Market Overview

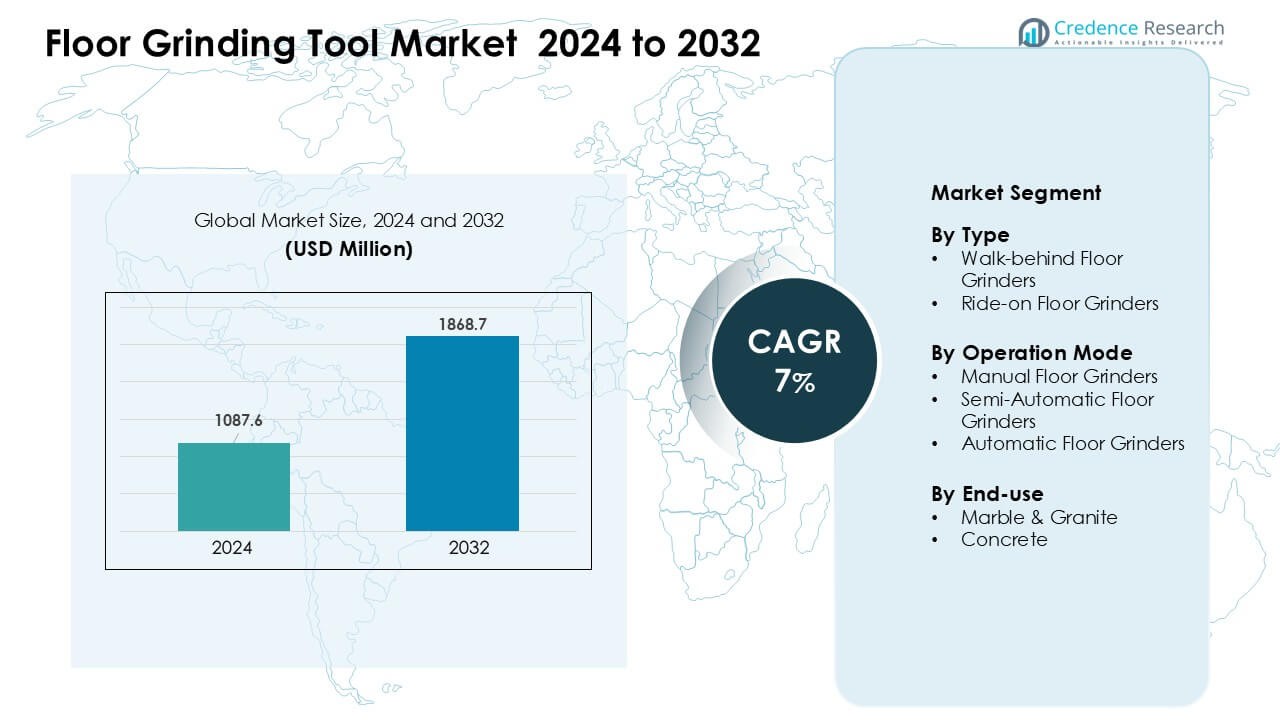

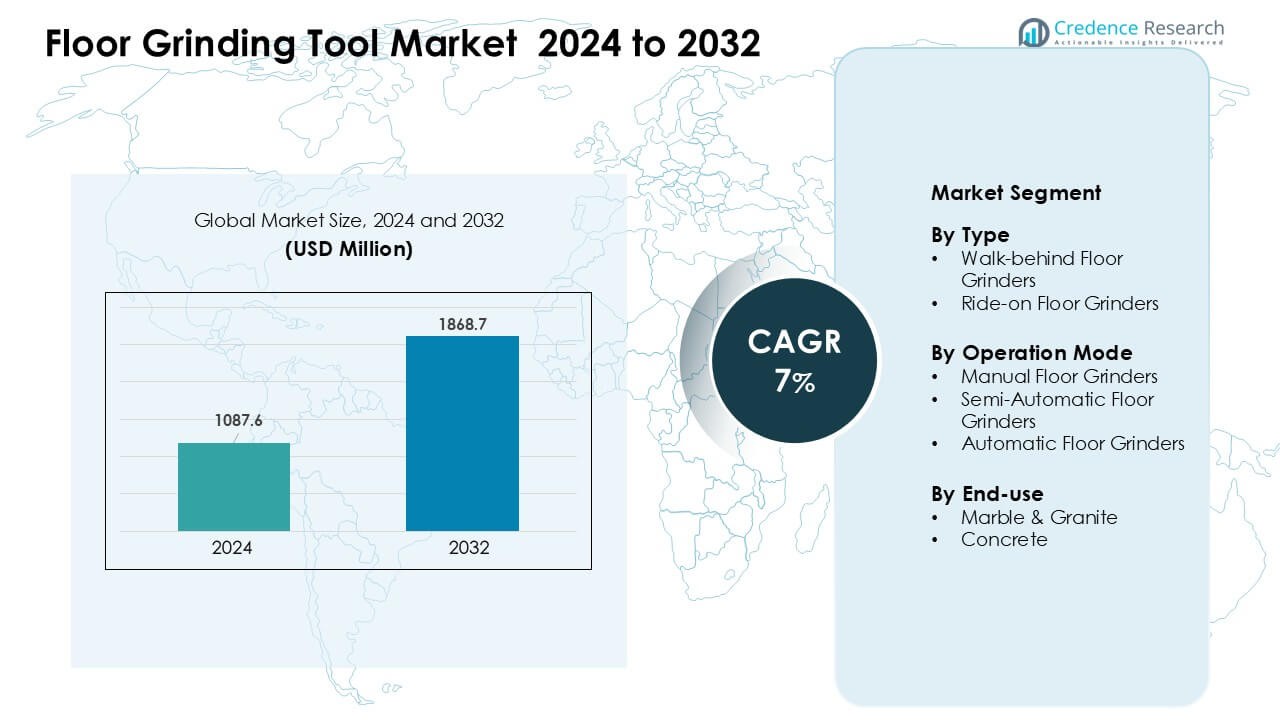

Floor Grinding Tool Market was valued at USD 1087.6 million in 2024 and is anticipated to reach USD 1868.7 million by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floor Grinding Tool Market Size 2024 |

USD 1087.6 Million |

| Floor Grinding Tool Market, CAGR |

7% |

| Floor Grinding Tool Market Size 2032 |

USD 1868.7 Million |

The floor grinding tool market features strong competition from Klindex s.r.l., National Flooring Equipment, Tyrolit – Schleifmittelwerke Swarovski AG & Co K.G., LINAX Co., Ltd., Achilli S.r.l., Scanmaskin Sverige AB, Bartell Global, Roll GmbH, Husqvarna Group, and Fujian Xingyi Polishing Machine Co., Ltd. These companies focus on advanced tooling, dust-control systems, and automated features to improve grinding speed and surface precision. North America emerged as the leading region in 2024 with a 34% share, supported by high renovation activity, strong demand for polished concrete floors, and strict workplace safety rules that accelerate adoption of high-performance grinding equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The floor grinding tool market was valued at USD 6 million in 2024 and is projected to reach USD 1868.7 million by 2032, growing at a CAGR of 7%.

- Demand grows as construction and renovation projects expand, with concrete applications leading the end-use segment at about 62% share due to rising adoption of polished and durable flooring.

- Trends include strong movement toward dust-control systems and low-vibration designs, along with wider use of semi-automatic and automatic grinders in large commercial and industrial sites.

- Competition remains intense as key players invest in advanced diamond tooling, automated features, and stronger service networks to support consistent performance across varied project scales.

- North America held the largest regional share at 34% in 2024, while walk-behind grinders dominated the type segment with around 58% share, supported by rising use across residential, commercial, and industrial floor preparation activities.

Market Segmentation Analysis:

By Type

Walk-behind floor grinders led the type segment in 2024 with about 58% share. Buyers preferred walk-behind units due to easier handling, lower cost, and wide use across small and mid-size construction tasks. These grinders offered strong control on renovation sites, which raised demand in commercial and residential projects. Ride-on grinders grew in large industrial flooring jobs, but higher prices kept adoption slower. The steady growth of building restoration and smoother workflow needs helped walk-behind models stay dominant across global markets.

- For instance, Husqvarna’s PG 450 walk-behind floor grinder features a 450 mm grinding width, a 2.2 kW motor, and single-phase 230 V operation, making the model suitable for concrete surface preparation and coating removal in commercial buildings.

By Operation Mode

Manual floor grinders dominated the operation mode segment in 2024 with nearly 47% share. Contractors used manual grinders for their lower upfront cost, simple repair needs, and flexible use in tight spaces. Many small firms favored manual units because these tools supported spot grinding and quick surface fixes. Semi-automatic and automatic grinders gained traction as builders looked for higher speed and reduced labor effort. Rising focus on productivity is expected to shift demand gradually, but manual grinders stayed ahead due to broad accessibility and budget-friendly use.

- For instance, EDCO’s SEC-NG manual single-disc grinder is powered by a 5 HP electric motor and supports grinding discs up to 250 mm in diameter, enabling efficient edge work and spot grinding in confined floor areas.

By End-use

Concrete applications held the largest share in 2024 with around 62%. Concrete floors required frequent leveling, coating removal, and surface polishing, which boosted steady use of grinding tools. Large demand came from commercial buildings, warehouses, and industrial floors where durable surfaces were essential. Marble and granite grinding expanded in premium interiors, but the niche scale kept volumes lower. Growth in infrastructure upgrades and modern flooring standards helped concrete remain the primary driver for floor grinding tool adoption worldwide.

Key Growth Drivers

Growing Construction and Renovation Activities

Rising construction and renovation activity remains a major growth driver for the floor grinding tool market. Builders depend on grinding tools to level floors, prepare surfaces, and remove coatings in residential, commercial, and industrial projects. The steady rise in urban housing upgrades and interior redesign work creates strong and recurring tool demand. Many contractors also prefer grinding machines due to their ability to improve floor durability and surface finish with less manual effort. Expanding real estate investments and ongoing remodeling needs continue to push buyers toward efficient grinding equipment that speeds up site work while reducing downtime.

Shift Toward Polished Concrete Flooring

Strong global interest in polished concrete floors acts as a key driver for the market. Polished concrete offers low maintenance, high durability, and a clean visual appeal, which makes the finish popular in retail, warehousing, airports, and public infrastructure. Floor grinding tools play a central role in surface polishing, which drives tool adoption as more facilities choose long-life flooring solutions. The trend supports steady demand across both new construction and retrofit projects. Industrial users also value polished concrete because the surface reduces dust, supports heavy equipment, and cuts long-term maintenance costs compared with tiles or epoxy floors.

- For instance, HTC Group’s DURATIQ 5 is a professional planetary floor grinder designed for concrete grinding and polishing in commercial and industrial spaces. The machine supports HTC’s metal-bond, hybrid, and resin diamond tooling and is commonly used within the HTC Superfloor™ concrete flooring system.

Advancements in Tooling and Automation

Ongoing improvements in grinding discs, machine design, and automation systems boost market expansion. Modern grinders now deliver higher precision, faster removal rates, and longer tool life, attracting contractors seeking consistent quality. Automated and semi-automatic units also reduce labor fatigue and improve workflow efficiency, which supports rising use in large-scale projects. Manufacturers invest in dust-control attachments and vibration-reduction systems, which enhance worker safety and compliance with site regulations. These innovations make grinding tools more productive and reliable, increasing their adoption across complex flooring tasks in commercial and industrial environments.

- For instance, Klindex’s Expander 750 planetary grinder offers variable-speed control and integrated dust-extraction ports and is designed for heavy-duty concrete grinding and polishing in large commercial and industrial flooring applications.

Key Trends & Opportunities

Rising Demand for Dust-Control and Low-Emission Tools

A major trend shaping the market is the shift toward dust-control and low-emission grinding systems. Builders and facility owners increasingly prioritize tools that limit airborne particles, especially in enclosed commercial spaces. New grinders feature integrated vacuum ports, sealed housings, and HEPA-compatible systems that support cleaner and safer job sites. Many regions now enforce stricter dust regulations, which pushes contractors toward compliant tools. This shift opens opportunities for manufacturers offering advanced filtration accessories and green, low-impact grinding solutions suited for sensitive environments such as hospitals, schools, and food-processing areas.

- For instance, Tyrolit a leading surface-preparation equipment manufacturer offers dust-extractors designed to integrate directly with their concrete grinders; these extractors capture dust at the source and filter even fine silica particles, enabling compliance with occupational-safety regulations and reducing respirable dust exposure.

Expanding Use in Industrial Warehousing and Commercial Facilities

Another important trend is the rising use of grinding tools in industrial and commercial flooring. Warehousing, logistics hubs, and retail centers demand smooth, level, and durable floor surfaces to support heavy equipment and high foot traffic. These sectors increasingly adopt polished concrete and require regular resurfacing, which creates added opportunity for grinding tool makers. Growth in e-commerce warehousing also strengthens demand for heavy-duty machines capable of high-speed work on large floor areas. Manufacturers benefit from offering wide machine lines that match the segment’s varied workload needs.

- For instance, Bartell Global’s Predator 800 floor grinder features an 800 mm grinding width and dual 15 HP motors, enabling high-output concrete grinding and polishing across large warehouse, logistics, and commercial floor surfaces.

Key Challenges

High Initial Cost of Advanced Grinding Machines

The high purchase cost of automatic and ride-on grinders remains a key challenge for the market. Small contractors often struggle to invest in premium machines due to tight budgets and fluctuating project volume. High-grade diamond tooling also adds recurring expenses. These factors push some users toward renting rather than owning equipment, which slows long-term sales growth. The cost barrier limits adoption in developing markets, where lower-priced manual grinders remain common. Manufacturers must balance advanced features with affordability to expand market penetration.

Skilled Labor Shortage and Training Gaps

A shortage of skilled operators poses another major challenge in the floor grinding tool industry. Effective grinding requires knowledge of speed, pressure, grit sequence, and surface conditions. Limited training availability leads to inconsistent results, damaged floors, or low tool life. Many contractors face difficulty hiring experienced operators, especially for large machines and polished concrete projects. The skill gap slows the transition to advanced grinders and raises operational risks. Wider training programs and simplified machine controls are essential to support industry growth and ensure quality outcomes across project types.

Regional Analysis

North America

North America led the floor grinding tool market in 2024 with around 34% share. Strong renovation activity, growth in polished concrete flooring, and tight workplace safety rules supported rising demand across commercial and industrial sites. Contractors in the U.S. and Canada preferred advanced grinders with dust-control systems due to stricter silica regulations. Large warehousing and retail projects also strengthened tool adoption. Expanding real estate upgrades and steady infrastructure spending kept walk-behind and semi-automatic models in high use across both new construction and maintenance work.

Europe

Europe held nearly 28% share in 2024, driven by strict construction standards and a strong focus on long-life flooring solutions. Demand grew in Germany, the U.K., France, and Nordic countries as builders increased the use of polished concrete in commercial and public facilities. The region’s emphasis on low-emission and dust-controlled tools pushed buyers toward advanced grinding systems. Ongoing infrastructure renovation and green building programs supported steady adoption. Industrial facilities also upgraded aging floors, which kept the market stable across large warehouses and logistics sites.

Asia Pacific

Asia Pacific captured about 31% share in 2024 and remained the fastest-growing region. China, India, and Southeast Asia drove high demand due to rapid urbanization, industrial expansion, and strong commercial construction pipelines. Large-scale infrastructure and real estate projects increased the need for concrete surface preparation tools. Contractors in the region adopted walk-behind grinders widely due to cost benefits, while industrial hubs shifted toward automatic units for higher efficiency. Growing acceptance of polished concrete flooring in malls, airports, and factories strengthened long-term market prospects.

Latin America

Latin America accounted for nearly 4% share in 2024, supported by moderate construction growth and expanding commercial renovation work. Brazil and Mexico led demand, with rising use of grinding tools for warehouse floors, retail spaces, and hospitality upgrades. Budget-friendly manual grinders remained dominant, but gradual adoption of semi-automatic models started in higher-value projects. Infrastructure improvements and industrial facility expansion created steady need for concrete surface preparation. However, market growth varied due to economic swings, limiting faster adoption of advanced tooling.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, driven by steady demand from commercial, hospitality, and industrial developments. Countries such as the UAE and Saudi Arabia supported market growth through large infrastructure and mixed-use projects that required high-quality concrete flooring. Polished concrete gained traction in malls and airports, boosting tool adoption. Africa’s demand grew slower but saw increased use in urban commercial buildings. Budget constraints kept manual grinders common, while premium models expanded only in high-investment projects across Gulf countries.

Market Segmentations:

By Type

- Walk-behind Floor Grinders

- Ride-on Floor Grinders

By Operation Mode

- Manual Floor Grinders

- Semi-Automatic Floor Grinders

- Automatic Floor Grinders

By End-use

- Marble & Granite

- Concrete

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the floor grinding tool market includes key players such as Klindex s.r.l., National Flooring Equipment, Tyrolit – Schleifmittelwerke Swarovski AG & Co K.G., LINAX Co., Ltd., Achilli S.r.l., Scanmaskin Sverige AB, Bartell Global, Roll GmbH, Husqvarna Group, and Fujian Xingyi Polishing Machine Co., Ltd. Competition centers on product durability, grinding efficiency, automation features, and dust-control technology. Leading companies invest in advanced diamond tooling, low-vibration designs, and integrated vacuum systems to support safer and faster workflows. Many brands expand rental programs and service networks to attract contractors seeking reliable solutions for concrete polishing and surface preparation. As commercial renovation and industrial flooring projects grow worldwide, manufacturers aim to strengthen global reach and introduce machines that reduce labor dependence while improving precision and output quality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Klindex s.r.l.

- National Flooring Equipment

- Tyrolit – Schleifmittelwerke Swarovski AG & Co K.G.

- LINAX Co., Ltd.

- Achilli S.r.l.

- Scanmaskin Sverige AB

- Bartell Global

- Roll GmbH

- Husqvarna Group

- Fujian Xingyi Polishing Machine Co., Ltd

Recent Developments

- In March 2025, National Flooring Equipment acquired Syntec Diamond Tools to expand its offering of diamond tooling and surface‑preparation equipment.

- In September 2024, Husqvarna Group Launched a new full range of large floor grinders. They use a common platform design featuring Dual Drive Technology, ergonomic remote controls, dustproof and waterproof grinding heads, mist-cooler for better tool life, integrated weights, and a quick EZchange system for tool holders

Report Coverage

The research report offers an in-depth analysis based on Type, Operation Mode, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as polished concrete flooring expands across commercial and industrial spaces.

- Automated and semi-automatic grinders will gain traction due to labor shortages.

- Adoption of dust-control systems will increase as safety rules tighten globally.

- Manufacturers will focus on energy-efficient and low-vibration machine designs.

- Rental services will grow as small contractors avoid high upfront costs.

- Emerging markets will adopt advanced grinders as construction activity accelerates.

- Diamond tooling innovations will enhance grinding speed and surface precision.

- Smart sensors and digital monitoring features will improve job-site efficiency.

- Industrial warehouses will drive steady demand for heavy-duty grinding systems.

- Sustainability goals will support wider use of long-life flooring solutions that rely on grinding tools.