Market Overview:

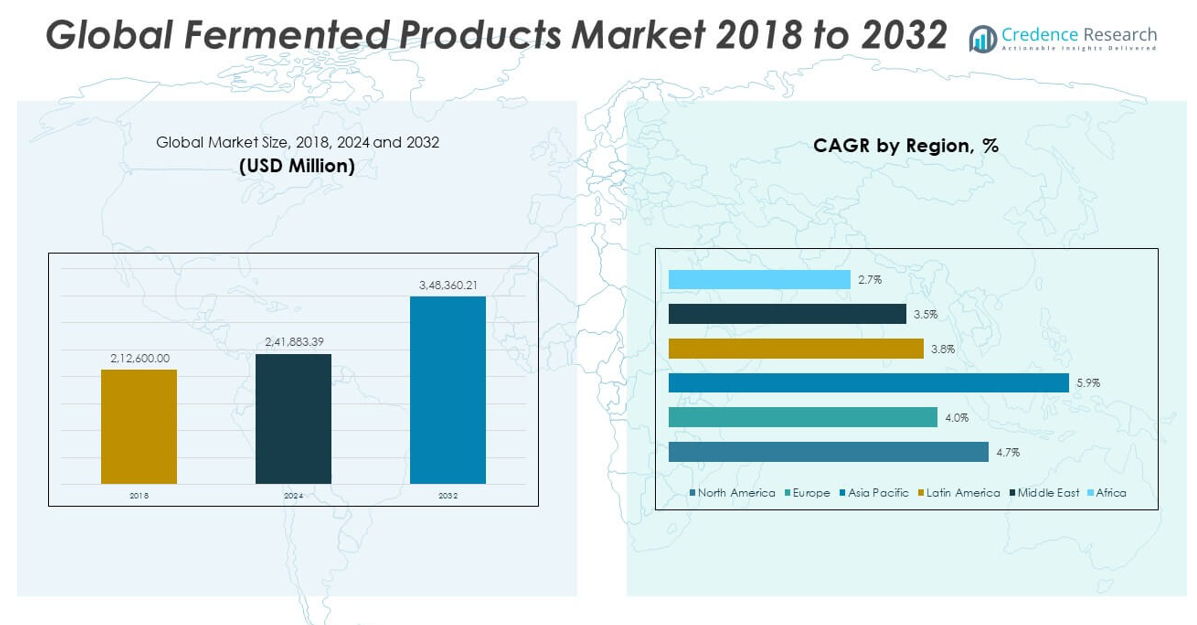

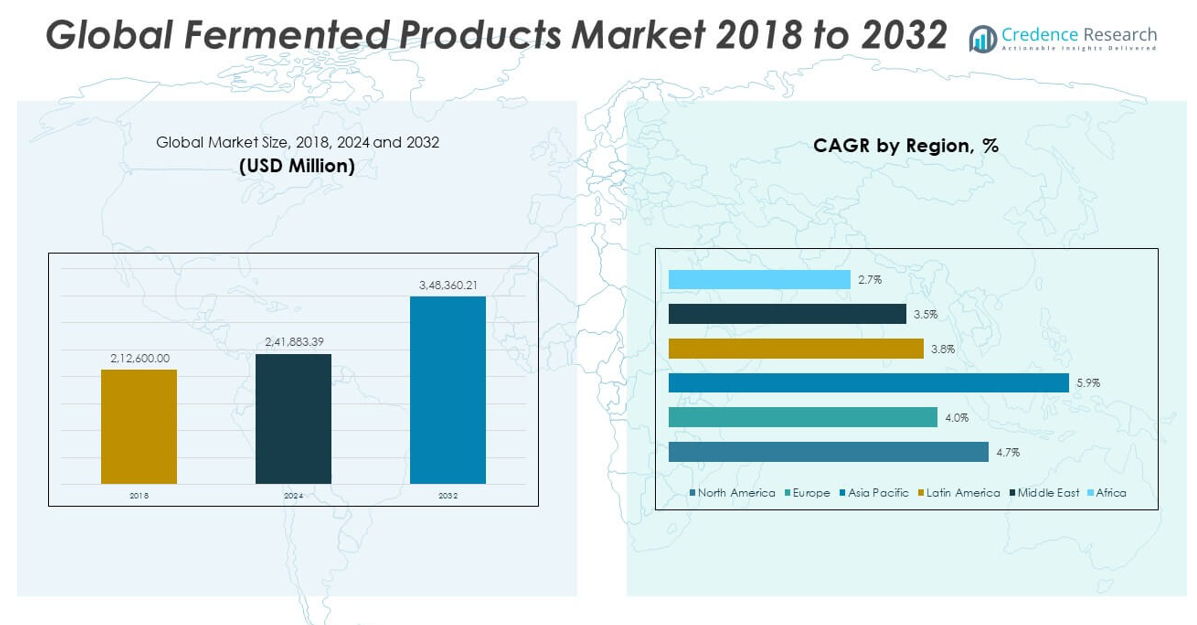

The Global Fermented Products Market size was valued at USD 2,12,600.00 million in 2018 to USD 2,41,883.39 million in 2024 and is anticipated to reach USD 3,48,360.21 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fermented Products Market Size 2024 |

USD 2,41,883.39 million |

| Fermented Products Market, CAGR |

4.7% |

| Fermented Products Market Size 2032 |

USD 3,48,360.21 million |

The Global Fermented Products Market is driven by a confluence of health, lifestyle, and manufacturing factors. Rising consumer preference for functional foods that promote digestive and immune health has significantly accelerated demand for fermented items enriched with probiotics and beneficial enzymes. An aging global population, increased prevalence of gastrointestinal disorders, and growing awareness of the gut microbiome’s role in overall health have led to greater acceptance of fermented products as part of daily diets. In addition to health trends, the market benefits from growing adoption of plant-based and vegan diets, with soy-based fermented foods like tempeh and miso witnessing robust growth. Fermented beverages such as kombucha, probiotic shots, and cultured drinks are gaining ground as alternatives to sugary soft drinks. Innovation in flavor profiles, packaging formats, and shelf-stable formulations is allowing brands to target new demographics and channels, including sports nutrition, wellness retail, and e-commerce. Manufacturers are also leveraging advancements in fermentation technology to improve product stability, safety, and scalability, which is essential to meet rising global demand.

Regionally, the Global Fermented Products Market displays varied dynamics, with strong performance across both developed and emerging markets. North America holds a significant share, driven by heightened health awareness, widespread adoption of functional foods, and strong distribution networks. The U.S. continues to see growth in fermented dairy alternatives and kombucha, while Canada shows increasing interest in fermented vegetables and beverages. Europe remains a mature market, anchored by traditional consumption of products such as kefir, sauerkraut, and yogurt. Countries like Germany, France, and the U.K. are witnessing a resurgence in demand due to clean-label trends and preference for locally sourced, naturally preserved foods. The Asia-Pacific region represents the fastest-growing segment, propelled by a long-standing cultural tradition of fermented foods and rising urban health consciousness. China, Japan, South Korea, and India are key contributors, with fermented soy products, pickled vegetables, and dairy alternatives driving volume. In Latin America and the Middle East & Africa, the market is gradually expanding due to improving awareness of nutritional benefits and the growing presence of multinational health food brands. Together, these regional trends highlight the Global Fermented Products Market’s broad appeal and strong potential for continued growth across multiple geographies and consumer segments.

Market Insights:

- The Global Fermented Products Market was valued at USD 2,12,600.00 million in 2018, rose to USD 2,41,883.39 million in 2024, and is anticipated to reach USD 3,48,360.21 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Rising health consciousness and functional food trends are fueling demand for fermented products enriched with probiotics, enzymes, and bioactive compounds, especially among millennials and older adults focused on managing gut health, immunity, and metabolic function.

- The market is expanding rapidly with the rise of plant-based and lactose-free diets, boosting sales of tempeh, miso, coconut-based yogurts, plant-derived kefir, and other non-dairy fermented alternatives aligned with ethical and allergen-conscious preferences.

- Innovations in flavor profiles, packaging, and convenience formats—such as probiotic shots, kombucha, cultured drinks, and shelf-stable snacks—are strengthening consumer appeal across e-commerce, wellness retail, and fitness channels.

- Advancements in fermentation technology, including starter culture development, controlled environments, and process automation, are improving product consistency, microbial safety, and scalability, making it easier to meet global demand.

- The industry faces operational challenges from inconsistent batch quality, temperature sensitivity, and short shelf life, especially in regions with weak cold chain infrastructure, increasing production risks and limiting distribution for smaller brands.

- In emerging markets, limited awareness of probiotic benefits, lack of education on usage, and regulatory ambiguity around labeling and health claims are constraining growth, calling for consumer outreach and standardized global labeling frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Health Awareness and Demand for Functional Foods Accelerate Fermented Product Consumption:

Consumers are increasingly prioritizing health and wellness, prompting a shift toward functional foods that offer tangible health benefits. The Global Fermented Products Market benefits directly from this trend, with products rich in probiotics, enzymes, and bioactive compounds gaining traction for their role in digestive and immune health. Fermented foods are widely perceived as natural remedies for gut-related disorders and are becoming regular staples in diets aimed at improving metabolic and gastrointestinal function. Health-conscious individuals are seeking alternatives to heavily processed items, and fermented products provide a clean-label, nutrient-rich option. This trend spans across age groups, but is especially strong among millennials and older adults who are proactive about managing long-term health. The rise in chronic conditions such as irritable bowel syndrome (IBS), lactose intolerance, and bloating further supports the demand for fermented solutions.

- For instance, Danone’s Activia yogurt contains over 10 billion live Bifidobacterium animalis DN-173 010 (probiotic) cultures per serving, with clinical studies showing a significant reduction in bloating and digestive discomfort in 70% of regular consumers after four weeks of daily intake.

Growth in Vegan, Plant-Based, and Lactose-Free Diets Creates New Avenues for Fermented Innovations:

The rising global shift toward plant-based and lactose-free diets has opened up significant opportunities for non-dairy and vegan fermented products. The Global Fermented Products Market is witnessing strong momentum in areas such as fermented soy, coconut-based yogurts, plant-derived kefir, and tempeh, driven by changing consumer preferences. It serves health-focused individuals who seek probiotic benefits without consuming animal-derived ingredients. This aligns with ethical, environmental, and allergen-conscious food choices, further expanding the market’s appeal. The introduction of clean-label, dairy-free fermentation formats is helping brands position themselves in mainstream health and specialty food aisles. Companies are investing in R&D to mimic the texture, taste, and functional attributes of traditional dairy fermented products using sustainable plant-based alternatives.

- For instance, Alpro’s plant-based yogurt alternatives, made from fermented soy and coconut, deliver 3.5 grams of protein and over 1 billion live cultures per 100-gram serving, and are now available in more than 30 countries, reflecting the brand’s successful expansion into the vegan and lactose-free segment.

Innovation in Product Formats, Flavors, and Convenience Strengthens Market Penetration Across Demographics:

The market’s ability to adapt to modern consumer lifestyles is a critical driver of its continued growth. The Global Fermented Products Market is increasingly defined by innovations in flavor variety, on-the-go packaging, and ready-to-consume formats. It appeals to busy urban consumers who prioritize both nutrition and convenience. Manufacturers are introducing single-serve probiotic shots, flavored fermented beverages, and shelf-stable cultured snacks to meet demand across age groups. These innovations also help brands reach consumers who may not be familiar with traditional fermented products. Expanding product offerings beyond conventional categories allows producers to enter new retail channels, including online platforms, fitness centers, and health-focused cafés.

Technological Advancements in Fermentation Processes Improve Product Consistency and Scalability:

Modern fermentation technology enables manufacturers to achieve consistent taste, safety, and shelf life in large-scale production environments. The Global Fermented Products Market is benefiting from advancements in starter culture development, controlled fermentation environments, and process automation. It supports uniform quality, reduces production time, and minimizes microbial risks, which are essential for scaling to meet growing demand. Technology is also allowing producers to experiment with novel substrates and strains, expanding the nutritional value and diversity of fermented offerings. Companies that invest in biotechnological innovations can offer safer, more stable, and longer-lasting products while maintaining authenticity. These improvements are particularly valuable for brands looking to expand globally and comply with stringent food safety regulations.

Market Trends:

Expansion of Fermented Beverages into Mainstream and Premium Retail Channels Broadens Consumer Access:

Fermented beverages are gaining visibility and shelf space in both mainstream supermarkets and premium health stores. The Global Fermented Products Market is responding to this trend by introducing kombucha, fermented herbal tonics, and probiotic juices in various formats and price tiers. It enables brands to reach health-focused buyers while appealing to consumers exploring alternatives to carbonated soft drinks and artificially sweetened beverages. Retailers are allocating more space to chilled fermented drinks as consumer interest shifts toward gut-friendly refreshment. The rise of private-label offerings and co-branded health beverage lines is helping to expand product availability across price-sensitive and premium consumer segments. This trend strengthens the position of fermented drinks in daily routines, from breakfast companions to fitness hydration products.

- For instance, GT’s Living Foods, a leading kombucha producer, reported distributing over 1.5 million bottles of kombucha per week in the U.S. in 2024, with each bottle containing more than 2 billion live probiotics and organic acids, as verified by third-party laboratory testing.

Cross-Cultural Culinary Influence Is Driving the Globalization of Traditional Fermented Foods:

Global exposure to diverse cuisines is encouraging the adoption of regional fermented products across international markets. The Global Fermented Products Market is seeing increased demand for traditional foods such as kimchi, miso, sauerkraut, and natto outside their native countries. It reflects a broader consumer interest in authenticity, culinary exploration, and cultural variety in food consumption. Restaurants, foodservice providers, and specialty retailers are incorporating fermented items into global fusion menus, encouraging mainstream acceptance. Food media and cooking shows are further popularizing these products by highlighting their taste, nutritional value, and historical significance. This cross-cultural culinary expansion allows producers to introduce authentic fermented items to new regions while tailoring packaging and labeling for local preferences.

- For instance, CJ CheilJedang exported Bibigo kimchi in 2024, with each 100-gram serving containing live lactic acid bacteria, and expanded distribution to 50 countries, making it one of the most widely available traditional fermented foods globally.

Digital Platforms and E-Commerce Are Enhancing Distribution and Consumer Engagement:

Online sales channels are transforming how consumers discover and purchase fermented products. The Global Fermented Products Market is increasingly leveraging digital platforms to improve accessibility, educate buyers, and promote niche products. It allows smaller and specialty brands to reach targeted audiences without heavy reliance on traditional retail distribution. Subscription models, direct-to-consumer (DTC) offerings, and influencer marketing campaigns are helping brands build loyalty among health-conscious users. Online reviews, nutritional blogs, and recipe content also contribute to consumer education, demystifying fermented foods and beverages. The shift toward digital commerce accelerates innovation cycles by allowing rapid feedback and customized marketing.

Clean-Label Certifications and Transparent Ingredient Sourcing Are Shaping Purchase Behavior:

Consumers are paying closer attention to product labels, driving demand for transparency in ingredients, processing methods, and sourcing practices. The Global Fermented Products Market is aligning with this shift by highlighting non-GMO ingredients, organic certifications, and additive-free formulations. It helps build consumer trust and positions fermented offerings as wholesome and minimally processed. Companies are investing in traceable supply chains and sustainable sourcing to reinforce brand credibility. Clean-label trends also influence packaging decisions, with more brands using recyclable materials and emphasizing natural fermentation techniques. This growing preference for clean-label, ethically sourced fermented products is reshaping how producers develop and market their product lines.

Market Challenges Analysis:

Inconsistent Product Quality and Short Shelf Life Complicate Large-Scale Fermentation Operations:

Maintaining consistent product quality across batches poses a major challenge for manufacturers in the Global Fermented Products Market. Natural fermentation processes are highly sensitive to temperature, microbial strains, and handling conditions, which can lead to variability in flavor, texture, and nutritional content. It becomes particularly difficult to control these variables at scale, especially in regions with limited cold chain infrastructure. Short shelf life is another concern, as many fermented products contain live cultures that require refrigeration and lose potency over time. Retailers often hesitate to stock such items in large volumes due to spoilage risk and logistical complexity. These quality control challenges increase production costs and limit distribution potential for small and mid-sized brands.

Limited Consumer Awareness and Regulatory Ambiguity Restrict Market Penetration in Emerging Regions:

In many developing markets, consumer understanding of the health benefits and proper consumption of fermented products remains low. The Global Fermented Products Market faces hurdles in educating new buyers about probiotic content, storage needs, and dosage for health benefits. It is further complicated by inconsistent labeling standards and the absence of unified regulations around probiotic claims and microbial composition. Governments in some regions have yet to establish clear frameworks for verifying health claims related to fermented goods, creating uncertainty for both producers and consumers. Lack of awareness also leads to misperceptions about taste, safety, or relevance to local diets, which slows adoption. Brands must invest in targeted education and transparent labeling to overcome skepticism and regulatory gaps.

Market Opportunities:

Rising Demand for Personalized Nutrition Opens New Avenues for Product Diversification:

The growing interest in personalized nutrition presents a strong opportunity for innovation within the Global Fermented Products Market. Consumers are seeking food products that align with specific health goals such as gut health, immunity support, and metabolic balance. It allows manufacturers to develop targeted formulations using customized probiotic strains, functional ingredients, and unique fermentation methods. Brands can introduce products tailored to age groups, dietary restrictions, or specific medical needs, creating niche categories within the market. Advances in microbiome research and DNA-based health assessments are driving demand for more specialized fermented offerings. This trend supports premium pricing and encourages customer loyalty through personalized value.

Untapped Growth Potential in Institutional and Foodservice Segments Expands Market Reach:

Expanding the presence of fermented products in foodservice and institutional sectors offers untapped commercial potential. The Global Fermented Products Market can benefit from increased adoption in school meals, hospitals, and corporate wellness programs focused on preventive health. It supports steady demand and introduces fermented foods to broader demographics unfamiliar with their benefits. Hotels, quick-service restaurants, and cafés are incorporating items like probiotic smoothies, fermented condiments, and cultured snacks into their menus. Bulk packaging and recipe customization make fermented products suitable for large-scale service formats. Capturing this demand requires tailored supply solutions and strategic partnerships with institutional buyers.

Market Segmentation Analysis:

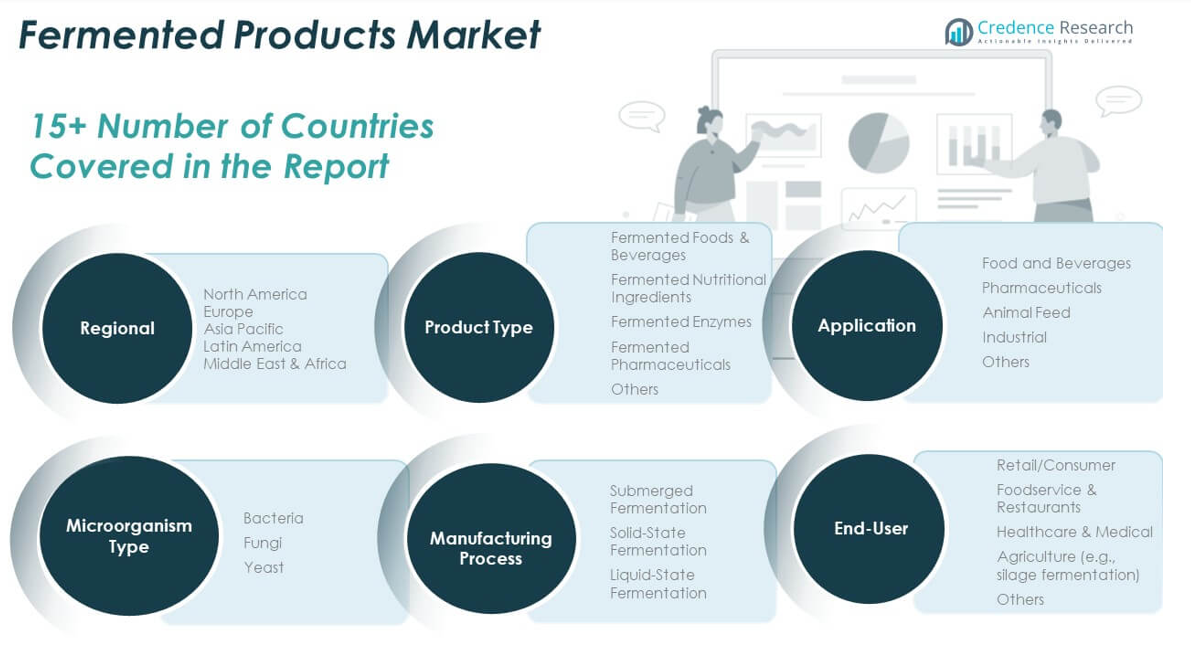

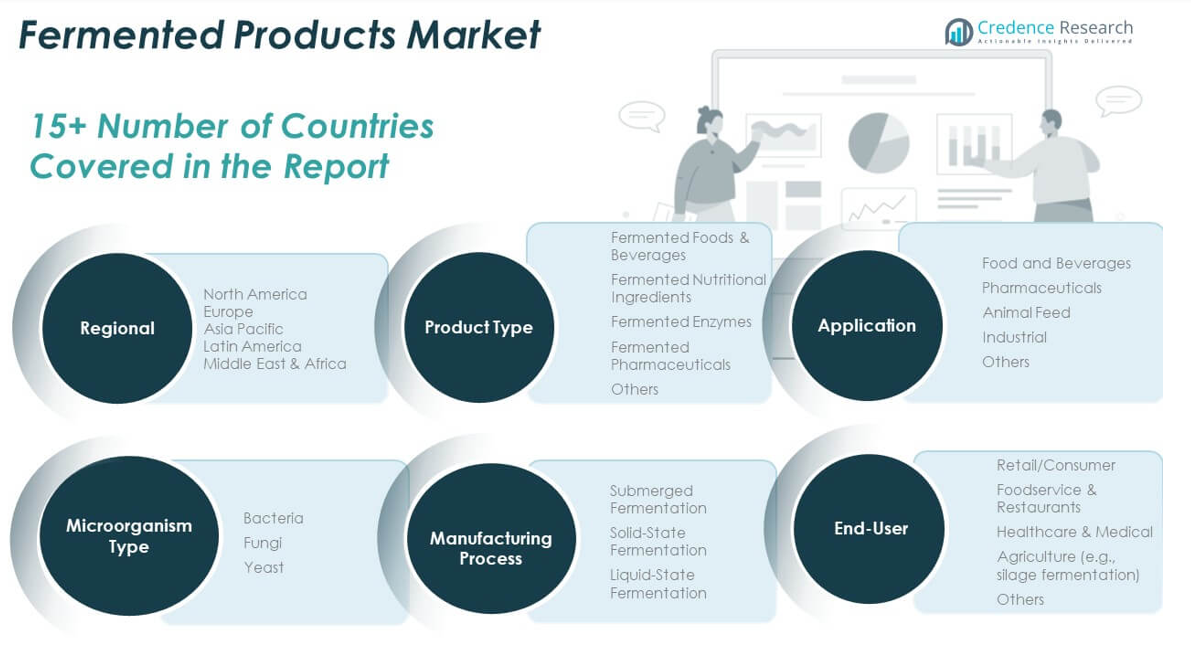

By Product Type

The Global Fermented Products Market features a broad product portfolio. Fermented foods and beverages lead the segment, with yogurt, cheese, kombucha, and fermented tea maintaining high consumer demand due to their probiotic content. Fermented nutritional ingredients such as lactic acid, citric acid, succinic acid, and acetic acid support applications in food preservation, flavoring, and pharmaceuticals. Fermented enzymes—amylase, protease, lipase, and cellulase—are key in industrial processing and biotechnology. The pharmaceutical segment benefits from fermentation-derived antibiotics like penicillin, streptomycin, erythromycin, and tetracycline. A miscellaneous “Others” category captures niche and emerging products.

- For instance, Chr. Hansen, a global leader in microbial solutions, produced over 2,000 metric tons of food-grade lactic acid bacteria cultures in 2024, supplying more than 3,000 food and beverage manufacturers worldwide for use in yogurt, cheese, and probiotic drinks.

By Application

Food and beverages account for the largest market share, driven by functional food trends and dietary supplementation. Pharmaceuticals represent the next significant application, especially in antibiotic production. Animal feed and industrial applications follow, contributing to sustainable agriculture and chemical processing.

- For instance, Pfizer’s Kalamazoo, Michigan facility is one of the world’s largest producers of active pharmaceutical ingredients (API) through fermentation, manufacturing 1,200 metric tons of ingredients annually.

By Microorganism Type

Bacteria dominate due to their extensive use in dairy, enzyme, and pharmaceutical fermentations. Fungi and yeast also play important roles, particularly in beverage, enzyme, and ethanol production.

By Manufacturing Process

Submerged fermentation is the most commonly used method, favored for scalability and consistency. Solid-state and liquid-state fermentation are utilized based on substrate type and end-use requirements.

By End-User

Retail and consumer segments drive demand for ready-to-consume fermented products. Foodservice and restaurants are adopting fermented items into modern menus. Healthcare and agriculture sectors use fermentation for therapeutic and silage applications. Other end-users include specialty and industrial buyers with unique functional needs.

Segmentation:

By Product Type

- Fermented Foods & Beverages

- Yogurt

- Cheese

- Kombucha

- Fermented Tea

- Others

- Fermented Nutritional Ingredients

- Lactic Acid

- Citric Acid

- Succinic Acid

- Acetic Acid

- Others

- Fermented Enzymes

- Amylase

- Protease

- Lipase

- Cellulase

- Others

- Fermented Pharmaceuticals

- Penicillin

- Streptomycin

- Erythromycin

- Tetracycline

- Others

- Others

By Application

- Food and Beverages

- Pharmaceuticals

- Animal Feed

- Industrial

- Others

By Microorganism Type

By Manufacturing Process

- Submerged Fermentation

- Solid-State Fermentation

- Liquid-State Fermentation

By End-User

- Retail/Consumer

- Foodservice & Restaurants

- Healthcare & Medical

- Agriculture (e.g., silage fermentation)

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Fermented Products Market size was valued at USD 73,474.56 million in 2018 to USD 82,529.16 million in 2024 and is anticipated to reach USD 1,18,686.95 million by 2032, at a CAGR of 4.7% during the forecast period. North America holds a dominant position in the Global Fermented Products Market with a significant revenue share. It benefits from high health awareness, strong purchasing power, and established retail and distribution networks. The United States is leading the region, with widespread consumption of kombucha, yogurt alternatives, and fermented supplements. Canada shows increasing demand for fermented vegetables and cultured beverages. Market players in this region focus on flavor innovations and probiotic fortification to attract health-conscious consumers. It continues to evolve with growing interest in clean-label, functional, and vegan fermented offerings.

Europe

The Europe Fermented Products Market size was valued at USD 54,808.28 million in 2018 to USD 59,883.71 million in 2024 and is anticipated to reach USD 81,360.45 million by 2032, at a CAGR of 4.0% during the forecast period. Europe is a mature and tradition-driven segment of the Global Fermented Products Market. Countries such as Germany, France, and the UK have long-standing consumption of products like kefir, sauerkraut, and cultured dairy. Clean-label preferences and sustainable sourcing are reinforcing market performance. European consumers increasingly favor organic and locally produced fermented goods. Regulatory frameworks in the EU help standardize health claims and ensure product quality. It remains a stable market with innovation focused on natural preservation and plant-based transitions.

Asia Pacific

The Asia Pacific Fermented Products Market size was valued at USD 56,424.04 million in 2018 to USD 66,819.27 million in 2024 and is anticipated to reach USD 1,05,448.91 million by 2032, at a CAGR of 5.9% during the forecast period. Asia Pacific represents the fastest-growing region in the Global Fermented Products Market. Traditional dietary habits that include fermented soy, pickled vegetables, and fermented teas support strong demand across China, Japan, South Korea, and India. Rapid urbanization, rising disposable income, and growing health awareness are driving growth. Local manufacturers and multinational brands alike are expanding portfolios to include both traditional and modern fermented items. It benefits from deep cultural integration and increasing interest in functional foods among younger consumers. This region continues to be a strategic focus for product development and market expansion.

Latin America

The Latin America Fermented Products Market size was valued at USD 13,606.40 million in 2018 to USD 15,332.99 million in 2024 and is anticipated to reach USD 20,507.96 million by 2032, at a CAGR of 3.8% during the forecast period. Latin America is an emerging region in the Global Fermented Products Market with moderate growth potential. Brazil and Argentina lead regional demand, supported by evolving dietary trends and increasing awareness of probiotic benefits. Yogurt and fermented dairy products are commonly consumed, while beverages and plant-based items are gradually gaining popularity. Distribution is improving across urban retail and online channels. It remains price-sensitive, with growing opportunities in affordable health-focused product lines. Regional players are forming alliances with global companies to enhance product quality and reach.

Middle East

The Middle East Fermented Products Market size was valued at USD 8,759.12 million in 2018 to USD 9,383.50 million in 2024 and is anticipated to reach USD 12,299.03 million by 2032, at a CAGR of 3.5% during the forecast period. The Middle East market is expanding steadily within the Global Fermented Products Market framework. Cultural use of dairy-based fermented items and rising health interest contribute to consistent demand. The UAE and Saudi Arabia show growing consumption of probiotic drinks and fortified yogurt. Product launches are often tailored to religious and cultural norms, including halal-certified options. Health-focused retail outlets are enhancing product accessibility. It is seeing gradual diversification with the introduction of plant-based fermented goods.

Africa

The Africa Fermented Products Market size was valued at USD 5,527.60 million in 2018 to USD 7,934.75 million in 2024 and is anticipated to reach USD 10,056.90 million by 2032, at a CAGR of 2.7% during the forecast period. Africa holds a small but growing share in the Global Fermented Products Market. Traditional fermented foods are deeply embedded in local diets, though commercial product penetration remains limited. Urbanization and improvements in retail infrastructure are slowly expanding access to packaged fermented goods. South Africa and Egypt are showing increased demand for fortified dairy and functional beverages. Awareness campaigns around gut health and nutrition are helping grow consumer interest. It presents long-term potential, particularly with investments in food processing and cold chain logistics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Cargill Incorporated

- Hansen Holding A/S

- Conagra Brands Inc.

- Danone

- Dohler GmbH

- General Mills Inc.

- Kerry Group plc

- KeVita Inc. (PepsiCo Inc.)

- Koninklijke DSM N.V.

- Lallemand Inc.

- Mars Incorporated

- Meiji Holdings Co. Ltd.

- Mondelez International

- Nestlé S.A.

- Royal FrieslandCampina N.V.

Competitive Analysis:

The Global Fermented Products Market is moderately fragmented, with competition driven by innovation, product diversity, and brand positioning. Key players such as Nestlé, Danone, PepsiCo, Yakult Honsha, General Mills, and Unilever lead through extensive product portfolios and global distribution networks. It supports strong competition among multinational brands, niche organic producers, and regional specialists. Companies compete on factors such as probiotic content, clean-label credentials, flavor variety, and shelf life. Strategic partnerships, product line extensions, and investments in R&D help players differentiate and expand market share. The rise of plant-based and functional fermented offerings has encouraged both legacy brands and new entrants to develop specialized product lines. E-commerce growth and digital marketing have also lowered entry barriers for smaller companies targeting health-conscious consumers. The market rewards agility in innovation, responsiveness to regional taste preferences, and transparent communication of health benefits.

Recent Developments:

- In June 2025, Cargill announced the acquisition of full ownership of Teys Australia and Teys USA, building on a 14-year partnership with the Teys family. This move ensures long-term stability for Teys’ operations and expands Cargill’s protein business. Earlier in February 2025, Cargill also moved to acquire full ownership of SJC Bioenergia in Brazil, reinforcing its commitment to renewable energy and integrated bioenergy operations. In June 2025, Aditya Birla Group acquired Cargill’s specialty chemical manufacturing facility in Dalton, Georgia, marking a strategic expansion in the U.S. chemicals sector.

- In June 2025, Conagra Brands introduced more than 50 new frozen foods, including single-serve and multi-serve meals, vegetable sides, and plant-based options, as part of its ongoing portfolio modernization. The company also announced that by the end of 2025, its entire U.S. frozen product portfolio will be free from certified Food, Drug & Cosmetic (FD&C) colors, aligning with consumer demand for cleaner labels and healthier ingredients.

- In May 2025, Angel Yeast launched the Feravor™ series, a next-generation yeast-derived protein and natural flavor solution, at the Global Bakery Expo. Feravor™ leverages patented microbial fermentation technology to deliver clean-label, flavor-enhancing ingredients for bakery and plant-based foods. The company also showcased its flagship AngeoPro yeast protein, which contains 80% protein content and won the 2025 World Best Ingredient Innovation Award. Additionally, Angel Yeast is set to open its new Baiyang Biotechnology Park in September 2025, integrating advanced fermentation and protein separation technologies to boost global supply of high-value yeast-derived products.

- In March 2025, Archer Daniels Midland (ADM) signed a non-binding memorandum of understanding with Mitsubishi Corporation to form a strategic alliance. The partnership aims to explore collaboration across the agriculture value chain, including logistics and production, with a goal to boost annual grain handling volume by 50% to about 30 million tons by 2030. This alliance is designed to strengthen food system resilience and support sustainable supply chains globally.

Market Concentration & Characteristics:

The Global Fermented Products Market displays moderate market concentration, with a mix of large multinational corporations and a growing number of regional and artisanal producers. It is characterized by strong product diversity, including dairy, plant-based, soy, and beverage segments, each catering to different consumer health and dietary needs. The market thrives on innovation, clean-label demand, and functional health positioning, with high sensitivity to regional taste preferences and cultural traditions. It supports both premium and mass-market offerings, allowing brands to operate across multiple price tiers. Consumer interest in gut health, natural preservation, and culinary exploration continues to shape product development. The market favors brands that combine scientific credibility with accessible, flavor-forward formulations.

Report Coverage:

The research report offers an in-depth analysis based on product types, applications, microorganisms, processes, and end-users. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for probiotic-rich products will increase as consumers prioritize digestive and immune health.

- Plant-based fermented alternatives will expand, supported by vegan and lactose-intolerant demographics.

- Traditional fermented foods from Asia and Eastern Europe will gain popularity in global markets.

- E-commerce will become a key distribution channel, especially for niche and functional products.

- Foodservice and institutional sectors will integrate more fermented offerings into menus.

- Clean-label formulations and transparency in sourcing will influence purchasing decisions.

- Technological advances in fermentation will improve consistency, shelf life, and scalability.

- Personalized nutrition will drive demand for targeted probiotic strains and functional blends.

- Regulatory frameworks around health claims and labeling will become more standardized.

- Strategic partnerships and innovation will define competitive positioning across regions.