Market Overview:

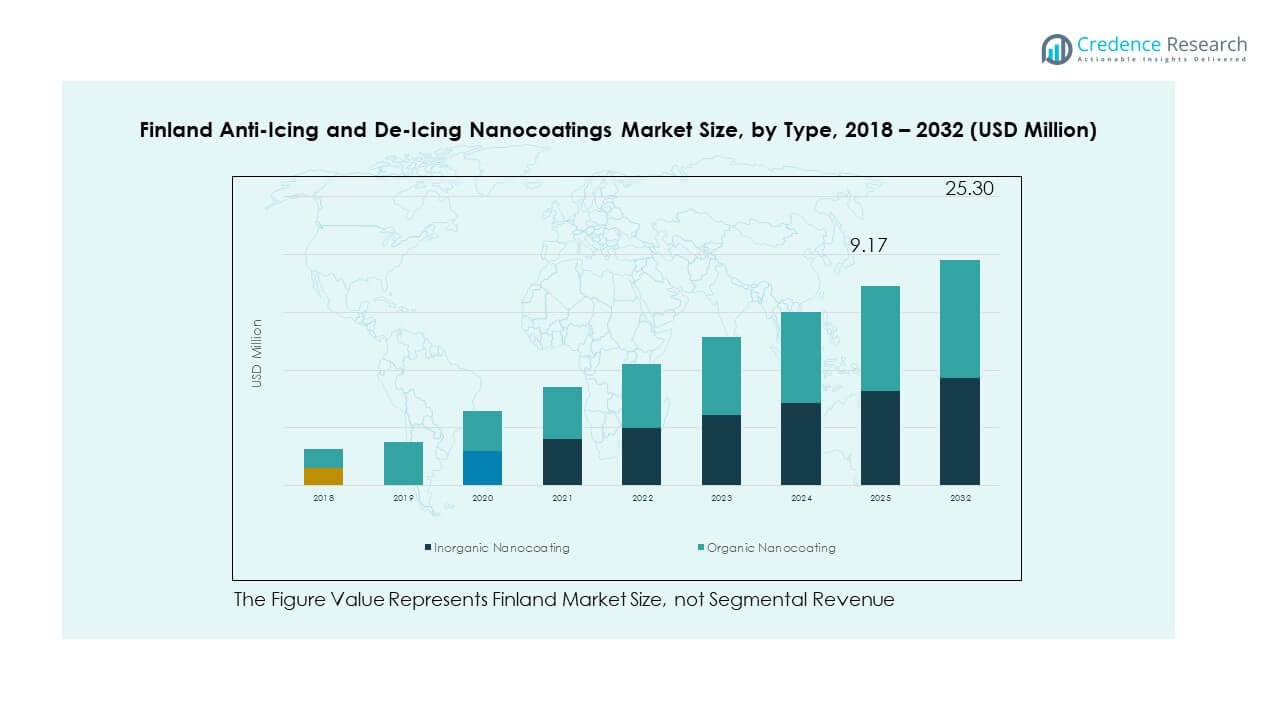

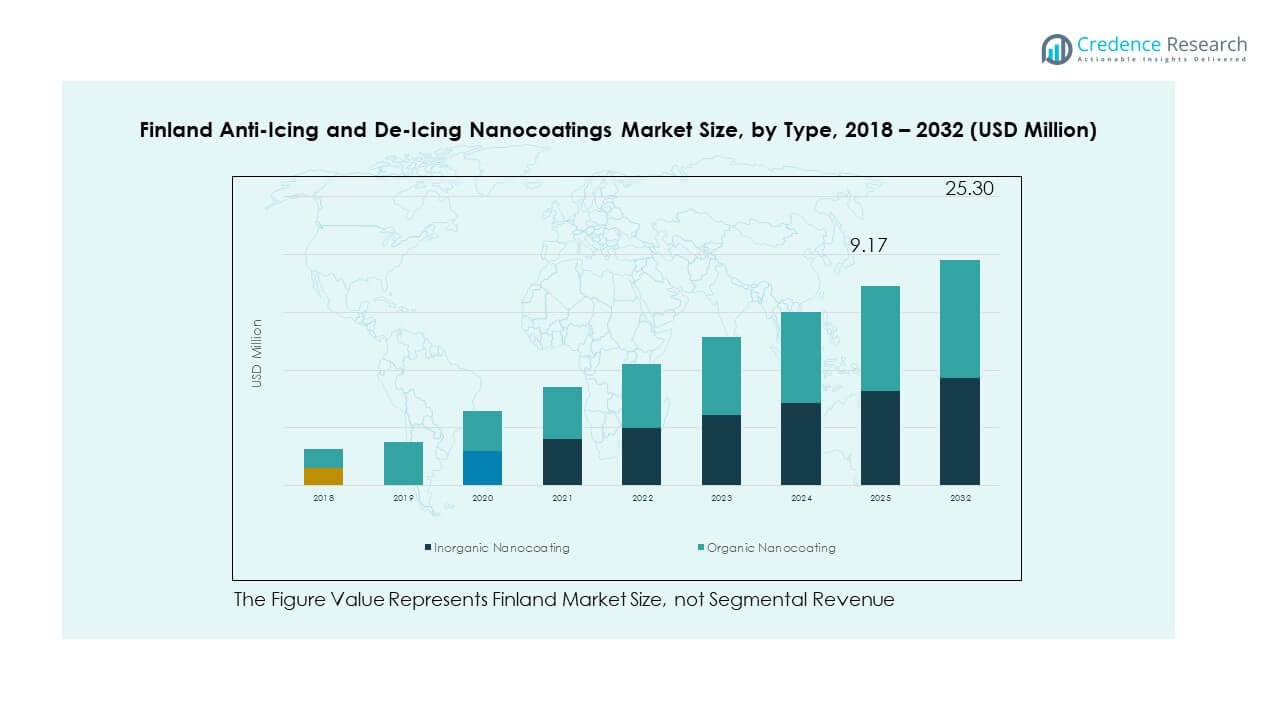

The Finland Anti-Icing and De-Icing Nanocoatings Market size was valued at USD 3.34 million in 2018 to USD 7.98 million in 2024 and is anticipated to reach USD 25.3 million by 2032, at a CAGR of 15.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Finland Anti-Icing and De-Icing Nanocoatings Market Size 2024 |

USD 7.98 Million |

| Finland Anti-Icing and De-Icing Nanocoatings Market, CAGR |

15.3% |

| Finland Anti-Icing and De-Icing Nanocoatings Market Size 2032 |

USD 25.3 Million |

Growth in this market is driven by the rising need for advanced coatings to improve safety and efficiency in extreme winter conditions. Finland’s transportation, aviation, and renewable energy sectors are investing heavily in nanocoatings that reduce ice buildup and minimize maintenance costs. Increasing demand for energy efficiency, combined with stricter safety standards, is creating favorable conditions for manufacturers to expand production and innovate. Strong R&D activities and collaborations between Finnish research institutes and global players are further strengthening the adoption of advanced solutions.

The Finland Anti-Icing and De-Icing Nanocoatings Market is driven by strong domestic demand across transport, energy, and marine sectors. Southern Finland leads with 42% share, supported by major airports, dense road networks, and research hubs in Helsinki and Turku. Western Finland holds 28% share, fueled by shipbuilding in Turku, offshore industries, and wind turbine applications in Vaasa. Eastern and Northern Finland together account for 30% share, where harsh weather, aviation hubs like Rovaniemi, and forest-based industries create steady demand for durable, sustainable nanocoating solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Finland Anti-Icing and De-Icing Nanocoatings Market was valued at USD 3.34 million in 2018, reached USD 7.98 million in 2024, and is projected to hit USD 25.3 million by 2032, growing at a CAGR of 15.3%.

- Southern Finland leads with 42% share, supported by airports, dense road networks, and industrial clusters; Western Finland follows with 28% share due to shipbuilding and offshore industries; Eastern and Northern Finland together hold 30% share, driven by harsh winters and aviation hubs.

- Northern Finland contributes to the fastest growth within the market, holding part of the 30% share, fueled by extreme weather, airport demand, and reliance on durable coatings for forest and trade industries.

- In 2024, inorganic nanocoatings accounted for 54% of the market share, favored for their durability and strong performance under severe conditions.

- Organic nanocoatings held the remaining 46% share, gaining momentum in textiles, electronics, and packaging due to their flexibility and eco-friendly properties.

Market Drivers:

Rising Demand for Safety and Efficiency in Harsh Winter Conditions

The Finland Anti-Icing and De-Icing Nanocoatings Market is strongly driven by the country’s extreme climatic conditions, which create consistent demand for reliable anti-icing solutions. Harsh winters increase risks for aviation, automotive, and infrastructure, making advanced coatings a necessity. Aviation operators invest in nanocoatings to reduce ice formation on aircraft surfaces, improving safety and cutting delays. Road and rail transport authorities also push adoption to enhance reliability and reduce accidents. Energy producers use coatings to keep wind turbine blades ice-free, securing uninterrupted power generation. The continuous focus on public safety reinforces market adoption across industries. It remains a critical driver in sectors where downtime or safety lapses have high economic and operational costs. Continuous government and private sector investments further strengthen this demand foundation.

- For instance, research at the University of Tampere verified that the Nanoksi Fotonit® coating destroys up to 98% of viruses, including influenza, on treated surfaces within two hours. The technology was applied at Helsinki Airport, where it substantially improved hygiene levels and customer satisfaction ratings.

Increasing Emphasis on Cost Efficiency and Maintenance Reduction

Cost efficiency is another key driver fueling the growth of the Finland Anti-Icing and De-Icing Nanocoatings Market. Nanocoatings reduce the need for frequent manual de-icing, saving both time and resources. Aviation companies gain operational savings by limiting the use of chemical de-icers and lowering maintenance hours. Transport operators benefit from longer-lasting performance, with fewer disruptions during peak winter months. The coatings also extend the lifespan of vehicles, infrastructure, and machinery exposed to ice. Lower corrosion and mechanical stress make nanocoatings a financially sound choice for multiple industries. It continues to attract investments from companies seeking long-term savings. Energy operators also see improved return on investment through uninterrupted production cycles. The balance between reduced costs and enhanced reliability is shaping strong adoption across key industries.

Strong Research and Innovation Ecosystem Supporting Market Expansion

The presence of research-driven universities and companies is significantly boosting the Finland Anti-Icing and De-Icing Nanocoatings Market. Finland’s innovation ecosystem focuses on nanotechnology and advanced materials, creating a strong platform for product development. Collaborations between global firms and Finnish institutes enable faster commercialization of cutting-edge coatings. The government’s support for research grants and sustainability programs accelerates these developments. It strengthens the position of Finland as a hub for advanced anti-icing technologies. Growing intellectual property portfolios and product testing facilities provide a competitive edge. International companies also view Finland as an ideal test environment due to severe winters. Local innovation attracts global attention, fostering more partnerships and cross-border projects. These dynamics make innovation a central market growth driver.

- For instance, VTT Technical Research Centre of Finland has developed bio-based nanocellulose coatings that demonstrated strong oxygen, grease, and mineral oil barrier performance, verified through peer-reviewed packaging trials and commercial pilots. The technology is recognized as a key innovation in sustainable advanced materials within Finland’s research and industrial ecosystem.

Regulatory Push for Safer and Sustainable Anti-Icing Solutions

Strict regulatory standards across aviation, transportation, and energy sectors act as strong drivers for the Finland Anti-Icing and De-Icing Nanocoatings Market. Authorities enforce rules on safety, emissions, and environmental sustainability. Coatings that limit chemical de-icer use align with regulations targeting reduced pollution. Aviation regulators mandate higher safety compliance, boosting demand for reliable nanocoatings. Transport authorities promote sustainable winter solutions for roads and rail networks. It creates strong incentives for industries to adopt nanocoatings over traditional methods. Government climate goals also support wider application of eco-friendly technologies. Regulations encourage industries to adopt advanced coatings as a standard practice. This policy-driven push continues to reinforce market expansion across sectors.

Market Trends:

Integration of Nanocoatings with Smart and Connected Systems

The Finland Anti-Icing and De-Icing Nanocoatings Market is witnessing strong adoption of smart technologies combined with coatings. Companies are integrating nanocoatings with sensors and connected systems for real-time ice detection. Aviation operators use predictive maintenance tools supported by these innovations. Energy operators monitor wind turbines using smart coatings that signal surface changes. Automotive industries explore self-reporting coatings that enhance safety in winter driving. It drives adoption of digitalized solutions across industries seeking automation. Smart nanocoatings align with Finland’s focus on digital transformation. The combination of coatings and data analytics is creating a new segment within the industry. Companies see this as a long-term trend shaping the competitive landscape.

Growing Focus on Eco-Friendly and Sustainable Coating Solutions

Sustainability is emerging as a defining trend in the Finland Anti-Icing and De-Icing Nanocoatings Market. Companies are developing coatings with reduced environmental impact by limiting chemical usage. Wind energy projects favor coatings that help meet renewable energy goals. Aviation industries explore solutions that cut emissions by reducing fuel consumption during de-icing delays. Sustainable nanocoatings align with Finland’s strong environmental policies. It ensures better compliance while supporting green transition strategies. Eco-friendly materials are gaining acceptance across international markets influenced by European regulations. Sustainable products are also enhancing brand reputation in competitive industries. Market leaders are investing heavily in R&D to maintain this trend.

- For instance, Tikkurila provides over 300 ecolabel-certified products, including coatings for anti-icing surfaces in transport and infrastructure. Its solutions comply with LEED v4.1, BREEAM v6, and carry EPDs, reinforcing sustainable adoption.

Expansion of Applications Across Multiple Industrial Verticals

The scope of the Finland Anti-Icing and De-Icing Nanocoatings Market is expanding into new industries. Beyond aviation and energy, sectors such as marine, construction, and electronics are adopting coatings. Marine transport operators adopt coatings for ice resistance in Nordic waters. Construction firms use coatings to protect infrastructure during winter. Electronics companies explore solutions for devices operating in cold climates. It demonstrates the versatility of nanocoatings across diverse applications. This cross-industry expansion boosts overall demand. Widening end-use industries ensure a broader market base for suppliers. Companies entering these verticals secure new growth opportunities.

Rising Collaborations Between International Players and Finnish Innovators

Collaborations are shaping a major trend in the Finland Anti-Icing and De-Icing Nanocoatings Market. International companies are partnering with Finnish research centers to leverage expertise. These collaborations accelerate testing and deployment of coatings under Nordic conditions. Aviation and energy firms see Finland as a natural testing hub. Joint ventures strengthen both R&D and commercialization strategies. It enables faster scaling of innovative solutions into global markets. Collaborative projects also attract funding from European institutions. This cooperation improves competitiveness in international markets. Long-term alliances are expected to dominate the innovation pipeline.

- For example, IGL Coatings, a global leader in eco-friendly ceramic nanocoatings, announced a strategic partnership in Finland with Janne Lindroos Oy for national distribution. This collaboration expands access for Finnish automotive fleets and detailing businesses to IGL’s multi-award-winning low/zero-VOC nanotech coatings, supporting sustainable maintenance practices and innovation transfer between Europe and Finland.

Market Challenges Analysis:

High Costs and Barriers to Large-Scale Adoption

One of the major challenges in the Finland Anti-Icing and De-Icing Nanocoatings Market is high product and installation costs. Developing advanced nanocoatings requires expensive raw materials and sophisticated manufacturing processes. Many small and mid-sized operators find adoption financially difficult. Industries with limited budgets often rely on traditional de-icing chemicals instead. It restricts widespread penetration, particularly outside large aviation and energy firms. Long approval cycles and testing requirements also increase the overall cost burden. Limited awareness among smaller industries further slows uptake. Price-sensitive buyers hesitate to shift from conventional methods without clear return on investment. Overcoming cost barriers remains a priority for suppliers.

Performance Reliability and Limited Awareness Among End-Users

Performance consistency under different weather conditions presents another challenge for the Finland Anti-Icing and De-Icing Nanocoatings Market. Coatings may deliver varied results depending on environmental intensity, creating concerns for operators. Industries require proven reliability before large-scale investments. Limited awareness of nanotechnology among road and rail operators reduces adoption speed. It often delays decision-making in emerging application areas. The absence of standardized testing protocols complicates product comparisons. Suppliers must educate end-users to strengthen trust in advanced coatings. Market expansion also depends on scaling awareness campaigns. Addressing knowledge gaps will determine how fast new industries adopt these technologies.

Market Opportunities:

Strong Potential in Emerging Application Areas Beyond Aviation and Energy

New opportunities are rising in the Finland Anti-Icing and De-Icing Nanocoatings Market as demand spreads beyond aviation and energy. Construction, marine, and infrastructure sectors are actively exploring coatings for performance improvement. The marine industry seeks coatings to minimize ice formation on vessels navigating Arctic waters. Infrastructure operators look for reliable coatings to reduce winter maintenance costs. It encourages suppliers to diversify product portfolios targeting new industries. Companies offering application-specific solutions gain competitive advantage. Expanding adoption across multiple industries strengthens market growth potential. Suppliers see these emerging applications as major revenue drivers.

Growing Export Potential Through International Collaboration and Technology Leadership

Export opportunities represent another key growth area for the Finland Anti-Icing and De-Icing Nanocoatings Market. Finland’s expertise positions local innovators to become global leaders in nanocoatings. International collaborations provide a platform to test and scale solutions for different climates. European regulations favor advanced coatings, creating strong export potential in nearby regions. It positions Finnish firms to supply both domestic and international demand. Market participants can leverage partnerships with global aviation and energy operators. Technology leadership ensures sustained competitiveness in future markets. Export-driven expansion enhances long-term revenue growth for domestic suppliers.

Market Segmentation Analysis:

The Finland Anti-Icing and De-Icing Nanocoatings Market is segmented

By type

Into inorganic and organic nanocoatings. Inorganic nanocoatings hold strong demand due to their durability, thermal stability, and effectiveness under extreme weather conditions. They are widely applied in aviation, transportation, and energy sectors where long-term protection is essential. Organic nanocoatings, on the other hand, are gaining traction for their flexibility, lightweight nature, and eco-friendly properties. It is attracting industries such as textiles, electronics, and packaging that require tailored, cost-effective solutions. Both types contribute significantly to market growth, offering diverse applications across sectors.

- For instance, VTT Technical Research Centre of Finland scaled plasma-assisted sol-gel inorganic nanocoatings onto polyethylene and paperboard substrates, achieving high-barrier, grease-resistant packaging films. The EU-funded Atmospheric Plasmas project proved successful industrial transition, demonstrating strong durability and performance at full coating line speeds, reinforcing Finland’s expertise in nanocoating innovation.

By application

Transportation leads the market with adoption across aviation, automotive, and railways to enhance safety and reduce maintenance. Energy is another key application, with wind turbines relying on nanocoatings to minimize ice formation and sustain performance during winters. Electronics and food packaging sectors are emerging segments, using coatings to improve durability and prevent moisture or frost damage. The textiles segment is also exploring coatings to deliver weather-resistant fabrics for outdoor and industrial use. It highlights the versatility of nanocoatings across industries, with expanding applications creating multiple growth avenues. This diverse demand pattern strengthens the long-term potential of the market.

- For instance, Natural Resources Institute Finland (Luke) created biobased nanoparticle coatings using spruce needle wax, esterified lignins, and waxes. These coatings improved textile hydrophobicity from a WCA of 43° to ~150°, while maintaining breathability and adding antibacterial and UV-blocking functions, verified through trials at Finnish pilot plants.

Segmentation:

By Type

- Inorganic Nanocoating

- Organic Nanocoating

By Application

- Transportation

- Textiles

- Energy

- Electronics

- Food & Packaging

- Others

Regional Analysis:

The Finland Anti-Icing and De-Icing Nanocoatings Market is shaped strongly by domestic demand from transport and energy sectors. Southern Finland holds 42% share, supported by its dense road networks, major airports, and industrial clusters. The region’s harsh winters and high traffic volume create consistent need for effective nanocoating solutions. Research institutes and universities in Helsinki and Turku drive innovation, reinforcing product development and testing. International firms often pilot advanced coatings in this region due to its infrastructure readiness. Strong adoption in public infrastructure projects enhances regional growth.

Western Finland accounts for 28% share, driven by its strong marine and offshore industries. Shipbuilding activity in Turku and growing demand for maritime safety solutions increase adoption of anti-icing coatings. It benefits from collaborations between coating manufacturers and shipping operators seeking cost-effective ice protection. Local innovation hubs also encourage smaller firms to develop sustainable nanocoatings suited for marine use. Industrial zones across Vaasa support energy-related applications, especially in wind turbines exposed to freezing conditions. Strong export activity in this region further strengthens its market presence.

Eastern and Northern Finland together hold 30% share, supported by extreme weather conditions and extensive forest-based industries. Northern Finland’s aviation hubs, such as Rovaniemi, demand reliable anti-icing coatings for airport infrastructure and aircraft maintenance. Harsh climatic conditions drive high dependency on durable solutions. Eastern Finland contributes with its cross-border trade and road networks, where consistent icing risk raises adoption. Research in cold-climate material science supports innovation tailored for these regions. It creates opportunities for specialized coatings that align with EU environmental regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Battelle

- PPG

- Fraunhofer

- Hygratek

- Nanosonic

- Luna Innovations

- Nanovere Technologies

- NEI Corporation

- Cytonix

- Other Key Players

Competitive Analysis:

The Finland Anti-Icing and De-Icing Nanocoatings Market features strong competition shaped by both domestic innovators and international players. Companies such as Battelle, PPG, and Fraunhofer lead with extensive R&D capabilities and established global networks. Local firms and research institutions in Helsinki, Turku, and Vaasa strengthen the ecosystem by piloting advanced coatings tailored to Finland’s harsh winter conditions. It creates an environment where international players often collaborate with Finnish research centers to accelerate product testing and deployment. Global players dominate aviation and energy applications, while smaller Finnish innovators contribute to niche solutions in marine, infrastructure, and textiles. Competitive strategies focus on innovation, sustainability, and cost efficiency. Firms invest in developing coatings that reduce reliance on chemical de-icers, improve durability, and align with EU environmental standards. It drives continuous product launches targeting critical sectors such as transportation and wind energy. Strategic partnerships between Finnish universities and international manufacturers provide a steady pipeline of innovations. Companies expand market presence through acquisitions, collaborations, and regional pilots in Finland’s infrastructure projects.

Recent Developments:

- In February 2025, PPG introduced its non-BPA HOBA Pro 2848 coatings for aluminum bottles at Paris Packaging Week, reinforcing its commitment to sustainable and innovative coating solutions while strengthening its position in advanced coatings markets.

- In January 2025, a Riga-based nanocoating startup, Naco Technologies, secured €1.5 million in a pre-Series A funding round co-led by Radix Ventures. It will use the funding to build a production facility in Poland and accelerate its international expansion, especially for coatings that improve hydrogen production efficiency.

- In October 2024, PPG announced a strategic portfolio shift by agreeing to sell its US and Canada architectural coatings business to American Industrial Partners, with the deal expected to close by early 2025. The move allows PPG to redirect resources toward high-growth segments such as advanced coatings, including anti-icing nanocoatings designed for Nordic climates.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Finland Anti-Icing and De-Icing Nanocoatings Market will expand as transport and aviation prioritize advanced safety solutions.

- Wind energy operators will strengthen demand for nanocoatings to ensure efficiency in cold weather.

- Marine industries in Western Finland will adopt coatings to reduce risks in offshore operations.

- Public infrastructure projects will integrate nanocoatings to improve road, rail, and airport reliability.

- Research institutes in Helsinki and Turku will drive innovation through partnerships with global firms.

- Local companies will explore specialized coatings for textiles, electronics, and consumer applications.

- EU environmental regulations will encourage industries to adopt eco-friendly nanocoating technologies.

- Strategic collaborations will grow between Finnish innovators and international manufacturers to expand market presence.

- Export opportunities will rise as Finland positions itself as a leader in cold-climate nanocoatings.

- Increasing awareness among smaller industries will widen adoption across non-traditional applications.