Market Overview

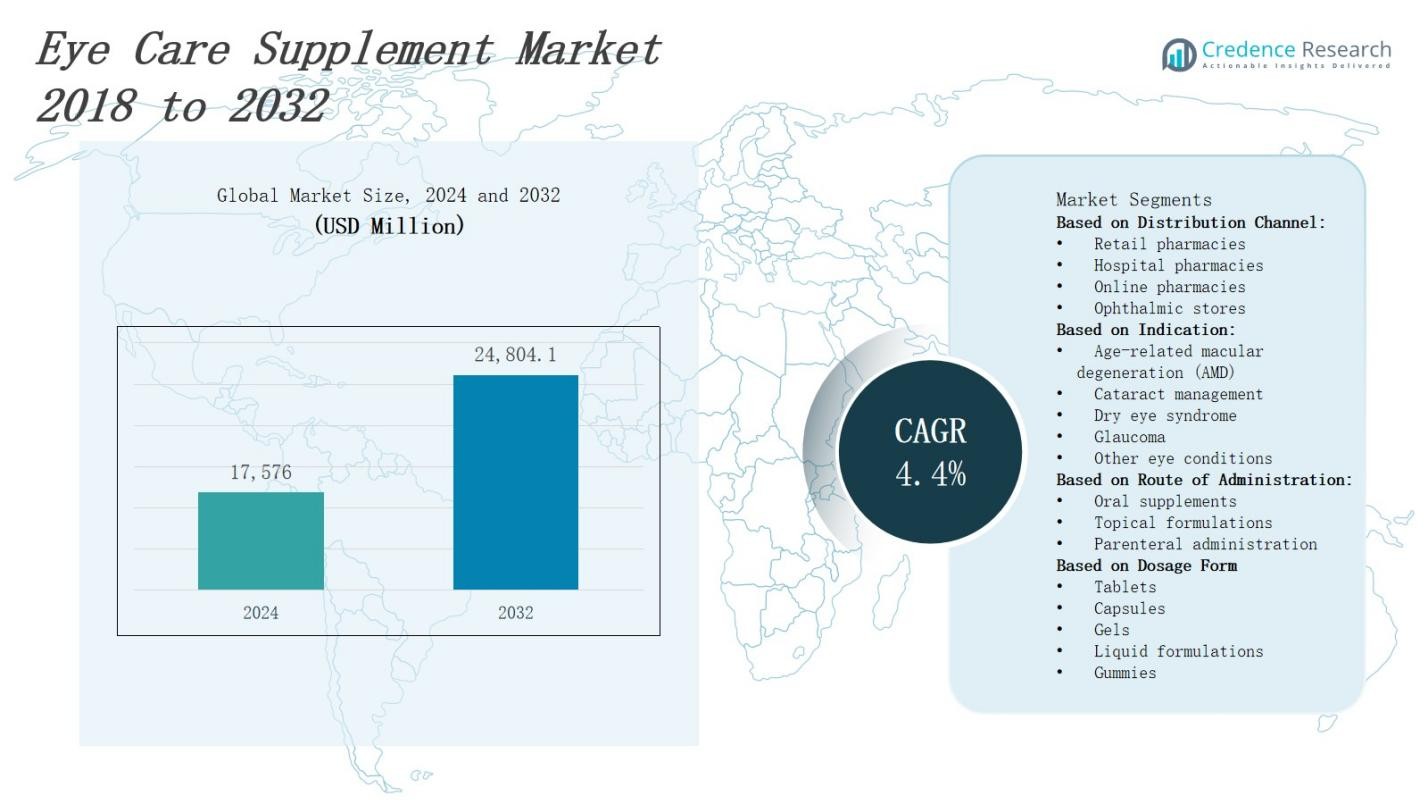

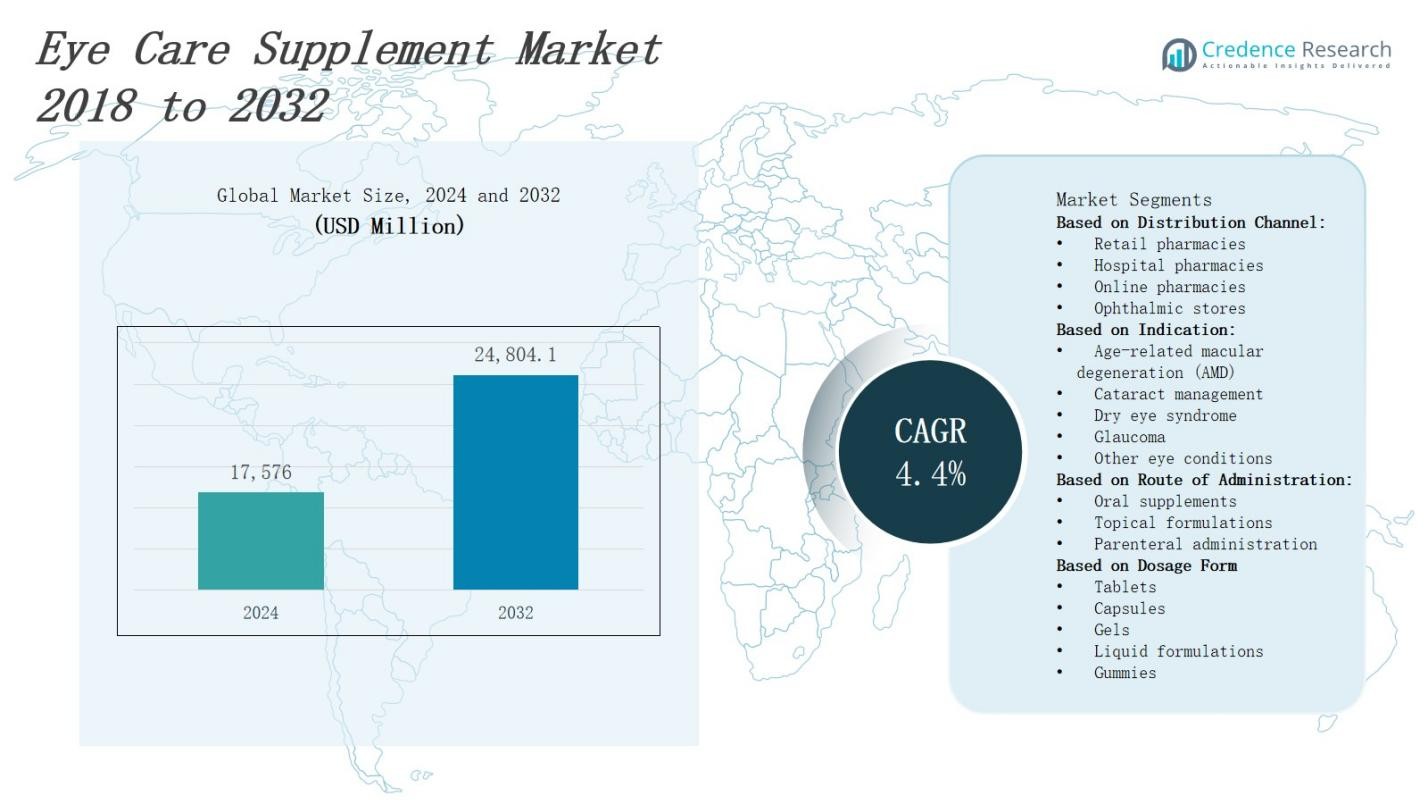

The eye care supplement market is expected to grow from USD 17,576 million in 2024 to USD 24,804.1 million by 2032, at a compound annual growth rate of 4.4%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Eye Care Supplement Market Size 2024 |

USD 17,576 Million |

| Eye Care Supplement Market, CAGR |

4.4% |

| Eye Care Supplement Market Size 2032 |

USD 24,804.1 Million |

Rapid growth in the global eye care supplement market stems from aging populations, rising prevalence of ocular disorders and escalating digital screen exposure. Consumers prioritize preventative healthcare and seek formulations enriched with lutein, zeaxanthin and omega‑3 fatty acids to support visual function. Manufacturers innovate by incorporating novel delivery systems, personalized blends and clean-label ingredients. Widespread e‑commerce adoption and expanded retail presence improve accessibility. Regulatory frameworks for nutraceutical safety strengthen consumer confidence. Marketing collaborations with healthcare professionals drive credibility. Clinical trials validate efficacy, and sustainability initiatives with transparent sourcing appeal to environmentally conscious buyers. These factors collectively sustain robust market momentum.

North America leads with strong healthcare infrastructure, driven by Bausch & Lomb and Pfizer. Europe holds significant share under strict nutraceutical regulations, where Novartis and Vitabiotics excel. Asia‑Pacific records rapid growth from rising incomes and digital health adoption, featuring Amway, The Nature’s Bounty Co. Latin America shows steady uptake via expanding pharmacy networks and pricing from NutraChamps and ZeaVision. Middle East & Africa posts gradual gains through wellness campaigns and partnerships with Kemin Industries and EyeScience Labs. It underscores regional diversity and dynamics in the eye care supplement market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The eye care supplement market will expand from USD 17,576 million in 2024 to USD 24,804.1 million by 2032 at a 4.4% CAGR.

- Aging populations and rising rates of macular degeneration, cataracts and dry eye drive demand for lutein‑, zeaxanthin‑ and omega‑3‑enriched formulas.

- Consumers embrace preventative wellness and seek personalized blends, clean‑label ingredients and novel sustained‑release delivery systems.

- E‑commerce subscriptions and expanded retail presence boost accessibility and encourage repeat purchases.

- Stricter nutraceutical safety regulations and third‑party audits reinforce product credibility and label accuracy.

- Collaborative campaigns with healthcare professionals and ophthalmology clinics increase patient recommendations.

- Clinical trials validating efficacy and transparent, sustainable sourcing strengthen consumer trust and support market momentum.

Market Drivers

Aging Demographics and Rising Ocular Disorders

The eye care supplement market gains momentum from global ageing cohorts facing vision impairments. Seniors confront risks of macular degeneration, cataracts and dry eye syndrome, driving demand for targeted nutrients. Extended screen exposure among younger consumers elevates oxidative stress and spurs supplementation. Healthcare professionals recommend lutein and zeaxanthin to preserve retinal function. Public awareness campaigns highlight vision benefits and boost uptake. Research firms project sustained annual demand growth through 2032.

- For instance, Novartis’ Beovu (brolucizumab) has become an approved treatment for wet age-related macular degeneration (AMD), with real-world data showing 50% of patients still experience unresolved retinal fluid and a third require monthly injections despite modern therapies.

Preventive Healthcare and Nutraceutical Adoption

The eye care supplement market benefits from consumer focus on preventive wellness and growing acceptance of nutraceuticals. Patients seek formulations enriched with omega‑3 fatty acids, lutein and zeaxanthin to maintain ocular health. Brands develop innovative personalized blends and advanced delivery systems to enhance bioavailability. Clinical studies validate product efficacy and encourage physician recommendations. Clean‑label ingredients and transparent sourcing strengthen consumer trust. Marketing collaborations with optometrists drive product credibility and sales.

- For instance, in May 2024, HealthyCell released Eye Health MicroGel, an ultra-absorbable supplement featuring lutein, zeaxanthin, astaxanthin, lycopene, vitamin A, and vitamin E, aiming to improve vision and provide comprehensive antioxidant protection for ocular health.

E‑Commerce Expansion and Retail Accessibility

The eye care supplement market leverages digital platforms and expanded retail networks to reach diverse consumer segments. E‑commerce channels deliver convenient purchase experiences and subscription models that foster brand loyalty. Brick‑and‑mortar pharmacies and specialty stores integrate educational displays to inform buyers. Strategic alliances with healthcare clinics and wellness centers drive professional endorsements. Multilingual marketing campaigns enhance regional penetration. Direct‑to‑consumer communications streamline product launches and promotions. These distribution efforts sustain growth.

Regulatory Compliance and Sustainability Initiatives

The eye care supplement market gains credibility from stringent regulatory oversight and comprehensive industry-wide quality standards. Approval processes and compliance requirements ensure product safety and label accuracy. Manufacturers adopt Good Manufacturing Practices and conduct third‑party audits to uphold regulatory expectations. Clinical trials and peer‑reviewed research establish efficacy claims and support marketing approvals. Investor backing for green initiatives increases capital for product innovation. Independent certifications reassure consumers and foster brand loyalty.

Market Trends

Advanced Formulations and Personalized Nutrition Drive Innovation

Manufacturers develop nutrient combinations and personalized formulas to address diverse vision needs. It leverages technologies for sustained release and targeted delivery that improve absorption. Consumer demand drives trial of botanical extracts with carotenoids. Brands highlight efficacy through dosage customization on age and activity factors. Research institutes publish comparative studies that inform product improvements. Regulatory audits ensure consistent quality. This innovation push strengthens consumer engagement in the eye care supplement market.

- For instance, Tears again® is a commercially available spray using phospholipid liposome technology to relieve dry eye symptoms, which has shown significantly improved results over traditional isotonic saline solutions.

Expansion of Digital Health Platforms and Distribution Networks

Digital platforms streamline product discovery and purchase with personalized recommendations. It supports subscription services that boost repeat sales and drive brand loyalty. Telehealth consultations integrate supplement recommendations into patient care plans. Retail pharmacies adopt interactive kiosks to educate consumers. Direct‑to‑consumer websites offer transparent ingredient details and user reviews. Social media influencers collaborate with clinicians to increase market visibility. These channel innovations accelerate growth in the global eye care supplement market.

- For instance, Boots UK deployed interactive kiosks equipped with digital touch screens in over 400 retail stores, enabling consumers to access detailed product information and ingredient transparency at the point of sale.

Surge in Clinical Validation and Professional Endorsements

Peer‑reviewed trials confirm benefits of carotenoid and omega‑3 formulations for retinal health. It prompts healthcare providers to recommend supplements during routine eye exams. Scientific conferences highlight emerging data on dose‑response relationships. Pharma companies sponsor multicenter studies to support label claims. Professional associations publish guidelines endorsing nutrient‑based interventions. Patient advocacy groups host webinars that raise supplement awareness. These evidence‑driven efforts reinforce credibility and boost acceptance of the eye care supplement market.

Emphasis on Sustainability and Transparent Sourcing

Consumers demand sustainable practices and traceable ingredient origins. It drives brands to partner with certified farms and ethical suppliers. Packaging innovations reduce plastic use and support circular models. Third‑party audits verify purity and ecological impact. Marketing materials showcase fair‑trade certifications and environmental goals. Brands report carbon footprints to demonstrate accountability and invest in renewable energy. Strong sustainability emphasis differentiates products and enhances global trust in the eye care supplement market.

Market Challenges Analysis

Rising Regulatory Scrutiny and Complex Compliance Requirements

Regulators tighten safety standards for dietary products and enforce strict labeling guidelines for the eye care supplement market. Companies must secure approvals and update documentation to meet evolving policies. It demands regular audits and penalty risk for noncompliance. Smaller firms struggle with resource allocation for testing and certification. Frequent policy updates disrupt product development timelines. Quality control teams ensure batch consistency under rigorous inspection protocols. International variations in regulations complicate global distribution strategies.

Intense Competition and Price Sensitivity Pressure

Major nutraceutical brands invest heavily in marketing and product differentiation to capture share in the eye care supplement market, increasing barriers for new entrants. It drives retailers to demand volume discounts and promotional support. Many consumers compare prices online before purchasing, which erodes profit margins. Private label offerings add pressure on established brands to justify premium pricing. Innovation cycles accelerate due to competitive dynamics and shorten product life spans. Strategic partnerships and loyalty programs aim to retain customers amid price war

Market Opportunities

Collaboration with Eye Care Professionals Expands Distribution Channels

Healthcare networks partner with supplement manufacturers to incorporate recommendations into patient treatment plans. It enables product placement in clinics. Telehealth platforms integrate supplement guidance into virtual consultations with optometrists. Companies establish educational seminars for ophthalmologists to promote evidence-based products. Corporate wellness programs include vision-support supplements. Subscription services enable automated replenishment. This collaborative approach strengthens credibility and drives adoption in the eye care supplement market.

Penetration of Emerging Economies and Niche Demographics Offers Growth Potential

Manufacturers target regions with growing disposable incomes and rising health awareness. It addresses unmet needs among aging populations in Asia‑Pacific and Latin America. Specialized formulas for diabetic retinopathy and digital eye strain attract new customer segments. Customizable bundles attract enthusiasts concerned about eye fatigue. Data analytics deliver insights for tailored marketing campaigns. This geographic and demographic expansion fuels long‑term growth opportunities in the eye care supplement market.

Market Segmentation Analysis:

By Distribution Channel

Retail pharmacies hold leading share due to wide consumer reach. Hospital pharmacies support prescriptions for medical indications. Online pharmacies drive convenience and subscription models. Ophthalmic stores attract specialist customers who favor tailored solutions. It strengthens brand visibility across channels. These outlets sustain supply consistency and rapid restock for the eye care supplement market.

- For instance, Bausch & Lomb’s products are widely available in retail pharmacies, ensuring steady supply and quick restocking to meet consumer demand.

By Indication

Age-related macular degeneration drives demand for lutein-rich formulas. Cataract management relies on antioxidant blends to support lens health. Dry eye syndrome prompts selection of omega‑3 and hyaluronic acid. Glaucoma patients seek supplements that protect optic nerves. Other eye conditions include diabetic retinopathy and vision fatigue. It ensures targeted solutions and fuels growth in the eye care supplement market.

By Route of Administration

Oral supplements provide systemic nutrient delivery. Topical formulations offer direct support to the ocular surface. Parenteral administration serves severe deficiency cases under medical supervision. It enhances bioavailability for critical care scenarios. These routes diversify product portfolios and satisfy clinical requirements. They underpin robust development strategies within the eye care supplement market.

- For instance, oral vitamin B12 supplements combined with artificial tears have been clinically shown to improve symptoms of dry eye syndrome by repairing corneal nerve layers and reducing eye discomfort.

Segments:

Based on Distribution Channel:

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

- Ophthalmic stores

Based on Indication:

- Age-related macular degeneration (AMD)

- Cataract management

- Dry eye syndrome

- Glaucoma

- Other eye conditions

Based on Route of Administration:

- Oral supplements

- Topical formulations

- Parenteral administration

Based on Dosage Form

- Tablets

- Capsules

- Gels

- Liquid formulations

- Gummies

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 35% share, Europe holds 25% share, Asia‑Pacific holds 30% share, Latin America holds 6% share and Middle East & Africa holds 4% share. The United States leads demand through high healthcare expenditure and widespread preventative care adoption. It benefits from strong partnerships between supplement brands and ophthalmology clinics. Retail pharmacies and online channels offer extensive product variety. Physician endorsements reinforce consumer trust. Market players invest in local clinical studies to support efficacy claims. This robust infrastructure sustains leadership in the eye care supplement market.

Europe

North America holds 35% share, Europe holds 25% share, Asia‑Pacific holds 30% share, Latin America holds 6% share and Middle East & Africa holds 4% share. Germany and the United Kingdom drive regional growth with well‑established nutraceutical regulations. It leverages public health campaigns that highlight vision preservation. Pharmacies and health stores feature targeted formulations for age‑related eye disorders. Brands emphasize clean‑label ingredients to comply with stringent EU standards. Cross‑border e‑commerce facilitates wider reach. This regulatory clarity and consumer awareness underpin expansion in the eye care supplement market.

Asia‑Pacific

North America holds 35% share, Europe holds 25% share, Asia‑Pacific holds 30% share, Latin America holds 6% share and Middle East & Africa holds 4% share. China and India record rapid uptake thanks to growing disposable incomes and rising urbanization. It capitalizes on digital health platforms that deliver localized supplement recommendations. Retail chains expand into tier‑2 cities to capture emerging demand. Local manufacturers develop formulas with region‑specific botanical extracts. Government initiatives support preventive healthcare and nutraceutical research. This dynamic environment drives notable gains in the eye care supplement market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZeaVision LLC

- Pfizer Inc

- NutraChamps

- The Nature’s Bounty Co.

- EyeScience Labs, LLC

- Vitabiotics Ltd

- Bausch & Lomb Incorporated

- Kemin Industries, Inc.

- Amway Corporation

- Novartis International AG

Competitive Analysis

The eye care supplement market features intense rivalry among established multinationals and agile niche players. Bausch & Lomb leverages decades of ophthalmic expertise and wide distribution through eye care clinics and pharmacies. Vitabiotics and The Nature’s Bounty Co. emphasize clean‑label credentials and target wellness‑oriented consumers. Novartis and Pfizer integrate clinical research and physician outreach to validate efficacy claims. Amway deploys direct‑selling networks and subscription models to foster customer loyalty. ZeaVision and EyeScience Labs differentiate through specialized formulations addressing digital eye strain. Kemin Industries supplies proprietary carotenoid ingredients to brand owners, enhancing formulation quality. NutraChamps competes on price with streamlined online channels. It pressures incumbents to refine value propositions and optimize supply chains. Strategic partnerships between supplement manufacturers and healthcare providers amplify market reach. Continuous product innovation, combined with targeted marketing and robust quality assurances, defines the competitive landscape and drives companies to secure leading positions.

Recent Developments

- In 2024, Bausch + Lomb launched Blink NutriTears, a clinically proven daily nutritional supplement for dry eye relief.

- In May 2024, HealthyCell launched Eye Health MicroGel, an ultra‑absorbable supplement formulated with lutein, zeaxanthin, astaxanthin, lycopene, vitamins A and E to support vision.

- In January 2024, Cepham introduced Luteye, a novel eye‑health formula combining lutein, zeaxanthin and oleocanthal‑enriched extra virgin olive oil for aging vision support.

- On October 17, 2024, SCOPE Health Inc. acquired EYETAMINS, a company specializing in innovative eye health supplements developed by Dr. Kaushal Kulkarni, a neuro-ophthalmologist.

Market Concentration & Characteristics

The eye care supplement market displays moderate concentration with top five companies controlling a significant share. It features leading players such as Bausch & Lomb, Pfizer, Novartis and Vitabiotics that leverage clinical credibility and extensive distribution networks. Mid‑size firms compete through product differentiation, emphasizing clean‑label credentials and novel delivery systems. Private labels from retail chains intensify price competition while subscription models foster customer loyalty. Regulatory barriers and high R&D costs restrict new entrants and maintain stability. Price sensitivity varies by region, prompting tiered offerings that range from premium physician‑recommended formulas to mass‑market blends. Consolidation trends and strategic partnerships reflect companies’ efforts to expand portfolios and access emerging channels. Quality certifications and clinical trial data serve as key decision factors for consumers. This structure ensures that innovation and brand strength define competitive advantage in this sector.

Report Coverage

The research report offers an in-depth analysis based on Distribution Channel, Indication, Route of Administration, Dosage Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will launch data-driven personalized nutrient blends based on genetic, individual, clinical, and lifestyle insights.

- Optometrist partnerships will strengthen professional endorsement of eye care supplements within trusted clinical practice settings.

- Direct-to-consumer subscription platforms will optimize adherence and ensure personalized eye health support with timely delivery.

- Transparent sourcing and sustainability commitments will differentiate brands in competitive global eye care supplement landscape.

- Integration with digital health applications will enable personalized dosing recommendations and secure remote adherence monitoring.

- Emerging botanical extracts backed by clinical trials will expand treatment options for diverse ocular conditions.

- Expansion into emerging markets will cater to ageing demographics with tailored educational and marketing initiatives.

- Collaboration between supplement manufacturers and ophthalmology clinics will rapidly amplify patient education and product uptake.

- Regulatory harmonization will streamline approvals, shorten review cycles and accelerate cross-border distribution of eye supplements.

- Strategic mergers and acquisitions will drive portfolio diversification and strengthen supply chain resilience across regions.