Market Overview:

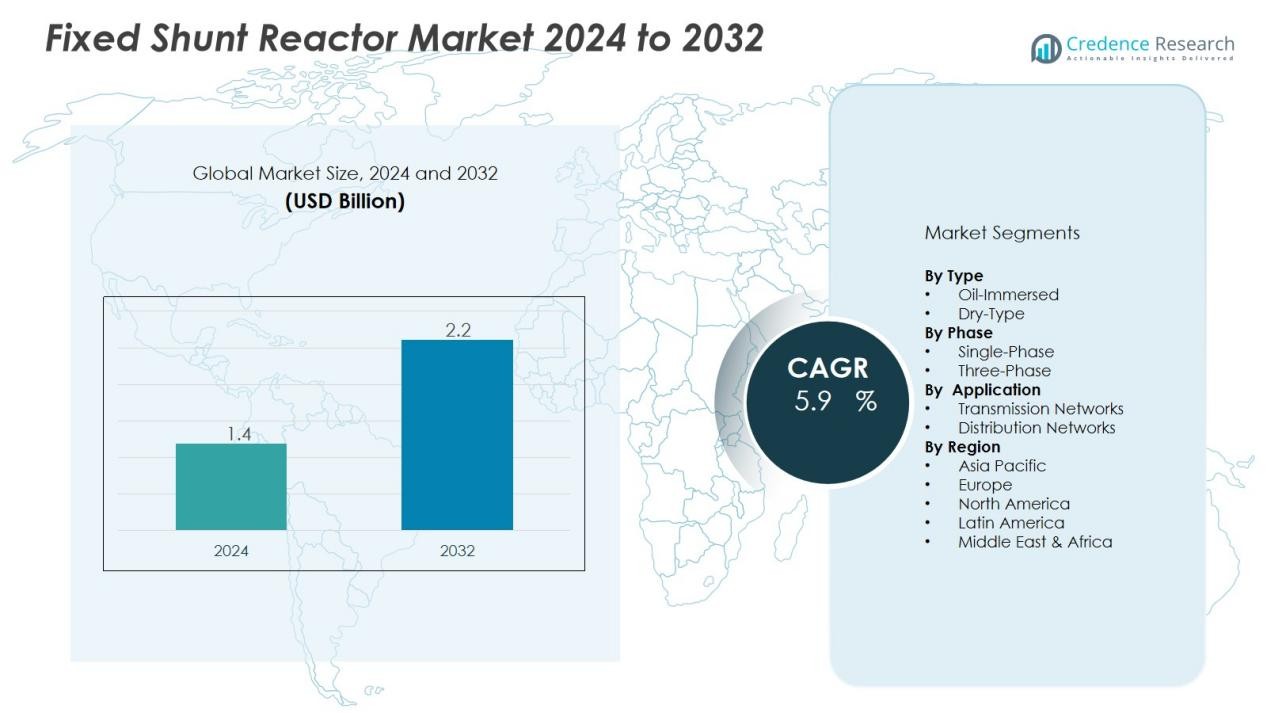

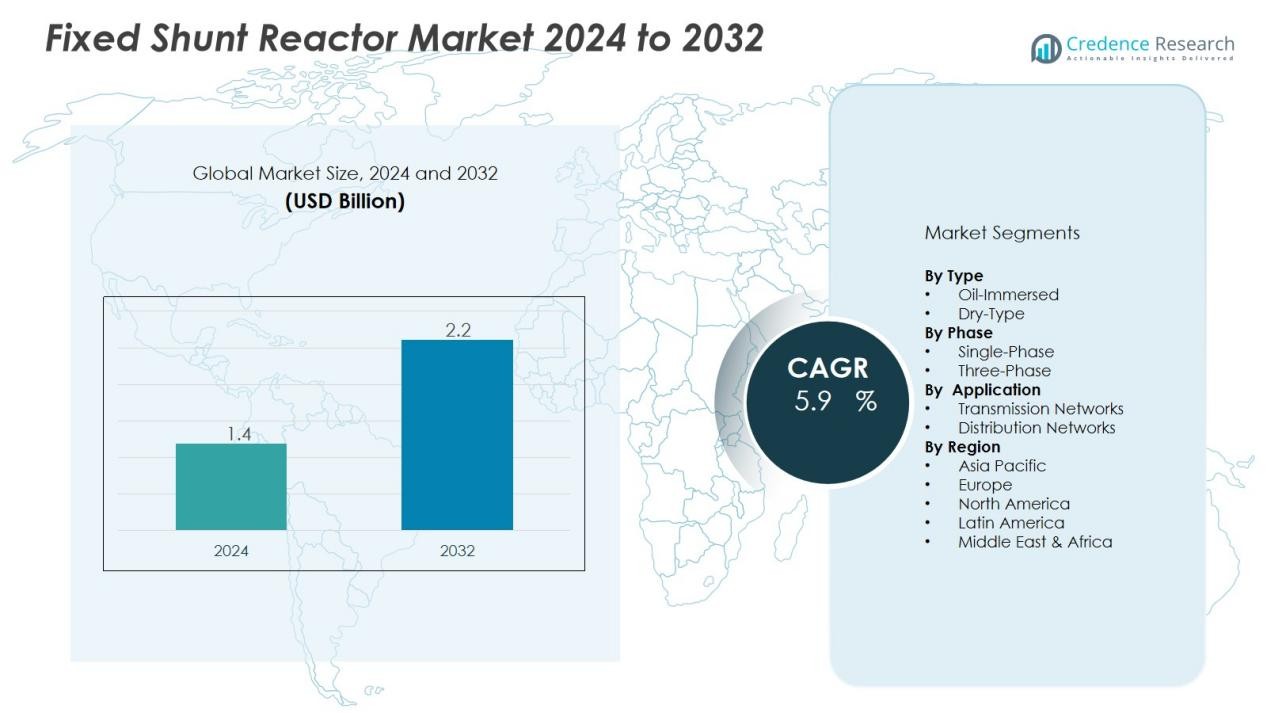

The fixed shunt reactor market size was valued at USD 1.4 billion in 2024 and is anticipated to reach USD 2.2 billion by 2032, at a CAGR of 5.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Shunt Reactor Market Size 2024 |

USD 1.4 Billion |

| Fixed Shunt Reactor Market, CAGR |

5.9% |

| Fixed Shunt Reactor Market Size 2032 |

USD 2.2 Billion |

Key drivers include the increasing focus on reducing transmission losses, expanding high-voltage networks, and enhancing grid reliability. The adoption of renewable energy projects and the push for energy efficiency in developing and developed economies further support market expansion. Growing investments in smart grid technologies and rising urbanization also contribute to the market’s momentum, creating consistent demand for shunt reactors in diverse grid applications.

Regionally, Asia Pacific dominates the market, led by China and India’s rapid grid expansion and renewable energy integration. Europe follows, with strong demand driven by cross-border electricity networks and decarbonization goals. North America shows steady growth supported by grid modernization programs. Meanwhile, the Middle East, Africa, and Latin America present emerging opportunities, fueled by electrification initiatives and rising investments in power infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The fixed shunt reactor market was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.2 billion by 2032, growing at a CAGR of 5.9%.

- The market is driven by the need to reduce transmission losses, expand high-voltage networks, and ensure grid reliability.

- Integration of renewable energy and modernization projects accelerate adoption, with fixed shunt reactors stabilizing variable power flows.

- Rising urbanization and industrial growth in developing economies boost demand for efficient and reliable power infrastructure.

- High installation costs and complex maintenance remain major challenges, limiting adoption in budget-constrained regions.

- Asia Pacific leads the market with 42% share, supported by China and India’s rapid grid expansion and renewable integration.

- Europe holds 27% and North America 20%, both driven by renewable commitments and grid modernization initiative.

Market Drivers:

Growing Demand for Voltage Stability and Grid Reliability:

The fixed shunt reactor market benefits from the rising need for voltage stability in power systems. With grids operating under higher loads, maintaining steady voltage becomes critical to avoid failures. Fixed shunt reactors absorb reactive power and support efficient grid operation under varying demand. It plays an important role in ensuring reliable electricity supply in both developed and developing regions. Utilities continue to adopt these solutions to improve network resilience.

- For instance, General Electric secured multi-million-dollar contracts in February 2024 to supply 765 kV fixed shunt reactors to the Power Grid Corporation of India (PGCIL), enhancing voltage stability in one of the world’s largest transmission networks.

Expansion of High-Voltage Transmission and Distribution Networks:

The expansion of high-voltage transmission networks drives consistent demand for fixed shunt reactors. Growing electricity consumption across industrial, commercial, and residential sectors requires robust grid infrastructure. Fixed shunt reactors provide effective control over reactive power in large-scale transmission systems. It enables utilities to minimize energy losses while supporting stable and efficient power delivery. Governments and private players invest in new installations to meet rising power needs.

- For instance, Siemens has produced over 820 fixed shunt reactor units with a mean time between failures (MTBF) of 872 years, highlighting their reliability in stabilizing high-voltage transmission networks and supporting efficient power delivery.

Integration of Renewable Energy and Grid Modernization Initiatives:

The integration of renewable energy into national grids boosts the adoption of fixed shunt reactors. Wind and solar power introduce variability that challenges voltage control and grid balance. Fixed shunt reactors help stabilize networks and improve efficiency in renewable-rich systems. It supports the transition toward cleaner energy by ensuring seamless integration of intermittent sources. Grid modernization projects further accelerate investments in advanced reactor solutions.

Rising Urbanization and Industrial Growth Driving Energy Infrastructure:

The fixed shunt reactor market gains traction from urbanization and rapid industrialization in emerging economies. Growing cities and industries demand reliable electricity distribution supported by advanced grid infrastructure. Fixed shunt reactors reduce transmission losses and improve overall power efficiency in expanding networks. It ensures stable performance even under fluctuating loads, supporting industrial growth and urban expansion. Rising infrastructure investments further strengthen market prospects.

Market Trends:

Rising Focus on Renewable Integration and Energy Efficiency:

The fixed shunt reactor market is witnessing strong momentum from renewable energy integration. Countries are rapidly deploying wind and solar projects that require advanced grid stabilization measures. Fixed shunt reactors help control voltage fluctuations and optimize reactive power in renewable-rich systems. It plays a vital role in enabling transmission operators to handle intermittent energy flows while maintaining efficiency. The trend aligns with global energy transition goals, pushing utilities to modernize infrastructure. Governments and private entities are investing heavily in transmission upgrades, strengthening long-term demand for reactor installations.

- For Instance, In 2018, Oman Electricity Transmission Company (OETC) installed 290 MVAr of fixed 400 kV shunt reactors connecting the Sur Power Plant and the New Izki Grid Station to address excessively high voltage levels caused by the new gas-fired Sur Power Plant, specifically the Ferranti effect, and not due to renewable energy projects.

Increasing Adoption of Smart Grid Technologies and Digital Monitoring:

The adoption of smart grid technologies is reshaping demand patterns in the fixed shunt reactor market. Utilities are deploying digital monitoring systems to enhance performance, improve asset management, and reduce operational costs. It enables real-time control, predictive maintenance, and better integration of distributed energy resources. Fixed shunt reactors with smart monitoring features are gaining traction, ensuring higher reliability in modern grids. The trend highlights a shift toward intelligent power systems where efficiency and automation are priorities. Growing emphasis on minimizing energy losses and enhancing operational flexibility further drives this transformation.

- For instance, Siemens delivered three 120 – 300 MVAr variable shunt reactor units with integrated digital monitoring to Hornsea Project One in the UK, enabling remote condition monitoring with temperature sensing accuracy within ±1 °C.

Market Challenges Analysis:

High Installation Costs and Maintenance Complexity Limiting Adoption:

The fixed shunt reactor market faces challenges due to high upfront installation costs. Large-scale reactors require significant capital investment, making adoption difficult for utilities with limited budgets. It also demands specialized equipment and skilled labor, raising project expenses further. Maintenance complexity creates added pressure, as reactors must be regularly monitored for safe and efficient performance. Utilities in emerging economies often delay projects because of financial constraints. These cost barriers limit widespread deployment, especially in smaller-scale networks.

Technical Limitations and Integration Challenges in Modern Grids:

The fixed shunt reactor market is also challenged by technical limitations in advanced grid environments. Reactors may not adapt easily to rapidly changing load conditions or dynamic energy flows. It requires precise coordination with other grid equipment, creating operational complexity. Poor integration can lead to inefficiencies and reduced system performance. In regions with high renewable penetration, balancing fluctuating energy sources further complicates usage. These issues push utilities to seek alternative solutions, slowing adoption in certain markets.

Market Opportunities:

Expansion of Renewable Energy Projects Creating New Growth Potential:

The fixed shunt reactor market has significant opportunities from the global shift toward renewable energy. Growing investments in wind and solar power increase the demand for reliable grid stabilization solutions. Fixed shunt reactors provide critical support by managing voltage levels and enhancing reactive power control. It ensures smooth integration of intermittent energy sources into existing transmission networks. Governments are funding large-scale renewable projects that require advanced grid equipment. This creates a steady pipeline of opportunities for manufacturers and service providers.

Smart Grid Development and Emerging Market Investments Driving Adoption:

The fixed shunt reactor market is also positioned to benefit from smart grid initiatives. Utilities are adopting digital technologies and automation to improve efficiency and reduce losses. Fixed shunt reactors integrated with monitoring systems fit well into these advanced infrastructures. It enables predictive maintenance, better asset utilization, and higher operational reliability. Emerging economies are investing heavily in modernizing power networks to support rapid urbanization and industrialization. These infrastructure upgrades open new opportunities for deploying fixed shunt reactors at scale.

Market Segmentation Analysis:

By Type:

The fixed shunt reactor market is segmented into oil-immersed and dry-type reactors. Oil-immersed reactors dominate due to their higher efficiency and suitability for high-voltage applications. It provides effective cooling and longer operational life, making it preferred for large utility projects. Dry-type reactors are gaining traction in urban and indoor installations due to safety and lower maintenance requirements. Growing demand for compact and environmentally safe solutions is supporting this segment’s growth.

- For instance, ABB’s gapped-core oil-immersed fixed shunt reactors include units rated up to 150 MVAr at 300 kV, with over 2,500 reactors manufactured and in service globally since the 1970s.

By Phase:

The market is divided into single-phase and three-phase configurations. Single-phase reactors are widely used in long transmission lines to maintain voltage stability and reduce losses. It offers flexibility and ease of deployment in diverse transmission applications. Three-phase reactors are preferred in industrial and high-capacity grid systems requiring uniform performance. The growing expansion of large-scale power infrastructure boosts the demand for three-phase installations. Utilities are investing in both segments to meet system-specific requirements.

- For instance, EMIS offers a single-phase AC line reactor, model PQR series, rated for 230 VAC and currents ranging from 2A to 1000A at 50 Hz, designed to reduce current spikes and harmonic distortion while protecting variable frequency drives with an impedance of 4%.

By Application:

The fixed shunt reactor market finds application in transmission and distribution networks. Transmission networks account for the largest share due to rising investments in high-voltage grid expansion. It plays a critical role in reactive power control and loss reduction in long-distance electricity transmission. Distribution networks also drive demand, especially with growing urbanization and localized grid development. Integration of renewable energy and smart grid upgrades is creating new opportunities across applications. Both segments are expected to expand steadily with ongoing infrastructure modernization.

Segmentations:

By Type:

By Phase:

By Application:

- Transmission Networks

- Distribution Networks

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific:

Asia Pacific holds 42% market share in the fixed shunt reactor market, making it the leading region. China and India contribute significantly due to rapid industrialization, grid expansion, and renewable energy integration. It benefits from large-scale investments in high-voltage transmission and cross-border interconnection projects. Governments in the region focus on reducing transmission losses and improving energy efficiency. Rising urbanization and population growth further increase electricity demand, driving continuous grid development. Manufacturers are targeting Asia Pacific with cost-effective solutions to serve growing infrastructure needs.

Europe:

Europe accounts for 27% market share in the fixed shunt reactor market, supported by renewable energy deployment. Countries such as Germany, France, and the UK are leading investments in smart grids and transmission upgrades. It is driven by strong commitments to decarbonization and cross-border electricity networks. Fixed shunt reactors help manage reactive power in grids with high renewable penetration. The region also benefits from stringent energy regulations that encourage efficient transmission systems. Utilities across Europe continue to adopt advanced reactor technologies to support stability and reliability.

North America:

North America secures 20% market share in the fixed shunt reactor market, with steady growth across the United States and Canada. Grid modernization initiatives and replacement of aging infrastructure remain key growth factors. It is influenced by rising electricity demand from commercial and industrial sectors. Renewable integration, especially wind and solar, strengthens the need for effective voltage control. The region’s utilities invest heavily in digital monitoring systems to improve grid resilience. These efforts create consistent opportunities for fixed shunt reactor suppliers and technology providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- Siemens

- General Electric Company

- Crompton Greaves Consumer Electricals Limited

- Fuji Electric Co., Ltd.

- TOSHIBA CORPORATION

- Mitsubishi Electric Corporation

- Trench Group

- NISSIN ELECTRIC Co., Ltd.

- Hilkar

- Hitachi Energy Ltd

- TBEA

Competitive Analysis:

The fixed shunt reactor market is highly competitive with the presence of global and regional players. Key companies include ABB, Siemens, General Electric Company, Crompton Greaves Consumer Electricals Limited, Fuji Electric Co., Ltd., Toshiba Corporation, Mitsubishi Electric Corporation, Trench Group, NISSIN ELECTRIC Co., Ltd., and Hilkar. It is driven by continuous investments in technology, efficiency improvements, and smart monitoring solutions. Leading players focus on strengthening their portfolios through product innovation and large-scale utility partnerships. Regional manufacturers compete by offering cost-effective solutions tailored to local infrastructure needs. The market also reflects a growing emphasis on digital integration, predictive maintenance, and eco-friendly designs. Competition remains intense, with players targeting growth opportunities in Asia Pacific, Europe, and North America.

Recent Developments:

- In June 2025, ABB launched four new robots at Automatica 2025 in Munich including the IRB 6730S, IRB 6750S, and IRB 6760, emphasizing increased robot density and energy efficiency with the OmniCore platform.

- In July 2025, Siemens completed a $5.1 billion acquisition of Dotmatics, a life sciences R&D software provider.

- In September 2025, GE Aerospace partnered with BETA Technologies for hybrid electric flight technology development.

Report Coverage:

The research report offers an in-depth analysis based on Type, Phase, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The fixed shunt reactor market will expand with continued investments in high-voltage transmission networks.

- It will gain momentum from renewable energy integration, supporting voltage stability in variable generation systems.

- Utilities will adopt advanced fixed shunt reactors with digital monitoring features to enhance efficiency.

- It will benefit from government initiatives focused on reducing transmission losses and improving power quality.

- Smart grid development will accelerate demand for reactors with predictive maintenance and automation capabilities.

- It will experience rising adoption in emerging economies driven by urbanization and industrial growth.

- Manufacturers will focus on cost-effective and compact designs to address infrastructure constraints.

- It will attract investments from utilities modernizing aging infrastructure across developed regions.

- Regional interconnection projects will boost demand for reliable grid stabilization equipment.

- It will see growing opportunities as energy transition policies drive the need for stable transmission systems.