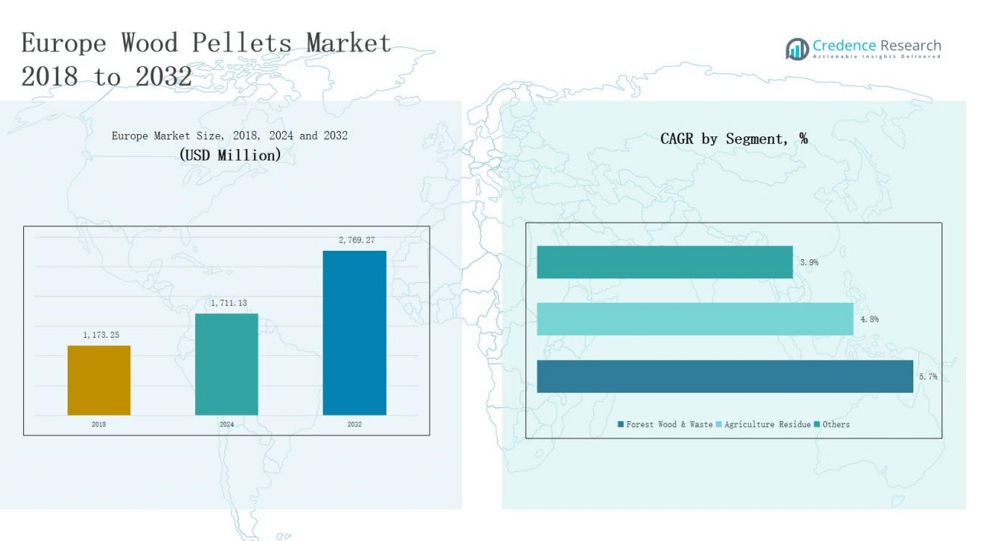

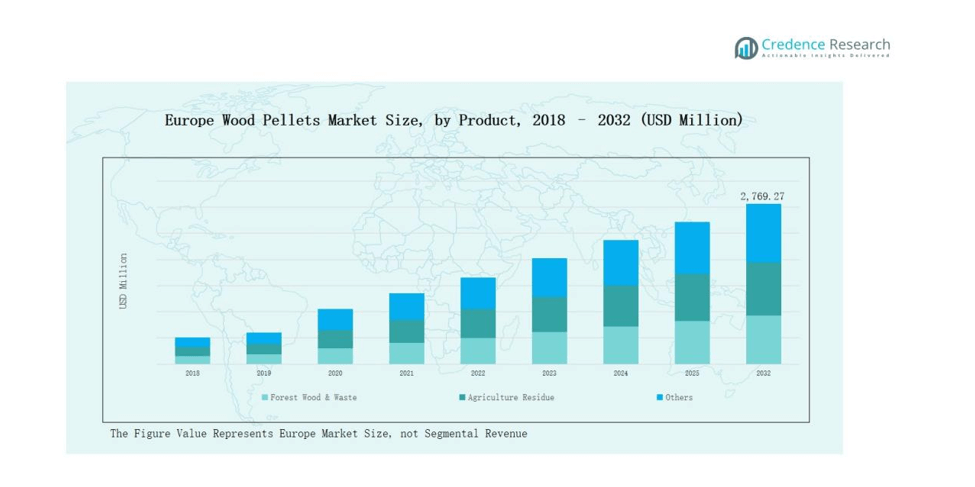

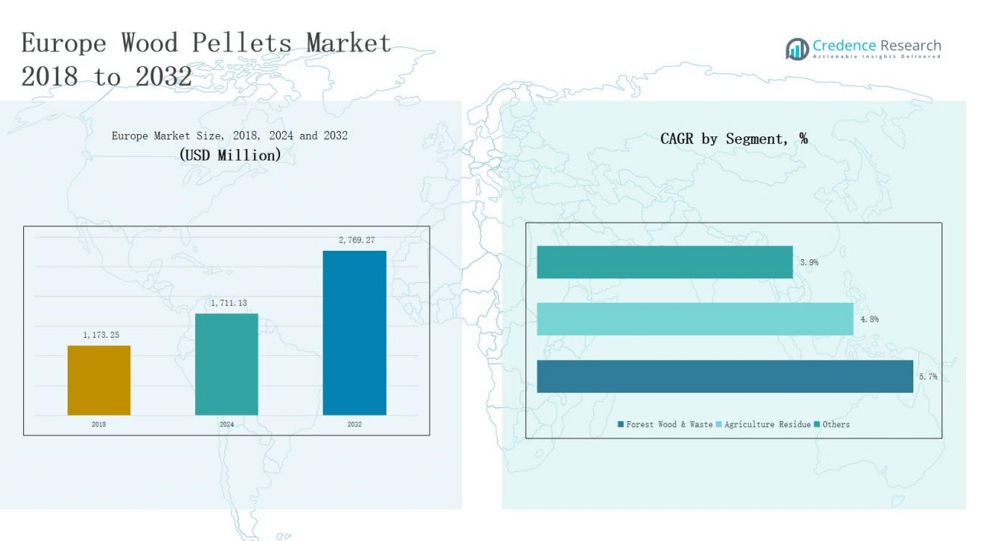

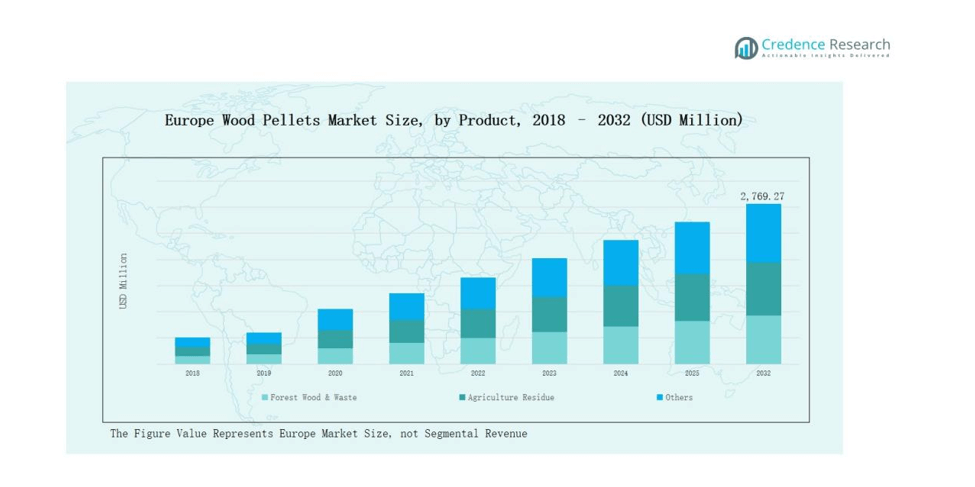

Europe Wood Pellets Market size was valued at USD 1,173.25 million in 2018 to USD 1,711.13 million in 2024 and is anticipated to reach USD 2,769.27 million by 2032, at a CAGR of 5.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Wood Pellets Market Size 2024 |

USD 1,711.13 million |

| Europe Wood Pellets Market, CAGR |

5.68% |

| Europe Wood Pellets Market Size 2032 |

USD 2,769.27 million |

The Europe Wood Pellets Market is shaped by major players such as AS Graanul Invest, Drax Biomass Inc, Enviva Partners LP, German Pellets GmbH, Pinnacle Renewable Energy Inc, Lignetics of Idaho Inc, Land Energy Girvan Limited, and Zilkha Biomass Energy LLC, which dominate through large-scale production capacities, strong supply chains, and long-term contracts with energy utilities. These companies emphasize sustainable sourcing, capacity expansion, and compliance with EU renewable energy standards to maintain competitiveness. Among regional markets, the UK leads with 28% share in 2024, supported by large-scale biomass power generation projects and reliance on imports, securing its position as the top consumer in Europe.

Market Insights

- The Europe Wood Pellets Market grew from USD 1,173.25 million in 2018 to USD 1,711.13 million in 2024 and is projected to reach USD 2,769.27 million by 2032.

- Forest wood and waste led with 70% share in 2024, supported by abundant forestry resources, sustainable practices, and EU directives promoting biomass adoption across Northern and Eastern Europe.

- Industrial pellets for CHP and district heating dominated with 55% share in 2024, driven by widespread use in Scandinavian and Central European district heating networks.

- The UK was the largest regional market with 28% share in 2024, supported by biomass conversion projects, including Drax Power Station, and continued reliance on pellet imports.

- Leading players such as AS Graanul Invest, Drax Biomass, Enviva Partners, German Pellets GmbH, Pinnacle Renewable Energy, and others drive competitiveness through capacity expansion, long-term contracts, and sustainability compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Forest wood and waste dominates the Europe wood pellets market, accounting for nearly 70% share in 2024. Its strong position is supported by abundant forest resources across Northern and Eastern Europe, which provide a stable feedstock for pellet production. This segment benefits from established forestry industries, EU renewable energy directives, and investments in sustainable biomass utilization. Agricultural residue follows with about 20% share, driven by rising use of crop waste and energy diversification efforts. Other raw materials, including mixed biomass waste, hold the remaining 10%, mainly serving niche energy applications.

- For instance, Estonia’s Graanul Invest, Europe’s largest wood pellet producer, sources residues from certified forests across the Baltics to support over 2.5 million tons of annual output, directly feeding district heating networks in Europe.

By Application

Industrial pellets for combined heat and power (CHP) and district heating lead the Europe market, representing almost 55% share in 2024. The dominance comes from extensive adoption in Scandinavian and Central European countries with district heating networks. Industrial pellets for co-firing hold about 25% share, supported by policies encouraging coal-to-biomass conversion in power plants. Residential and commercial heating pellets account for nearly 15% share, largely driven by household adoption in Germany, Austria, and Italy. Other smaller applications contribute around 5%, primarily in emerging bioenergy initiatives.

- For instance, Austria has over 180,000 pellet heating systems installed in homes, supported by federal subsidies promoting renewable heating.

Market Overview

Strong Policy Support for Renewable Energy

The Europe wood pellets market is strongly driven by favorable policy frameworks and renewable energy targets set by the European Union. The Renewable Energy Directive (RED II) mandates increased renewable shares in energy consumption, creating demand for sustainable bioenergy solutions like wood pellets. Governments across Europe provide subsidies, incentives, and tax benefits to encourage biomass adoption. This policy-driven demand ensures long-term stability, especially in countries with ambitious decarbonization goals such as Germany, the UK, and Scandinavia, where biomass plays a central role in energy transition.

- For instance, in the UK, Drax Power Station has converted four of its six generating units from coal to sustainably sourced biomass, making it the largest single-site producer of renewable electricity in the country.

Expansion of District Heating Networks

The market benefits significantly from the expansion of district heating systems across Europe, particularly in Northern and Central regions. Wood pellets serve as a reliable fuel for combined heat and power (CHP) plants, supporting efficient energy generation. Countries like Sweden, Denmark, and Finland lead in integrating pellets into municipal heating networks, reducing reliance on fossil fuels. Rising urbanization, energy efficiency goals, and government investments in district energy infrastructure further support this trend, making district heating a central driver of pellet consumption across European markets.

Abundant Forest Resources and Biomass Supply

Europe’s vast forestry resources provide a secure and consistent raw material supply for pellet production. Nations such as Austria, Germany, and the Baltic states leverage sustainable forestry practices to convert wood residues into pellets. This availability ensures competitive production costs and stable supply chains, reducing dependence on imported fuels. With strong emphasis on sustainable forest management, pellet producers can meet rising domestic and export demand. The abundance of biomass feedstock continues to strengthen Europe’s position as the leading global wood pellet producer and exporter.

- For instance, Holzindustrie Schweighofer in Austria operates large pellet facilities directly connected to its sawmills, producing over 550,000 tonnes annually using only sawmill by-products, demonstrating efficient resource use.

Key Trends & Opportunities

Shift Toward Sustainable Heating in Residential Sector

A rising trend in the Europe wood pellets market is the growing adoption of pellet-based heating systems in residential and commercial buildings. Consumers are increasingly shifting to biomass heating as a cleaner and more cost-efficient alternative to oil or coal. Financial incentives for pellet boilers and stoves, along with rising awareness of carbon-neutral solutions, drive this adoption. Germany, Austria, and Italy are witnessing strong uptake in households, creating opportunities for manufacturers to expand product offerings tailored to small-scale heating applications.

- For instance, Drax Group in the UK, which converts coal-fired power plants to biomass, with wood pellets supporting around 5% of the nation’s electricity generation, promoting cleaner energy use in large-scale heating and power.

Rising Export Opportunities to Global Markets

Europe’s established production base and advanced biomass supply chains position it as a key exporter of wood pellets. Countries like Latvia, Estonia, and Lithuania are expanding exports to meet growing demand in Asia-Pacific and North America. Increasing coal phase-outs globally present a major opportunity for European producers to expand supply to international utilities. This trend not only boosts revenues but also enhances Europe’s strategic importance in the global renewable energy trade, offering long-term growth potential for the regional pellet industry.

- For instance, Enviva, the world’s largest wood pellet producer, has long-term supply contracts with European utilities such as Ørsted in Denmark, which uses biomass as a central part of its coal phase-out strategy.

Key Challenges

Supply Chain Vulnerabilities and Price Volatility

The Europe wood pellets market faces challenges from fluctuating raw material availability and transportation constraints. Dependence on forest residues can be disrupted by logging restrictions, seasonal variations, or geopolitical issues affecting timber trade. Rising logistics costs and fuel price volatility also impact pellet pricing, reducing competitiveness compared to other renewable energy sources. These supply chain uncertainties increase risks for producers and end-users, making stable policy support and diversified raw material sourcing crucial for long-term market resilience.

Competition from Alternative Renewable Sources

Pellets face increasing competition from alternative renewable energy technologies such as solar, wind, and heat pumps. These technologies often receive greater policy focus and financial incentives, which can slow biomass adoption. In residential heating, heat pumps are gaining traction as a cleaner, more efficient solution. This competitive pressure challenges pellet producers to innovate and position biomass as complementary rather than competing. Without continuous efficiency improvements and stronger policy backing, wood pellets risk losing market share in the renewable energy mix.

Sustainability Concerns and Regulatory Scrutiny

Growing concerns around the environmental sustainability of large-scale biomass use create challenges for the pellet market. Critics argue that extensive forest harvesting for pellets may undermine carbon neutrality goals. Regulatory scrutiny is intensifying, with stricter sustainability criteria and certification requirements being implemented. Meeting these standards adds compliance costs and operational complexity for producers. Negative perceptions around biomass sustainability could limit future policy support, making transparency in sourcing and commitment to certified sustainable forestry practices critical for maintaining market acceptance.

Regional Analysis

UK

The UK holds 28% share of the Europe Wood Pellets Market in 2024. Strong demand is driven by large-scale biomass conversion projects, including Drax Power Station, which remains a major consumer of imported pellets. The country has prioritized biomass as part of its renewable energy mix, ensuring stable consumption levels. Residential use of pellets is comparatively smaller but supported by incentive programs. The UK relies heavily on imports from the U.S. and Baltic nations, creating supply chain dependencies. It remains a leading market due to policy commitments and long-term contracts.

Germany

Germany accounts for 20% share of the Europe Wood Pellets Market in 2024. The country’s strong residential sector adoption supports steady demand, particularly in southern regions where pellet boilers and stoves are common. Government subsidies and renewable heat incentives continue to promote pellet-based heating systems. Domestic production benefits from abundant forestry resources and sustainable management practices. Industrial demand is smaller compared to residential use but growing with increasing bioenergy initiatives. Germany maintains its position as a key consumer and producer in the regional landscape.

France

France represents 15% share of the Europe Wood Pellets Market in 2024. It benefits from strong government backing for renewable heating solutions, especially through incentive programs that encourage pellet stove installations. The residential sector dominates consumption, with rural households leading adoption. Domestic producers meet much of the local demand, supported by forestry resources and sustainable practices. Industrial use of pellets is limited but gaining traction through co-firing in selected plants. France continues to focus on energy diversification to reduce fossil fuel dependency.

Italy

Italy holds 12% share of the Europe Wood Pellets Market in 2024. Its pellet consumption is mainly concentrated in the residential and small commercial sectors. The country has one of the largest installed bases of pellet stoves in Europe, making household use the dominant segment. Limited domestic production leads to heavy reliance on imports from Austria and Eastern Europe. Italy’s growing emphasis on reducing heating oil use continues to strengthen pellet demand. It remains a key consumer market, driven by lifestyle adoption and energy efficiency goals.

Spain

Spain contributes 8% share of the Europe Wood Pellets Market in 2024. Rising awareness of sustainable heating options is driving demand across residential and commercial buildings. Domestic production has expanded, supported by the availability of forestry resources. Incentives for renewable energy adoption are gradually supporting growth, though adoption is slower compared to northern markets. Industrial pellet use remains modest, but interest in co-firing is emerging. Spain shows strong growth potential as the government strengthens its renewable energy roadmap.

Russia

Russia accounts for 10% share of the Europe Wood Pellets Market in 2024. Its large forestry resources provide a strong production base, much of which is directed toward exports. Domestic consumption remains relatively small, but international demand drives expansion. Russia has become a significant supplier to European and Asian markets, reinforcing its role in global biomass trade. Infrastructure development supports capacity expansion, though geopolitical uncertainties impact trade flows. Russia remains a critical player due to its export-oriented pellet industry.

Rest of Europe

The Rest of Europe holds 7% share of the Europe Wood Pellets Market in 2024. Countries in the Baltics, Scandinavia, and Eastern Europe contribute through both production and consumption. Latvia, Estonia, and Lithuania are major exporters, supplying large volumes to Western Europe. Scandinavian nations continue to expand pellet use in district heating systems, supporting stable demand. Eastern Europe benefits from forestry resources and growing adoption in households. This segment strengthens Europe’s overall supply chain resilience and export competitiveness.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Wood Pellets Market is highly competitive, shaped by established producers, regional suppliers, and international exporters. Leading players such as AS Graanul Invest, Drax Biomass, Enviva Partners, German Pellets GmbH, and Pinnacle Renewable Energy dominate the market with large production capacities and long-term supply contracts. Their focus on securing sustainable raw materials, expanding export capacity, and meeting strict EU renewable energy directives strengthens their market position. Regional companies, including Land Energy Girvan, Lignetics of Idaho, and Zilkha Biomass Energy, contribute by serving niche and domestic heating markets. Competition is influenced by pricing strategies, geographic proximity to feedstock, and compliance with sustainability certifications like ENplus. Rising demand from residential heating and industrial CHP plants has intensified investment in capacity expansion across the Baltics, Germany, and Scandinavia. Companies increasingly pursue mergers, acquisitions, and partnerships to secure feedstock security and strengthen cross-border distribution networks, maintaining resilience against supply chain disruptions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- AS Graanul Invest

- Drax Biomass Inc

- Enviva Partners, LP

- German Pellets GmbH

- Land Energy Girvan Limited

- Lignetics of Idaho, Inc

- Pinnacle Renewable Energy Inc

- Zilkha Biomass Energy, LLC

- Others

Recent Developments

- In June 2025, Green Alliance acquired BioEnergy Europe – Pellet and Fire, a biomass distributor in Sicily. The move expanded Green Alliance’s footprint in southern Italy, strengthened its distribution network, and supported growth toward surpassing €100 million in annual turnover.

- In December 2024, Drax signed a supply agreement with Pathway Energy in the United States. The deal covers over one million tonnes of biomass per year from its US plants, supporting the production of 30 million gallons of sustainable aviation fuel annually in Texas.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wood pellets will grow as Europe strengthens renewable energy targets.

- District heating networks will expand pellet consumption in Northern and Central Europe.

- Residential pellet heating will increase in Germany, Austria, Italy, and France.

- Imports will remain vital for the UK and Italy due to limited domestic production.

- Baltic countries will enhance their role as leading exporters to global markets.

- Producers will invest more in certified sustainable forestry and biomass sourcing.

- Advanced pellet boilers and stoves will gain popularity in households and small businesses.

- Co-firing in coal plants will create new opportunities as energy systems decarbonize.

- Trade diversification will reduce risks from geopolitical uncertainties in pellet supply.

- Industry consolidation through mergers and partnerships will strengthen market stability and competitiveness.