| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EV Fleet Management System Market Size 2024 |

USD 25,007.76 Million |

| EV Fleet Management System Market, CAGR |

5.40% |

| EV Fleet Management System Market Size 2032 |

USD 39,257.92 Million |

Market Overview

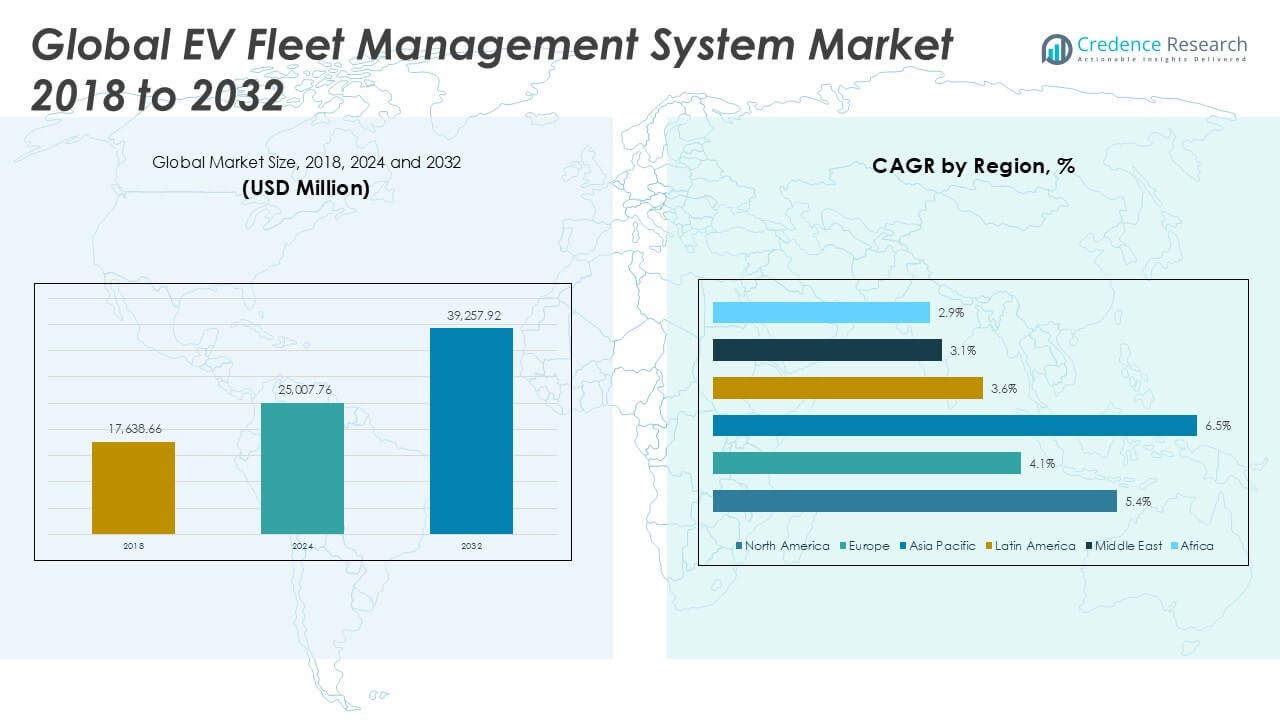

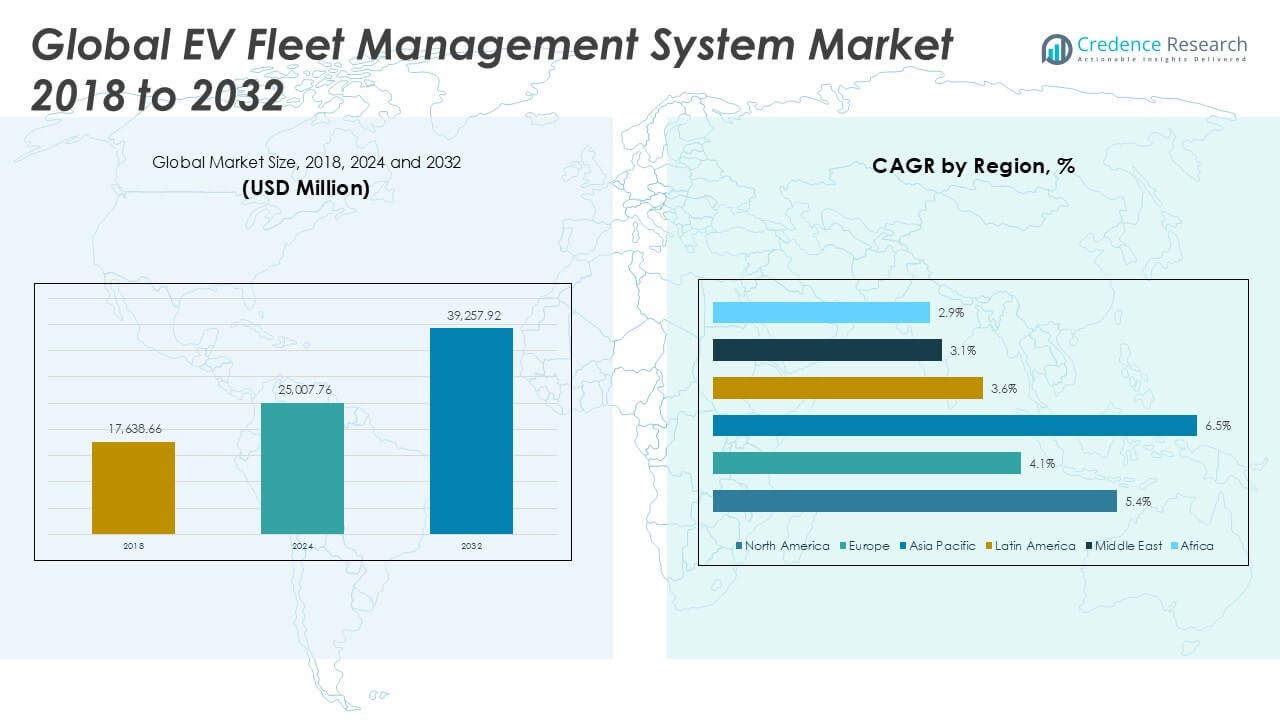

The EV Fleet Management System Market was valued at USD 17,638.66 million in 2018, increased to USD 25,007.76 million in 2024, and is anticipated to reach USD 39,257.92 million by 2032, at a CAGR of 5.40% during the forecast period.

The EV Fleet Management System Market is experiencing robust growth, driven by the rapid adoption of electric vehicles in commercial and public transport fleets. Organizations increasingly prioritize sustainability and operational efficiency, fueling demand for advanced fleet management solutions that optimize route planning, monitor real-time vehicle performance, and reduce maintenance costs. The integration of telematics, IoT, and cloud-based analytics enhances decision-making and supports predictive maintenance, leading to improved fleet utilization. Market growth is further supported by favorable government policies, incentives for electric vehicle adoption, and expanding charging infrastructure. Key trends include the rise of AI-powered data analytics, the shift toward Mobility-as-a-Service (MaaS) models, and the development of smart charging and energy management platforms. These trends enable fleet operators to streamline operations, minimize total cost of ownership, and comply with evolving environmental regulations, positioning the EV Fleet Management System Market for sustained expansion over the coming years.

The EV Fleet Management System Market demonstrates strong growth across key regions, with North America, Europe, and Asia Pacific emerging as leading hubs for technology adoption and fleet electrification. North America, led by the United States and Canada, benefits from robust government support, advanced charging infrastructure, and a mature electric vehicle ecosystem. Europe’s market is propelled by strict environmental regulations and progressive public transport initiatives, with Germany, the UK, and France playing major roles. In Asia Pacific, China, Japan, and South Korea drive rapid expansion through aggressive fleet electrification targets and digital innovation. Leading key players in the EV Fleet Management System Market include Geotab Inc., recognized for its advanced telematics solutions, Samsara, offering integrated fleet management platforms, and Verizon Connect, providing scalable, cloud-based systems. Webfleet (Bridgestone) also stands out, delivering comprehensive connectivity and energy management tools for diverse electric fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The EV Fleet Management System Market was valued at USD 17,638.66 million in 2018, reached USD 25,007.76 million in 2024, and is projected to hit USD 39,257.92 million by 2032, with a CAGR of 5.40% during the forecast period.

- Increasing adoption of electric vehicles in commercial, public, and logistics fleets is fueling market demand, as operators focus on reducing emissions and lowering operational costs.

- Growing government support, emission regulations, and investments in charging infrastructure are key drivers accelerating fleet electrification and management system deployments.

- Notable trends include the integration of telematics, IoT, and AI-powered analytics for real-time monitoring, predictive maintenance, and dynamic route optimization in electric fleets.

- Competitive activity remains intense, with leading companies such as Geotab Inc., Samsara, and Verizon Connect introducing advanced cloud-based platforms and energy management solutions.

- Key restraints for market growth involve integration challenges with legacy fleet management systems, limited charging infrastructure in certain regions, and concerns over data security and system interoperability.

- Regionally, North America and Asia Pacific show robust adoption, driven by supportive policies and rapid infrastructure growth, while Europe advances through strong regulatory frameworks and sustainable transport programs; Latin America, the Middle East, and Africa experience slower but steady progress due to ongoing infrastructure development and targeted fleet initiatives.

Market Drivers

Sustained Electrification of Commercial and Public Fleets Fuels Market Demand

Rising adoption of electric vehicles within commercial and public transportation sectors drives robust growth in the EV Fleet Management System Market. Businesses and government organizations seek to reduce carbon emissions and operating expenses by transitioning large vehicle fleets from internal combustion engines to electric powertrains. The shift creates demand for specialized management systems capable of monitoring battery status, optimizing charging schedules, and ensuring seamless integration with broader fleet operations. Increasing availability and diversity of electric vehicles across multiple classes, including delivery vans, buses, and service vehicles, further supports this expansion. Fleet operators require advanced tools for real-time tracking, route optimization, and energy management. These requirements position the market as essential for facilitating large-scale electrification initiatives.

- For instance, Geotab Inc. currently manages data for more than 4 million connected vehicles worldwide, supporting large-scale fleet transitions with real-time insights and EV-specific analytics.

Government Incentives and Regulatory Pressures Shape Market Direction

Strong regulatory mandates and supportive government policies significantly influence the EV Fleet Management System Market. Many regions implement ambitious emission reduction targets, creating compliance requirements for fleet operators and public transit authorities. Governments provide incentives, such as subsidies, tax credits, and grants, to accelerate electric fleet deployment and promote technology upgrades. Regulatory bodies also establish standards for fleet efficiency, data reporting, and environmental performance. These frameworks encourage organizations to invest in comprehensive management systems that support monitoring, reporting, and compliance with evolving rules. It benefits from policy-driven momentum and growing regulatory complexity.

- For instance, the United States allocated $5 billion through the National Electric Vehicle Infrastructure (NEVI) Formula Program to accelerate nationwide EV infrastructure deployment, boosting demand for advanced fleet management solutions.

Advancements in Connected Vehicle Technologies Transform Fleet Management

Technological innovations in telematics, IoT, and cloud-based analytics play a pivotal role in the evolution of the EV Fleet Management System Market. Integration of advanced sensors, real-time data analytics, and wireless communication networks enables predictive maintenance, proactive route adjustments, and remote diagnostics. Fleet managers leverage connected solutions to increase vehicle uptime, enhance driver safety, and optimize total cost of ownership. Access to granular data allows for informed decision-making and improved energy efficiency. The ability to seamlessly connect vehicles, charging infrastructure, and back-end systems creates operational synergies and new service opportunities. Technology advancements underpin market expansion by delivering measurable value to fleet operators.

Rising Focus on Operational Efficiency and Cost Reduction Drives Adoption

Organizations prioritize operational efficiency and cost reduction, driving adoption of EV fleet management solutions. The need to manage energy consumption, minimize charging downtime, and maximize asset utilization pushes demand for intelligent platforms. Advanced management systems facilitate automated scheduling, centralized control of charging operations, and dynamic resource allocation. These solutions enable fleet operators to track key performance indicators and implement data-driven strategies for maintenance and replacement. The EV Fleet Management System Market supports organizations in achieving sustainability objectives while maintaining financial performance. Focus on efficient resource management and long-term savings strengthens its market outlook.

Market Trends

Integration of Artificial Intelligence and Machine Learning Enhances Fleet Operations

AI and machine learning technologies are increasingly shaping the EV Fleet Management System Market, providing actionable insights for predictive maintenance, battery optimization, and driver behavior analytics. Fleet operators leverage these advanced analytics to forecast battery life, anticipate maintenance needs, and reduce operational risks. Smart algorithms enable automated route planning, dynamic energy management, and real-time adjustments to minimize delays and energy usage. The integration of AI supports continuous performance improvements across diverse fleet environments. It positions fleet management platforms as essential tools for proactive decision-making and cost control. Adoption of these technologies accelerates competitive differentiation among service providers.

- For instance, Samsara’s AI-powered platform processes over 5 trillion sensor data points annually, empowering fleet customers with predictive analytics and real-time safety interventions.

Expansion of Smart Charging and Energy Management Platforms

The development of sophisticated charging management solutions remains a defining trend in the EV Fleet Management System Market. Fleet operators demand platforms that support remote monitoring, automated billing, and real-time scheduling for multi-vehicle charging operations. Integration with renewable energy sources and grid-responsive charging further enhances flexibility and sustainability. Advanced platforms enable load balancing, reduce peak demand costs, and ensure efficient utilization of charging infrastructure. It supports seamless coordination between vehicles and charging networks, reducing downtime and improving energy efficiency. Growing importance of energy management drives continued investment in these platforms.

- For instance, ChargePoint’s network delivered over 188 million charging sessions as of 2023, providing fleet operators with real-time charging management and detailed energy analytics across 225,000 active charging ports.

Rise of Mobility-as-a-Service (MaaS) and Subscription-Based Fleet Solutions

Mobility-as-a-Service is transforming how organizations deploy and manage electric fleets, pushing the EV Fleet Management System Market toward flexible, subscription-based models. Fleet operators and service providers utilize centralized platforms to manage diverse vehicle types, usage scenarios, and customer needs. Subscription-based solutions facilitate scalable, on-demand fleet expansion without significant upfront investment. Integration of MaaS with fleet management systems supports streamlined bookings, usage tracking, and automated billing. The trend aligns with broader shifts toward asset-light operations and digital mobility ecosystems. It enhances accessibility and responsiveness for fleet customers.

Emphasis on Real-Time Data Integration and Interoperability

Demand for seamless data exchange across vehicles, charging stations, and enterprise systems is a key trend shaping the EV Fleet Management System Market. Open APIs and standardized protocols enable interoperability between disparate systems, allowing operators to centralize data management and analytics. Real-time data integration supports instant monitoring of fleet status, performance, and compliance. Enhanced connectivity enables quick response to operational disruptions, regulatory changes, or energy market fluctuations. The market sees growing adoption of unified platforms that aggregate, visualize, and analyze real-time information for improved operational control. Integration capabilities define future competitiveness and customer value.

Market Challenges Analysis

Complex Integration with Existing Legacy Systems Limits Adoption

The need to integrate EV fleet management solutions with legacy infrastructure presents a significant challenge for many organizations. Legacy systems often lack compatibility with modern telematics, IoT devices, and cloud-based platforms, making seamless data exchange difficult. Fleet operators face high costs and technical complexities in upgrading or replacing outdated hardware and software. The EV Fleet Management System Market faces resistance from organizations hesitant to disrupt established operations or invest in comprehensive overhauls. Disparate data sources, varying communication protocols, and security concerns further complicate system integration. Achieving full interoperability requires substantial planning, skilled resources, and ongoing technical support.

Limited Charging Infrastructure and Range Anxiety Hinder Scalability

Widespread deployment of EV fleets relies on access to reliable and scalable charging infrastructure, a challenge in many regions. Gaps in public and private charging station coverage create operational bottlenecks, limit route flexibility, and contribute to range anxiety among fleet operators. The EV Fleet Management System Market experiences delays in project rollouts when infrastructure development lags behind vehicle deployment. Operators must carefully plan charging schedules, manage peak loads, and address downtime risks. Infrastructure constraints may discourage potential adopters from transitioning to electric fleets. It faces mounting pressure to offer solutions that optimize charging utilization and address these logistical hurdles.

Market Opportunities

Expansion of Smart Cities and Government Sustainability Initiatives Creates Growth Potential

The rise of smart city projects and expanding government sustainability initiatives generate substantial opportunities for the EV Fleet Management System Market. Urban areas are prioritizing cleaner mobility solutions and efficient transportation networks, prompting investments in electric vehicle fleets and advanced management platforms. Governments allocate funding for public charging stations, digital infrastructure, and integrated mobility systems. The market can support city planners and fleet operators by offering real-time monitoring, predictive analytics, and dynamic route optimization. Partnerships with municipalities and transit agencies can unlock new revenue streams and strengthen market presence. It stands to benefit from increased policy alignment and public-private collaborations focused on sustainable urban mobility.

Integration with Renewable Energy and Advanced Analytics Supports Market Differentiation

Growing adoption of renewable energy sources in fleet operations opens new avenues for value creation in the EV Fleet Management System Market. Operators seek solutions that connect with solar panels, wind energy systems, and grid storage to reduce operational costs and carbon footprints. Advanced analytics and AI-driven insights help optimize energy consumption, forecast charging needs, and manage peak demand periods. The market can offer platforms that enable automated energy management, smart charging, and data-driven decision-making for fleet sustainability. Enhanced integration capabilities position vendors as essential partners for forward-thinking organizations. It gains a competitive edge by aligning fleet management with broader environmental and energy goals.

Market Segmentation Analysis:

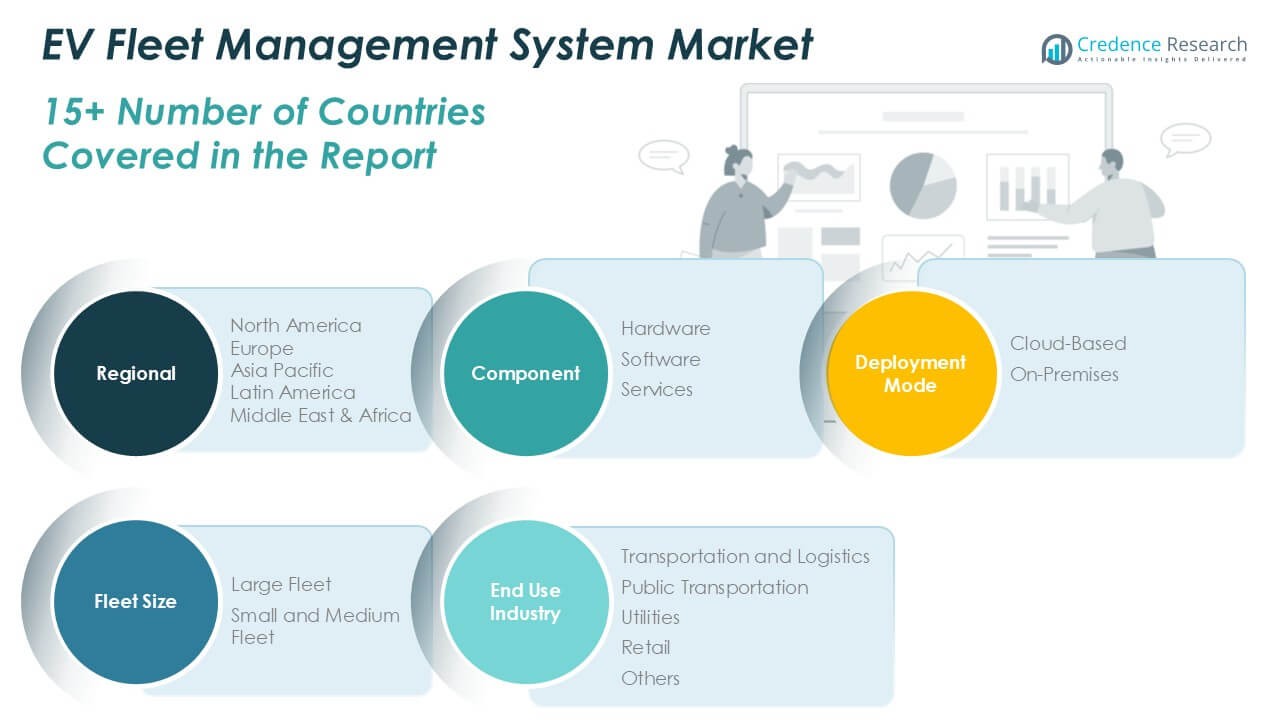

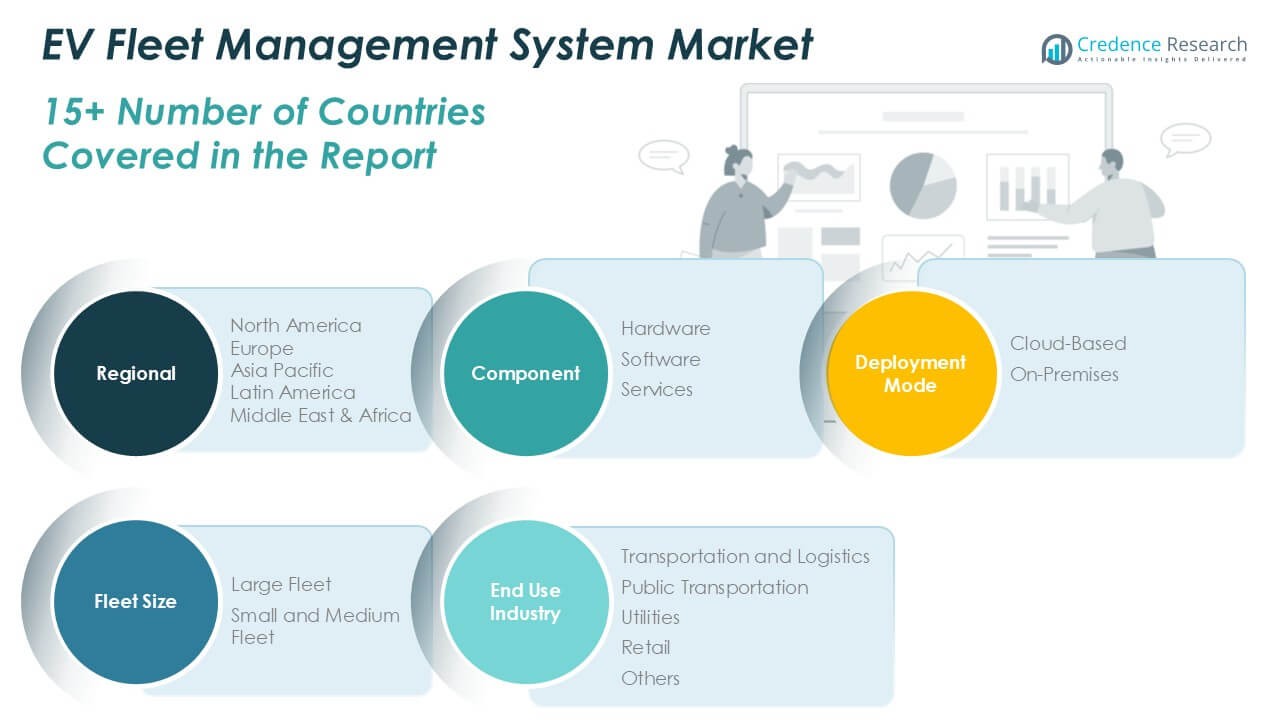

By Component:

The market divides into hardware, software, and services. Hardware remains fundamental, driven by demand for telematics devices, GPS trackers, battery management units, and sensors essential for vehicle monitoring and real-time data collection. Software commands significant growth, propelled by rising adoption of cloud-based analytics, fleet optimization platforms, and mobile applications. Software solutions enable predictive maintenance, energy management, and compliance reporting, becoming central to modern fleet operations. Services such as system integration, maintenance, training, and technical support ensure continuous system performance and user adoption. The combined strength of these components supports end-to-end fleet management capabilities for organizations seeking operational efficiency.

- For instance, Verizon Connect supports more than 24,000 customers with its fleet management hardware and software, processing millions of data points per day to optimize operations.

By Deployment Mode:

The market segments into cloud-based and on-premises solutions. Cloud-based deployment dominates, favored for its scalability, flexibility, and remote accessibility. Fleet operators benefit from seamless updates, data synchronization, and lower upfront infrastructure costs. It also allows for centralized control of multiple sites and easy integration with third-party applications. On-premises deployment appeals to organizations with strict data security policies or specific regulatory requirements, offering greater control over sensitive operational data. Both deployment models meet distinct business needs and continue to coexist within the market landscape.

- For instance, Webfleet (Bridgestone) enables cloud-based fleet management for over 60,000 businesses globally, delivering real-time insights and seamless multi-site coordination for diverse operational requirements.

By Fleet Size:

The EV Fleet Management System Market addresses both large fleets and small and medium fleets. Large fleets, including public transportation, logistics, and delivery companies, represent a significant share, requiring advanced solutions for route planning, resource allocation, and multi-site coordination. These operators value automation, analytics, and integration with broader enterprise systems. Small and medium fleets demand cost-effective, easy-to-deploy solutions that support basic fleet tracking, maintenance scheduling, and performance monitoring. The market serves a wide spectrum of customers, ensuring scalability and adaptability to varying operational scales and complexities.

Segments:

Based on Component:

- Hardware

- Software

- Services

Based on Deployment Mode:

Based on Fleet Size:

- Large Fleet

- Small and Medium Fleet

Based on End Use Industry:

- Transportation and Logistics

- Public Transportation

- Utilities

- Retail

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America EV Fleet Management System Market

North America EV Fleet Management System Market grew from USD 7,518.19 million in 2018 to USD 10,545.75 million in 2024 and is projected to reach USD 16,602.14 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.4%. North America is holding a 42% market share. The United States leads regional adoption, driven by strong government incentives, a well-developed charging infrastructure, and widespread corporate sustainability initiatives. Canada follows with growing investments in green transportation, while Mexico sees steady expansion in logistics and public fleet electrification. Market growth benefits from early adoption of advanced telematics, integration with renewable energy, and a high focus on reducing fleet emissions.

Europe EV Fleet Management System Market

Europe EV Fleet Management System Market grew from USD 3,284.92 million in 2018 to USD 4,401.53 million in 2024 and is set to reach USD 6,281.53 million by 2032, at a CAGR of 4.1%. Europe captures a 16% market share. Germany, the UK, and France serve as key contributors, supported by stringent emission regulations, robust EV infrastructure, and strong government policy alignment. The European Union’s climate targets drive rapid adoption in commercial fleets, public transport, and shared mobility programs. Companies leverage data analytics and smart charging to optimize operations and comply with environmental standards.

Asia Pacific EV Fleet Management System Market

Asia Pacific EV Fleet Management System Market grew from USD 5,264.36 million in 2018 to USD 7,867.22 million in 2024 and is anticipated to reach USD 13,435.28 million by 2032, achieving the highest CAGR of 6.5%. Asia Pacific holds a 34% market share. China dominates with large-scale fleet electrification across public transit and logistics sectors, supported by aggressive government targets and a massive domestic EV industry. Japan and South Korea see strong uptake in corporate and urban mobility fleets. Expanding charging networks and digital infrastructure underpin sustained regional growth.

Latin America EV Fleet Management System Market

Latin America EV Fleet Management System Market grew from USD 762.52 million in 2018 to USD 1,066.40 million in 2024 and is forecast to reach USD 1,463.64 million by 2032, reflecting a CAGR of 3.6%. Latin America claims a 4% market share. Brazil and Mexico drive regional activity, spurred by urban air quality initiatives and the gradual rollout of public charging infrastructure. Chile and Colombia demonstrate increasing interest in green fleet programs. Market momentum depends on policy support and growing awareness of the long-term economic benefits of electrification.

Middle East EV Fleet Management System Market

Middle East EV Fleet Management System Market grew from USD 480.37 million in 2018 to USD 620.88 million in 2024 and will likely reach USD 817.64 million by 2032, with a CAGR of 3.1%. The region accounts for a 2% market share. The United Arab Emirates leads adoption, investing in smart city initiatives and sustainable transportation solutions. Saudi Arabia follows, focusing on diversifying its economy and promoting clean mobility. Limited but growing infrastructure and government-driven pilot projects support steady market development across the Gulf states.

Africa EV Fleet Management System Market

Africa EV Fleet Management System Market grew from USD 328.29 million in 2018 to USD 505.98 million in 2024 and is estimated to reach USD 657.69 million by 2032, posting a CAGR of 2.9%. Africa maintains a 2% market share. South Africa remains at the forefront, supported by pilot EV projects and regional distribution hubs. Kenya and Egypt see emerging activity tied to public transport upgrades and renewable energy initiatives. The market faces challenges from infrastructure gaps and policy uncertainty but offers opportunities through targeted government and private sector collaboration.

Key Player Analysis

- Geotab Inc.

- Samsara

- Verizon Connect

- Motive

- Webfleet (Bridgestone)

- ChargePoint

- Driivz

- Ampcontrol

- Uffizio

- Fleet Complete

Competitive Analysis

The EV Fleet Management System Market is characterized by intense competition among leading technology providers focused on delivering advanced telematics, real-time analytics, and seamless energy management solutions. Key players include Geotab Inc., Samsara, Verizon Connect, Motive, Webfleet (Bridgestone), ChargePoint, Driivz, Ampcontrol, Uffizio, and Fleet Complete. These companies consistently invest in research and development to enhance their platforms with AI-driven predictive maintenance, dynamic route optimization, and integration capabilities for various electric vehicle models and charging networks. Companies differentiate their offerings through AI-powered predictive maintenance, dynamic route optimization, and advanced energy management features. Strategic partnerships with automotive manufacturers, energy providers, and technology firms are common, aiming to expand service portfolios and enhance customer reach. The market places a premium on platform scalability, user-friendly interfaces, and interoperability with various vehicle types and operational environments. Continuous innovation in security, compliance, and data privacy also plays a crucial role in building customer trust. Competitive intensity remains high, with organizations prioritizing research and development, strategic collaborations, and tailored solutions to meet the evolving needs of commercial, public, and logistics fleet operators worldwide.

Recent Developments

- In January 2024, MoveEV, an AI-powered EV transition platform, partnered with Geotab. The collaboration integrates MoveEV’s flagship product, ReimburseEV, into the Geotab Marketplace, marking a significant step in advancing sustainable fleet management. In September 2023, Trimble partnered with transportation solution provider Next Generation Logistics to make its Engage Lane solution available to their base of shippers through the Transportation Cloud.

- In December 2023, Komatsu completed the acquisition of iVolve Holdings through its wholly-owned subsidiary in Australia. With this acquisition, the company expects to cater to iVolve’s customers in North America and Australia and target mid-tier operations.

- In December 2023, Traxall International, a sister company of Fleet Operations, completed the acquisition of Fleet Logistics Group. This acquisition was done to develop one of the largest independent mobility and fleet management providers with over 400,000 contracts under management in Europe.

- In June 2023, ZEVX, an EV systems provider, introduced OpenZEVX, a SaaS fleet management software dedicated to e-mobility solutions and battery-electric powertrains. The new launch is expected to enable fleet managers to enhance EV powertrains and charging systems to optimize EV range, performance, and driver safety.

- In June 2023, Webfleet, Bridgestone‘s fleet management software, introduced a trailer management solution, named Webfleet Trailer. The new solution is dedicated to supporting transport and logistics firms with trailer fleets operating long haul.

Market Concentration & Characteristics

The EV Fleet Management System Market exhibits moderate to high market concentration, with a handful of global technology leaders capturing significant market share through continuous innovation, strong brand presence, and comprehensive solution portfolios. It is defined by rapid adoption of cloud-based platforms, real-time telematics, and integration with advanced energy management systems. Leading companies set the standard for platform interoperability, security, and scalable architecture, appealing to both large enterprise fleets and smaller operators. The market is shaped by a demand for end-to-end fleet optimization, AI-driven analytics, and seamless connectivity with diverse vehicle models and charging networks. Emphasis on regulatory compliance, sustainability goals, and data-driven decision-making drives product differentiation and service development. It benefits from ongoing advancements in IoT, artificial intelligence, and smart charging technologies, positioning the market for sustained growth and technological leadership in fleet electrification and management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Fleet Size, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of EV fleet management systems will grow as more companies transition to electric commercial vehicles.

- Governments across regions will continue offering incentives and regulations promoting EV fleet integration.

- Advancements in telematics and IoT will enhance real-time vehicle tracking and performance monitoring.

- Integration of AI and machine learning will improve predictive maintenance and route optimization.

- Fleet operators will increasingly focus on lowering operational costs through energy-efficient management systems.

- The rise of shared mobility and e-commerce will boost demand for EV fleet solutions across urban centers.

- Cloud-based platforms will gain popularity due to their scalability and remote accessibility.

- Partnerships between automakers and software providers will drive innovation in fleet intelligence.

- Growing concerns over carbon emissions will push companies to adopt cleaner, trackable fleet technologies.

- The market will witness increased demand for end-to-end platforms that offer vehicle, battery, and charging infrastructure management.