Market overview

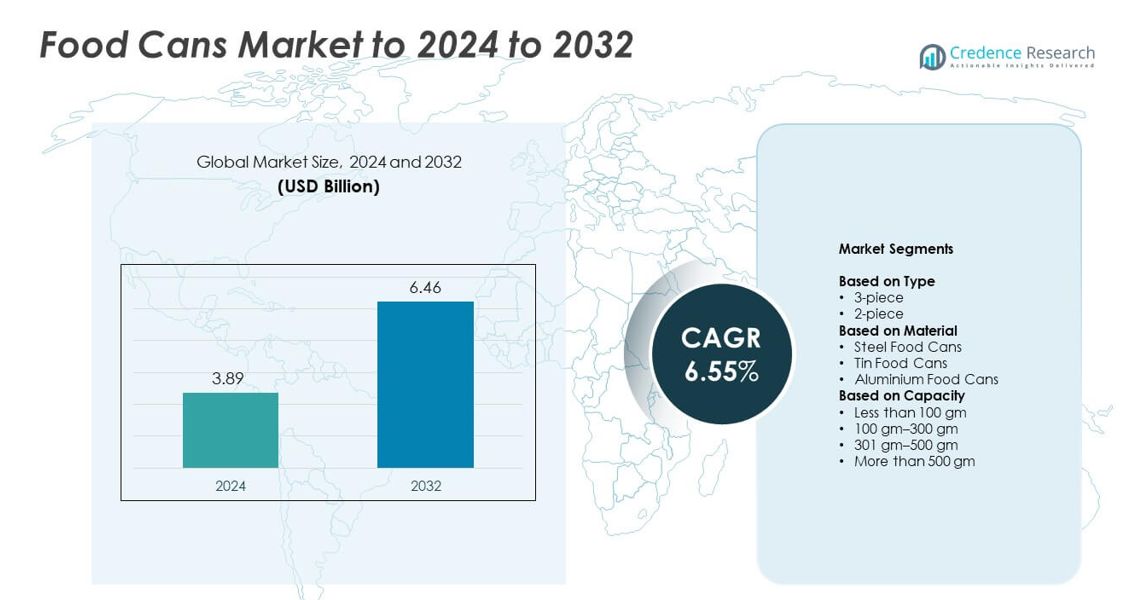

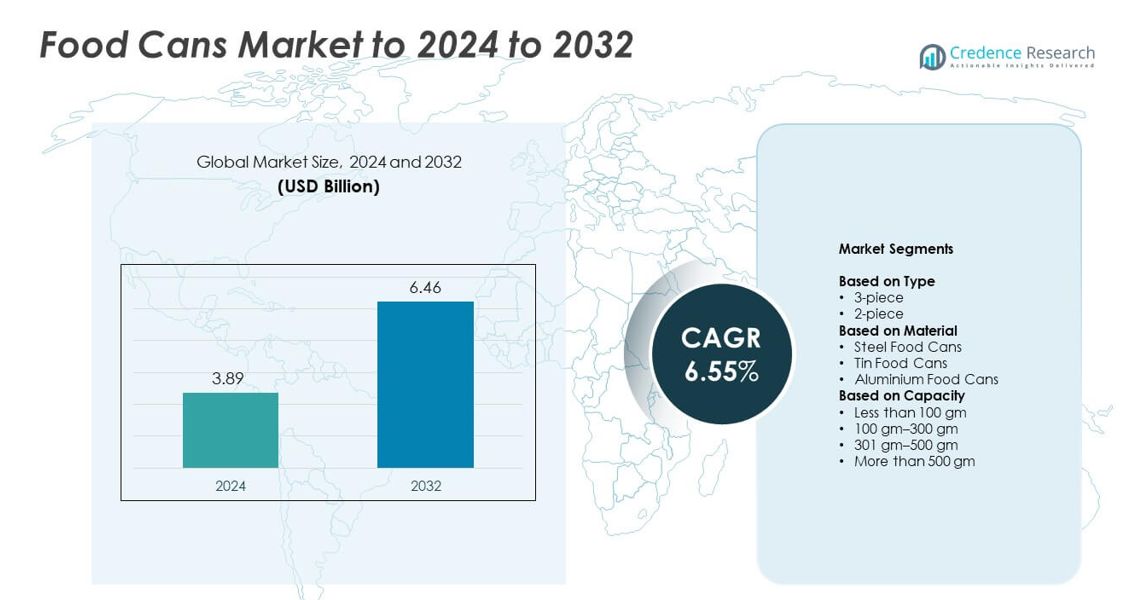

Food Cans Market size was valued USD 3.89 Billion in 2024 and is anticipated to reach USD 6.46 Billion by 2032, at a CAGR of 6.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Cans Market Size 2024 |

USD 3.89 Billion |

| Food Cans Market, CAGR |

6.5% |

| Food Cans Market Size 2032 |

USD 6.46 Billion |

The food cans market is led by major players such as Ball Corporation, Ardagh Group, Silgan Holdings Inc., CPMC Holdings Limited, and Toyo Seikan Group Holdings Ltd. These companies dominate through strong manufacturing capabilities, global distribution networks, and continuous investments in sustainable packaging innovations. They focus on lightweight metal designs, recyclable materials, and advanced printing technologies to enhance brand appeal and reduce environmental impact. North America emerged as the leading region in 2024, capturing a 34% market share, driven by high consumption of processed and ready-to-eat foods, robust recycling infrastructure, and strong presence of established packaging manufacturers.

Market Insights

- The food cans market was valued at USD 3.89 billion in 2024 and is projected to reach USD 6.46 billion by 2032, growing at a CAGR of 6.55%.

• Market growth is driven by rising demand for processed and ready-to-eat foods, supported by increasing urbanization and changing lifestyles.

• Trends such as the shift toward recyclable and lightweight metal packaging and adoption of digital printing technologies are enhancing product appeal and sustainability.

• The market is moderately consolidated, with leading players focusing on R&D, eco-friendly materials, and strategic collaborations to strengthen their positions.

• North America led with a 34% share in 2024, followed by Europe with 29% and Asia-Pacific with 27%, while the 3-piece can segment dominated with a 58% share due to its versatility and cost efficiency in food packaging applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The 3-piece segment dominated the food cans market in 2024 with a 58% share. This segment’s strength comes from its versatility and cost-effectiveness in packaging a wide range of food items such as soups, vegetables, and pet food. The 3-piece structure offers strong sealing and durability, ideal for products needing extended shelf life. Manufacturers favor this type for its compatibility with high-speed filling lines and easy labeling. Meanwhile, the 2-piece cans segment is growing due to demand for lightweight and recyclable options in beverages and ready-to-eat meals.

- For instance, Silgan’s Fort Dodge plant makes 1.5 billion cans and 4.9 billion ends yearly.

By Material

Steel food cans held the largest market share of around 46% in 2024, driven by their strength, cost efficiency, and superior protection against contamination. Steel’s magnetic properties also make recycling easier, aligning with global sustainability goals. Its high barrier resistance ensures long-term preservation of nutritional content, appealing to canned meat and seafood producers. Tin and aluminum cans follow, gaining traction in premium and portable food segments. Aluminum’s lightweight nature and corrosion resistance further boost its adoption for high-end food and beverage applications.

- For instance, thyssenkrupp Rasselstein’s Andernach site has about 1.5 million tons tinplate capacity.

By Capacity

Cans with a capacity of 301 gm–500 gm dominated the market with a 41% share in 2024. This range is ideal for household food portions, balancing convenience and cost. The segment benefits from growing consumption of processed vegetables, soups, and pet foods. Manufacturers prefer this capacity due to standardized filling and easy stacking during storage and transport. Demand for larger cans above 500 gm is also rising, mainly from institutional buyers and food service industries seeking bulk packaging for sauces and canned fruits.

Key Growth Drivers

Rising Demand for Processed and Ready-to-Eat Foods

The growing consumption of processed and ready-to-eat foods is a key driver of the food cans market. Urbanization, busy lifestyles, and increasing workforce participation have boosted demand for convenient packaging. Canned food offers long shelf life and easy storage, making it ideal for quick meals. Rising disposable incomes in developing economies such as India, China, and Brazil further support market growth. Major food brands are expanding canned product lines to meet this rising demand for convenience and long-lasting preservation.

- For instance, Hormel’s SPAM has surpassed 9 billion cans sold since launch.

Focus on Food Safety and Extended Shelf Life

Consumers’ growing awareness of food safety and product integrity drives the adoption of metal cans. Food cans provide an airtight seal that protects against contamination, bacteria, and UV light. This ensures preservation of flavor, nutrition, and freshness without additives. Food manufacturers increasingly prefer cans over flexible packaging due to superior protection and recyclability. Rising regulatory emphasis on safe food storage and traceability standards in regions like North America and Europe further strengthens demand.

- For instance, Ardagh and Crown grants help capture nearly 140 million aluminum cans per year at MRFs.

Sustainability and Recycling Initiatives

The market benefits from a global shift toward sustainable packaging solutions. Metal cans, including steel and aluminum, are highly recyclable and can be reused without quality loss. Governments and consumers favor packaging with lower environmental impact, boosting can adoption across food categories. Companies are investing in eco-friendly coating technologies and lightweight can designs to reduce material usage. The rising emphasis on circular economy practices encourages recycling, making metal food cans a sustainable alternative to plastics.

Key Trends & Opportunities

Premium and Lightweight Packaging Solutions

A key trend shaping the market is the shift toward premium and lightweight metal packaging. Manufacturers are introducing thinner yet stronger materials that reduce costs and improve portability. These innovations enhance shelf appeal and minimize transportation emissions. Growing use of decorative labeling and easy-open lids adds value for consumers seeking convenience and aesthetics. This trend aligns with the expansion of high-value canned categories such as organic foods and ready gourmet meals in retail shelves.

- For instance, Toyo Seikan’s CBR cans cut 350 ml weight by 1.5 g and 500 ml by 2.0 g.

Expansion in Emerging Economies

Emerging economies offer major growth opportunities for can manufacturers. Rapid urbanization, improved cold-chain logistics, and increasing retail penetration are fueling the adoption of canned foods. Rising demand for affordable, long-lasting meal options supports market expansion in Asia-Pacific, Latin America, and Africa. Local producers are collaborating with international packaging companies to introduce cost-effective and region-specific can designs. This expansion aligns with rising consumption of canned fruits, vegetables, and fish products in developing regions.

- For instance, Showa Aluminum Can lifted Vietnam capacity to 3.1 billion units annually.

Adoption of Smart and Decorative Can Designs

The integration of digital printing and smart labeling is a growing opportunity in the food cans industry. Manufacturers use QR codes and interactive packaging for product traceability and consumer engagement. Decorative and embossed designs also enhance brand visibility in competitive retail spaces. Technological improvements in coating and printing processes help deliver attractive, corrosion-resistant surfaces. These innovations improve differentiation while supporting sustainability through solvent-free and energy-efficient production methods.

Key Challenges

High Raw Material Costs

Fluctuating prices of steel, tin, and aluminum pose a key challenge for manufacturers. Volatile raw material costs directly affect production margins and pricing strategies. Global supply chain disruptions and energy price hikes have increased material procurement costs. Smaller manufacturers face difficulty maintaining profitability under such conditions. The industry is exploring lightweighting and material optimization to offset cost fluctuations, but long-term volatility remains a major restraint on profitability and competitiveness.

Competition from Alternative Packaging Solutions

Rising competition from flexible and plastic packaging alternatives limits market expansion. Pouches and cartons are lighter and often cheaper, appealing to cost-sensitive consumers. Advancements in barrier films have narrowed the gap in preservation quality, challenging the traditional dominance of cans. Brands are diversifying packaging formats to meet changing consumer preferences for convenience and sustainability. To retain relevance, can manufacturers are focusing on recyclability, aesthetics, and improved functionality to compete with evolving packaging innovations.

Regional Analysis

North America

North America held the largest share of 34% in the food cans market in 2024. The region’s dominance stems from strong demand for packaged and ready-to-eat foods, particularly in the U.S. and Canada. Consumers value the long shelf life, safety, and recyclability of metal cans. Leading food producers are expanding canned product lines across soups, vegetables, and pet food categories. Sustainability initiatives and advanced recycling infrastructure further support market growth. The presence of major packaging companies and consistent innovation in can design continue to strengthen regional competitiveness.

Europe

Europe accounted for a 29% share of the food cans market in 2024, driven by high consumer awareness of sustainable packaging. Countries such as Germany, France, and the U.K. emphasize circular economy policies and strict recycling regulations. Demand for canned fruits, seafood, and organic food is growing, supported by strong retail networks. Manufacturers in the region are adopting lightweight steel and aluminum cans to meet environmental standards. Increasing focus on reducing food waste also promotes the adoption of metal packaging solutions that extend product shelf life.

Asia-Pacific

Asia-Pacific captured a 27% share in the food cans market in 2024, making it the fastest-growing region. Rapid urbanization, expanding retail sectors, and growing middle-class populations are fueling demand for canned and convenience foods. China, Japan, and India lead regional growth with rising consumption of ready meals, beverages, and seafood. Local manufacturers are investing in advanced canning technologies to enhance production efficiency. Government efforts promoting sustainable packaging and expanding food exports further accelerate market expansion across emerging Asian economies.

Latin America

Latin America held an 6% share of the food cans market in 2024, supported by expanding food processing industries and increasing exports. Brazil, Mexico, and Argentina are key contributors, driven by demand for canned fruits, sauces, and meats. Rising consumer preference for durable and affordable food packaging fuels steady adoption. Local producers are collaborating with global can manufacturers to improve packaging standards. Economic growth and urban lifestyle shifts continue to create opportunities for regional market expansion in the coming years.

Middle East & Africa

The Middle East & Africa accounted for a 4% share in the food cans market in 2024. Growing urban populations and demand for longer shelf-life food products drive market growth. GCC countries such as Saudi Arabia and the UAE are investing in food processing and packaging infrastructure to reduce import dependency. Canned vegetables, dairy products, and meat items are gaining traction due to rising convenience needs. Limited recycling facilities remain a challenge, but government sustainability initiatives are gradually improving regional adoption of metal cans.

Market Segmentations:

By Type

By Material

- Steel Food Cans

- Tin Food Cans

- Aluminium Food Cans

By Capacity

- Less than 100 gm

- 100 gm–300 gm

- 301 gm–500 gm

- More than 500 gm

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the food cans market is characterized by the presence of several global and regional players such as Ball Corporation, Ardagh Group, Silgan Holdings Inc., CPMC Holdings Limited, Toyo Seikan Group Holdings Ltd., Sonoco Products, Huber Packaging Group, Can Pack S.A., Allstate Can Corporation, Independent Can, Kraft Heinz Company, Coca-Cola European Partners, Heineken, Carlsberg, Suntory, Lucky Star Ltd, Irwin Packaging Pty Ltd., and Nespresso. The market is moderately consolidated, with leading companies focusing on product innovation, sustainability, and capacity expansion to strengthen their market presence. Key players are investing in lightweight materials, advanced coating technologies, and digital printing to enhance can aesthetics and performance. Strategic mergers, partnerships, and geographic expansion into emerging economies are supporting business diversification. Increasing competition encourages manufacturers to prioritize recyclable and eco-friendly materials, driving sustainable growth while catering to the rising global demand for safe and long-lasting food packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ball Corporation

- Ardagh Group

- Silgan Holdings Inc.

- CPMC Holdings Limited

- Toyo Seikan Group Holdings Ltd.

- Sonoco Products

- Huber Packaging Group

- Can Pack S.A.

- Allstate Can Corporation

- Independent Can

- Kraft Heinz Company

- Coca-Cola European Partners

- Heineken

- Carlsberg

- Suntory

- Lucky Star Ltd

- Irwin Packaging Pty Ltd.

- Nespresso

Recent Developments

- In 2024, Nespresso revealed the launch of its first ready-to-drink coffee in a can.

- In 2023, Ball Corporation Launched Eyeris technology, a high-resolution printing method for aluminum cans, providing photo-realistic imagery to enhance brand identity.

- In 2023, Ardagh Group Partnered with Newell Brands to design and manufacture the Ball® Honeybee Keepsake Mason Jars, suitable for canning and crafting.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The food cans market will continue expanding due to rising demand for convenient packaging.

- Sustainable and recyclable metal packaging will gain higher preference among manufacturers and consumers.

- Emerging economies in Asia-Pacific and Latin America will drive significant consumption growth.

- Technological advancements will enhance can design, printing quality, and corrosion resistance.

- Lightweight materials will reduce production costs and improve transportation efficiency.

- The adoption of smart labeling and QR-enabled cans will enhance product traceability.

- Growing online retail and e-commerce platforms will increase canned food visibility and sales.

- Partnerships between food producers and packaging firms will strengthen innovation pipelines.

- Regulatory pressure for eco-friendly packaging will accelerate the transition to recyclable materials.

- The premiumization of canned food products will open new growth opportunities in global markets.