Market Overview

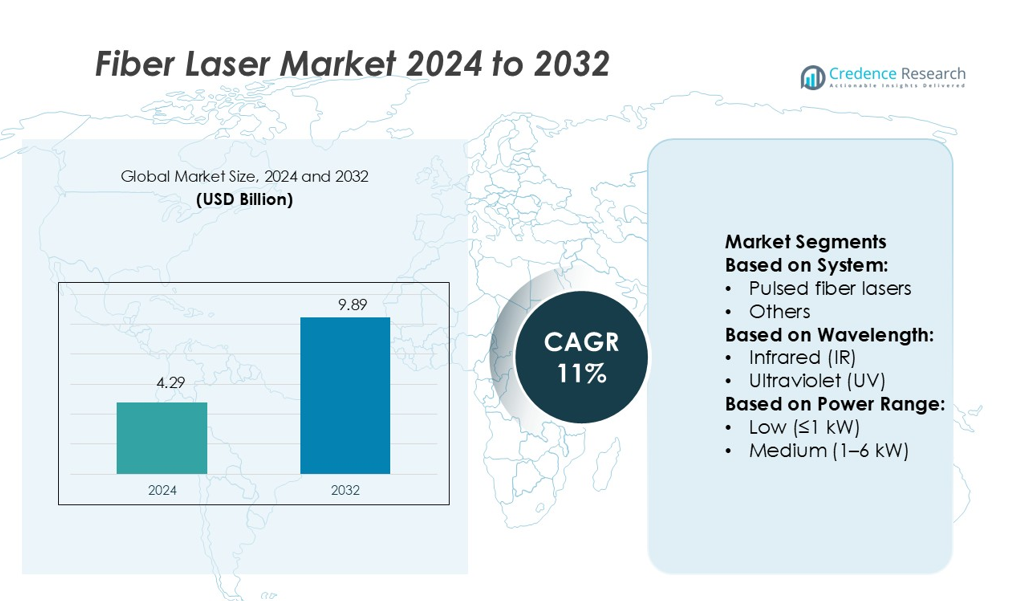

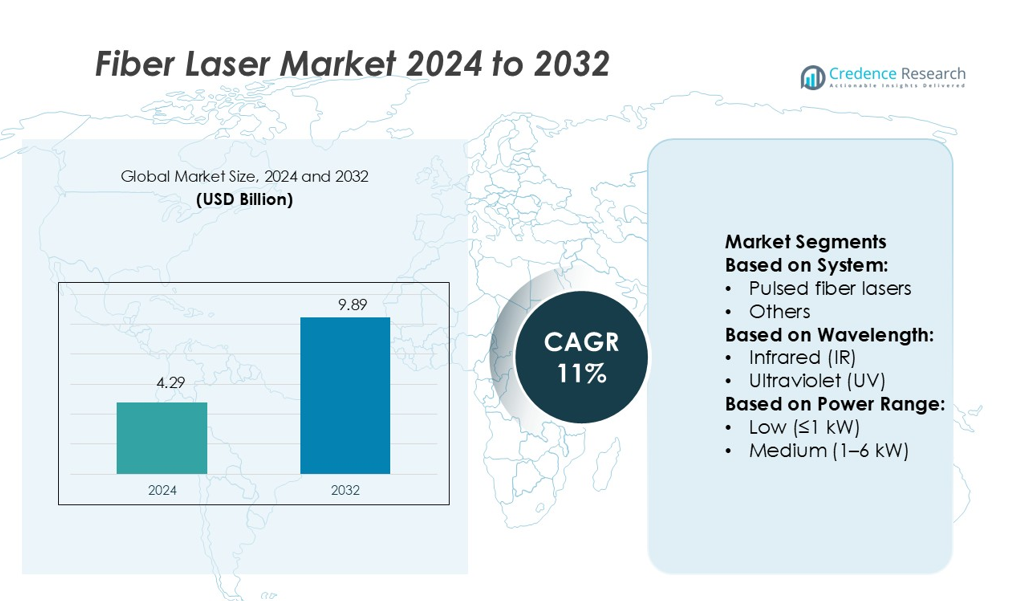

Fiber Laser Market size was valued USD 4.29 billion in 2024 and is anticipated to reach USD 9.89 billion by 2032, at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Laser Market Size 2024 |

USD 4.29 billion |

| Fiber Laser Market, CAGR |

11% |

| Fiber Laser Market Size 2032 |

USD 9.89 billion |

The Fiber Laser Market is characterized by strong competition among leading manufacturers focusing on technology development and strategic expansion. Key companies are investing in advanced laser systems with improved power output, stability, and energy efficiency to strengthen their market positions. These firms are also adopting automation, AI integration, and smart manufacturing tools to enhance productivity and operational reliability. North America leads the market with a 39.2% share, supported by a mature industrial base, strong R&D investment, and early technology adoption. This regional dominance is further reinforced by the presence of major industries in automotive, aerospace, and electronics, which drive consistent demand for high-performance fiber laser solutions.

Market Insights

- The Fiber Laser Market size was valued at USD 4.29 billion in 2024 and is expected to reach USD 9.89 billion by 2032, growing at a CAGR of 11%.

- Rising demand for precision manufacturing, increased automation, and Industry 4.0 adoption are driving market growth.

- Leading players are focusing on advanced technologies such as AI integration, energy efficiency, and smart production systems to gain a competitive edge.

- High initial investment and technical limitations in specific material processing remain key restraints impacting market expansion.

- North America leads the market with a 39.2% share, followed by Europe and Asia Pacific, while continuous wave (CW) fiber lasers dominate the segment due to their strong use in automotive and aerospace industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By System

Continuous wave (CW) fiber lasers hold the dominant market share in the Fiber Laser Market due to their superior beam quality and high efficiency. These systems support precision cutting, welding, and marking in industries like automotive, electronics, and aerospace. CW fiber lasers deliver stable output power, enabling faster processing speeds and reduced operational costs. Their long service life and low maintenance needs further strengthen their adoption. Pulsed fiber lasers are also gaining momentum for micro-machining applications, while other systems remain limited to specialized uses with smaller deployment scales.

- For instance, MegaFood’s Women’s Multi Gummies feature a formulation that delivers 19 essential nutrients per two-gummy serving. The formula includes 25 mcg of vitamin D3 sourced from cholecalciferol, 400 mcg of folate (as folic acid, DFE), and methylated B12 for better absorption.

By Wavelength

Infrared (IR) wavelength dominates the Fiber Laser Market with the largest market share, driven by its compatibility with diverse materials. IR lasers offer strong absorption in metals, making them ideal for cutting, engraving, and welding applications. Their energy efficiency and ability to operate at high speeds increase productivity in manufacturing environments. Sectors such as electronics, automotive, and defense rely heavily on IR systems for precision work. Ultraviolet (UV) and visible wavelength lasers serve niche applications like microelectronics and medical devices, while mid-infrared usage is growing steadily.

- For instance, Vitafusion Calcium Gummies, contains 500 mg of calcium and 1,000 IU of vitamin D per two gummies, while being free of artificial sweeteners, gluten, dairy, and synthetic dyes.

By Power Range

High power fiber lasers (>6 kW) lead the Fiber Laser Market with the highest market share, supported by strong adoption in heavy manufacturing. These lasers enable deep penetration welding, thick metal cutting, and advanced fabrication processes. High power systems improve processing speed and reduce cycle time, resulting in higher throughput. Their application in shipbuilding, automotive, and aerospace drives sustained demand. Medium power systems (1–6 kW) are widely used in general manufacturing, while low power lasers (≤1 kW) remain essential for marking, engraving, and light-duty applications.

Key Growth Drivers

Rising Demand for Precision Manufacturing

The Fiber Laser Market is growing due to the increasing use of precision manufacturing. Fiber lasers offer high accuracy, stable beam quality, and minimal maintenance compared to conventional systems. These features make them ideal for industries like automotive, electronics, and medical device manufacturing. Manufacturers use fiber lasers for cutting, welding, and marking with reduced operational costs. The rising demand for lightweight components and microfabrication further accelerates adoption across production lines. High processing speed and flexibility provide a strong competitive edge in high-volume applications.

- For instance, Broadex Technologies is sampling 400G QSFP-DD DR4 transceivers in both 500 m and 2 km variants based on a silicon-photonic platform using 7 nm DSP chips, achieving a bit error rate of 10⁻⁹ without forward error correction and a TDECQ as low as 0.6 dB.

Expanding Applications in Automotive and Aerospace

Automotive and aerospace industries are driving market expansion by adopting fiber lasers for component production. Fiber lasers enable fast, clean, and precise welding of lightweight metals and alloys. They improve production efficiency while maintaining structural integrity in complex assemblies. Aerospace manufacturers use them for drilling turbine components and cutting advanced materials. Automotive companies rely on them for EV battery welding and lightweight body construction. These applications enhance product quality, reduce production time, and align with growing automation trends in manufacturing.

- For instance, Cisco Systems offers coherent 400G QSFP-DD optical modules that transmit a single 400G wavelength over long distances. Under the OpenZR+ specification, and typically with optical amplification, these modules can support point-to-point links of up to 120 km.

Technological Advancements and Integration

Continuous advancements in laser technology are strengthening market growth. Fiber lasers are now integrated with AI-driven controls, robotics, and IoT platforms. These integrations enable real-time process monitoring, predictive maintenance, and energy efficiency. Improved power scaling and beam delivery have expanded the use of fiber lasers in heavy industries like shipbuilding and energy. Their modular design also allows easy system upgrades, lowering total ownership costs. These innovations support mass customization and smart manufacturing initiatives, increasing market competitiveness.

Key Trends & Opportunities

Shift Toward Green and Energy-Efficient Solutions

Energy efficiency is becoming a key trend in the Fiber Laser Market. Manufacturers are adopting high-efficiency fiber lasers to lower energy consumption and carbon emissions. These systems generate less heat, reduce cooling requirements, and deliver longer operational life. This shift aligns with global sustainability goals and regulatory compliance. Green manufacturing initiatives encourage industries to replace CO₂ and solid-state lasers with fiber-based solutions. This trend creates strong opportunities for vendors offering eco-friendly and low-maintenance technologies.

- For instance, Corning’s SMF-28® Ultra optical fiber offers high performance, including industry-leading low attenuation. The Corning SMF-28® ULL (Ultra-Low-Loss) fiber, a variant specifically designed for long-haul and high-data-rate networks, can achieve a typical attenuation as low as 0.16 dB/km at 1550 nm.

Automation and Industry 4.0 Adoption

Fiber lasers are central to Industry 4.0 strategies across manufacturing sectors. Automated production lines integrate fiber lasers with robotic arms and digital control systems for seamless operations. This integration boosts output quality, repeatability, and efficiency. Real-time monitoring improves production visibility and reduces downtime. As industries accelerate digital transformation, fiber laser solutions become a preferred choice for smart factories. This creates new opportunities for system integrators, component suppliers, and advanced software developers.

- For instance, Fujikura’s “Green PLUS” product line includes a small-diameter, high-density optical fiber cable whose fiber count is packaged using 200 µm diameter fibers instead of the conventional 250 µm, increasing fiber count per cross-section.

Expanding Use in Medical and Microelectronics

Growing demand from the medical and microelectronics sectors presents strong opportunities. Fiber lasers are widely used in surgical device manufacturing, stent cutting, and microelectronics fabrication. Their precision and non-contact operation ensure high-quality outcomes with minimal material damage. Miniaturization trends in electronics further increase their use in PCB cutting and wafer processing. This creates a profitable segment for high-power, ultra-short pulse fiber lasers designed for fine and complex manufacturing tasks.

Key Challenges

High Initial Investment Costs

Despite their efficiency, fiber laser systems involve significant upfront costs. Small and medium enterprises face budget constraints that limit adoption. Expenses related to installation, integration, and training add to the financial burden. Although operational savings balance long-term costs, the initial investment remains a barrier for many businesses. This restricts wider market penetration, especially in developing economies. Vendors need to offer cost-effective leasing models or modular solutions to overcome this challenge.

Technical Limitations in Specific Applications

Fiber lasers are not suitable for all materials and production needs. Some reflective metals, like copper and brass, pose processing challenges, leading to reduced beam efficiency or back reflections. Applications requiring ultra-thick material cutting may also demand alternative technologies. These technical limitations restrict fiber laser use in certain industries. Ongoing R&D is addressing these issues, but current constraints still affect adoption rates in niche markets such as heavy construction and specialized metallurgy.

Regional Analysis

North America

North America leads the Fiber Laser Market with a 39.2% share. The region benefits from advanced manufacturing infrastructure and rapid adoption of Industry 4.0 technologies. Strong demand from automotive, aerospace, and electronics industries drives fiber laser installations. The United States dominates due to its well-established industrial base and continuous R&D investment. Canada is emerging with growing applications in medical device manufacturing and precision engineering. Favorable government incentives for smart manufacturing further support growth. Strategic partnerships between OEMs and laser system providers strengthen market presence and enhance technological integration.

Europe

Europe accounts for 27.4% of the global Fiber Laser Market. Germany, Italy, and France lead adoption due to their strong automotive and industrial equipment sectors. The region emphasizes sustainable manufacturing and energy efficiency, boosting demand for fiber laser solutions. High penetration of automation and robotics enhances production efficiency. Europe’s focus on advanced welding, cutting, and marking solutions supports strong market momentum. Strict energy regulations and the shift toward eco-friendly technologies further increase adoption. Government funding for innovation and research helps maintain the region’s competitive edge in advanced manufacturing.

Asia Pacific

Asia Pacific holds 24.8% of the Fiber Laser Market, driven by China, Japan, and South Korea. The region shows strong growth due to rapid industrialization, increased electronics production, and rising automotive manufacturing. China dominates production and consumption due to its large manufacturing ecosystem and favorable government policies. Japan and South Korea focus on precision applications in microelectronics and semiconductors. Expanding EV production and infrastructure investments also boost demand. Lower labor costs and strong export capacity make the region a key manufacturing hub, strengthening its role in global supply chains.

Latin America

Latin America represents 5.6% of the Fiber Laser Market. Brazil and Mexico lead the region’s adoption, supported by growing industrialization and manufacturing modernization. Automotive and electronics industries are key growth drivers. Fiber lasers are increasingly used for welding, cutting, and marking to enhance production efficiency. The region’s shift toward smart manufacturing practices is accelerating adoption. Investment in renewable energy and metal fabrication sectors adds new application areas. However, slower technological penetration compared to other regions slightly limits growth but offers strong expansion potential in the medium term.

Middle East & Africa

The Middle East & Africa (MEA) holds a 3.0% share of the Fiber Laser Market. The region’s growth is supported by industrial diversification in the UAE and Saudi Arabia. Increasing investments in construction, oil and gas, and metal processing drive demand for high-power fiber lasers. South Africa is emerging with applications in automotive and heavy industries. Government-backed initiatives to develop local manufacturing capabilities strengthen market potential. Although adoption remains lower than other regions, strategic investments in infrastructure and technology modernization are expected to boost fiber laser integration in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By System:

- Pulsed fiber lasers

- Others

By Wavelength:

- Infrared (IR)

- Ultraviolet (UV)

By Power Range:

- Low (≤1 kW)

- Medium (1–6 kW)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fiber Laser Market features strong competition among key players such as Owens Corning, Seal Reinforced Fiberglass, Saint-Gobain Vetrotex, BLG Fiberglass, Nihon Glass Fiber Industrial, Advanced Fiber Products, Nippon Electric Glass (NEG), PPG Industries, Johns Manville, and Ashland Global Holdings. The Fiber Laser Market is becoming increasingly competitive as companies focus on innovation and efficiency to gain an edge. Manufacturers are investing in advanced laser technologies that offer high power, superior beam quality, and improved energy efficiency. Many are integrating automation, AI-driven controls, and smart monitoring systems to enhance productivity and reduce operational costs. Product portfolios are expanding to serve diverse applications in automotive, aerospace, electronics, and medical device manufacturing. Strategic collaborations, R&D investments, and capacity expansions are strengthening global supply chains. In addition, growing emphasis on sustainable and eco-friendly solutions is shaping competitive strategies across the industry.

Key Player Analysis

Recent Developments

- In April 2025, BICO Industries signed a contract with the Environmental Funds Administration (AFM) to finance the construction of a factory to produce non-woven fiberglass material by recycling fiberglass waste resulting from both its current activity (production of fiberglass mesh for reinforcing thermal systems) and by collecting it from the market.

- In November 2024, IPG Photonics Corporation introduced its YLR‑AMB dual-beam fiber laser series (1-4 kW), designed for additive-manufacturing environments. The lasers feature independently controlled core and ring beams for improved build quality, efficiency, and compact integration.

- In October 2024, Coherent Corp. introduced the EDGE FL series of high-power fiber lasers, offering 1.5 to 20 kW power levels to cut applications in the machine tool industry. Designed for high performance at competitive pricing, the series emphasizes beam quality, energy efficiency, and seamless integration with Coherent’s optics and EDGE CUT packages to provide a complete, value-driven laser-cutting solution.

- In February 2023, Saint-Gobain announced the acquisition of U.P. Twiga Fiberglass Ltd., a leader in India’s glass wool insulation market. This strategic move aims to enhance Saint-Gobain’s position in interior and façade solutions, addressing the increasing demand for energy-efficient and acoustic comfort solutions.

Report Coverage

The research report offers an in-depth analysis based on System, Wavelength, Power Range

and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for precision manufacturing applications.

- Technological innovations will enhance laser power, stability, and beam quality.

- Automation and Industry 4.0 adoption will drive wider integration across industries.

- Growing use in automotive and aerospace sectors will boost production efficiency.

- Sustainability goals will push demand for energy-efficient fiber laser systems.

- Medical and microelectronics applications will create strong growth opportunities.

- R&D investments will improve processing capabilities for complex materials.

- Emerging economies will witness increasing adoption in manufacturing operations.

- Strategic partnerships will strengthen global supply networks and market presence.

- Advanced software integration will enable real-time monitoring and predictive maintenance.Top of Form