Market Overview

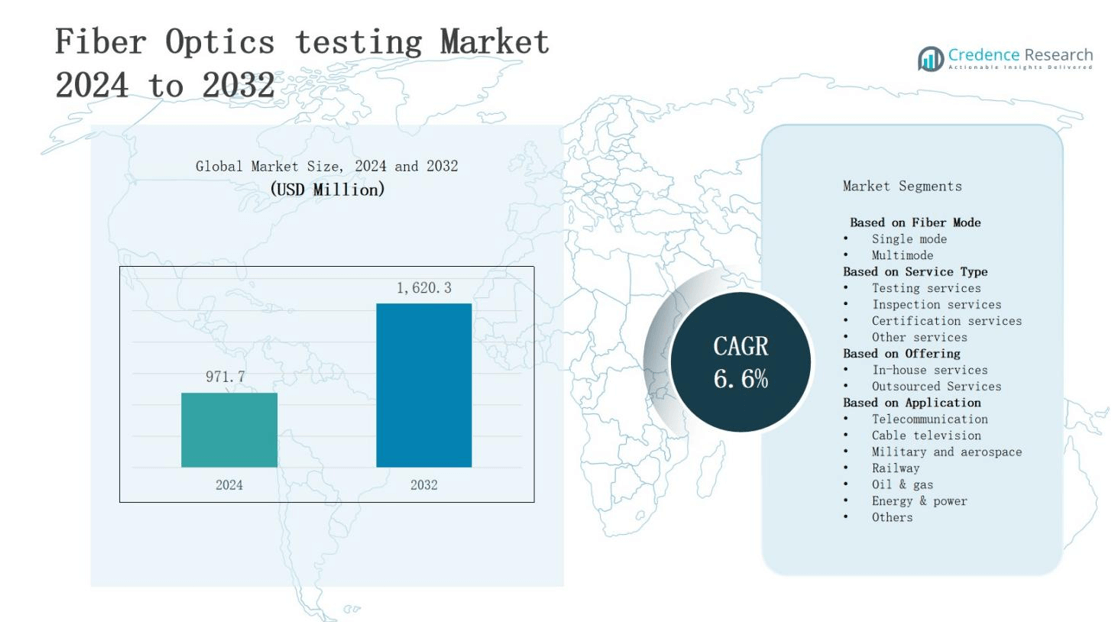

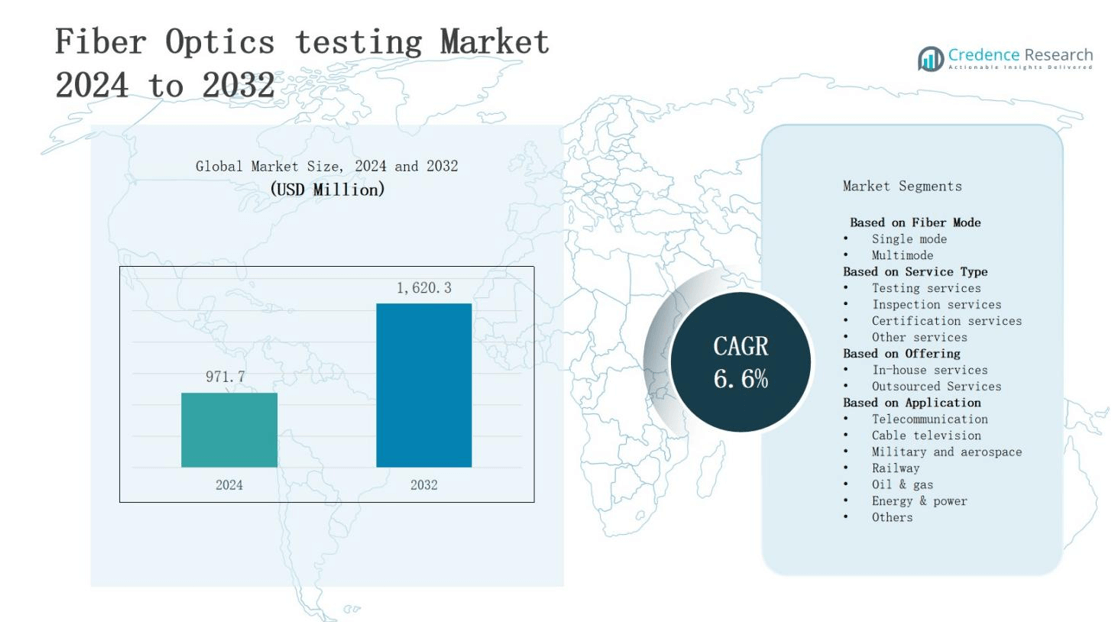

The fiber optics testing market is projected to grow from USD 971.7 million in 2024 to USD 1,620.3 million by 2032, registering a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Optics Testing Market Size 2024 |

USD 971.7 million |

| Fiber Optics Testing Market, CAGR |

6.6% |

| Fiber Optics Testing MarketSize 2032 |

USD 1,620.3 million |

The fiber optics testing market grows as demand for high-speed broadband, 5G deployment, and expanding data center networks accelerates the need for precise testing solutions. Increasing adoption of fiber in telecommunication, aerospace, defense, and industrial applications drives investment in advanced testing equipment to ensure performance, reliability, and compliance with stringent standards. Rising focus on network efficiency and low-latency communication fosters innovation in automated, portable, and cloud-enabled testing tools. Trends include integration of AI-driven analytics, real-time monitoring capabilities, and scalable testing platforms to support large-scale fiber rollouts, along with growing preference for multifunctional devices that reduce operational costs and enhance productivity.

The fiber optics testing market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing distinct growth drivers. North America leads with advanced telecom infrastructure and high 5G adoption, while Europe benefits from FTTH rollouts and strict quality standards. Asia-Pacific grows rapidly through large-scale network expansions in China, India, and Japan. The Rest of the World sees rising adoption in Latin America, the Middle East, and Africa. Key players include Corning Incorporated, Molex, Amphenol Corporation, Fujikura, Ltd., and EXFO Inc., driving innovation and global market presence.

Market Insights

- The fiber optics testing market is projected to grow from USD 971.7 million in 2024 to USD 1,620.3 million by 2032, at a CAGR of 6.6%, driven by broadband expansion, 5G rollouts, and rising data center demand.

- Increasing adoption of fiber in telecom, aerospace, defense, and industrial applications fuels investment in advanced testing solutions to ensure performance, reliability, and compliance with global standards.

- AI-driven analytics, real-time monitoring, and multifunctional portable devices are enhancing testing efficiency, reducing operational costs, and supporting large-scale network deployments.

- High equipment costs and budget constraints limit adoption for small and mid-sized operators, while the shortage of skilled technicians poses operational challenges in emerging and developed markets.

- North America leads with 35% market share, followed by Asia-Pacific at 28%, Europe at 27%, and Rest of the World at 10%, each region driven by unique infrastructure priorities.

- Strict quality regulations, FTTH expansion, and cloud adoption in Europe, along with government-led broadband projects in Asia-Pacific, sustain strong regional demand.

- Key players such as Corning Incorporated, Molex, Amphenol Corporation, Fujikura, Ltd., and EXFO Inc. drive global market growth through innovation, AI integration, and strategic partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Speed Broadband and 5G Deployment

The fiber optics testing market benefits from the rapid global expansion of high-speed broadband and 5G networks. Telecommunication operators invest heavily in fiber infrastructure to meet growing bandwidth demands. It requires precise testing to ensure signal integrity, low latency, and minimal data loss. Stringent performance standards drive adoption of advanced testing solutions. Expanding rural connectivity programs increase deployment scale. The push for reliable, high-capacity networks strengthens the market’s long-term growth outlook.

- For instance, Amazon Web Services, Google Cloud, and Microsoft Azure invest heavily in fiber optics testing to maintain uninterrupted performance and low latency across their hyperscale data centers globally.

Growth in Data Centers and Cloud Computing Infrastructure

The expansion of global data centers and cloud-based services significantly supports the fiber optics testing market. Increasing digitalization in banking, healthcare, and e-commerce requires robust, high-speed fiber connections. It drives the need for continuous performance verification and fault detection. Large-scale hyperscale data centers demand sophisticated testing tools for uptime assurance. Rising adoption of AI and big data analytics intensifies network capacity requirements. Reliable fiber networks remain essential for supporting uninterrupted service delivery.

- For instance, VIAVI Solutions’ FiberComplete PRO cuts 576-fiber cable testing from 3 days to ~1.2 days using automated MPO cable certification.

Stringent Quality Standards and Regulatory Compliance

Strict international standards for optical network performance fuel demand for advanced fiber testing solutions. It ensures compliance with specifications such as insertion loss, return loss, and OTDR analysis. Governments and industry bodies mandate rigorous inspection protocols to maintain safety and reliability. Testing tools are essential for certifying new installations and maintaining existing infrastructure. Regulatory adherence enhances customer trust and network stability. The emphasis on quality drives consistent investment in upgraded testing capabilities.

Technological Advancements in Testing Equipment

Continuous innovation in fiber testing tools enhances efficiency, accuracy, and ease of use. The fiber optics testing market increasingly adopts portable, multifunctional, and automated devices. It enables field engineers to conduct faster and more comprehensive evaluations. Integration of AI analytics improves fault detection and predictive maintenance. Cloud-based platforms allow remote data sharing and real-time monitoring. These advancements reduce operational costs, enhance productivity, and support large-scale fiber deployment projects across multiple sectors.

Market Trends

Adoption of AI-Driven and Automated Testing Solutions

The fiber optics testing market is witnessing strong adoption of AI-driven and automated testing technologies. It enables faster fault detection, predictive maintenance, and improved diagnostic accuracy. Automation reduces human error and speeds up large-scale network verification. AI algorithms enhance data interpretation, allowing proactive issue resolution before service disruption. Service providers benefit from reduced operational costs and higher efficiency. The trend supports the growing complexity of 5G, IoT, and cloud-connected networks worldwide.

- For instance, Hexatronic Data Center Systems uses machine learning algorithms for predictive degradation detection in high-density fiber deployments supporting AI data centers, ensuring early issue detection and minimal downtime.

Integration of Cloud-Based Testing and Remote Monitoring

The shift toward cloud-based platforms is reshaping the fiber optics testing market. It allows remote data access, centralized reporting, and real-time collaboration between field engineers and network managers. Cloud integration supports large-scale deployments by ensuring consistent performance tracking across regions. Remote monitoring reduces the need for on-site visits, lowering operational expenses. The approach strengthens scalability for telecom and data center operators. Cloud-enabled testing aligns with the increasing digitalization of network management processes.

- For instance, AWS CloudWatch, which provides comprehensive monitoring for cloud resources and applications, offering automated alarms and dashboards that help maintain infrastructure performance in real time.

Development of Multifunctional and Portable Testing Devices

Manufacturers are focusing on compact, multifunctional testing equipment that consolidates multiple functions into a single unit. The fiber optics testing market benefits from devices that handle OTDR analysis, power measurement, and fault localization efficiently. It improves mobility for field engineers and accelerates troubleshooting. Portability is critical for outdoor and remote network installations. This trend also caters to maintenance needs in harsh environments. Enhanced durability and battery performance increase operational flexibility.

Growing Emphasis on Green and Energy-Efficient Testing Practices

Sustainability is becoming a notable trend in the fiber optics testing market, with manufacturers designing energy-efficient tools and eco-friendly components. It reduces power consumption without compromising testing accuracy. The focus aligns with global carbon reduction targets and environmental regulations. Companies are also adopting recyclable materials in device manufacturing. Energy-conscious designs appeal to environmentally responsible network operators. This trend reflects the telecom industry’s broader shift toward sustainable infrastructure solutions and greener operational practices.

Market Challenges Analysis

High Equipment Costs and Budget Constraints

The fiber optics testing market faces challenges due to the high cost of advanced testing equipment. It requires significant capital investment, which can strain budgets for small and mid-sized service providers. Sophisticated devices with AI integration, cloud connectivity, and multifunctional capabilities come at a premium. Limited funding can delay network upgrades and maintenance activities. Operators may rely on outdated tools, risking lower testing accuracy. The cost factor can slow technology adoption in price-sensitive markets.

Shortage of Skilled Technicians and Training Requirements

A shortage of skilled fiber optics technicians presents a major obstacle to market growth. The fiber optics testing market depends on personnel who can operate advanced tools, interpret data, and follow strict testing protocols. It often requires specialized training, which can be costly and time-consuming. Without proper expertise, testing accuracy and efficiency suffer. Limited training resources in emerging regions worsen the challenge. Addressing the skills gap is essential to maintain high network performance standards.

Market Opportunities

Expansion of 5G Networks and Fiber-to-the-Home (FTTH) Deployments

The fiber optics testing market holds strong opportunities in the rapid global expansion of 5G infrastructure and FTTH projects. It requires precise and efficient testing solutions to ensure high-speed connectivity, low latency, and network reliability. Governments and telecom operators are investing heavily in fiber rollouts to meet growing data demands. Emerging markets present significant potential as broadband penetration rises. Large-scale deployments create sustained demand for advanced testing equipment. The trend positions testing providers for long-term growth.

Integration of IoT, Smart Cities, and Data Center Infrastructure

Rising adoption of IoT devices, smart city initiatives, and expanding data centers offers lucrative opportunities for the fiber optics testing market. It supports the deployment of dense fiber networks needed for high-volume data transfer. Smart infrastructure projects require continuous performance verification to maintain efficiency and reliability. Data center operators seek advanced tools for real-time monitoring and diagnostics. The growing complexity of interconnected systems amplifies the need for high-precision testing solutions, fueling sustained market expansion.

Market Segmentation Analysis:

By Fiber Mode

The fiber optics testing market is segmented into single mode and multimode fibers. Single mode dominates due to its capability to support long-distance, high-bandwidth communication with minimal signal loss. It is widely used in telecom networks, data centers, and 5G backhaul systems. Multimode fibers serve short-distance applications such as enterprise networks and LANs. Each mode requires specialized testing parameters to ensure performance. The growing demand for high-speed connectivity sustains both segments.

- For instance, Fluke Networks offers field-tough fiber testers such as the SimpliFiber Pro and CertiFiber Pro that accelerate fiber certification processes for both single mode and multimode fibers.

By Service Type

The market includes testing, inspection, certification, and other specialized services. Testing services hold the largest share, driven by the need to verify optical performance during installation and maintenance. Inspection services ensure physical and operational integrity of fiber networks. Certification services validate compliance with international standards, enhancing reliability. It supports the deployment of mission-critical networks where performance assurance is vital. The demand for end-to-end service packages is increasing.

- For instance, VIAVI Solutions’ SmartClass test equipment, which integrates fiber inspection, Tier 1 certification, and fault location into a single handheld device, enabling efficient and accurate verification of fiber links.

By Offering

Based on offering, the market divides into in-house and outsourced services. Large telecom operators and data center providers prefer in-house testing to maintain control over operations and protect proprietary data. Outsourced services appeal to smaller firms seeking cost efficiency and specialized expertise without heavy equipment investment. It enables flexible scaling of testing operations based on project needs. Both models contribute to market growth by catering to different operational strategies.

Segments:

Based on Fiber Mode

Based on Service Type

- Testing services

- Inspection services

- Certification services

- Other services

Based on Offering

- In-house services

- Outsourced Services

Based on Application

- Telecommunication

- Cable television

- Military and aerospace

- Railway

- Oil & gas

- Energy & power

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 35% share of the fiber optics testing market, driven by advanced telecom infrastructure and widespread 5G deployment. The region’s strong data center presence in the United States and Canada fuels demand for continuous network testing. It benefits from high investment in broadband expansion projects and government-backed connectivity programs. Stringent regulatory compliance and quality assurance standards increase reliance on advanced testing tools. The growing adoption of IoT and smart city applications further strengthens market growth. Service providers in the region focus on integrating AI and automation into testing operations for higher efficiency.

Europe

Europe accounts for 27% share of the fiber optics testing market, supported by rapid fiber-to-the-home (FTTH) rollouts and digital transformation initiatives. Countries such as Germany, France, and the United Kingdom lead large-scale network upgrades. It benefits from strong adoption of cloud services and cross-border data connectivity needs. EU regulations emphasize quality control and performance standards, boosting the need for certified testing services. The expansion of 5G networks across urban and rural areas accelerates demand for portable and multifunctional testing devices. Regional operators invest heavily in sustainable and energy-efficient testing technologies.

Asia-Pacific

Asia-Pacific commands 28% share of the fiber optics testing market, with growth fueled by extensive telecom network expansions in China, India, and Japan. Government-led broadband penetration programs support high-volume fiber deployments. It experiences rising demand from data centers, industrial automation projects, and smart city developments. Low-latency connectivity requirements for gaming, streaming, and enterprise applications drive innovation in testing equipment. Regional manufacturers play a key role in supplying cost-effective yet advanced solutions. The competitive landscape encourages continuous technological upgrades.

Rest of the World

The Rest of the World holds 10% share of the fiber optics testing market, driven by infrastructure projects in Latin America, the Middle East, and Africa. It sees increasing adoption of fiber in both urban and underserved areas. Investment in submarine cable projects and cross-border connectivity enhances testing requirements. Governments in the Middle East are prioritizing high-speed internet to support economic diversification. Telecom operators in Africa focus on cost-efficient solutions to expand coverage. Emerging markets present untapped potential for outsourced testing services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The fiber optics testing market is highly competitive, with companies focusing on innovation, product quality, and strategic partnerships to strengthen their market presence. Key players such as Corning Incorporated, Molex, Amphenol Corporation, Infinite Electronics International, Inc., Hitachi Information & Telecommunication Engineering, Ltd., Belden Inc., HIROSE ELECTRIC CO., LTD., Fujikura, Ltd., and EXFO Inc. lead advancements in testing solutions that enhance network performance and reliability. It is characterized by continuous investment in portable, automated, and multifunctional devices to meet the demands of telecom, data centers, and industrial sectors. Companies leverage R&D to integrate AI-driven analytics, cloud-based monitoring, and faster fault detection capabilities into their offerings. Market leaders expand their global footprint through mergers, acquisitions, and partnerships with service providers to address large-scale 5G rollouts, FTTH deployments, and international connectivity projects. Strong brand reputation, technical expertise, and after-sales support remain critical for competitive advantage, while emerging players aim to capture niche segments through cost-effective, high-precision testing solutions tailored for specific regional requirements. This dynamic environment fosters consistent technological upgrades and competitive pricing strategies.

Recent Developments

- In March 2025, VeEX Inc. introduced the industry’s first remote optical test tool aimed at enhancing fiber network construction and maintenance efficiency.

- In April 2025, Pasternack, a brand under Infinite Electronics, launched its first range of fiber optic cable assemblies, available in both standard and custom lengths with same-day shipping.

- In February 2025, Viavi Solutions, in partnership with AT&T and Verizon, began delivering the NITRO Wireless Open RAN Test Suite to ACCoRD labs to advance Open RAN testing and deployment capabilities.

- In February 2024, Korea’s Radio Frequency Association (RAPA) and Anritsu Corporation of Japan signed a Memorandum of Understanding (MoU) to collaborate on B5G and 6G technologies. This includes establishing a testing environment for validating frequency bands and technical cooperation from the proof-of-concept stage.

Market Concentration & Characteristics

The fiber optics testing market demonstrates moderate concentration, with a mix of global leaders and specialized regional players competing through technological innovation and service quality. It features established companies with extensive product portfolios, strong brand recognition, and strategic partnerships, alongside emerging firms targeting niche applications and cost-sensitive segments. Competition centers on advanced features such as AI integration, cloud-enabled monitoring, and multifunctional portable devices. The market is characterized by high entry barriers due to capital-intensive equipment, specialized technical expertise, and stringent compliance requirements. Demand is fueled by 5G rollouts, FTTH expansions, and large-scale data center deployments, creating opportunities for both in-house and outsourced service providers. Companies differentiate through performance accuracy, operational efficiency, and after-sales support, while ongoing R&D drives continuous upgrades in testing capabilities. The combination of regulatory-driven demand and evolving network technologies sustains a dynamic, innovation-led competitive environment.

Report Coverage

The research report offers an in-depth analysis based on Fiber mode, Service Type, Offering, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of AI-powered testing tools will enhance fault detection accuracy and predictive maintenance.

- Expansion of 5G networks will create sustained demand for high-performance fiber testing solutions.

- Increasing fiber-to-the-home deployments will drive the need for large-scale, rapid testing capabilities.

- Cloud-based testing platforms will enable real-time collaboration and remote diagnostics.

- Portable and multifunctional devices will become standard for field operations.

- Rising smart city projects will accelerate investment in advanced fiber network testing.

- Energy-efficient and eco-friendly testing equipment will gain preference among operators.

- Outsourced testing services will expand as smaller providers seek cost-effective solutions.

- Integration of automated testing processes will reduce operational downtime and improve efficiency.

- Demand for certified and compliant testing services will grow with stricter global quality standards.