Market Overview

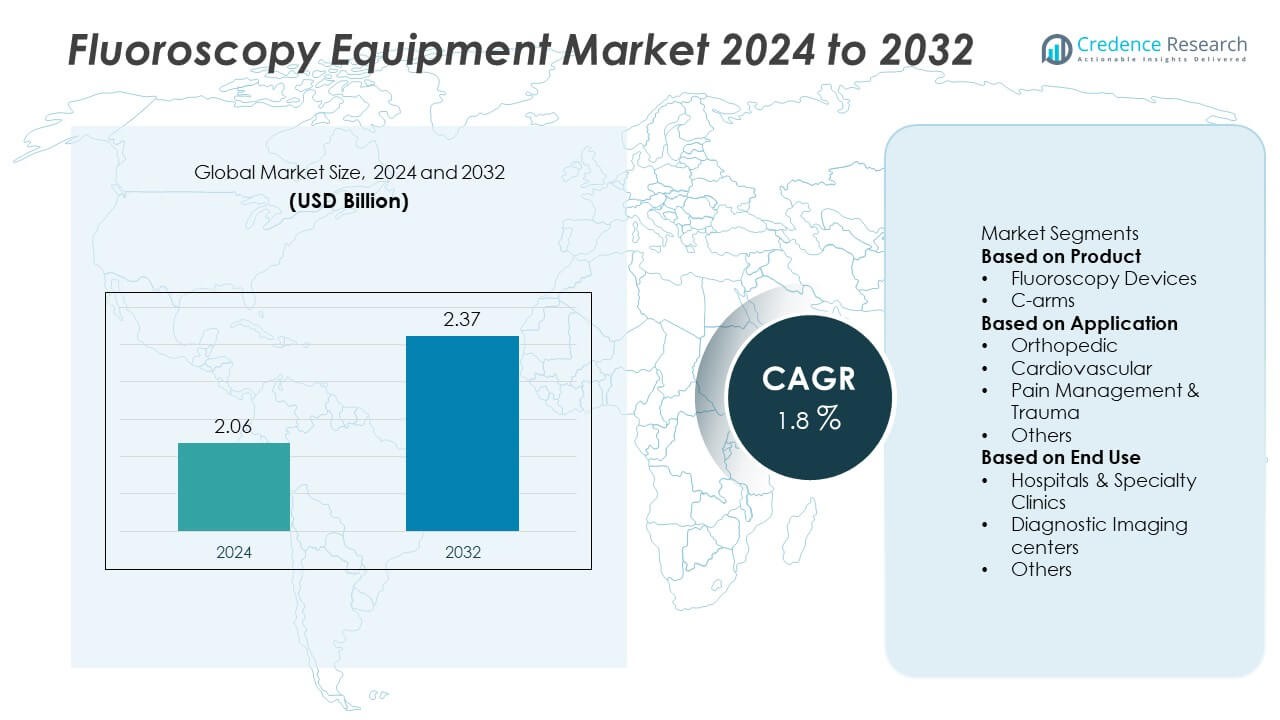

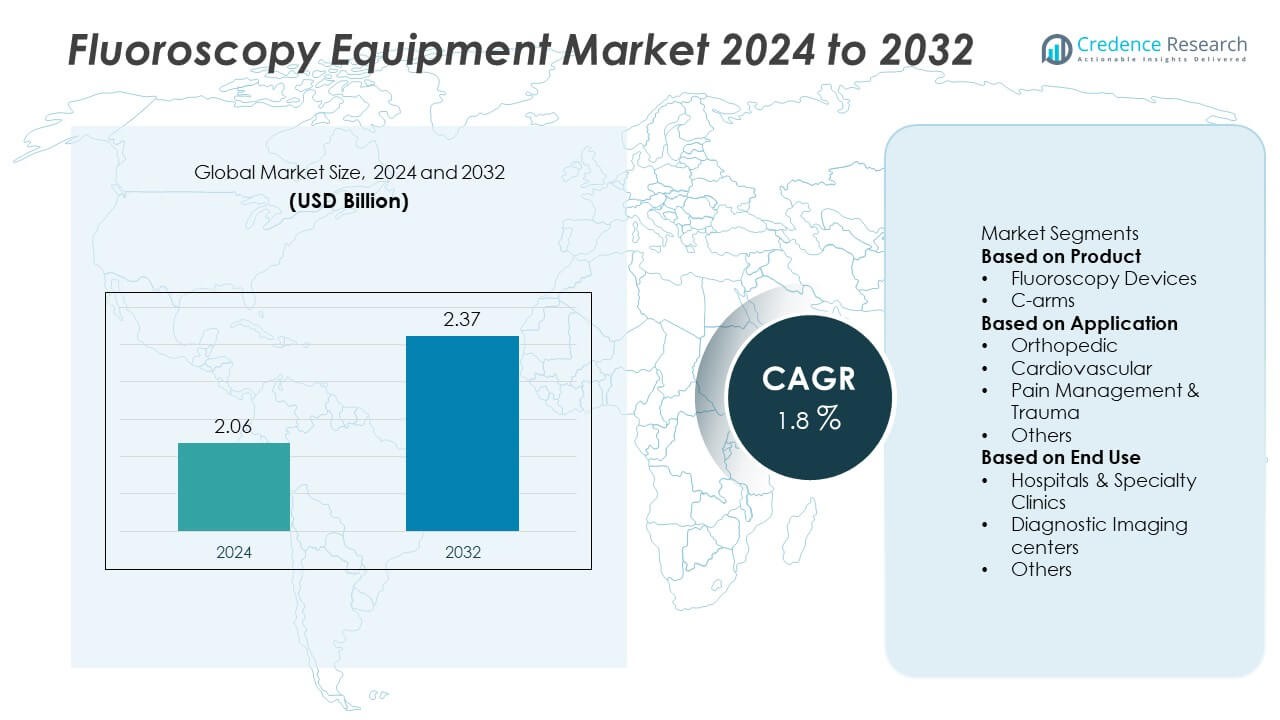

The Fluoroscopy Equipment market size was valued at USD 2.06 billion in 2024 and is projected to reach USD 2.37 billion by 2032, growing at a CAGR of 1.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluoroscopy Equipment market Size 2024 |

USD 2.06 Billion |

| Fluoroscopy Equipment market , CAGR |

1.8% |

| Fluoroscopy Equipment market Size 2032 |

USD 2.37 Billion |

The Fluoroscopy Equipment market is led by major players such as GE HealthCare, Siemens Healthineers, Koninklijke Philips NV, Canon Medical Systems Corporation, Hitachi Medical Systems, Shimadzu Corporation, Ziehm Imaging GmbH, Hologic Inc., Orthoscan Inc., and Carestream Health. These companies drive market growth through advancements in flat-panel detector technology, AI-based image enhancement, and radiation dose optimization. North America dominates the market with a 38% share, supported by strong adoption of advanced imaging systems and well-established healthcare infrastructure. Europe holds a 29% share, driven by increasing demand for digital fluoroscopy in hospitals. Asia-Pacific follows with a 27% share, propelled by rapid healthcare modernization and growing investment in diagnostic imaging facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fluoroscopy Equipment market was valued at USD 2.06 billion in 2024 and is projected to reach USD 2.37 billion by 2032, expanding at a CAGR of 1.8% during the forecast period.

- Market growth is driven by the rising adoption of minimally invasive procedures, advancements in digital imaging technology, and increased focus on radiation dose management for patient safety.

- Key trends include the integration of AI-based image processing, growing use of mobile C-arms, and adoption of hybrid imaging systems to improve diagnostic accuracy and workflow efficiency.

- The market features strong competition among GE HealthCare, Siemens Healthineers, Philips, and Canon Medical Systems, all focusing on innovation, strategic collaborations, and product diversification.

- North America leads with a 38% share, followed by Europe with 29% and Asia-Pacific with 27%, while the C-arms segment dominates the market with a 57% share due to its flexibility and wide clinical applications.

Market Segmentation Analysis:

By Product

The C-arms segment dominated the Fluoroscopy Equipment market in 2024 with a 57% share. C-arms are widely used in surgical imaging due to their flexibility, mobility, and ability to provide real-time visualization during procedures. The demand for both fixed and mobile C-arms continues to grow, driven by the rising volume of minimally invasive surgeries and orthopedic interventions. Continuous advancements in flat-panel detectors, dose reduction technologies, and digital integration enhance clinical accuracy. Hospitals and surgical centers prefer C-arms for their high image quality, easy maneuverability, and compatibility with hybrid operating rooms.

- For instance, Ziehm Imaging introduced the Vision RFD Hybrid Edition, featuring a 30 × 30 cm flat-panel detector and a liquid cooling system capable of prolonged fluoroscopy for demanding procedures. The system’s SmartDose technology offers a comprehensive concept for high image quality and minimized dose exposure, with significant savings for patients and staff.

By Application

The orthopedic segment held the largest market share of 41% in 2024, supported by the increasing prevalence of bone fractures, joint replacements, and spinal disorders. Fluoroscopy plays a vital role in guiding orthopedic surgeries and ensuring precise implant placement. The rising adoption of minimally invasive orthopedic techniques and real-time imaging solutions drives demand. Technological innovations in 3D fluoroscopy and radiation dose optimization strengthen its use in trauma and reconstructive procedures. Growing aging populations and expanding access to advanced surgical facilities further enhance segment growth globally.

- For instance, the Siemens Healthineers Cios Spin system delivered intraoperative 3D imaging using its Retina 3D scan technology, which provides a maximum spatial resolution of 0.3 mm. This enabled precise navigation during spinal fusion surgeries. The system’s integration with a Metal Artifact Reduction (MAR) algorithm improved the visualization of titanium implants, which helps detect malplacements during procedures.

By End Use

The hospitals and specialty clinics segment accounted for a 68% share of the Fluoroscopy Equipment market in 2024. Hospitals remain the primary users due to their extensive patient base and advanced imaging infrastructure. The increasing number of complex surgical and interventional procedures supports continuous equipment upgrades. Specialty clinics are also adopting compact and mobile fluoroscopy systems to enhance procedural efficiency. Growing investment in modern imaging suites, combined with the need for faster diagnostics and integrated data management, continues to reinforce hospital dominance in this market segment.

Key Growth Drivers

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive surgeries has significantly driven the fluoroscopy equipment market. Surgeons rely on real-time imaging to enhance procedural accuracy, reduce complications, and shorten recovery times. Fluoroscopy provides dynamic visualization essential for orthopedic, cardiovascular, and pain management procedures. The global rise in chronic diseases and trauma cases continues to expand surgical volumes, boosting demand for advanced fluoroscopy systems in hospitals and outpatient surgical centers.

- For instance, GE HealthCare’s OEC 3D C-arm system captures a high-resolution 512³ voxel volume using a 200° isocentric sweep, enabling detailed 3D reconstructions during orthopedic and spinal surgeries. The system also includes advanced analysis tools and interfaces with navigation systems to assist with precise implant positioning.

Technological Advancements in Imaging Systems

Rapid innovations in fluoroscopic imaging technology are improving diagnostic precision and patient safety. The introduction of digital flat-panel detectors, dose-reduction algorithms, and AI-assisted image processing enhances workflow efficiency. These advancements allow clinicians to achieve clearer images with lower radiation exposure, improving both safety and performance. Manufacturers are focusing on hybrid imaging solutions that integrate fluoroscopy with CT or MRI for comprehensive visualization, driving equipment upgrades across medical institutions.

- For instance, the Canon Medical Systems Ultimax-i system integrates an advanced 43 × 43 cm flat-panel detector and proprietary DoseRite technology to reduce patient radiation exposure. The system’s integrated Super Noise Reduction Filter (SNRF) processes images in real-time to maintain high image quality at a reduced dose.

Expanding Use in Orthopedic and Trauma Care

Fluoroscopy systems play a crucial role in orthopedic and trauma management due to their ability to provide real-time imaging during surgical procedures. Rising cases of bone fractures, sports injuries, and spinal disorders are fueling system demand. Hospitals increasingly rely on C-arms for precision in implant placement and alignment during orthopedic surgeries. The trend toward day-care surgeries and advanced rehabilitation centers is further enhancing the adoption of compact, mobile fluoroscopy devices.

Key Trends & Opportunities

Integration of Artificial Intelligence and Digital Platforms

AI integration is reshaping the fluoroscopy equipment landscape by improving image analysis and workflow automation. Smart imaging platforms can automatically adjust radiation doses, detect anatomical structures, and enhance contrast in real time. This reduces operator dependency and improves clinical outcomes. Additionally, digital connectivity allows seamless data sharing across departments, supporting telemedicine and remote diagnostics. The growing focus on smart, connected imaging solutions offers significant opportunities for system manufacturers.

- For instance, Philips’ UNIQUE image processing in its fluoro systems dynamically adjusts exposure over 1,000 image segments per frame, optimizing balance between overexposed and underexposed zones. Their grid-controlled fluoroscopy mode cuts non-useful radiation by more than 20 mGy in routine abdominal scans while preserving diagnostic detail.

Rising Demand for Mobile and Compact Fluoroscopy Units

Healthcare facilities are increasingly adopting mobile fluoroscopy units for flexibility in surgical and diagnostic environments. Compact C-arms offer mobility, lower maintenance costs, and rapid deployment, making them suitable for smaller clinics and ambulatory surgical centers. Their ease of use and integration with digital data systems improve efficiency in emergency and trauma cases. The expanding network of outpatient facilities and the need for point-of-care imaging create strong growth opportunities for portable fluoroscopy systems.

- For instance, Hologic Inc. launched its Fluoroscan InSight FD Mini C-Arm equipped with a 24 × 24 cm flat-panel detector. The system delivered 15-frame-per-second fluoroscopy and achieved sub-100 µm image resolution, enabling orthopedic surgeons to capture high-precision images during hand and wrist surgeries.

Key Challenges

High Equipment Cost and Maintenance Requirements

Fluoroscopy systems are capital-intensive, requiring significant investment in installation, calibration, and maintenance. Advanced digital and hybrid systems further increase procurement costs, limiting adoption in smaller healthcare facilities. Regular maintenance and radiation safety compliance also raise operational expenses. These financial barriers are particularly challenging in developing economies, where budget constraints and limited reimbursement policies slow equipment replacement and modernization cycles.

Radiation Exposure and Safety Concerns

Radiation exposure during fluoroscopic procedures remains a major safety challenge for both patients and healthcare staff. Despite technological improvements in dose management, prolonged use can still pose health risks. Hospitals must invest in shielding, monitoring, and staff training to meet regulatory safety standards. Continuous focus on balancing image quality with minimal radiation levels is essential for improving long-term safety outcomes and sustaining clinical confidence in fluoroscopic imaging.

Regional Analysis

North America

North America held a 38% share of the fluoroscopy equipment market in 2024, driven by high healthcare spending and advanced medical infrastructure. The region benefits from strong adoption of digital fluoroscopy systems and increased demand for minimally invasive surgeries. The United States leads the market due to the presence of major manufacturers, well-established hospitals, and favorable reimbursement policies. Growing emphasis on radiation dose reduction and AI-based image enhancement supports continuous equipment upgrades. Ongoing investments in hybrid operating rooms and image-guided surgery centers further strengthen the region’s dominance in diagnostic imaging technologies.

Europe

Europe accounted for a 29% market share in 2024, supported by rising demand for real-time imaging in orthopedic and cardiovascular procedures. The region’s focus on improving patient safety and reducing radiation exposure has accelerated the transition to digital fluoroscopy. Germany, France, and the United Kingdom lead the market through strong healthcare infrastructure and growing investments in hospital modernization. Increasing regulatory emphasis on radiation management and the expansion of specialized diagnostic centers continue to drive market growth across Western and Northern Europe.

Asia-Pacific

Asia-Pacific captured a 27% share of the fluoroscopy equipment market in 2024, fueled by the rapid expansion of healthcare infrastructure and medical imaging capabilities. China, Japan, India, and South Korea are key contributors, with rising demand for minimally invasive and image-guided procedures. Increasing government investments in public hospitals and diagnostic facilities are driving adoption of mobile and digital C-arm systems. The growing burden of trauma, orthopedic, and cardiac conditions also supports equipment deployment. Continuous advancements in affordable, portable fluoroscopy units are making imaging technology more accessible across developing economies.

Rest of the World

The Rest of the World region represented a 6% share of the fluoroscopy equipment market in 2024. Growth is primarily supported by rising healthcare investments in Latin America and the Middle East. Brazil, Mexico, and the United Arab Emirates are witnessing steady improvements in hospital imaging capacity and technology upgrades. Although limited access and budget constraints hinder widespread adoption, expanding private healthcare facilities and international partnerships are improving market penetration. Increased awareness of image-guided procedures and gradual adoption of digital radiology systems create long-term opportunities for regional market expansion.

Market Segmentations:

By Product

- Fluoroscopy Devices

- C-arms

By Application

- Orthopedic

- Cardiovascular

- Pain Management & Trauma

- Others

By End Use

- Hospitals & Specialty Clinics

- Diagnostic Imaging centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fluoroscopy Equipment market is defined by key players such as GE HealthCare, Siemens Healthineers, Koninklijke Philips NV, Canon Medical Systems Corporation, Hitachi Medical Systems, Shimadzu Corporation, Ziehm Imaging GmbH, Hologic Inc., Orthoscan Inc., and Carestream Health. These companies compete through continuous innovation in digital fluoroscopy systems, radiation dose optimization, and hybrid imaging solutions. GE HealthCare and Siemens Healthineers lead with extensive product portfolios integrating AI and advanced detector technology for enhanced imaging precision. Philips and Canon focus on compact and mobile fluoroscopy units to expand accessibility in smaller healthcare facilities. Meanwhile, Ziehm Imaging and Orthoscan specialize in portable C-arms designed for orthopedic and trauma applications. Partnerships, R&D investments, and software-driven workflow optimization remain central to competitive differentiation. Overall, the market’s competition emphasizes image quality, patient safety, and seamless integration with hospital information systems to meet evolving clinical and regulatory standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE HealthCare

- Shimadzu Corporation

- Hologic Inc.

- Canon Medical Systems Corporation

- Ziehm Imaging GmbH

- Koninklijke Philips NV

- Orthoscan Inc.

- Carestream Health

- Hitachi Medical Systems

- Siemens Healthineers

Recent Developments

- In July 2025, Siemens Healthineers received FDA clearance for its Luminos Q.namix R and Luminos Q.namix T systems, combining radiography and fluoroscopy capabilities in one platform.

- In March 2025, GE HealthCare partnered with NVIDIA to co-develop autonomous X-ray and ultrasound imaging using the Isaac for Healthcare simulation platform.

- In December 2024, Siemens Healthineers launched the Luminos Q.namix 1 platform as its next-generation integrated fluoroscopy/radiography system.

- In July 2023, Canon Medical Systems launched a multipurpose fluoroscopic table with new functions, Zexira i9 digital X-ray RF system. It is a digital X-ray RF system which is equipped with all the essential features to meet clinical demands.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for advanced fluoroscopy systems will grow with the rise in image-guided surgeries.

- Manufacturers will focus on AI-based imaging tools to improve accuracy and reduce radiation exposure.

- Mobile and compact fluoroscopy units will gain popularity in outpatient and trauma care facilities.

- Hybrid imaging solutions combining fluoroscopy with CT or MRI will become more common in hospitals.

- Continuous R&D investment will enhance image quality, workflow efficiency, and system connectivity.

- Asia-Pacific will see rapid market expansion due to healthcare modernization and technology upgrades.

- North America and Europe will continue leading through high adoption of digital imaging systems.

- Companies will strengthen partnerships to expand service networks and after-sales support.

- Government initiatives promoting radiation safety will encourage the replacement of legacy systems.

- Sustainability efforts will push the development of low-dose, energy-efficient fluoroscopy technologies.