Market Overview

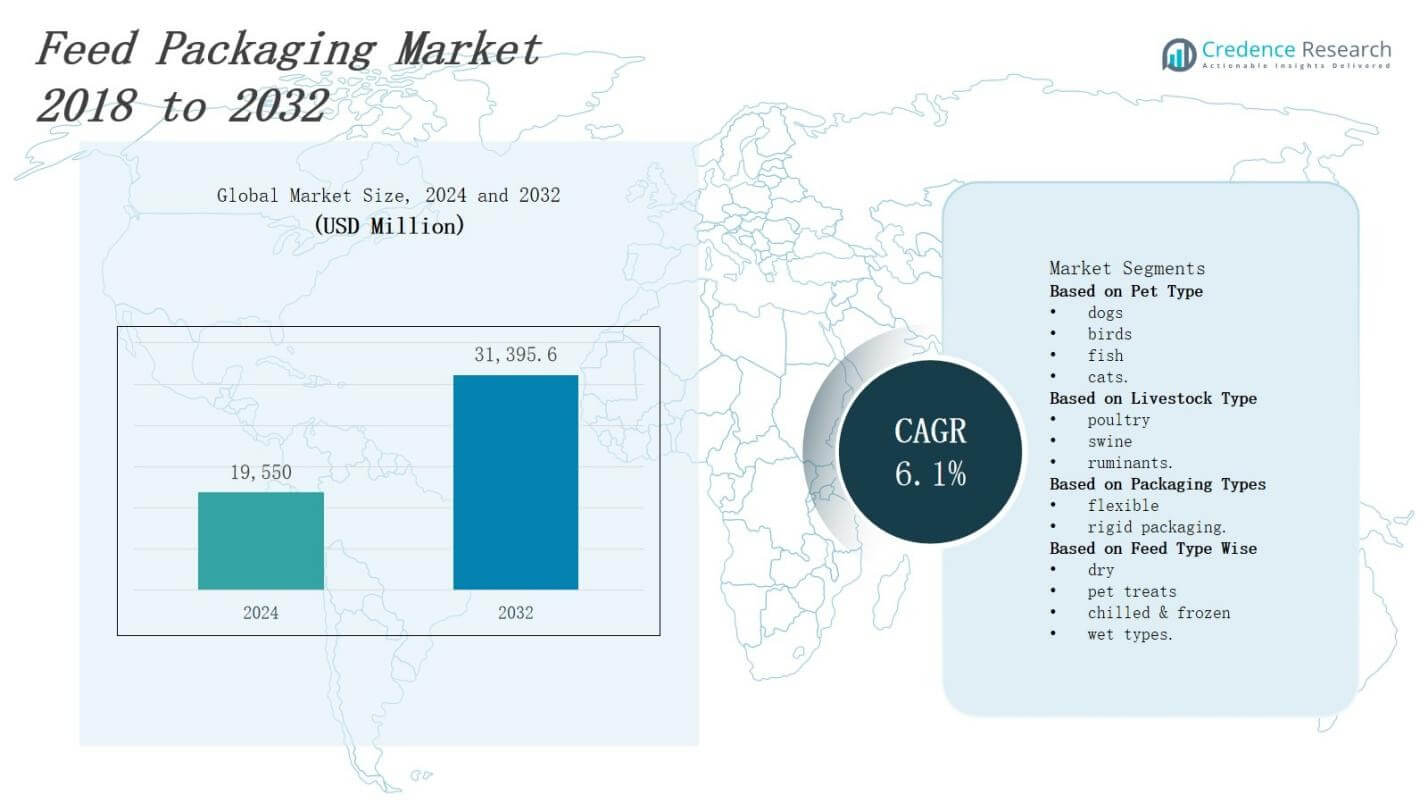

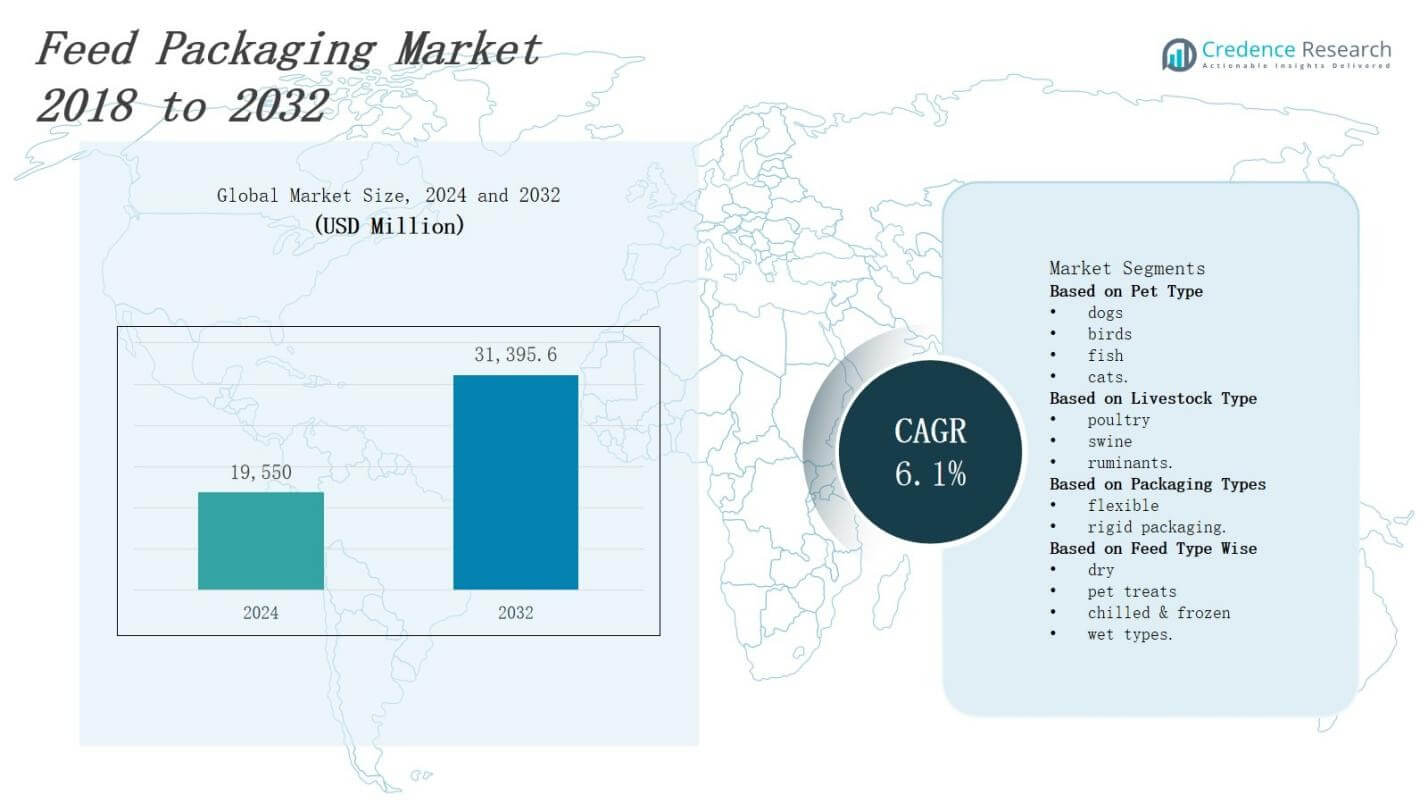

The feed packaging market is projected to grow from USD 19,550 million in 2024 to USD 31,395.6 million by 2032, registering a compound annual growth rate of 6.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Feed Packaging Market Size 2024 |

USD 19,550 Million |

| Feed Packaging Market, CAGR |

6.1% |

| Feed Packaging Market Size 2032 |

USD 31,395.6 Million |

The feed packaging market experiences strong growth driven by rising global demand for animal nutrition, increased livestock production, and expanding pet food industries. Manufacturers prioritize durable, moisture-resistant, and contamination-proof packaging to ensure product safety and shelf life. The shift toward eco-friendly and recyclable materials supports regulatory compliance and sustainability goals. Growth in e-commerce and bulk feed delivery accelerates adoption of flexible and lightweight packaging formats. Technological advancements in barrier films, vacuum sealing, and smart labeling enhance product traceability and quality control. Brands leverage digital printing for better branding and consumer engagement, aligning with evolving buyer preferences and supply chain optimization.

The feed packaging market spans North America, Europe, Asia Pacific, and the Rest of the World, including Latin America, the Middle East, and Africa. Asia Pacific leads with strong demand from livestock and pet sectors, followed by North America and Europe, driven by premiumization and sustainability regulations. The Rest of the World shows steady growth with rising feed production. Key players include Amcor Limited, Mondi Group, Sonoco Products Company, Winpak Ltd., NNZ Group, LC Packaging, NPP Group Limited, NYP Corp., El Dorado Packaging Inc., and Shenzhen Longma Industrial Co. Limited.

Market Insights

- The feed packaging market is projected to grow from USD 19,550 million in 2024 to USD 31,395.6 million by 2032, registering a CAGR of 6.1%.

- Rising global demand for livestock and pet nutrition drives the need for contamination-proof, durable packaging that ensures feed safety and shelf life.

- Manufacturers prioritize recyclable, lightweight packaging materials to comply with sustainability regulations and reduce environmental impact.

- Technological advancements in barrier films, vacuum sealing, and smart labeling enhance feed traceability, inventory control, and spoilage prevention.

- E-commerce growth and bulk feed delivery fuel demand for flexible packaging formats such as pouches and sacks that lower logistics costs.

- Volatile raw material prices and evolving environmental regulations challenge packaging manufacturers with cost pressures and compliance burdens.

- Asia Pacific leads with 34% market share, followed by North America (28%), Europe (25%), and the Rest of the World (13%), with key players including Amcor, Mondi, Sonoco, Winpak, NNZ Group, and others.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Demand for Livestock and Pet Nutrition Fuels Packaging Innovation

The feed packaging market grows with the increasing demand for livestock and pet nutrition across emerging and developed economies. Rising meat consumption, poultry farming, and aquaculture expansion require reliable packaging to preserve feed quality. Pet ownership trends contribute to high-quality feed production, driving demand for protective packaging formats. It ensures hygiene, shelf life, and transportation efficiency. Growing consumer awareness about animal health enhances the need for clean-label, contamination-free packaging.

- For instance, Mondi partnered with Saga Nutrition to launch recyclable mono-material packaging for dry pet food, replacing non-recyclable plastics and enhancing freshness while supporting a circular economy.

Shift Toward Sustainable Packaging Materials Strengthens Market Position

Sustainability goals and regulatory pressure drive the shift from traditional plastic to recyclable and biodegradable packaging materials. The feed packaging market benefits from growing investments in eco-friendly films and compostable solutions. It helps brands meet compliance standards while appealing to environmentally conscious buyers. Producers focus on reducing carbon footprints by adopting lightweight, recyclable formats. The trend supports circular economy objectives and aligns with brand reputation management across global markets.

- For instance, Dell replaced traditional plastic foam with mushroom-based packaging derived from mycelium. This packaging decomposes within 30 days, providing durable product protection while drastically cutting environmental impact.

Advancements in Barrier Technologies and Smart Features Enhance Product Safety

Manufacturers integrate advanced barrier films and smart technologies to maintain nutritional value and prevent spoilage. The feed packaging market adopts multi-layer laminates, vacuum sealing, and moisture-control features to enhance shelf stability. Smart labels and QR codes allow traceability, improving supply chain transparency. It enables better inventory management and quality assurance. Innovation in materials and sealing techniques ensures resilience during bulk transport and long-term storage.

E-commerce Expansion and Supply Chain Optimization Boost Flexible Formats

Rapid growth in online livestock feed distribution and pet food sales drives demand for efficient, flexible packaging. The feed packaging market shifts toward pouches, sacks, and bulk bags with enhanced handling convenience. It enables cost savings in storage, logistics, and shelf display. Manufacturers optimize packaging design to support automation and reduce labor costs. These formats support brand differentiation and meet evolving customer service expectations in both B2B and B2C channels.

Market Trends

Adoption of Flexible and Lightweight Packaging Formats Across Livestock Feed Industry

The feed packaging market shows a strong shift toward flexible packaging formats such as woven polypropylene bags, multiwall paper sacks, and polyethylene pouches. These options offer cost efficiency, easier handling, and reduced transportation weight. It helps improve stacking and storage while reducing damage during transit. Livestock and aquaculture sectors adopt these formats for bulk and retail applications. Brands invest in tamper-evident and resealable closures to enhance user convenience and feed protection.

- For instance, Jumbo Plastics offers Flexible Intermediate Bulk Containers (FIBCs) and polypropylene bags ranging from 50 to 100 kg capacity that improve logistics and product quality by facilitating easier storage and handling.

Increased Integration of Smart and Traceable Packaging Technologies

Smart packaging technologies gain traction in the feed packaging market, driven by rising demand for traceability, authentication, and inventory management. Manufacturers adopt QR codes, RFID tags, and sensor-enabled labels to ensure quality monitoring and product verification. It supports transparent supply chains and meets compliance with feed safety regulations. Producers track batches from production to end-use, minimizing contamination risks. These features improve consumer trust and support better logistics operations across the value chain.

- For instance, Tapkit, a UK-based startup, offers a dynamic QR code platform that enables producers to link packaging to live product information and change content post-packaging, improving real-time consumer engagement and transparency.

Rising Preference for Sustainable and Eco-Friendly Packaging Materials

Sustainable packaging remains a leading trend as brands replace conventional plastics with bio-based and recyclable alternatives. The feed packaging market incorporates materials such as kraft paper, biodegradable films, and compostable liners to meet environmental goals. It aligns with global regulations focused on plastic waste reduction and circular economy strategies. Companies emphasize green certifications and life cycle assessments to validate sustainability claims. Demand grows from environmentally aware consumers and institutional buyers seeking reduced environmental footprints.

Customization and Branding Strategies Elevate Product Differentiation

Manufacturers prioritize packaging designs that reflect brand identity, enhance shelf appeal, and communicate product benefits. The feed packaging market sees rising demand for digital printing, high-definition graphics, and multilingual labeling. It enables better engagement with end users and retailers across diverse markets. Customized packaging supports targeted marketing for specific feed types, such as organic or species-specific blends. Visual differentiation becomes essential in competitive environments where functionality and aesthetics influence purchase decisions.

Market Challenges Analysis

Volatile Raw Material Costs Disrupt Pricing Stability and Margin Planning

Fluctuating prices of raw materials such as plastic resins, paper pulp, and adhesives challenge profitability and long-term contract planning. The feed packaging market faces continuous cost pressures due to global supply disruptions, currency fluctuations, and energy cost volatility. It forces manufacturers to either absorb losses or pass costs to customers, affecting competitiveness. Sourcing sustainable materials also adds cost burdens in markets with low price tolerance. Maintaining price stability while ensuring product quality remains difficult, particularly for small and mid-sized producers with limited bargaining power.

Stringent Regulatory Compliance and Waste Management Complexity

Tightening environmental and food safety regulations across regions increases compliance burdens for packaging manufacturers. The feed packaging market must adhere to evolving rules related to recyclability, labeling accuracy, and feed contamination prevention. It requires frequent redesign of materials, structures, and ink formulations to meet certification requirements. Waste disposal and recycling infrastructure gaps in some regions hinder circular economy adoption. It complicates sustainability commitments for global brands aiming for consistent environmental performance across markets.

Market Opportunities

Expansion in Emerging Markets Drives Demand for Localized Packaging Solutions

Rapid livestock farming growth in Asia Pacific, Latin America, and Africa creates strong demand for efficient and affordable packaging solutions. The feed packaging market benefits from rising feed production volumes and government support for agricultural modernization. It enables manufacturers to establish local production units and tailor materials to regional requirements. Companies can capitalize on rural distribution models and develop bulk and small-format packaging options. Localization helps reduce logistics costs and improve market penetration in price-sensitive economies.

Innovation in Sustainable Materials and Digital Technologies Unlocks Growth

Growing consumer awareness and regulatory incentives accelerate the shift toward recyclable, compostable, and bio-based materials. The feed packaging market gains opportunities through innovation in paper-polymer laminates, water-based inks, and compostable liners. It allows companies to align with sustainability goals while maintaining performance standards. Digital printing, smart labeling, and blockchain traceability tools enhance product differentiation and supply chain transparency. These technologies attract partnerships with premium feed brands and unlock value across B2B and retail segments.

Market Segmentation Analysis:

By Pet Type

The feed packaging market sees strong demand across pet segments, with dog and cat food leading sales due to rising pet ownership and premiumization trends. It supports varied packaging formats, including resealable pouches and moisture-resistant bags, tailored for convenience and freshness. Bird and fish feed packaging also shows steady growth, driven by increasing hobbyist interest and aquaculture expansion. Manufacturers design species-specific packaging to ensure nutritional integrity and improve handling efficiency in retail and bulk channels.

- For instance, TC Transcontinental Packaging has invested in recyclable mono-material films called VieVERTe and BOPE films to enhance sustainability and freshness for dog and cat food packaging.

By Livestock Type

Poultry dominates the livestock segment, with increasing demand for protein-rich feed across broiler and layer categories. The feed packaging market adapts to large-scale poultry operations with bulk sacks and durable packaging for farm delivery. Swine feed packaging emphasizes strength and protection against moisture contamination during transport. Ruminant feed, particularly for cattle and goats, favors rugged packaging suited for varied rural conditions. It requires high-capacity formats with clear labeling and resistance to rough handling.

- For instance, Godrej Agrovet Limited, a major player in India, packages its poultry feed in durable, moisture-resistant plastic sacks with clear nutritional labeling to support large-scale farm distribution and end-user convenience.

By Packaging Types

Flexible packaging leads due to its lightweight nature, ease of storage, and reduced shipping costs. The feed packaging market incorporates films, pouches, and woven bags that enhance durability and sustainability. It enables high-speed filling and customization for branding. Rigid packaging remains relevant for premium products, small volumes, and liquid or semi-moist feeds. Buckets, containers, and tubs serve niche applications where resealability and product stability are critical. Both types meet varied operational and environmental demands.

Segments:

Based on Pet Type

Based on Livestock Type

Based on Packaging Types

- flexible

- rigid packaging.

Based on Feed Type Wise

- dry

- pet treats

- chilled & frozen

- wet types

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 28% share of the feed packaging market, driven by large-scale livestock production and a mature pet food industry. Strong demand for premium and functional packaging supports innovation in barrier films, resealable formats, and digital labeling. It benefits from well-developed retail infrastructure and strict regulatory oversight, which require traceable and safe feed packaging. Companies invest in sustainable materials and automation to enhance operational efficiency. The United States leads regional growth with advanced feed processing facilities and consistent demand across poultry and cattle sectors.

Europe

Europe accounts for 25% share of the feed packaging market, supported by high standards for animal nutrition and environmental regulations. The region emphasizes recyclable and biodegradable packaging solutions aligned with EU sustainability directives. It sees increased demand from poultry, swine, and aquaculture sectors, particularly in Germany, France, and the Netherlands. Producers implement smart packaging technologies to enhance traceability and safety. The pet food industry in Europe also pushes the demand for premium packaging, including rigid tubs and labeled pouches for cats and dogs.

Asia Pacific

Asia Pacific leads with 34% share of the feed packaging market, fueled by expanding livestock and aquaculture sectors in China, India, and Southeast Asia. It sees growing demand for cost-effective, bulk packaging formats for poultry and ruminants. Rising pet ownership and urbanization boost sales of small-format flexible packaging in the pet segment. It benefits from government support for agriculture modernization and improved rural distribution. Manufacturers expand local production to meet regional needs and reduce logistics costs.

Rest of the World

The Rest of the World, comprising Latin America, the Middle East, and Africa, holds 13% share of the feed packaging market. Growth is driven by increasing livestock farming and gradual adoption of modern packaging practices. Brazil, South Africa, and Saudi Arabia show rising demand for moisture-resistant and tamper-proof packaging formats. It presents opportunities for affordable, sustainable solutions tailored to regional climate and infrastructure conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Winpak Ltd.

- NYP Corp.

- Shenzhen Longma Industrial Co. Limited (China)

- NNZ Group

- El Dorado Packaging Inc.

- Plasteuropa Group

- ABC Packaging Direct

- Amcor Limited

- NPP Group Limited

- Sonoco Products Company

- Mondi Group

- LC Packaging

Competitive Analysis

The feed packaging market is highly competitive, with global and regional players focusing on material innovation, cost efficiency, and sustainable practices. Companies such as Amcor Limited, Mondi Group, and Sonoco Products Company lead with advanced multilayer films, barrier technologies, and eco-friendly formats. Mid-sized firms like NNZ Group, NPP Group Limited, and LC Packaging compete by offering customized bulk packaging and local supply capabilities. It sees strong participation from emerging players such as Shenzhen Longma Industrial Co. Limited and ABC Packaging Direct, which target niche segments and small-format packaging. Strategic partnerships, regional expansions, and investments in automation strengthen competitiveness across all tiers. Product differentiation, compliance with food safety regulations, and fast turnaround times are critical to market positioning. The feed packaging market continues to attract innovation through smart labeling, recyclable materials, and digital printing solutions that align with changing end-user expectations and sustainability goals.

Recent Developments

- In June 2025, Amcor introduced its sustainable Perflex® shrink bag with an integrated handle, developed for Butterball turkey breast. The new solution lowers carbon emissions by 22% and enhances operational efficiency.

- In 2025, Amcor and Metsä Group initiated a collaboration to develop recyclable fibre-based packagi ng combining Muoto™ moulded fibre with Amcor’s high-barrier film and lidding, targeting extended shelf life and sustainability.

- In June 2024, Sonoco Products Company announced a USD 3.9 billion acquisition of Eviosys, a major European food can manufacturer, to strengthen its metal and aerosol packaging portfolio and expand its presence in the global feed packaging space.

- In October 2024, Mondi Group partnered with Saga Nutrition to introduce the re/cycle FlexiBag—a recyclable mono-material packaging for dry pet food. It replaces multi-layer plastic, maintains freshness, and meets CEFLEX recycling standards.

Market Concentration & Characteristics

The feed packaging market exhibits moderate concentration, with a mix of global leaders and regional manufacturers competing across price, quality, and innovation. Large players such as Amcor, Mondi Group, and Sonoco Products Company dominate through extensive product portfolios, advanced technologies, and strong distribution networks. Mid-sized firms and local suppliers address regional demand with customized, cost-effective packaging solutions. It features strong barriers to entry due to capital requirements, regulatory compliance, and material innovation needs. The market values durability, moisture resistance, and tamper-proof features, especially in bulk and long-haul transport formats. Manufacturers invest in eco-friendly materials, smart labeling, and automation to gain competitive advantage. Strategic partnerships with feed producers and retailers help companies align packaging with specific end-user needs. It operates across a broad range of livestock and pet applications, requiring varied packaging types, from flexible sacks to rigid containers. Companies focus on cost-efficiency, regulatory compliance, and sustainability to maintain market position.

Report Coverage

The research report offers an in-depth analysis based on Pet Type, Livestock Type, Packaging Type, Feed Type Wise and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable packaging materials will increase due to stricter environmental regulations.

- Flexible packaging formats will continue to replace rigid options across livestock and pet feed segments.

- Smart packaging technologies will gain traction to support traceability and supply chain transparency.

- Manufacturers will invest in automation to improve production efficiency and reduce labor costs.

- Growth in online feed sales will drive demand for lightweight, durable, and tamper-evident packaging.

- Regional players will expand product lines to meet localized preferences and cost requirements.

- Bulk packaging formats will see higher adoption in commercial livestock operations.

- Branding and customization will become key differentiators in the competitive pet feed packaging segment.

- Innovation in barrier technologies will improve shelf life and prevent contamination during storage and transit.

- Collaborations between feed producers and packaging firms will increase to develop tailored, performance-driven solutions.