Market Overview

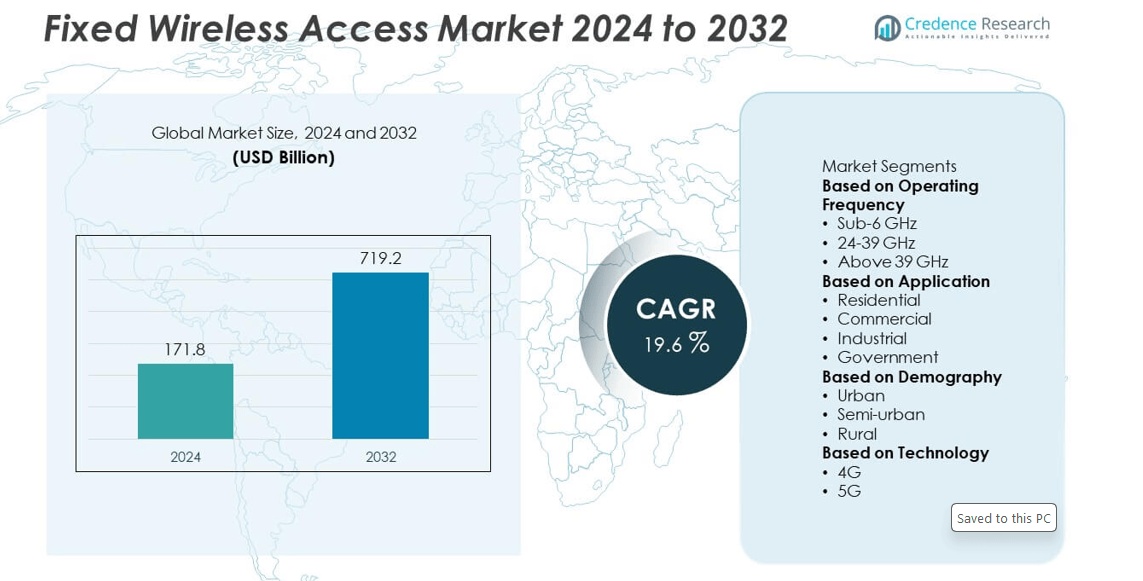

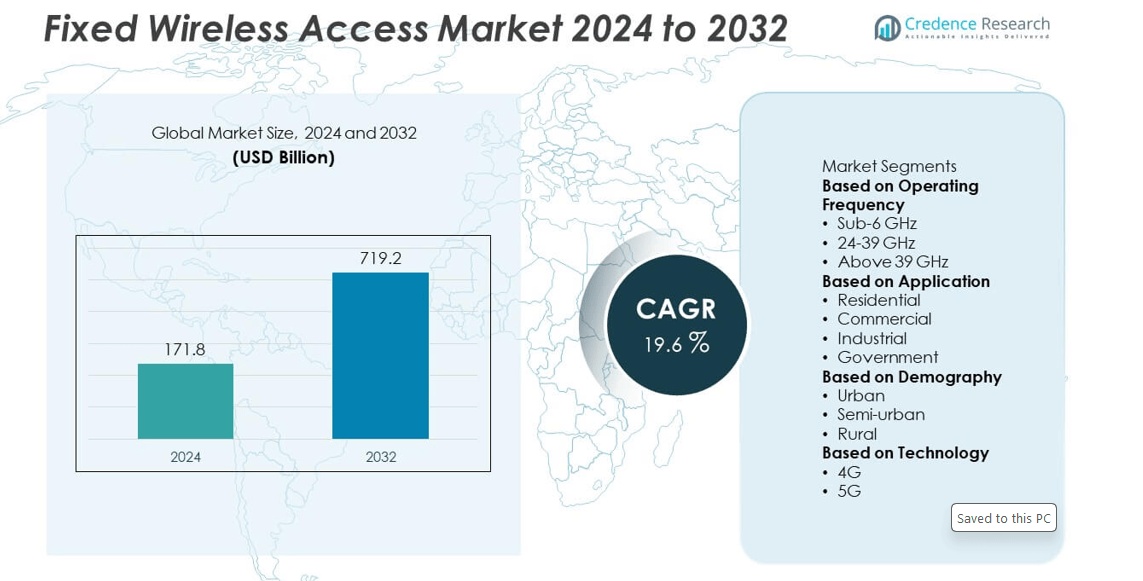

The Fixed Wireless Access Market was valued at USD 171.8 billion in 2024 and is anticipated to reach USD 719.2 billion by 2032, expanding at a CAGR of 19.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Wireless Access Market Size 2024 |

USD 171.8 billion |

| Fixed Wireless Access Market, CAGR |

19.6% |

| Fixed Wireless Access Market Size 2032 |

USD 719.2 billion |

Fixed Wireless Access Market grows with rising demand for high-speed broadband, rapid 5G rollout, and expansion into underserved regions. Consumers and enterprises adopt wireless broadband to support remote work, video streaming, and cloud-based applications. Governments promote connectivity programs to bridge the digital divide and enhance digital inclusion.

North America leads the Fixed Wireless Access Market with strong demand for 5G-enabled broadband, driven by extensive deployment by major telecom providers. The United States and Canada adopt fixed wireless solutions to expand high-speed internet access across suburban and rural communities, supported by government-backed digital inclusion initiatives. Europe follows with rapid expansion across Germany, the UK, and France, where operators invest in spectrum allocation and rural coverage projects. Asia-Pacific emerges as the fastest-growing region, fueled by large populations, rapid urbanization, and growing internet penetration in China, India, and Japan. Latin America and the Middle East & Africa show steady adoption, supported by rising mobile data usage and cost-efficient broadband models. Key players such as Verizon Communications Inc., Nokia Corporation, Huawei Technologies Co., Ltd., and Vodafone Group Plc strengthen their regional presence through advanced 5G networks, infrastructure partnerships, and customer-focused service innovations, positioning themselves as leaders in global wireless broadband solutions.

Market Insights

- Fixed Wireless Access Market was valued at USD 171.8 billion in 2024 and is projected to reach USD 719.2 billion by 2032, expanding at a CAGR of 19.6% during the forecast period.

- The market grows with rising demand for high-speed broadband, fueled by remote work, cloud adoption, and the need for reliable connectivity in suburban and rural regions.

- Trends highlight the role of 5G networks, hybrid broadband models, and integration with IoT and smart city projects, creating new opportunities for telecom operators and enterprises.

- Leading players including Verizon Communications Inc., Nokia Corporation, Huawei Technologies Co., Ltd., and Vodafone Group Plc compete through 5G infrastructure investments, partnerships, and service innovations to strengthen market presence.

- Market restraints include spectrum availability, high deployment costs, and competition from fiber and satellite broadband services, which create challenges for operators aiming for scalability and profitability.

- North America leads with strong 5G deployment and government-backed digital inclusion programs, Europe advances with rural broadband projects and spectrum investments, while Asia-Pacific emerges as the fastest-growing hub driven by urbanization and high data demand.

- Latin America and the Middle East & Africa register steady adoption with growing reliance on cost-efficient wireless broadband to improve household and enterprise connectivity, supported by national digital strategies and rising internet penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for High-Speed Broadband Connectivity

Fixed Wireless Access Market expands with rising demand for fast and reliable internet. Consumers and businesses seek alternatives to wired broadband in urban, suburban, and rural areas. Increasing digital transformation across industries drives adoption of high-bandwidth services. The growing need for video conferencing, streaming, and cloud applications strengthens demand. Governments encourage broadband expansion to close connectivity gaps. It reinforces the role of fixed wireless solutions as efficient alternatives to traditional infrastructure.

- For instance, Verizon added 278,000 FWA subscribers, growing its total fixed wireless base to over 5.1 million customers. This growth reflects the ongoing demand for high-speed connectivity.

Rapid Deployment of 5G Technology and Infrastructure

Widespread 5G rollout supports large-scale adoption of fixed wireless services. Fixed Wireless Access Market benefits from 5G’s low latency, high speed, and scalability. Telecom operators leverage 5G networks to deliver affordable broadband without extensive fiber deployment. Advanced spectrum availability further enhances service capacity and performance. Enterprises embrace 5G-based fixed wireless for reliable backup and business continuity. It accelerates the shift toward wireless broadband as a mainstream solution.

- For instance, Inseego unveiled its FX5000 5G-Advanced router in March 2025, achieving live data speeds above 11 Gbps download and 3.7 Gbps upload, powered by Qualcomm’s Dragonwing FWA Gen 4 Elite platform, demonstrating the capacity of 5G-enabled FWA infrastructure.

Rising Adoption in Underserved and Rural Areas

Limited fiber penetration in remote and rural regions drives reliance on fixed wireless networks. Fixed Wireless Access Market addresses last-mile connectivity challenges with cost-effective deployment. Wireless solutions overcome barriers of terrain and distance, reducing infrastructure investment needs. Rural households adopt fixed wireless for education, healthcare, and e-commerce access. Governments fund projects to bridge the digital divide and improve regional competitiveness. It strengthens the market’s role in inclusive digital access.

Cost Efficiency and Flexibility of Wireless Broadband Solutions

Businesses and consumers seek cost-efficient alternatives to fixed-line broadband. Fixed Wireless Access Market provides flexible deployment without extensive digging or cabling. Wireless systems reduce installation timelines while ensuring scalability. Enterprises use it for temporary sites, disaster recovery, and expanding office networks. Flexibility in coverage areas improves service adoption among diverse user groups. It positions fixed wireless as a strategic solution to support evolving connectivity needs.

Market Trends

Expansion of 5G-Based Fixed Wireless Services

Fixed Wireless Access Market witnesses rapid expansion with the global rollout of 5G networks. Telecom operators invest heavily in spectrum allocation and network infrastructure to deliver higher speeds. 5G technology enhances capacity and reduces latency, making fixed wireless competitive with fiber. Households and enterprises adopt 5G-based services for both primary and backup connectivity. It accelerates growth by enabling scalable broadband solutions across urban and suburban areas.

- For instance, T-Mobile USA added 454,000 fixed wireless broadband customers in Q2 2025, raising its total FWA base to 7.3 million subscribers, underscoring the rapid adoption of 5G-powered fixed wireless nationwide.

Integration of Fixed Wireless in Smart Cities and IoT Ecosystems

Smart city initiatives create demand for reliable broadband solutions. Fixed Wireless Access Market benefits from integration with IoT applications, including surveillance, traffic management, and connected utilities. Wireless broadband supports low-latency communication critical for IoT operations. Governments and municipalities adopt fixed wireless to modernize infrastructure with minimal disruption. It strengthens the role of fixed wireless as a key enabler of digital urban ecosystems.

- For instance, Telstra launched its Dynamic 5G slicing service in July 2025, offering enterprises guaranteed minimum throughput for dedicated applications with performance monitoring and analytics—tailored for mission-critical uses in sectors like logistics and construction.

Rising Popularity of Hybrid Broadband Models

Hybrid broadband models combining fiber and fixed wireless gain traction. Fixed Wireless Access Market adapts to strategies that use wireless for last-mile connectivity while leveraging fiber backbones. This approach reduces deployment costs and speeds up service availability in underserved areas. Telecom providers design hybrid solutions to balance performance and cost efficiency. It ensures broader coverage and resilience in network delivery models.

Focus on Sustainable and Cost-Effective Deployments

Sustainability trends influence how telecom operators deploy infrastructure. Fixed Wireless Access Market embraces energy-efficient equipment and eco-friendly designs to reduce environmental impact. Lower dependency on extensive cabling reduces carbon emissions during deployment. Governments support green initiatives, encouraging operators to adopt sustainable practices. It highlights fixed wireless as a scalable and environmentally responsible alternative to traditional broadband expansion.

Market Challenges Analysis

Spectrum Availability and Infrastructure Limitations

Fixed Wireless Access Market faces challenges related to spectrum allocation and network infrastructure. Limited spectrum availability in some regions restricts the capacity to deliver high-speed services. Competition among telecom operators for spectrum licenses raises costs and slows expansion. Infrastructure gaps, particularly in rural and developing areas, further hinder large-scale adoption. Service quality often depends on line-of-sight conditions, which may be disrupted by terrain or urban density. It creates operational hurdles that affect service reliability and customer satisfaction.

High Deployment Costs and Competitive Pressures

Capital investment for network equipment, towers, and antennas remains a significant barrier. Fixed Wireless Access Market requires ongoing upgrades to support 5G and future technologies, increasing financial pressure on operators. High upfront costs make it difficult for smaller providers to compete with established telecom companies. Intense competition from fiber and satellite broadband services limits pricing flexibility. Customer expectations for low-cost, high-speed services further squeeze profit margins. It compels providers to innovate while managing expenses to remain competitive in a rapidly evolving market.

Market Opportunities

Expansion into Underserved and Rural Markets

Fixed Wireless Access Market presents strong opportunities in underserved and rural areas with limited fiber connectivity. Governments and regulators support broadband expansion to bridge the digital divide. Wireless solutions enable faster and more cost-effective deployment compared to laying fiber in difficult terrains. Educational institutions, healthcare facilities, and small businesses in rural regions adopt fixed wireless to access reliable internet. Service providers gain opportunities to expand subscriber bases and strengthen community development. It positions fixed wireless as a critical tool for inclusive digital access.

Growth Potential in Enterprise and Industrial Applications

Enterprises increasingly rely on fixed wireless for scalable and flexible broadband connectivity. Fixed Wireless Access Market expands as businesses demand reliable internet for cloud computing, video conferencing, and IoT integration. Industrial sectors such as manufacturing, logistics, and energy deploy fixed wireless to enable automation and real-time monitoring. Temporary sites, disaster recovery, and events further create demand for portable and high-capacity wireless broadband. Service providers can diversify offerings by targeting enterprise-grade solutions with guaranteed service levels. It creates opportunities to capture high-value clients and strengthen competitive positioning.

Market Segmentation Analysis:

By Operating Frequency

Fixed Wireless Access Market is segmented by operating frequency into sub-6 GHz, 24 GHz–39 GHz, and above 39 GHz. Sub-6 GHz bands dominate due to their ability to provide wider coverage and reliable performance, particularly in rural and suburban areas. The mid-band spectrum balances speed and coverage, making it a preferred choice for telecom operators deploying 5G fixed wireless services. High-frequency bands, including 24 GHz–39 GHz and above 39 GHz, deliver ultra-fast speeds and low latency, but their coverage remains limited by shorter range and line-of-sight restrictions. Demand for high-frequency bands grows in urban areas where data traffic is high and advanced infrastructure supports deployment. It reflects how spectrum availability and frequency allocation shape service adoption across diverse geographies.

- For instance, On August 26, 2025, AT&T announced the acquisition of 50 MHz of nationwide spectrum from EchoStar for $23 billion, consisting of 30 MHz of 3.45 GHz mid-band and 20 MHz of 600 MHz low-band.

By Application

Segmentation by application includes residential, commercial, industrial, and government. Residential users represent the largest segment, driven by demand for affordable, high-speed broadband in both urban and underserved regions. The commercial sector increasingly adopts fixed wireless to support digital tools, cloud computing, and video conferencing. Industrial applications expand with IoT-enabled operations in manufacturing, logistics, and energy sectors. Government projects leverage fixed wireless for public connectivity, smart city deployments, and emergency response communications. Fixed Wireless Access Market benefits from versatile applications that address both consumer and enterprise needs. It positions fixed wireless as a scalable broadband solution across industries.

- For instance, In July 2025, Verizon reported that its Fixed Wireless Access (FWA) subscriber base was over 5.1 million, consisting of 3.07 million residential and 2.03 million business accounts. This highlights continued adoption across both consumer and enterprise applications, though the residential subscriber growth has slowed.

By Demography

Fixed Wireless Access Market is segmented by demography into urban, semi-urban, and rural. Urban areas dominate due to dense populations, advanced telecom infrastructure, and early adoption of 5G networks. Semi-urban regions show strong growth as operators expand coverage to peri-urban areas where fiber penetration is limited. Rural markets emerge as a critical opportunity, with fixed wireless bridging connectivity gaps caused by challenging geography and high fiber deployment costs. Governments and telecom operators invest in rural broadband initiatives to promote digital inclusion and economic development. It highlights how demographic factors influence adoption patterns and determine market expansion strategies.

Segments:

Based on Operating Frequency

- Sub-6 GHz

- 24-39 GHz

- Above 39 GHz

Based on Application

- Residential

- Commercial

- Industrial

- Government

Based on Demography

Based on Technology

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Fixed Wireless Access Market, accounting for 37% in 2024. Strong adoption is driven by early deployment of 5G networks in the United States and Canada. Leading telecom operators expand coverage across urban, suburban, and rural areas to meet rising demand for high-speed broadband. Enterprises adopt fixed wireless for flexible connectivity, disaster recovery, and hybrid network models. Government initiatives such as the Federal Communications Commission’s broadband funding programs strengthen rural penetration. Mexico also shows increasing uptake, supported by expanding telecom infrastructure and growing internet penetration. It positions North America as the most advanced regional market for fixed wireless adoption.

Europe

Europe represents 27% of the market share in 2024, supported by widespread 5G deployments and strong policy focus on digital inclusion. Countries such as Germany, the UK, and France lead adoption with robust telecom infrastructure and government-backed spectrum allocation. Fixed Wireless Access Market in Europe benefits from regulatory support promoting high-speed connectivity in rural and underserved communities. Businesses adopt fixed wireless for cloud-based applications and IoT integration, further boosting regional demand. Investments in spectrum auctions and partnerships between telecom providers enhance service offerings. It strengthens Europe’s role as a rapidly expanding market for wireless broadband solutions.

Asia-Pacific

Asia-Pacific holds 25% of the global market share in 2024, making it the fastest-growing regional segment. High population density, rapid urbanization, and limited fiber penetration in emerging economies drive strong adoption. China, India, and Japan lead growth, with operators investing in 5G networks and expanding fixed wireless solutions to urban and semi-urban areas. Rising demand for remote education, healthcare, and e-commerce supports adoption across households. Telecom providers in Southeast Asia also expand fixed wireless offerings to address connectivity gaps. It highlights Asia-Pacific as a key driver of future global market expansion.

Latin America

Latin America accounts for 6% of the market share in 2024, with growth led by Brazil, Mexico, and Chile. Operators focus on delivering affordable wireless broadband in regions with limited fiber deployment. Fixed Wireless Access Market expands as households and small businesses demand scalable internet solutions. Government-led digital inclusion programs further promote adoption, especially in rural communities. Economic challenges and limited spectrum availability remain barriers to rapid growth. It shows a market with promising opportunities but constrained by infrastructure and investment limitations.

Middle East & Africa

Middle East & Africa represent 5% of the global market share in 2024, driven by rising internet penetration and government-backed digital initiatives. Gulf countries such as Saudi Arabia and the UAE lead adoption with large-scale 5G deployments. African nations adopt fixed wireless to overcome fiber infrastructure limitations and improve rural connectivity. Enterprises and public sector projects increase usage in education, healthcare, and government services. Limited investment capacity and regulatory complexities hinder faster expansion. It reflects steady but gradual adoption supported by national broadband programs and growing demand for affordable connectivity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Fixed Wireless Access Market features leading players such as FS.com, Vodafone Group Plc, Verizon Communications Inc., Nokia Corporation, Inseego Corp, AT&T Inc., Telstra, T Mobile USA, Inc., Huawei Technologies Co., Ltd., and CommScope Inc. These companies compete by advancing 5G infrastructure, expanding coverage, and enhancing service reliability to capture growing demand for high-speed broadband. Strategic investments in spectrum allocation and innovative network equipment strengthen their ability to deliver scalable wireless solutions in both developed and emerging markets. Product portfolios focus on delivering low-latency, high-capacity connectivity that supports residential, commercial, and industrial applications. Partnerships with governments and enterprises accelerate adoption in rural and underserved areas, positioning fixed wireless as a cost-efficient alternative to fiber deployment. Competitive intensity increases with continuous innovation in customer premises equipment, antennas, and cloud-based network management tools. It highlights a dynamic market where global players seek leadership by balancing affordability, performance, and expansion strategies across diverse regions.

Recent Developments

- In July 2025, Verizon added 275,000 Fixed Wireless Access subscribers in Q2 2025, bringing its total FWA to 5.1 million subscribers.

- In May 2025, Tre Sweden (Hi3G Access) has partnered with Nokia to enhance its fixed wireless access (FWA) services for households and small businesses in areas lacking fibre connectivity.

- In 2023, Nokia Corporation launched a purpose-built FWA receiver tailored for the North American market

Report Coverage

The research report offers an in-depth analysis based on Operating Frequency, Application, Demography, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fixed wireless access will grow with increasing reliance on high-speed broadband.

- 5G technology will drive large-scale adoption by enabling faster and more reliable connections.

- Hybrid broadband models combining fiber and wireless will gain wider acceptance.

- Enterprises will adopt fixed wireless to support cloud applications, IoT, and remote work.

- Rural and underserved areas will see accelerated deployments supported by government programs.

- Smart city initiatives will create opportunities for integration with IoT and public infrastructure.

- Equipment innovation will improve efficiency, reduce costs, and enhance network performance.

- Competition from fiber and satellite broadband will shape pricing and service strategies.

- Partnerships between telecom providers and governments will expand digital inclusion projects.

- Global operators will strengthen regional presence through investment in scalable and sustainable networks.