Market Overview

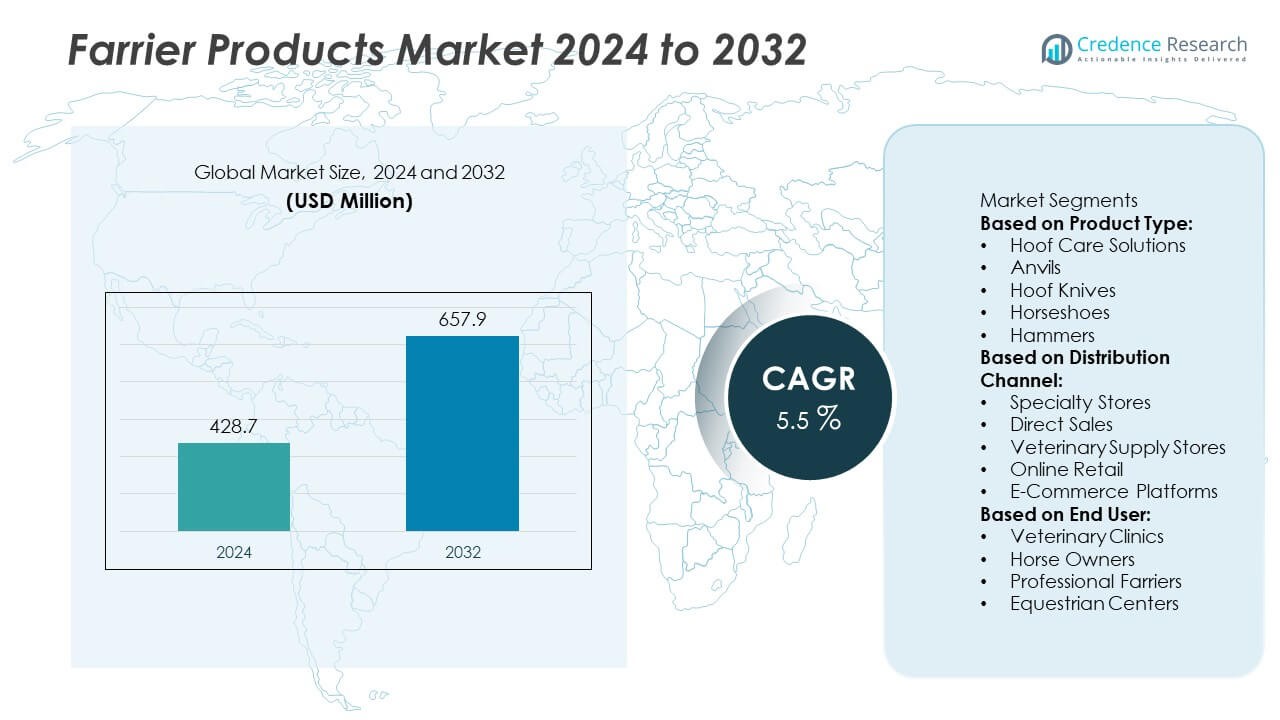

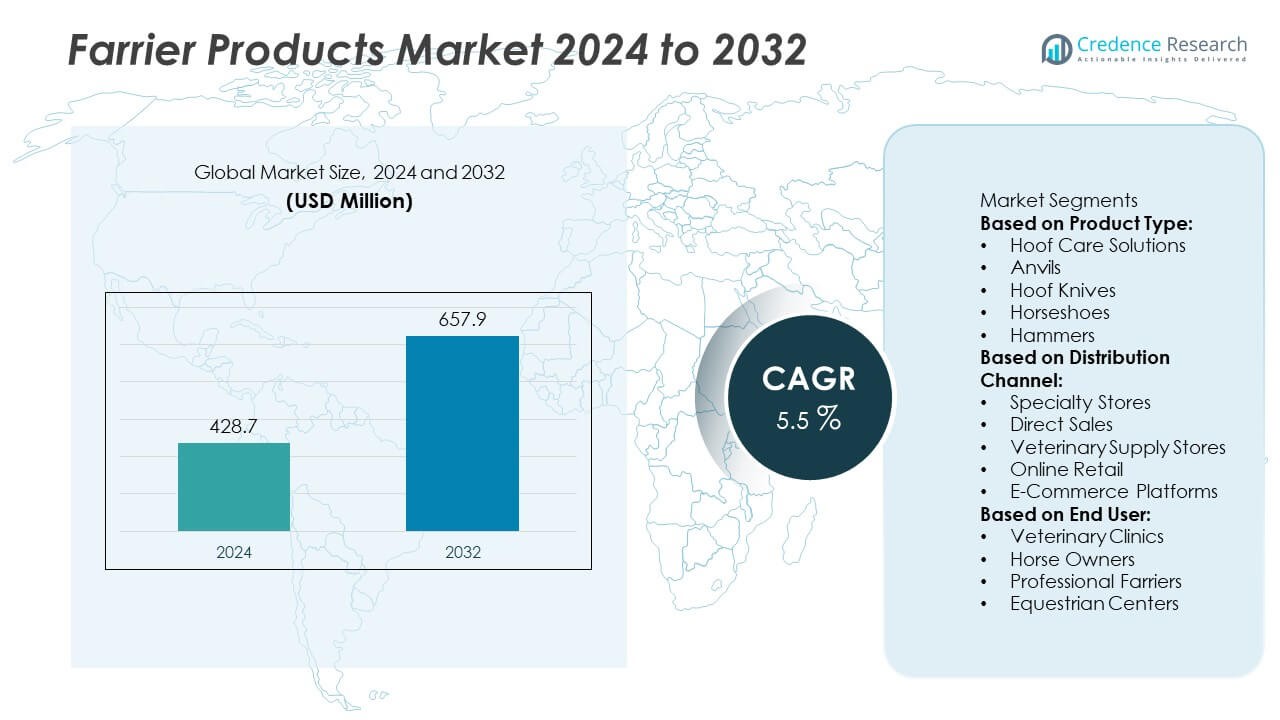

The Farrier Products Market was valued at USD 428.7 million in 2024 and is projected to reach USD 657.9 million by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Farrier Products Market Size 2024 |

USD 428.7 Million |

| Farrier Products Market, CAGR |

5.5% |

| Farrier Products Market Size 2032 |

USD 657.9 Million |

The Farrier Products Market grows through rising equine ownership, expanding sports and recreational riding, and increasing focus on hoof health and performance. Demand strengthens with advanced hoof care solutions, lightweight horseshoes, and ergonomic tools that enhance efficiency for farriers and veterinarians.

The Farrier Products Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region contributing uniquely to industry growth. North America maintains leadership supported by a well-established equestrian culture, high horse ownership, and strong veterinary infrastructure. Europe follows with rising investments in equestrian sports and advanced hoof care practices. Asia-Pacific emerges as a fast-growing market, driven by increasing horse ownership in emerging economies and expanding equestrian tourism. Latin America and the Middle East & Africa show steady development, supported by traditional horse-riding cultures and government-backed equestrian initiatives. Key players such as Diamond Farrier Co., SoundHorse Technologies, GE Forge & Tool, and Vettec, Inc. actively expand their product portfolios with innovative farrier solutions, focusing on durability, precision, and advanced materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Farrier Products Market was valued at USD 428.7 million in 2024 and is projected to reach USD 657.9 million by 2032, expanding at a CAGR of 5.5% during the forecast period.

- Market growth is driven by rising demand for professional hoof care and increasing awareness among horse owners regarding the importance of preventive care, fueling consistent product adoption across multiple end-user categories.

- Technological advancements influence market trends, with companies introducing lightweight horseshoes, adhesive-based solutions, and ergonomic farrier tools to improve efficiency, durability, and horse performance in both recreational and professional equestrian settings.

- Competitive intensity remains high as leading players such as Diamond Farrier Co., GE Forge & Tool, SoundHorse Technologies, and Vettec, Inc. expand their product portfolios, adopt advanced manufacturing techniques, and strengthen global distribution networks.

- Market restraints include high product costs, limited availability of skilled farriers in certain regions, and dependency on traditional practices that delay the adoption of modern farrier solutions.

- Regional analysis highlights North America as a dominant market supported by established equestrian infrastructure, while Europe shows strong growth linked to sporting events, and Asia-Pacific emerges as the fastest-growing region due to rising horse ownership and expanding equestrian tourism.

- The industry outlook reflects a balance of innovation and tradition, where established players and new entrants focus on sustainable materials, improved farrier training support, and tailored solutions that align with evolving equestrian and veterinary care practices.

Market Drivers

Rising Demand for Professional Hoof Care and Equine Health

The Farrier Products Market grows through increasing focus on equine health and professional hoof care. Horse owners and veterinarians emphasize preventive measures to avoid lameness, infections, and performance decline. It benefits from growing awareness campaigns by veterinary associations that highlight the role of hoof balance in overall equine wellness. Demand for specialized farrier tools, therapeutic horseshoes, and hoof care products is expanding across both domestic and commercial equine sectors. Rising horse populations in sports, leisure, and agricultural applications also strengthen product adoption. The push for routine farrier services ensures consistent demand across global markets.

- For instance, Vettec, Inc. reported that its Equi-Pak CS adhesive, designed to seal out moisture and treat mild thrush, was used in more than 120,000 hoof procedures in 2024.

Expansion of Equine Sports and Competitive Riding Activities

Rising participation in equine sports drives higher consumption of farrier products globally. Competitive racing, dressage, polo, and show jumping require advanced hoof care solutions that optimize performance and reduce injury risks. It enables farriers to use lightweight alloys, shock-absorbing horseshoes, and customized corrective solutions for athletic horses. Sponsorships and investments in equestrian tournaments fuel spending on hoof protection and maintenance. Countries with strong equestrian traditions, including the United States, UK, Germany, and UAE, invest heavily in farrier innovations. The connection between equine performance and hoof health reinforces steady growth in farrier-related products and services.

- For instance, Polyflex Horseshoes developed direct glue-on polyurethane horseshoes that mimic hoof composition and act as a flexible, shock-absorbing barrier; their shoes support natural hoof mechanisms and allow custom fitting through their encapsulated wire and wear plate technology.

Technological Advancements in Hoof Care Solutions

Innovation in farrier tools and products is reshaping the market landscape. Advanced horseshoes made of composite materials or 3D-printed designs enhance durability, comfort, and adaptability. It allows farriers to address complex hoof conditions with greater precision and efficiency. Adhesive and therapeutic hoof care products continue to gain traction in veterinary practices. Leading companies invest in research and development to expand portfolios with environmentally friendly and biomechanically superior solutions. Integration of digital tools, such as hoof scanners and pressure analysis devices, strengthens farrier decision-making. The availability of modern solutions encourages broader adoption across traditional and advanced equine markets.

Rising Veterinary Services and Equine Care Investments

The global equine healthcare ecosystem continues to expand, directly benefiting farrier product adoption. Rising veterinary clinics and mobile farrier services improve accessibility in both urban and rural areas. It helps horse owners maintain regular hoof care routines supported by professional expertise. Growing disposable income among equine enthusiasts drives higher spending on advanced farrier services and specialized products. Government initiatives in livestock and animal welfare also strengthen awareness of hoof health. Integration of farrier care within veterinary services ensures long-term adoption of innovative and preventive hoof care products.

Market Trends

Growing Adoption of Advanced Horseshoe Materials

The Farrier Products Market reflects a clear trend toward innovative horseshoe materials that improve equine performance and comfort. Lightweight aluminum and composite shoes gain traction in sports and racing applications, while shock-absorbing designs reduce stress on joints. It enables farriers to meet specific requirements for performance horses and leisure animals alike. The rise of 3D-printed horseshoes creates opportunities for personalized solutions tailored to unique hoof structures. Such innovations support both corrective and preventive care. The growing emphasis on material science underscores the sector’s shift toward customization and durability.

- For instance, SoundHorse Technologies introduced its Sigafoos Series horseshoes with Kevlar® fabric cuffs and urethane adhesives, which can withstand over 1,000 pounds of direct pull strength per shoe during testing, extending durability in competitive equine events.

Increasing Popularity of Therapeutic and Corrective Solutions

Therapeutic farrier products continue to expand across veterinary and equestrian communities. Corrective shoes designed for laminitis, tendon injuries, and conformational defects strengthen product demand. It enhances equine mobility and supports faster recovery from injuries. Adhesive shoes and flexible hoof care solutions also gain adoption in rehabilitation programs. Farriers integrate these products with advanced diagnostic tools to deliver targeted treatment plans. The trend highlights the growing role of farrier care in veterinary-led equine healthcare.

Rising Use of Digital and Smart Farrier Tools

Technology integration transforms traditional hoof care practices. Smart farrier tools, including digital hoof mapping and pressure analysis systems, gain traction in both training and clinical settings. It allows professionals to measure hoof balance and gait efficiency with higher accuracy. Mobile applications that track hoof care routines and service records improve communication between farriers, veterinarians, and horse owners. Advanced grinders, nippers, and forges designed for efficiency are also entering mainstream markets. This trend strengthens precision, transparency, and efficiency across farrier services.

Growing Emphasis on Sustainability in Farrier Products

Sustainable practices influence product development across the market. Companies explore recyclable composites, eco-friendly adhesives, and low-emission production processes for farrier tools and shoes. It aligns with global sustainability goals in both veterinary and equestrian industries. Customers show rising preference for products that reduce waste and environmental impact while maintaining quality. Brands integrate lifecycle management and sustainable sourcing into their portfolios. The trend reshapes competitive strategies and reflects a long-term shift toward environmentally responsible hoof care solutions.

Market Challenges Analysis

Shortage of Skilled Farriers and Training Limitations

The Farrier Products Market faces a challenge from the shortage of skilled professionals capable of handling advanced tools and specialized therapeutic products. The profession requires years of training, and limited educational institutions restrict the supply of qualified farriers. It reduces the adoption of technologically advanced products, particularly in emerging markets. Many horse owners in rural regions rely on untrained providers, leading to inconsistent hoof care and limited demand for premium solutions. The lack of structured apprenticeship programs in several regions further widens the skill gap. This challenge creates barriers to the widespread use of modern farrier innovations.

High Cost of Advanced Farrier Products and Tools

Premium farrier products such as therapeutic horseshoes, smart diagnostic tools, and custom composite shoes often carry high costs. It limits access for smaller stables, rural owners, and low-budget veterinary practices. Rising material prices for aluminum, composites, and adhesives add to overall product expense. The lack of price standardization across regions contributes to affordability issues, particularly in developing equestrian markets. High equipment costs for professional farriers, such as advanced forges and grinders, also discourage upgrades. This economic constraint slows the pace of adoption and creates a divide between premium users and budget-conscious segments.

Market Opportunities

Expansion of Therapeutic and Corrective Farriery

The Farrier Products Market presents strong opportunities in therapeutic and corrective hoof care. Growing awareness of equine health drives demand for specialized horseshoes, adhesives, and hoof repair materials. It supports veterinarians and farriers in addressing lameness, injuries, and structural imbalances more effectively. Advanced product categories such as composite shoes, orthopedic pads, and glue-on solutions are gaining traction. The increasing role of equine rehabilitation centers strengthens adoption of such specialized tools. This opportunity aligns with the rising focus on performance horses, racing, and competition segments that require advanced hoof care solutions.

Digitalization and Smart Farriery Tools

Technological integration creates new prospects for the Farrier Products Market, particularly in diagnostic and monitoring tools. Smart hoof wearables, pressure-sensing horseshoes, and digital gait analysis systems open pathways for data-driven hoof care. It allows farriers and horse owners to identify abnormalities and intervene early, improving long-term animal performance. Mobile applications that connect farriers with clients expand service access and improve scheduling efficiency. Vendors exploring these innovations are positioned to capture demand from professional equine sports and large-scale stables. This opportunity reflects the transition of farriery from traditional craftsmanship to technology-enabled services.

Market Segmentation Analysis:

By Product Type

The Farrier Products Market segments by product type into horseshoes, nails, rasps, hoof knives, anvils, hammers, hoof stands, and hoof care solutions. Horseshoes dominate due to their critical role in equine health and performance, with demand driven by both professional farriers and recreational horse owners. Nails and rasps remain essential consumables, creating steady recurring demand. Hoof knives and hammers are widely used tools that support daily farrier operations, while anvils and hoof stands are integral for workshops and mobile services. Hoof care solutions such as conditioners and antiseptics gain traction as horse owners increasingly emphasize preventive healthcare. The diversity of products ensures consistent market demand across professional and amateur segments.

- For instance, GE Forge & Tool manufactures over 15,000 farrier hammers annually, each tested to withstand impact forces above 2,500 psi, ensuring durability in intensive farrier use.

By Distribution Channel

Distribution segmentation includes online retail, e-commerce platforms, specialty stores, veterinary supply stores, and direct sales. Online channels lead growth due to rising digital adoption, offering accessibility and convenience for farriers and horse owners in rural and urban areas. E-commerce platforms expand product availability globally, while specialty stores provide expert advice and customized solutions. Veterinary supply stores strengthen their role as trusted providers of quality farrier essentials, especially in professional and clinical settings. Direct sales maintain importance for established brands seeking to build long-term customer relationships. The distribution structure reflects a balance between digital innovation and traditional networks, broadening access across diverse buyer groups.

- For instance, Anvil Brand sells its renowned horseshoe nails-used on Budweiser Clydesdales and Disney performance horses-through both specialty farrier stores and its own branded channel, ensuring consistent availability for both professional and recreational customers.

By End User

End user segmentation highlights professional farriers, veterinary clinics, equestrian centers, and horse owners. Professional farriers represent the largest share, given their reliance on a wide range of specialized tools and consumables to deliver services. Veterinary clinics increasingly adopt farrier products for integrated hoof care and corrective treatments. Equestrian centers drive steady demand as they maintain large horse populations, requiring regular shoeing and hoof care. Horse owners contribute to market expansion through personal care and recreational use, supported by the growing popularity of equestrian sports and leisure riding. The Farrier Products Market aligns with the needs of each end-user group, ensuring adaptability across professional and personal applications.

Segments:

Based on Product Type:

- Hoof Care Solutions

- Anvils

- Hoof Knives

- Horseshoes

- Hammers

Based on Distribution Channel:

- Specialty Stores

- Direct Sales

- Veterinary Supply Stores

- Online Retail

- E-Commerce Platforms

Based on End User:

- Veterinary Clinics

- Horse Owners

- Professional Farriers

- Equestrian Centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share of the Farrier Products Market at 35%, supported by its strong equestrian culture, professional farrier networks, and widespread horse ownership. The United States dominates regional demand with its well-established horse racing, rodeo, and recreational riding sectors. Canada contributes with a significant base of veterinary clinics and equestrian centers that require high-quality farrier tools. Rising interest in horse sports and recreational activities continues to sustain demand. The region also benefits from the presence of established farrier product manufacturers and distributors that strengthen supply chains. Innovation in hoof care solutions and advanced horseshoe designs further accelerates product adoption across both professional and leisure markets.

Europe

Europe holds a market share of 28%, driven by its long equestrian tradition and strong presence of professional farriers. Countries such as the United Kingdom, Germany, and France remain major contributors, supported by horse racing, show jumping, and breeding activities. The region emphasizes high-quality and durable products, with demand for specialized horseshoes and advanced hoof care solutions growing steadily. Strong veterinary networks and equestrian institutions fuel adoption across diverse end-users. The European market also reflects rising interest in eco-friendly materials and ergonomic farrier tools that reduce strain during work. Growth is reinforced by continuous training programs and associations that promote skilled farriery practices.

Asia-Pacific

Asia-Pacific captures a market share of 20%, with rapid growth fueled by increasing horse ownership in emerging economies and expanding equestrian sports. China, India, and Australia lead demand, with rising disposable incomes and government-backed equestrian development programs playing key roles. The market benefits from expanding online platforms that improve product accessibility across the region. Demand for affordable yet reliable products appeals strongly to horse owners and small-scale equestrian centers. Countries like Japan and South Korea show growing interest in premium farrier solutions for racing and competitive sports. The region’s expansion reflects both rising equine healthcare awareness and growing investment in leisure riding activities.

Latin America

Latin America represent of 10% the Farrier Products Market, with Brazil, Argentina, and Mexico leading regional adoption. The market is driven by the importance of horses in agricultural activities, sports, and cultural traditions such as rodeos and polo. Professional farriers maintain steady demand for consumables like nails and rasps, while horse owners increasingly purchase hoof care products for preventive maintenance. E-commerce channels expand product availability, particularly in rural areas where traditional retail access is limited. Growing veterinary infrastructure strengthens regional adoption of advanced hoof care solutions. Rising interest in equestrian tourism also contributes to higher demand for durable and cost-effective farrier products.

Middle East & Africa

The Middle East & Africa accounts for 7% of the market, supported by the cultural and historical significance of horses across the region. Countries like the UAE and Saudi Arabia drive adoption due to their strong investment in horse racing and breeding programs. Africa contributes primarily through agricultural applications and growing recreational riding communities. Demand is rising for farrier consumables such as nails and hoof care solutions, supported by expanding veterinary facilities. Imports from Europe and North America dominate supply, with growing opportunities for local manufacturing. The region’s equestrian heritage ensures a stable demand base, reinforced by increasing modernization of horse care practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DS Farrier Solutions

- Polyflex Horseshoes

- GE Forge & Tool

- Embee Corporation

- SoundHorse Technologies

- Anvil Brand, Inc.

- Diamond Farrier Co.

- NC Tool Co., Inc.

- Polyshoe Pty Ltd.

- Vettec, Inc.

Competitive Analysis

Competitive analysis of the Farrier Products Market highlights the dominance of Diamond Farrier Co., GE Forge & Tool, SoundHorse Technologies, Vettec, Inc., Anvil Brand, Inc., NC Tool Co., Inc., Polyflex Horseshoes, Embee Corporation, DS Farrier Solutions, and Polyshoe Pty Ltd. These companies strengthen their position through innovation, product reliability, and strategic distribution networks. Diamond Farrier Co. and GE Forge & Tool lead with precision-engineered farrier tools and durable horseshoes designed for professional use. Vettec, Inc. and SoundHorse Technologies advance therapeutic hoof care with adhesives and composite solutions that improve equine health outcomes. Polyflex Horseshoes and Polyshoe Pty Ltd. introduce polymer-based horseshoes that reduce weight and enhance performance for sport horses. NC Tool Co., Inc. and Anvil Brand, Inc. deliver trusted anvils, forging tools, and shoeing equipment that maintain strong adoption among farriers. Embee Corporation and DS Farrier Solutions expand regional access with versatile product portfolios, reinforcing a market driven by quality, customization, and technological progress.

Recent Developments

- In June 2025, Vettec released an updated version of its hoof care catalog featuring six new instant hoof pad materials—Equi‑Build, Equi‑Pak, Equi‑Pak|CS, Equi‑Pak|Soft, Sil‑Pak, and Sole‑Guard—designed to support heel and sole growth, eliminate thrush, protect against stone bruising, and improve overall hoof performance

- In April 2025, Vettec introduced the Sil‑Pak Soft hoof-packing product featuring a Shore hardness of 15.

- In February, 2025, Vettec launched Sil‑Pak Soft on, a skin-safe silicone hoof-packing material that becomes weight-bearing within two minutes. It targets cushioning and protection under pads while sealing voids effectively.

Market Concentration & Characteristics

The Farrier Products Market demonstrates moderate concentration, with a blend of established global players and specialized regional manufacturers shaping competition. It reflects a fragmented landscape where companies compete through innovation in product durability, ergonomics, and material performance. Leading firms strengthen their position by offering comprehensive product lines covering horseshoes, adhesives, anvils, rasps, and hoof care solutions, ensuring a one-stop approach for farriers and equestrian professionals. It shows a balance between traditional craftsmanship and advanced technologies, such as lightweight polymer horseshoes and adhesive bonding systems that enhance equine comfort and performance. Regional companies target niche demands with customized offerings, while larger players invest in distribution expansion and digital platforms to reach wider customer bases. It maintains strong ties with equestrian sports, veterinary clinics, and rural economies, where product quality and reliability directly impact animal welfare. The market emphasizes innovation, user convenience, and compliance with international quality standards, highlighting its resilient and adaptive characteristics.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced hoof care solutions will rise with increasing awareness of equine health.

- Adoption of lightweight and synthetic horseshoes will expand across performance horses.

- Digital platforms and e-commerce channels will strengthen product accessibility worldwide.

- Veterinary clinics will increase reliance on innovative adhesives and hoof repair products.

- Customization of farrier tools and equipment will gain traction among professional farriers.

- Global equestrian events will boost demand for high-performance farrier products.

- Sustainability and eco-friendly materials will influence product innovation.

- Training programs and farrier schools will support wider adoption of modern tools.

- Strategic partnerships between manufacturers and veterinary organizations will enhance market growth.

- Expansion into emerging equestrian markets will create new business opportunities.