Market Overview

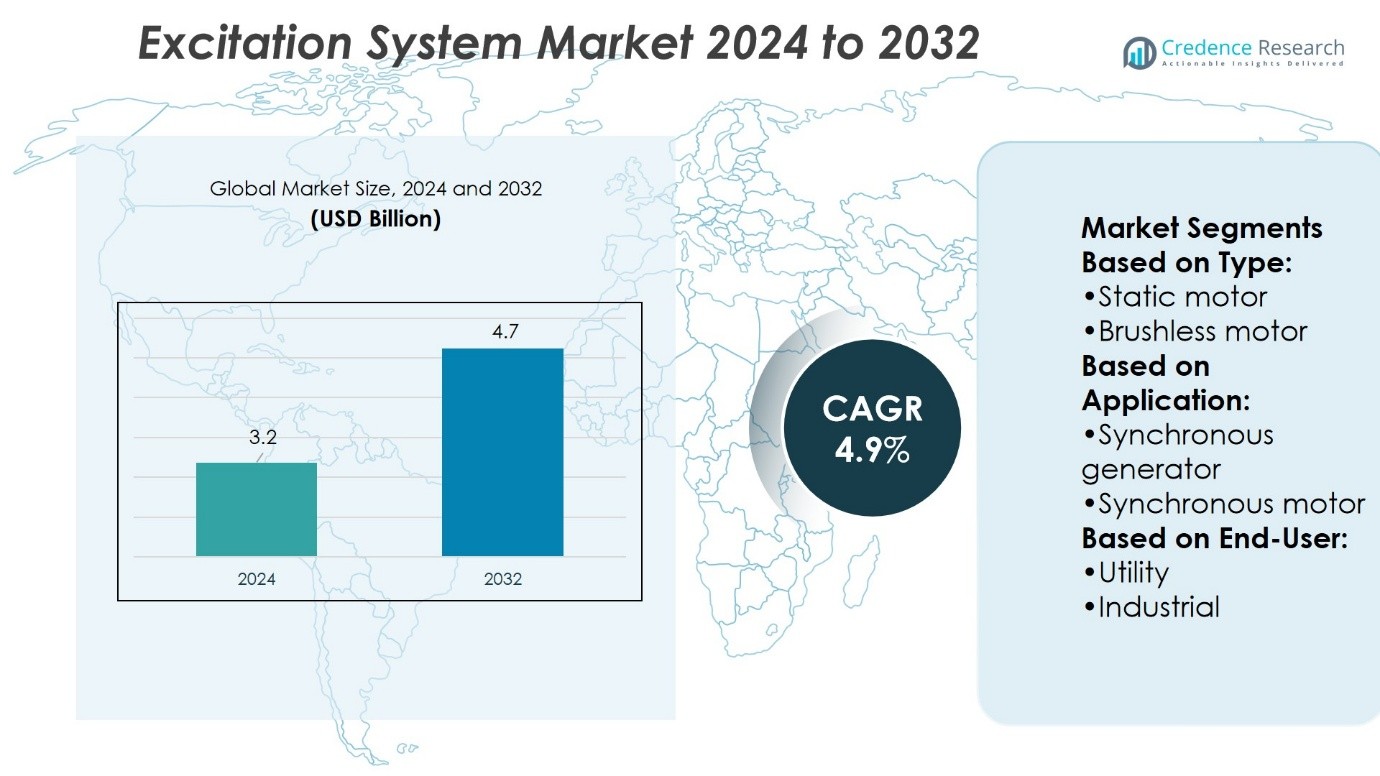

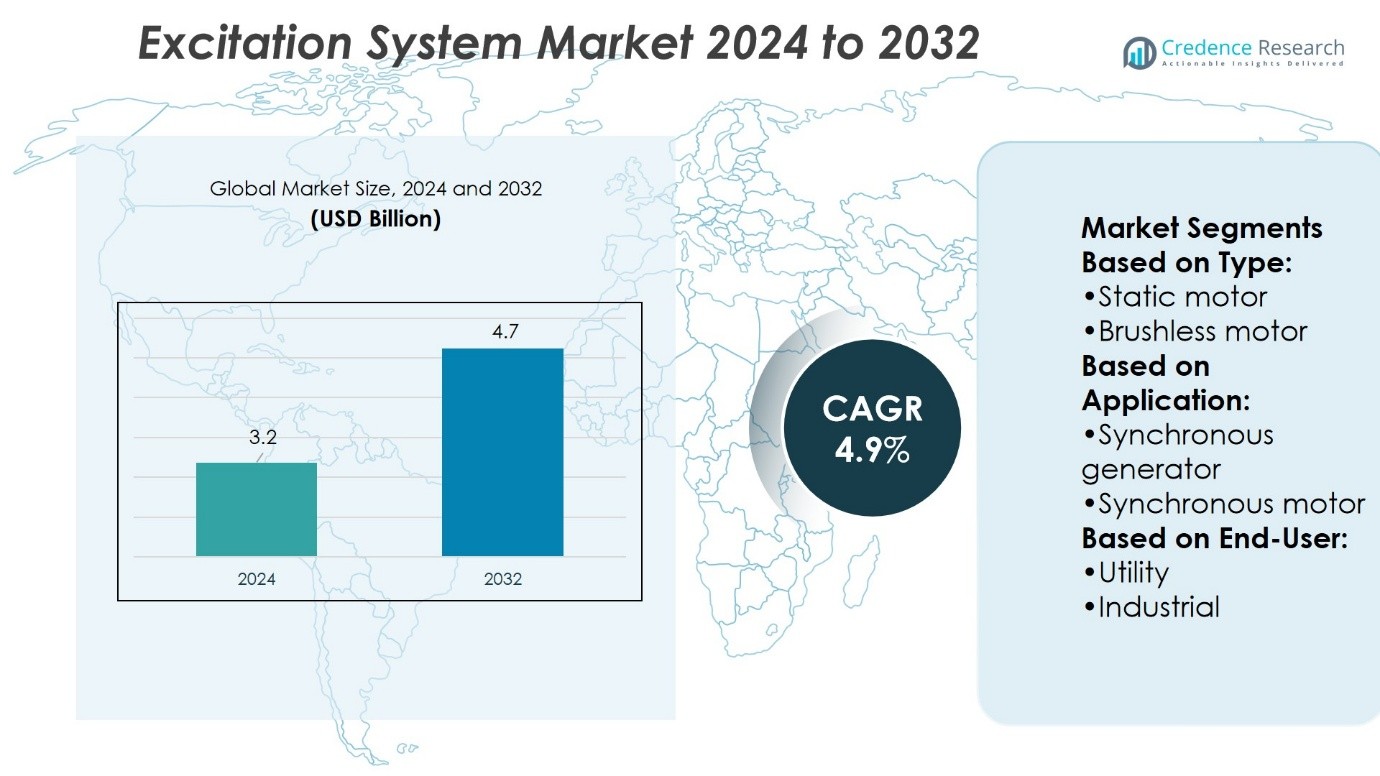

Excitation System Market size was valued at USD 3.2 billion in 2024 and is anticipated to reach USD 4.7 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Excitation System Market Size 2024 |

USD 3.2 Billion |

| Excitation System Market, CAGR |

4.9% |

| Excitation System Market Size 2032 |

USD 4.7 Billion |

The Excitation System Market grows with rising demand for grid stability, renewable energy integration, and modernization of aging infrastructure. Utilities and industries adopt advanced systems to ensure reliable voltage regulation and improve efficiency under varying load conditions. Digital control platforms, automation, and predictive monitoring tools drive adoption by reducing downtime and enhancing operational safety. The market benefits from strong investments in smart grids and sustainable power projects. It also reflects a clear trend toward compact, modular, and energy-efficient designs that support both large-scale utilities and industrial applications. Growing electrification in emerging economies further accelerates long-term growth.

North America holds a significant share of the Excitation System Market, supported by grid modernization and advanced power infrastructure. Europe follows with strong demand from renewable integration and replacement of aging systems, while Asia Pacific leads growth through industrial expansion and large-scale electrification projects. Latin America and the Middle East & Africa show steady progress with investments in energy access and infrastructure development. Key players driving competitiveness include ABB, Mitsubishi Electric, General Electric, Emerson, and Basler Electric.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Excitation System Market size was valued at USD 3.2 billion in 2024 and is expected to reach USD 4.7 billion by 2032, at a CAGR of 4.9%.

- Rising demand for grid stability and renewable energy integration drives consistent market growth.

- Modernization of aging infrastructure creates opportunities for advanced and efficient excitation systems.

- Digital control, automation, and predictive monitoring emerge as key trends improving performance and safety.

- Competition intensifies as global players focus on innovation, modular designs, and service expansion.

- High installation costs and integration challenges act as restraints in cost-sensitive regions.

- North America shows strong adoption, Europe upgrades aging grids, Asia Pacific leads with industrial growth, while Latin America and Middle East & Africa expand through energy access projects.

Market Drivers

Rising Demand for Grid Reliability and Power Stability

The Excitation System Market grows with increasing demand for stable and reliable power grids. Governments and utilities invest in advanced systems that regulate generator voltage and improve grid performance. It ensures uninterrupted supply in regions experiencing rapid industrialization and urban expansion. Rising power consumption drives the adoption of systems that support frequency regulation and dynamic response. Grid operators prioritize technologies that improve fault tolerance and minimize outages. The demand for secure power flow creates consistent opportunities for system deployment.

- For instance, Basler Electric’s the company’s product documentation explicitly states that the DECS-2100 can operate in a wide range of applications that require excitation currents “up to 10,000 Adc”.

Expanding Renewable Energy Integration Across Global Grids

The Excitation System Market benefits from the large-scale integration of renewable energy sources. Wind, solar, and hydro plants require stable voltage control to manage variability. It provides critical support for renewable generators to connect seamlessly to national grids. Utilities deploy excitation systems to balance fluctuating inputs and ensure grid stability. Expanding clean energy projects accelerate the need for advanced control solutions. Countries advancing decarbonization goals create a strong demand pipeline for these systems. Growth aligns closely with renewable energy penetration.

- For instance, ANDRITZ Group recently awarded a modernization contract for the Grand Coulee Dam Is John W. Keys III pump-generating plant (total dam capacity: 6,809 MW). They are replacing automation systems across all six units—installing digital excitation systems.

Advancements in Automation and Digital Control Technologies

The Excitation System Market advances with the adoption of digital control and automation. Intelligent monitoring tools allow real-time adjustments and predictive maintenance. It enables higher efficiency by reducing manual intervention and improving operational accuracy. Utilities deploy systems with microprocessor-based controls that optimize generator performance. Demand rises for solutions offering remote diagnostics and adaptive algorithms. Automation reduces downtime while enhancing safety in grid operations. These features push innovation in next-generation excitation systems.

Rising Investments in Infrastructure Modernization and Energy Security

The Excitation System Market gains strength from large-scale investments in infrastructure modernization. Governments prioritize grid upgrades to support industrial growth and rising consumer demand. It supports energy security strategies by improving grid resilience against failures. Emerging economies expand their power generation capacity, driving wider adoption of excitation systems. Advanced nations replace outdated systems to meet stricter reliability standards. Rising infrastructure budgets in power and energy sectors create long-term opportunities. The market continues to align with global energy modernization trends.

Market Trends

Growing Shift Toward Digital and Automated Control Platforms

The Excitation System Market shows a strong trend toward advanced digital platforms. Power utilities adopt systems with microprocessor-based controllers that deliver precise voltage regulation. It improves flexibility by enabling real-time monitoring and predictive diagnostics. Demand rises for solutions with automated fault detection and adaptive algorithms. Automation reduces dependency on manual control and improves operational safety. Vendors compete by offering integrated platforms with higher efficiency and lower maintenance needs.

- For instance, GE Vernova’s EX2100e is a fourth-generation digital excitation control system that builds on over 50 years of experience and an installed base of more than 10,000 total GE excitation units in 70 countries across steam, gas, and hydro generators.

Rising Adoption of Renewable Energy-Compatible Excitation Systems

The Excitation System Market trends reflect rapid adoption of renewable-compatible solutions. Renewable integration demands systems capable of stabilizing intermittent generation from wind, solar, and hydro plants. It ensures reliable grid connection while maintaining performance during variable supply conditions. Utilities prioritize excitation systems designed for renewable-heavy power mixes. Growing investments in clean energy projects worldwide expand opportunities for advanced voltage regulation systems. This trend reinforces the market’s alignment with global decarbonization goals.

- For instance, F&S Prozessautomation’s TIBS®-XD2S TC excitation unit delivers synchronization voltage support from 10 V AC up to 450 V AC and maintains control accuracy within ± 0.5 %, while offering functions like reactive power control, V/f droop control, and dual-stage excitation current limiting—all in a compact envelope.

Increasing Focus on Grid Modernization and Smart Infrastructure

The Excitation System Market evolves with global efforts toward smart grid development. Governments and utilities invest in modern infrastructure that supports advanced monitoring and control. It allows dynamic responses to fluctuations and strengthens grid reliability. Demand grows for excitation systems integrated with digital communication protocols and IoT-based analytics. The move toward intelligent grids boosts installations of flexible and adaptive systems. This trend underlines the need for technology that ensures long-term energy security.

Emphasis on Compact, Modular, and High-Efficiency Designs

The Excitation System Market highlights a trend toward compact and modular designs. Manufacturers introduce flexible systems that can be tailored to varying generator capacities. It supports simplified installation, faster commissioning, and reduced operational downtime. Modular architecture allows easy upgrades and lowers lifecycle costs for utilities. Efficiency improvements, including energy-saving components, enhance performance while minimizing emissions. The trend reflects an industry shift toward sustainable, space-saving, and cost-effective solutions.

Market Challenges Analysis

High Installation Costs and Complex Integration with Existing Infrastructure

The Excitation System Market faces challenges linked to high upfront costs and complex integration. Utilities and power plants often delay modernization projects due to limited budgets. It requires substantial investment in equipment, skilled labor, and installation processes. Integrating advanced systems with legacy infrastructure creates compatibility issues and operational risks. Power providers face downtime concerns during replacement or upgrade activities. These financial and technical hurdles slow adoption in cost-sensitive regions. Market players must address affordability to accelerate deployment.

Technical Skill Shortages and Cybersecurity Concerns in Digital Systems

The Excitation System Market also encounters challenges from technical skill shortages and cybersecurity risks. Operating advanced digital platforms demands specialized knowledge, which is scarce in many regions. It limits the pace of adoption despite the availability of modern solutions. Increasing digitalization raises vulnerability to cyberattacks targeting critical power infrastructure. Utilities must invest in strong cybersecurity frameworks to ensure system protection. Limited awareness and lack of training programs create gaps in handling new systems. Addressing workforce readiness and security resilience remains critical for market expansion.

Market Opportunities

Expanding Role in Renewable Energy Integration and Sustainable Power Projects

The Excitation System Market holds strong opportunities in renewable energy expansion and sustainability initiatives. Renewable plants require advanced excitation systems to stabilize fluctuating voltage and frequency. It ensures grid reliability while supporting large-scale wind, solar, and hydro projects. Governments invest heavily in clean energy infrastructure, creating consistent demand for modern solutions. Emerging economies with ambitious renewable targets provide high-growth potential for suppliers. The alignment with global decarbonization goals strengthens long-term opportunities for advanced technologies.

Rising Demand from Grid Modernization and Emerging Smart Infrastructure

The Excitation System Market benefits from growing investments in grid modernization and smart infrastructure. Utilities seek advanced systems capable of real-time monitoring, automated control, and predictive diagnostics. It supports resilient grid networks designed to handle higher loads and dynamic fluctuations. Modular and digital designs provide flexibility for integration with smart grids. Urbanization and industrial growth in developing regions drive expansion of reliable power systems. These opportunities position excitation technologies as vital enablers of modern energy ecosystems.

Market Segmentation Analysis:

By Type

The Excitation System Market is segmented into static motor and brushless motor types. Static motor excitation systems remain widely adopted due to their cost-effectiveness and simpler design. It provides stable performance in applications where reliability outweighs high efficiency needs. Brushless motor systems gain traction because of their compact design, higher efficiency, and lower maintenance requirements. Industries and utilities prefer brushless options to minimize downtime and reduce operational costs. The growing adoption of advanced power infrastructure strengthens the demand for brushless systems. Both segments continue to evolve with improvements in automation and digital monitoring features.

- For instance, ABB’s UNITROL 1000 series offers brushless excitation for synchronous machines ranging from 100 kVA to 80 MVA. Notably, the UNITROL 1020 module delivers continuous excitation current up to 20 A, the 1010 model supports up to 10 A, and the compact 1005 handles up to 5 A—all using modern microprocessor control and IGBT-based circuitry.

By Application

The Excitation System Market is divided into synchronous generators and synchronous motors. Synchronous generators dominate demand, supported by their critical role in power generation plants. It ensures stable voltage control and supports grid reliability during load fluctuations. The rise in renewable energy projects further fuels the need for excitation systems in generators. Synchronous motors represent a growing segment as industries seek improved efficiency and stable performance in heavy machinery. Demand increases in sectors such as mining, manufacturing, and process industries. Both applications benefit from digital upgrades that enhance operational precision and fault tolerance.

- For instance, Emerson documentation explicitly states that the Ovation excitation control system can handle “field current requirements up to 10,000 amps” for large generators.

By End User

The Excitation System Market by end user includes utilities and industrial sectors. Utilities hold a strong share, driven by the need for reliable voltage regulation in power generation and distribution networks. It enables grid operators to maintain consistent performance under varying load conditions. Industrial users adopt excitation systems to ensure uninterrupted operation of motors and generators in demanding environments. Manufacturing, oil and gas, and chemical sectors invest in advanced solutions to reduce downtime and increase efficiency. The expansion of industrial automation further supports demand in this segment. Both utilities and industries prioritize systems that combine high reliability with cost efficiency.

Segments:

Based on Type:

- Static motor

- Brushless motor

Based on Application:

- Synchronous generator

- Synchronous motor

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of nearly 30% in the Excitation System Market. The region maintains its leadership due to high investments in grid modernization and advanced digital control technologies. The United States and Canada drive strong adoption of synchronous generators in both utility and industrial sectors. It benefits from large-scale renewable energy integration, particularly wind and hydro projects that require reliable voltage regulation. Market growth is also supported by government initiatives focused on improving energy security and reducing grid downtime. The presence of major suppliers and technology providers strengthens competition and ensures continuous innovation. North America is expected to maintain steady growth as industries replace aging systems with smart, automated excitation platforms that improve reliability and efficiency.

Europe

Europe accounts for nearly 25% of the Excitation System Market. The region places strong emphasis on sustainability, energy efficiency, and decarbonization policies, which directly drive demand for modern excitation systems. Countries such as Germany, France, and the United Kingdom invest heavily in renewable energy integration, making grid stability solutions a priority. It also faces the challenge of aging infrastructure, which creates opportunities for replacement and retrofit projects across power utilities. European industries demand reliable synchronous motors for heavy-duty applications in manufacturing, oil and gas, and chemicals. Regional suppliers focus on compact and modular designs that support stricter regulatory requirements and improve energy performance. Growth remains steady as Europe balances renewable expansion with modernization of conventional power plants.

Asia Pacific

Asia Pacific holds the largest market share at nearly 36–40% of the Excitation System Market. China, India, and Japan dominate demand with extensive power generation projects and fast-paced industrialization. It benefits from large-scale investment in renewable energy, especially solar, hydro, and wind projects that need advanced excitation systems for voltage stability. Urbanization and infrastructure development across emerging economies further fuel adoption in both utilities and industries. Governments in the region prioritize electrification and grid upgrades to meet rising power demand. Market participants introduce cost-effective and high-performance solutions tailored for large-capacity projects. Asia Pacific stands out as the fastest-growing region due to rapid modernization and strong government support for clean energy expansion.

Latin America

Latin America represents nearly 5–7% of the Excitation System Market. The region shows gradual adoption driven by infrastructure expansion in Brazil, Mexico, and Argentina. It supports mining, oil, and manufacturing industries that rely on stable synchronous motors and generators. Growth opportunities arise from renewable energy projects, especially hydropower, which plays a key role in Latin America’s energy mix. It also benefits from international investments aimed at strengthening power distribution networks and reducing blackouts. Despite financial constraints in some countries, utilities invest in compact and efficient excitation systems that minimize operational costs. The region is expected to show steady progress as governments focus on improving energy access and system reliability.

Middle East & Africa

The Middle East & Africa account for nearly 5% of the Excitation System Market. The region expands steadily due to large-scale investments in power generation and infrastructure development. Gulf countries such as Saudi Arabia and the UAE focus on megaprojects and renewable energy adoption, while African nations prioritize electrification to meet rising population demand. It benefits from growth in both conventional thermal power plants and solar projects. Demand comes from utilities upgrading grids as well as industries such as oil, gas, and mining. Market players partner with local governments to provide reliable systems adapted to challenging operating environments. The region presents strong long-term opportunities as electrification and diversification projects accelerate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Electric

- Basler Electric

- ANDRITZ GROUP

- JEUMONT Electric

- Goltens

- General Electric

- F&S Prozessautomation

- ABB

- KinetSync (Kinetics Industries, Inc.)

- Emerson

Competitive Analysis

The Excitation System Market include Mitsubishi Electric, Basler Electric, ANDRITZ GROUP, JEUMONT Electric, Goltens, General Electric, F&S Prozessautomation, ABB, KinetSync (Kinetics Industries, Inc.), and Emerson. The Excitation System Market is highly competitive, driven by innovation, advanced digital technologies, and strong service capabilities. Companies focus on developing systems that enhance grid reliability, improve efficiency, and support renewable energy integration. Demand for modular and compact solutions continues to grow, as utilities and industries prioritize flexible installations and reduced lifecycle costs. Market participants invest in digital monitoring, automation, and predictive maintenance to meet rising expectations for operational stability. Competition is also shaped by regional expansion strategies, partnerships with power utilities, and strong after-sales service networks. The landscape reflects a clear emphasis on sustainability, energy efficiency, and long-term system reliability.

Recent Developments

- In March 2025, Tokyo Gas Engineering Solutions (TGES) received the 100 MW Sodegaura power plant in Japan, which operates on ten Wartsila 34SG engines. Wartsila’s flexibility with grid balancing aids Japan in optimizing renewable energy use. The plant was constructed by TGES for the parent company, Tokyo Gas, who fully owns and operates the facility.

- In June 2024, ABB designed OPTIMAX 6.4, software solution that is a key component of their new digital energy infrastructure, The Enhancement Systems, which mainly focuses on endorsing energy efficiency and to accelerate decarbonization. Along with that, the company endorsed their energy platform with cutting edge technology in modular mode.

- In April 2024, WEG launched the W23 Sync+Ultra, achieving IE6 efficiency with 20% lower losses than the previous IE5 standard. This industrial motor sets new performance benchmarks in the synchronous motor market.

- In January 2023, Ansaldo Energia, in partnership with Terna, transported a synchronous condenser and transformer to the Codrongianos electrical station in Sassari province, utilizing both sea and land routes. The synchronous condenser, a specialized type of electric generator, will be connected to Terna’s transmission grid to facilitate reactive energy exchange and enhance short-circuit power.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing investments in renewable energy integration.

- Demand will rise for digital and automated excitation systems in utilities and industries.

- Grid modernization projects will create steady opportunities across developed and emerging regions.

- Compact and modular designs will gain wider acceptance for easier installation and upgrades.

- Adoption will increase in synchronous motors used in heavy industrial applications.

- Advanced monitoring and predictive maintenance features will drive technology upgrades.

- Strong focus on energy efficiency will encourage development of high-performance systems.

- Emerging economies will accelerate adoption through infrastructure and electrification projects.

- Cybersecurity integration will become a priority in digital excitation platforms.

- Partnerships and regional expansions will strengthen competition among global suppliers.