Market Overviews

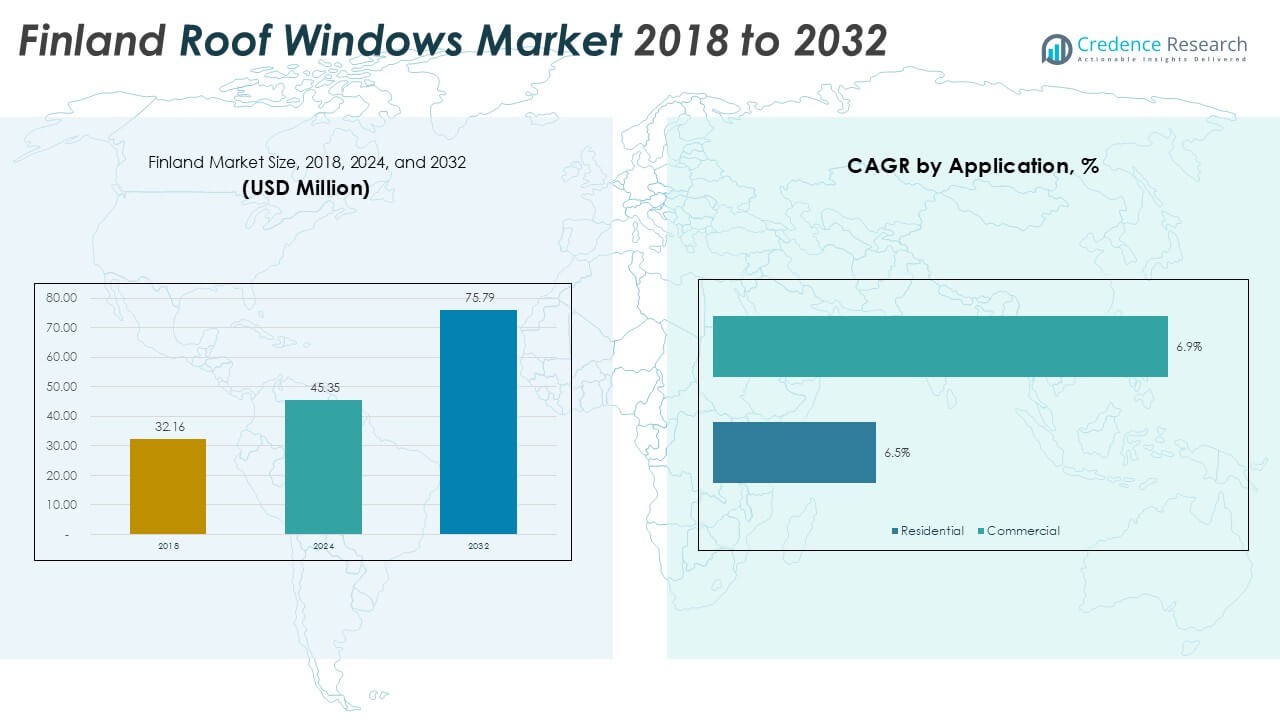

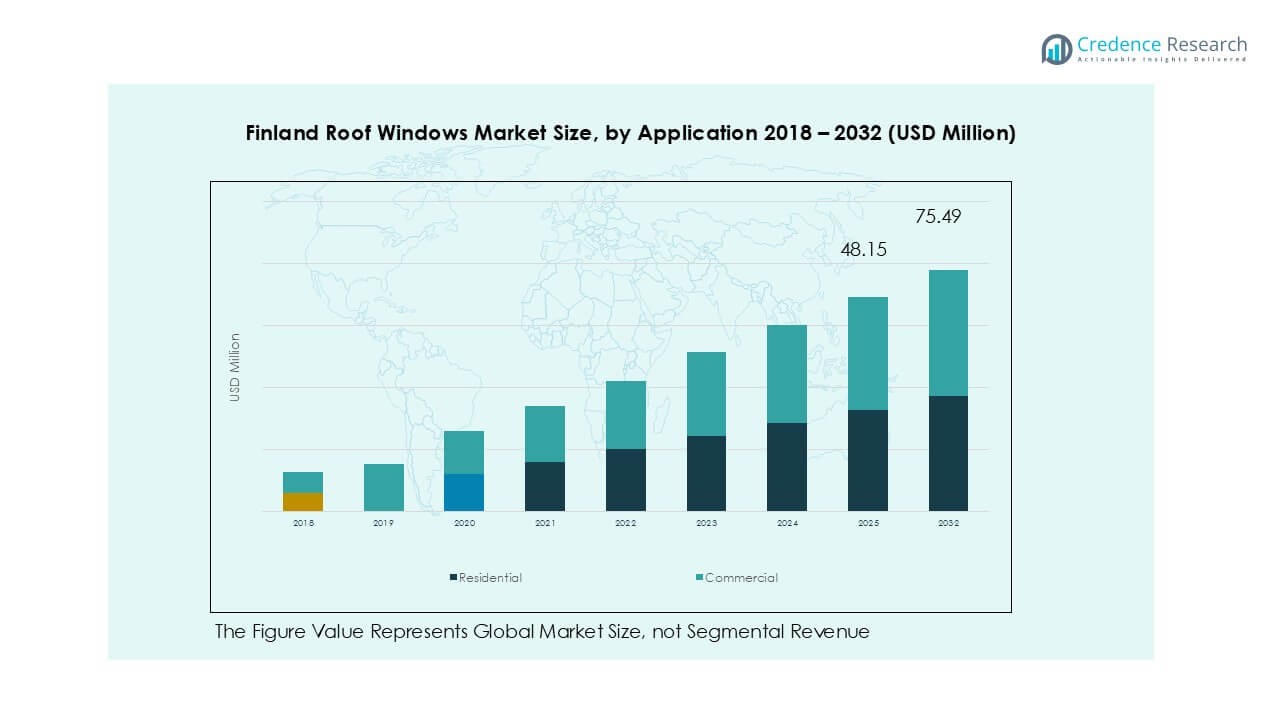

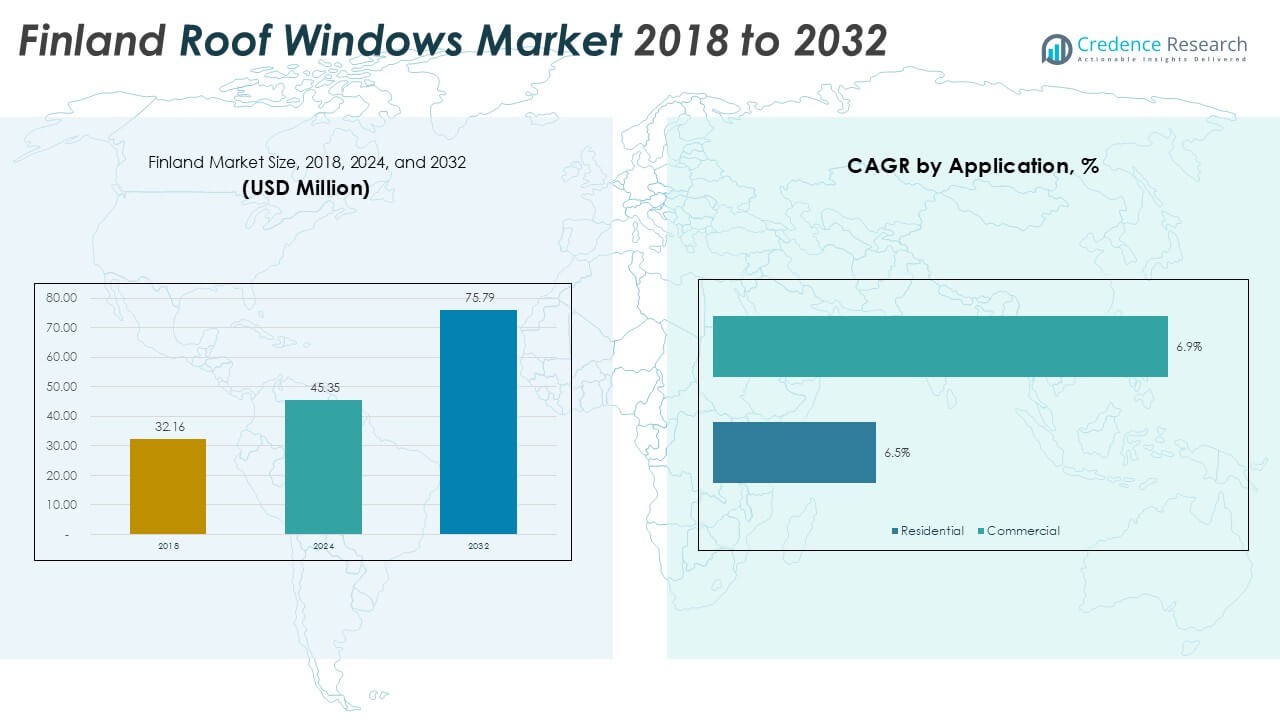

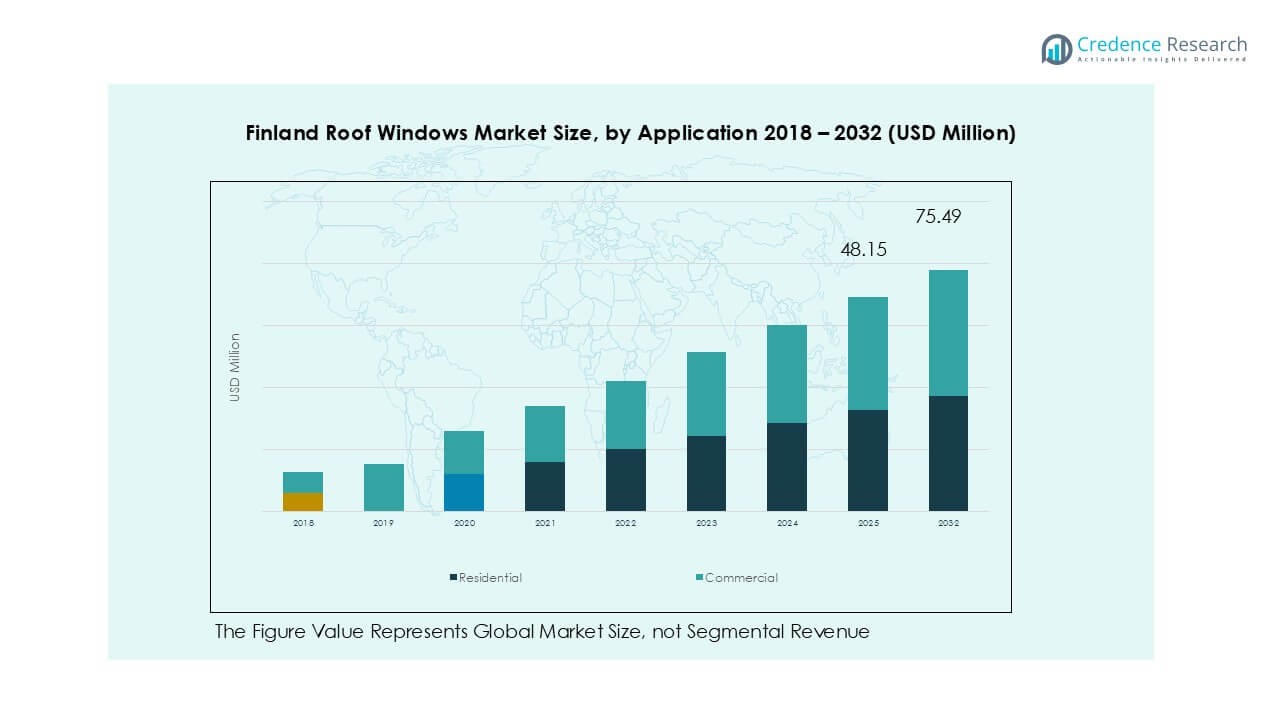

Finland Roof Windows market size was valued at USD 32.16 million in 2018 to USD 45.35 million in 2024 and is anticipated to reach USD 75.79 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Finland Roof Windows Market Size 2024 |

USD 45.35 Million |

| Finland Roof Windows Market, CAGR |

6.6% |

| Finland Roof Windows Market Size 2032 |

USD 75.79 Million |

The Finland Roof Windows market is led by Velux Group, Lammin Ikkuna Oy, Tiivi, Lumon Suomi Oy, and Pihla Group, which together account for a major share of installations nationwide. Velux Group holds a strong presence with a wide portfolio of double- and triple-glazed solutions and smart home-compatible models. Lammin Ikkuna Oy focuses on sustainable wooden and PU-framed windows, while Tiivi and Pihla Group drive growth in renovation projects with customizable designs. Southern Finland leads the market with over 35% share, supported by dense urban housing and green building initiatives. Western Finland follows with about 25%, fueled by strong renovation activity and prefabricated housing projects, while Eastern and Northern regions contribute steadily through rural residential upgrades and tourism-driven construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Finland Roof Windows market was valued at USD 45.35 million in 2024 and is projected to reach USD 75.79 million by 2032, growing at a CAGR of 6.6% during the forecast period.

- Rising energy-efficiency regulations and government renovation incentives are key drivers boosting adoption of double- and triple-glazed roof windows across residential projects.

- Trends include growing preference for smart, automated roof windows and increasing use of triple glazing to meet near-zero energy building standards.

- The market is moderately consolidated with Velux Group, Lammin Ikkuna Oy, Tiivi, Lumon Suomi Oy, and Pihla Group competing through product innovation, sustainable materials, and factory-assembled solutions.

- Southern Finland leads with over 35% market share, followed by Western Finland at 25%, while residential applications dominate with more than 65% share, driven by renovation and daylight optimization initiatives; commercial projects also grow steadily with focus on energy performance in offices and hotels.

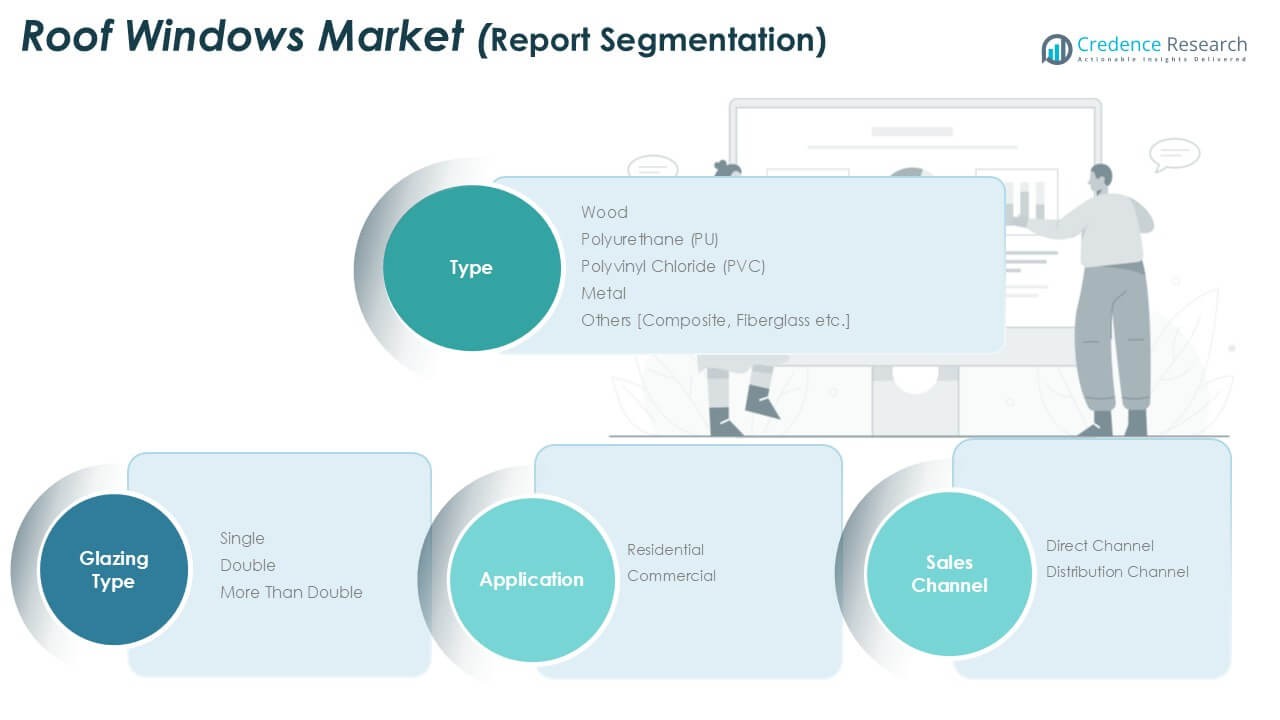

Market Segmentation Analysis:

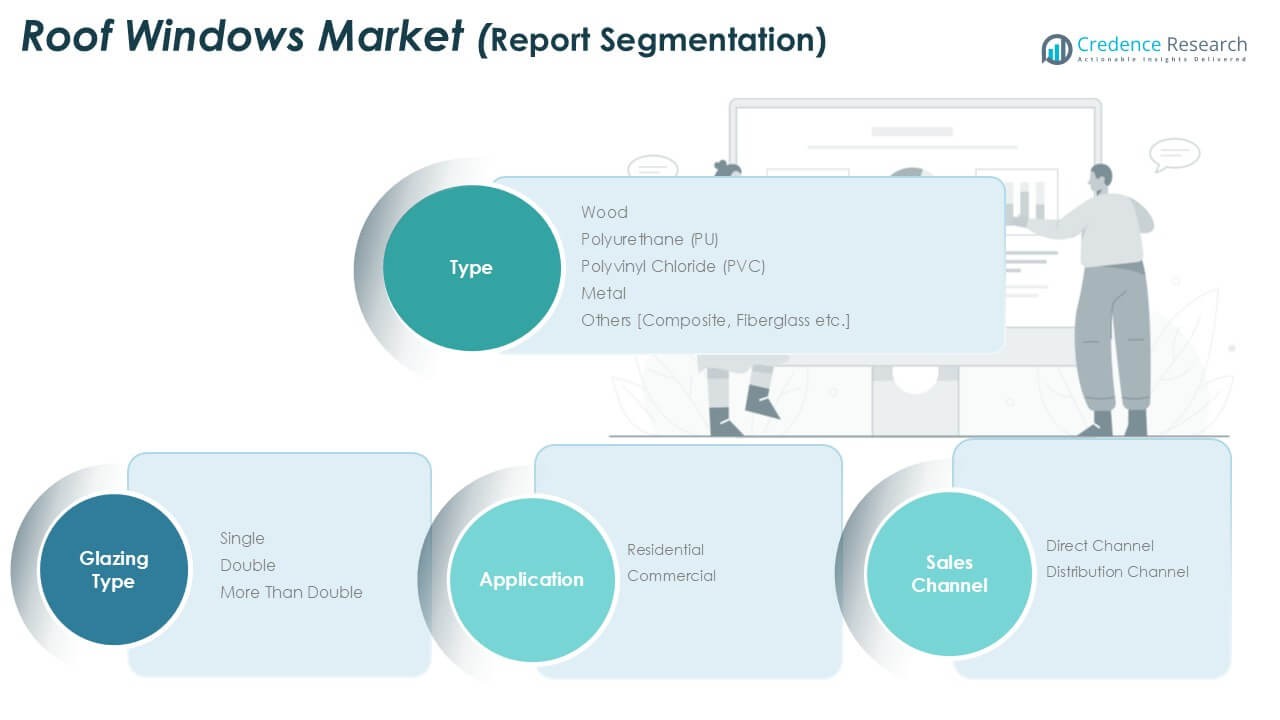

By Type

The Finland Roof Windows market is segmented into wood, polyurethane (PU), polyvinyl chloride (PVC), metal, and others. Wood dominates with over 40% market share, driven by its natural insulation properties and aesthetic appeal for Nordic architecture. Wood frames are widely preferred in residential projects due to their durability and energy efficiency, aligning with Finland’s strict building codes. PU and PVC windows gain traction for low maintenance and moisture resistance, particularly in bathrooms and kitchens. Metal variants serve niche industrial and commercial projects where strength and security are prioritized.

- For instance, Lammin Ikkuna Oy offers fixed wood-aluminium windows with U-values typically ranging from 0.76 to 1.0 W/m²K, depending on the specific glazing. More advanced models, such as their Eko Watti energy windows, can achieve even lower U-values.

By Application

The market is classified into residential and commercial applications, with residential leading at over 65% share. Strong housing renovation activity and rising demand for energy-efficient homes fuel growth in this segment. Roof windows enhance natural daylight, reducing dependence on artificial lighting and improving indoor air quality. Commercial applications include offices, educational institutions, and hospitality spaces focusing on wellness and sustainability certifications. Government incentives for green building projects further boost adoption of roof windows in both new builds and retrofits, supporting long-term market expansion.

- For example, Pihla Termo wood-aluminium windows can reach U-values as low as 0.63 W/m²K in their energy-saving quad-/triple-glazed variants.

By Glazing Type

Glazing types include single, double, and triple or more glazed roof windows, with double glazing holding over 50% share. Double-glazed windows balance cost, insulation, and noise reduction, making them the preferred choice in most residential and small commercial projects. Triple-glazed solutions are gaining popularity in Finland due to extreme winter conditions, offering superior thermal efficiency and compliance with near-zero energy building standards. Single-glazed windows are now limited to cost-sensitive applications. Growing awareness of energy savings and carbon footprint reduction continues to drive upgrades toward advanced glazing solutions.

Key Growth Drivers

Rising Energy-Efficiency Regulations

Finland enforces strict energy-efficiency standards, boosting demand for advanced roof windows. Homeowners and builders prefer energy-rated products that improve thermal insulation and reduce heating costs during long winters. Double- and triple-glazed roof windows help meet near-zero energy building requirements. This trend is supported by government incentives for retrofitting older housing stock. Manufacturers invest in low-U-value designs and integrated ventilation systems to meet these regulations. The push for sustainable housing continues to be a strong growth catalyst for the Finland roof windows market.

- For instance, Finland requires new buildings to use glazing with U-values no higher than 1.0 W/(m²·K) for windows and external doors.

Increasing Renovation and Remodeling Activities

Renovation projects dominate Finland’s construction sector, driving consistent roof window installations. Many detached homes and summer cottages undergo upgrades to enhance natural lighting and energy performance. Skylights and roof windows are preferred solutions for adding daylight to attics and upper floors. Renovation grants and tax benefits offered by the Finnish government encourage homeowners to adopt energy-efficient solutions. Rising consumer interest in improving indoor comfort further fuels demand. This steady renovation cycle provides a reliable revenue stream for market players across the country.

- For instance, Finland offers a tax deduction for household expenses related to certain work, including energy improvements. The maximum deduction for most household work is €1,600 per person annually. However, a higher maximum deduction of €3,500 is available for expenses related to replacing an oil heating system with a more sustainable energy source. This enhanced deduction is a temporary measure set to expire after the 2027 tax year.

Growing Adoption of Smart Home Solutions

Smart home integration acts as a significant growth driver for the roof windows market. Consumers increasingly demand automated and sensor-based windows that open or close based on temperature, rain, or air quality. These solutions improve ventilation and energy management while offering convenience. Leading manufacturers introduce Wi-Fi-enabled roof windows and remote-control systems compatible with mobile apps. The trend aligns with Finland’s tech-savvy population and rising adoption of IoT-based home solutions. This driver also creates opportunities for premium-priced, value-added products.

Key Trends & Opportunities

Rising Popularity of Modular and Prefabricated Homes

Finland sees strong demand for modular and prefabricated homes, opening opportunities for pre-installed roof windows. Prefab construction allows manufacturers to offer integrated daylight solutions that meet energy standards. Builders favor factory-assembled roof windows for consistent quality and reduced onsite labor. The trend also supports faster project completion times, especially in urban housing developments. This creates a growing market for tailored solutions from window manufacturers who collaborate with prefab home builders.

- For instance, Hawo Suomi Oy builds prefabricated tiny homes and holiday houses sized from 21 m² to 54 m², including lofts, in factories for fast delivery and installation.

Shift Toward Triple-Glazing Solutions

Triple-glazed roof windows are gaining traction as Finland focuses on reducing carbon emissions and improving building performance. These windows offer superior insulation, noise reduction, and comfort compared to double-glazed alternatives. Builders use triple-glazing to comply with EU directives for near-zero energy buildings. Although the cost is higher, long-term savings on energy bills make it attractive to consumers. Manufacturers continue to innovate with lightweight triple-glass units, making installation easier and appealing to a broader market segment.

- For instance, manufacturers also develop thin triple insulating glass units; one innovation uses a total glazing thickness near 25 mm while maintaining performance similar to traditional thicker units.

Key Challenges

High Installation and Maintenance Costs

Roof windows involve higher installation costs compared to conventional windows, which can deter adoption. Skilled labor is required to ensure proper sealing and insulation to avoid leaks. Maintenance of wooden frames, including repainting and resealing, adds to long-term expenses. Price-sensitive customers may delay or avoid installation, limiting penetration in budget-conscious segments. Market players must address cost concerns with prefabricated kits, DIY-friendly solutions, or financing options to broaden accessibility.

Seasonal Demand Fluctuations

The market faces seasonal demand challenges due to Finland’s harsh winter conditions. Construction activity slows during extreme cold months, delaying installations and affecting sales cycles. Manufacturers and distributors must manage inventory carefully to avoid overstocking or shortages. Seasonal peaks require strong logistics and project planning to meet tight timelines during spring and summer. These fluctuations create operational and cash flow challenges for suppliers, impacting overall market stability.

Regional Analysis

Southern Finland

Southern Finland leads the roof windows market with over 35% market share, supported by dense urbanization and strong residential construction. Cities like Helsinki, Espoo, and Turku see high demand for roof windows in new housing projects and renovations. Growing adoption of energy-efficient and smart home solutions fuels sales, with double- and triple-glazed windows preferred for thermal performance. Renovation subsidies and strict energy codes encourage homeowners to upgrade old windows. Commercial spaces, including offices and retail buildings, also integrate roof windows to enhance natural light and comply with green building certifications.

Western Finland

Western Finland holds around 25% market share, driven by strong industrial and residential development in cities like Tampere and Vaasa. Renovation activity is a major growth driver as older housing stock is upgraded for energy efficiency. Homeowners favor wooden and PU roof windows for aesthetic and thermal benefits. Demand for triple-glazed models is rising to meet near-zero energy building requirements. Prefabricated housing projects in the region boost demand for factory-assembled roof windows. The presence of leading manufacturers and distributors ensures strong product availability and installation services.

Eastern Finland

Eastern Finland accounts for close to 15% market share, with growth supported by smaller-scale residential projects and rural housing renovations. Roof windows are commonly installed to improve daylighting in detached houses and cottages. Energy-efficiency incentives encourage the use of double- and triple-glazed windows to reduce heating costs in cold winters. Adoption remains price-sensitive, favoring durable but cost-effective PVC and PU frames. Distribution networks are expanding to meet demand in remote areas. Seasonal construction patterns affect sales volume, but renovation activities provide consistent demand throughout the year.

Northern Finland (Lapland)

Northern Finland, including Lapland, holds about 10% market share but shows growing interest due to tourism-driven construction. Hotels, lodges, and cabins increasingly adopt roof windows to maximize natural light and enhance guest experiences during long daylight periods. Triple-glazed solutions dominate this region because of extreme cold and the need for superior insulation. Seasonal demand peaks during spring and summer, aligning with active construction periods. Government funding for energy-efficient housing projects in remote areas supports market expansion. Distribution logistics and higher installation costs remain challenges but create opportunities for local installers.

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- Southern Finland

- Western Finland

- Eastern Finland

- Northern Finland (Lapland)

Competitive Landscape

The Finland Roof Windows market is moderately consolidated, with key players including Velux Group, Lammin Ikkuna Oy, Tiivi, Lumon Suomi Oy, and Pihla Group leading the competition. Velux Group dominates with a broad range of double- and triple-glazed roof windows, smart control systems, and strong brand recognition. Lammin Ikkuna Oy focuses on energy-efficient wooden and PU-framed solutions tailored for Nordic climates. Tiivi and Pihla Group emphasize customization and high-performance glazing for residential renovations, while Lumon Suomi Oy leverages its expertise in glass solutions to expand daylighting products. International players such as Glazing Vision Ltd and DK ROOF A/S compete through premium skylight offerings. The competitive focus is on product innovation, sustainability compliance, and partnerships with construction firms. Companies invest in R&D for low-U-value windows, IoT-enabled automation, and factory-assembled kits to meet rising demand for energy-efficient and smart home solutions, strengthening their presence across Finland.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lammin Ikkuna Oy

- Velux Group

- DK ROOF A/S

- Toft Kobber ApS

- Tiivi

- Lumon Suomi Oy

- Skylights Plus

- UnikFunkis A/S

- Lonsdale Metal Co

- Jonas Vinduer

- Pihla Group

- Glazing Vision Ltd

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for triple-glazed roof windows will rise due to stricter energy-efficiency standards.

- Renovation projects will continue to drive installations in residential and summer cottages.

- Smart and automated roof window systems will gain higher adoption in urban homes.

- Manufacturers will focus on low-U-value designs to meet near-zero energy building requirements.

- Prefabricated housing growth will create opportunities for factory-fitted roof window solutions.

- Partnerships between window makers and construction firms will strengthen distribution networks.

- Use of sustainable and recyclable frame materials like wood and PU will expand.

- Commercial building projects will adopt roof windows to meet green certification goals.

- Seasonal demand planning and local installation services will become more efficient.

- Innovation in lightweight glazing solutions will simplify installation and boost market penetration.