Market Overview

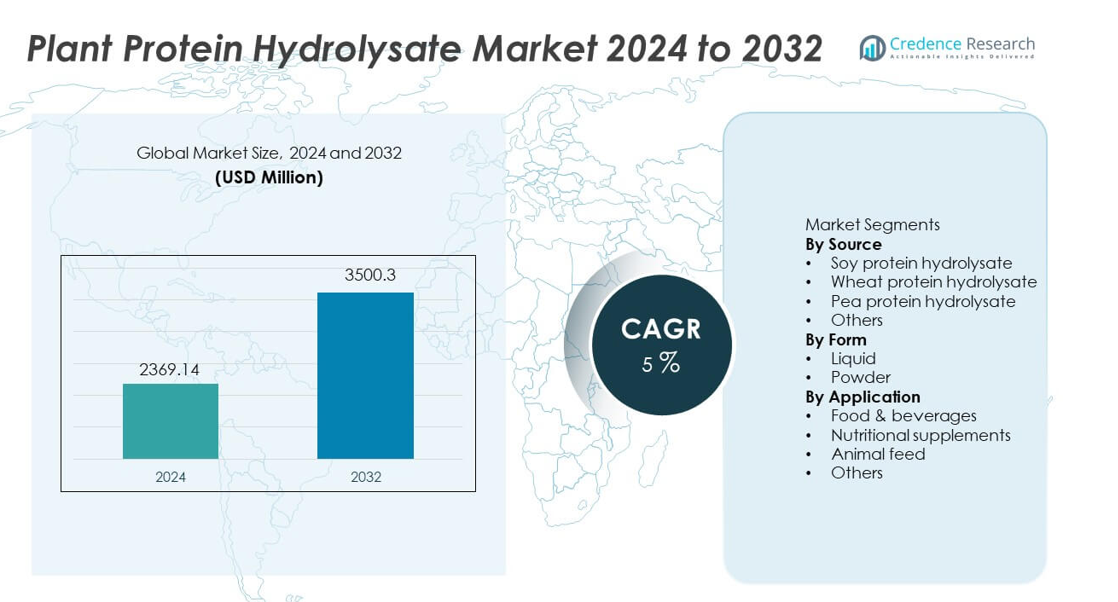

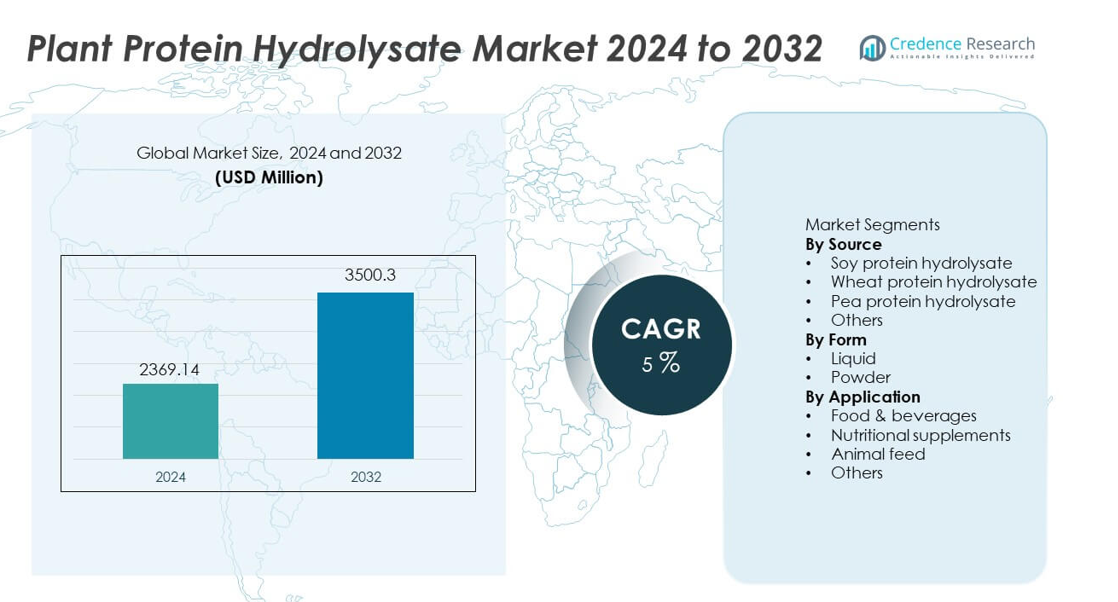

The Plant Protein Hydrolysate market was valued at USD 2,369.14 million in 2024 and is projected to reach USD 3,500.3 million by 2032, expanding at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant Protein Hydrolysate Market Size 2024 |

USD 2,369.14 million |

| Plant Protein Hydrolysate Market, CAGR |

5% |

| Plant Protein Hydrolysate Market Size 2032 |

USD 3,500.3 million |

Top players in the Plant Protein Hydrolysate market include Kerry Group, Archer Daniels Midland Company, Cargill, Tate & Lyle, Glanbia PLC, FrieslandCampina, Arla Foods, Ingredion, Corbion, and Axiom Foods, each expanding their presence through advanced enzymatic processes, functional protein formulations, and broader use in supplements and fortified foods. These companies strengthen competitiveness by improving digestibility, solubility, and amino acid profiles for sports nutrition and clinical applications. North America leads the market with 36% share, supported by strong fitness adoption and nutraceutical use, followed by Europe with 30% share, driven by sustainable sourcing, clean-label requirements, and rising demand across performance nutrition and dietary products.

Market Insights

- The Plant Protein Hydrolysate market reached USD 2,369.14 million in 2024 and will reach USD 3,500.3 million by 2032, growing at a CAGR of 5.

- Demand rises as plant-based performance nutrition expands, with soy protein hydrolysate leading the source segment at 38% share due to cost-effective sourcing and high amino acid levels.

- Trends increase as pea and wheat protein hydrolysates gain visibility in functional beverages and clean-label nutritional supplements supported by allergy-friendly and sustainable characteristics.

- Competition strengthens as leading companies invest in enzymatic hydrolysis, flavor masking, and improved solubility to enhance product acceptance in sports and clinical nutrition categories.

- North America leads with 36% share, followed by Europe at 30%, Asia Pacific at 22%, Latin America at 7%, and Middle East and Africa at 5%, reflecting global adoption of plant-based performance protein solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Soy protein hydrolysate leads this segment with 38% share, supported by high amino acid content, cost-effective sourcing, and wide use in performance nutrition and functional foods. Pea protein hydrolysate grows steadily as a clean-label alternative with strong digestibility and allergen-friendly properties. Wheat protein hydrolysate remains important in bakery applications but shows slower growth due to gluten concerns. Other emerging plant sources expand through rising interest in sustainable protein options. Growth remains driven by fitness nutrition, plant-based diets, and expanding use of hydrolyzed proteins in ready-to-drink beverages.

- For instance, Kerry Group reported a facility upgrade that supported clean-label plant protein production across Europe. Kerry has invested in a significant facility upgrade in Georgia, USA, which more than doubles the previous capacity and supports the growing demand for alternative protein markets.

By Form

Powder accounts for 62% share, driven by strong demand in sports supplements, meal replacements, and dry premixes. Powder formulations offer longer shelf life, easier transport, and higher stability in functional blends. Liquid hydrolysates hold steady presence in beverages and infant nutrition, but remain secondary due to storage limitations and shorter shelf stability. The shift toward plant-based protein shakes and fortified snacks continues to strengthen powder adoption. Manufacturers introduce instantized and flavored hydrolysate powders to widen usage across foodservice and retail channels.

- For instance, Glanbia Nutritionals scaled its instantized plant hydrolysate capacity, improving solubility for performance drinks and ready-to-mix blends. Glanbia offers various plant-based protein solutions, such as its BevEdge Pea Protein, which is designed for superior dispersibility and flavor in powdered drink mixes, a notable improvement over conventional plant proteins that mix poorly.

By Application

Nutritional supplements dominate with 44% share, supported by strong use in sports nutrition, protein shakes, and recovery formulas. Food and beverage products adopt hydrolyzed proteins to enhance protein density in dairy alternatives, bakery products, and functional beverages. Animal feed applications grow through improved digestibility and suitability as sustainable alternatives to animal protein concentrates. Other uses include medical nutrition, clinical formulations, and specialized dietary products. Rising fitness awareness, aging populations, and interest in fast-absorbing protein support strong demand across multiple application areas.

Key Growth Drivers

Increasing Demand for Clean-Label and Plant-Based Proteins

Demand rises as consumers shift toward plant proteins due to sustainability concerns, lactose intolerance, and growing interest in vegan and flexitarian diets. Plant protein hydrolysates offer high digestibility and faster absorption that support sports nutrition and active lifestyles. Manufacturers highlight natural sourcing, allergen-free profiles, and non-GMO formulation. Foodservice brands expand their use in dairy alternatives and functional beverages, strengthening commercial adoption. Clean-label positioning and protein enrichment trends continue driving expansion across multiple end-use categories.

- For instance, Tate & Lyle expanded plant-based ingredient output in Indiana to serve global clean-label food manufacturers. The expansion efforts have included investment in production lines and a focus on speciality starches, which are key components in many plant-based and clean-label food and drink products.

Rising Use in Sports Nutrition and Performance Products

Growth accelerates as athletes and fitness users adopt plant protein hydrolysates for post-workout recovery and muscle support. Hydrolyzed proteins help deliver faster amino acid uptake and improved digestion compared to conventional plant proteins. Supplements, protein bars, and ready-to-drink performance beverages increasingly include hydrolysate ingredients. Brands expand formulations for vegan athletes seeking high-quality protein sources. Increasing awareness of plant-based fitness nutrition supports strong adoption in advanced sports markets.

- For instance, Arla Foods Ingredients validated rapid-absorption characteristics through clinical studies showing that their whey protein hydrolysates are “pre-digested” for faster access to the bloodstream.

Expanding Application in Clinical and Nutritional Products

Plant protein hydrolysates gain acceptance in infant formulas, medical foods, and clinical nutrition due to hypoallergenic properties and enhanced digestibility. Growing demand for protein-enriched clinical diets, especially among seniors and patients with digestive disorders, supports long-term market potential. Regulatory approval for plant-based ingredients expands opportunities in specialized healthcare segments. Innovative research increases the use of plant hydrolysates in therapeutic nutrition and immune-support products.

Key Trends & Opportunities

Innovation in Functional and Flavored Protein Products

Manufacturers develop flavored and functional hydrolysates that improve taste and nutritional performance across beverages, bars, and fortified foods. Natural sweeteners, flavor masking, and instant solubility enhance product acceptance. This trend opens opportunities for premium protein snacks and meal replacement formulations.

- For instance, Corbion developed protein hydrolysate blends, helping developers meet targeted nutrition profiles in fortified snacks.

Growth of Sustainable and Non-Allergen Protein Sources

Sustainable sourcing and non-allergen protein options such as pea and rice hydrolysates gain momentum among health-conscious users. Companies promote eco-friendly sourcing, lower environmental impact, and non-GMO formulations. Demand strengthens in regions with rising plant-based diets and sustainability awareness.

- For instance, Ingredion produces plant-based protein concentrates and flours from peas at its Canadian plant, supporting non-allergen supply across global markets. The facility in Vanscoy, Saskatchewan, underwent significant expansion and upgrades to align with stringent manufacturing and quality standards, producing a range of protein products suitable for various food and beverage applications.

Key Challenges

Higher Production Costs Compared to Conventional Proteins

Plant protein hydrolysates require specialized processing, enzymatic hydrolysis, and quality control, which raise production costs. These price points limit adoption in cost-sensitive markets and restrict mainstream penetration. Manufacturers pursue scale efficiencies and alternative supply chains to manage cost pressures.

Taste, Texture, and Formulation Limitations

Bitterness and off-flavors affect consumer perception, especially in liquid formulations. Texture challenges require flavor masking and ingredient optimization. Improving palatability remains critical for expanding use in beverages and performance supplements.

Regional Analysis

North America

North America leads the market with 36% share, supported by high adoption of plant-based sports nutrition, protein-fortified beverages, and vegan dietary products. The United States drives strong demand for pea and soy hydrolysates in performance supplements and functional foods. Rising awareness of protein enrichment among aging consumers supports clinical nutrition applications. Major brands expand retail availability through e-commerce and health-focused stores. Growing plant-based trends and fitness culture continue strengthening product uptake across mainstream channels.

Europe

Europe holds 30% share, driven by rising preference for sustainable protein sources, clean-label products, and non-allergen ingredients. Countries including Germany, the UK, and France drive strong adoption in sports supplements and medical nutrition. Nutraceutical manufacturers increasingly incorporate hydrolyzed proteins due to digestibility and amino acid availability. Sustainability commitments and non-GMO sourcing requirements encourage industry innovation. Growing vegan populations and interest in performance nutrition continue driving category expansion across the region.

Asia Pacific

Asia Pacific accounts for 22% share, supported by growing fitness awareness, rising disposable income, and expanding demand for protein-fortified foods. China, Japan, and India show increased consumption driven by sports supplements and plant-protein functional beverages. Pea and soy hydrolysates gain strong acceptance due to traditional plant protein consumption patterns. Local manufacturers invest in nutraceutical and clinical formulations to target fast-growing urban markets. Government focus on nutrition programs strengthens long-term opportunities.

Latin America

Latin America captures 7% share, driven by increasing adoption of sports nutrition and plant-based health products across Brazil, Mexico, and Argentina. Fitness culture encourages wider acceptance of hydrolyzed proteins in supplements and fortified beverages. Economic conditions affect premium product demand, but rising wellness awareness supports steady growth. Local brands introduce affordable plant protein products using regional supply chains, strengthening price competitiveness.

Middle East & Africa

Middle East and Africa hold 5% share, supported by gradual adoption of plant-based dietary solutions and rising urban fitness trends in Gulf countries and South Africa. Nutritional supplements gain visibility through pharmacies and specialty nutrition stores. Limited local production increases reliance on imported hydrolyzed proteins, especially for sports and clinical applications. Awareness campaigns and increasing e-commerce penetration support long-term category development.

Market Segmentations:

By Source

- Soy protein hydrolysate

- Wheat protein hydrolysate

- Pea protein hydrolysate

- Others

By Form

By Application

- Food & beverages

- Nutritional supplements

- Animal feed

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading companies such as Kerry Group, Archer Daniels Midland Company, Cargill, Tate & Lyle, Glanbia PLC, FrieslandCampina, Arla Foods, Ingredion, Corbion, and Axiom Foods, all working to expand plant protein hydrolysate offerings across nutritional supplements, functional foods, and sports beverages. Major players invest in enzymatic hydrolysis technologies, flavor masking solutions, and improved protein solubility to enhance functionality in finished products. Companies focus on sustainable sourcing and allergen-free formulations to support clean-label positioning. Strategic partnerships with nutraceutical and food manufacturers help strengthen global distribution and product development. Regional players introduce affordable plant-based proteins using locally sourced materials, intensifying competition. Premium brands emphasize high amino acid profiles and rapid absorption benefits to capture demand among fitness consumers, while new entrants target specialized dietary applications including medical and infant nutrition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, Ingredion introduces all-new Pea Protein VITESSENCE Pea 100 HD, This new product is helpful in keeping cold pressed bars soft till the end of their shelf life. Along with nutrition benefits for consumer preference, that ensures the bars have the desired texture and sensory attributes throughout their shelf life.

- In February 2024, Roquette, a plant-based ingredient manufacturer, released four new pea protein products designed to improve flavor, mouthfeel, and overall performance in plant and protein foods. Newest in the NUTRALYS offering are the isolates NUTRALYS Pea F853M and NUTRALYS H85 (hydrolysate) and textured versions NUTRALYS T Pea 700FL and NUTRALYS T Pea 700M.

- In November 2023, Agri Sciences Biologicals introduced Yaarn, a hydrolyzed protein-based growth-promoting product for farmers’ crop cultivation. Yaarn is made from sheep wool and uniquely contains a highly efficient and exclusive blend of hydrolyzed proteins, peptides, and amino acids which confers multiple benefits—specifically to increase nutrient uptake, improve the quality of fruits, and boost overall yield and plant vigor.

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plant-based performance proteins will rise among fitness consumers.

- Clinical nutrition use will expand due to hypoallergenic and digestible profiles.

- Functional beverages and fortified snacks will adopt more hydrolyzed protein.

- Pea and sustainable plant sources will gain higher adoption in mainstream products.

- Flavor masking and solubility improvement will support wider product acceptance.

- Premium formulations will increase for recovery-focused sports nutrition ranges.

- E-commerce channels will enhance visibility across global supplement markets.

- Clean-label compliance will drive removal of artificial additives from formulations.

- Local sourcing and regional processing will help reduce production costs.

- Long-term R&D investment will focus on amino acid optimization and bioavailability.